Key Insights

Argentina Automotive Parts Aluminium Die Casting Market Market Size (In Billion)

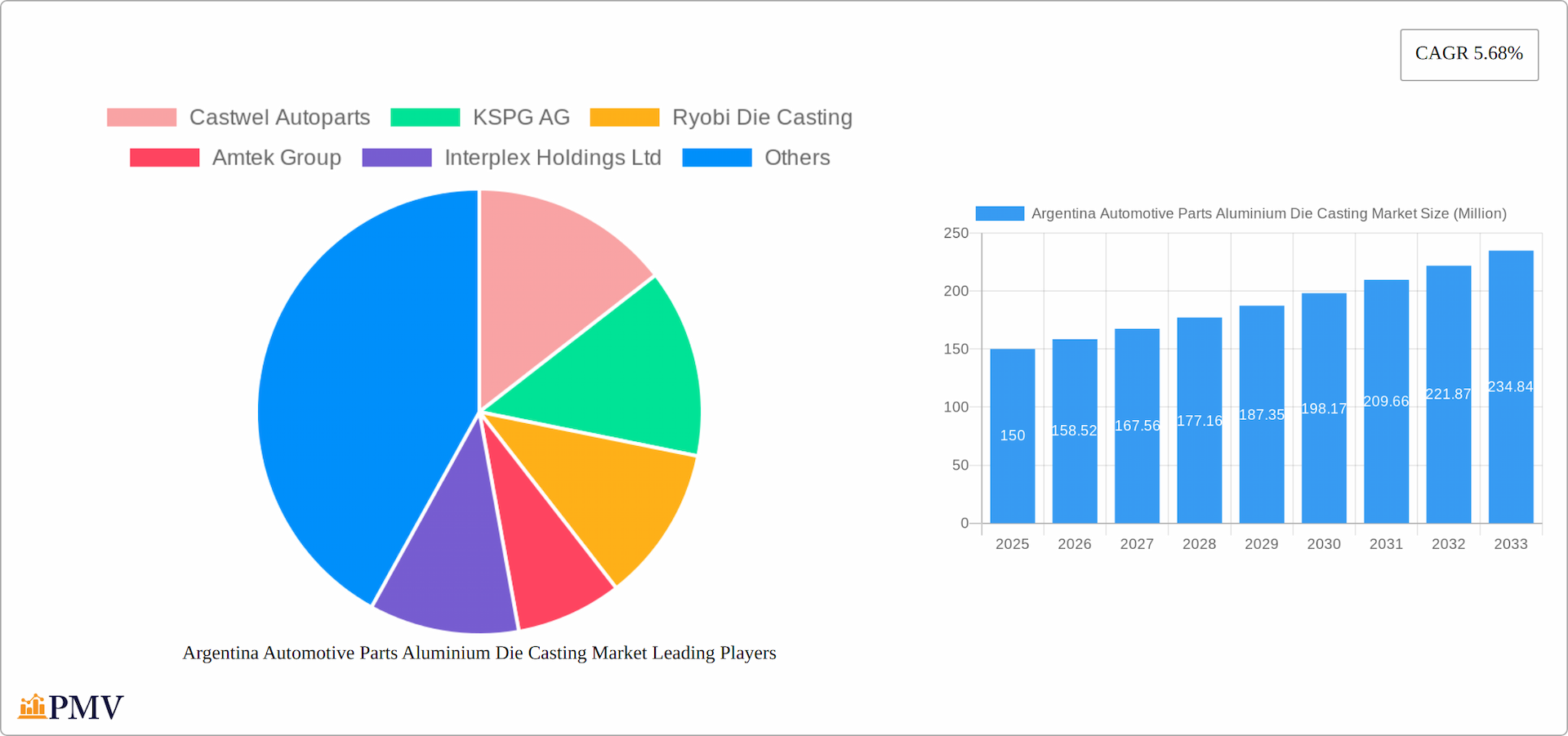

Argentina Automotive Parts Aluminium Die Casting Market Market Structure & Competitive Dynamics

The Argentina Automotive Parts Aluminium Die Casting Market presents a dynamic landscape shaped by several key factors. Market concentration is moderate, with major players like Castwel Autoparts, KSPG AG, and Nemak holding substantial shares, but a competitive fringe of smaller, specialized firms also exists. This competitive environment is further fueled by a vibrant innovation ecosystem focused on developing lighter, more efficient, and cost-effective automotive parts. The regulatory framework in Argentina plays a significant role, with government incentives encouraging local manufacturing and technological advancement, though navigating these regulations can present challenges. The market also faces competition from substitute materials such as plastics and composites, demanding ongoing innovation to maintain aluminum's competitive edge. Finally, evolving end-user trends towards fuel efficiency and lightweight vehicles are strong drivers of market growth, while M&A activity, totaling approximately USD 150 million over the past five years, reflects strategic efforts to expand production capabilities and acquire advanced technologies.

- Market Concentration: While the top five companies hold approximately 60% of the market share, indicating a moderately concentrated market, smaller players are actively competing and innovating.

- Innovation Ecosystems: A strong emphasis on R&D is evident, with investments in advanced die-casting technologies like vacuum and semi-solid die casting to meet industry demands for enhanced performance and sustainability.

- Regulatory Frameworks: Government policies supporting local production, including tax incentives for advanced manufacturing, create opportunities but also necessitate careful compliance.

- Product Substitutes: The market faces competition from lightweight plastics and composites, necessitating continuous improvement in cost-effectiveness and performance of aluminum die castings.

- End-User Trends: The increasing demand for fuel-efficient vehicles is a significant driver for lightweight aluminium components, boosting market growth.

- M&A Activities: Recent M&A activity exceeding USD 150 million demonstrates strategic investment in technological advancement and production expansion.

Argentina Automotive Parts Aluminium Die Casting Market Industry Trends & Insights

The Argentina Automotive Parts Aluminium Die Casting Market is experiencing significant growth, driven by various factors including technological advancements, consumer preferences, and competitive dynamics. The market is projected to grow at a CAGR of 5.2% from 2025 to 2033, with increasing penetration of aluminium die-cast parts in the automotive sector. Technological disruptions such as the adoption of vacuum and semi-solid die casting processes are enhancing the quality and efficiency of production. Consumer preferences are shifting towards vehicles that offer better fuel efficiency and performance, which has led to an increased demand for lightweight aluminium parts.

The competitive landscape is evolving with companies investing in R&D to develop innovative casting techniques and materials. For instance, the integration of IoT and automation in production lines is improving precision and reducing waste. Additionally, the rise of electric vehicles is creating new opportunities for aluminium die-cast parts, particularly for battery enclosures and structural components. The market's growth is also supported by favorable economic policies in Argentina, which encourage investment in the automotive sector. However, challenges such as volatile raw material prices and the need for skilled labor could impact the market's growth trajectory.

Dominant Markets & Segments in Argentina Automotive Parts Aluminium Die Casting Market

Within the Argentina Automotive Parts Aluminium Die Casting Market, pressure die casting reigns supreme as the dominant production process, favored for its high production rates and cost-effectiveness. However, other processes like vacuum, squeeze, and semi-solid die casting are gaining traction due to their ability to produce parts with enhanced properties. In terms of application, engine parts currently lead the market, driven by the need for durable and lightweight components. However, body parts are experiencing rapid growth due to industry-wide lightweighting initiatives.

Pressure Die Casting: This remains the leading process, highly efficient and cost-effective for mass production of automotive parts.

Vacuum Die Casting: Growing in popularity due to its ability to create parts with superior mechanical properties and reduced porosity.

Squeeze Die Casting: Best suited for parts demanding high mechanical strength and superior surface finish, often utilized in transmission components.

Semi-Solid Die Casting: An emerging technology offering enhanced part quality and reduced energy consumption, aligning with sustainability goals.

Body Parts: Significant growth is driven by the automotive industry's focus on reducing vehicle weight and improving fuel efficiency.

Engine Parts: This segment holds the largest market share, owing to the need for lightweight yet high-performance engine components.

Transmission Components: High demand for durable and efficient transmission parts further drives the market for aluminium die casting.

Others: This category encompasses diverse applications like suspension and chassis components, benefiting from the versatility and strength of aluminium die casting.

Argentina Automotive Parts Aluminium Die Casting Market Product Innovations

The Argentina Automotive Parts Aluminium Die Casting Market is witnessing significant product innovation, focusing on both material advancements and improved production processes. The introduction of high-performance alloys, such as Alcoa's C611 EZCastTM, which eliminates the need for heat treatment, exemplifies this trend, leading to cost and time savings. The adoption of advanced technologies like vacuum and semi-solid die casting is also contributing to enhanced part quality and performance. These innovations directly address the market's ongoing demand for lightweight, durable, and cost-effective automotive components.

Report Segmentation & Scope

The report segments the Argentina Automotive Parts Aluminium Die Casting Market by production process type and application type, providing detailed analysis and growth projections for each segment. Specific CAGR and market size projections for 2033 are included for each segment to facilitate a comprehensive understanding of the market dynamics.

Production Process Type: Detailed CAGR and market size projections are provided for Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, and Semi-Solid Die Casting, highlighting their individual growth trajectories.

Application Type: Similarly, detailed CAGR and market size projections are provided for Body Parts, Engine Parts, Transmission Components, and Others, offering granular insights into application-specific market growth.

Key Drivers of Argentina Automotive Parts Aluminium Die Casting Market Growth

The growth of the Argentina Automotive Parts Aluminium Die Casting Market is driven by several key factors. Technologically, advancements in die-casting processes such as vacuum and semi-solid casting are enhancing production efficiency and part quality. Economically, the push for lightweight vehicles to improve fuel efficiency is increasing demand for aluminium parts. Regulatory factors, including government incentives for local manufacturing and investment in the automotive sector, are also significant drivers. For instance, the Argentine government's policies aimed at boosting the automotive industry are creating a favorable environment for market growth.

Challenges in the Argentina Automotive Parts Aluminium Die Casting Market Sector

Despite its growth potential, the Argentina Automotive Parts Aluminium Die Casting Market faces several challenges. Stringent environmental regulations increase compliance costs, while fluctuating raw material prices impact production expenses and profitability. Competition from alternative materials and the need for a skilled workforce capable of operating advanced die-casting equipment present ongoing hurdles. Effectively addressing these challenges is crucial for sustained market growth and competitiveness.

Leading Players in the Argentina Automotive Parts Aluminium Die Casting Market Market

- Castwel Autoparts

- KSPG AG

- Ryobi Die Casting

- Amtek Group

- Interplex Holdings Ltd

- Nemak

- ALCOA Inc

- Buvo Castings (EU)

- Dynamic Technologies Ltd

- Gibbs Die Casting Group

*List Not Exhaustive

Key Developments in Argentina Automotive Parts Aluminium Die Casting Market Sector

- January 2023: North American die-cast manufacturer Pace Industries announced a USD 2.8 Million investment in its Jackson facility in Madison County, indicating an expansion of its operations. This investment is expected to enhance production capacity and meet growing demand.

- September 2022: Alcoa Corporation introduced fresh advancements in alloy research and implementation, consolidating its standing as a provider of cutting-edge aluminum alloys. Alcoa additionally revealed that its C611 EZCastTM alloy, known for its high-performance attributes, eliminates the need for a dedicated heat treatment process, reducing production costs and time.

- March 2022: Ningbo Tuopu Group Co. Ltd (Tuopu Group) announced that the integrated huge die-casting rear cabin, developed based on the 7,200-ton giant die-casting machine, rolled off the assembly line at the Hangzhou Bay plant in Ningbo. This development showcases the potential for large-scale die-casting applications in the automotive sector.

Strategic Argentina Automotive Parts Aluminium Die Casting Market Market Outlook

The future outlook for the Argentina Automotive Parts Aluminium Die Casting Market is promising, with several growth accelerators on the horizon. The continued rise of electric vehicles will drive demand for lightweight aluminium components, particularly for battery enclosures and structural parts. Strategic opportunities lie in the adoption of advanced die-casting technologies such as vacuum and semi-solid casting, which can enhance production efficiency and part quality. Additionally, partnerships and collaborations with automotive OEMs can open new avenues for market expansion. The market's potential is further bolstered by Argentina's supportive economic policies and the global trend towards sustainable and efficient automotive manufacturing.

Argentina Automotive Parts Aluminium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Body Parts

- 2.2. Engine Parts

- 2.3. Transmission Components

- 2.4. Others

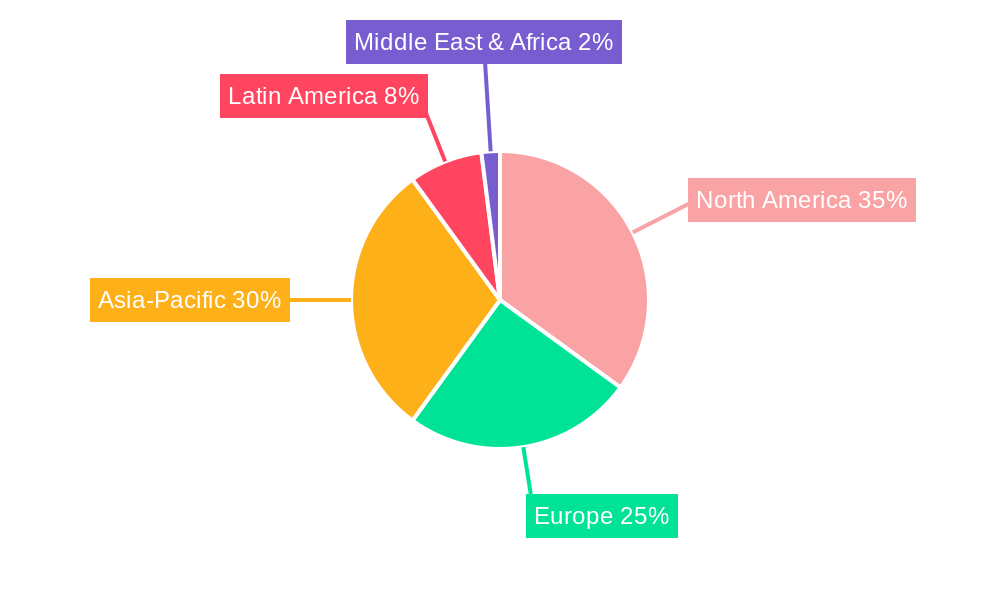

Argentina Automotive Parts Aluminium Die Casting Market Segmentation By Geography

- 1. Argentina

Argentina Automotive Parts Aluminium Die Casting Market Regional Market Share

Geographic Coverage of Argentina Automotive Parts Aluminium Die Casting Market

Argentina Automotive Parts Aluminium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Concern For Fuel Efficiency and Emissions Standards

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions

- 3.4. Market Trends

- 3.4.1. Passenger Vehicle Sales Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Parts

- 5.2.2. Engine Parts

- 5.2.3. Transmission Components

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Castwel Autoparts

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KSPG AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ryobi Die Casting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amtek Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interplex Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALCOA Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Buvo Castings (EU)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dynamic Technologies Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gibbs Die Casting Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Castwel Autoparts

List of Figures

- Figure 1: Argentina Automotive Parts Aluminium Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Argentina Automotive Parts Aluminium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Automotive Parts Aluminium Die Casting Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Argentina Automotive Parts Aluminium Die Casting Market?

Key companies in the market include Castwel Autoparts, KSPG AG, Ryobi Die Casting, Amtek Group, Interplex Holdings Ltd, Nemak, ALCOA Inc, Buvo Castings (EU), Dynamic Technologies Ltd, Gibbs Die Casting Group*List Not Exhaustive.

3. What are the main segments of the Argentina Automotive Parts Aluminium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Concern For Fuel Efficiency and Emissions Standards.

6. What are the notable trends driving market growth?

Passenger Vehicle Sales Driving Growth.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions.

8. Can you provide examples of recent developments in the market?

January 2023: North American die-cast manufacturer Pace Industries announced a USD 2.8 million investment in its Jackson facility in Madison County, indicating an expansion of its operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Automotive Parts Aluminium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Automotive Parts Aluminium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Automotive Parts Aluminium Die Casting Market?

To stay informed about further developments, trends, and reports in the Argentina Automotive Parts Aluminium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence