India's Ultra-High-Net-Worth Individuals Shift Focus: From Luxury Apartments to AIFs – A Real Estate Investment Revolution

Athreya's insights reveal a dramatic shift in investment strategies among India's wealthiest individuals. The traditional allure of luxury apartments in prime locations is fading, replaced by a growing interest in Alternative Investment Funds (AIFs) as a preferred method of real estate investment. This significant change reflects a maturing market, sophisticated investor preferences, and a search for higher returns and diversified portfolios.

The Decline of Luxury Real Estate as a Primary Investment?

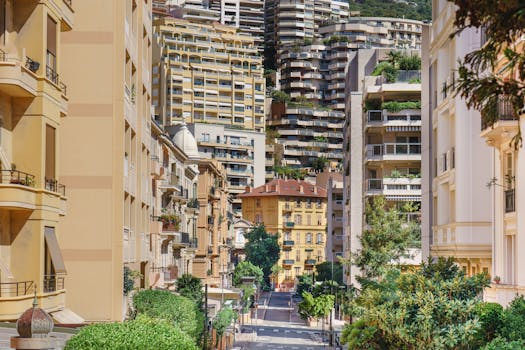

For years, luxury residential properties in major Indian cities like Mumbai, Delhi, Bengaluru, and Gurgaon have been considered prime assets for the ultra-high-net-worth individuals (UHNWIs). However, according to Athreya, a leading financial expert (replace "Athreya" with the actual name and title if known), this trend is experiencing a noticeable downturn. Several factors contribute to this shift:

- High Capital Costs and Illiquidity: Luxury apartments require significant upfront investment, and selling them quickly can be challenging. This illiquidity contrasts sharply with the relative ease of managing investments in AIFs.

- Regulatory Scrutiny: Increased regulatory scrutiny in the luxury real estate market, including stricter compliance norms and taxation, has made these investments less attractive.

- Slower Appreciation: While luxury real estate traditionally appreciates in value, the rate of appreciation has slowed in recent years compared to other asset classes.

- Lack of Diversification: Investing heavily in a single luxury property presents a significant concentration risk, unlike a well-diversified AIF portfolio.

The Rise of AIFs: A More Sophisticated Approach to Real Estate Investment

Alternative Investment Funds (AIFs) are increasingly becoming the preferred vehicle for sophisticated investors looking for exposure to the real estate sector. These funds offer several compelling advantages:

- Higher Potential Returns: AIFs focusing on real estate can offer higher potential returns compared to direct investment in individual properties, often through strategies like real estate debt funds, private equity in real estate development projects, or REITs (Real Estate Investment Trusts).

- Diversification and Risk Management: AIFs allow UHNWIs to diversify their real estate investments across multiple projects and geographies, mitigating the risk associated with any single asset underperforming.

- Professional Management: These funds are managed by experienced professionals with expertise in real estate investment and risk management, relieving investors of the burden of direct property management.

- Accessibility to Exclusive Deals: AIFs often have access to exclusive deals and investment opportunities unavailable to individual investors.

- Liquidity (Relative): While not as liquid as traditional stocks, many AIFs offer more liquidity than direct real estate investments, especially with structured exit strategies.

AIF Categories Relevant to Real Estate Investments

Several categories of AIFs are particularly relevant for real estate investment:

- Category I AIFs: These funds focus on infrastructure development, often including significant real estate components.

- Category II AIFs: These are generally more flexible and can encompass a wider array of real estate-related investments, including debt and equity.

- Category III AIFs: While riskier, these hedge funds can utilize leveraged strategies within the real estate sector for potentially higher returns.

Navigating the AIF Landscape: Due Diligence and Expert Advice

Despite the benefits, investing in AIFs requires careful consideration. It's crucial for potential investors to conduct thorough due diligence, including:

- Fund Manager Track Record: Examining the fund manager’s past performance, investment strategy, and risk management approach is paramount.

- Fund Structure and Fees: Understanding the fund's structure, fee schedule, and lock-in periods is essential for informed decision-making.

- Investment Strategy: Investors should carefully assess the fund's investment strategy and its alignment with their own risk tolerance and financial goals.

- Regulatory Compliance: Ensuring the fund is compliant with all relevant regulations and legal requirements is crucial.

Seeking advice from qualified financial advisors specializing in AIFs is strongly recommended before making any investment decisions. Understanding the complexities of different AIF structures and the potential risks involved is vital for successful participation in this segment of the market.

The Future of Real Estate Investment in India

Athreya's observations signify a broader trend in India's evolving investment landscape. The shift towards AIFs demonstrates the sophistication and maturity of the country's high-net-worth individuals, who are increasingly seeking higher returns, diversification, and professional management of their assets. This strategic realignment is expected to continue, shaping the future of real estate investment in India and paving the way for more innovative and sophisticated investment vehicles. The demand for transparent and well-regulated AIFs will likely grow, driving further growth and innovation within the Indian alternative investment market.

Keywords:

- Alternative Investment Funds (AIFs)

- Real Estate Investment

- India

- Ultra-High-Net-Worth Individuals (UHNWIs)

- Luxury Apartments

- Real Estate Investment Trusts (REITs)

- Real Estate Debt Funds

- Private Equity Real Estate

- Investment Strategies

- Portfolio Diversification

- Risk Management

- Due Diligence

- Financial Advisors

- High-Net-Worth Individuals (HNWIs)

- Indian Real Estate Market

- Mumbai Real Estate

- Delhi Real Estate

- Bengaluru Real Estate

- Gurgaon Real Estate

This article is for informational purposes only and does not constitute financial advice. Consult a financial professional before making any investment decisions.