**

Condo Prices Plummet: Is This Gen Z and Millennial's Chance to Crack the Housing Market?

For years, the dream of homeownership has felt increasingly out of reach for Gen Z and Millennials. Soaring housing prices, fierce competition, and rising interest rates have created a challenging landscape for first-time buyers. But a shift is happening. Recent data indicates a significant downturn in condo prices across many major cities, presenting a potential opportunity for younger generations to finally break into the housing market. This could be your shot.

The Condo Market Correction: A Buyer's Market Emerges

The real estate market, particularly the condo sector, is experiencing a correction. After years of unprecedented growth, fueled by low interest rates and high demand, prices are now falling in many areas. This isn't necessarily a market crash, but rather a recalibration, offering a much-needed breather for potential buyers burdened by affordability concerns. This correction is affecting first-time homebuyers, condo prices, and affordable housing in major ways.

Several factors contribute to this decline:

- Rising Interest Rates: Higher interest rates make mortgages more expensive, reducing affordability and cooling buyer demand. This directly impacts the mortgage rates and housing affordability that many young adults face.

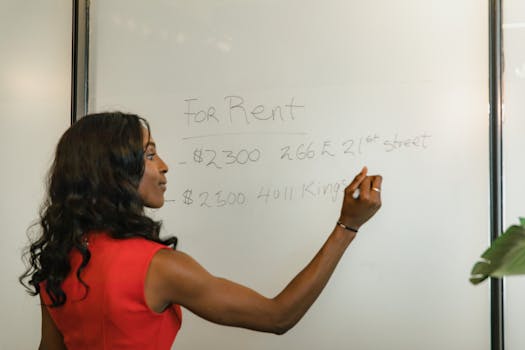

- Increased Inventory: An increase in the number of condos available for sale is creating more competition among sellers, leading to price reductions. This is a major boon to first-time homebuyers searching for affordable condos.

- Economic Uncertainty: Concerns about inflation and a potential recession are making some potential buyers hesitant, further impacting demand.

This combination of factors is creating a buyer's market, especially for condos. This means that buyers have more negotiating power and may be able to find properties at significantly lower prices than they would have just a year ago.

Why Condos Are a Strategic Entry Point for Young Buyers

Condos often represent a more affordable entry point into the housing market compared to single-family homes. They typically require a smaller down payment and lower purchase price, making them more accessible to younger generations with limited savings. Additionally, many condo buildings offer amenities such as swimming pools, gyms, and security systems, often at a lower cost than comparable amenities in single-family homes.

Advantages of Condo Ownership for Gen Z and Millennials:

- Lower Purchase Price: Condos generally cost less than single-family homes in the same area.

- Lower Down Payment Requirements: Often requiring a smaller down payment, making them more accessible.

- Amenities Included: Many condo buildings include amenities that would otherwise be expensive to maintain.

- Lower Maintenance: Exterior maintenance and landscaping are typically handled by the condo association.

- Location, Location, Location: Condos are frequently situated in desirable urban areas close to employment centers and entertainment.

This makes condos an increasingly attractive option for young professionals, students, and those seeking a more convenient and low-maintenance lifestyle.

Navigating the Condo Market: Tips for Success

While falling condo prices present an opportunity, it's crucial to approach the market strategically:

- Research Thoroughly: Do your homework! Understand the current market conditions in your target area, compare prices, and analyze property values. Utilize online resources, real estate agents, and market analysis tools. Understanding real estate trends is critical.

- Secure Pre-Approval: Getting pre-approved for a mortgage before starting your search will give you a clear understanding of your budget and strengthen your negotiating position. Understanding mortgage pre-approval is a necessary first step.

- Work with a Real Estate Agent: A skilled real estate agent can provide invaluable guidance, help you navigate the complexities of the buying process, and assist in negotiating favorable terms.

- Inspect Carefully: Don't skip the home inspection! Hiring a qualified inspector can help identify potential problems before you commit to a purchase.

The Future of Condo Prices: What to Expect

While prices are falling now, it's important to avoid speculation. Predicting the future of the real estate market is always challenging. However, experts suggest that while further price adjustments are possible, a significant crash is unlikely. The market is expected to stabilize, but the current buyer-friendly conditions may not last indefinitely.

Don't Miss This Window of Opportunity

For Gen Z and Millennials, the current downturn in condo prices might be a rare opportunity to achieve the dream of homeownership. While challenges remain, the combination of lower prices, increased inventory, and strategic planning can significantly increase your chances of success. Now is the time to act decisively and leverage this favorable market condition. Don't wait until interest rates rise again or prices rebound. This could be your chance to finally enter the housing market and start building your future.