Key Insights

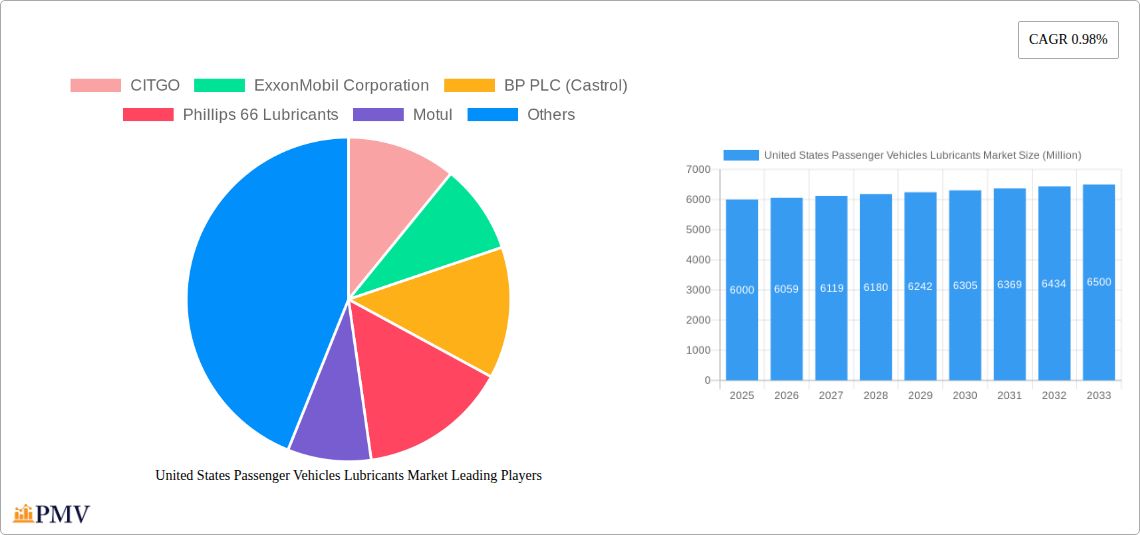

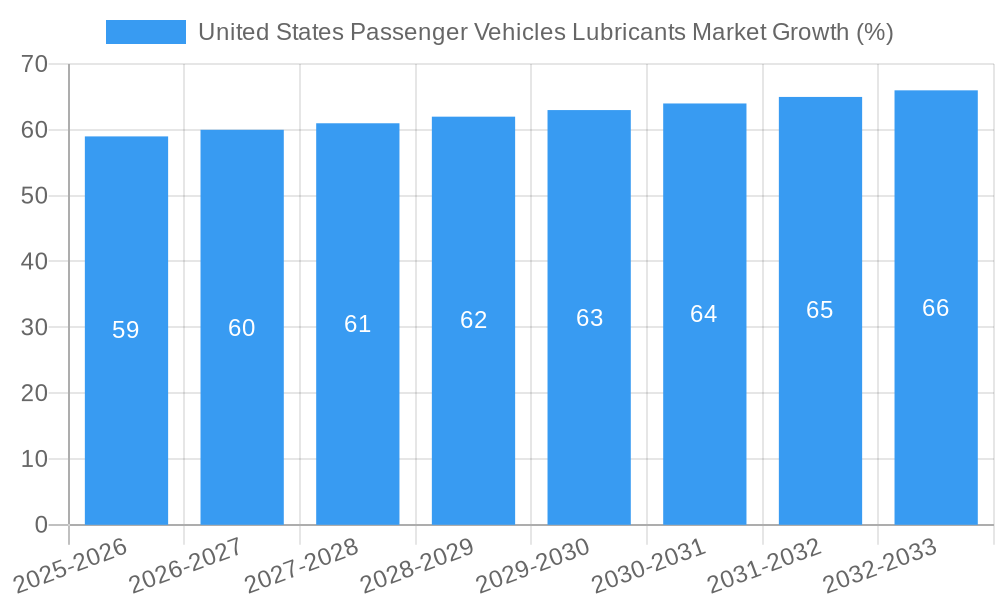

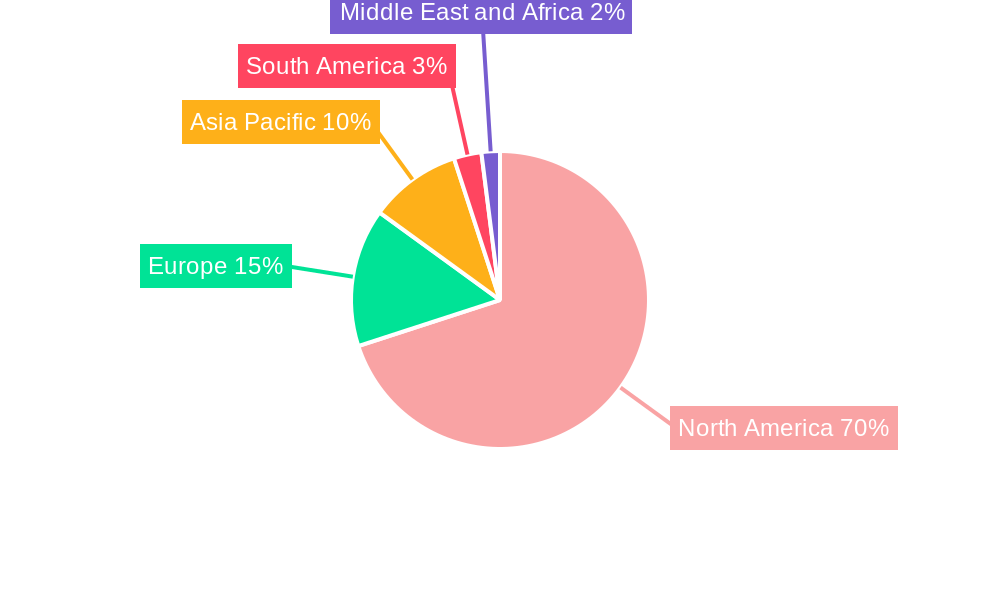

The United States passenger vehicle lubricants market is a significant segment within the broader automotive lubricants industry, characterized by a moderate growth trajectory. While precise market sizing for the US passenger vehicle segment specifically is absent from the provided data, we can infer its substantial contribution based on the overall market size and regional breakdown. Given a global CAGR of 0.98% and the substantial size and importance of the US automotive market, a reasonable estimation for the US passenger vehicle lubricants market size in 2025 would be in the range of $5-7 billion. This is based on the understanding that passenger vehicles constitute a significant portion of the overall vehicle population in the US, and their regular need for oil changes and other lubricant replacements drives consistent demand. Growth drivers include increasing vehicle ownership, particularly in light of a growing population and robust economy, coupled with the rising adoption of advanced lubricant formulations catering to improved fuel efficiency and engine performance. However, factors such as the increasing prevalence of electric vehicles (EVs) and hybrid vehicles, which require less frequent lubricant changes, could act as a restraint on growth in the coming years. The market is segmented by product type, encompassing engine oils, greases, hydraulic fluids, and transmission & gear oils, each exhibiting varying growth rates based on technological advancements and consumer preferences. Major players like ExxonMobil, Chevron, and Castrol dominate the market through their extensive distribution networks and strong brand recognition.

The future of the US passenger vehicle lubricants market will likely be shaped by the ongoing shift towards electric and hybrid vehicles. While this presents a challenge, opportunities exist in developing specialized lubricants for these new vehicle types and in leveraging digital technologies to improve supply chain efficiency and customer engagement. Furthermore, increasing regulatory pressures on emissions and environmental concerns will drive innovation in developing more sustainable and environmentally friendly lubricant formulations. The focus will likely shift towards higher-performing, longer-lasting lubricants designed to maximize fuel efficiency and extend engine life, thereby increasing profitability and environmental sustainability across the value chain. The competitive landscape will remain intense, with established players vying for market share against newer entrants with innovative product offerings.

United States Passenger Vehicles Lubricants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Passenger Vehicles Lubricants Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data analysis, incorporating historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) to present a holistic view of the market.

United States Passenger Vehicles Lubricants Market Market Structure & Competitive Dynamics

The United States passenger vehicle lubricants market exhibits a moderately consolidated structure, dominated by a few multinational players alongside several regional and specialized companies. Key players such as ExxonMobil, Shell, Chevron, and BP (Castrol) command significant market share, leveraging their established brand reputation and extensive distribution networks. However, smaller, specialized lubricant manufacturers like AMSOIL and Motul are gaining traction by focusing on niche segments and high-performance products. The market is characterized by intense competition, driven by price wars, product innovation, and strategic acquisitions and mergers. The CAGR for the market during the forecast period is estimated to be xx%.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be around xx, indicating a moderately concentrated market.

- Innovation Ecosystems: Significant R&D investments are focused on developing energy-efficient, environmentally friendly lubricants, meeting stringent OEM specifications and improving fuel economy.

- Regulatory Frameworks: Compliance with EPA regulations and ILSAC standards significantly impacts product formulation and market entry.

- Product Substitutes: The emergence of electric vehicles (EVs) poses a long-term threat, though the market for lubricants in hybrid vehicles remains robust.

- End-User Trends: Increasing demand for high-performance lubricants driven by the shift towards more powerful engines and advanced vehicle technologies fuels growth.

- M&A Activities: The past five years have witnessed several smaller M&A deals valued at a cumulative xx Million, mainly focused on expanding distribution networks and acquiring specialized lubricant technologies.

United States Passenger Vehicles Lubricants Market Industry Trends & Insights

The US passenger vehicle lubricants market is experiencing robust growth, fueled by several key trends. The rising number of vehicles on the road, coupled with increasing vehicle miles traveled, creates a consistently high demand for lubricants. Furthermore, the automotive industry's shift towards advanced engine technologies and stringent emission regulations drives the demand for high-performance, energy-efficient lubricants. These technological advancements necessitate the development of specialized lubricants tailored to meet specific vehicle requirements, enhancing market complexity and fostering innovation. Consumer preference for premium lubricants with enhanced performance attributes and extended drain intervals also contributes to market growth. The ongoing competitive landscape further fuels innovation and drives improvements in product quality and price competitiveness. This dynamic interplay of factors has resulted in a projected CAGR of xx% during the forecast period. Market penetration of synthetic lubricants continues to rise, currently estimated at xx%.

Dominant Markets & Segments in United States Passenger Vehicles Lubricants Market

The geographical distribution of the market is relatively even across the US, reflecting the widespread presence of passenger vehicles. However, states with higher population densities and larger automotive industries, such as California, Texas, and Florida, tend to demonstrate higher consumption rates.

By Product Type:

- Engine Oils: This segment dominates the market, representing xx Million in 2025 and is projected to maintain its leading position due to the fundamental need for engine lubrication in all passenger vehicles. Key drivers include:

- Stricter emission regulations leading to the demand for higher-quality engine oils.

- Increased vehicle ownership and usage.

- Technological advancements in engine oil formulations, including synthetic blends.

- Greases: This segment accounts for xx Million in 2025 and is expected to witness steady growth driven by the continued use of grease in various vehicle components.

- Hydraulic Fluids: This segment, valued at xx Million in 2025, is projected to exhibit moderate growth aligned with the overall market expansion.

- Transmission & Gear Oils: This segment holds a significant share, valued at xx Million in 2025, driven by regular maintenance requirements and the use of advanced transmission systems in modern vehicles.

United States Passenger Vehicles Lubricants Market Product Innovations

Recent innovations in passenger vehicle lubricants focus heavily on improving fuel economy, extending oil drain intervals, and enhancing engine protection. Formulations incorporating advanced additives, such as friction modifiers and detergents, are becoming increasingly prevalent. Synthetic-based lubricants, known for their superior performance characteristics, continue to gain market share. Furthermore, the industry is actively developing bio-based and sustainable lubricants to meet growing environmental concerns. The successful integration of these innovations directly impacts market competitiveness, driving product differentiation and market penetration.

Report Segmentation & Scope

This report segments the US passenger vehicle lubricants market comprehensively by product type:

- Engine Oils: This segment is further categorized by viscosity grade (e.g., 5W-30, 10W-40), type (conventional, synthetic, synthetic blend), and application (gasoline engines, diesel engines). Growth projections for this segment are strong, driven by the ongoing need for regular engine maintenance and increasing adoption of advanced engine oils.

- Greases: This segment is segmented by application (chassis, wheel bearings, etc.) and consistency (NLGI grades). Growth is anticipated to be moderate, reflecting the relatively stable demand for grease in passenger vehicles.

- Hydraulic Fluids: Categorized by type (mineral oil-based, synthetic-based) and application (power steering, automatic transmissions). Growth is moderate.

- Transmission & Gear Oils: Segmented by type (manual transmission, automatic transmission) and viscosity grade. Growth projections are moderate, in line with overall market trends. Competitive dynamics within each segment are analyzed, highlighting key players and their market positioning.

Key Drivers of United States Passenger Vehicles Lubricants Market Growth

Several factors are propelling the growth of the US passenger vehicle lubricants market:

- Rising Vehicle Ownership: The continuous increase in vehicle ownership across the US fuels consistent demand for lubricants.

- Stringent Emission Regulations: These regulations are encouraging the development and adoption of more efficient and environmentally friendly lubricants.

- Technological Advancements: Innovations in engine technology and lubricant formulations improve performance and fuel efficiency.

Challenges in the United States Passenger Vehicles Lubricants Market Sector

The US passenger vehicle lubricants market faces several challenges:

- Fluctuating Crude Oil Prices: These prices directly impact the cost of raw materials and production, potentially affecting profitability.

- Environmental Regulations: Meeting stringent environmental regulations requires significant R&D investment and compliance costs.

- Competition: Intense competition among established players and the entry of new participants create pressure on pricing and margins.

Leading Players in the United States Passenger Vehicles Lubricants Market Market

- CITGO

- ExxonMobil Corporation

- BP PLC (Castrol)

- Phillips 66 Lubricants

- Motul

- Royal Dutch Shell Plc

- Chevron Corporation

- TotalEnergies

- Valvoline Inc

- AMSOIL Inc

Key Developments in United States Passenger Vehicles Lubricants Market Sector

- May 2021: CITGO Lubricants launched its new SuperGard motor oils, meeting the ILSAC GF-6 standard.

- June 2021: TotalEnergies and Stellantis renewed their partnership, focusing on lubricant development and innovation.

- July 2021: Mighty Auto Parts partnered with Total Specialties USA to distribute Quartz Ineo and Quartz 9000 lubricants.

Strategic United States Passenger Vehicles Lubricants Market Market Outlook

The US passenger vehicle lubricants market presents significant growth potential. Continued technological advancements, stringent emission regulations, and the increasing adoption of advanced engine technologies will drive demand for high-performance lubricants. Companies focused on innovation, sustainability, and strategic partnerships are poised to benefit the most. The market's future hinges on navigating environmental concerns, adapting to evolving vehicle technologies, and maintaining competitive advantage through product innovation and efficient distribution.

United States Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

United States Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. United States

United States Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants

- 3.3. Market Restrains

- 3.3.1. Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific United States Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 China

- 6.1.2 India

- 6.1.3 Japan

- 6.1.4 South Korea

- 6.1.5 Philippines

- 6.1.6 Indonesia

- 6.1.7 Malaysia

- 6.1.8 Thailand

- 6.1.9 Vietnam

- 6.1.10 Rest of Asia Pacific

- 7. North America United States Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United States

- 7.1.2 Mexico

- 7.1.3 Canada

- 7.1.4 Rest of North America

- 8. Europe United States Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Germany

- 8.1.2 United kingdom

- 8.1.3 France

- 8.1.4 Italy

- 8.1.5 Russia

- 8.1.6 Spain

- 8.1.7 Rest of Europe

- 9. South America United States Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Colombia

- 9.1.4 Rest of South America

- 10. Middle East and Africa United States Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Saudi Arabia

- 10.1.2 South Africa

- 10.1.3 Qatar

- 10.1.4 United Arab Emirates

- 10.1.5 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CITGO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ExxonMobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BP PLC (Castrol)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Phillips 66 Lubricants

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Motul

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Royal Dutch Shell Plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chevron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TotalEnergies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Valvoline Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AMSOIL Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CITGO

List of Figures

- Figure 1: United States Passenger Vehicles Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Passenger Vehicles Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 9: China United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: China United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 11: India United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Japan United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: South Korea United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Philippines United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Philippines United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Indonesia United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Malaysia United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Malaysia United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Thailand United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Thailand United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Vietnam United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Rest of Asia Pacific United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia Pacific United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 31: United States United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United States United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Mexico United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Canada United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Rest of North America United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 41: Germany United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: United kingdom United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United kingdom United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: France United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Italy United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 49: Russia United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Russia United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: Spain United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 57: Brazil United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Brazil United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 59: Argentina United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Argentina United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: Colombia United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Colombia United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 63: Rest of South America United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of South America United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 67: Saudi Arabia United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Saudi Arabia United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 69: South Africa United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: South Africa United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 71: Qatar United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Qatar United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 73: United Arab Emirates United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: United Arab Emirates United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 75: Rest of Middle East and Africa United States Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East and Africa United States Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 77: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 78: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 79: United States Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 80: United States Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 0.98%.

2. Which companies are prominent players in the United States Passenger Vehicles Lubricants Market?

Key companies in the market include CITGO, ExxonMobil Corporation, BP PLC (Castrol), Phillips 66 Lubricants, Motul, Royal Dutch Shell Plc, Chevron Corporation, TotalEnergies, Valvoline Inc, AMSOIL Inc.

3. What are the main segments of the United States Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future.

8. Can you provide examples of recent developments in the market?

July 2021: Mighty Distributing System (Mighty Auto Parts), a pioneer in automotive aftermarket goods and services, announced a new relationship with Total Specialties USA. It would target the Quartz Ineo and Quartz 9000 sub-ranges, geared for light automobiles and meet European OEMs' most stringent criteria.June 2021: TotalEnergies and Stellantis group renewed their partnership for cooperation across different segments. Along with the renewal of partnerships with Peugeot, Citroën, and DS Automobiles, the new collaboration extends to Opel, and Vauxhall as well. This partnership includes the development and innovation of lubricants, first-fill in Stellantis group vehicles, recommendation of Quartz lubricants, and shared usage of charging stations operated by TotalEnergies, among others.May 2021: CITGO Lubricants launched its new motor oils (SuperGard) to meet the ILSAC GF-6 Motor Oils Standard. These oils address the requirement for improved mileage and upgraded motor abilities for passenger vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the United States Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence