Key Insights

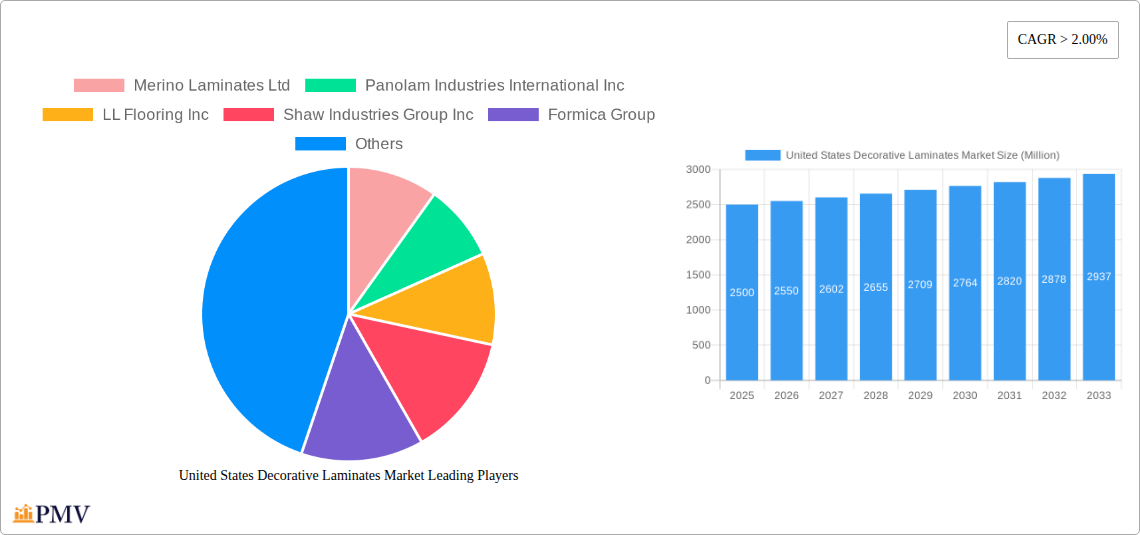

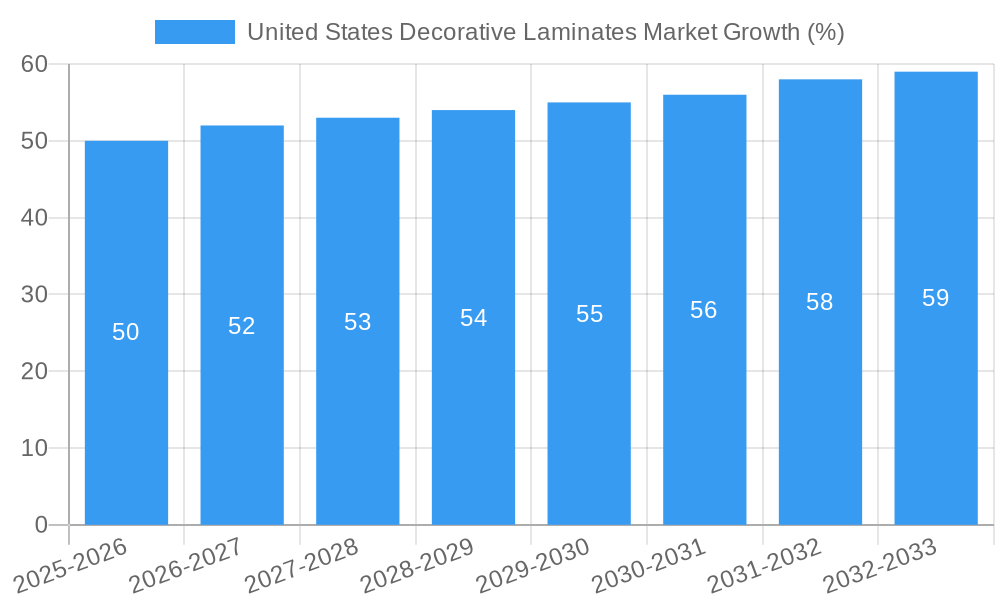

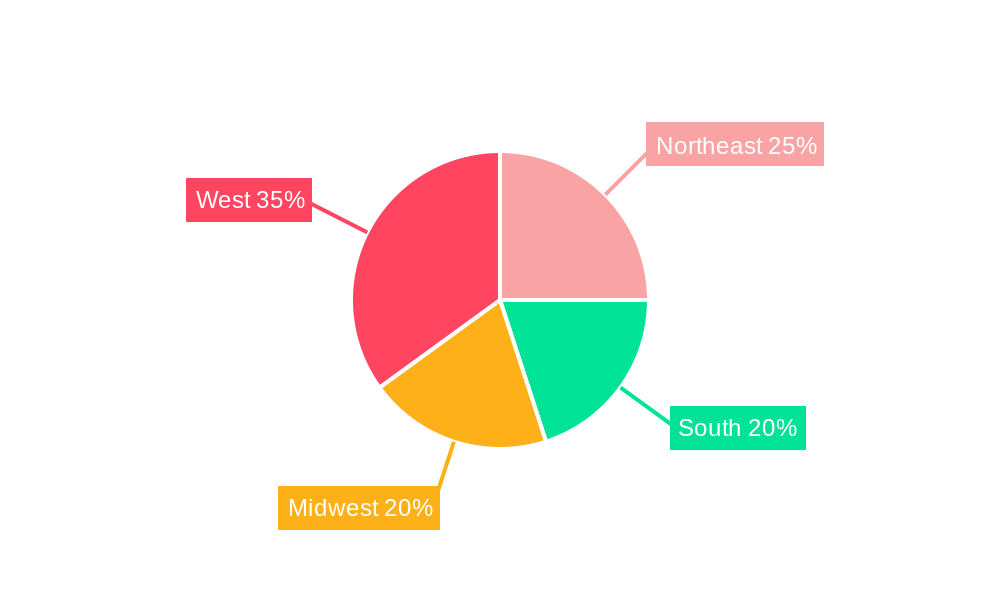

The United States decorative laminates market, valued at approximately $2.5 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 2% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning construction and renovation sectors, particularly within the residential and non-residential segments, significantly boost demand for decorative laminates in furniture, cabinetry, flooring, and wall panel applications. Furthermore, the increasing preference for durable, aesthetically pleasing, and cost-effective surfacing solutions continues to fuel market growth. Growing demand for sustainable and eco-friendly laminates, alongside innovative product developments such as high-pressure laminates (HPL) with enhanced performance characteristics, contribute to the market’s positive trajectory. However, fluctuations in raw material prices, particularly plastic resins and wood substrates, pose a potential constraint. The market is segmented by raw material (plastic resins, overlays, adhesives, wood substrate), application (furniture, cabinets, flooring, wall panels, tabletops, countertops), and end-user industry (residential, non-residential, transportation). The residential segment currently holds a larger market share compared to the non-residential segment, but the latter is anticipated to experience faster growth driven by commercial construction projects. Leading players like Formica Group, Wilsonart International, and Shaw Industries Group Inc. are strategically focusing on product diversification, technological advancements, and expansion into new geographic regions to solidify their market positions. Regional variations exist, with the Northeast and West regions anticipated to show relatively stronger growth compared to the South and Midwest due to higher construction activity and consumer spending.

The competitive landscape is characterized by both established multinational corporations and regional players. The strategic focus on innovation in design and material science has helped to expand the applications and appeal of decorative laminates. The market is likely to witness increased consolidation through mergers and acquisitions as companies strive for enhanced economies of scale and broader market reach. The rising adoption of digital printing technologies allows for greater customization options, boosting the appeal of decorative laminates among consumers and commercial projects alike. Long-term growth will depend on managing raw material costs, embracing sustainable manufacturing practices, and consistently delivering high-quality, innovative products that meet the evolving demands of the market. The forecast period of 2025-2033 presents a significant opportunity for growth within the U.S. decorative laminates market.

This comprehensive report provides an in-depth analysis of the United States Decorative Laminates Market, offering invaluable insights for businesses and investors. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth projections. The study incorporates detailed segmentation by raw material (Plastic Resin, Overlays, Adhesives, Wood Substrate), application (Furniture, Cabinets, Flooring, Wall Panels, Other Applications), and end-user industry (Residential, Non-Residential, Transportation).

United States Decorative Laminates Market Market Structure & Competitive Dynamics

This section delves into the competitive intensity of the US decorative laminates market. We analyze market concentration, identifying key players and their respective market shares (e.g., Formica Group holding xx% and Wilsonart International holding yy%). The report explores innovation ecosystems, highlighting R&D investments and the introduction of new technologies impacting the market. Regulatory frameworks influencing manufacturing and product safety are examined, alongside an assessment of product substitutes (e.g., solid surface materials) and their impact on market share. Furthermore, the report analyzes end-user trends, focusing on shifting preferences in design and sustainability, and details significant M&A activities within the industry, including deal values (e.g., a recent acquisition valued at $xx Million). The analysis incorporates detailed assessments of competitive strategies, including pricing strategies, product differentiation, and market expansion tactics. The report also incorporates the influence of macroeconomic factors on the competitiveness of the market, particularly consumer spending power and construction activity.

United States Decorative Laminates Market Industry Trends & Insights

This section offers a comprehensive overview of the current trends and future growth prospects of the US decorative laminates market. We analyze market growth drivers, such as the increasing demand for aesthetically pleasing and durable materials in residential and commercial construction projects and the renovation boom. Technological disruptions, including advancements in resin technology and digital printing, are evaluated alongside their impact on product quality and manufacturing efficiency. The report identifies prevailing consumer preferences, focusing on sustainability concerns and design trends that influence material selection and the market penetration rate of eco-friendly laminates. The influence of supply chain dynamics and raw material costs on profitability is assessed. Finally, a detailed analysis of competitive dynamics, including market share fluctuations, pricing strategies, and innovative product launches, provides a complete picture of the market’s landscape. This includes the Compound Annual Growth Rate (CAGR) projected at xx% for the forecast period (2025-2033).

Dominant Markets & Segments in United States Decorative Laminates Market

This section pinpoints the leading segments and regions within the US decorative laminates market.

- Leading Raw Material: Plastic Resin is projected to dominate the market due to xx.

- Leading Application: The Furniture segment demonstrates significant growth potential driven by xx and xx.

- Leading End-User Industry: The Residential sector holds a leading market share due to factors including xx and xx.

Detailed analysis is provided for each segment highlighting specific growth drivers (e.g., increasing housing starts for the residential sector, government spending on infrastructure projects for non-residential sectors). The dominance analysis includes insights into regional variations in market size and growth, influencing factors such as economic policies and regional construction activity are also discussed.

United States Decorative Laminates Market Product Innovations

Recent product developments within the US decorative laminates market focus on enhanced durability, improved aesthetics, and sustainable manufacturing processes. Innovations like antimicrobial laminates, high-gloss finishes, and textured surfaces cater to evolving consumer preferences and provide manufacturers with a competitive edge. The integration of digital printing technology allows for highly customized designs, further expanding market opportunities. These innovations align with broader industry trends in sustainable and eco-friendly materials.

Report Segmentation & Scope

This report provides a detailed segmentation of the United States Decorative Laminates Market based on raw material, application, and end-user industry.

Raw Material: The market is segmented into Plastic Resin, Overlays, Adhesives, and Wood Substrate, with growth projections and competitive analyses provided for each. Market size for each segment is provided, with Plastic Resin expected to be the largest segment at $xx Million in 2025.

Application: The report segments the market by Furniture, Cabinets, Flooring, Wall Panels, and Other Applications (Table Tops and Counter Tops), offering growth projections and competitive analyses for each application area. The Furniture application is projected to grow at xx% CAGR from 2025 to 2033.

End-User Industry: The market is segmented into Residential, Non-residential, and Transportation, analyzing growth potential and competitive dynamics within each end-user sector. The Residential segment is projected to account for the largest market share in 2025 due to xx factors.

Key Drivers of United States Decorative Laminates Market Growth

The US decorative laminates market is experiencing growth driven by several key factors. Increased construction activity, particularly in residential and commercial sectors, fuels the demand for decorative laminates. Furthermore, rising consumer disposable incomes and a preference for aesthetically pleasing and durable interiors are key drivers. Technological advancements, such as improved printing techniques and the introduction of new materials, expand design possibilities and boost market appeal. Government initiatives promoting sustainable building practices also contribute to the market's growth.

Challenges in the United States Decorative Laminates Market Sector

The US decorative laminates market faces several challenges. Fluctuations in raw material prices, particularly resin and wood substrate costs, impact profitability and pricing strategies. Supply chain disruptions can lead to production delays and increased costs. Increasing competition from alternative materials, such as solid surface materials, necessitates continuous product innovation and differentiation. Lastly, stringent environmental regulations can increase compliance costs for manufacturers. These factors collectively create a complex and dynamic market landscape.

Leading Players in the United States Decorative Laminates Market Market

- Merino Laminates Ltd

- Panolam Industries International Inc

- LL Flooring Inc

- Shaw Industries Group Inc

- Formica Group

- ATI Decorative Laminates

- Uniboard Canada Inc

- Wilsonart International

- Armstrong World Industries Inc

- Mohawk Industries Inc

- Arpa Industriale SpA

- OMNOVA Solutions Inc

Key Developments in United States Decorative Laminates Market Sector

- October 2022: Uniboard Canada announced the appointment of Atlantic Plywood as a distributor for Uniboard products in the US Midwest, expanding its distribution network and market reach for Thermally Fused Laminates (TFL) and High Pressure Laminates (HPL).

- August 2022: LL Flooring opened three new stores, increasing its retail presence and market access for decorative laminate flooring products.

These developments signify increased competition and expanded market access for key players within the US decorative laminates market.

Strategic United States Decorative Laminates Market Market Outlook

The US decorative laminates market presents significant growth opportunities driven by ongoing construction activity, evolving consumer preferences, and continuous product innovation. Strategic partnerships, targeted product development, and expansion into new market segments offer significant potential for market leaders. Companies focusing on sustainable and eco-friendly products are poised for strong growth. The market is expected to witness further consolidation as key players seek to expand their market share and geographical reach. The focus on high-quality, durable, and aesthetically appealing products will drive future market success.

United States Decorative Laminates Market Segmentation

-

1. Raw Material

- 1.1. Plastic Resin

- 1.2. Overlays

- 1.3. Adhesives

- 1.4. Wood Substrate

-

2. Application

- 2.1. Furniture

- 2.2. Cabinets

- 2.3. Flooring

- 2.4. Wall Panels

- 2.5. Other Applications (Table Tops and Counter Tops)

-

3. End-User Industry

- 3.1. Residential

- 3.2. Non-residential

- 3.3. Transportation

United States Decorative Laminates Market Segmentation By Geography

- 1. United States

United States Decorative Laminates Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Sector; Increased Consumption of Furniture; Low Cost of Installation and Maintenance

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Furniture Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Plastic Resin

- 5.1.2. Overlays

- 5.1.3. Adhesives

- 5.1.4. Wood Substrate

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Furniture

- 5.2.2. Cabinets

- 5.2.3. Flooring

- 5.2.4. Wall Panels

- 5.2.5. Other Applications (Table Tops and Counter Tops)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.3.3. Transportation

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Northeast United States Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 7. South United States Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest United States Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 9. West United States Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Merino Laminates Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Panolam Industries International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 LL Flooring Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shaw Industries Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Formica Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ATI Decorative Laminates

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Uniboard Canada Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Wilsonart International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Armstrong World Industries Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mohawk Industries Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Arpa Industriale SpA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 OMNOVA Solutions Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Merino Laminates Ltd

List of Figures

- Figure 1: United States Decorative Laminates Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Decorative Laminates Market Share (%) by Company 2024

List of Tables

- Table 1: United States Decorative Laminates Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Decorative Laminates Market Volume Square Meters Forecast, by Region 2019 & 2032

- Table 3: United States Decorative Laminates Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 4: United States Decorative Laminates Market Volume Square Meters Forecast, by Raw Material 2019 & 2032

- Table 5: United States Decorative Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: United States Decorative Laminates Market Volume Square Meters Forecast, by Application 2019 & 2032

- Table 7: United States Decorative Laminates Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: United States Decorative Laminates Market Volume Square Meters Forecast, by End-User Industry 2019 & 2032

- Table 9: United States Decorative Laminates Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Decorative Laminates Market Volume Square Meters Forecast, by Region 2019 & 2032

- Table 11: United States Decorative Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Decorative Laminates Market Volume Square Meters Forecast, by Country 2019 & 2032

- Table 13: Northeast United States Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northeast United States Decorative Laminates Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 15: South United States Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South United States Decorative Laminates Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 17: Midwest United States Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Midwest United States Decorative Laminates Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 19: West United States Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West United States Decorative Laminates Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 21: United States Decorative Laminates Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 22: United States Decorative Laminates Market Volume Square Meters Forecast, by Raw Material 2019 & 2032

- Table 23: United States Decorative Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: United States Decorative Laminates Market Volume Square Meters Forecast, by Application 2019 & 2032

- Table 25: United States Decorative Laminates Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 26: United States Decorative Laminates Market Volume Square Meters Forecast, by End-User Industry 2019 & 2032

- Table 27: United States Decorative Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Decorative Laminates Market Volume Square Meters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Decorative Laminates Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the United States Decorative Laminates Market?

Key companies in the market include Merino Laminates Ltd, Panolam Industries International Inc, LL Flooring Inc, Shaw Industries Group Inc, Formica Group, ATI Decorative Laminates, Uniboard Canada Inc, Wilsonart International, Armstrong World Industries Inc, Mohawk Industries Inc, Arpa Industriale SpA, OMNOVA Solutions Inc.

3. What are the main segments of the United States Decorative Laminates Market?

The market segments include Raw Material, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Sector; Increased Consumption of Furniture; Low Cost of Installation and Maintenance.

6. What are the notable trends driving market growth?

Furniture Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: Uniboard Canada announced the appointment of Atlantic Plywood as a distributor for Uniboard products in the US Midwest. The offering will include 24 specifically selected colors of Uniboard's Thermally Fused Laminates (TFL) and High Pressure Laminates (HPL) product line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Square Meters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Decorative Laminates Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Decorative Laminates Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Decorative Laminates Market?

To stay informed about further developments, trends, and reports in the United States Decorative Laminates Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence