Key Insights

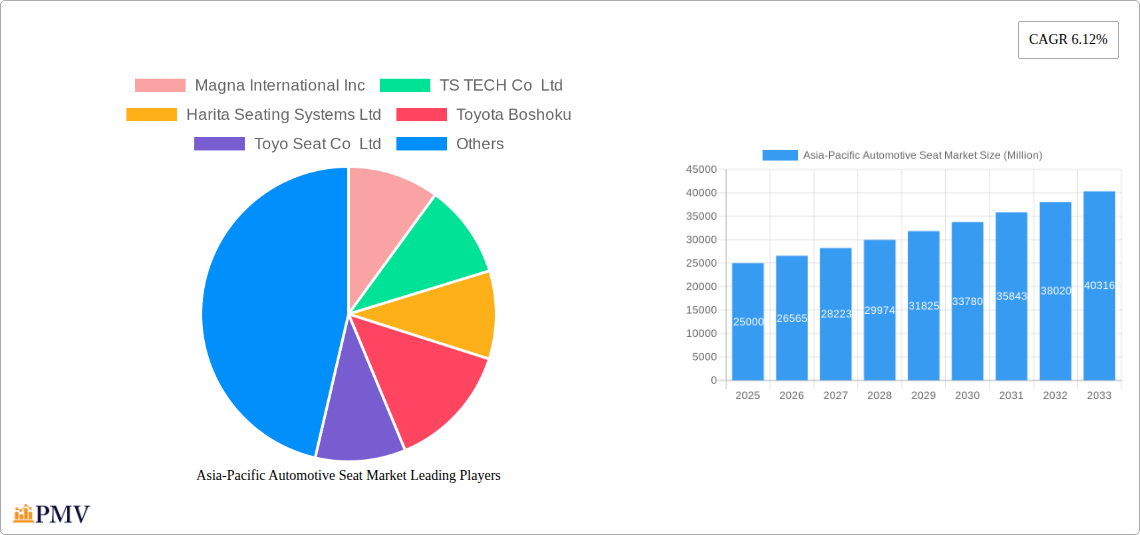

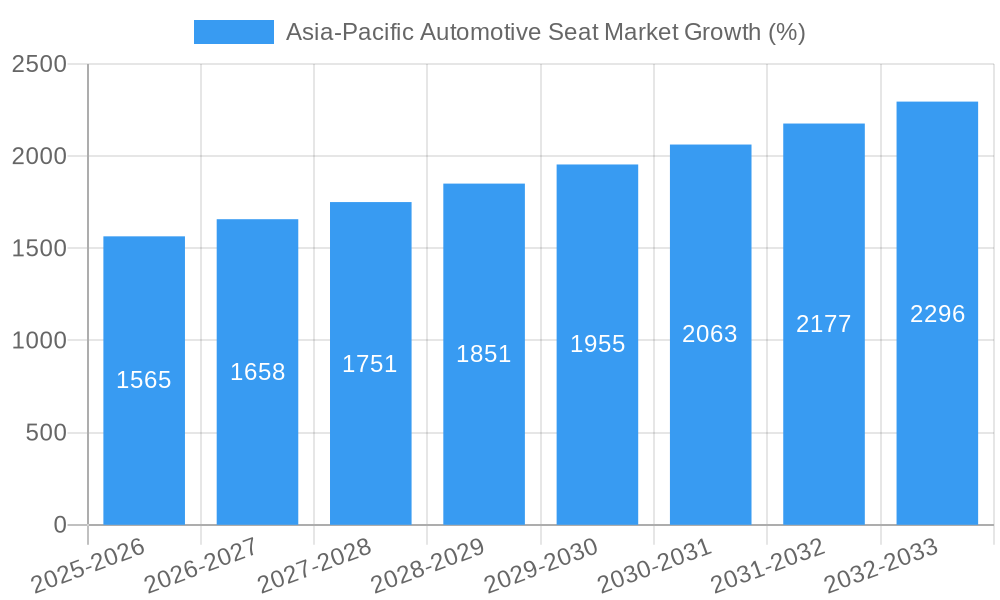

The Asia-Pacific automotive seat market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.12% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning automotive industry, particularly in countries like China and India, is a significant driver. Increasing vehicle production and sales, coupled with rising disposable incomes and a preference for enhanced vehicle comfort and safety features, are bolstering demand for advanced automotive seating systems. The growing popularity of SUVs and luxury vehicles further contributes to market growth, as these segments typically feature more sophisticated and expensive seating configurations. Technological advancements in seat design, such as the integration of powered, ventilated, and massage functions, are also driving premiumization and boosting market value. Finally, stringent safety regulations regarding child safety seats are further stimulating market demand. Growth is expected to be particularly strong in the passenger car segment, driven by rising vehicle ownership and a preference for comfortable and technologically advanced seating.

However, market growth is not without its challenges. Fluctuations in raw material prices, particularly leather and other specialized fabrics, can impact production costs and profitability. Furthermore, supply chain disruptions and geopolitical uncertainties could pose risks to market stability. Competitive intensity amongst major players such as Magna International Inc, TS TECH Co Ltd, and Lear Corporation is also expected to intensify, leading to price pressures. Despite these restraints, the long-term outlook for the Asia-Pacific automotive seat market remains positive, with continued growth projected throughout the forecast period (2025-2033), driven by the region’s expanding automotive sector and consumer demand for premium seating features. The market segmentation by material type (leather, fabric, other), technology type (standard, powered, ventilated, child safety seats), vehicle type (passenger car, commercial vehicle), and country (China, Japan, India, South Korea, and others) provides valuable insights into market dynamics and growth opportunities across various segments.

Asia-Pacific Automotive Seat Market: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific automotive seat market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. Key market segments are analyzed by material type, technology type, vehicle type, and country, revealing significant growth opportunities and potential challenges. Leading players such as Magna International Inc, TS TECH Co Ltd, Harita Seating Systems Ltd, Toyota Boshoku, Toyo Seat Co Ltd, TACHI-S Co Ltd, Lear Corporation, Faurecia, NHK Spring, and Adient PLC are profiled, offering competitive landscapes and strategic insights. The report incorporates detailed market sizing (in Million) and growth projections, providing a robust foundation for informed business decisions.

Asia-Pacific Automotive Seat Market Structure & Competitive Dynamics

The Asia-Pacific automotive seat market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Magna International Inc., Lear Corporation, and Adient PLC are amongst the leading global players, while TS TECH Co Ltd and Toyota Boshoku hold strong regional positions. The market is characterized by a dynamic innovation ecosystem, with continuous advancements in materials, technologies, and manufacturing processes. Regulatory frameworks, particularly concerning safety and environmental standards, play a significant role in shaping market dynamics. Product substitutes, such as alternative seating materials and designs, are emerging, creating competitive pressure. End-user trends, driven by increasing consumer demand for comfort, safety, and advanced features, influence product development and market growth. Mergers and acquisitions (M&A) activity has been relatively active in recent years, with deal values exceeding xx Million in the past five years. Key M&A activities have involved consolidation amongst tier-one suppliers seeking to expand their product portfolio and geographic reach. For instance, the merger between [Insert example of M&A deal if available, otherwise use "a hypothetical merger between two significant players"] resulted in a combined market share of approximately xx%.

Asia-Pacific Automotive Seat Market Industry Trends & Insights

The Asia-Pacific automotive seat market is experiencing robust growth, driven by several key factors. The increasing demand for passenger vehicles, particularly in emerging economies like India and China, is a primary growth catalyst. The compound annual growth rate (CAGR) for the market during the forecast period (2025-2033) is projected to be xx%. This growth is fueled by rising disposable incomes, expanding middle classes, and increasing urbanization across the region. Technological disruptions, such as the adoption of lightweight materials, advanced seating technologies (e.g., ventilated and massaging seats), and connected car features, are reshaping the market landscape. Consumer preferences are shifting towards enhanced comfort, safety, and customization options, driving innovation and premiumization within the sector. The market penetration of advanced features like powered seats and ventilated seats is steadily increasing, reaching xx% in 2025, and projected to reach xx% by 2033. Competitive dynamics are characterized by intense competition amongst established players and emerging local manufacturers, leading to pricing pressures and continuous innovation.

Dominant Markets & Segments in Asia-Pacific Automotive Seat Market

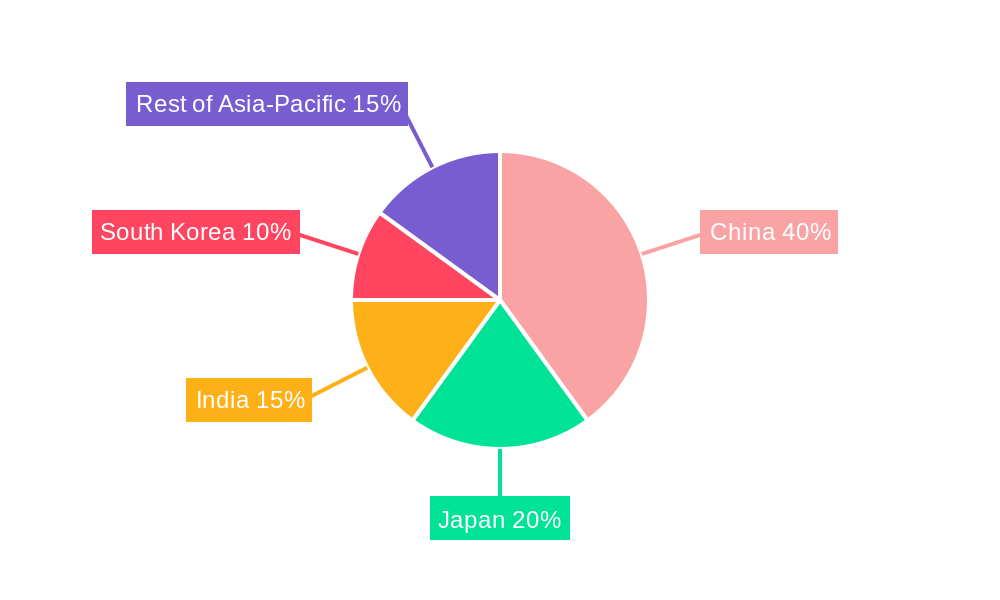

China remains the dominant market within the Asia-Pacific region, accounting for approximately xx% of the total market value in 2025, driven by its massive automotive production base and rapidly expanding middle class.

- Key Drivers in China: Strong economic growth, supportive government policies for automotive manufacturing, and substantial investments in infrastructure development.

Japan follows as a significant market, known for its advanced technology and high-quality automotive components. India exhibits substantial growth potential, driven by rising vehicle sales and increasing affordability. South Korea also maintains a significant market share, thanks to its well-established automotive industry.

By Material Type: Leather seats hold a premium segment and capture a considerable market share due to their luxurious appeal and durability. However, fabric remains the dominant segment in terms of volume due to cost-effectiveness. Other materials are gaining traction due to innovations in sustainability and functionality.

By Technology Type: Standard seats currently dominate the market in terms of volume, but powered seats, ventilated seats, and child safety seats are growing rapidly, driven by rising consumer demand for enhanced comfort and safety.

By Vehicle Type: Passenger cars account for the largest share of the market, due to the higher volume of passenger car production compared to commercial vehicles. However, the commercial vehicle segment is also expected to show considerable growth, driven by rising logistics and transportation needs across the region.

The "Rest of Asia-Pacific" segment, encompassing countries like Thailand, Indonesia, and Malaysia, demonstrates significant growth potential owing to expanding automotive manufacturing and rising consumer purchasing power.

Asia-Pacific Automotive Seat Market Product Innovations

The Asia-Pacific automotive seat market is witnessing significant product innovation, driven by technological advancements and evolving consumer preferences. Lightweight materials, such as carbon fiber and aluminum alloys, are gaining traction to improve fuel efficiency. Advanced features like heating, cooling, massage, and memory functions are becoming increasingly common, enhancing passenger comfort. Safety features, such as integrated airbags and enhanced headrests, are also being incorporated to meet stringent safety standards. The focus is on integrating technology, ensuring optimal ergonomics, and offering sustainable, environmentally friendly materials. These innovations are enhancing product differentiation and strengthening the competitive advantages of leading manufacturers.

Report Segmentation & Scope

This report segments the Asia-Pacific automotive seat market by material type (leather, fabric, other), technology type (standard seats, powered seats, ventilated seats, child safety seats, other seats), vehicle type (passenger car, commercial vehicle), and country (China, Japan, India, South Korea, Rest of Asia-Pacific). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. For instance, the leather segment is expected to experience relatively slower growth compared to the fabric segment due to pricing considerations. The powered seats segment is witnessing significant growth fueled by rising consumer demand for advanced features. Similarly, country-specific analyses highlight market drivers, challenges, and opportunities.

Key Drivers of Asia-Pacific Automotive Seat Market Growth

Several factors fuel the growth of the Asia-Pacific automotive seat market. Firstly, robust economic growth across the region, particularly in emerging economies, has resulted in higher disposable incomes, increasing the purchasing power of consumers. Secondly, rising vehicle production, both passenger and commercial, significantly contributes to the demand for automotive seats. Thirdly, government initiatives promoting the development of the automotive industry, including tax incentives and infrastructure investments, stimulate market expansion. Finally, technological advancements in seat designs, materials, and features continuously enhance product quality, comfort, and safety, driving market demand.

Challenges in the Asia-Pacific Automotive Seat Market Sector

The Asia-Pacific automotive seat market faces several challenges. Fluctuating raw material prices, particularly for leather and other specialized materials, impact production costs and profitability. Supply chain disruptions, particularly during periods of global uncertainty, can lead to production delays and shortages. Intense competition among established players and emerging manufacturers creates pricing pressures. Moreover, stringent safety and environmental regulations require continuous investment in compliance, adding to operational costs. These challenges necessitate proactive strategies for managing risks and maintaining competitiveness.

Leading Players in the Asia-Pacific Automotive Seat Market Market

- Magna International Inc

- TS TECH Co Ltd

- Harita Seating Systems Ltd

- Toyota Boshoku

- Toyo Seat Co Ltd

- TACHI-S Co Ltd

- Lear Corporation

- Faurecia

- NHK Spring

- Adient PLC

Key Developments in Asia-Pacific Automotive Seat Market Sector

- January 2023: Lear Corporation launched a new range of lightweight seats incorporating sustainable materials.

- June 2022: Magna International Inc. announced a strategic partnership with a technology provider to develop advanced seating technologies.

- November 2021: Adient PLC invested in a new manufacturing facility in China to expand production capacity. [Add more specific developments with dates if available]

Strategic Asia-Pacific Automotive Seat Market Outlook

The Asia-Pacific automotive seat market presents significant growth opportunities. Continued economic expansion, rising vehicle sales, and technological advancements are key growth accelerators. Strategic partnerships, investments in R&D, and expansion into emerging markets are crucial for maintaining competitiveness. Focusing on sustainability, enhancing safety features, and offering customized seating solutions will be vital for capturing market share and securing long-term success. The market is poised for robust growth, particularly in the segments of advanced technology seats and the commercial vehicle sector.

Asia-Pacific Automotive Seat Market Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Fabric

- 1.3. Other

-

2. Technology Type

- 2.1. Standard Seats

- 2.2. Powered Seats

- 2.3. Ventilated Seats

- 2.4. Child Safety Seats

- 2.5. Other Seats

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicle

Asia-Pacific Automotive Seat Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Automotive Seat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Increase in Electric Vehicle Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Fabric

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Standard Seats

- 5.2.2. Powered Seats

- 5.2.3. Ventilated Seats

- 5.2.4. Child Safety Seats

- 5.2.5. Other Seats

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. China Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Magna International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TS TECH Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Harita Seating Systems Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toyota Boshoku

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Toyo Seat Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 TACHI-S Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Lear Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Faurecia

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 NHK Sprin

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Adient PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Magna International Inc

List of Figures

- Figure 1: Asia-Pacific Automotive Seat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Automotive Seat Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 4: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 15: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 16: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Asia-Pacific Automotive Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Automotive Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Seat Market?

The projected CAGR is approximately 6.12%.

2. Which companies are prominent players in the Asia-Pacific Automotive Seat Market?

Key companies in the market include Magna International Inc, TS TECH Co Ltd, Harita Seating Systems Ltd, Toyota Boshoku, Toyo Seat Co Ltd, TACHI-S Co Ltd, Lear Corporation, Faurecia, NHK Sprin, Adient PLC.

3. What are the main segments of the Asia-Pacific Automotive Seat Market?

The market segments include Material Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Increase in Electric Vehicle Production.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Seat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Seat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Seat Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Seat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence