Key Insights

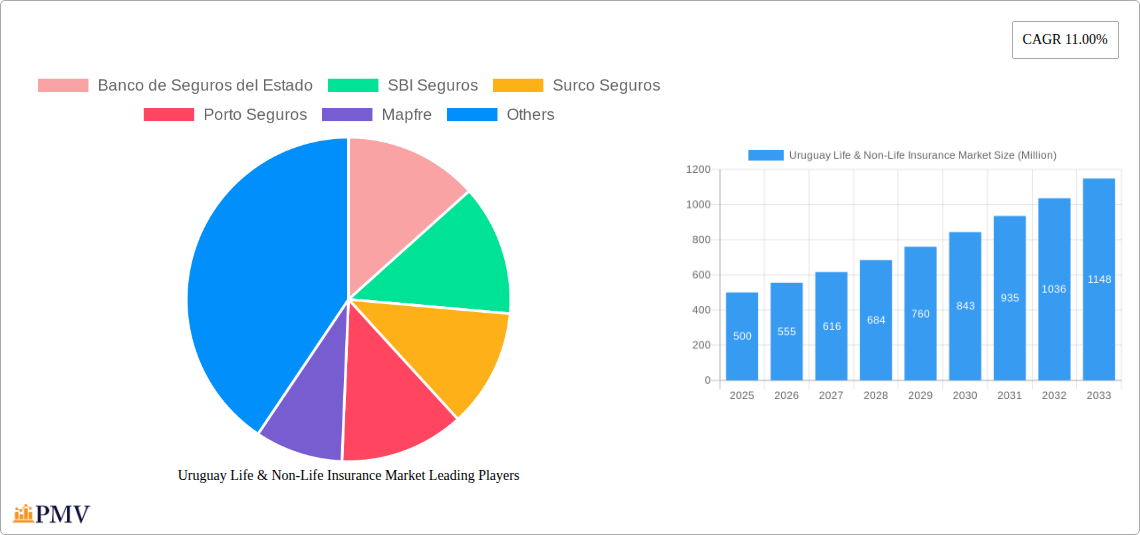

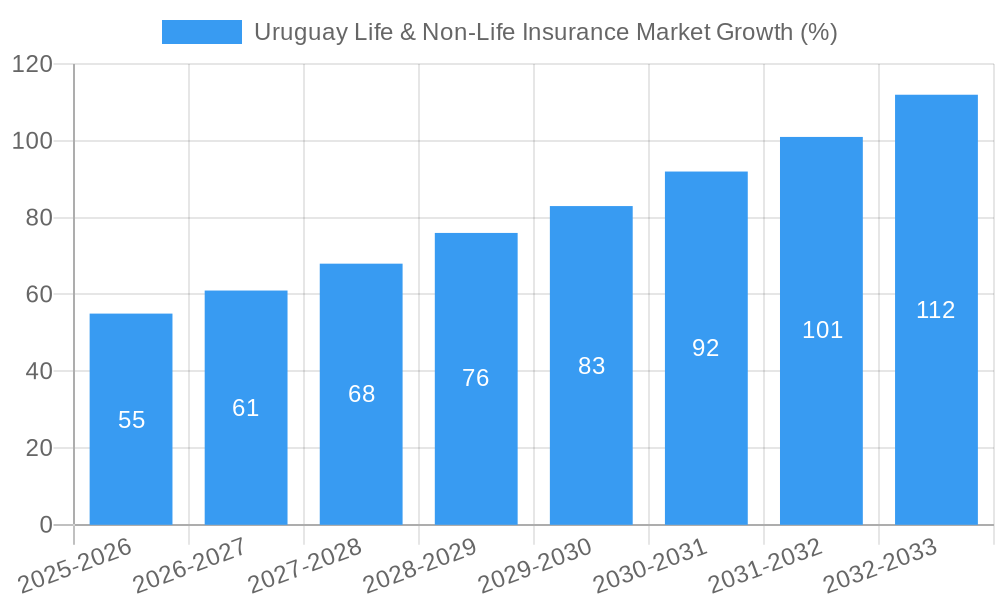

The Uruguayan life and non-life insurance market presents a compelling investment opportunity, exhibiting robust growth prospects. The market, currently valued at an estimated [Estimate Market Size in 2025 based on provided CAGR and study period; e.g., $500 million], is projected to experience a compound annual growth rate (CAGR) of 11% from 2025 to 2033. This expansion is fueled by several key drivers, including a rising middle class with increased disposable income, growing awareness of insurance products, and government initiatives promoting financial inclusion. Furthermore, the increasing prevalence of chronic diseases and a growing demand for health insurance are significantly contributing to the growth of the life insurance segment. The market's expansion is also supported by the development of digital insurance platforms and the adoption of innovative insurance solutions tailored to the specific needs of the Uruguayan population. However, challenges remain, such as economic volatility and regulatory changes, which could impact the market's trajectory.

Despite these potential headwinds, the positive growth trajectory is expected to continue due to the increasing penetration of insurance products in underserved segments of the population and strategic investments by both domestic and international insurance companies. The competitive landscape is diverse, with a mix of established players like Banco de Seguros del Estado and Mapfre, alongside smaller, more agile insurers. This competitive environment fosters innovation and drives the development of competitive pricing and product offerings, further benefiting consumers. The market is segmented by product type (life, health, non-life, etc.), distribution channels, and geographic region, offering various investment and expansion opportunities within the sector. Understanding these nuances is critical for navigating this dynamic market and capitalizing on its considerable growth potential.

Uruguay Life & Non-Life Insurance Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Uruguay Life & Non-Life Insurance Market, offering valuable insights for industry professionals, investors, and stakeholders. The study covers the period 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Key segments, competitive dynamics, and future growth potential are meticulously examined. The report features data on market size (in Millions), CAGR, market share, and M&A activity, providing actionable intelligence to navigate this dynamic market.

Uruguay Life & Non-Life Insurance Market Market Structure & Competitive Dynamics

The Uruguayan Life & Non-Life insurance market exhibits a moderately concentrated structure, with several dominant players alongside a number of smaller, niche insurers. Market share data reveals that Banco de Seguros del Estado holds the largest share, followed by SBI Seguros and Mapfre. However, the market is witnessing increasing competition from both domestic and international players. The regulatory framework, while relatively stable, is undergoing periodic updates to enhance consumer protection and market transparency. Innovation in product offerings remains a key competitive differentiator, with digitalization driving the adoption of innovative insurance solutions. The M&A landscape has been relatively quiet in recent years, with deal values remaining below xx Million. However, future consolidation is anticipated, driven by the need for scale and enhanced competitiveness. End-user trends indicate a growing preference for customized and digital insurance products.

- Market Concentration: High, dominated by a few major players.

- Innovation Ecosystem: Moderate, with increasing focus on digitalization.

- Regulatory Framework: Stable, undergoing periodic updates.

- Product Substitutes: Limited, with increasing competition from Fintech players.

- End-User Trends: Shift towards digital and customized products.

- M&A Activity: Relatively low in recent years; expected increase in the forecast period.

Uruguay Life & Non-Life Insurance Market Industry Trends & Insights

The Uruguayan Life & Non-Life insurance market is projected to experience steady growth over the forecast period, driven by factors such as increasing insurance awareness, expanding middle class, and government initiatives promoting financial inclusion. The CAGR is estimated to be xx% during 2025-2033. Market penetration remains relatively low, indicating significant untapped potential. Technological disruptions are transforming the industry, with digital platforms, AI-powered underwriting, and telematics driving efficiency and customer experience. Consumer preferences are shifting towards personalized products and seamless digital interactions. Competitive dynamics are intensifying, with incumbents facing challenges from agile Fintech players. The market is characterized by increasing price competition and a focus on value-added services. The growing adoption of digital channels and the increasing demand for health insurance are key factors driving market growth.

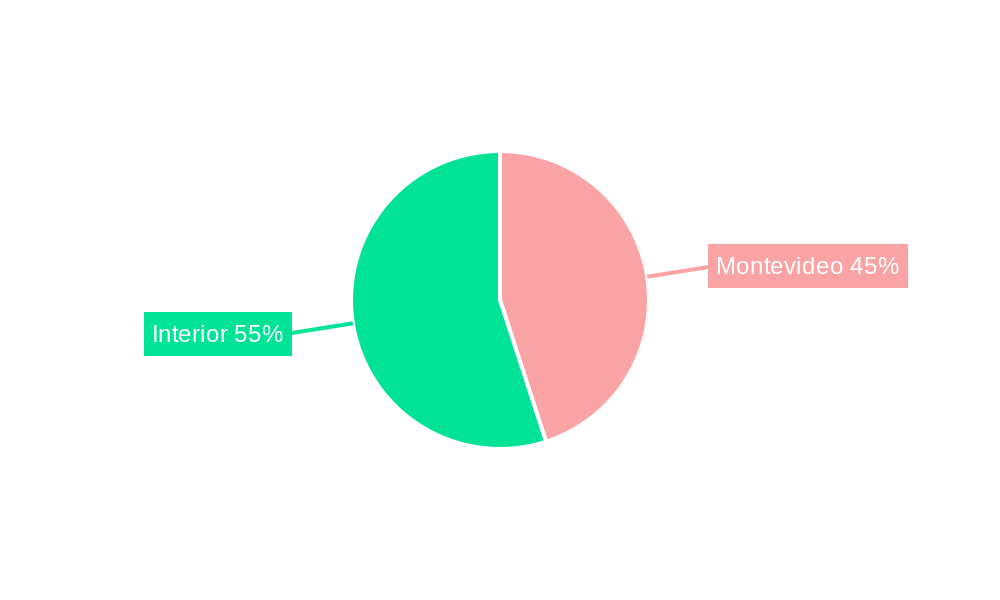

Dominant Markets & Segments in Uruguay Life & Non-Life Insurance Market

The Montevideo metropolitan area represents the largest segment within the Uruguayan Life & Non-Life insurance market, accounting for approximately xx% of the total market value in 2025. This dominance is attributed to several key factors:

- Higher Population Density: Montevideo has the highest population concentration in Uruguay.

- Economic Activity: The city is the hub of economic activity, creating higher demand for insurance.

- Developed Infrastructure: Advanced infrastructure and technology support the insurance sector.

- Higher Disposable Incomes: Higher disposable incomes among Montevideo residents lead to greater purchasing power for insurance products.

The Life insurance segment holds a xx% market share, mainly driven by increasing awareness of retirement planning and protection needs. The Non-Life segment contributes to the remaining share, with motor insurance being the largest sub-segment. However, the growth trajectory is projected to see both segments expanding with the overall market.

Uruguay Life & Non-Life Insurance Market Product Innovations

Recent innovations in the Uruguayan Life & Non-Life insurance market include the introduction of microinsurance products targeting low-income segments, the integration of telematics in motor insurance for personalized risk assessment, and the rise of digital platforms for streamlined policy management and claims processing. These developments are aligning with global trends and enhancing market competitiveness. Technological advancements in data analytics are contributing to improved risk underwriting and personalized offerings. The adoption of these technologies improves efficiency and customer experience, driving both market penetration and premium growth.

Report Segmentation & Scope

This report segments the Uruguayan Life & Non-Life insurance market by product type (Life and Non-Life), distribution channel (direct and indirect), and geography (Montevideo and Rest of Uruguay). Growth projections vary across segments, with the Non-Life segment projected to show slightly higher growth than the Life segment during the forecast period. Market size estimates and competitive analyses are provided for each segment, including details on pricing strategies and customer acquisition costs. Further granular analysis of various sub-segments like health, motor, property, and liability is also included.

Key Drivers of Uruguay Life & Non-Life Insurance Market Growth

Several factors are driving growth in the Uruguayan Life & Non-Life insurance market. Economic growth is fueling rising disposable incomes, increasing demand for insurance protection. Government regulations aimed at improving financial inclusion are enhancing market accessibility. Technological advancements, particularly digitalization, are boosting efficiency and customer experience, improving market penetration. Furthermore, increasing awareness of insurance benefits through targeted public awareness campaigns is stimulating demand.

Challenges in the Uruguay Life & Non-Life Insurance Market Sector

The Uruguayan Life & Non-Life insurance market faces challenges such as relatively low insurance penetration, a limited number of insurance products designed for specific customer niches, and the high cost of acquiring new customers. Regulatory hurdles and compliance costs pose additional challenges to insurers. Competition from international players and the emergence of Insurtech start-ups are also impacting market dynamics. Addressing these challenges requires insurers to adapt to the changing market environment and develop innovative strategies to enhance their competitiveness.

Leading Players in the Uruguay Life & Non-Life Insurance Market Market

- Banco de Seguros del Estado

- SBI Seguros

- Surco Seguros

- Porto Seguros

- Mapfre

- Sancor Seguros

- Berkley Uruguay Seguros

- Surety Insures SA

- FAR Insurance company SA

- State Insurance Bank

- CUTCSA Seguros SA

- HDI Seguros SA (List Not Exhaustive)

Key Developments in Uruguay Life & Non-Life Insurance Market Sector

- March 08, 2022: Banco de Seguros del Estado inaugurated a new agency in Río Branco, expanding its reach and accessibility. This expansion signifies a strategic move to enhance market penetration in underserved areas.

- November 09, 2022: SBI Seguros expanded its commercial risk portfolio by introducing bail insurance, catering to a growing market segment and strengthening its competitive position. This signifies a proactive response to evolving market needs and an effort to diversify revenue streams.

Strategic Uruguay Life & Non-Life Insurance Market Market Outlook

The Uruguayan Life & Non-Life insurance market presents significant growth opportunities over the next decade. Continued economic growth, increasing insurance awareness, and the adoption of digital technologies will drive market expansion. Strategic investments in digital infrastructure and innovative product development are crucial for success. Opportunities exist in the underserved segments, particularly among SMEs and low-income populations. Partnerships with fintech companies and the leveraging of data analytics to improve risk management are key strategic imperatives for players aiming to capture significant market share in the years to come.

Uruguay Life & Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Other Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other distribution channels

Uruguay Life & Non-Life Insurance Market Segmentation By Geography

- 1. Uruguay

Uruguay Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Health Insurance in Uruguay

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uruguay Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Other Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uruguay

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Banco de Seguros del Estado

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SBI Seguros

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Surco Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porto Seguros

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mapfre

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sancor Seguros

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berkley Uruguay Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Surety Insures SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FAR Insurance company SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 State Insurance Bank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CUTCSA Seguros SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HDI Seguros SA**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Banco de Seguros del Estado

List of Figures

- Figure 1: Uruguay Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uruguay Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 4: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 7: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uruguay Life & Non-Life Insurance Market?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Uruguay Life & Non-Life Insurance Market?

Key companies in the market include Banco de Seguros del Estado, SBI Seguros, Surco Seguros, Porto Seguros, Mapfre, Sancor Seguros, Berkley Uruguay Seguros, Surety Insures SA, FAR Insurance company SA, State Insurance Bank, CUTCSA Seguros SA, HDI Seguros SA**List Not Exhaustive.

3. What are the main segments of the Uruguay Life & Non-Life Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Health Insurance in Uruguay.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On March 08, 2022, Banco de Seguros del Estado in Río Branco Agency, located at Virrey Arredondo 930, Río Branco, Department of Cerro Largo, was inaugurated. The allocation of this Agency was given within the framework of a call for expressions of interest made by the BSE in July 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uruguay Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uruguay Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uruguay Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Uruguay Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence