Key Insights

The United States iodine market, while lacking precise figures in the provided data, exhibits strong growth potential fueled by several key drivers. The global market's CAGR exceeding 3% suggests a similarly positive trajectory for the US, likely mirroring global trends. Demand is driven by increasing applications across diverse sectors. Animal feed represents a significant segment, driven by the importance of iodine in animal health and productivity. The medical sector utilizes iodine extensively in pharmaceuticals and disinfectants, further boosting market demand. Growth in the biocides segment, linked to hygiene and sanitation needs, is also contributing to market expansion. Furthermore, specialized applications like optical polarizing films and fluorochemicals, while smaller segments, represent high-value areas contributing to overall market revenue. The US market's strength is likely enhanced by robust domestic manufacturing capabilities, supported by companies like Iofina and Woodward Iodine Corporation, and a strong regulatory framework ensuring product quality and safety. Competition among these players and the potential entry of new players, particularly in the recycling segment, will shape the market landscape. However, potential restraints may include price fluctuations in raw materials and the environmental impact of iodine extraction.

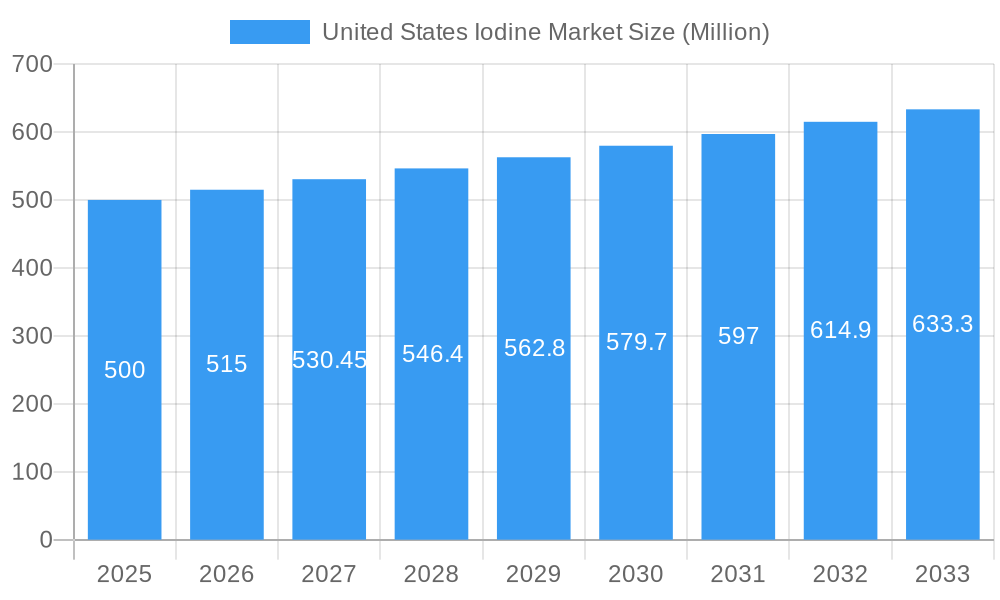

United States Iodine Market Market Size (In Million)

Despite a lack of specific US market size data, we can infer significant revenue based on the global market and the US's economic size and consumption patterns. Considering the global market's value (though not given), the US, as a major economy, likely holds a substantial share. The market segmentation detailed earlier (Underground Brines, Caliche Ore, Recycling, Seaweeds; Inorganic Salts and Complexes, Organic Compounds, Elementals and Isotopes; Animal Feed, Medical, Biocides, Optical Polarizing Films, Fluorochemicals, Nylon, Other Applications) strongly suggests a diverse and expanding market, with growth potential across each segment. Further research into specific US production and consumption data would be necessary to generate exact figures. However, the available information strongly points towards a healthy and expanding US iodine market with a promising future.

United States Iodine Market Company Market Share

United States Iodine Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States iodine market, covering market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is crucial for businesses, investors, and researchers seeking to understand and capitalize on the opportunities within this dynamic market.

United States Iodine Market Structure & Competitive Dynamics

The United States iodine market exhibits a moderately concentrated structure, with key players like Iofina, SQM SA, Samrat Pharmachem Limited, American Elements, ACF Minera SA, KIVA Holding Inc, Iochem Corporation, Woodward Iodine Corporation (WIC) (ISE Chemicals Corporation), and Deep Water Chemicals holding significant market share. The market is characterized by ongoing innovation in extraction techniques, product formulations, and applications. Regulatory frameworks, primarily overseen by the FDA and EPA, influence production and use, particularly concerning safety and environmental impact. Product substitution is limited due to iodine's unique properties, although alternative chemical compounds might be used in certain niche applications. End-user trends favor sustainable and high-purity iodine sources, driving demand for recycled iodine and sustainably sourced materials. Mergers and acquisitions (M&A) activity has been relatively moderate, with deal values in the xx Million range over the past five years, primarily focused on consolidating production capacity and expanding geographical reach. Market share varies significantly between companies, with the top three players collectively holding an estimated xx% market share in 2024.

United States Iodine Market Industry Trends & Insights

The US iodine market is experiencing steady growth, projected at a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include increasing demand from the animal feed, medical, and industrial sectors. Technological advancements in iodine extraction and purification are enhancing efficiency and reducing costs. Growing consumer awareness of iodine's nutritional benefits fuels demand in the dietary supplement market. However, fluctuations in raw material prices and geopolitical events pose challenges. Market penetration of iodine in novel applications like optical polarizing films and fluorochemicals is increasing, further driving market expansion. The competitive landscape is characterized by both price competition and innovation-driven differentiation, with established players facing competition from new entrants.

Dominant Markets & Segments in United States Iodine Market

Leading Source: Underground brines currently dominate the iodine source segment, accounting for approximately xx% of the market in 2024, driven by relatively high iodine concentration and cost-effective extraction methods in certain regions. The growth of this segment is directly related to the exploration and development of new brine deposits.

Key Form: Inorganic salts and complexes constitute the largest segment by form, driven by their widespread applications across various industries, particularly animal feed and industrial uses. The growth of this segment is influenced by price dynamics and technological advancements leading to improved production efficiency.

Dominant Application: The animal feed sector is the largest iodine application segment, driven by the essential role of iodine in animal health and productivity. Growth here is correlated with livestock production trends and stringent regulatory requirements. The medical and pharmaceutical segments also demonstrate strong growth, albeit at a slower rate compared to animal feed.

Regional Dominance: The Western region of the United States holds a significant market share due to the presence of major iodine production facilities and high demand from key industries in California. Factors like established infrastructure and proximity to end-users contribute to regional dominance. Growth in this region is largely dependent on the sustained demand from the agricultural and industrial sectors.

United States Iodine Market Product Innovations

Recent product innovations focus on developing higher-purity iodine products to meet the stringent requirements of specific applications, such as pharmaceuticals and electronics. This includes advancements in purification techniques and the introduction of novel iodine compounds with improved performance characteristics. Companies are also exploring sustainable iodine extraction methods and developing environmentally friendly formulations to meet growing environmental concerns. The market sees ongoing development of specialized iodine forms for specific applications enhancing product differentiation and market fit.

Report Segmentation & Scope

This report segments the US iodine market based on source (underground brines, caliche ore, recycling, seaweeds), form (inorganic salts and complexes, organic compounds, elementals and isotopes), and application (animal feed, medical, biocides, optical polarizing films, fluorochemicals, nylon, other applications). Each segment's growth projections, market size estimates, and competitive dynamics are analyzed individually within the report. Growth projections for each segment vary based on their respective drivers and challenges.

Key Drivers of United States Iodine Market Growth

The US iodine market growth is driven by increasing demand from diverse sectors, particularly animal feed, where iodine is a crucial nutrient for livestock health, and the medical industry, where it plays a crucial role in pharmaceuticals and diagnostics. Furthermore, technological advancements, such as improved extraction methods and the development of new applications in areas like electronics and specialty chemicals, contribute significantly to market expansion. Favorable government regulations supporting iodine fortification in food and feed further boost market growth.

Challenges in the United States Iodine Market Sector

Fluctuations in raw material prices and supply chain disruptions pose significant challenges to market growth. The regulatory landscape, though supportive in some areas, can also present hurdles, necessitating compliance with stringent safety and environmental standards. Competition from substitute chemicals in certain applications, alongside cost pressures, impacts profit margins and growth trajectories. These factors can lead to unpredictable pricing and reduced profitability for market players.

Leading Players in the United States Iodine Market Market

- Iofina

- SQM SA

- Samrat Pharmachem Limited

- American Elements

- ACF Minera SA

- KIVA Holding Inc

- Iochem Corporation

- Woodward Iodine Corporation (WIC) (ISE Chemicals Corporation)

- Deep Water Chemicals

Key Developments in United States Iodine Market Sector

- February 2022: Iofina announced negotiations with brine partners to build a new iodine plant, IO9, anticipating construction to commence before the end of 2022, indicating strong growth expectations.

Strategic United States Iodine Market Outlook

The future of the US iodine market appears promising, with continued growth driven by expanding applications across various industries and sustained demand from existing sectors. Strategic opportunities lie in developing innovative iodine-based products, optimizing extraction processes for greater sustainability, and expanding into emerging markets. Companies focusing on research and development, sustainable practices, and strategic partnerships will be well-positioned to capitalize on future growth opportunities.

United States Iodine Market Segmentation

-

1. Source

- 1.1. Underground Brines

- 1.2. Caliche Ore

- 1.3. Recycling

- 1.4. Seaweeds

-

2. Form

- 2.1. Inorganic Salts and Complexes

- 2.2. Organic Compounds

- 2.3. Elementals and Isotopes

-

3. Application

- 3.1. Animal Feed

- 3.2. Medical

- 3.3. Biocides

- 3.4. Optical Polarizing Films

- 3.5. Fluorochemicals

- 3.6. Nylon

- 3.7. Other Applications

United States Iodine Market Segmentation By Geography

- 1. United States

United States Iodine Market Regional Market Share

Geographic Coverage of United States Iodine Market

United States Iodine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Medical Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health Risks from Excessive Iodine Intake

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Medical Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Iodine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Underground Brines

- 5.1.2. Caliche Ore

- 5.1.3. Recycling

- 5.1.4. Seaweeds

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Inorganic Salts and Complexes

- 5.2.2. Organic Compounds

- 5.2.3. Elementals and Isotopes

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Animal Feed

- 5.3.2. Medical

- 5.3.3. Biocides

- 5.3.4. Optical Polarizing Films

- 5.3.5. Fluorochemicals

- 5.3.6. Nylon

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iofina

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SQM SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samrat Pharmachem Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Elements

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACF Minera SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KIVA Holding Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Iochem Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Woodward Iodine Corporation (WIC) (ISE Chemicals Corporation)*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Deep Water Chemicals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Iofina

List of Figures

- Figure 1: United States Iodine Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Iodine Market Share (%) by Company 2025

List of Tables

- Table 1: United States Iodine Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: United States Iodine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 3: United States Iodine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Iodine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Iodine Market Revenue Million Forecast, by Source 2020 & 2033

- Table 6: United States Iodine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 7: United States Iodine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: United States Iodine Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Iodine Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the United States Iodine Market?

Key companies in the market include Iofina, SQM SA, Samrat Pharmachem Limited, American Elements, ACF Minera SA, KIVA Holding Inc, Iochem Corporation, Woodward Iodine Corporation (WIC) (ISE Chemicals Corporation)*List Not Exhaustive, Deep Water Chemicals.

3. What are the main segments of the United States Iodine Market?

The market segments include Source, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Medical Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Medical Sector.

7. Are there any restraints impacting market growth?

Health Risks from Excessive Iodine Intake.

8. Can you provide examples of recent developments in the market?

In February 2022, Iofina was in negotiations with brine partners to create a new iodine plant, IO9. These negotiations are progressing, with the expectation to commence construction before 2022 ends. The company believes the outlook for iodine demand will remain strong in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Iodine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Iodine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Iodine Market?

To stay informed about further developments, trends, and reports in the United States Iodine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence