Key Insights

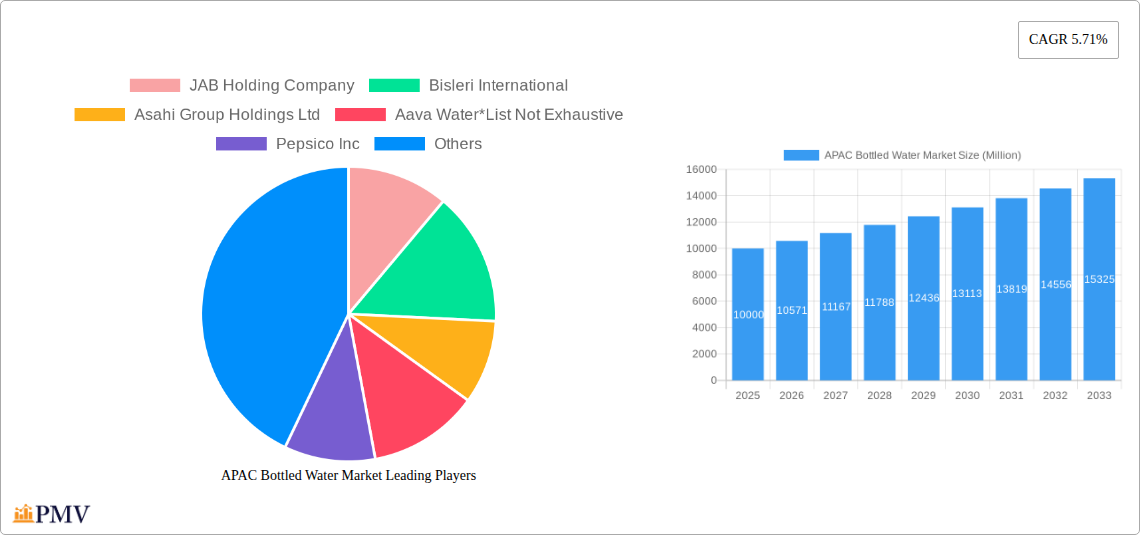

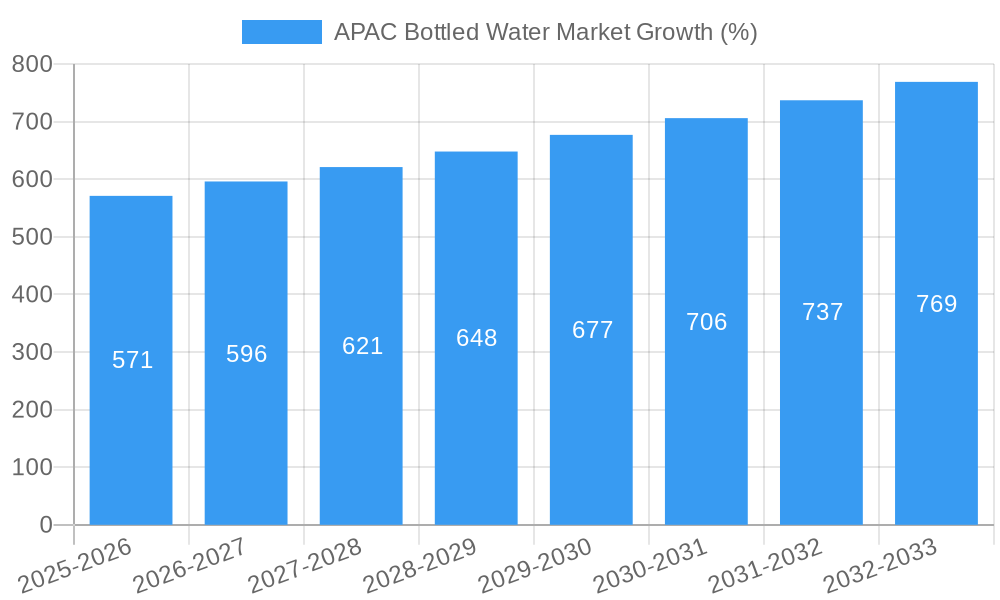

The Asia-Pacific (APAC) bottled water market is experiencing robust growth, driven by rising health consciousness, increasing disposable incomes, and a growing preference for convenient hydration solutions. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 5.71% and a hypothetical 2019 market size), is projected to expand significantly over the forecast period (2025-2033). Key growth drivers include the escalating demand for functional waters enriched with vitamins, minerals, or electrolytes, coupled with shifting consumer preferences toward healthier alternatives to sugary drinks. The increasing urbanization across the region further fuels market expansion, as readily accessible bottled water becomes increasingly vital for urban populations. Significant market segmentation exists, with the off-trade channel (supermarkets, convenience stores) dominating sales, while still water holds the largest market share within the product type segment. Leading players like Coca-Cola, Nestlé, and PepsiCo are aggressively investing in product innovation and distribution networks to capitalize on this lucrative market. However, environmental concerns surrounding plastic waste and fluctuating raw material prices pose significant restraints on market growth.

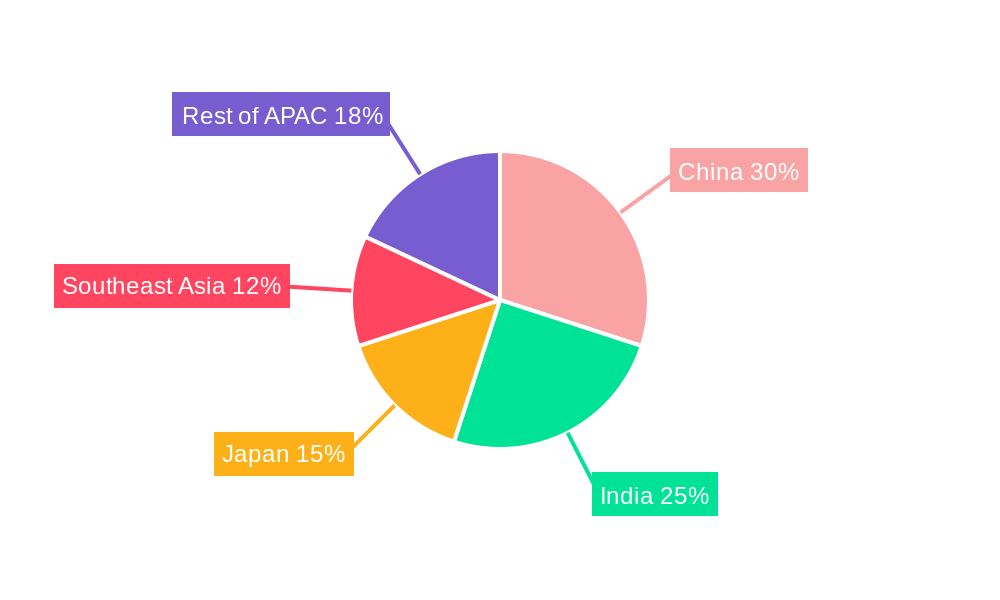

Within the APAC region, considerable variations exist in market dynamics across countries. China, India, and Japan represent major markets, exhibiting high consumption rates driven by population size and economic development. Growth in Southeast Asian nations is also noteworthy, owing to rising middle-class populations and increased access to modern retail channels. The competitive landscape is characterized by a mix of established multinational corporations and local players. The ongoing trend toward premiumization—consumers opting for higher-priced, functional, or sustainably packaged water—presents an opportunity for both established and emerging brands. Future growth will hinge on addressing environmental sustainability issues, innovating with product offerings, and effectively penetrating underserved markets within the region. Strategic partnerships, mergers, and acquisitions are likely to shape the competitive dynamics in the coming years.

APAC Bottled Water Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific bottled water market, covering the period from 2019 to 2033. It offers invaluable insights into market trends, competitive dynamics, and future growth opportunities, equipping stakeholders with the knowledge needed to navigate this dynamic sector. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project market trends up to 2033. Key players like Coca-Cola, Nestlé, and Danone are analyzed, along with emerging brands like Aava Water. The market is segmented by distribution channel (on-trade, off-trade) and water type (still, sparkling, functional). The report is crucial for investors, manufacturers, distributors, and anyone seeking to understand this rapidly evolving market.

APAC Bottled Water Market Structure & Competitive Dynamics

The APAC bottled water market exhibits a complex structure, shaped by diverse competitive dynamics. Market concentration is moderate, with a few multinational giants holding significant shares alongside numerous regional and local players. Key players such as The Coca-Cola Company, Nestlé S.A., Danone S.A., and PepsiCo Inc. dominate the market, leveraging extensive distribution networks and strong brand recognition. However, regional players like Bisleri International and Tibet Water Resources Ltd. maintain substantial market share within their respective geographic areas. The market exhibits a dynamic innovation ecosystem, with continuous product launches and diversification driving competition. Regulatory frameworks vary across APAC nations, influencing pricing, labeling, and sustainability practices. The market faces competition from substitutes such as tap water and other beverages. Consumer preferences are evolving towards healthier and functional options, creating opportunities for specialized bottled water products.

M&A activity has been relatively moderate in recent years, with deal values averaging xx Million. However, strategic acquisitions are anticipated to increase as larger players seek to expand their market reach and product portfolios. For example, a recent xx Million acquisition of a regional bottled water brand by a multinational player showcases this trend. Market share analysis reveals that the top five players collectively hold approximately xx% of the market share, leaving significant opportunities for smaller players to thrive with niche products and strategic regional focus.

APAC Bottled Water Market Industry Trends & Insights

The APAC bottled water market is experiencing robust growth, driven by several key factors. Rising disposable incomes and urbanization are fueling increased demand for convenient and readily available hydration options. Health and wellness trends, particularly the growing awareness of the importance of hydration, are further boosting consumption. The increasing prevalence of lifestyle diseases and a shift towards healthier alternatives are also contributing to market expansion. Consumer preference for premium and functional bottled water is driving innovation and product diversification, with a focus on flavored, enhanced, and mineral-rich waters. The market is witnessing technological disruptions, with advancements in packaging, manufacturing, and distribution efficiency. The adoption of sustainable and eco-friendly packaging solutions is also gaining momentum, driven by growing environmental concerns.

The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, reflecting the aforementioned growth drivers. Market penetration is expected to increase significantly in underdeveloped regions, driven by rising incomes and improved infrastructure. Intense competition among established players and emerging brands creates price sensitivity and necessitates continuous innovation to maintain a competitive edge. The rising focus on sustainability presents both challenges and opportunities for companies to adopt environmentally friendly practices and appeal to the increasing number of environmentally conscious consumers.

Dominant Markets & Segments in APAC Bottled Water Market

Leading Region: China dominates the APAC bottled water market due to its vast population, high disposable income in urban areas, and rapidly growing demand for packaged beverages.

Leading Country: China leads in consumption volume and value, driving significant market share. India follows closely, fueled by a large population and increasing health consciousness.

Dominant Segment – Distribution Channel: The off-trade segment (retail stores, supermarkets, online channels) holds the largest market share, reflecting consumer preference for convenience and readily available products.

Dominant Segment – Type: Still water remains the dominant segment, driven by its widespread acceptance and perceived health benefits. However, the sparkling water segment is experiencing rapid growth due to the rising popularity of flavored and functional waters.

Key Drivers for China's Dominance:

- Strong economic growth and rising disposable incomes.

- Extensive and well-established distribution networks.

- Increasing health awareness among consumers.

- Favorable regulatory environment.

Key Drivers for India's Growth:

- Large and growing population.

- Increasing urbanization and changing lifestyles.

- Rising health consciousness and preference for healthy beverages.

- Expanding retail infrastructure and online channels.

The analysis reveals that while still water holds the largest segment in terms of volume, sparkling and functional waters are exhibiting the highest growth rates, driven by increasing health awareness and evolving consumer preferences for unique flavors and added benefits.

APAP Bottled Water Market Product Innovations

The APAC bottled water market is witnessing significant product innovation, focusing on enhanced functionality, unique flavors, and sustainable packaging. Recent launches include fruit-infused sparkling waters, mineral-rich waters targeting specific health benefits, and waters with added electrolytes or vitamins. Companies are also investing in innovative packaging materials, such as recyclable and biodegradable plastics, to address environmental concerns. This product innovation is driven by consumers’ demand for healthier and more convenient alternatives to traditional carbonated soft drinks, and companies are actively responding by introducing products that cater to this demand, creating a more competitive market landscape.

Report Segmentation & Scope

The APAC bottled water market is segmented based on distribution channels and product types.

Distribution Channel:

- On-Trade: This segment includes sales through restaurants, hotels, and bars. Growth is driven by increasing tourism and out-of-home consumption patterns. Market size is projected to reach xx Million by 2033.

- Off-Trade: This segment includes retail sales through supermarkets, convenience stores, and online channels. It represents the larger market share, fueled by widespread availability and convenience. Market size is projected to reach xx Million by 2033.

Product Type:

- Still Water: This segment dominates the market due to its widespread acceptance and perceived health benefits. Market size is projected to reach xx Million by 2033.

- Sparkling Water: This segment is experiencing the fastest growth due to rising demand for flavored and functional waters. Market size is projected to reach xx Million by 2033.

- Functional Water: This segment includes water enhanced with vitamins, minerals, or electrolytes. It is characterized by premium pricing and targeted marketing towards health-conscious consumers. Market size is projected to reach xx Million by 2033.

Key Drivers of APAC Bottled Water Market Growth

Several factors are driving the growth of the APAC bottled water market. Rising disposable incomes in many APAC countries are leading to increased spending on convenience goods, including bottled water. Urbanization is driving up demand for convenient hydration options, especially in densely populated areas. Health and wellness trends are also contributing to the rise in bottled water consumption, with consumers increasingly seeking healthier alternatives to sugary drinks. Furthermore, improving retail infrastructure and distribution networks are making bottled water more accessible to a wider consumer base.

Challenges in the APAC Bottled Water Market Sector

The APAC bottled water market faces several challenges. Fluctuating raw material prices (e.g., plastic resin) and transportation costs can impact profitability. Stringent regulations regarding water quality and labeling vary across different countries, posing compliance challenges for manufacturers. The growing environmental concerns surrounding plastic waste necessitate the adoption of eco-friendly packaging solutions, adding to production costs. Finally, intense competition among numerous players, including both international and local brands, puts downward pressure on pricing and profit margins.

Leading Players in the APAC Bottled Water Market

- JAB Holding Company

- Bisleri International

- Asahi Group Holdings Ltd

- Aava Water

- Pepsico Inc

- Danone S.A.

- The Coca-Cola Company

- TATA Group

- Suntory Beverage & Food Ltd

- Tibet Water Resources Ltd

- Nestlé S.A.

Key Developments in APAC Bottled Water Market Sector

- January 2022: An unnamed company unveiled a range of four distinct fruit and botanical flavor combinations in its sparkling water line for the Indian market.

- March 2022: Danone Waters China introduced its inaugural zero-sugar sparkling water.

- October 2022: The Coca-Cola Company launched SmartWater in the Chinese market.

- November 2022: Aava launched its sparkling water range.

These launches highlight the growing trend towards healthier and more flavorful options within the APAC bottled water market, showcasing innovation and increased competition in the sector.

Strategic APAC Bottled Water Market Outlook

The APAC bottled water market presents significant growth opportunities in the coming years. Continued economic growth and urbanization will fuel demand for convenient hydration solutions. The increasing health consciousness of consumers will drive demand for functional and premium bottled water products. Companies that successfully adapt to evolving consumer preferences, embrace sustainable practices, and innovate in product development and distribution will be best positioned to capitalize on the market's potential. Focus on niche markets, efficient supply chains, and environmentally friendly packaging will be crucial for long-term success.

APAC Bottled Water Market Segmentation

-

1. Type

- 1.1. Still Water

- 1.2. Sparkling Water

- 1.3. Functional Water

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Home and Office Delivery (HOD)

- 2.2.4. Online Retail Stores

- 2.2.5. Other Off-trade Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

APAC Bottled Water Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.71% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Premiumization With the Growth of Fortified and Flavored Water; Lack of Safe Drinking Water Propels the Market Studied

- 3.3. Market Restrains

- 3.3.1. Unorganized Sector Coupled With Counterfeit Scandals of Bottled Water

- 3.4. Market Trends

- 3.4.1. Premiumization With the Growth of Fortified and Flavored Water

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Still Water

- 5.1.2. Sparkling Water

- 5.1.3. Functional Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Home and Office Delivery (HOD)

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Still Water

- 6.1.2. Sparkling Water

- 6.1.3. Functional Water

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Home and Office Delivery (HOD)

- 6.2.2.4. Online Retail Stores

- 6.2.2.5. Other Off-trade Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Still Water

- 7.1.2. Sparkling Water

- 7.1.3. Functional Water

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Home and Office Delivery (HOD)

- 7.2.2.4. Online Retail Stores

- 7.2.2.5. Other Off-trade Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Still Water

- 8.1.2. Sparkling Water

- 8.1.3. Functional Water

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Home and Office Delivery (HOD)

- 8.2.2.4. Online Retail Stores

- 8.2.2.5. Other Off-trade Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Still Water

- 9.1.2. Sparkling Water

- 9.1.3. Functional Water

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Home and Office Delivery (HOD)

- 9.2.2.4. Online Retail Stores

- 9.2.2.5. Other Off-trade Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Still Water

- 10.1.2. Sparkling Water

- 10.1.3. Functional Water

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Home and Office Delivery (HOD)

- 10.2.2.4. Online Retail Stores

- 10.2.2.5. Other Off-trade Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. China APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 13. India APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 15. Southeast Asia APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 17. Indonesia APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 18. Phillipes APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 19. Singapore APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 20. Thailandc APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 21. Rest of Asia Pacific APAC Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 22. Competitive Analysis

- 22.1. Global Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 JAB Holding Company

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 Bisleri International

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Asahi Group Holdings Ltd

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 Aava Water*List Not Exhaustive

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Pepsico Inc

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 Danone S A

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 The Coca-Cola Company

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 TATA Group

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.9 Suntory Beverage & Food Ltd

- 22.2.9.1. Overview

- 22.2.9.2. Products

- 22.2.9.3. SWOT Analysis

- 22.2.9.4. Recent Developments

- 22.2.9.5. Financials (Based on Availability)

- 22.2.10 Tibet Water Resources Ltd

- 22.2.10.1. Overview

- 22.2.10.2. Products

- 22.2.10.3. SWOT Analysis

- 22.2.10.4. Recent Developments

- 22.2.10.5. Financials (Based on Availability)

- 22.2.11 Nestlé S A

- 22.2.11.1. Overview

- 22.2.11.2. Products

- 22.2.11.3. SWOT Analysis

- 22.2.11.4. Recent Developments

- 22.2.11.5. Financials (Based on Availability)

- 22.2.1 JAB Holding Company

List of Figures

- Figure 1: Global APAC Bottled Water Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific APAC Bottled Water Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific APAC Bottled Water Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: China APAC Bottled Water Market Revenue (Million), by Type 2024 & 2032

- Figure 5: China APAC Bottled Water Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: China APAC Bottled Water Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: China APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: China APAC Bottled Water Market Revenue (Million), by Geography 2024 & 2032

- Figure 9: China APAC Bottled Water Market Revenue Share (%), by Geography 2024 & 2032

- Figure 10: China APAC Bottled Water Market Revenue (Million), by Country 2024 & 2032

- Figure 11: China APAC Bottled Water Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Japan APAC Bottled Water Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Japan APAC Bottled Water Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Japan APAC Bottled Water Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: Japan APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: Japan APAC Bottled Water Market Revenue (Million), by Geography 2024 & 2032

- Figure 17: Japan APAC Bottled Water Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: Japan APAC Bottled Water Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Japan APAC Bottled Water Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: India APAC Bottled Water Market Revenue (Million), by Type 2024 & 2032

- Figure 21: India APAC Bottled Water Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: India APAC Bottled Water Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: India APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: India APAC Bottled Water Market Revenue (Million), by Geography 2024 & 2032

- Figure 25: India APAC Bottled Water Market Revenue Share (%), by Geography 2024 & 2032

- Figure 26: India APAC Bottled Water Market Revenue (Million), by Country 2024 & 2032

- Figure 27: India APAC Bottled Water Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Australia APAC Bottled Water Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Australia APAC Bottled Water Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Australia APAC Bottled Water Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Australia APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Australia APAC Bottled Water Market Revenue (Million), by Geography 2024 & 2032

- Figure 33: Australia APAC Bottled Water Market Revenue Share (%), by Geography 2024 & 2032

- Figure 34: Australia APAC Bottled Water Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Australia APAC Bottled Water Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Rest of Asia Pacific APAC Bottled Water Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Rest of Asia Pacific APAC Bottled Water Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Rest of Asia Pacific APAC Bottled Water Market Revenue (Million), by Geography 2024 & 2032

- Figure 41: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Geography 2024 & 2032

- Figure 42: Rest of Asia Pacific APAC Bottled Water Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global APAC Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global APAC Bottled Water Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global APAC Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southeast Asia APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Indonesia APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Phillipes APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Singapore APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Thailandc APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific APAC Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global APAC Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global APAC Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global APAC Bottled Water Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global APAC Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global APAC Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global APAC Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Global APAC Bottled Water Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global APAC Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global APAC Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global APAC Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Global APAC Bottled Water Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Global APAC Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global APAC Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global APAC Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Global APAC Bottled Water Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global APAC Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global APAC Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global APAC Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Global APAC Bottled Water Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Global APAC Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Bottled Water Market?

The projected CAGR is approximately 5.71%.

2. Which companies are prominent players in the APAC Bottled Water Market?

Key companies in the market include JAB Holding Company, Bisleri International, Asahi Group Holdings Ltd, Aava Water*List Not Exhaustive, Pepsico Inc, Danone S A, The Coca-Cola Company, TATA Group, Suntory Beverage & Food Ltd, Tibet Water Resources Ltd, Nestlé S A.

3. What are the main segments of the APAC Bottled Water Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Premiumization With the Growth of Fortified and Flavored Water; Lack of Safe Drinking Water Propels the Market Studied.

6. What are the notable trends driving market growth?

Premiumization With the Growth of Fortified and Flavored Water.

7. Are there any restraints impacting market growth?

Unorganized Sector Coupled With Counterfeit Scandals of Bottled Water.

8. Can you provide examples of recent developments in the market?

November 2022: Aava launched its sparkling water range, which claims to retain natural minerals and makes for the perfect zero-calorie natural mixer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Bottled Water Market?

To stay informed about further developments, trends, and reports in the APAC Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence