Key Insights

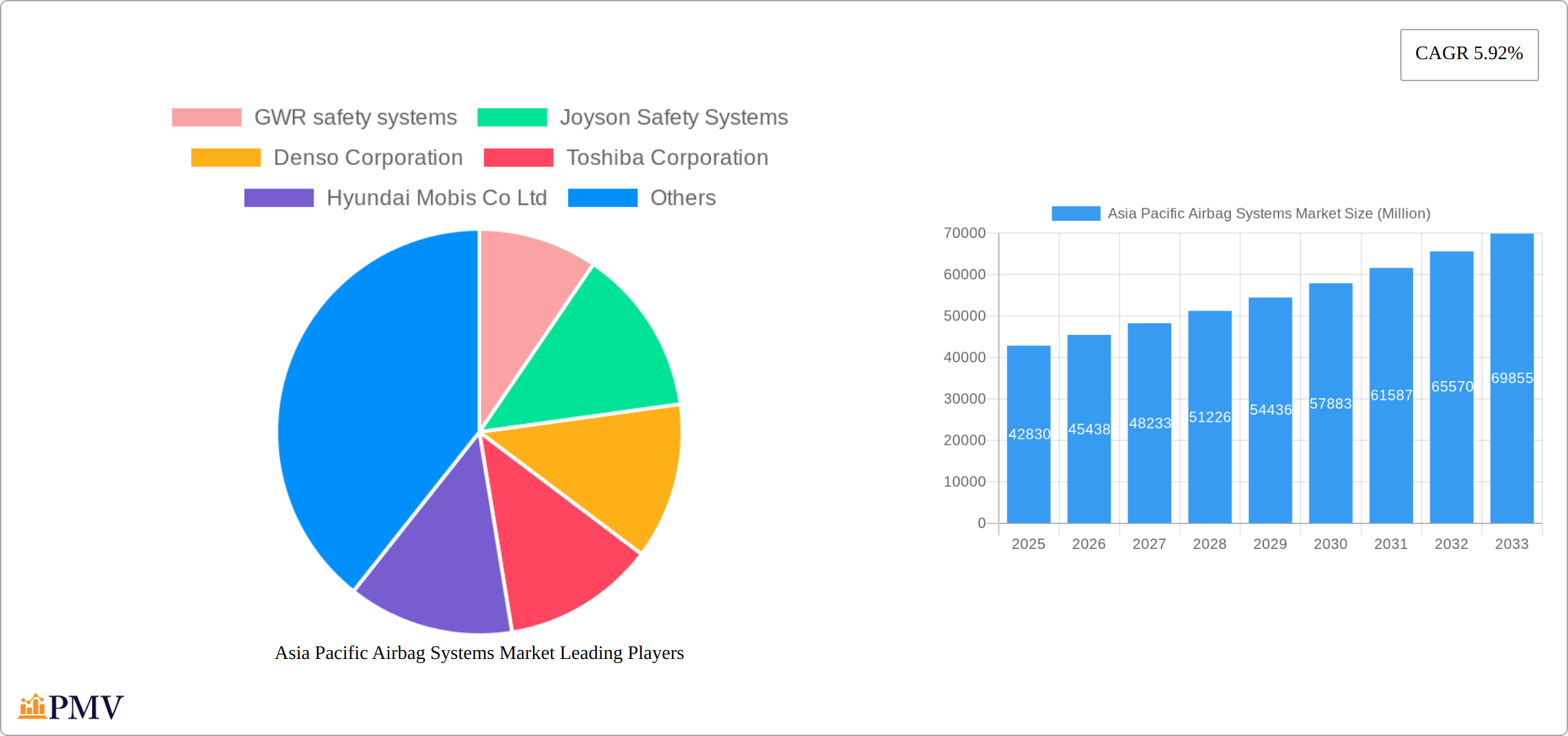

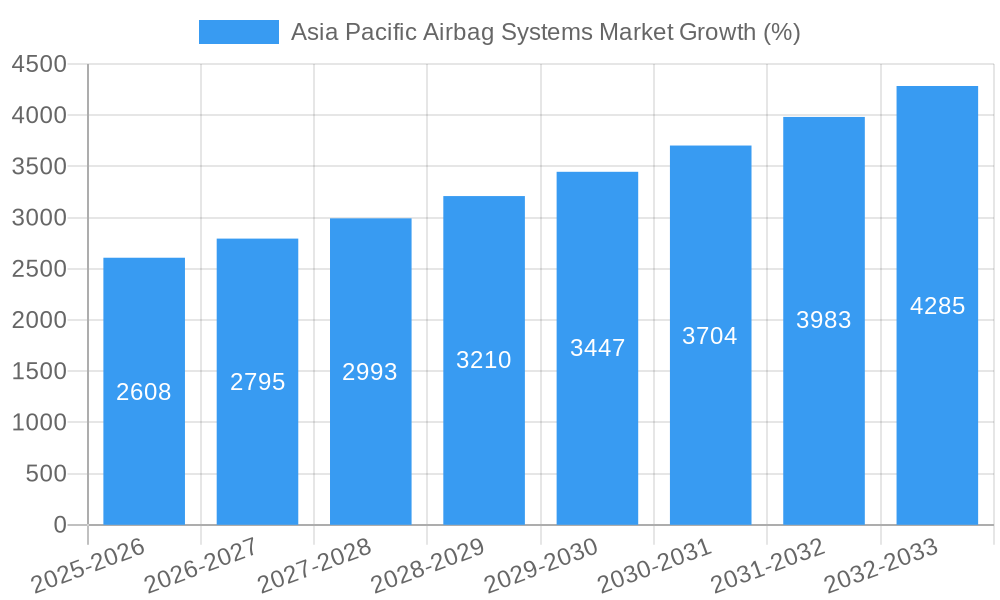

The Asia Pacific airbag systems market, valued at $42.83 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.92% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing stringency of automotive safety regulations across the region is mandating the inclusion of airbag systems in both passenger and commercial vehicles. Secondly, rising consumer awareness of road safety and a growing preference for vehicles equipped with advanced safety features are boosting demand. Furthermore, the burgeoning automotive industry in countries like China, India, and South Korea is contributing significantly to market growth. Technological advancements, such as the integration of advanced driver-assistance systems (ADAS) and the development of more sophisticated airbag designs (e.g., curtain airbags, knee airbags), are also driving market expansion. The rising adoption of electric vehicles (EVs) further contributes to market growth, as they typically require sophisticated safety systems.

However, certain factors could potentially restrain market growth. These include the high initial investment costs associated with airbag system integration, especially for smaller vehicle manufacturers or in developing economies. Fluctuations in raw material prices and economic downturns could also impact market growth. The market segmentation reveals a significant share held by passenger vehicles, followed by commercial vehicles, buses, and trucks. OEMs represent a major sales channel, though the aftermarket segment shows potential for expansion as vehicle lifecycles extend. Key players like Autoliv, Bosch, and Takata (assuming it's still active and its market position is maintained within the forecast period) will benefit from the Asia Pacific market's dynamic expansion. The dominance of countries like China, Japan, India, and South Korea in automotive production and sales underscores the importance of these markets within the regional outlook.

Asia Pacific Airbag Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Airbag Systems Market, offering invaluable insights for stakeholders across the automotive safety industry. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The report quantifies the market in Millions (USD) and delves into crucial segments including Airbag Type (Curtain, Front, Knee, Side, Other), Vehicle Type (Passenger Vehicles, Commercial Vehicles, Buses, Trucks), and Sales Channel (OEMs, Aftermarket). Key players like Autoliv Inc, Robert Bosch GmbH, and Joyson Safety Systems are analyzed in detail.

Asia Pacific Airbag Systems Market Structure & Competitive Dynamics

The Asia Pacific airbag systems market exhibits a moderately concentrated structure, with several major players holding significant market share. Autoliv Inc, Robert Bosch GmbH, and Joyson Safety Systems are currently among the leading companies, collectively accounting for an estimated xx% of the market in 2025. However, the market is characterized by intense competition, driven by ongoing innovation and the increasing demand for advanced safety features. The regulatory landscape, particularly concerning safety standards and emission regulations, plays a crucial role in shaping market dynamics.

The innovation ecosystem is vibrant, with companies investing heavily in R&D to develop lighter, more efficient, and technologically advanced airbag systems. Product substitution is minimal, given the essential safety function of airbags, though advancements in material science and system design continuously improve performance and cost-effectiveness. End-user trends favor advanced features like multi-stage deployment systems and improved occupant protection technologies. Mergers and acquisitions (M&A) activity is relatively frequent, with deal values ranging from USD xx Million to USD xx Million in recent years. These M&A activities aim to enhance technological capabilities, expand market reach, and consolidate market share. For example, the xx Million USD acquisition of Company X by Company Y in 2022 significantly impacted market dynamics.

Asia Pacific Airbag Systems Market Industry Trends & Insights

The Asia Pacific airbag systems market is experiencing robust growth, driven by several key factors. Rising vehicle production, particularly in rapidly developing economies like India and China, fuels demand. Stringent government regulations mandating airbag installation in vehicles further stimulate market expansion. Furthermore, increasing consumer awareness of vehicle safety and a rising preference for advanced safety features are contributing to market growth. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), driven by these factors. Technological disruptions, such as the integration of advanced driver-assistance systems (ADAS) and the development of smart airbags, are reshaping the competitive landscape. This trend leads to improved occupant protection and a higher market penetration of sophisticated airbag technologies. Consumer preferences are shifting toward lighter, more compact, and more effective airbag systems that optimize safety and vehicle performance. Competitive dynamics are intensified by ongoing innovation, pricing pressures, and the increasing adoption of advanced manufacturing technologies.

Dominant Markets & Segments in Asia Pacific Airbag Systems Market

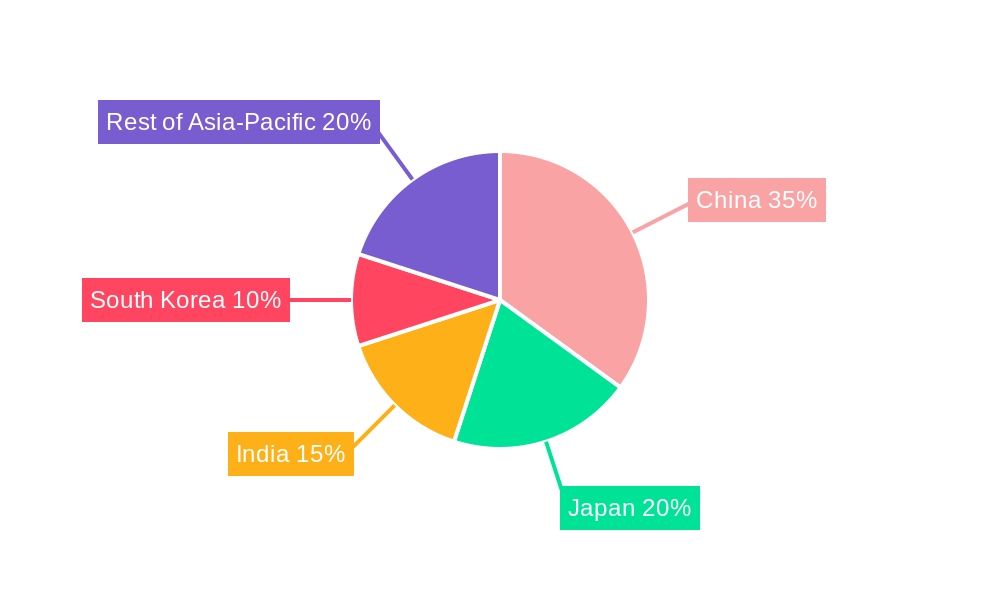

China and India represent the dominant markets within the Asia Pacific region, primarily due to their large vehicle production volumes and supportive governmental policies promoting automotive safety. Within the segmentations:

- Airbag Type: The front airbag segment holds the largest market share due to its mandatory installation in most vehicles. However, the curtain and side airbag segments are experiencing faster growth, driven by increasing consumer demand for enhanced safety features.

- Vehicle Type: Passenger vehicles dominate the market due to their higher production volumes. However, the commercial vehicle segment exhibits a significant growth rate, driven by increasing awareness of safety standards within this sector.

- Sales Channel: OEMs (Original Equipment Manufacturers) constitute the primary sales channel, given the mandatory nature of airbags in newly manufactured vehicles. The aftermarket segment, while smaller, is showing growth driven by replacement and retrofitting needs.

Key drivers for the dominant segments include supportive government policies regarding vehicle safety, favorable economic growth, and increasing infrastructure development that supports the automotive industry. The dominance of these segments is projected to continue throughout the forecast period, supported by ongoing growth within the automotive sector and rising consumer preferences.

Asia Pacific Airbag Systems Market Product Innovations

Recent advancements in airbag technology include the development of lighter, more compact systems that improve vehicle fuel efficiency and overall performance. Smart airbags, equipped with sensors that adapt deployment based on collision severity and occupant position, are gaining traction. The integration of ADAS further enhances safety by providing early warnings and automated braking capabilities in conjunction with airbag deployment. These innovations cater to the growing demand for enhanced occupant safety and contribute to the overall improvement of vehicle safety standards.

Report Segmentation & Scope

This report provides a detailed segmentation of the Asia Pacific Airbag Systems market across various parameters:

Airbag Type: Curtain, Front, Knee, Side, Other. Each segment’s growth projection, market size, and competitive dynamics are analyzed.

Vehicle Type: Passenger Vehicles, Commercial Vehicles, Buses, Trucks. Each segment's market size, growth rate, and key characteristics are investigated.

Sales Channel: OEMs and Aftermarket. The report analyzes market size, growth potential, and competitive landscape within each channel.

The report encompasses both historical data (2019-2024) and future projections (2025-2033), providing a comprehensive view of the market.

Key Drivers of Asia Pacific Airbag Systems Market Growth

The Asia Pacific airbag systems market growth is primarily driven by factors such as:

- Increasing Vehicle Production: The rapid growth of the automotive industry in the region is a major driver of market expansion.

- Stringent Government Regulations: Mandatory airbag installation regulations in several countries are boosting market demand.

- Rising Consumer Awareness: Growing consumer awareness of vehicle safety is leading to increased preference for vehicles equipped with airbags.

- Technological Advancements: Innovations in airbag technology are improving safety, fuel efficiency, and consumer appeal.

Challenges in the Asia Pacific Airbag Systems Market Sector

The Asia Pacific airbag systems market faces several challenges:

- Supply Chain Disruptions: Global supply chain issues can impact the availability of raw materials and components.

- Intense Competition: The market is characterized by intense competition among established players and new entrants.

- Price Fluctuations: Raw material prices significantly impact production costs and profit margins.

- Regulatory Compliance: Meeting increasingly stringent safety and environmental regulations presents challenges for manufacturers.

Leading Players in the Asia Pacific Airbag Systems Market

- GWR safety systems

- Joyson Safety Systems

- Denso Corporation

- Toshiba Corporation

- Hyundai Mobis Co Ltd

- Key Safety Systems

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Toyoda Gosei Co Ltd

- Yanfeng KSS (Shanghai) Automotive Safety Systems Co Ltd

- ZF Friedrichshafen AG

Key Developments in Asia Pacific Airbag Systems Market Sector

- February 2023: Uno Minda invested USD 21.16 Million to expand its airbag manufacturing facility in Rajasthan, India, increasing production capacity and market presence.

- May 2022: Yanfeng and ARC Automotive formed a joint venture for the production of airbag inflators, strengthening their market position and expanding their product portfolio.

Strategic Asia Pacific Airbag Systems Market Outlook

The Asia Pacific airbag systems market presents significant growth opportunities, driven by continuous technological advancements, rising vehicle sales, and increasing consumer demand for enhanced safety features. Strategic partnerships, investments in R&D, and expansion into new markets are vital for success. The focus on lightweight, cost-effective, and technologically advanced airbag systems will shape future market dynamics, creating further opportunities for innovation and market consolidation. Companies that can adapt to changing consumer preferences and regulatory requirements are poised to benefit most from the market's continued expansion.

Asia Pacific Airbag Systems Market Segmentation

-

1. Airbag Type

- 1.1. Curtain

- 1.2. Front

- 1.3. Knee

- 1.4. Sire

- 1.5. Other Airbag Types

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

- 2.3. Busses

- 2.4. Trucks

-

3. Sales Channel

- 3.1. OEMs

- 3.2. Aftermarket

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia Pacific Airbag Systems Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Airbag Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Safety Standards Implemented by Governing Bodies; Others

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw Material Price; Others

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Witness Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Curtain

- 5.1.2. Front

- 5.1.3. Knee

- 5.1.4. Sire

- 5.1.5. Other Airbag Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.2.3. Busses

- 5.2.4. Trucks

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEMs

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. China Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6.1.1. Curtain

- 6.1.2. Front

- 6.1.3. Knee

- 6.1.4. Sire

- 6.1.5. Other Airbag Types

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Commercial Vehicles

- 6.2.3. Busses

- 6.2.4. Trucks

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEMs

- 6.3.2. Aftermarket

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Airbag Type

- 7. Japan Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Airbag Type

- 7.1.1. Curtain

- 7.1.2. Front

- 7.1.3. Knee

- 7.1.4. Sire

- 7.1.5. Other Airbag Types

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Vehicles

- 7.2.3. Busses

- 7.2.4. Trucks

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEMs

- 7.3.2. Aftermarket

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Airbag Type

- 8. India Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Airbag Type

- 8.1.1. Curtain

- 8.1.2. Front

- 8.1.3. Knee

- 8.1.4. Sire

- 8.1.5. Other Airbag Types

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Commercial Vehicles

- 8.2.3. Busses

- 8.2.4. Trucks

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEMs

- 8.3.2. Aftermarket

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Airbag Type

- 9. South Korea Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Airbag Type

- 9.1.1. Curtain

- 9.1.2. Front

- 9.1.3. Knee

- 9.1.4. Sire

- 9.1.5. Other Airbag Types

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Vehicles

- 9.2.2. Commercial Vehicles

- 9.2.3. Busses

- 9.2.4. Trucks

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEMs

- 9.3.2. Aftermarket

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Airbag Type

- 10. Rest of Asia Pacific Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Airbag Type

- 10.1.1. Curtain

- 10.1.2. Front

- 10.1.3. Knee

- 10.1.4. Sire

- 10.1.5. Other Airbag Types

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Vehicles

- 10.2.2. Commercial Vehicles

- 10.2.3. Busses

- 10.2.4. Trucks

- 10.3. Market Analysis, Insights and Forecast - by Sales Channel

- 10.3.1. OEMs

- 10.3.2. Aftermarket

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Airbag Type

- 11. China Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 GWR safety systems

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Joyson Safety Systems

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Denso Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Toshiba Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Hyundai Mobis Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Key Safety Systems

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Continental AG

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Autoliv Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Robert Bosch GmbH

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Toyoda Gosei Co Ltd

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Yanfeng KSS (Shanghai) Automotive Safety Systems Co Ltd

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 ZF Friedrichshafen AG

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 GWR safety systems

List of Figures

- Figure 1: Asia Pacific Airbag Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Airbag Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 3: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia Pacific Airbag Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 16: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 18: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 21: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 22: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 23: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 26: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 31: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 32: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 33: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 36: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 37: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 38: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Airbag Systems Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the Asia Pacific Airbag Systems Market?

Key companies in the market include GWR safety systems, Joyson Safety Systems, Denso Corporation, Toshiba Corporation, Hyundai Mobis Co Ltd, Key Safety Systems, Continental AG, Autoliv Inc, Robert Bosch GmbH, Toyoda Gosei Co Ltd, Yanfeng KSS (Shanghai) Automotive Safety Systems Co Ltd, ZF Friedrichshafen AG.

3. What are the main segments of the Asia Pacific Airbag Systems Market?

The market segments include Airbag Type, Vehicle Type, Sales Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Safety Standards Implemented by Governing Bodies; Others.

6. What are the notable trends driving market growth?

Passenger Car Segment to Witness Momentum.

7. Are there any restraints impacting market growth?

Volatility in Raw Material Price; Others.

8. Can you provide examples of recent developments in the market?

February 2023: Uno Minda announced an investment of USD 21.16 million in Rajasthan, India. Through this expansion, the company expanded its airbag manufacturing facility across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Airbag Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Airbag Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Airbag Systems Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Airbag Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence