Key Insights

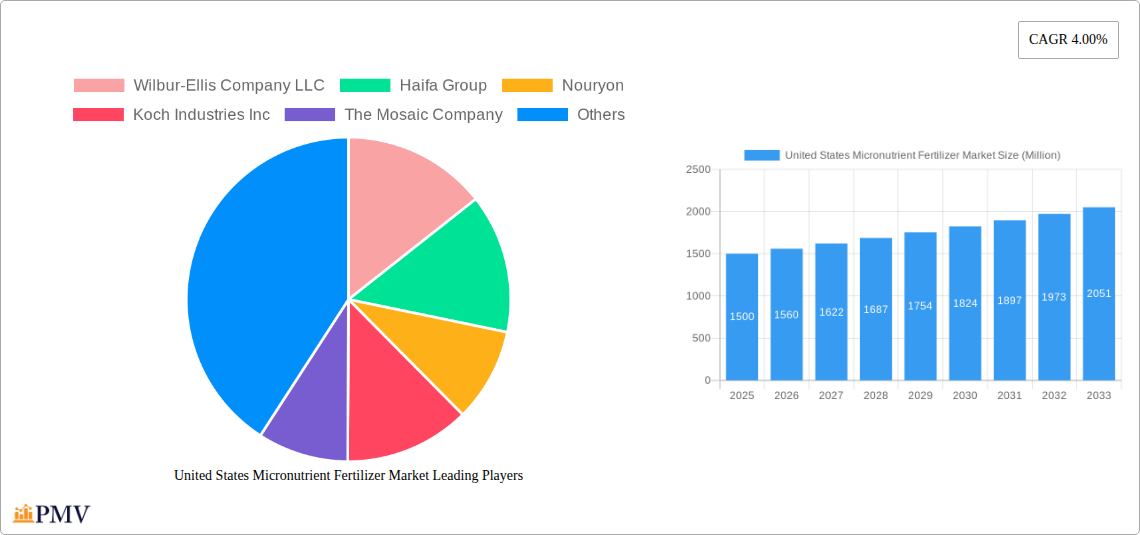

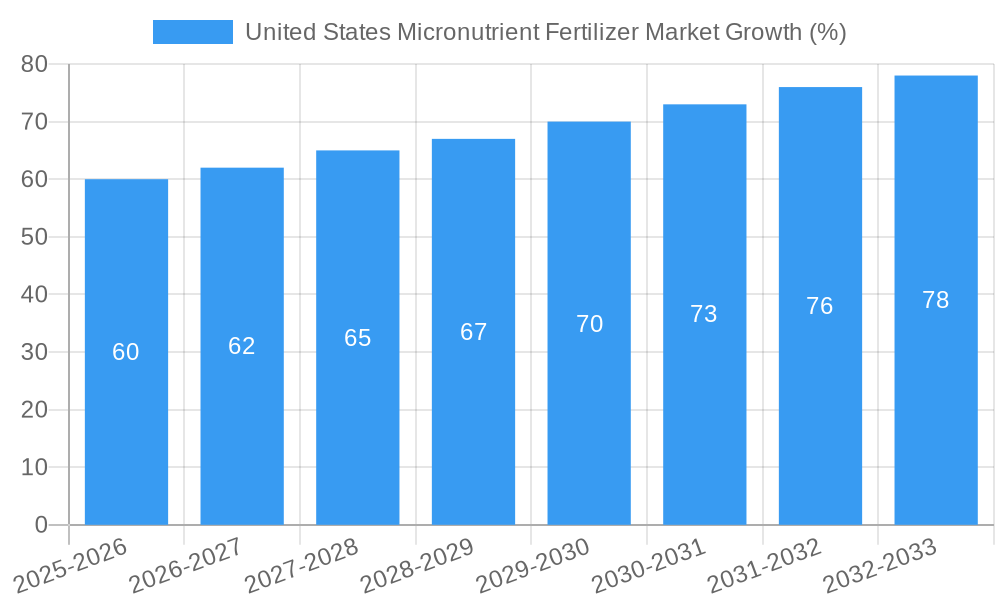

The United States micronutrient fertilizer market is experiencing robust growth, driven by the increasing demand for high-yield crops and the growing awareness of soil nutrient deficiencies. With a projected CAGR of 4.00% from 2025 to 2033, the market is poised for significant expansion. Key drivers include the rising global population and the subsequent need for increased food production, coupled with the intensified adoption of precision agriculture techniques. Furthermore, government initiatives promoting sustainable agricultural practices and the increasing prevalence of soil testing to identify micronutrient deficiencies are further fueling market growth. The market is segmented by application mode (fertigation, foliar, soil), crop type (field crops, horticultural crops, turf & ornamental), and product type (Boron, Copper, Iron, Manganese, Molybdenum, Zinc, Others). Fertigation application is expected to dominate due to its efficiency and effectiveness in delivering micronutrients directly to plant roots. Field crops, including corn and soybeans, represent a substantial segment, driven by their widespread cultivation. Among the micronutrients, Zinc and Iron are expected to hold the largest market share due to their vital role in plant growth and overall crop yield. While the market faces some restraints, including price fluctuations in raw materials and potential environmental concerns related to fertilizer runoff, these are anticipated to be offset by the aforementioned growth drivers. The competitive landscape is characterized by both established global players and regional companies, reflecting a dynamic and evolving market structure.

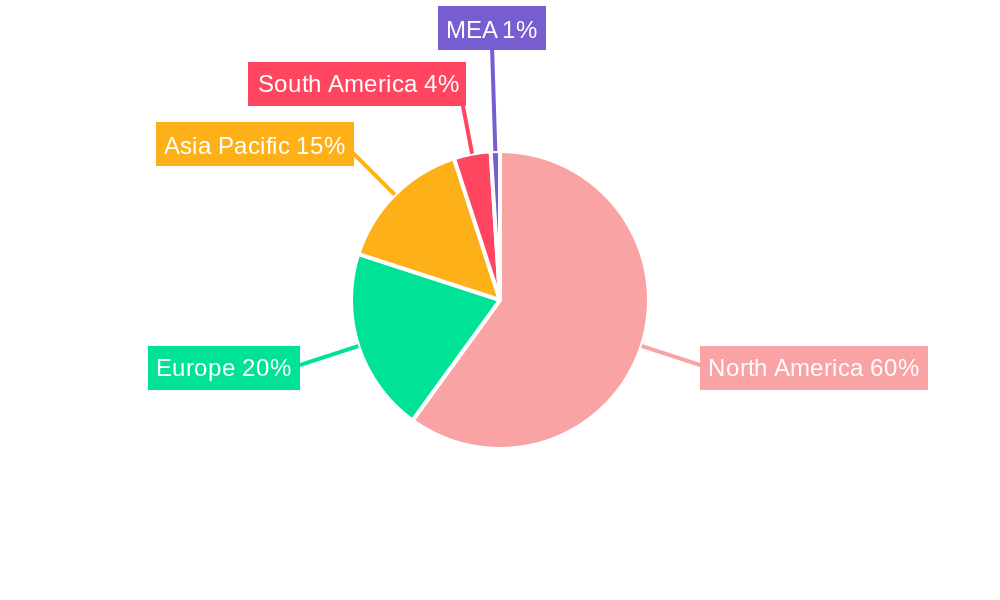

The United States' substantial agricultural sector and commitment to agricultural innovation significantly contribute to the market's growth trajectory. While precise market size data for the United States is missing from the initial prompt, we can reasonably assume that its market share within the North American market is substantial, given the country's agricultural dominance. Considering the overall projected CAGR and North America's expected contribution, we can predict strong year-on-year growth within the US market, mirroring global trends. Key players are likely to focus on developing innovative formulations and expanding distribution networks to enhance market penetration and capitalize on the growing demand for high-efficiency and environmentally-friendly micronutrient fertilizers.

United States Micronutrient Fertilizer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States micronutrient fertilizer market, offering invaluable insights for stakeholders across the agricultural value chain. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It segments the market by application mode (fertigation, foliar, soil), crop type (field crops, horticultural crops, turf & ornamental), and product type (Boron, Copper, Iron, Manganese, Molybdenum, Zinc, Others), providing detailed market size estimations in Million USD for each segment. Key players like Wilbur-Ellis Company LLC, Haifa Group, Nouryon, Koch Industries Inc, The Mosaic Company, The Andersons Inc, Yara International AS, and Sociedad Quimica y Minera de Chile SA are analyzed for their market share, strategies, and competitive dynamics.

United States Micronutrient Fertilizer Market Market Structure & Competitive Dynamics

The United States micronutrient fertilizer market exhibits a moderately consolidated structure, with a few major players holding significant market share. The market is characterized by intense competition, driven by innovation in product formulations, application technologies, and distribution channels. Regulatory frameworks, particularly those related to environmental protection and pesticide use, significantly impact market dynamics. The market has witnessed considerable M&A activity in recent years, reflecting the strategic importance of securing supply chains and expanding market reach. For example, Nouryon's acquisition of ADOB in April 2023 significantly broadened its portfolio. The overall deal value for M&A activities in the period 2019-2024 is estimated at xx Million USD. Market concentration is measured by the Herfindahl-Hirschman Index (HHI), currently estimated at xx, indicating a moderately consolidated market.

- Market Concentration: Moderately consolidated, with top 5 players holding an estimated xx% market share in 2024.

- Innovation Ecosystems: Active, with ongoing R&D in chelation technology, controlled-release formulations, and precision application methods.

- Regulatory Frameworks: Stringent environmental regulations drive the demand for sustainable and eco-friendly micronutrient fertilizers.

- Product Substitutes: Limited effective substitutes exist, making micronutrient fertilizers essential for optimal crop yields.

- End-User Trends: Increasing adoption of precision agriculture and sustainable farming practices.

- M&A Activities: Significant consolidation through acquisitions, aiming for market expansion and portfolio diversification. Examples include the acquisition of Horticoop Andina by Haifa Group (March 2022) and Mote Farm Service Inc. by The Andersons Inc (October 2022).

United States Micronutrient Fertilizer Market Industry Trends & Insights

The United States micronutrient fertilizer market is experiencing robust growth, driven by factors such as increasing awareness of micronutrient deficiencies in soils, rising demand for high-yield crops, and technological advancements in fertilizer formulations and application techniques. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors: growing consumer demand for sustainably produced food, increasing adoption of precision agriculture techniques that optimize nutrient use, and government initiatives promoting sustainable agricultural practices. Technological advancements like nanotechnology-based fertilizers are enhancing nutrient uptake efficiency, leading to increased market penetration. The market is also influenced by changing consumer preferences towards organically produced crops, resulting in increased demand for organic micronutrient fertilizers.

Dominant Markets & Segments in United States Micronutrient Fertilizer Market

The dominant segment within the US micronutrient fertilizer market is currently the Field Crops segment, driven by the large acreage under cultivation and the high demand for improved yields. Within application modes, fertigation is experiencing the fastest growth due to its efficiency and precision. The leading region is the Midwest, benefiting from favorable climatic conditions and extensive agricultural activity.

- Key Drivers for Field Crops Dominance:

- Large-scale farming operations.

- High demand for yield optimization.

- Government support for agricultural production.

- Key Drivers for Fertigation Dominance:

- Improved nutrient uptake efficiency.

- Reduced fertilizer waste.

- Precise application control.

- Regional Dominance (Midwest):

- Favorable climatic conditions.

- Extensive arable land.

- Well-established agricultural infrastructure.

The Iron segment holds a significant share within product types due to its widespread essentiality in plant nutrition. Horticultural crops are also showing strong growth due to the increasing demand for high-quality produce and ornamental plants.

United States Micronutrient Fertilizer Market Product Innovations

Recent innovations focus on enhancing nutrient uptake efficiency, improving the shelf life of products, and reducing environmental impact. This includes the development of chelated micronutrients with improved bioavailability and controlled-release formulations that minimize nutrient leaching. Nanotechnology-based fertilizers are gaining traction, offering superior nutrient delivery and improved crop yields. These innovations are improving market fit by addressing growers’ needs for higher efficiency and sustainability.

Report Segmentation & Scope

This report comprehensively segments the United States micronutrient fertilizer market across several parameters:

Application Mode: Fertigation, Foliar, Soil (Growth projections and market sizes are provided for each segment in the full report). The Fertigation segment is projected to show the highest growth due to its efficiency.

Crop Type: Field Crops, Horticultural Crops, Turf & Ornamental (Growth projections and market sizes are provided for each segment in the full report). Field Crops currently dominates the market due to its large scale.

Product Type: Boron, Copper, Iron, Manganese, Molybdenum, Zinc, Others (Growth projections and market sizes are provided for each segment in the full report). The Iron segment has significant market share because of its crucial role in plant health. Competitive dynamics vary across segments, reflecting the specific characteristics and applications of each micronutrient.

Key Drivers of United States Micronutrient Fertilizer Market Growth

Several factors contribute to the growth of the US micronutrient fertilizer market. Technological advancements in fertilizer formulations and application methods (e.g., precision agriculture, nanotechnology) improve efficiency. Government initiatives promoting sustainable agriculture incentivize the adoption of micronutrient fertilizers. The increasing demand for higher crop yields and improved crop quality globally necessitates the use of these nutrients. Finally, the growing consumer awareness of food quality and safety further pushes the demand for micronutrient-rich products.

Challenges in the United States Micronutrient Fertilizer Market Sector

The US micronutrient fertilizer market faces several challenges. Fluctuations in raw material prices increase production costs and affect market stability. Stringent environmental regulations necessitate the development of environmentally friendly products. Intense competition among existing players and the entry of new companies can lead to price wars and reduce profit margins. Supply chain disruptions can impact availability and timely delivery, affecting crop production schedules. These challenges could potentially decrease market growth by an estimated xx% annually unless effectively addressed.

Leading Players in the United States Micronutrient Fertilizer Market Market

- Wilbur-Ellis Company LLC

- Haifa Group

- Nouryon

- Koch Industries Inc

- The Mosaic Company

- The Andersons Inc

- Yara International AS

- Sociedad Quimica y Minera de Chile SA

Key Developments in United States Micronutrient Fertilizer Market Sector

- April 2023: Nouryon acquires ADOB, expanding its micronutrient portfolio and strengthening its market position.

- October 2022: The Andersons Inc. expands its retail network through the acquisition of Mote Farm Service Inc.

- March 2022: Haifa Group acquires Horticoop Andina, enhancing its presence in the Latin American market.

Strategic United States Micronutrient Fertilizer Market Market Outlook

The future of the US micronutrient fertilizer market looks promising, driven by several factors. Continued technological advancements and the increasing adoption of sustainable agricultural practices will fuel growth. Strategic partnerships and collaborations between fertilizer producers and agricultural technology companies are expected to create innovative solutions. Focus on developing customized micronutrient blends tailored to specific crop needs and soil conditions will further enhance market potential. The market's overall growth is strongly linked to the broader agricultural sector's performance and global food demand, indicating a positive outlook for the long term.

United States Micronutrient Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Micronutrient Fertilizer Market Segmentation By Geography

- 1. United States

United States Micronutrient Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America United States Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. South America United States Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Brazil

- 7.1.2 Argentina

- 7.1.3 Rest of South America

- 8. Asia Pacific United States Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 South Korea

- 8.1.5 Taiwan

- 8.1.6 Australia

- 8.1.7 Rest of Asia-Pacific

- 9. Europe United States Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Germany

- 9.1.2 France

- 9.1.3 Italy

- 9.1.4 United Kingdom

- 9.1.5 Netherlands

- 9.1.6 Rest of Europe

- 10. MEA United States Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Middle East

- 10.1.2 Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Wilbur-Ellis Company LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Haifa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nouryon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koch Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Mosaic Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Andersons Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yara International AS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sociedad Quimica y Minera de Chile SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Wilbur-Ellis Company LLC

List of Figures

- Figure 1: United States Micronutrient Fertilizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Micronutrient Fertilizer Market Share (%) by Company 2024

List of Tables

- Table 1: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Brazil United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Taiwan United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Germany United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United Kingdom United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Netherlands United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Middle East United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Africa United States Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 35: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 36: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 39: United States Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Micronutrient Fertilizer Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the United States Micronutrient Fertilizer Market?

Key companies in the market include Wilbur-Ellis Company LLC, Haifa Group, Nouryon, Koch Industries Inc, The Mosaic Company, The Andersons Inc, Yara International AS, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the United States Micronutrient Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

April 2023: ADOB, a major provider of chelating micronutrients, foliar, and other specialty farming solutions based in Poland, was acquired by Nouryon. Through the acquisition, the company broadened its innovative crop nutrition portfolio.October 2022: The Andersons entered an agreement to acquire the assets of Mote Farm Service Inc. to expand its retail farm center network.March 2022: The Haifa Group entered a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the Latin market and strengthen its position as a global superbrand in advanced plant nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Micronutrient Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Micronutrient Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Micronutrient Fertilizer Market?

To stay informed about further developments, trends, and reports in the United States Micronutrient Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence