Key Insights

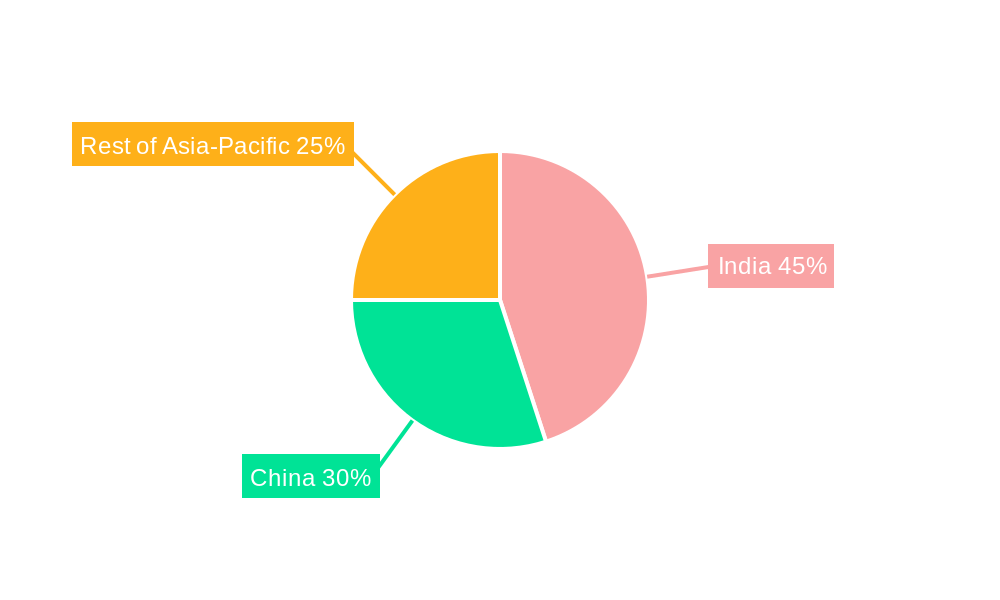

The Asia electric three-wheeler market is experiencing robust growth, driven by increasing urbanization, stringent emission norms, and government initiatives promoting electric mobility. The market, currently valued at approximately $XX million (assuming a reasonable market size based on global electric vehicle trends and the provided CAGR), is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 9% from 2025 to 2033. This growth is fueled by the rising demand for last-mile delivery solutions, affordable personal transportation, and environmentally friendly vehicles. Key segments driving this growth include passenger carriers and goods carriers, with a significant shift anticipated towards electric fuel types. While diesel remains a substantial segment, the adoption of electric three-wheelers is accelerating, particularly in densely populated urban areas. Challenges remain, including the relatively higher initial cost of electric vehicles compared to gasoline or diesel counterparts, and the need for expanded charging infrastructure. However, government subsidies, technological advancements leading to reduced battery costs, and improved battery life are mitigating these challenges. Leading players like Bajaj Auto, Mahindra & Mahindra, and TVS Motor Company are strategically investing in R&D and expanding their electric three-wheeler portfolios to capitalize on this expanding market. The Asia-Pacific region, specifically India, China, and other Southeast Asian nations, is expected to dominate the market due to favorable government policies, a large population base, and growing e-commerce sector.

The forecast period of 2025-2033 presents significant opportunities for market expansion. The increasing demand for efficient and sustainable urban transportation solutions will continue to drive the market forward. Furthermore, the development of advanced battery technologies, improved charging infrastructure, and the increasing availability of financing options will all contribute to market growth. The competitive landscape is dynamic, with both established automotive manufacturers and new entrants vying for market share. Companies are focusing on innovation in battery technology, vehicle design, and after-sales service to gain a competitive edge. The successful companies will likely be those that can effectively balance affordability, performance, and sustainability to meet the diverse needs of consumers and businesses alike.

Asia Electric Three-Wheeler Industry: Market Analysis, Trends & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia electric three-wheeler industry, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, technological advancements, and future growth potential. The report incorporates data from key players like Lohia Auto Industries, ElecTrike Japa, Bajaj Auto Limited, Atul Auto Limited, Ningbo Dowedo International Trade Co Ltd, Mahindra and Mahindra Ltd, TVS Motor Company, Piaggio & C SpA, ChongQing Zongshen Tricycle Manufacturing Co Ltd, and Scooters India Ltd. The total market size is projected to reach xx Million by 2033.

Asia Electric Three-Wheeler Industry Market Structure & Competitive Dynamics

The Asia electric three-wheeler market exhibits a moderately consolidated structure, with a few dominant players commanding significant market share. Market concentration is influenced by factors like technological capabilities, brand recognition, and distribution networks. Innovation ecosystems are developing, driven by government initiatives promoting electric mobility and the entry of technology-focused startups. Regulatory frameworks vary across Asian countries, impacting the adoption of electric three-wheelers. Product substitutes, such as motorcycles and small cars, compete for market share, especially in the passenger carrier segment. End-user trends are shifting toward eco-friendly and cost-effective transportation solutions, fueling the demand for electric three-wheelers. M&A activities have been observed, with deal values reaching xx Million in recent years, primarily focused on consolidating market presence and enhancing technological capabilities.

- Market Share: Bajaj Auto Limited and Mahindra and Mahindra Ltd hold a combined market share of approximately xx%.

- M&A Activity: Significant M&A activity observed in the historical period (2019-2024), with a total deal value exceeding xx Million. This trend is expected to continue, driven by market consolidation and expansion.

- Regulatory Landscape: Government incentives and stricter emission norms are key drivers of market growth.

Asia Electric Three-Wheeler Industry Industry Trends & Insights

The Asia electric three-wheeler market is experiencing robust growth, driven by several key factors. The increasing demand for last-mile connectivity, coupled with rising fuel prices and environmental concerns, is boosting the adoption of electric three-wheelers. Technological advancements, including improved battery technology and charging infrastructure, are further accelerating market growth. Consumer preferences are shifting towards electric vehicles due to their lower running costs and reduced environmental impact. Competitive dynamics are intensifying, with manufacturers focusing on product differentiation, improved performance, and enhanced features. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), resulting in a significant market penetration rate of xx% by 2033.

Dominant Markets & Segments in Asia Electric Three-Wheeler Industry

India currently dominates the Asian electric three-wheeler market, fueled by supportive government policies promoting electric mobility and a vast addressable market. Passenger carriers comprise the largest segment, reflecting their prevalent use in urban transportation. However, the goods carrier segment is poised for substantial growth, driven by the escalating demand for efficient and sustainable last-mile delivery solutions. The widespread adoption of electric fuel types is projected to surpass xx million units by 2025, primarily due to government incentives and growing environmental concerns. Key market drivers include:

- India: Robust government support for electric vehicle adoption, expanding charging infrastructure, and high demand for last-mile connectivity solutions, particularly in densely populated urban areas and rural communities with limited public transport options. Government initiatives such as subsidies and tax breaks are further accelerating market penetration.

- Passenger Carrier Segment: High demand for affordable personal transportation and efficient urban mobility solutions, especially in congested cities where traditional vehicles struggle. The increasing popularity of ride-hailing services and e-commerce further contributes to this segment's growth.

- Electric Fuel Type: Government incentives, increasingly stringent emission regulations, and the continuous decline in battery costs, making electric three-wheelers a more economically viable and environmentally friendly alternative to combustion engine vehicles. Advancements in battery technology are extending range and improving performance, further enhancing market appeal.

- E-commerce Boom: The rapid growth of e-commerce and the subsequent surge in last-mile delivery needs are significantly boosting the demand for electric goods carriers. Their efficiency, cost-effectiveness, and environmental friendliness make them ideal for navigating congested urban environments.

Asia Electric Three-Wheeler Industry Product Innovations

The Asian electric three-wheeler market is characterized by continuous product innovation, focusing on improvements across several key areas. Manufacturers are prioritizing enhanced battery technology, resulting in extended range and faster charging times. Advanced safety features are being incorporated to improve driver and passenger safety. Furthermore, the integration of connected features and smart technologies is enhancing user experience and facilitating efficient fleet management. These innovations are collectively aimed at increasing the overall value proposition of electric three-wheelers, driving greater market adoption and fostering stronger competition among manufacturers.

Report Segmentation & Scope

This report segments the Asian electric three-wheeler market based on vehicle type (Passenger Carrier, Goods Carrier) and fuel type (Petrol, CNG/LPG, Diesel, Electric). Each segment undergoes individual analysis, providing detailed insights into market size, growth projections, and competitive dynamics. The Electric segment is projected to exhibit the highest growth rate, fueled by environmental concerns and increasingly strict government regulations. The Goods Carrier segment is anticipated to experience substantial growth due to the booming e-commerce logistics sector and the expanding need for last-mile delivery services across diverse urban and rural areas. The report also analyzes regional variations within Asia, highlighting key differences in market dynamics and growth trajectories.

Key Drivers of Asia Electric Three-Wheeler Industry Growth

The growth of the Asian electric three-wheeler industry is driven by several key factors: Government incentives and subsidies are significantly lowering the initial cost of ownership, making electric three-wheelers a more financially attractive option. Stringent emission norms are making electric vehicles a more environmentally responsible alternative compared to internal combustion engine vehicles. Technological advancements continually improve battery life, range, and charging infrastructure, addressing some of the early concerns surrounding electric vehicle adoption. Finally, the rising demand for last-mile connectivity and efficient urban mobility solutions across various Asian markets is a major catalyst for this industry's growth.

Challenges in the Asia Electric Three-Wheeler Industry Sector

The Asia electric three-wheeler industry faces challenges including the high initial cost of electric vehicles compared to conventional three-wheelers, limited charging infrastructure in certain regions, and the need for improved battery technology to enhance range and lifespan. Supply chain disruptions and the availability of raw materials also pose challenges. These factors could impact the overall market growth and penetration rate, particularly in regions with limited infrastructure and financial resources. The total impact of these challenges is estimated at xx Million in lost revenue annually.

Leading Players in the Asia Electric Three-Wheeler Industry Market

- Lohia Auto Industries

- ElecTrike Japa

- Bajaj Auto Limited

- Atul Auto Limited

- Ningbo Dowedo International Trade Co Ltd

- Mahindra and Mahindra Ltd

- TVS Motor Company

- Piaggio & C SpA

- ChongQing Zongshen Tricycle Manufacturing Co Ltd

- Scooters India Ltd

Key Developments in Asia Electric Three-Wheeler Industry Sector

- June 2023: Bajaj Auto Limited launches a new electric three-wheeler model with enhanced battery technology.

- October 2022: The Indian government announces a new set of incentives for electric vehicle adoption.

- March 2021: Mahindra and Mahindra Ltd acquires a significant stake in an electric three-wheeler battery technology company.

Strategic Asia Electric Three-Wheeler Industry Market Outlook

The Asia electric three-wheeler market holds significant growth potential, driven by increasing urbanization, rising fuel prices, and stringent emission norms. Strategic opportunities exist in expanding charging infrastructure, developing innovative battery technologies, and creating efficient fleet management solutions. The market is expected to witness significant consolidation, with larger players acquiring smaller companies to enhance their market share and technological capabilities. Focus on affordability, range, and safety features will be crucial for market leadership.

Asia Electric Three-Wheeler Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Carrier

- 1.2. Goods Carrier

-

2. Fuel Type

- 2.1. Petrol

- 2.2. CNG/LPG

- 2.3. Diesel

- 2.4. Electric

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Bangladesh

- 3.5. Sri Lanka

- 3.6. Rest of Asia

Asia Electric Three-Wheeler Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Indonesia

- 4. Bangladesh

- 5. Sri Lanka

- 6. Rest of Asia

Asia Electric Three-Wheeler Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Industry’s Shift Toward the Adoption of Electric Three Wheelers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Carrier

- 5.1.2. Goods Carrier

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. CNG/LPG

- 5.2.3. Diesel

- 5.2.4. Electric

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Indonesia

- 5.3.4. Bangladesh

- 5.3.5. Sri Lanka

- 5.3.6. Rest of Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Indonesia

- 5.4.4. Bangladesh

- 5.4.5. Sri Lanka

- 5.4.6. Rest of Asia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Carrier

- 6.1.2. Goods Carrier

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Petrol

- 6.2.2. CNG/LPG

- 6.2.3. Diesel

- 6.2.4. Electric

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Indonesia

- 6.3.4. Bangladesh

- 6.3.5. Sri Lanka

- 6.3.6. Rest of Asia

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Carrier

- 7.1.2. Goods Carrier

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Petrol

- 7.2.2. CNG/LPG

- 7.2.3. Diesel

- 7.2.4. Electric

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Indonesia

- 7.3.4. Bangladesh

- 7.3.5. Sri Lanka

- 7.3.6. Rest of Asia

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Indonesia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Carrier

- 8.1.2. Goods Carrier

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Petrol

- 8.2.2. CNG/LPG

- 8.2.3. Diesel

- 8.2.4. Electric

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Indonesia

- 8.3.4. Bangladesh

- 8.3.5. Sri Lanka

- 8.3.6. Rest of Asia

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Bangladesh Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Carrier

- 9.1.2. Goods Carrier

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Petrol

- 9.2.2. CNG/LPG

- 9.2.3. Diesel

- 9.2.4. Electric

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Indonesia

- 9.3.4. Bangladesh

- 9.3.5. Sri Lanka

- 9.3.6. Rest of Asia

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Sri Lanka Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Carrier

- 10.1.2. Goods Carrier

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Petrol

- 10.2.2. CNG/LPG

- 10.2.3. Diesel

- 10.2.4. Electric

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Indonesia

- 10.3.4. Bangladesh

- 10.3.5. Sri Lanka

- 10.3.6. Rest of Asia

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Rest of Asia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Passenger Carrier

- 11.1.2. Goods Carrier

- 11.2. Market Analysis, Insights and Forecast - by Fuel Type

- 11.2.1. Petrol

- 11.2.2. CNG/LPG

- 11.2.3. Diesel

- 11.2.4. Electric

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Indonesia

- 11.3.4. Bangladesh

- 11.3.5. Sri Lanka

- 11.3.6. Rest of Asia

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. China Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 14. India Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Lohia Auto Industries

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 ElecTrike Japa

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Bajaj Auto Limited

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Atul Auto Limited

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Ningbo Dowedo International Trade Co Ltd

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Mahindra and Mahindra Ltd

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 TVS Motor Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Piaggio & C SpA

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 ChongQing Zongshen Tricycle Manufacturing Co Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Scooters India Ltd

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Lohia Auto Industries

List of Figures

- Figure 1: Asia Electric Three-Wheeler Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Electric Three-Wheeler Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 23: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 24: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 31: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 32: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 36: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Electric Three-Wheeler Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Asia Electric Three-Wheeler Industry?

Key companies in the market include Lohia Auto Industries, ElecTrike Japa, Bajaj Auto Limited, Atul Auto Limited, Ningbo Dowedo International Trade Co Ltd, Mahindra and Mahindra Ltd, TVS Motor Company, Piaggio & C SpA, ChongQing Zongshen Tricycle Manufacturing Co Ltd, Scooters India Ltd.

3. What are the main segments of the Asia Electric Three-Wheeler Industry?

The market segments include Vehicle Type, Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Industry’s Shift Toward the Adoption of Electric Three Wheelers.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Electric Three-Wheeler Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Electric Three-Wheeler Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Electric Three-Wheeler Industry?

To stay informed about further developments, trends, and reports in the Asia Electric Three-Wheeler Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence