Key Insights

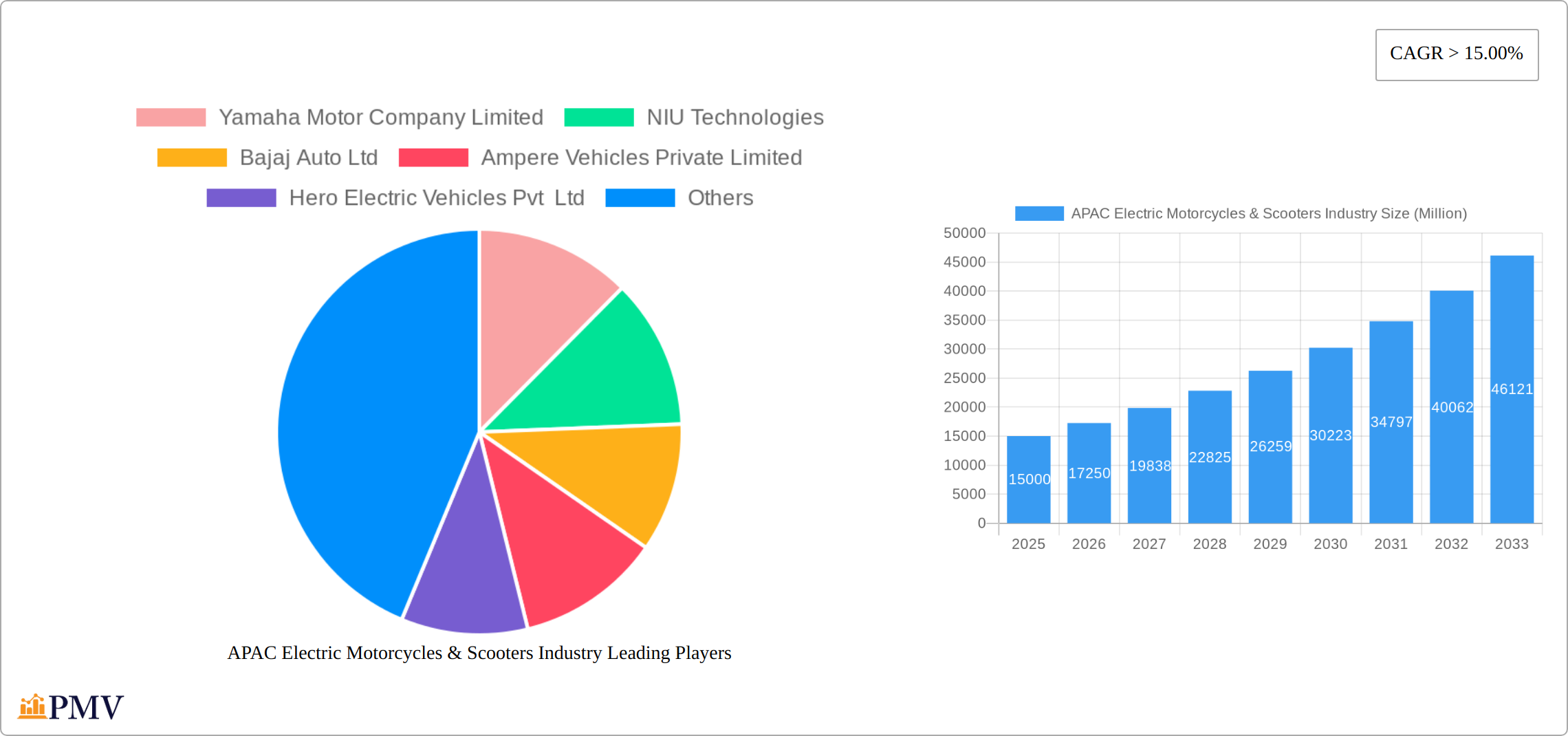

The Asia-Pacific (APAC) electric motorcycles and scooters market is experiencing robust growth, driven by increasing environmental concerns, government incentives promoting electric vehicle adoption, and the rising affordability of electric two-wheelers. A compound annual growth rate (CAGR) exceeding 15% indicates a significant expansion, with the market size expected to reach substantial figures by 2033. Key growth drivers include expanding charging infrastructure, technological advancements leading to improved battery life and performance, and a shift towards sustainable transportation solutions in densely populated urban areas. China and India are currently the dominant markets within APAC, contributing significantly to the overall market size. However, other countries like Japan and South Korea are also witnessing increasing adoption rates, fueled by their strong technological capabilities and environmentally conscious consumer base. The market is segmented by propulsion type (hybrid and electric) and geographically. While hybrid vehicles contribute to the overall market, pure electric scooters and motorcycles are experiencing the most rapid growth due to their lower running costs and environmental benefits. The competitive landscape is characterized by a mix of established automotive players like Yamaha and Bajaj Auto, alongside emerging electric vehicle startups such as NIU Technologies and Ola Electric, resulting in fierce competition and rapid innovation. Challenges facing the market include the relatively higher initial cost of electric vehicles compared to gasoline-powered models and concerns regarding battery lifespan and charging infrastructure availability in certain regions. Nevertheless, government policies aimed at reducing emissions and fostering the electric vehicle sector are expected to mitigate these challenges and further accelerate market expansion throughout the forecast period.

The significant growth in the APAC electric two-wheeler market is poised to continue, particularly fueled by increasing urban populations and rising middle-class incomes, making electric vehicles a more accessible and attractive transport option. The industry is witnessing considerable investment in research and development, leading to improved battery technology, enhanced performance, and greater consumer confidence. The proliferation of innovative business models, including battery swapping programs and subscription services, further accelerates market penetration. Furthermore, collaborations between established automotive manufacturers and technology companies are fostering the development of smart, connected electric two-wheelers with advanced features, adding to their appeal. Although challenges remain in ensuring widespread charging infrastructure and addressing consumer range anxiety, ongoing government support and private sector investments are paving the way for substantial market expansion across the APAC region in the coming years. The diverse range of players, from established manufacturers to agile startups, ensures a vibrant and dynamic market with ongoing innovation and competition.

APAC Electric Motorcycles & Scooters Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) electric motorcycles and scooters industry, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth prospects, equipping stakeholders with actionable intelligence to navigate this rapidly evolving sector. The report leverages rigorous data analysis, incorporating key industry developments and expert opinions, to provide a holistic view of the APAC electric two-wheeler market. With a focus on key players such as Yamaha, NIU Technologies, and Bajaj Auto, this report is essential for investors, manufacturers, and industry professionals seeking to capitalize on the burgeoning electric mobility revolution in APAC.

APAC Electric Motorcycles & Scooters Industry Market Structure & Competitive Dynamics

This section analyzes the APAC electric motorcycle and scooter market's structure and competitive landscape, encompassing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of established players and emerging startups. Market share is highly dynamic, with intense competition driven by technological innovation and government incentives. The xx Million market value is dominated by a few key players, but smaller companies are rapidly gaining traction with niche offerings and disruptive technologies.

- Market Concentration: The APAC electric two-wheeler market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% of the total market share in 2024.

- Innovation Ecosystems: Strong government support for R&D, coupled with a vibrant startup ecosystem, fuels rapid innovation in battery technology, charging infrastructure, and smart features.

- Regulatory Frameworks: Varying government regulations across APAC countries influence market access and adoption rates. Incentive schemes and emission standards significantly impact the market growth trajectory.

- Product Substitutes: Competition arises from traditional internal combustion engine (ICE) motorcycles and scooters, as well as other forms of personal transportation like bicycles and ride-sharing services.

- End-User Trends: Growing environmental awareness, rising fuel prices, and the increasing affordability of electric vehicles are driving consumer preference for electric two-wheelers.

- M&A Activities: The APAC electric two-wheeler market has witnessed several significant M&A deals in recent years, valued at approximately xx Million, primarily driven by strategies for expanding market reach and acquiring technological expertise.

APAC Electric Motorcycles & Scooters Industry Industry Trends & Insights

The APAC electric motorcycle and scooter market exhibits robust growth driven by several factors. Government policies promoting electric mobility, along with increasing environmental concerns and technological advancements, are key drivers. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Market penetration is rapidly increasing, particularly in urban areas with supportive infrastructure. Technological disruptions, such as advancements in battery technology and charging infrastructure, are significantly impacting market dynamics. Consumer preferences are shifting towards feature-rich, technologically advanced, and affordable electric vehicles.

Dominant Markets & Segments in APAC Electric Motorcycles & Scooters Industry

China and India dominate the APAC electric motorcycle and scooter market, primarily due to large populations, supportive government policies, and a rapidly expanding middle class. Japan and South Korea also contribute significantly, although their market shares are smaller compared to China and India. The electric segment within Propulsion Type holds a substantially larger market share than the hybrid segment due to cost-effectiveness and technological advancements.

- China:

- Strong government support for electric vehicles.

- Extensive manufacturing base and supply chain.

- High consumer adoption rates.

- India:

- Large and growing consumer base.

- Increasing affordability of electric two-wheelers.

- Government initiatives promoting electric mobility.

- Japan:

- Technological advancements in battery technology and electric vehicle components.

- Focus on high-quality and technologically advanced products.

- South Korea:

- Development of advanced electric vehicle technologies.

- Government initiatives to support the adoption of electric vehicles.

APAC Electric Motorcycles & Scooters Industry Product Innovations

The APAC electric motorcycle and scooter industry is characterized by continuous product innovation, focusing on enhancing battery life, range, charging speed, and smart features. Advancements in battery technology, such as solid-state batteries and improved battery management systems, are improving performance and range. Integration of smart features, like connectivity, GPS navigation, and anti-theft systems, is further enhancing consumer appeal. This innovation is crucial for maintaining a competitive edge in the market.

Report Segmentation & Scope

This report segments the APAC electric motorcycle and scooter market by propulsion type (Hybrid and Electric) and by country (China, India, Japan, South Korea). Growth projections and market size estimations are provided for each segment, alongside analyses of competitive dynamics.

- Propulsion Type: The Electric segment is projected to dominate the market throughout the forecast period, driven by its cost-effectiveness and technological improvements. The Hybrid segment is expected to experience moderate growth, but its market share will remain comparatively small.

- Country: China and India will continue to be the leading markets, while Japan and South Korea are expected to showcase steady growth, although at a slower pace compared to the leading nations.

Key Drivers of APAP Electric Motorcycles & Scooters Industry Growth

Several factors are driving the growth of the APAC electric motorcycle and scooter industry. These include:

- Government incentives and policies: Subsidies, tax breaks, and emission standards are encouraging adoption.

- Technological advancements: Improvements in battery technology and charging infrastructure are enhancing vehicle performance and usability.

- Rising fuel prices and environmental concerns: These factors are boosting consumer interest in eco-friendly alternatives.

- Increasing affordability: The decreasing cost of electric two-wheelers is making them more accessible to a broader consumer base.

Challenges in the APAC Electric Motorcycles & Scooters Industry Sector

Despite significant growth potential, several challenges exist in the APAC electric motorcycle and scooter industry. These include:

- Range anxiety: Consumers remain concerned about limited driving ranges.

- Charging infrastructure limitations: Inadequate charging infrastructure in some areas hampers adoption.

- High initial purchase costs: Although costs are decreasing, electric vehicles remain more expensive than comparable ICE vehicles in some segments.

- Battery lifespan and recycling concerns: Managing battery disposal and recycling remains a significant environmental challenge.

Leading Players in the APAC Electric Motorcycles & Scooters Industry Market

- Yamaha Motor Company Limited

- NIU Technologies

- Bajaj Auto Ltd

- Ampere Vehicles Private Limited

- Hero Electric Vehicles Pvt Ltd

- Yadea Group Holdings Ltd

- Okinawa Autotech Pvt Ltd

- Zhejiang Luyuan Electric Vehicle Co Ltd

- Dongguan Tailing Electric Vehicle Co Ltd

- Gogoro Limited

- TVS Motor Company Limited

- REVOLT Intellicorp Pvt Ltd

- Ola Electric Mobility Pvt Ltd

- Ather Energy Pvt Ltd

Key Developments in APAC Electric Motorcycles & Scooters Industry Sector

- January 2023: Yadea launched new products and technologies at CES, showcasing advancements in electric two-wheeler technology.

- September 2022: Gogoro launched its battery swapping system and Smart scooters in Tel Aviv, expanding its global reach.

- August 2022: An unnamed company established a new R&D center, focusing on product innovation and improvement.

Strategic APAC Electric Motorcycles & Scooters Industry Market Outlook

The APAC electric motorcycle and scooter market holds immense potential for future growth. Continued technological innovation, supportive government policies, and increasing consumer awareness will drive market expansion. Strategic opportunities exist for companies focusing on battery technology, charging infrastructure, and innovative product design. The market is poised for significant expansion, offering lucrative prospects for early entrants and established players alike.

APAC Electric Motorcycles & Scooters Industry Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

APAC Electric Motorcycles & Scooters Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Electric Motorcycles & Scooters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Hybrid and Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Hybrid and Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Hybrid and Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Hybrid and Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Hybrid and Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. North America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Argentina

- 15. Middle East and Africa APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Yamaha Motor Company Limited

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 NIU Technologies

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bajaj Auto Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Ampere Vehicles Private Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hero Electric Vehicles Pvt Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Yadea Group Holdings Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Okinawa Autotech Pvt Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Zhejiang Luyuan Electric Vehicl

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dongguan Tailing Electric Vehicle Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Gogoro Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 TVS Motor Company Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 REVOLT Intellicorp Pvt Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Ola Electric Mobility Pvt Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Ather Energy Pvt Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Yamaha Motor Company Limited

List of Figures

- Figure 1: Global APAC Electric Motorcycles & Scooters Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 13: North America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 14: North America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 17: South America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 18: South America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 21: Europe APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 22: Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 25: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 26: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 29: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 30: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of North America APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: India APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Mexico APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Brazil APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 28: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Mexico APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 33: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of South America APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 38: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: United Kingdom APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Germany APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: France APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Spain APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Russia APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Benelux APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Nordics APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 49: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Turkey APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Israel APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: GCC APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: North Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 57: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: China APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Japan APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: ASEAN APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Oceania APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Electric Motorcycles & Scooters Industry?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the APAC Electric Motorcycles & Scooters Industry?

Key companies in the market include Yamaha Motor Company Limited, NIU Technologies, Bajaj Auto Ltd, Ampere Vehicles Private Limited, Hero Electric Vehicles Pvt Ltd, Yadea Group Holdings Ltd, Okinawa Autotech Pvt Ltd, Zhejiang Luyuan Electric Vehicl, Dongguan Tailing Electric Vehicle Co Ltd, Gogoro Limited, TVS Motor Company Limited, REVOLT Intellicorp Pvt Ltd, Ola Electric Mobility Pvt Ltd, Ather Energy Pvt Ltd.

3. What are the main segments of the APAC Electric Motorcycles & Scooters Industry?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

January 2023: Yadea, the world's leading electric two-wheeler brand, made its debut at the Consumer Electronics Show (CES) in Las Vegas, Nevada, unveiling a range of new products and technologies in its 2023 product launch.September 2022: Gogoro Inc. announced the launch of its industry-leading battery swapping system and Smart scooters in the Tel Aviv metropolitan area. In partnership with market leaders Metro Motor and Paz Group, the companies expect to launch in other cities in Israel in the future.August 2022: The company announced the establishment of a new R&D center, which it claims will help introduce new features, and improve quality, safety, and technological innovations for its products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Electric Motorcycles & Scooters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Electric Motorcycles & Scooters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Electric Motorcycles & Scooters Industry?

To stay informed about further developments, trends, and reports in the APAC Electric Motorcycles & Scooters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence