Key Insights

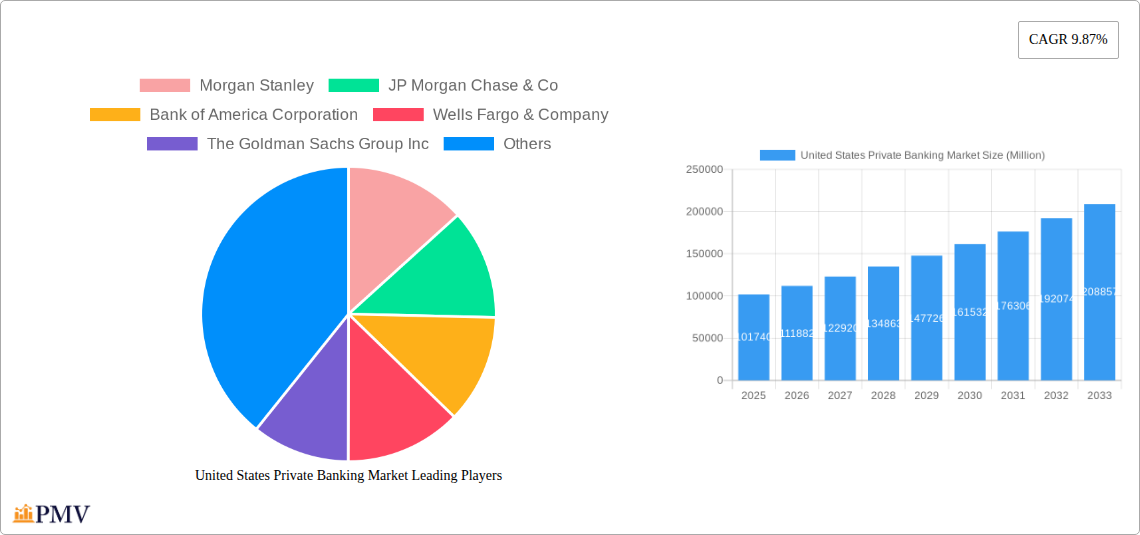

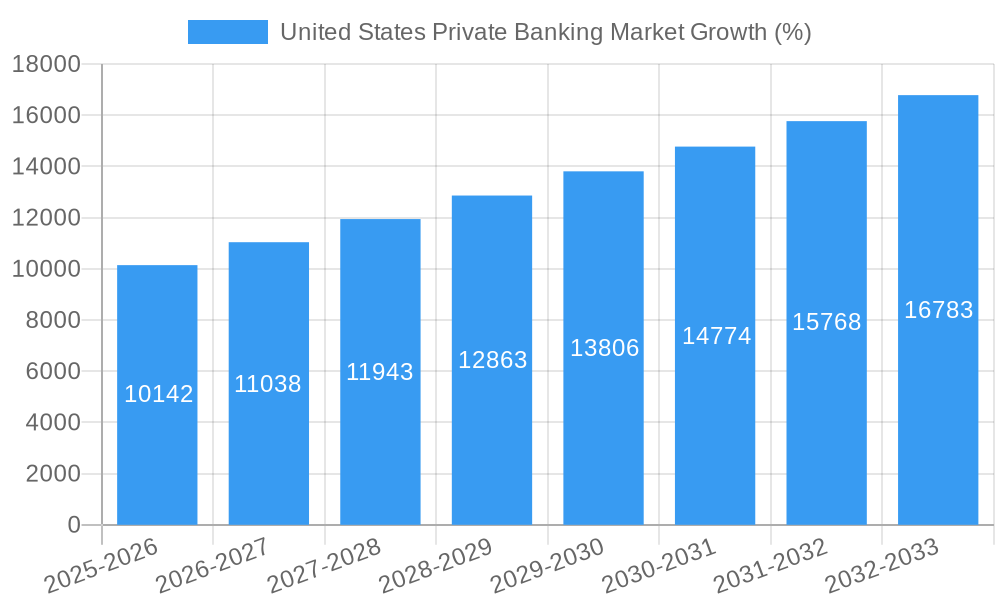

The United States private banking market, valued at $101.74 billion in 2025, is projected to experience robust growth, driven by a rising high-net-worth individual (HNWI) population and increasing wealth concentration. The market's Compound Annual Growth Rate (CAGR) of 9.87% from 2019 to 2033 indicates a significant expansion over the forecast period (2025-2033). This growth is fueled by several key factors, including a surge in entrepreneurial activity leading to the creation of new wealth, increasing demand for sophisticated wealth management solutions like personalized investment strategies, tax optimization, and estate planning, and a growing preference for digital banking channels offering enhanced convenience and accessibility. Furthermore, the competitive landscape is shaped by established players like Morgan Stanley, JP Morgan Chase & Co., Bank of America, and Wells Fargo, along with boutique firms catering to niche client segments. These firms are continually investing in technological advancements and expanding their service offerings to meet evolving client needs and maintain a competitive edge.

The market's growth trajectory, however, is not without challenges. Regulatory scrutiny, particularly concerning compliance and data privacy, continues to present hurdles for private banks. Economic fluctuations and geopolitical uncertainties also pose significant risks to investment portfolios and client wealth. Despite these constraints, the long-term outlook for the US private banking market remains positive, fueled by demographic shifts, technological innovation, and the ongoing need for sophisticated wealth management solutions among a growing HNWI population. The continued expansion of the market is expected to attract further investment and innovation within the sector, further solidifying its position as a critical component of the US financial landscape.

United States Private Banking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States private banking market, offering valuable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

United States Private Banking Market Market Structure & Competitive Dynamics

The United States private banking market is characterized by a moderately concentrated landscape, with a few major players commanding significant market share. Key players include Morgan Stanley, JP Morgan Chase & Co, Bank of America Corporation, Wells Fargo & Company, The Goldman Sachs Group Inc, Citigroup, Raymond James, Northern Trust, Charles Schwab, and U S Bancorp. However, the market also includes numerous smaller, niche players.

Market share is heavily influenced by brand recognition, client relationships, and the breadth of services offered. Recent mergers and acquisitions (M&A) activity has been moderate, with deal values averaging around xx Million per transaction in the historical period (2019-2024). These deals primarily focus on expanding service offerings and geographic reach. Regulatory frameworks, such as those imposed by the Federal Reserve and the Securities and Exchange Commission, significantly influence market operations and competition. Innovation ecosystems, driven by fintech advancements and evolving client preferences, are reshaping the industry landscape. The market experiences competition from alternative investment vehicles and wealth management platforms. End-user trends, notably increased demand for digital solutions and personalized financial planning, are key drivers of market evolution.

United States Private Banking Market Industry Trends & Insights

The US private banking market is witnessing robust growth fueled by several factors. Increasing high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) are driving demand for sophisticated wealth management services. Technological disruptions, particularly the rise of fintech solutions and digital banking platforms, are transforming customer interaction and service delivery. Consumer preferences are shifting toward personalized, digitally-enabled services, requiring private banks to adapt their offerings. Furthermore, evolving regulatory landscapes are prompting increased compliance and risk management practices. The market growth is expected to continue with a projected CAGR of xx% during the forecast period (2025-2033), driven by the factors mentioned above. Market penetration is expected to increase further as private banks expand their reach to broader client segments. Competitive dynamics are shaped by both established players and emerging fintech companies, leading to innovative product development and service enhancements.

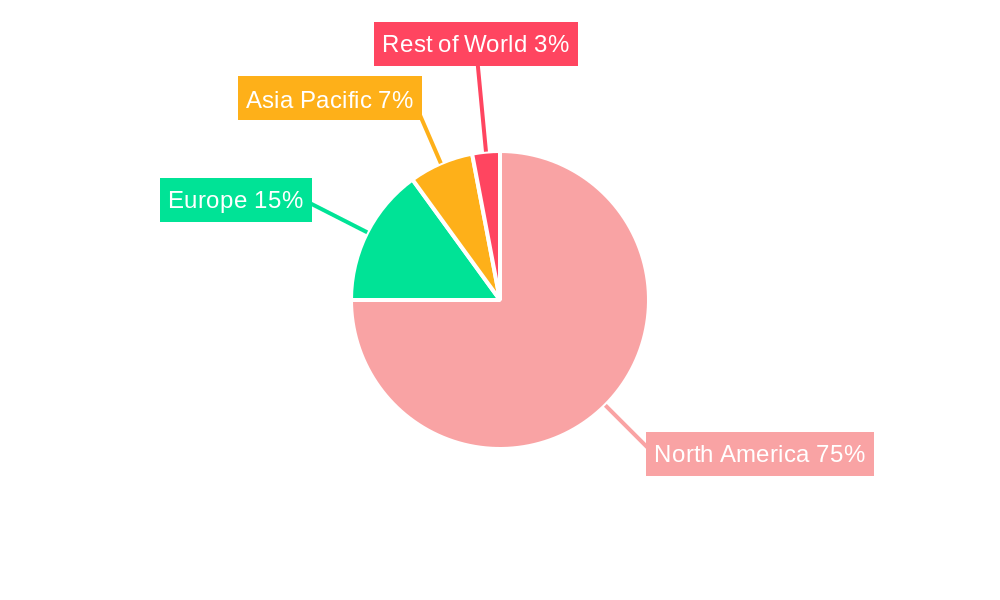

Dominant Markets & Segments in United States Private Banking Market

The Northeastern and Western regions of the United States currently dominate the private banking market due to a high concentration of HNWIs and UHNWIs. California and New York remain leading states in terms of market size and revenue generation.

- Key Drivers for Dominant Regions:

- High concentration of HNWIs and UHNWIs.

- Robust economic activity and financial centers.

- Established infrastructure supporting wealth management services.

- Supportive regulatory environment.

The dominance of these regions is expected to continue throughout the forecast period, albeit with increased competition from other regions experiencing economic growth and an increasing HNW population. This dominance reflects the long-standing presence of major private banking institutions in these areas, their established client networks, and their access to capital.

United States Private Banking Market Product Innovations

Recent product innovations include the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) for personalized portfolio management and risk assessment. Robotic process automation (RPA) streamlines back-office operations, improving efficiency and reducing costs. Digital platforms offer enhanced client engagement and self-service capabilities, catering to the growing demand for online access and convenience. These innovations aim to improve client experiences, enhance operational efficiency, and gain a competitive edge in a rapidly evolving market.

Report Segmentation & Scope

The report segments the United States private banking market based on several key factors including client type (HNWIs, UHNWIs), service type (investment management, financial planning, trust and estate services), and geographical location (Northeast, Southeast, Midwest, West, South). Each segment provides detailed analysis of market size, growth projections, and competitive dynamics. Specific market sizes for each segment are detailed within the full report.

Key Drivers of United States Private Banking Market Growth

Several key factors drive the growth of the US private banking market:

- Rising HNW and UHNW Population: The increasing number of affluent individuals fuels demand for wealth management services.

- Technological Advancements: Fintech solutions and digital banking enhance service delivery and client engagement.

- Favorable Regulatory Environment: Supportive government policies and regulations foster market growth.

Challenges in the United States Private Banking Market Sector

Significant challenges exist within the sector. Increased regulatory scrutiny and compliance costs impose significant burdens on private banks. Cybersecurity threats and data privacy concerns pose significant risks. Intense competition from both established players and emerging fintech companies requires constant innovation and adaptation. Maintaining client trust and managing reputational risk are paramount in an increasingly transparent and demanding environment.

Leading Players in the United States Private Banking Market Market

- Morgan Stanley

- JP Morgan Chase & Co

- Bank of America Corporation

- Wells Fargo & Company

- The Goldman Sachs Group Inc

- Citigroup

- Raymond James

- Northern Trust

- Charles Schwab

- U S Bancorp

- List Not Exhaustive

Key Developments in United States Private Banking Market Sector

- February 2024: Bank of America enhanced its digital banking platform to meet the growing demand for online financial management services, impacting customer acquisition and engagement.

- March 2024: Goldman Sachs Asset Management announced a significant expansion of its private credit portfolio, indicating increased investment activity and competition within the market. This expansion from USD 130 Billion to USD 300 Billion over five years will likely reshape the competitive landscape.

Strategic United States Private Banking Market Market Outlook

The future of the US private banking market looks promising, with continued growth expected across all major segments. Strategic opportunities lie in leveraging technology to enhance client experiences, expanding into underserved markets, and developing innovative wealth management solutions. Companies that adapt swiftly to changing consumer preferences and technological disruptions while maintaining strong regulatory compliance will gain a competitive advantage and capture significant market share.

United States Private Banking Market Segmentation

-

1. Type

- 1.1. Asset Management Service

- 1.2. Insurance Service

- 1.3. Trust Service

- 1.4. Tax Consulting

- 1.5. Real Estate Consulting

-

2. Application

- 2.1. Personal

- 2.2. Enterprise

United States Private Banking Market Segmentation By Geography

- 1. United States

United States Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of HNWIs; Digitization of Private Banking

- 3.3. Market Restrains

- 3.3.1. Rising Number of HNWIs; Digitization of Private Banking

- 3.4. Market Trends

- 3.4.1. Rising Number of HNWIs Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Private Banking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Asset Management Service

- 5.1.2. Insurance Service

- 5.1.3. Trust Service

- 5.1.4. Tax Consulting

- 5.1.5. Real Estate Consulting

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Enterprise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Morgan Stanley

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JP Morgan Chase & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank of America Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wells Fargo & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Goldman Sachs Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Citigroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raymond James

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northern Trust

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charles Schwab

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 U S Bancorp**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Morgan Stanley

List of Figures

- Figure 1: United States Private Banking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Private Banking Market Share (%) by Company 2024

List of Tables

- Table 1: United States Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Private Banking Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Private Banking Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Private Banking Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Private Banking Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: United States Private Banking Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: United States Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Private Banking Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Private Banking Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: United States Private Banking Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: United States Private Banking Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: United States Private Banking Market Volume Billion Forecast, by Application 2019 & 2032

- Table 13: United States Private Banking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Private Banking Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Private Banking Market?

The projected CAGR is approximately 9.87%.

2. Which companies are prominent players in the United States Private Banking Market?

Key companies in the market include Morgan Stanley, JP Morgan Chase & Co, Bank of America Corporation, Wells Fargo & Company, The Goldman Sachs Group Inc, Citigroup, Raymond James, Northern Trust, Charles Schwab, U S Bancorp**List Not Exhaustive.

3. What are the main segments of the United States Private Banking Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 101.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of HNWIs; Digitization of Private Banking.

6. What are the notable trends driving market growth?

Rising Number of HNWIs Driving the Market.

7. Are there any restraints impacting market growth?

Rising Number of HNWIs; Digitization of Private Banking.

8. Can you provide examples of recent developments in the market?

February 2024: Bank of America furthered its efforts in tailoring digital banking experiences as clients increasingly gravitated toward managing their finances online.March 2024: Goldman Sachs Asset Management, a division of Goldman Sachs Group, revealed plans to bolster its private credit portfolio. The firm aims to grow it from the current USD 130 billion to a target of USD 300 billion over the next five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Private Banking Market?

To stay informed about further developments, trends, and reports in the United States Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence