Key Insights

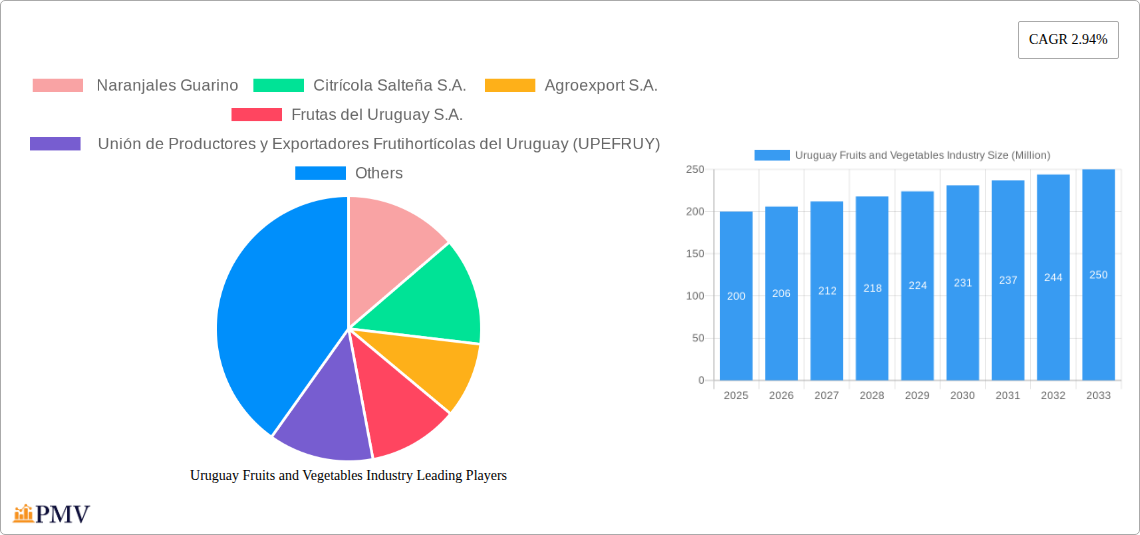

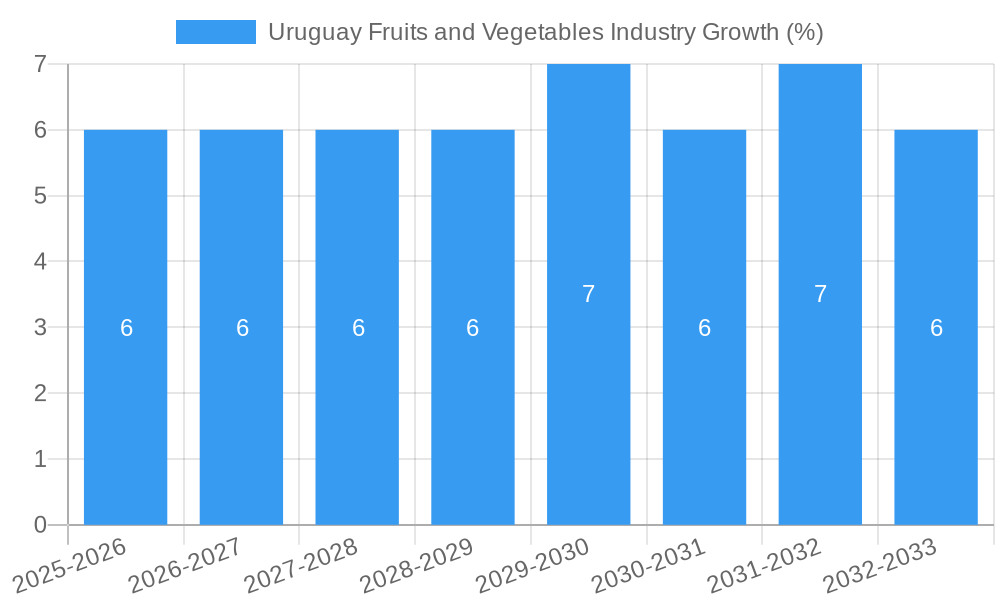

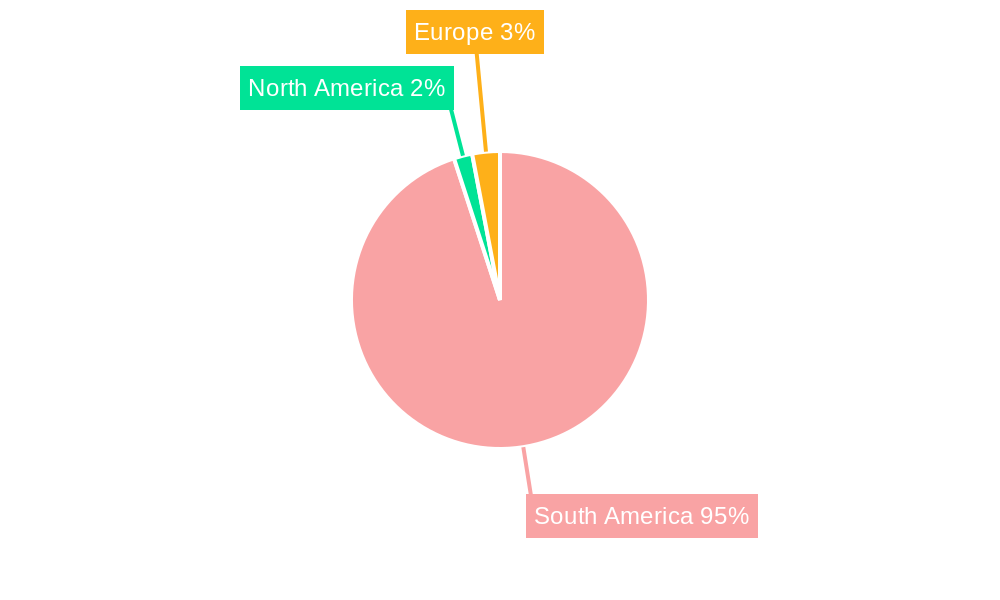

The Uruguayan fruits and vegetables industry, while relatively small compared to global giants, presents a promising market poised for moderate growth. The 2.94% CAGR (2019-2024) indicates a steady expansion, driven by increasing domestic consumption fueled by a growing population and rising disposable incomes. Furthermore, a growing focus on health and wellness is boosting demand for fresh produce, particularly organic options. This trend is further amplified by increasing international demand for high-quality Uruguayan fruits and vegetables, particularly within the South American region. Key players like Naranjales Guarino, Citrícola Salteña S.A., and Agroexport S.A. are vital in shaping this market, contributing significantly to exports and domestic supply chains. However, challenges remain, including potential limitations in production capacity, vulnerability to climate change impacting yields, and competition from larger, more established fruit and vegetable exporters in South America. The segmentation into organic and conventional production types highlights a crucial market dynamic, with the organic segment experiencing faster growth due to evolving consumer preferences.

The industry's future trajectory relies on several factors. Investing in sustainable agricultural practices, improving infrastructure to support efficient transportation and storage, and fostering stronger international partnerships will be crucial for sustained growth. Further diversification of exports beyond South America, coupled with effective marketing strategies highlighting the quality and sustainability of Uruguayan produce, will open new market avenues. The strong presence of cooperatives like UPEFRUY and Conaprole underscores a collaborative approach within the industry, facilitating access to resources and markets. This collaborative structure, combined with strategic investments in technology and innovation, positions the Uruguayan fruits and vegetables industry for continued growth and expansion in the coming decade. Precise market sizing beyond the given data requires further industry-specific research, but based on the provided CAGR and market trends, a steady, though modest, increase in market value is anticipated.

Uruguay Fruits and Vegetables Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Uruguay fruits and vegetables industry, covering the period from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, this report offers invaluable insights for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The forecast period spans from 2025 to 2033, building upon the historical period of 2019-2024. The report includes detailed analysis of market size (in Millions), CAGR, market share, and key industry trends, focusing on both organic and conventional production of fruits and vegetables.

Uruguay Fruits and Vegetables Industry Market Structure & Competitive Dynamics

The Uruguayan fruits and vegetables industry exhibits a moderately concentrated market structure, with several key players dominating specific segments. Market share is largely influenced by factors such as production volume, export capabilities, and access to key distribution channels. While precise market share data for individual companies remains confidential, Naranjales Guarino, Citrícola Salteña S.A., Agroexport S.A., and Frutas del Uruguay S.A. are considered prominent players. The industry’s innovation ecosystem is relatively nascent, with limited venture capital investment compared to other agricultural sectors globally. However, recent government initiatives aimed at boosting agricultural technology are beginning to stimulate innovation.

The regulatory framework is generally supportive of agricultural exports, with various government agencies providing assistance to producers. Product substitutes, particularly imported fruits and vegetables, pose a competitive challenge, requiring domestic producers to focus on quality, branding, and niche markets. End-user trends increasingly favor organic and sustainably produced products, pushing producers to adapt their practices. M&A activity in the sector has been relatively low in recent years, with reported deal values under $xx Million during the historical period. However, future consolidation is anticipated as larger players seek to expand their market share.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Nascent, but growing with government support.

- Regulatory Framework: Supportive of exports.

- Product Substitutes: Imported fruits and vegetables.

- End-User Trends: Growing demand for organic produce.

- M&A Activity: Low in recent years; projected increase in future years.

Uruguay Fruits and Vegetables Industry Industry Trends & Insights

The Uruguayan fruits and vegetables industry is experiencing steady growth, driven primarily by increasing domestic consumption and expanding export markets. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was approximately xx%, and is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as precision agriculture techniques and improved post-harvest handling, are enhancing productivity and reducing losses. Consumer preferences are shifting towards healthier, more convenient options, boosting demand for pre-cut fruits, value-added products, and organic produce. Market penetration of organic produce is increasing, albeit from a relatively small base, with projections indicating xx% market share by 2033. Competitive dynamics are characterized by increasing pressure from imports, necessitating improvements in efficiency and quality to maintain market share.

Dominant Markets & Segments in Uruguay Fruits and Vegetables Industry

The dominant segment within the Uruguayan fruits and vegetables industry is currently the export market, particularly for citrus fruits and blueberries. Key drivers for this dominance include favorable climatic conditions, well-established export infrastructure, and access to international markets. The organic segment is experiencing rapid growth, although it still represents a smaller portion of the overall market compared to conventional production.

- Key Drivers for Export Market Dominance:

- Favorable climate

- Established export infrastructure

- Access to international markets (e.g., Israel for blueberries)

- Key Drivers for Organic Segment Growth:

- Growing consumer demand for organic products

- Government support for organic agriculture

- Opportunities for premium pricing

While regional variations exist within Uruguay, the overall market is relatively homogeneous in terms of production and consumption patterns. Government policies promoting agricultural exports and investments in irrigation infrastructure have been key in supporting the industry's growth.

Uruguay Fruits and Vegetables Industry Product Innovations

Recent innovations in the Uruguayan fruits and vegetables industry include the launch of six new citrus varieties by the country's citrus breeding program in December 2022. These improved varieties offer enhanced disease resistance, increased yields, and superior flavor profiles, making them highly competitive in international markets. Technological advancements in post-harvest technologies are also contributing to improved product quality and shelf life, expanding market opportunities. The development and adoption of sustainable farming practices, such as integrated pest management and precision agriculture, are aligning with growing consumer demand for environmentally friendly products.

Report Segmentation & Scope

This report segments the Uruguay fruits and vegetables market by Product Type (Fruits and Vegetables) and Production Type (Organic and Conventional). Within each of these segments, further sub-segmentation may be conducted based on specific product categories (e.g., citrus fruits, blueberries, grapes) and production methods. Growth projections and market size estimates are provided for each segment, alongside an analysis of the competitive dynamics within each. The report aims to provide a comprehensive overview of the market, including historical data, current market trends, and future projections.

Key Drivers of Uruguay Fruits and Vegetables Industry Growth

Several key factors are driving the growth of the Uruguay fruits and vegetables industry. These include favorable climatic conditions suitable for diverse crops; increasing domestic consumption spurred by population growth and rising incomes; and expanding export markets, particularly in South America, North America, and Europe; Government support for agricultural development through investments in infrastructure and technology also plays a vital role. The growing demand for organic and sustainably produced food is also creating new market opportunities for Uruguayan producers.

Challenges in the Uruguay Fruits and Vegetables Industry Sector

The Uruguayan fruits and vegetables industry faces challenges including the vulnerability to climate change impacts, such as droughts and extreme weather events, leading to yield variability; competition from larger, more established producers in other countries; and the need for continuous investment in technology and infrastructure to maintain competitiveness. Supply chain inefficiencies, particularly in post-harvest handling and logistics, can also result in significant losses and increase costs. The cost of labor and compliance with increasing international standards for food safety and sustainability can further limit profitability.

Leading Players in the Uruguay Fruits and Vegetables Industry Market

- Naranjales Guarino

- Citrícola Salteña S.A.

- Agroexport S.A.

- Frutas del Uruguay S.A.

- Unión de Productores y Exportadores Frutihortícolas del Uruguay (UPEFRUY)

- Cooperativa Nacional de Productores de Leche (Conaprole)

- Bardanca S.A.

Key Developments in Uruguay Fruits and Vegetables Industry Sector

- December 2022: Launch of six new citrus varieties by Uruguay's Citrus Breeding Program. This development promises to enhance the competitiveness of Uruguayan citrus exports.

- June 2022: Uruguay's blueberry industry gained new market access to Israel. This opens significant opportunities for exporting high-quality, long-shelf-life blueberries.

Strategic Uruguay Fruits and Vegetables Industry Market Outlook

The future of the Uruguayan fruits and vegetables industry appears positive, driven by favorable climate conditions, growing domestic and export demand, and ongoing investments in agricultural technology. Strategic opportunities exist in developing value-added products, expanding into niche markets (such as organic and specialty produce), and strengthening supply chains to improve efficiency and reduce losses. Focus on sustainability and adherence to international quality standards will be crucial for maintaining competitiveness in a globalized market.

Uruguay Fruits and Vegetables Industry Segmentation

- 1. Vegetables

- 2. Fruits

- 3. Vegetables

- 4. Fruits

Uruguay Fruits and Vegetables Industry Segmentation By Geography

- 1. Uruguay

Uruguay Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Adoption of Strategies to Increase Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Fruits

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Uruguay

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 6. Brazil Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Naranjales Guarino

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Citrícola Salteña S.A.

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Agroexport S.A.

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Frutas del Uruguay S.A.

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Unión de Productores y Exportadores Frutihortícolas del Uruguay (UPEFRUY)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cooperativa Nacional de Productores de Leche (Conaprole)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Bardanca S.A.

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Naranjales Guarino

List of Figures

- Figure 1: Uruguay Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uruguay Fruits and Vegetables Industry Share (%) by Company 2024

List of Tables

- Table 1: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 4: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 5: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 6: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 7: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 8: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 9: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 10: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 11: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: Brazil Uruguay Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Brazil Uruguay Fruits and Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: Argentina Uruguay Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Uruguay Fruits and Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America Uruguay Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Uruguay Fruits and Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 22: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 23: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 24: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 25: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 26: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 27: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 28: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 29: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uruguay Fruits and Vegetables Industry?

The projected CAGR is approximately 2.94%.

2. Which companies are prominent players in the Uruguay Fruits and Vegetables Industry?

Key companies in the market include Naranjales Guarino, Citrícola Salteña S.A. , Agroexport S.A. , Frutas del Uruguay S.A. , Unión de Productores y Exportadores Frutihortícolas del Uruguay (UPEFRUY) , Cooperativa Nacional de Productores de Leche (Conaprole), Bardanca S.A. .

3. What are the main segments of the Uruguay Fruits and Vegetables Industry?

The market segments include Vegetables, Fruits, Vegetables, Fruits.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Adoption of Strategies to Increase Productivity.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

December 2022: Uruguay's Citrus Breeding Program launched six new citrus varieties. These cultivars will be available for growers through an international licensing call until February 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uruguay Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uruguay Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uruguay Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the Uruguay Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence