Key Insights

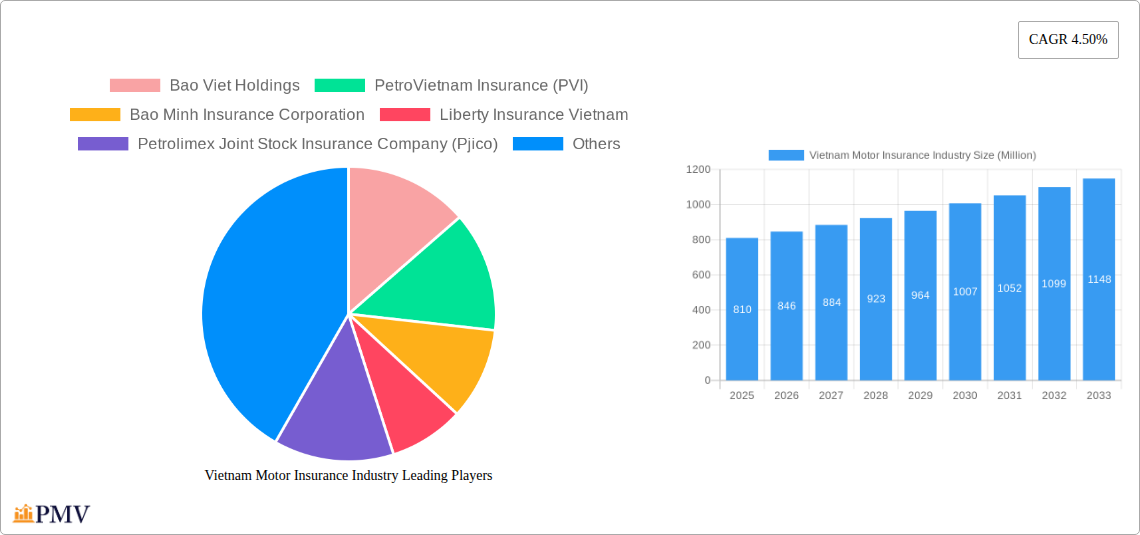

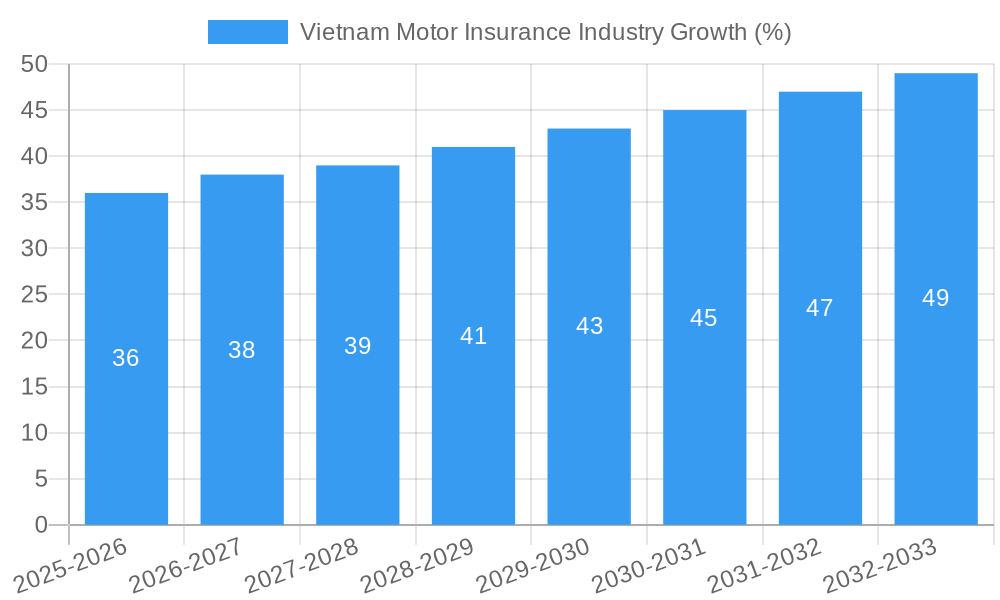

The Vietnam motor insurance market, valued at approximately $810 million in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Vietnam's burgeoning middle class and increasing vehicle ownership rates are driving demand for motor insurance coverage. Secondly, government regulations promoting road safety and mandatory insurance coverage contribute significantly to market growth. Thirdly, the insurance sector's ongoing modernization, including digitalization efforts and improved customer service, enhances accessibility and consumer confidence. Increased awareness of the benefits of comprehensive motor insurance and a growing understanding of risk mitigation also play crucial roles. Competitive pressures among established players like Bao Viet Holdings, PetroVietnam Insurance (PVI), and Bao Minh Insurance Corporation, alongside the entry of new international and domestic insurers, further stimulate market dynamism and innovation.

However, challenges remain. The relatively low insurance penetration rate compared to regional peers indicates considerable untapped potential, yet also presents hurdles in terms of educating consumers about the value proposition of motor insurance. Furthermore, fluctuating fuel prices and economic uncertainties can impact consumer spending on non-essential items like insurance. Addressing these factors requires a combination of proactive marketing strategies, government initiatives to raise awareness, and continued innovation within the insurance sector to offer more affordable and accessible products tailored to diverse consumer needs. The presence of both domestic giants and international players creates a dynamic competitive landscape that will continue to shape the market's trajectory in the coming years. The forecast suggests substantial market expansion, with opportunities for both established insurers and new entrants to capitalize on the growing demand for motor insurance in Vietnam.

Vietnam Motor Insurance Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Vietnam motor insurance industry, covering market dynamics, competitive landscape, and future growth prospects from 2019 to 2033. With a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for investors, insurers, and industry stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The report utilizes data from the historical period (2019-2024) and incorporates the latest industry developments, including the significant impact of Vietnam's accession to the ASEAN Compulsory Motor Insurance Scheme (ACMI). The market size is expected to reach xx Million by 2033.

Vietnam Motor Insurance Industry Market Structure & Competitive Dynamics

This section analyzes the structure and competitive dynamics of the Vietnam motor insurance market. The market is characterized by a mix of both domestic and international players, with varying degrees of market concentration. Key players include Bao Viet Holdings, PetroVietnam Insurance (PVI), Bao Minh Insurance Corporation, Liberty Insurance Vietnam, Petrolimex Joint Stock Insurance Company (Pjico), AAA Assurance Corporation, BIDV Insurance Corporation, Fubon Insurance Company, Phu Hung Assurance Corporation, and Samsung Vina Insurance Company. This list is not exhaustive.

Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025. The regulatory framework, while evolving, plays a significant role in shaping competitive dynamics. Innovation in product offerings and distribution channels is crucial for success. Recent M&A activities, while not frequent, have involved xx Million in deal values over the past five years, primarily focused on expanding market reach and product diversification. Product substitution is limited due to regulatory requirements for mandatory insurance. End-user trends show increasing demand for digital insurance solutions and bundled products.

Vietnam Motor Insurance Industry Industry Trends & Insights

The Vietnam motor insurance market is experiencing significant growth, driven by factors such as rising vehicle ownership, increasing urbanization, and a growing middle class. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration remains relatively low compared to regional peers, presenting significant untapped potential. Technological disruptions, such as telematics and AI-powered risk assessment, are transforming the industry. Consumer preferences are shifting toward more convenient and personalized insurance solutions, driving the adoption of digital platforms and mobile applications. Competitive dynamics are intensifying, with players focusing on product differentiation, customer service, and cost optimization.

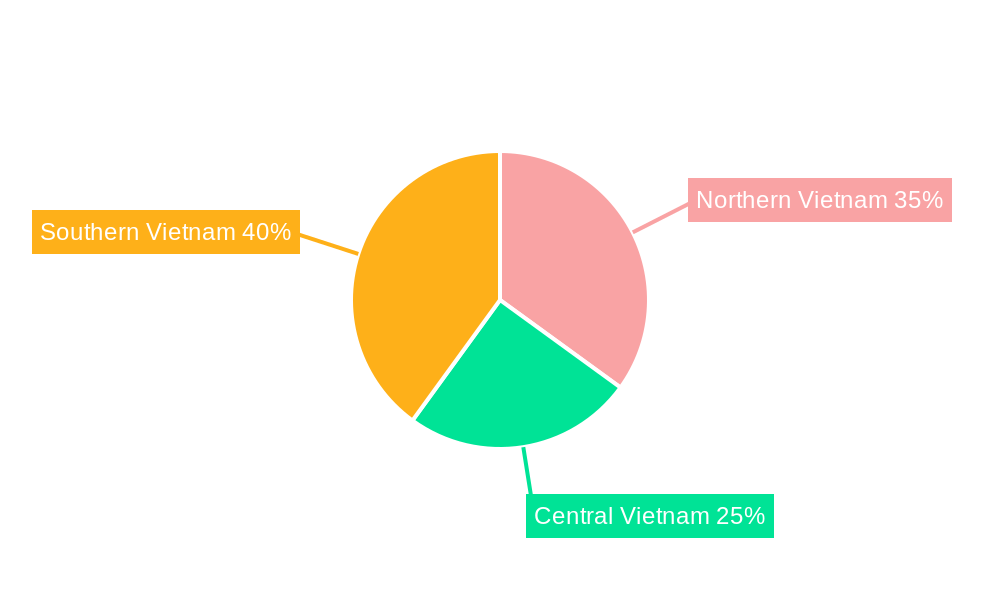

Dominant Markets & Segments in Vietnam Motor Insurance Industry

The Vietnam motor insurance market is dominated by the urban areas of major cities like Hanoi and Ho Chi Minh City due to higher vehicle density and economic activity. Key drivers for this dominance include:

- Economic Policies: Government initiatives promoting economic growth and infrastructure development stimulate vehicle sales and insurance demand.

- Infrastructure: Well-developed road networks in urban areas contribute to higher vehicle usage and accident rates, leading to greater insurance demand.

The dominance of urban areas is further strengthened by the concentration of businesses and individuals with higher disposable incomes, leading to greater capacity for insurance premiums. Rural areas show a lower level of market penetration due to lower vehicle ownership and income levels. However, future growth potential lies in expanding coverage to these underserved areas.

Vietnam Motor Insurance Industry Product Innovations

The Vietnam motor insurance industry is witnessing increased product innovation, driven by technological advancements. Telematics-based insurance is gaining traction, offering customized premiums based on driver behavior. Insurers are also developing bundled insurance products, integrating motor insurance with other financial services to enhance customer value. These innovations address the evolving needs of customers and enhance market competitiveness.

Report Segmentation & Scope

The report segments the Vietnam motor insurance market by various parameters, including vehicle type (two-wheelers, four-wheelers, commercial vehicles), insurance type (third-party liability, comprehensive), and geographical region (urban, rural). Each segment's growth projections, market size, and competitive landscape are thoroughly analyzed. For example, the two-wheeler segment is projected to exhibit a higher CAGR than the four-wheeler segment due to the high volume of two-wheeler vehicles in the country. This trend is influenced by the penetration of personal injury insurance schemes.

Key Drivers of Vietnam Motor Insurance Industry Growth

Several factors are driving the growth of the Vietnam motor insurance industry:

- Rising Vehicle Ownership: The increasing number of vehicles on the road fuels demand for motor insurance.

- Government Regulations: Mandatory insurance requirements contribute to market growth.

- Economic Growth: A thriving economy leads to higher disposable incomes, enabling greater affordability of insurance.

Challenges in the Vietnam Motor Insurance Industry Sector

The Vietnam motor insurance industry faces certain challenges including:

- High Accident Rates: The high number of road accidents leads to increased claims payouts, impacting profitability.

- Insurance Awareness: Low insurance awareness among the population presents a barrier to market penetration.

- Competition: Intense competition amongst insurers necessitates effective strategies for customer acquisition and retention.

Leading Players in the Vietnam Motor Insurance Industry Market

- Bao Viet Holdings

- PetroVietnam Insurance (PVI)

- Bao Minh Insurance Corporation

- Liberty Insurance Vietnam

- Petrolimex Joint Stock Insurance Company (Pjico)

- AAA Assurance Corporation

- BIDV Insurance Corporation

- Fubon Insurance Company

- Phu Hung Assurance Corporation

- Samsung Vina Insurance Company

Key Developments in Vietnam Motor Insurance Industry Sector

- December 2023: Cathay Insurance Vietnam partnered with SAWAD to launch a "Dual Finance" initiative, combining financial assistance with mandatory insurance. Cathay also plans to introduce a personal injury insurance scheme. This signals a move towards comprehensive financial solutions for customers.

- November 2023: Vietnam joined the ASEAN Compulsory Motor Insurance Scheme (ACMI), requiring all vehicles traveling within ASEAN to have mandatory third-party liability insurance. This development significantly impacts market dynamics by enhancing cross-border travel insurance needs.

Strategic Vietnam Motor Insurance Industry Market Outlook

The Vietnam motor insurance market holds substantial future potential, driven by continued economic growth, rising vehicle ownership, and increasing awareness of insurance benefits. Strategic opportunities exist for insurers to leverage technological advancements, expand into underserved markets, and offer innovative products tailored to customer needs. The focus on digital insurance platforms and the expanding middle class will be key to future market success.

Vietnam Motor Insurance Industry Segmentation

-

1. Policy Type

- 1.1. Compulsory Third-Party Liability Insurance (CTPL)

- 1.2. Comprehensive Insurance

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Banks

- 3.4. Online

- 3.5. Other Distribution Channels

Vietnam Motor Insurance Industry Segmentation By Geography

- 1. Vietnam

Vietnam Motor Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government

- 3.3. Market Restrains

- 3.3.1. Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government

- 3.4. Market Trends

- 3.4.1. Surge in Vehicle Ownership Generating Major Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Motor Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Compulsory Third-Party Liability Insurance (CTPL)

- 5.1.2. Comprehensive Insurance

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Banks

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bao Viet Holdings

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PetroVietnam Insurance (PVI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bao Minh Insurance Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Liberty Insurance Vietnam

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrolimex Joint Stock Insurance Company (Pjico)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AAA Assurance Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BIDV Insurance Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fubon Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Phu Hung Assurance Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Vina Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bao Viet Holdings

List of Figures

- Figure 1: Vietnam Motor Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Motor Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Motor Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Motor Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Vietnam Motor Insurance Industry Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 4: Vietnam Motor Insurance Industry Volume Billion Forecast, by Policy Type 2019 & 2032

- Table 5: Vietnam Motor Insurance Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Vietnam Motor Insurance Industry Volume Billion Forecast, by Vehicle Type 2019 & 2032

- Table 7: Vietnam Motor Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Vietnam Motor Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Vietnam Motor Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Vietnam Motor Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Vietnam Motor Insurance Industry Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 12: Vietnam Motor Insurance Industry Volume Billion Forecast, by Policy Type 2019 & 2032

- Table 13: Vietnam Motor Insurance Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Vietnam Motor Insurance Industry Volume Billion Forecast, by Vehicle Type 2019 & 2032

- Table 15: Vietnam Motor Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Vietnam Motor Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: Vietnam Motor Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Vietnam Motor Insurance Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Motor Insurance Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Vietnam Motor Insurance Industry?

Key companies in the market include Bao Viet Holdings, PetroVietnam Insurance (PVI), Bao Minh Insurance Corporation, Liberty Insurance Vietnam, Petrolimex Joint Stock Insurance Company (Pjico), AAA Assurance Corporation, BIDV Insurance Corporation, Fubon Insurance Company, Phu Hung Assurance Corporation, Samsung Vina Insurance Company**List Not Exhaustive.

3. What are the main segments of the Vietnam Motor Insurance Industry?

The market segments include Policy Type, Vehicle Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government.

6. What are the notable trends driving market growth?

Surge in Vehicle Ownership Generating Major Demand in the Market.

7. Are there any restraints impacting market growth?

Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government.

8. Can you provide examples of recent developments in the market?

December 2023: Cathay Insurance Vietnam joined hands with SAWAD to unveil an all-inclusive "Dual Finance" initiative. This program empowers customers to seek financial assistance while securing mandatory insurance coverage seamlessly. To cater to its clientele's diverse needs, Cathay has set to roll out a personal injury insurance scheme in December, complementing its existing financial support and automobile insurance offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Motor Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Motor Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Motor Insurance Industry?

To stay informed about further developments, trends, and reports in the Vietnam Motor Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence