Key Insights

The Active and Intelligent Packaging market within the pharmaceutical industry is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.00% from 2025 to 2033, reaching a market size of approximately $XX million by 2033. Key drivers of this growth include the increasing demand for extended shelf-life products and the need for enhanced safety and quality control in pharmaceuticals. Active packaging solutions such as oxygen scavengers, moisture absorbers, and anti-microbial packaging are pivotal in maintaining the integrity of sensitive pharmaceutical products. Meanwhile, intelligent packaging, including time-temperature indicators and RFID technology, plays a crucial role in monitoring and ensuring product safety throughout the supply chain. The market is also influenced by trends toward sustainability and technological advancements, encouraging the development of eco-friendly and smart packaging solutions.

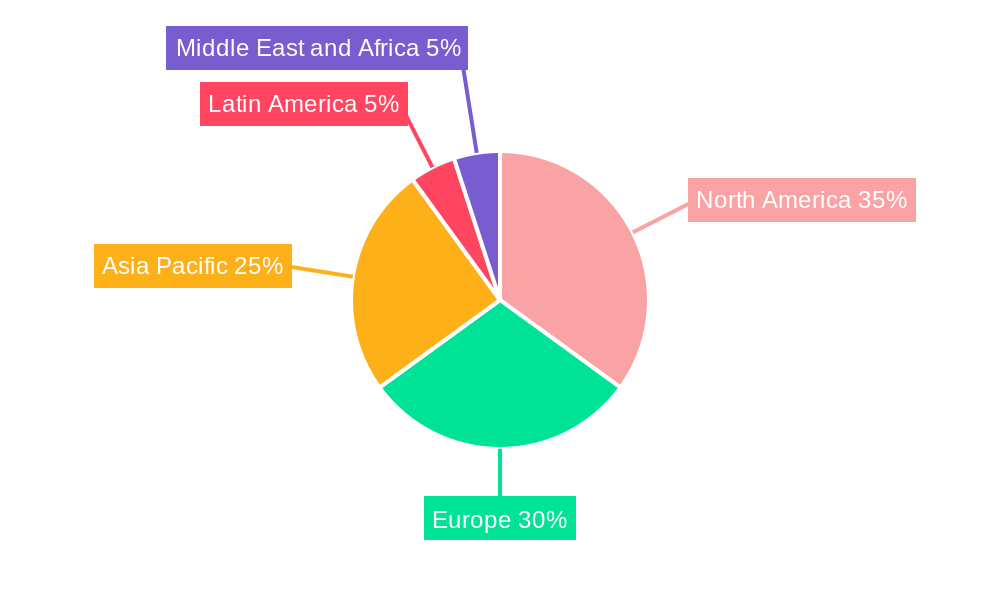

Segmentation within the market reveals a diverse range of active and intelligent packaging technologies. In the active packaging segment, oxygen scavengers are expected to hold a significant share due to their effectiveness in preventing oxidation and spoilage. Microwave susceptors, odor absorbers/emitters, and moisture/humidity absorbers are also gaining traction for their specific applications in pharmaceuticals. On the intelligent packaging front, sensors and devices like time-temperature indicators are increasingly utilized to ensure the efficacy of temperature-sensitive drugs. RFID and NFC technologies are also on the rise, offering enhanced tracking and anti-counterfeiting measures. Regionally, North America and Europe lead the market due to stringent regulatory standards and advanced healthcare infrastructure, while Asia Pacific is poised for rapid growth due to expanding pharmaceutical sectors in countries like China and India.

Active and Intelligent Packaging in Pharmaceutical Industry Market Structure & Competitive Dynamics

The Active and Intelligent Packaging market within the pharmaceutical industry is characterized by a mix of established players and innovative startups, leading to a moderately concentrated market structure. Key players such as Dessicare Inc, WestRock Company, and Honeywell International Inc hold significant market shares, with Dessicare Inc holding approximately 12% of the market. The innovation ecosystem thrives on continuous R&D investments, with companies like Timestrip UK Ltd and Landec Corporation pioneering new technologies in intelligent packaging solutions.

Regulatory frameworks, particularly from the FDA and EMA, play a crucial role in shaping market dynamics, ensuring safety and efficacy of packaging solutions. The presence of substitutes like traditional packaging methods challenges market growth, yet the superior functionality of active and intelligent packaging drives its adoption. End-user trends indicate a shift towards smart packaging to enhance product integrity and consumer trust.

Mergers and acquisitions are pivotal, with notable deals like the acquisition of Bemis Company Inc by Amcor Ltd for xx Million dollars, reflecting strategic consolidation efforts. Such activities are poised to intensify competition and foster technological advancements, further influencing market dynamics.

- Market Concentration: Moderate, with top players holding significant shares.

- Innovation Ecosystem: Driven by R&D investments and partnerships.

- Regulatory Frameworks: Governed by stringent standards from FDA and EMA.

- Product Substitutes: Traditional packaging methods pose challenges.

- End-User Trends: Increasing demand for smart and safe packaging solutions.

- M&A Activities: Strategic acquisitions shaping market landscape.

Active and Intelligent Packaging in Pharmaceutical Industry Industry Trends & Insights

The Active and Intelligent Packaging market in the pharmaceutical sector is poised for robust growth, driven by a compound annual growth rate (CAGR) of approximately 6% from 2025 to 2033. Key growth drivers include the rising demand for enhanced product safety and shelf-life extension, with active packaging solutions like oxygen scavengers and moisture absorbers witnessing increased adoption. Technological disruptions, such as the integration of IoT and AI in packaging solutions, are revolutionizing the industry. Companies like Ball Corporation and Crown Holdings Inc are at the forefront of these innovations, enhancing their market penetration.

Consumer preferences are shifting towards more sustainable and intelligent packaging options, influenced by heightened awareness of product quality and environmental impact. This trend is particularly evident in developed markets like North America and Europe, where regulatory frameworks support the adoption of such technologies.

Competitive dynamics are intense, with companies like Sealed Air Corporation and Amcor Ltd investing heavily in R&D to maintain their market positions. The competition is further intensified by the entry of new players, particularly in the intelligent packaging segment, where sensors and devices such as Time-Temperature Indicators (TTIs) are gaining traction. The market's growth is also supported by strategic collaborations and partnerships, such as those between CCL Industries Inc and BASF SE, aimed at leveraging complementary strengths.

The overall market is expected to reach a value of xx Million dollars by 2033, driven by these trends and the continuous evolution of technology and consumer demands.

Dominant Markets & Segments in Active and Intelligent Packaging in Pharmaceutical Industry

The North American region emerges as the dominant market for Active and Intelligent Packaging in the pharmaceutical industry, primarily due to its advanced healthcare infrastructure and stringent regulatory environment. Within this region, the United States holds the largest market share, driven by a strong pharmaceutical sector and high consumer demand for quality products.

- Economic Policies: Supportive government policies and incentives for innovation.

- Infrastructure: Advanced healthcare and pharmaceutical manufacturing facilities.

- Regulatory Environment: Stringent standards promoting the adoption of advanced packaging solutions.

In terms of segments, the Active Packaging category, particularly Oxygen Scavengers, leads the market. This dominance is attributed to their ability to extend product shelf life and ensure product integrity. Oxygen scavengers are widely used in pharmaceutical packaging to prevent oxidative degradation, thereby maintaining drug efficacy.

- Oxygen Scavengers: Dominant due to their critical role in extending shelf life.

- Microwave Susceptors: Growing popularity for heating applications in pharmaceuticals.

- Odor Absorbers/Emitters: Increasing adoption for improving patient experience.

- Moisture/Humidity Absorbers: Essential for maintaining product stability.

- Anti-microbial Packaging: Rising demand for enhancing product safety.

- Others Active Packagings (Pure Absorbers and Carbon Emitters): Niche yet growing segments.

Within Intelligent Packaging, the Sensors & Devices segment, specifically Time-Temperature Indicators (TTIs), is gaining significant traction. TTIs are crucial for monitoring the temperature history of pharmaceutical products, ensuring they remain within safe limits during storage and transportation.

- Coding and Marking: Essential for product traceability and compliance.

- Sensors & Devices (Time-Temperature Indicators (TTIs)): Leading due to their critical role in product monitoring.

- RFID & NFC: Growing adoption for enhancing supply chain efficiency.

- Other Intelligent Packaging: Emerging technologies with potential for future growth.

The dominance of these segments and regions is expected to continue, driven by ongoing technological advancements and increasing consumer demand for safe and effective pharmaceutical products.

Active and Intelligent Packaging in Pharmaceutical Industry Product Innovations

Product innovations in the Active and Intelligent Packaging sector are driven by technological advancements and the need for enhanced product safety and traceability. Companies are focusing on developing smart packaging solutions that integrate sensors and IoT technologies to monitor product conditions in real-time. For instance, Timestrip UK Ltd's Time-Temperature Indicators (TTIs) provide critical data on product exposure to temperature fluctuations, ensuring product integrity. These innovations not only meet the growing regulatory demands but also align with consumer preferences for transparency and safety, thereby providing a competitive edge in the market.

Report Segmentation & Scope

The Active and Intelligent Packaging market in the pharmaceutical industry is segmented into Active Packaging and Intelligent Packaging. Within Active Packaging, key sub-segments include:

- Oxygen Scavengers: Projected to grow at a CAGR of 5.5%, reaching a market size of xx Million dollars by 2033, driven by their role in extending product shelf life.

- Microwave Susceptors: Expected to see a CAGR of 4.8%, with a market size of xx Million dollars by 2033, due to their application in heating pharmaceuticals.

- Odor Absorbers/Emitters: Anticipated to grow at a CAGR of 5.2%, reaching xx Million dollars by 2033, enhancing patient experience.

- Moisture/Humidity Absorbers: Forecasted to grow at a CAGR of 5.7%, with a market size of xx Million dollars by 2033, crucial for product stability.

- Anti-microbial Packaging: Expected to grow at a CAGR of 6.1%, reaching xx Million dollars by 2033, enhancing product safety.

- Others Active Packagings (Pure Absorbers and Carbon Emitters): Projected to grow at a CAGR of 4.5%, with a market size of xx Million dollars by 2033, catering to niche applications.

Intelligent Packaging includes:

- Coding and Marking: Projected to grow at a CAGR of 5.3%, reaching a market size of xx Million dollars by 2033, essential for product traceability.

- Sensors & Devices (Time-Temperature Indicators (TTIs)): Expected to see a CAGR of 6.3%, with a market size of xx Million dollars by 2033, critical for product monitoring.

- RFID & NFC: Anticipated to grow at a CAGR of 5.9%, reaching xx Million dollars by 2033, enhancing supply chain efficiency.

- Other Intelligent Packaging: Forecasted to grow at a CAGR of 4.7%, with a market size of xx Million dollars by 2033, driven by emerging technologies.

Each segment is witnessing competitive dynamics, with companies like BASF SE and CCL Industries Inc leading in innovation and market expansion.

Key Drivers of Active and Intelligent Packaging in Pharmaceutical Industry Growth

The growth of Active and Intelligent Packaging in the pharmaceutical industry is propelled by several key drivers. Technologically, advancements in IoT and AI are enabling the development of smart packaging solutions that enhance product safety and traceability. Economically, the rising demand for pharmaceuticals, coupled with the need for extended shelf life, drives market expansion. Regulatory factors, such as stringent standards from the FDA and EMA, necessitate the adoption of advanced packaging to ensure compliance and product integrity. These drivers collectively fuel the market's growth trajectory.

Challenges in the Active and Intelligent Packaging in Pharmaceutical Industry Sector

The Active and Intelligent Packaging sector faces several challenges. Regulatory hurdles, particularly in obtaining approvals for new packaging technologies, can delay market entry and increase costs. Supply chain issues, such as the availability of raw materials and logistics, impact production and distribution. Competitive pressures are intense, with companies vying for market share through continuous innovation and cost reduction. These challenges result in a quantifiable impact, with potential delays in product launches and increased operational costs by up to 15%.

Leading Players in the Active and Intelligent Packaging in Pharmaceutical Industry Market

- Dessicare Inc

- WestRock Company

- Timestrip UK Ltd

- Honeywell International Inc

- Coveris Holdings SA

- Sonoco Products Company

- Landec Corporation

- Ball Corporation

- Crown Holdings Inc

- Amcor Ltd

- BASF SE

- CCL Industries Inc

- Graphic Packaging

- Sealed Air Corporation

- *List Not Exhaustive

Key Developments in Active and Intelligent Packaging in Pharmaceutical Industry Sector

- January 2023: Amcor Ltd launched a new line of intelligent packaging solutions, enhancing product traceability and safety.

- March 2023: Honeywell International Inc announced a strategic partnership with a leading pharmaceutical company to develop advanced active packaging solutions.

- June 2023: Sealed Air Corporation acquired a startup specializing in sensor technology, aiming to expand its intelligent packaging portfolio.

- September 2023: BASF SE introduced a new anti-microbial packaging solution, addressing growing demand for product safety.

Strategic Active and Intelligent Packaging in Pharmaceutical Industry Market Outlook

The strategic outlook for Active and Intelligent Packaging in the pharmaceutical industry is promising, with growth accelerators such as technological advancements and increasing consumer demand for safe and effective products. Future market potential lies in the integration of IoT and AI for real-time monitoring and traceability. Strategic opportunities include expanding into emerging markets and leveraging partnerships to enhance R&D capabilities. The market is poised for continued growth, driven by these factors and the evolving needs of the pharmaceutical sector.

Active and Intelligent Packaging in Pharmaceutical Industry Segmentation

-

1. Active Packaging

- 1.1. Oxygen Scavengers

- 1.2. Microwave Susceptors

- 1.3. Odor Absorbers/Emitters

- 1.4. Moisture/ Humidity Absorbers

- 1.5. Anti-microbial Packaging

- 1.6. Others A

-

2. Intelligent Packaging

- 2.1. Coding and Marking

- 2.2. Sensors

- 2.3. RFID & NFC

- 2.4. Other Intelligent Packaging

Active and Intelligent Packaging in Pharmaceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active and Intelligent Packaging in Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancements in Pharmaceutical Packaging Industry

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. RFID & NFC Holds an Important Position in the Active & Intelligent Packaging in Pharmaceutical Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging

- 5.1.1. Oxygen Scavengers

- 5.1.2. Microwave Susceptors

- 5.1.3. Odor Absorbers/Emitters

- 5.1.4. Moisture/ Humidity Absorbers

- 5.1.5. Anti-microbial Packaging

- 5.1.6. Others A

- 5.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 5.2.1. Coding and Marking

- 5.2.2. Sensors

- 5.2.3. RFID & NFC

- 5.2.4. Other Intelligent Packaging

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging

- 6. North America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging

- 6.1.1. Oxygen Scavengers

- 6.1.2. Microwave Susceptors

- 6.1.3. Odor Absorbers/Emitters

- 6.1.4. Moisture/ Humidity Absorbers

- 6.1.5. Anti-microbial Packaging

- 6.1.6. Others A

- 6.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 6.2.1. Coding and Marking

- 6.2.2. Sensors

- 6.2.3. RFID & NFC

- 6.2.4. Other Intelligent Packaging

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging

- 7. Europe Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging

- 7.1.1. Oxygen Scavengers

- 7.1.2. Microwave Susceptors

- 7.1.3. Odor Absorbers/Emitters

- 7.1.4. Moisture/ Humidity Absorbers

- 7.1.5. Anti-microbial Packaging

- 7.1.6. Others A

- 7.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 7.2.1. Coding and Marking

- 7.2.2. Sensors

- 7.2.3. RFID & NFC

- 7.2.4. Other Intelligent Packaging

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging

- 8. Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging

- 8.1.1. Oxygen Scavengers

- 8.1.2. Microwave Susceptors

- 8.1.3. Odor Absorbers/Emitters

- 8.1.4. Moisture/ Humidity Absorbers

- 8.1.5. Anti-microbial Packaging

- 8.1.6. Others A

- 8.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 8.2.1. Coding and Marking

- 8.2.2. Sensors

- 8.2.3. RFID & NFC

- 8.2.4. Other Intelligent Packaging

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging

- 9. Latin America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging

- 9.1.1. Oxygen Scavengers

- 9.1.2. Microwave Susceptors

- 9.1.3. Odor Absorbers/Emitters

- 9.1.4. Moisture/ Humidity Absorbers

- 9.1.5. Anti-microbial Packaging

- 9.1.6. Others A

- 9.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 9.2.1. Coding and Marking

- 9.2.2. Sensors

- 9.2.3. RFID & NFC

- 9.2.4. Other Intelligent Packaging

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging

- 10. Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging

- 10.1.1. Oxygen Scavengers

- 10.1.2. Microwave Susceptors

- 10.1.3. Odor Absorbers/Emitters

- 10.1.4. Moisture/ Humidity Absorbers

- 10.1.5. Anti-microbial Packaging

- 10.1.6. Others A

- 10.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 10.2.1. Coding and Marking

- 10.2.2. Sensors

- 10.2.3. RFID & NFC

- 10.2.4. Other Intelligent Packaging

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging

- 11. North America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Dessicare Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 WestRock Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Timestrip UK Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Honeywell International Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Coveris Holdings SA

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Sonoco Products Company

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Landec Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Ball Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Crown Holdings Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Bemis Company Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 BASF SE

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 CCL Industries Inc *List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Graphic Packaging

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Sealed Air Corporation

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Amcor Ltd

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Dessicare Inc

List of Figures

- Figure 1: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Active Packaging 2024 & 2032

- Figure 13: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2024 & 2032

- Figure 14: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Intelligent Packaging 2024 & 2032

- Figure 15: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2024 & 2032

- Figure 16: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Active Packaging 2024 & 2032

- Figure 19: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2024 & 2032

- Figure 20: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Intelligent Packaging 2024 & 2032

- Figure 21: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2024 & 2032

- Figure 22: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Active Packaging 2024 & 2032

- Figure 25: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2024 & 2032

- Figure 26: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Intelligent Packaging 2024 & 2032

- Figure 27: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2024 & 2032

- Figure 28: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Active Packaging 2024 & 2032

- Figure 31: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2024 & 2032

- Figure 32: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Intelligent Packaging 2024 & 2032

- Figure 33: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2024 & 2032

- Figure 34: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Active Packaging 2024 & 2032

- Figure 37: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2024 & 2032

- Figure 38: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Intelligent Packaging 2024 & 2032

- Figure 39: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2024 & 2032

- Figure 40: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Active Packaging 2019 & 2032

- Table 3: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Intelligent Packaging 2019 & 2032

- Table 4: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Active Packaging 2019 & 2032

- Table 23: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Intelligent Packaging 2019 & 2032

- Table 24: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Active Packaging 2019 & 2032

- Table 28: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Intelligent Packaging 2019 & 2032

- Table 29: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Active Packaging 2019 & 2032

- Table 35: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Intelligent Packaging 2019 & 2032

- Table 36: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Active Packaging 2019 & 2032

- Table 42: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Intelligent Packaging 2019 & 2032

- Table 43: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Active Packaging 2019 & 2032

- Table 45: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Intelligent Packaging 2019 & 2032

- Table 46: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active and Intelligent Packaging in Pharmaceutical Industry?

The projected CAGR is approximately 9.00%.

2. Which companies are prominent players in the Active and Intelligent Packaging in Pharmaceutical Industry?

Key companies in the market include Dessicare Inc, WestRock Company, Timestrip UK Ltd, Honeywell International Inc, Coveris Holdings SA, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, Bemis Company Inc, BASF SE, CCL Industries Inc *List Not Exhaustive, Graphic Packaging, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the Active and Intelligent Packaging in Pharmaceutical Industry?

The market segments include Active Packaging, Intelligent Packaging .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Advancements in Pharmaceutical Packaging Industry.

6. What are the notable trends driving market growth?

RFID & NFC Holds an Important Position in the Active & Intelligent Packaging in Pharmaceutical Market.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active and Intelligent Packaging in Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active and Intelligent Packaging in Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active and Intelligent Packaging in Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Active and Intelligent Packaging in Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence