Key Insights

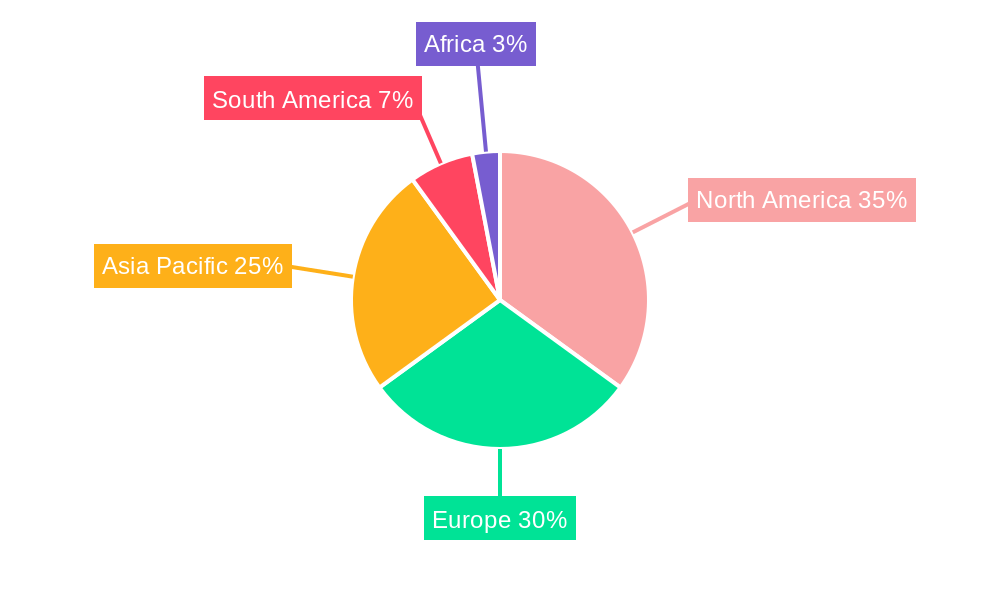

The global agricultural haying and forage machinery market is projected to reach $9.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2033. This expansion is propelled by escalating global demand for animal feed, stemming from population growth and increased consumption of dairy and meat products. Technological advancements, including precision agriculture and automation in harvesting equipment, are enhancing operational efficiency and driving market growth. Supportive government initiatives and subsidies for modern machinery also contribute to the positive market outlook. The market is segmented by machinery type, including mowers, balers, and forage harvesters. Key industry players include Kuhn Group, John Deere, CLAAS, Kubota, and CNH Industrial, who compete through innovation and strategic alliances. While North America and Europe currently lead market share, the Asia-Pacific region is expected to experience significant growth due to its expanding agricultural sector and mechanization efforts.

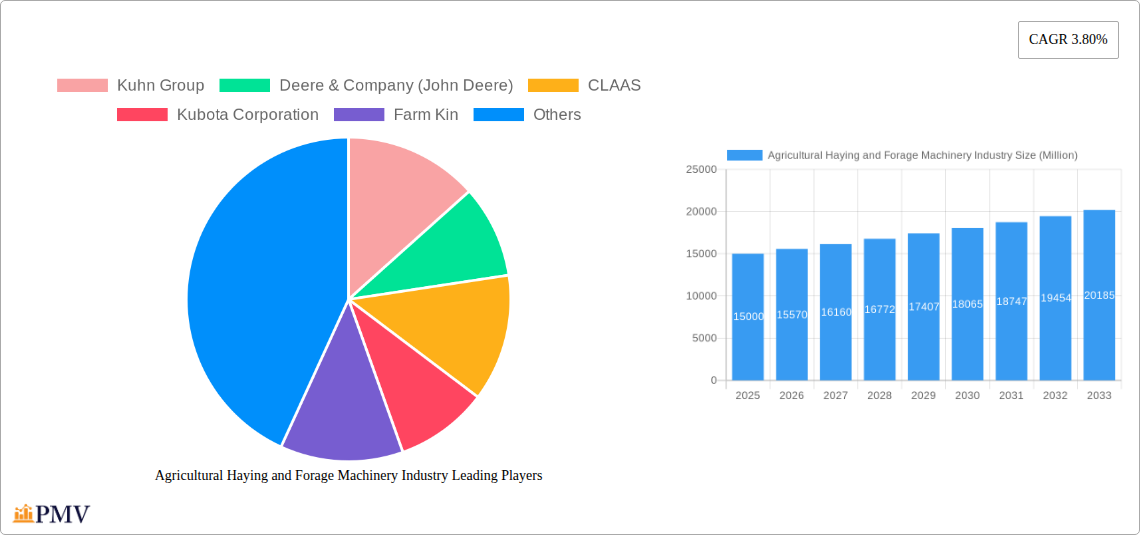

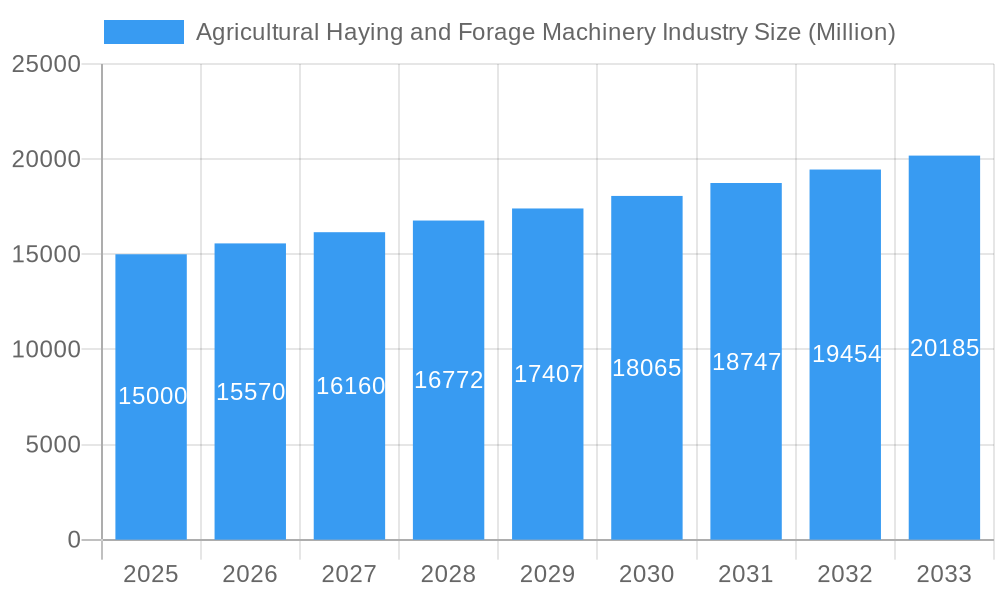

Agricultural Haying and Forage Machinery Industry Market Size (In Billion)

Potential restraints include volatility in raw material prices, affecting manufacturing costs and market pricing. Economic instability in key agricultural regions may also impact farmer investment. Additionally, stringent environmental regulations may necessitate costly equipment upgrades. Despite these challenges, the market demonstrates a positive long-term trajectory, underpinned by ongoing technological innovation, robust global food demand, and favorable government policies. Market segmentation across regions and machinery types presents diverse opportunities for industry participants.

Agricultural Haying and Forage Machinery Industry Company Market Share

Agricultural Haying and Forage Machinery Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Agricultural Haying and Forage Machinery Industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, using 2025 as the base year and estimated year. The market is segmented by Type: Mowers, Balers, Forage Harvesters, and Others. The report's analysis incorporates data from key players such as Kuhn Group, Deere & Company (John Deere), CLAAS, Kubota Corporation, Farm Kin, CNH Industrial, Krone North America Inc, Yanmar Company Limited, and AGCO Corporation, offering a complete picture of the market's structure, trends, and future prospects. The market size is projected to reach xx Million by 2033, representing a substantial growth opportunity.

Agricultural Haying and Forage Machinery Industry Market Structure & Competitive Dynamics

The global agricultural haying and forage machinery market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Kuhn Group, Deere & Company (John Deere), and CLAAS collectively account for approximately xx% of the global market share in 2025, demonstrating their strong brand recognition and extensive product portfolios. The market is characterized by ongoing innovation, driven by the need for enhanced efficiency, automation, and reduced operational costs. Regulatory frameworks related to emission standards and safety regulations influence the technological advancements and product design within the industry. The presence of substitute technologies, such as alternative harvesting methods, poses a moderate level of competitive pressure.

End-user trends, such as the increasing adoption of precision agriculture and the growing demand for high-quality forage, are shaping the market’s trajectory. Mergers and acquisitions (M&A) activity has been notable in recent years, with several significant deals valued at over $xx Million in 2024, leading to market consolidation and reshaping the competitive landscape.

- Market Concentration: Oligopolistic, with top 3 players holding xx% market share in 2025.

- Innovation Ecosystems: Strong focus on automation, precision technologies, and sustainable practices.

- Regulatory Frameworks: Stringent emission and safety standards drive product innovation.

- M&A Activity: Significant deals exceeding $xx Million observed in 2024, indicating consolidation.

Agricultural Haying and Forage Machinery Industry Industry Trends & Insights

The agricultural haying and forage machinery market is experiencing robust growth, driven by several key factors. The rising global population and increasing demand for livestock feed are primary drivers, fueling the need for efficient and high-capacity harvesting equipment. Technological advancements, such as the integration of GPS technology, automation features, and sensor-based monitoring systems, are enhancing productivity and precision in haying and forage operations. This is reflected in a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and a projected CAGR of xx% during the forecast period (2025-2033). Market penetration of technologically advanced equipment is steadily increasing, with an estimated xx% adoption rate in major agricultural regions by 2033. Consumer preferences are shifting toward equipment that offers improved fuel efficiency, reduced maintenance costs, and enhanced operator comfort. Intense competition among leading players is stimulating innovation and driving down prices, further benefiting end-users.

Dominant Markets & Segments in Agricultural Haying and Forage Machinery Industry

North America currently holds the leading position in the global agricultural haying and forage machinery market, driven by factors such as large-scale farming operations, advanced agricultural practices, and strong technological adoption. The high density of livestock farming and extensive acreage under cultivation in regions like the Midwest and the Great Plains support the high demand for efficient haying and forage machinery. Within the segment breakdown, the balers segment exhibits the highest market share due to its extensive use in various farming operations, both large and small scale.

- Key Drivers for North American Dominance:

- Large-scale farming operations.

- Advanced agricultural practices and technology adoption.

- High livestock density.

- Favorable government policies and subsidies supporting agriculture.

- Robust infrastructure supporting agricultural equipment distribution and maintenance.

- Dominant Segment: Balers The substantial market share of balers is attributable to the widespread application across various farm sizes and livestock production systems. The continuous innovation in baler technology, encompassing features such as high-density baling and automated bale wrapping, contributes significantly to its market prominence.

Agricultural Haying and Forage Machinery Industry Product Innovations

Recent product developments in the agricultural haying and forage machinery market demonstrate a clear emphasis on automation, precision, and sustainability. Innovations include advanced sensor technologies for optimized cutting and baling processes, autonomous operation capabilities, and improved fuel-efficient engines. These enhancements boost productivity, reduce labor costs, and minimize environmental impact. The integration of data analytics and precision farming platforms further optimizes operations and enhances overall efficiency. New models emphasize operator comfort, safety features, and simplified maintenance procedures, enhancing the overall user experience and reducing downtime.

Report Segmentation & Scope

This report segments the agricultural haying and forage machinery market by type, encompassing mowers, balers, forage harvesters, and others.

Mowers: This segment is characterized by various mower types, including disc mowers, drum mowers, and flail mowers, catering to diverse agricultural applications and crop types. The segment is expected to witness steady growth driven by the demand for efficient and high-capacity mowing solutions.

Balers: This segment is expected to exhibit significant growth owing to the widespread adoption of advanced baling techniques and the increasing demand for high-density bales.

Forage Harvesters: This segment is projected to experience substantial growth driven by the growing demand for efficient forage harvesting in large-scale agricultural operations.

Others: This segment encompasses various other types of haying and forage machinery, including tedders, rakes, and windrowers. Growth in this segment is influenced by the advancements in efficiency and automation.

Key Drivers of Agricultural Haying and Forage Machinery Growth

The growth of the agricultural haying and forage machinery market is propelled by several key factors. Increasing global food demand necessitates efficient agricultural practices, driving the adoption of technologically advanced machinery. Government support for agricultural mechanization through subsidies and incentives promotes market growth. The rising adoption of precision agriculture, leveraging technologies like GPS and sensors, boosts productivity and efficiency. Furthermore, growing awareness of sustainability and the need for environmentally friendly farming practices fuels innovation in fuel-efficient and low-emission machinery.

Challenges in the Agricultural Haying and Forage Machinery Industry Sector

The agricultural haying and forage machinery industry faces several challenges. Fluctuations in raw material prices, particularly steel and other components, impact manufacturing costs and profitability. Supply chain disruptions, particularly during periods of global uncertainty, can lead to production delays and shortages. Intense competition among established players and the emergence of new entrants create pressure on pricing and profit margins. Stricter environmental regulations regarding emissions and waste disposal necessitate ongoing investments in research and development for more sustainable technologies. These factors collectively influence the overall market dynamics and growth trajectory.

Leading Players in the Agricultural Haying and Forage Machinery Industry Market

Key Developments in Agricultural Haying and Forage Machinery Industry Sector

- 2024 Q4: John Deere launches a new series of autonomous forage harvesters.

- 2023 Q3: Kuhn Group announces a strategic partnership with a leading sensor technology provider.

- 2022 Q2: CLAAS introduces a new baler model with enhanced automation features.

- 2021 Q1: CNH Industrial acquires a smaller haying equipment manufacturer, expanding its product portfolio.

Strategic Agricultural Haying and Forage Machinery Industry Market Outlook

The agricultural haying and forage machinery market is poised for continued growth, driven by technological advancements, favorable government policies, and increasing demand for efficient and sustainable agricultural practices. Strategic opportunities exist in developing innovative solutions for precision agriculture, autonomous operations, and data-driven optimization. Companies focusing on sustainable technologies and enhancing customer service will gain a competitive advantage. The market's future is characterized by a strong focus on automation, improved efficiency, and reduced environmental impact, creating a promising landscape for both established players and innovative startups.

Agricultural Haying and Forage Machinery Industry Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

Agricultural Haying and Forage Machinery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Agricultural Haying and Forage Machinery Industry Regional Market Share

Geographic Coverage of Agricultural Haying and Forage Machinery Industry

Agricultural Haying and Forage Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Government Support to Farmers is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Haying and Forage Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Agricultural Haying and Forage Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mowers

- 6.1.2. Balers

- 6.1.3. Forage Harvesters

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mowers

- 6.2.2. Balers

- 6.2.3. Forage Harvesters

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Agricultural Haying and Forage Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mowers

- 7.1.2. Balers

- 7.1.3. Forage Harvesters

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mowers

- 7.2.2. Balers

- 7.2.3. Forage Harvesters

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Agricultural Haying and Forage Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mowers

- 8.1.2. Balers

- 8.1.3. Forage Harvesters

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mowers

- 8.2.2. Balers

- 8.2.3. Forage Harvesters

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Agricultural Haying and Forage Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mowers

- 9.1.2. Balers

- 9.1.3. Forage Harvesters

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mowers

- 9.2.2. Balers

- 9.2.3. Forage Harvesters

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa Agricultural Haying and Forage Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mowers

- 10.1.2. Balers

- 10.1.3. Forage Harvesters

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mowers

- 10.2.2. Balers

- 10.2.3. Forage Harvesters

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kuhn Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Deere & Company (John Deere)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CLAAS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kubota Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Farm Kin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CNH Industrial

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Krone North America Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yanmar Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AGCO Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kuhn Group

List of Figures

- Figure 1: Global Agricultural Haying and Forage Machinery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Agricultural Haying and Forage Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Agricultural Haying and Forage Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 17: Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: South America Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: South America Agricultural Haying and Forage Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Africa Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Africa Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Africa Agricultural Haying and Forage Machinery Industry Revenue (billion), by Type 2025 & 2033

- Figure 29: Africa Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Africa Agricultural Haying and Forage Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Africa Agricultural Haying and Forage Machinery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Argentina Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Agricultural Haying and Forage Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South Africa Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Africa Agricultural Haying and Forage Machinery Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Haying and Forage Machinery Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Agricultural Haying and Forage Machinery Industry?

Key companies in the market include Kuhn Group, Deere & Company (John Deere), CLAAS, Kubota Corporation, Farm Kin, CNH Industrial, Krone North America Inc, Yanmar Company Limited, AGCO Corporation.

3. What are the main segments of the Agricultural Haying and Forage Machinery Industry?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Government Support to Farmers is Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Haying and Forage Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Haying and Forage Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Haying and Forage Machinery Industry?

To stay informed about further developments, trends, and reports in the Agricultural Haying and Forage Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence