Key Insights

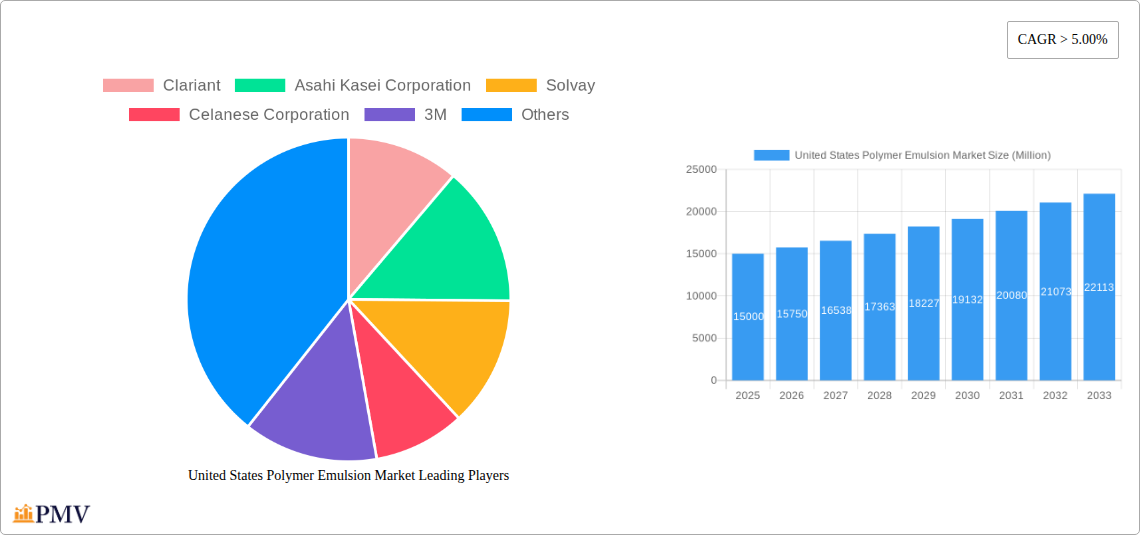

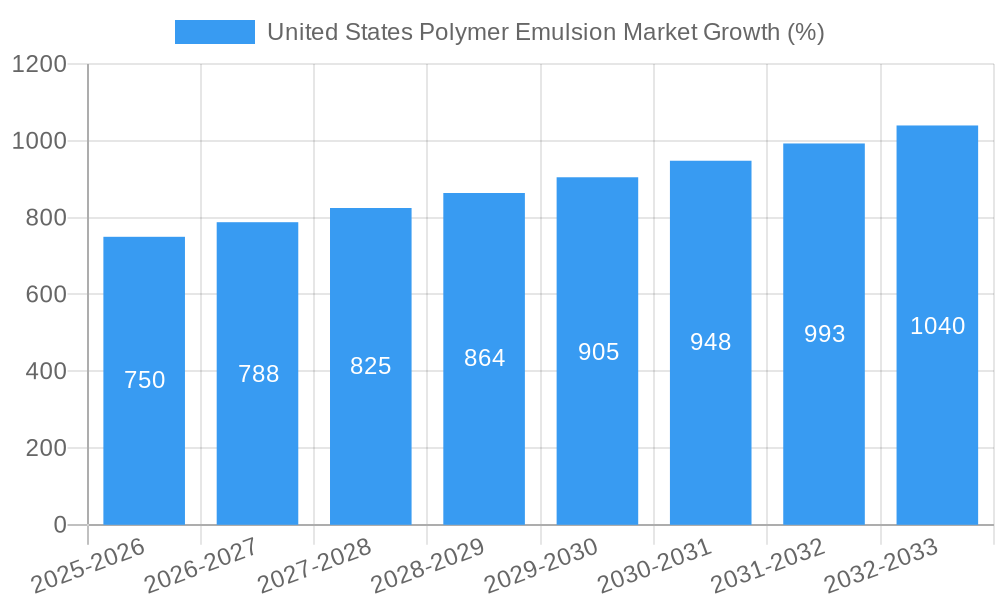

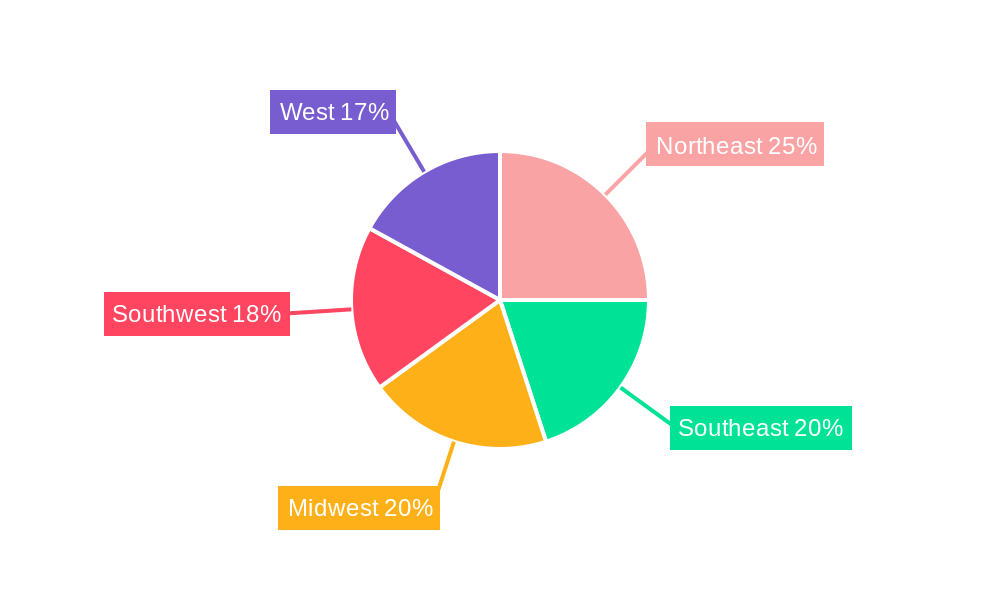

The United States Polymer Emulsion market, valued at approximately $X billion in 2025 (estimated based on provided CAGR and market size), is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for eco-friendly and high-performance coatings in construction, automotive, and packaging industries fuels the market's growth. Furthermore, the rising adoption of polymer emulsions in adhesives and carpet backing applications contributes significantly to market expansion. Technological advancements leading to improved emulsion properties, such as enhanced durability, flexibility, and water resistance, further boost market demand. Growth is segmented across various product types, including acrylics, polyurethane (PU) dispersions, styrene butadiene (SB) latex, and vinyl acetate, with acrylics currently holding a dominant market share due to their versatility and cost-effectiveness. The application segment is similarly diverse, with paints and coatings, adhesives and carpet backing, and paper and paperboard coatings representing significant end-use sectors. Regional variations exist, with the Northeast, Southeast, Midwest, Southwest, and West regions of the United States exhibiting varying growth trajectories depending on local industrial activity and construction projects.

Competitive intensity within the US Polymer Emulsion market is high, with major players like Clariant, Asahi Kasei Corporation, Solvay, Celanese Corporation, 3M, BASF SE, Arkema Group, ALLNEX NETHERLANDS B.V., Akzo Nobel N.V., Dow, The Lubrizol Corporation, Eni SpA, DIC CORPORATION, Wacker Chemie AG, and Reichhold LLC vying for market share. These companies are focusing on strategic partnerships, collaborations, and product innovation to maintain a competitive edge. Despite these positive factors, potential market restraints include fluctuating raw material prices and stringent environmental regulations impacting production processes. However, the industry's continuous innovation in sustainable and high-performance polymer emulsions is expected to mitigate these challenges and maintain the overall positive growth trajectory. The forecast period of 2025-2033 presents significant opportunities for expansion, particularly in specialized applications and sustainable product development.

United States Polymer Emulsion Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Polymer Emulsion Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and competitive dynamics. The report leverages extensive primary and secondary research to deliver actionable intelligence, enabling informed strategic planning and investment decisions.

United States Polymer Emulsion Market Market Structure & Competitive Dynamics

The United States polymer emulsion market exhibits a moderately consolidated structure, with several major players holding significant market share. Key players include Clariant, Asahi Kasei Corporation, Solvay, Celanese Corporation, 3M, BASF SE, Arkema Group, ALLNEX NETHERLANDS B.V., Akzo Nobel N.V., Dow, The Lubrizol Corporation, Eni SpA, DIC CORPORATION, Wacker Chemie AG, Reichhold LLC, and others. Market concentration is further analyzed through the Herfindahl-Hirschman Index (HHI), revealing a score of xx, suggesting a [Level of Concentration: e.g., moderately concentrated] market.

Innovation ecosystems within the industry are highly dynamic, driven by ongoing research and development in polymer chemistry and formulation technologies. Regulatory frameworks, including environmental regulations and safety standards (e.g., VOC emissions limits), significantly impact the market. Product substitutes, such as water-based coatings, compete with polymer emulsions, influencing market share dynamics. End-user trends, such as the increasing demand for eco-friendly products, are shaping product development strategies. M&A activities have played a notable role in market consolidation, with xx Million in total deal value recorded between 2019 and 2024, primarily driven by [State the reason, e.g., strategic acquisitions to expand product portfolios and geographical reach]. Key market share metrics for leading players are detailed within the report.

United States Polymer Emulsion Market Industry Trends & Insights

The United States polymer emulsion market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the expanding construction sector, increasing demand for paints and coatings, and the rising adoption of polymer emulsions in adhesives and carpet backing. Technological advancements in polymer synthesis and formulation are leading to the development of high-performance emulsions with enhanced properties, such as improved durability, water resistance, and adhesion. Consumer preference shifts towards sustainable and eco-friendly products are also influencing market trends, driving the demand for bio-based and low-VOC polymer emulsions. The market penetration of these eco-friendly alternatives is estimated at xx% in 2025 and is projected to reach xx% by 2033. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, pushing innovation and pricing pressures.

Dominant Markets & Segments in United States Polymer Emulsion Market

The Paints & Coatings application segment dominates the United States polymer emulsion market, accounting for approximately xx% of the total market value in 2025. This dominance is attributed to the widespread use of polymer emulsions in various paint formulations, driven by their superior performance characteristics and cost-effectiveness. Within product types, Acrylics hold the largest market share, exceeding xx Million in 2025 due to their versatility and favorable properties.

Key Drivers for Dominant Segments:

- Paints & Coatings: Strong growth in the construction and automotive industries, increasing demand for durable and aesthetically pleasing finishes.

- Acrylics (Product Type): Versatility, excellent film-forming properties, and cost-effectiveness compared to other types of polymer emulsions.

The South region of the United States demonstrates the strongest market performance, driven by robust construction activity and industrial development. Detailed regional and segmental analysis, including specific growth drivers for each region (e.g., economic policies, infrastructure development), are included in the full report.

United States Polymer Emulsion Market Product Innovations

Recent years have witnessed significant product innovations in the United States polymer emulsion market. Key developments include the introduction of high-performance emulsions with enhanced durability, water resistance, and UV stability. These innovations are driven by advancements in polymer chemistry and formulation technologies. Furthermore, there is a growing focus on developing bio-based and low-VOC emulsions to meet the increasing demand for environmentally friendly products. These developments are enhancing product competitiveness and expanding market applications.

Report Segmentation & Scope

This report segments the United States polymer emulsion market by product type and application.

Product Type:

- Acrylics: This segment is projected to maintain a significant market share throughout the forecast period, driven by its versatility and wide applications.

- Polyurethane (PU) Dispersions: This segment is expected to exhibit moderate growth, driven by its superior performance in specific applications.

- Styrene Butadiene (SB) Latex: This segment holds a considerable market share, primarily due to its cost-effectiveness.

- Vinyl Acetate: This segment shows steady growth, driven by its widespread use in adhesives and coatings.

- Other Product Types: This segment includes other types of polymer emulsions, each with its unique applications and market dynamics.

Application:

- Adhesives & Carpet Backing: This segment demonstrates steady growth, propelled by the construction and automotive industries.

- Paper & Paperboard Coatings: This segment experiences consistent demand, primarily due to its role in enhancing paper properties.

- Paints & Coatings: This segment constitutes the largest market share, reflecting the extensive use of polymer emulsions in various paint formulations.

- Other Applications: This segment includes a variety of other applications for polymer emulsions, contributing to the overall market growth.

Each segment is analyzed in detail, providing market size, growth projections, and competitive dynamics.

Key Drivers of United States Polymer Emulsion Market Growth

The growth of the United States polymer emulsion market is propelled by several key factors. The burgeoning construction sector fuels the demand for paints and coatings, major consumers of polymer emulsions. Technological advancements leading to improved performance characteristics, like enhanced durability and water resistance, drive adoption across various sectors. Moreover, the increasing focus on sustainability is encouraging the development and adoption of eco-friendly, low-VOC polymer emulsions, further stimulating market growth. Favorable government policies and infrastructure investments also positively contribute to market expansion.

Challenges in the United States Polymer Emulsion Market Sector

The United States polymer emulsion market faces certain challenges. Fluctuations in raw material prices can impact production costs and profitability. Stringent environmental regulations regarding VOC emissions necessitate ongoing innovation in low-VOC formulations, increasing R&D expenditures. Intense competition among established players and the emergence of new entrants exert pressure on pricing and profit margins. Supply chain disruptions caused by geopolitical events or unforeseen circumstances can negatively affect market stability and lead to production delays. The impact of these challenges on market growth is quantitatively analyzed in the full report.

Leading Players in the United States Polymer Emulsion Market Market

- Clariant

- Asahi Kasei Corporation

- Solvay

- Celanese Corporation

- 3M

- BASF SE

- Arkema Group

- ALLNEX NETHERLANDS B.V.

- Akzo Nobel N.V.

- Dow

- The Lubrizol Corporation

- Eni SpA

- DIC CORPORATION

- Wacker Chemie AG

- Reichhold LLC

Key Developments in United States Polymer Emulsion Market Sector

- October 2024: Company X launched a new line of sustainable polymer emulsions, expanding its product portfolio.

- June 2023: Company Y acquired Company Z, strengthening its market position in the adhesives segment.

- [Add more key developments with specific dates and concise descriptions of their impact]

Strategic United States Polymer Emulsion Market Market Outlook

The United States polymer emulsion market presents significant growth opportunities in the coming years. Continued expansion of the construction and automotive industries will drive demand for high-performance emulsions. The growing emphasis on sustainability and environmental concerns will fuel the demand for eco-friendly formulations. Strategic investments in R&D to develop innovative products with enhanced functionalities and exploring new applications will create lucrative opportunities for market players. Proactive engagement with regulatory bodies to address evolving environmental concerns will be crucial for sustained market success.

United States Polymer Emulsion Market Segmentation

-

1. Product Type

- 1.1. Acrylics

- 1.2. Polyurethane (PU) Dispersions

- 1.3. Styrene Butadiene (SB) Latex

- 1.4. Vinyl Acetate

- 1.5. Other Product Types

-

2. Application

- 2.1. Adhesives & Carpet Backing

- 2.2. Paper & Paperboard Coatings

- 2.3. Paints & Coatings

- 2.4. Other Applications

United States Polymer Emulsion Market Segmentation By Geography

- 1. United States

United States Polymer Emulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Awareness with Regard to Volatile Organic Compound (VOCs); Rising Construction Industry in the United States

- 3.3. Market Restrains

- 3.3.1. ; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Vinyl Acetate - the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Polymer Emulsion Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Acrylics

- 5.1.2. Polyurethane (PU) Dispersions

- 5.1.3. Styrene Butadiene (SB) Latex

- 5.1.4. Vinyl Acetate

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Adhesives & Carpet Backing

- 5.2.2. Paper & Paperboard Coatings

- 5.2.3. Paints & Coatings

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Northeast United States Polymer Emulsion Market Analysis, Insights and Forecast, 2019-2031

- 7. Southeast United States Polymer Emulsion Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest United States Polymer Emulsion Market Analysis, Insights and Forecast, 2019-2031

- 9. Southwest United States Polymer Emulsion Market Analysis, Insights and Forecast, 2019-2031

- 10. West United States Polymer Emulsion Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Clariant

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Asahi Kasei Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Celanese Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arkema Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ALLNEX NETHERLANDS B V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Akzo Nobel N V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dow

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Lubrizol Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eni SpA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DIC CORPORATION

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wacker Chemie AG*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Reichhold LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Clariant

List of Figures

- Figure 1: United States Polymer Emulsion Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Polymer Emulsion Market Share (%) by Company 2024

List of Tables

- Table 1: United States Polymer Emulsion Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Polymer Emulsion Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United States Polymer Emulsion Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: United States Polymer Emulsion Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Polymer Emulsion Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast United States Polymer Emulsion Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast United States Polymer Emulsion Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest United States Polymer Emulsion Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest United States Polymer Emulsion Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West United States Polymer Emulsion Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Polymer Emulsion Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: United States Polymer Emulsion Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: United States Polymer Emulsion Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Polymer Emulsion Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the United States Polymer Emulsion Market?

Key companies in the market include Clariant, Asahi Kasei Corporation, Solvay, Celanese Corporation, 3M, BASF SE, Arkema Group, ALLNEX NETHERLANDS B V, Akzo Nobel N V, Dow, The Lubrizol Corporation, Eni SpA, DIC CORPORATION, Wacker Chemie AG*List Not Exhaustive, Reichhold LLC.

3. What are the main segments of the United States Polymer Emulsion Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Awareness with Regard to Volatile Organic Compound (VOCs); Rising Construction Industry in the United States.

6. What are the notable trends driving market growth?

Vinyl Acetate - the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Polymer Emulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Polymer Emulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Polymer Emulsion Market?

To stay informed about further developments, trends, and reports in the United States Polymer Emulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence