Key Insights

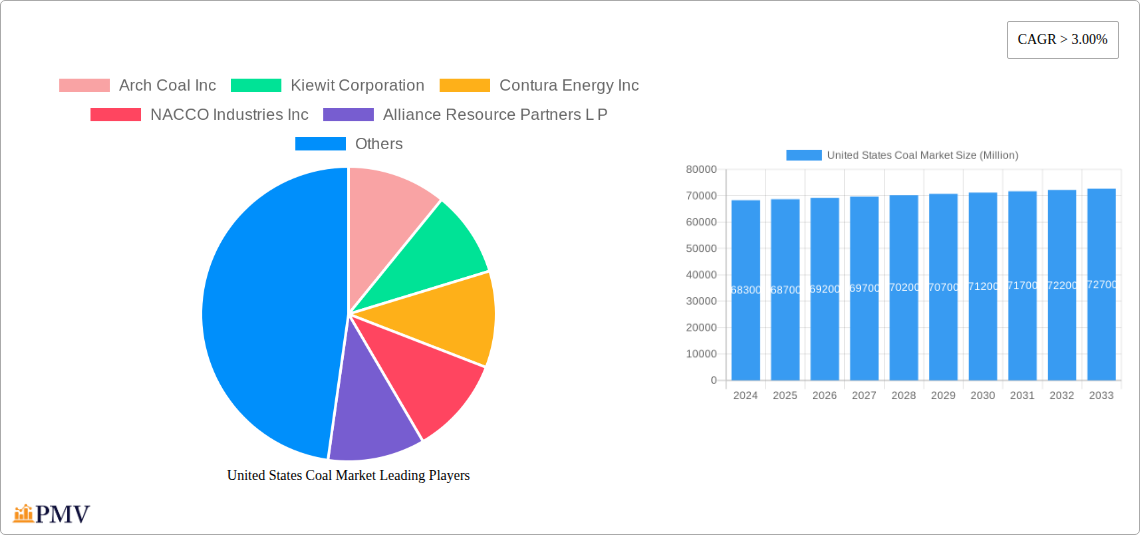

The United States coal market is projected to reach approximately $68.3 billion in 2024, exhibiting a modest Compound Annual Growth Rate (CAGR) of 0.8% through 2033. This growth is primarily driven by the persistent demand for coal in the power generation sector, which continues to rely on it as a baseload power source, especially during periods of high energy demand and grid instability. Furthermore, the metallurgical industry utilizes coal extensively in steel production, a sector that remains robust. While the overall market experiences a slow but steady expansion, specific applications like metallurgy are expected to contribute more significantly to this growth compared to others.

United States Coal Market Market Size (In Billion)

Despite the overall positive trend, the market faces considerable restraints, including increasing regulatory pressures aimed at reducing carbon emissions, the growing competitiveness of renewable energy sources, and the rising operational costs associated with coal mining. These factors collectively temper the market's potential for more rapid expansion. Trends indicate a gradual shift towards more efficient coal utilization technologies and an increased focus on cleaner coal initiatives, though the transition away from coal in the long term remains a significant undercurrent. The market is segmented by application, with Metallurgy and Power Generation being the primary segments, and a residual "Others" category. Key players like Peabody Energy Corp, Arch Coal Inc., and Vistra Corp are instrumental in shaping the market's trajectory.

United States Coal Market Company Market Share

United States Coal Market: Comprehensive Market Analysis, Trends, and Forecast (2019–2033)

This in-depth report provides a detailed examination of the United States coal market, encompassing its current state, historical performance, and future projections. Leveraging extensive data from the study period of 2019–2033, with the base year and estimated year both set at 2025, this analysis offers critical insights for stakeholders across the coal value chain. The forecast period of 2025–2033 provides a strategic outlook on market evolution, while the historical period of 2019–2024 grounds the analysis in past performance. This report is designed for industry professionals, investors, and policymakers seeking to understand the intricate dynamics and future trajectory of the U.S. coal sector.

United States Coal Market Market Structure & Competitive Dynamics

The United States coal market, while mature, exhibits a dynamic competitive landscape characterized by significant market concentration among a few dominant players. Key companies like Peabody Energy Corp, Arch Coal Inc, and Alliance Resource Partners L.P. command substantial market share, influencing pricing and supply. Innovation ecosystems within the sector are largely focused on improving operational efficiency, reducing environmental impact through advanced mining techniques, and exploring niche applications for coal byproducts. The regulatory framework remains a critical determinant, with evolving environmental policies and emissions standards significantly shaping operational strategies and market access. Product substitutes, primarily natural gas and renewable energy sources, continue to exert competitive pressure, particularly in the power generation segment, driving a shift in demand. End-user trends reveal a declining but still significant reliance on coal for metallurgical applications and a fluctuating demand for power generation, influenced by energy policies and economic conditions. Merger and acquisition (M&A) activities, although less frequent in recent years, have historically played a role in consolidating market share and acquiring strategic assets, with notable deal values in the past demonstrating a desire for vertical integration and resource control. The market's ability to adapt to these evolving dynamics will be crucial for its sustained relevance.

United States Coal Market Industry Trends & Insights

The United States coal market is undergoing a multifaceted transformation driven by evolving energy landscapes, technological advancements, and shifting global economic dynamics. A primary trend is the strategic pivot within the power generation sector, where a gradual but persistent decline in coal-fired power plants is being observed, influenced by a combination of regulatory pressures, the increasing affordability of natural gas and renewable energy alternatives, and the aging infrastructure of older coal facilities. This trend is partially offset by the persistent demand from the metallurgical coal segment, crucial for steel production. While this segment is also subject to global steel demand fluctuations, it remains a bedrock of U.S. coal consumption. The CAGR for the overall market is projected to be a negative xx% during the forecast period, reflecting the challenges in the power generation segment. However, specific sub-segments, like metallurgical coal, may exhibit more stable or even moderate positive growth rates. Technological disruptions are primarily centered on enhancing mining efficiency and environmental mitigation. Innovations in autonomous mining equipment, advanced dust suppression systems, and carbon capture technologies are being explored and implemented to reduce operational costs and meet increasingly stringent environmental standards. Consumer preferences are increasingly aligned with sustainability, pushing utilities and industrial users to explore cleaner energy alternatives, thereby indirectly impacting coal demand. Competitive dynamics are characterized by operational optimization and cost control among existing players, alongside strategic divestments and consolidations as companies adapt to market realities. The penetration of renewable energy sources continues to grow, directly challenging coal's dominance in the electricity generation mix. The market penetration of renewables is estimated to reach xx% by 2030, further intensifying competition. Despite these headwinds, coal's role in specific industrial applications and its established infrastructure ensure its continued, albeit diminished, presence in the U.S. energy portfolio. The ability of coal producers to innovate, adapt to regulatory changes, and serve niche markets will determine their long-term viability.

Dominant Markets & Segments in United States Coal Market

The United States coal market's dominance is primarily shaped by regional resource availability, existing infrastructure, and sector-specific demand. Geographically, the Appalachian Basin and the Illinois Basin remain the most significant coal-producing regions, boasting extensive reserves and well-established transportation networks. Economic policies, such as tax incentives for domestic manufacturing and energy security initiatives, play a crucial role in supporting coal demand, particularly for the metallurgical segment. Infrastructure, including rail lines and export terminals, facilitates the movement of coal from mines to end-users, both domestically and internationally.

Application: Power Generation While historically the largest segment, power generation's dominance is gradually declining due to environmental regulations and the rise of alternative energy sources. However, certain regions still rely on coal for baseload power, particularly where renewable energy integration is still developing or where existing coal plants are more cost-effective in the short term. Key drivers include energy security concerns and the need for reliable, dispatchable power. The market size for this segment is projected to be approximately $xx billion by 2033, with a negative CAGR of -xx%.

Application: Metallurgy The metallurgical coal segment, vital for steel production, remains a strong pillar of the U.S. coal market. Domestic steel manufacturing and international demand for steel products directly influence the consumption of metallurgical coal. Economic growth, infrastructure development globally, and the automotive industry are significant drivers for this segment. The market size for this segment is estimated to reach $xx billion by 2033, with a positive CAGR of +xx%.

Application: Others This segment encompasses various smaller applications, including industrial processes, cement production, and chemical manufacturing. While individually smaller, these applications collectively contribute to the overall coal demand. Factors influencing this segment include industrial output, economic diversification, and the availability of specialized coal grades. The market size for this segment is projected to be around $xx billion by 2033, with a stable CAGR of +xx%.

United States Coal Market Product Innovations

Product innovations in the United States coal market are increasingly focused on enhancing efficiency and addressing environmental concerns. These developments include the optimization of coal washing and processing techniques to produce higher-grade metallurgical coal with fewer impurities, thus improving its value proposition for steel manufacturers. Furthermore, research into coal-fired power plants with advanced emissions control technologies, such as enhanced scrubbers and carbon capture utilization and storage (CCUS) systems, aims to reduce the environmental footprint of coal energy generation. The development of specialized coal products for niche industrial applications, offering specific combustion properties or chemical compositions, also contributes to competitive advantage. These innovations are crucial for extending the market relevance of coal in a transitioning energy landscape, focusing on cleaner extraction and utilization to meet evolving regulatory and market demands.

Report Segmentation & Scope

This comprehensive report segments the United States coal market across its primary applications to provide a granular understanding of its dynamics.

Application: Metallurgy This segment analyzes the demand for metallurgical coal, crucial for steel production. It includes projections for market size and growth rate, examining the impact of global steel demand, domestic manufacturing trends, and technological advancements in steelmaking on this vital coal application. Competitive dynamics within this segment are influenced by the quality of coal produced and its cost-effectiveness for steel producers. The estimated market size for this segment in 2033 is $xx billion, with a projected CAGR of +xx%.

Application: Power Generation This segment focuses on the declining but still significant role of coal in electricity generation. It covers market size projections, growth rates, and the impact of environmental regulations, renewable energy competition, and energy policy on coal-fired power plants. Analysis includes the operational efficiency and emissions performance of existing plants, and the economic viability of coal versus alternatives. The estimated market size for this segment in 2033 is $xx billion, with a projected CAGR of -xx%.

Application: Others This segment encompasses all other significant uses of coal beyond metallurgy and power generation, including industrial heating, cement production, and chemical feedstock. It details market size projections and growth trends influenced by industrial activity, economic diversification, and the development of specialized coal products. Competitive dynamics in this segment are driven by cost-effectiveness and the availability of specific coal characteristics for diverse industrial processes. The estimated market size for this segment in 2033 is $xx billion, with a projected CAGR of +xx%.

Key Drivers of United States Coal Market Growth

The United States coal market's growth is underpinned by several key drivers. Firstly, robust demand from the metallurgical coal sector, essential for global steel production, continues to provide a stable revenue stream. This demand is intrinsically linked to global infrastructure development and manufacturing output. Secondly, energy security concerns and the inherent reliability of coal as a baseload power source in certain regions, despite the broader energy transition, act as a supporting factor. Thirdly, technological advancements in mining and processing are enhancing operational efficiency and reducing costs, making U.S. coal more competitive globally. Finally, government policies that support domestic energy production and industrial competitiveness, while evolving, can still provide a conducive environment for coal's continued, albeit selective, utilization.

Challenges in the United States Coal Market Sector

The United States coal market faces significant challenges that are reshaping its future trajectory. Stringent environmental regulations and evolving climate policies pose a primary restraint, increasing operational costs and driving a shift towards cleaner energy alternatives. The increasing competitiveness of natural gas and renewable energy sources, driven by cost reductions and policy support, directly erodes coal's market share, particularly in power generation. Supply chain disruptions, including transportation bottlenecks and labor availability, can impact production costs and delivery reliability. Furthermore, public perception and investor sentiment are increasingly unfavorable towards fossil fuels, leading to divestment pressures and reduced access to capital. These barriers collectively exert considerable downward pressure on coal demand and investment.

Leading Players in the United States Coal Market Market

- Arch Coal Inc

- Kiewit Corporation

- Contura Energy Inc

- NACCO Industries Inc

- Alliance Resource Partners L P

- Peabody Energy Corp

- Vistra Corp

Key Developments in United States Coal Market Sector

- 2023/07: Peabody Energy Corp announces strategic review of its Australia operations, signaling potential shifts in global resource allocation.

- 2023/05: Alliance Resource Partners L.P. reports strong first-quarter earnings driven by robust metallurgical coal demand, highlighting segment resilience.

- 2023/02: Contura Energy Inc. completes merger with Alpha Metallurgical Capital, creating a larger player in the metallurgical coal space.

- 2022/11: Vistra Corp. continues its transition strategy, increasing investments in renewable energy and battery storage, impacting its coal-fired power generation portfolio.

- 2022/09: Arch Coal Inc. emphasizes operational efficiency and cost management in response to market volatility and regulatory pressures.

Strategic United States Coal Market Market Outlook

The strategic outlook for the United States coal market hinges on its ability to adapt to evolving energy landscapes and capitalize on niche opportunities. While the power generation segment faces significant headwinds, the demand for high-quality metallurgical coal for steel production is expected to provide a stabilizing force. Strategic initiatives will likely focus on enhancing operational efficiencies, minimizing environmental impact through advanced technologies, and exploring value-added applications for coal byproducts. Companies that can effectively navigate regulatory frameworks and secure long-term contracts in the metallurgical and industrial segments are poised for greater resilience. Diversification into complementary energy sectors or infrastructure development may also represent viable long-term growth accelerators for some players. The market's future success will be defined by agility, innovation, and a keen understanding of specific end-user requirements.

United States Coal Market Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

United States Coal Market Segmentation By Geography

- 1. United States

United States Coal Market Regional Market Share

Geographic Coverage of United States Coal Market

United States Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arch Coal Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kiewit Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Contura Energy Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NACCO Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alliance Resource Partners L P

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistra Corp*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Arch Coal Inc

List of Figures

- Figure 1: United States Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Coal Market Share (%) by Company 2025

List of Tables

- Table 1: United States Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: United States Coal Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: United States Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Coal Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: United States Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: United States Coal Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: United States Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Coal Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Coal Market?

The projected CAGR is approximately 0.8%.

2. Which companies are prominent players in the United States Coal Market?

Key companies in the market include Arch Coal Inc, Kiewit Corporation, Contura Energy Inc, NACCO Industries Inc, Alliance Resource Partners L P, Peabody Energy Corp, Vistra Corp*List Not Exhaustive.

3. What are the main segments of the United States Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Coal Market?

To stay informed about further developments, trends, and reports in the United States Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence