**

Investing in the stock market can feel like navigating a minefield. With countless options available, identifying truly promising growth stocks can be challenging. However, one company is emerging as a potential powerhouse, presenting a compelling case for inclusion in your portfolio. This article delves into why [Company Name – Replace with chosen company, e.g., "SolarPowerTech"] could be the next big thing, examining its fundamentals, market position, and future growth potential. We'll explore its competitive advantages, risks involved, and provide actionable insights for informed investment decisions.

Unveiling the Potential of [Company Name] – A Deep Dive into a Promising Growth Stock

[Company Name] operates in the rapidly expanding [Industry – Replace with chosen industry, e.g., "renewable energy"] sector. This industry is experiencing explosive growth fueled by [Key Growth Drivers – Replace with specific drivers, e.g., "increasing government incentives, rising consumer demand for sustainable energy, and technological advancements"]. This favorable macroeconomic environment positions [Company Name] for substantial expansion.

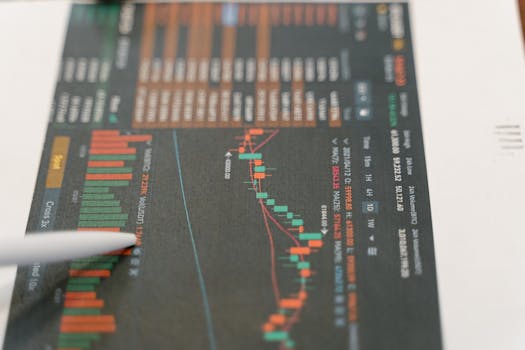

Strong Financials and Impressive Growth Trajectory

[Company Name]'s financial performance speaks volumes. Over the past [Number] years, the company has demonstrated consistent revenue growth averaging [Percentage] annually. This impressive growth trajectory is underpinned by [Specific Factors Contributing to Growth – Replace with specifics, e.g., "successful product launches, strategic acquisitions, and expansion into new markets"]. Key financial metrics like [Mention specific metrics – e.g., "earnings per share (EPS), revenue growth, and return on equity (ROE)"] showcase a healthy and robust financial foundation. Analyzing their financial statements reveals a company with [positive financial characteristics – e.g., "strong cash flow, low debt, and increasing profitability"].

Key Financial Highlights:

- Revenue Growth: [Specific percentage and timeframe]

- EPS Growth: [Specific percentage and timeframe]

- Debt-to-Equity Ratio: [Specific ratio]

- Market Cap: [Current market capitalization]

Competitive Advantages and Market Domination Potential

[Company Name] enjoys several competitive advantages that set it apart from its peers. These include [List specific competitive advantages – e.g., "patented technology, strong brand recognition, a highly efficient supply chain, and a skilled workforce"]. Their market share in the [Specific market segment – e.g., "residential solar panel market"] is growing steadily, signifying a strong market position and the potential for future market dominance.

Competitive Edge:

- Innovation: [Explain their innovative aspects and technology]

- Brand Recognition: [Explain their brand strength and customer loyalty]

- Strategic Partnerships: [List significant partnerships and collaborations]

- First-Mover Advantage: [If applicable, explain their first-mover advantages]

Understanding the Risks: A Balanced Perspective

While [Company Name] presents a compelling investment opportunity, it's crucial to acknowledge the inherent risks associated with growth stocks. These include [List specific risks – e.g., "competition from established players, dependence on government policies, supply chain disruptions, and technological obsolescence"]. A thorough risk assessment is essential before making any investment decision. Analyzing the company's sensitivity to macroeconomic factors like [mention factors – e.g., "interest rate hikes and inflation"] is crucial for a comprehensive evaluation.

Mitigating the Risks: A Prudent Approach

Investors can mitigate these risks by employing a diversified investment strategy. Don't put all your eggs in one basket. Diversification helps to reduce the impact of potential losses from a single investment. Regularly monitoring the company's performance and staying informed about industry trends are also crucial aspects of risk management. Consider using stop-loss orders to protect your investment against significant market downturns.

Is [Company Name] Right for Your Portfolio?

Whether [Company Name] is a suitable addition to your portfolio depends on your individual investment goals, risk tolerance, and investment timeline. It's a growth stock, implying higher risk but potentially higher returns. If you have a long-term investment horizon and are comfortable with a moderate level of risk, [Company Name] could be a valuable addition. Consult with a qualified financial advisor before making any investment decisions. Thorough due diligence and understanding your personal financial circumstances are paramount.

Actionable Steps:

- Conduct thorough research on the company's financials and industry outlook.

- Assess your risk tolerance and investment timeline.

- Diversify your portfolio to mitigate risks.

- Consult with a financial advisor for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own thorough research and seek professional advice before making any investment decisions. Past performance is not indicative of future results.