Key Insights

The anti-counterfeit packaging market is poised for significant expansion, driven by escalating product counterfeiting across food and beverage, pharmaceuticals, and consumer electronics. The market, valued at $204.08 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 9.4% from 2025 to 2033. This growth is propelled by heightened consumer awareness of counterfeit product risks, advancements in authentication technologies like track and trace systems and tamper-evident packaging, and stringent regulatory enforcement and brand protection initiatives. The food and beverage sector currently leads market share, with healthcare and pharmaceuticals following due to critical authenticity needs. Industrial and automotive sectors also show substantial growth potential as manufacturers prioritize brand integrity and financial protection.

Anti Counterfeit Measures in Packaging Industry Market Size (In Billion)

Despite robust opportunities, market entry barriers include high initial investment for advanced technologies and supply chain integration complexities. However, continuous innovation, consumer demand, and regulatory pressures are expected to mitigate these challenges. The competitive arena features established leaders such as 3M, Avery Dennison, and CCL Industries, alongside specialized technology providers like PharmaSecure and AlpVision, fostering a dynamic environment for evolving solutions.

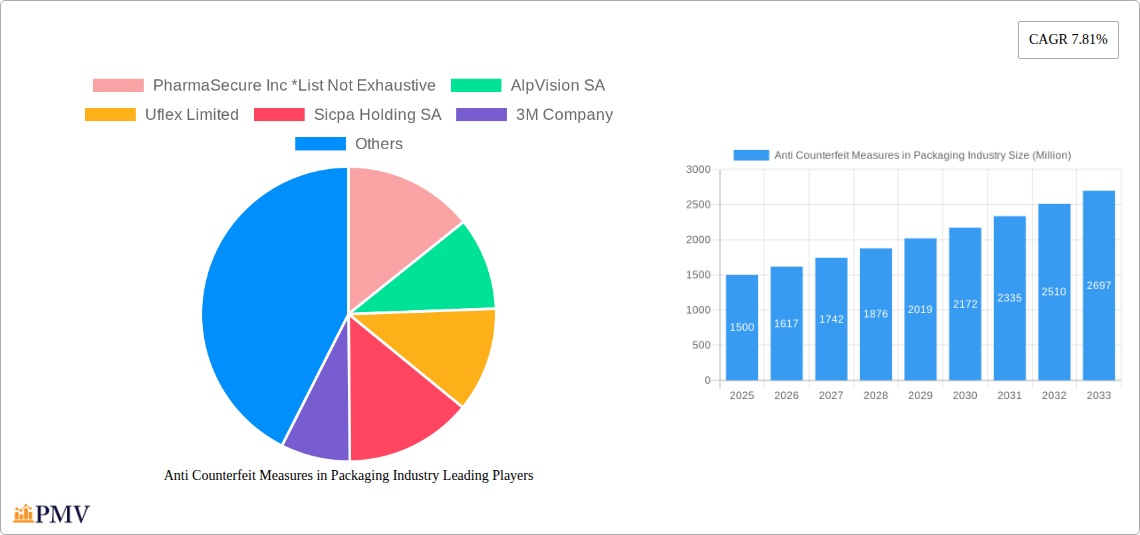

Anti Counterfeit Measures in Packaging Industry Company Market Share

Anti-Counterfeit Measures in Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global anti-counterfeit measures in the packaging industry, covering market size, growth drivers, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses operating in this dynamic sector. The market is projected to reach USD xx Billion by 2033, showcasing significant growth opportunities.

Anti Counterfeit Measures in Packaging Industry Market Structure & Competitive Dynamics

The anti-counterfeit packaging market is characterized by a moderately consolidated structure with several major players holding significant market share. Market leaders like 3M Company, Avery Dennison Corporation, and Sicpa Holding SA leverage their established brand reputation and extensive product portfolios to maintain their dominance. However, the market also accommodates numerous smaller, specialized companies focusing on niche technologies or end-user segments.

The competitive landscape is intensely innovative, with companies continuously investing in R&D to develop advanced authentication technologies like blockchain integration, AI-powered verification systems, and advanced material science solutions. Regulatory frameworks, varying across regions, significantly influence market dynamics. Stringent regulations in the pharmaceutical and healthcare sectors drive higher adoption of sophisticated anti-counterfeiting measures. Product substitutes, such as traditional security seals, exist but often lack the advanced features and traceability offered by modern technologies.

End-user trends play a crucial role. Increasing consumer awareness of counterfeits, especially in food and beverage and pharmaceuticals, is driving demand for robust anti-counterfeiting solutions. Mergers and acquisitions (M&A) activities have significantly shaped market dynamics. For example, Avery Dennison Corporation's acquisition of Vestcom in August 2021 for USD 1.45 Billion demonstrates the strategic importance of expanding capabilities in branded labeling. Overall, the market exhibits a complex interplay of technological advancements, regulatory pressures, and evolving consumer preferences. The estimated market share of the top three players in 2025 is approximately xx%, reflecting a moderate level of market concentration. The total value of M&A deals in the sector during the historical period (2019-2024) is estimated at USD xx Billion.

Anti Counterfeit Measures in Packaging Industry Industry Trends & Insights

The anti-counterfeit packaging market is experiencing robust growth, driven by several key factors. The rising prevalence of counterfeit products across various sectors, coupled with increased consumer awareness and demand for authenticity, significantly fuels market expansion. Technological disruptions, such as the integration of IoT, AI, and blockchain, are revolutionizing anti-counterfeiting strategies, enabling advanced traceability and verification systems. Consumer preferences are shifting towards products with verifiable authenticity, pushing manufacturers to adopt sophisticated security features. The increasing sophistication of counterfeiting techniques necessitates continuous innovation in anti-counterfeit technologies. This dynamic landscape fosters intense competition, prompting companies to constantly improve their offerings and invest in R&D. The market is witnessing a CAGR of xx% during the forecast period (2025-2033), with a market penetration rate of xx% in key segments by 2033.

Dominant Markets & Segments in Anti Counterfeit Measures in Packaging Industry

The healthcare and pharmaceuticals segment dominates the anti-counterfeit packaging market due to stringent regulatory requirements and high consumer sensitivity towards product authenticity. The Asia-Pacific region is projected as the leading regional market due to rapid economic growth, increasing consumer spending, and a rise in counterfeit products.

By Technology:

- Trace and Track: This segment is witnessing the highest growth due to the increasing demand for product traceability throughout the supply chain.

- Tamper-evident: This segment maintains a substantial market share due to its effectiveness in deterring product tampering.

- Covert & Overt: These technologies provide various levels of security and are deployed based on specific needs and budget constraints.

- Forensic Markers: This specialized segment is growing due to its ability to provide irrefutable evidence of counterfeiting.

By End User:

- Healthcare and Pharmaceuticals: Stringent regulations and high consumer sensitivity to counterfeit medicines drive the dominance of this segment.

- Food and Beverage: Growing consumer concerns over food safety and quality are boosting demand for anti-counterfeit solutions in this sector.

- Industrial and Automotive: This sector is witnessing increasing adoption of anti-counterfeit measures to protect against the use of substandard components.

- Consumer Electronics: The increasing value of electronics products makes anti-counterfeiting a necessity.

Key Drivers: Strong economic growth, supportive government regulations, and well-established supply chains contribute to market dominance in specific regions and segments.

Anti Counterfeit Measures in Packaging Industry Product Innovations

Recent advancements include the integration of blockchain technology for enhanced product traceability, AI-powered authentication systems for real-time verification, and the use of advanced materials with unique security features. These innovations provide stronger protection against counterfeiting, improved supply chain transparency, and enhanced consumer confidence.

Report Segmentation & Scope

The report segments the market by technology (Trace and Track, Tamper-evident, Covert, Overt, Forensic Markers) and end-user (Food and Beverage, Healthcare and Pharmaceuticals, Industrial and Automotive, Consumer Electronics, Other End Users). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The report also provides a regional breakdown, outlining growth potential across key geographical markets.

Key Drivers of Anti Counterfeit Measures in Packaging Industry Growth

The growth of the anti-counterfeit packaging market is fueled by several factors: increasing instances of counterfeiting, stringent government regulations, heightened consumer awareness, technological advancements, and the growing need for enhanced supply chain security. The rising adoption of advanced technologies like blockchain, AI, and IoT further boosts market growth.

Challenges in the Anti Counterfeit Measures in Packaging Industry Sector

Challenges include the high initial investment costs for implementing advanced anti-counterfeiting technologies, the complexity of integrating these technologies into existing supply chains, and the continuous evolution of counterfeiting techniques, requiring constant innovation. Furthermore, variations in regulatory landscapes across different regions pose complexities for global companies.

Leading Players in the Anti Counterfeit Measures in Packaging Industry Market

- PharmaSecure Inc

- AlpVision SA

- Uflex Limited

- Sicpa Holding SA

- 3M Company

- CCL Industries Inc

- Avery Dennison Corporation

- Applied DNA Sciences Inc

- Authentix Inc

- Zebra Technologies Corporation

- E I Du Pont De Nemours and Company

- Ampacet Corporation

Key Developments in Anti Counterfeit Measures in Packaging Industry Sector

- August 2021: Avery Dennison Corporation acquired Vestcom for USD 1.45 Billion, significantly expanding its presence in branded labeling for retail and consumer packaged goods. This acquisition highlights the consolidation trend within the industry and the strategic importance of enhancing labeling capabilities for effective anti-counterfeiting strategies.

Strategic Anti Counterfeit Measures in Packaging Industry Market Outlook

The anti-counterfeit packaging market presents significant growth potential driven by rising consumer demand for authentic products, technological advancements, and stricter regulations. Strategic opportunities lie in developing innovative, cost-effective solutions, focusing on emerging markets, and establishing strong partnerships across the supply chain. Investing in R&D and adapting to the constantly evolving counterfeiting landscape will be crucial for market success.

Anti Counterfeit Measures in Packaging Industry Segmentation

-

1. Technology

- 1.1. Trace and Track

- 1.2. Tamper-evident

- 1.3. Covert

- 1.4. Overt

- 1.5. Forensic Markers

-

2. End User

- 2.1. Food and Beverage

- 2.2. Healthcare and Pharmaceuticals

- 2.3. Industrial and Automotive

- 2.4. Consumer Electronics

- 2.5. Other End Users

Anti Counterfeit Measures in Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. South Africa

- 6.1. United Arab Emirates

- 6.2. Rest of Middle East

Anti Counterfeit Measures in Packaging Industry Regional Market Share

Geographic Coverage of Anti Counterfeit Measures in Packaging Industry

Anti Counterfeit Measures in Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming E-commerce Industry; Increasing Focus of Manufacturers on Brand Protection

- 3.3. Market Restrains

- 3.3.1. High-initial Costs

- 3.4. Market Trends

- 3.4.1. Pharmaceuticals and Healthcare to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Trace and Track

- 5.1.2. Tamper-evident

- 5.1.3. Covert

- 5.1.4. Overt

- 5.1.5. Forensic Markers

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare and Pharmaceuticals

- 5.2.3. Industrial and Automotive

- 5.2.4. Consumer Electronics

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Trace and Track

- 6.1.2. Tamper-evident

- 6.1.3. Covert

- 6.1.4. Overt

- 6.1.5. Forensic Markers

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Food and Beverage

- 6.2.2. Healthcare and Pharmaceuticals

- 6.2.3. Industrial and Automotive

- 6.2.4. Consumer Electronics

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Trace and Track

- 7.1.2. Tamper-evident

- 7.1.3. Covert

- 7.1.4. Overt

- 7.1.5. Forensic Markers

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Food and Beverage

- 7.2.2. Healthcare and Pharmaceuticals

- 7.2.3. Industrial and Automotive

- 7.2.4. Consumer Electronics

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Trace and Track

- 8.1.2. Tamper-evident

- 8.1.3. Covert

- 8.1.4. Overt

- 8.1.5. Forensic Markers

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Food and Beverage

- 8.2.2. Healthcare and Pharmaceuticals

- 8.2.3. Industrial and Automotive

- 8.2.4. Consumer Electronics

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Trace and Track

- 9.1.2. Tamper-evident

- 9.1.3. Covert

- 9.1.4. Overt

- 9.1.5. Forensic Markers

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Food and Beverage

- 9.2.2. Healthcare and Pharmaceuticals

- 9.2.3. Industrial and Automotive

- 9.2.4. Consumer Electronics

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Trace and Track

- 10.1.2. Tamper-evident

- 10.1.3. Covert

- 10.1.4. Overt

- 10.1.5. Forensic Markers

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Food and Beverage

- 10.2.2. Healthcare and Pharmaceuticals

- 10.2.3. Industrial and Automotive

- 10.2.4. Consumer Electronics

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. South Africa Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Trace and Track

- 11.1.2. Tamper-evident

- 11.1.3. Covert

- 11.1.4. Overt

- 11.1.5. Forensic Markers

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Food and Beverage

- 11.2.2. Healthcare and Pharmaceuticals

- 11.2.3. Industrial and Automotive

- 11.2.4. Consumer Electronics

- 11.2.5. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PharmaSecure Inc *List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 AlpVision SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Uflex Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sicpa Holding SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 3M Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CCL Industries Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Avery Dennison Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Applied Dna Sciences Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Authentix Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Zebra Technologies Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 E I Du Pont De Nemours and Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Ampacet Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 PharmaSecure Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Anti Counterfeit Measures in Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 9: Europe Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 21: Latin America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 27: Middle East Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 33: South Africa Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: South Africa Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 35: South Africa Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: South Africa Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: South Africa Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 11: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 27: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 33: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 34: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 36: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 37: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Counterfeit Measures in Packaging Industry?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Anti Counterfeit Measures in Packaging Industry?

Key companies in the market include PharmaSecure Inc *List Not Exhaustive, AlpVision SA, Uflex Limited, Sicpa Holding SA, 3M Company, CCL Industries Inc, Avery Dennison Corporation, Applied Dna Sciences Inc, Authentix Inc, Zebra Technologies Corporation, E I Du Pont De Nemours and Company, Ampacet Corporation.

3. What are the main segments of the Anti Counterfeit Measures in Packaging Industry?

The market segments include Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Booming E-commerce Industry; Increasing Focus of Manufacturers on Brand Protection.

6. What are the notable trends driving market growth?

Pharmaceuticals and Healthcare to Drive the Market Demand.

7. Are there any restraints impacting market growth?

High-initial Costs.

8. Can you provide examples of recent developments in the market?

In August 2021, - Avery Dennison Corporation acquired Vestcom for an investment of USD 1.45 billion. The acquisition will help the company expand its branded labeling offerings for retail and consumer packaged goods industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Counterfeit Measures in Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Counterfeit Measures in Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Counterfeit Measures in Packaging Industry?

To stay informed about further developments, trends, and reports in the Anti Counterfeit Measures in Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence