**

Super Micro Computer, Inc. (SMCI) has quietly become a titan in the data center infrastructure space. While less flashy than some of its larger competitors, SMCI's consistent growth, strategic acquisitions, and focus on innovation position it as a compelling investment opportunity for long-term investors seeking exposure to the booming data center market. This article delves into the reasons why SMCI deserves a closer look, examining its current performance, future prospects, and the potential risks involved.

Super Micro Computer (SMCI): A Deep Dive into the Data Center Giant

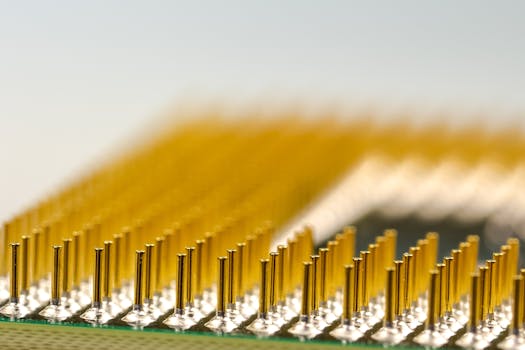

Super Micro Computer specializes in designing, manufacturing, and supplying high-performance computing systems, storage technology, and networking solutions. Their clientele spans diverse sectors, including cloud computing, enterprise IT, high-performance computing (HPC), artificial intelligence (AI), and machine learning (ML). This broad market reach provides a significant buffer against economic downturns affecting specific industries.

The Growing Demand for Data Center Infrastructure

The global data center market is experiencing exponential growth, fueled by the increasing reliance on cloud computing, the proliferation of big data, and the rise of AI and ML applications. This unrelenting demand for computing power and storage capacity is a major tailwind for SMCI, allowing them to capitalize on the need for advanced server technology and related infrastructure.

- Cloud Computing Expansion: The continued expansion of hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) directly benefits SMCI, as these companies require vast quantities of servers and networking equipment.

- AI and ML Boom: The burgeoning field of AI and ML requires immense computing power, creating a surge in demand for specialized hardware that SMCI is well-positioned to supply.

- 5G Infrastructure Deployment: The rollout of 5G networks worldwide necessitates significant investment in data center infrastructure, creating another significant growth opportunity for SMCI.

SMCI's Competitive Advantages

Super Micro Computer distinguishes itself through several key competitive advantages:

- Green Computing Focus: SMCI is a leader in developing energy-efficient servers and data center solutions, a critical factor for environmentally conscious organizations and a growing concern within the industry. This commitment to sustainability gives them a competitive edge in an increasingly ESG-conscious investment landscape.

- Customizable Solutions: SMCI provides highly customizable solutions tailored to the specific needs of its clients, allowing for flexibility and optimal performance. This personalized approach sets them apart from competitors offering standardized products.

- Strong Partnerships: SMCI fosters strong partnerships with leading technology companies, ensuring seamless integration and compatibility across various platforms. This collaborative approach broadens its reach and reinforces its market position.

- Strategic Acquisitions: The company's strategic acquisition strategy has been instrumental in expanding its product portfolio and technological capabilities. This approach allows for faster innovation and expansion into new markets.

Analyzing SMCI's Financial Performance and Future Projections

SMCI's consistent revenue growth and profitability demonstrate its strength within the competitive data center market. Investors should examine recent financial reports, looking at key performance indicators like:

- Revenue Growth: Examine the year-over-year and quarter-over-quarter growth in revenue to assess the company's trajectory.

- Profit Margins: Analyze profit margins to evaluate the company's efficiency and pricing power.

- Debt Levels: Assess the company's debt levels to understand its financial health and risk profile.

- Research and Development Spending: Analyze R&D spending to gauge the company's commitment to innovation and future growth.

Potential Risks and Challenges

While the outlook for SMCI appears positive, potential investors should be aware of several risks:

- Supply Chain Disruptions: Global supply chain challenges can impact the company's ability to source components and meet customer demand.

- Competition: The data center market is fiercely competitive, with numerous large and established players.

- Economic Slowdown: A general economic slowdown could negatively impact spending on IT infrastructure.

- Geopolitical Factors: International trade tensions and geopolitical instability can affect the company's operations and profitability.

Is Super Micro Computer a Buy?

Whether Super Micro Computer is a "buy" depends on individual investor risk tolerance, investment horizon, and diversification strategy. The company's strong market position, focus on innovation, and exposure to high-growth sectors make it a compelling proposition for long-term investors seeking exposure to the burgeoning data center market. However, potential risks, such as supply chain disruptions and macroeconomic headwinds, should be carefully considered.

Thorough due diligence, including reviewing financial statements and industry analyses, is essential before making any investment decision. Consulting with a financial advisor can provide valuable insights and personalized guidance based on your specific investment goals and risk profile. The information presented here is for educational purposes only and should not be construed as financial advice. Always conduct thorough research before making investment decisions. Remember that past performance is not indicative of future results.