Key Insights

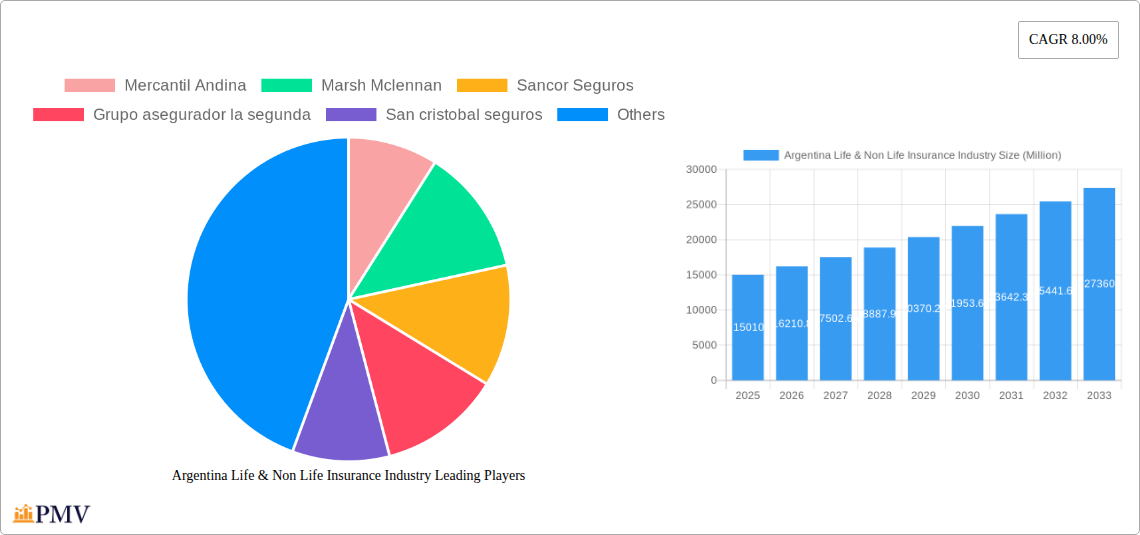

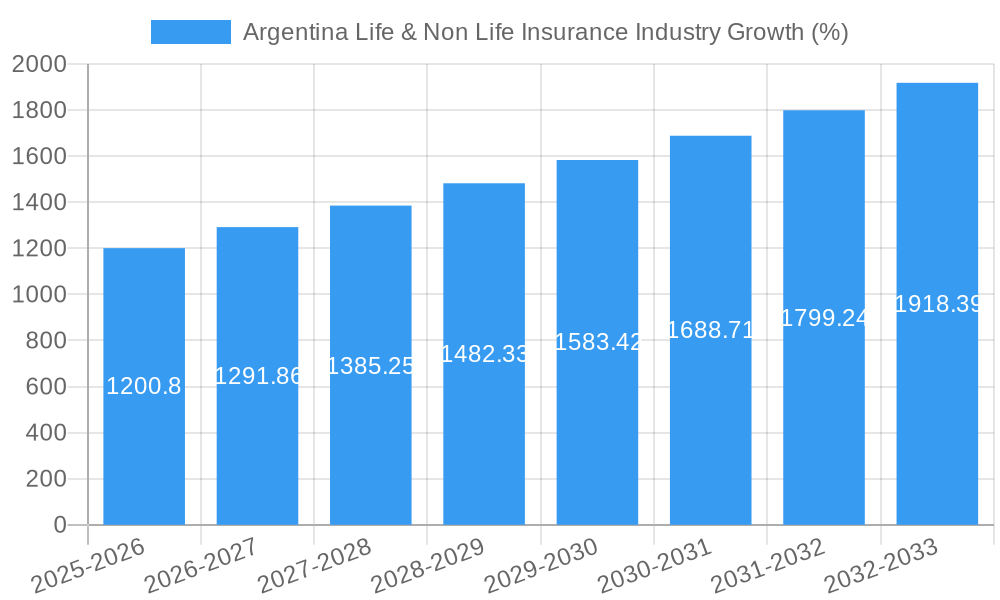

The Argentina Life & Non-Life Insurance market, valued at $15.01 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8% from 2025 to 2033. This growth is fueled by several key drivers. Rising disposable incomes and a growing middle class are increasing demand for insurance products, particularly health and life insurance. Furthermore, government initiatives promoting financial inclusion and insurance penetration are contributing to market expansion. Increasing awareness of the importance of risk management and protection against unforeseen events, coupled with effective marketing strategies by insurance companies, further fuels this growth. While economic instability and inflation pose challenges, the overall market outlook remains positive, driven by a rising demand for diverse insurance solutions. The competitive landscape comprises both domestic players such as Mercantil Andina, Sancor Seguros, and Grupo Asegurador La Segunda, and international companies like Chubb and Sura, indicating a blend of local expertise and global reach shaping the market's dynamics. The market segmentation (data unavailable but likely includes product lines like life, health, auto, and property) will likely reflect the diverse needs of the Argentine population and the focus of different players.

The forecast period (2025-2033) presents significant opportunities for growth, particularly in underserved segments and regions. The increasing adoption of digital technologies and Insurtech solutions provides avenues for enhanced customer experience and operational efficiency. However, regulatory changes and ongoing economic volatility could impact market growth trajectory. Companies are likely to focus on product innovation, strategic partnerships, and digital transformation to navigate these challenges and capture a larger market share. Successful players will be those who effectively adapt to evolving customer needs, leverage technological advancements, and maintain financial stability in a dynamic economic environment. Analyzing regional performance within Argentina will be crucial for targeted marketing and strategic investments.

Argentina Life & Non-Life Insurance Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Argentina Life & Non-Life Insurance industry, covering market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (historical period), with 2025 serving as the base and estimated year, and a forecast period extending from 2025-2033. This report is essential for insurers, investors, and industry stakeholders seeking actionable insights into this dynamic market. Market values are expressed in Millions.

Argentina Life & Non-Life Insurance Industry Market Structure & Competitive Dynamics

The Argentinian life and non-life insurance market exhibits a moderately concentrated structure, with several large players commanding significant market share. Market concentration is influenced by factors including stringent regulatory frameworks, the presence of both domestic and international insurers, and a complex M&A landscape. While precise market share data for each player fluctuates yearly, leading players such as Sancor Seguros and Grupo Asegurador La Segunda consistently hold substantial portions of the market. Innovation within the ecosystem is driven by both established firms adapting technology and the emergence of smaller, more agile players. Regulatory changes frequently impact market dynamics, necessitating continuous adaptation. Product substitutes, particularly in the non-life segment, are relatively limited. However, increased consumer awareness and demand for bespoke solutions are influencing product development. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, driven by strategic expansion and diversification goals.

- Market Concentration: Moderately concentrated, with several dominant players.

- M&A Activity: Moderate, with deal values between xx Million and xx Million.

- Innovation: Driven by technological adoption and agile newcomers.

- Regulatory Framework: Stringent and impacting market dynamics.

- Product Substitutes: Limited, with increasing demand for tailored solutions.

Argentina Life & Non-Life Insurance Industry Trends & Insights

The Argentinian life and non-life insurance market is characterized by a complex interplay of factors impacting its growth trajectory. The CAGR for the period 2019-2024 was xx%, with market penetration at xx%. Economic fluctuations significantly influence consumer spending on insurance products. Inflation and currency devaluation pose challenges, affecting both premium pricing and claim payouts. Technological disruption is transforming the industry through digital channels, data analytics, and AI-powered solutions. Consumer preferences are shifting towards personalized products and convenient digital services. This increased demand for tailored offerings necessitates insurers to develop innovative digital solutions while maintaining robust customer service. Competitive dynamics are intensifying, with players focusing on enhancing product offerings, strengthening distribution channels, and adopting advanced technologies to maintain market share.

Dominant Markets & Segments in Argentina Life & Non-Life Insurance Industry

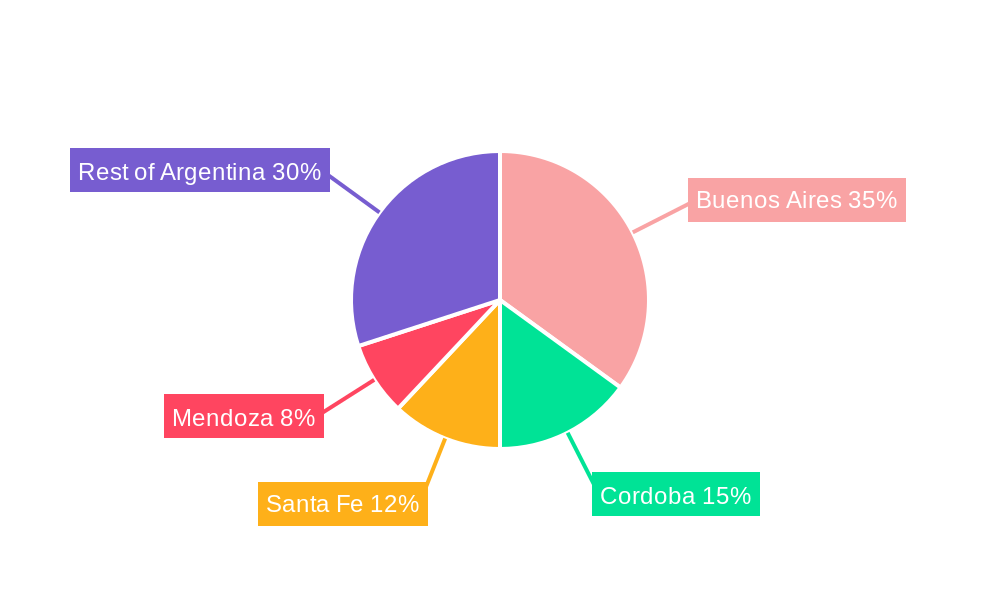

The Buenos Aires metropolitan area and surrounding regions represent the most dominant segment within the Argentinian insurance market due to higher population density, economic activity, and infrastructure development. Other significant regions include Córdoba and Santa Fe provinces. The non-life segment, particularly motor and property insurance, tends to dominate in terms of overall premium volume due to mandatory insurance regulations for vehicles.

- Key Drivers of Buenos Aires Dominance:

- High population density.

- Concentrated economic activity.

- Well-developed infrastructure.

- Stringent regulatory environment for vehicle insurance.

The market is also segmented by product type (life, health, motor, property, etc.) and distribution channels (direct, brokers, agents). The life insurance segment experiences slower growth compared to the non-life segment but shows potential for growth with evolving consumer needs and changing demographics.

Argentina Life & Non-Life Insurance Industry Product Innovations

Recent innovations focus on leveraging technology to enhance customer experience and operational efficiency. AI-powered pricing models are being implemented for increased accuracy and speed. Digital platforms are facilitating streamlined policy purchasing and claims management. Insurers are focusing on developing niche products catering to specific needs and offering flexible payment plans to attract and retain customers, adapting to the evolving needs and preferences of the Argentinian market.

Report Segmentation & Scope

The report segments the market by insurance type (life and non-life), product category (e.g., motor, health, property, etc.), distribution channel (direct, brokers, agents), and geographic region. Growth projections are provided for each segment, taking into account market size, competitive dynamics, and anticipated macroeconomic factors. The report provides detailed analysis and forecasts for each segment, highlighting key trends and growth opportunities.

Key Drivers of Argentina Life & Non-Life Insurance Industry Growth

Key growth drivers include increasing urbanization, rising disposable incomes (despite economic fluctuations), evolving consumer awareness of risk management, and government initiatives promoting financial inclusion. Technological advancements such as AI and data analytics are boosting efficiency and creating new product offerings. Furthermore, regulatory changes aimed at fostering market competition and consumer protection are indirectly contributing to growth.

Challenges in the Argentina Life & Non-Life Insurance Industry Sector

Significant challenges include macroeconomic instability, high inflation, and currency fluctuations. These factors affect both insurer profitability and consumer purchasing power. Regulatory complexities and bureaucratic hurdles can also impede efficient operations. Intense competition from both established players and new entrants requires continuous innovation and strategic adaptation to thrive. Lastly, a lack of financial literacy amongst a portion of the population remains a challenge in terms of penetration and market growth.

Leading Players in the Argentina Life & Non-Life Insurance Industry Market

- Mercantil Andina

- Marsh McLennan

- Sancor Seguros

- Grupo Asegurador La Segunda

- San Cristobal Seguros

- Chubb

- Parana Seguros

- Holando Seguros

- Experta Aseguradora de Riesgos del Trabajo S A

- Federacion Patronal Seguros

- Orbis Seguros

- Seguros Sura

Key Developments in Argentina Life & Non-Life Insurance Industry Sector

- June 2022: Seguros Sura partnered with Akur8, an AI pricing platform, to enhance its insurance pricing process across Argentina, Chile, and Colombia. This initiative aims to automate the pricing of life insurance products.

- October 2022: La Segunda introduced three new features for crop insurance, focusing on late corn: coverage of replanting expenses, extended hail and fire coverage, and policy discounts. This development reflects a focus on tailored agricultural insurance solutions.

Strategic Argentina Life & Non-Life Insurance Industry Market Outlook

The Argentinian life and non-life insurance market presents a complex but potentially rewarding landscape for insurers. Navigating the macroeconomic volatility and adapting to technological disruptions will be crucial for success. Insurers focusing on digital transformation, personalized products, and strategic partnerships will likely capture a larger share of the market. The growing demand for tailored solutions and the increasing use of technology will drive further innovation and market growth in the coming years. The forecast period shows promising potential, with consistent growth driven by market penetration and the adoption of new technological solutions.

Argentina Life & Non Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non- life insurance

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Argentina Life & Non Life Insurance Industry Segmentation By Geography

- 1. Argentina

Argentina Life & Non Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Life & Non Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non- life insurance

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mercantil Andina

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marsh Mclennan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sancor Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grupo asegurador la segunda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 San cristobal seguros

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Parana Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holando Seguros

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Experta Aseguradora de Riesgos del Trabajo S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Federacion Patronal Seguros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Orbis Seguros

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seguros Sura**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Mercantil Andina

List of Figures

- Figure 1: Argentina Life & Non Life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Life & Non Life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Life & Non Life Insurance Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Argentina Life & Non Life Insurance Industry?

Key companies in the market include Mercantil Andina, Marsh Mclennan, Sancor Seguros, Grupo asegurador la segunda, San cristobal seguros, Chubb, Parana Seguros, Holando Seguros, Experta Aseguradora de Riesgos del Trabajo S A, Federacion Patronal Seguros, Orbis Seguros, Seguros Sura**List Not Exhaustive.

3. What are the main segments of the Argentina Life & Non Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Seguros Sura collaborated with Akur8, an AI pricing platform, to boost its insurance pricing process across Argentina, Chile, and Colombia. This partnership will help Seguros Sura to automate the pricing process of their life insurance products to harmonize practices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Life & Non Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Life & Non Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Life & Non Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Argentina Life & Non Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence