Key Insights

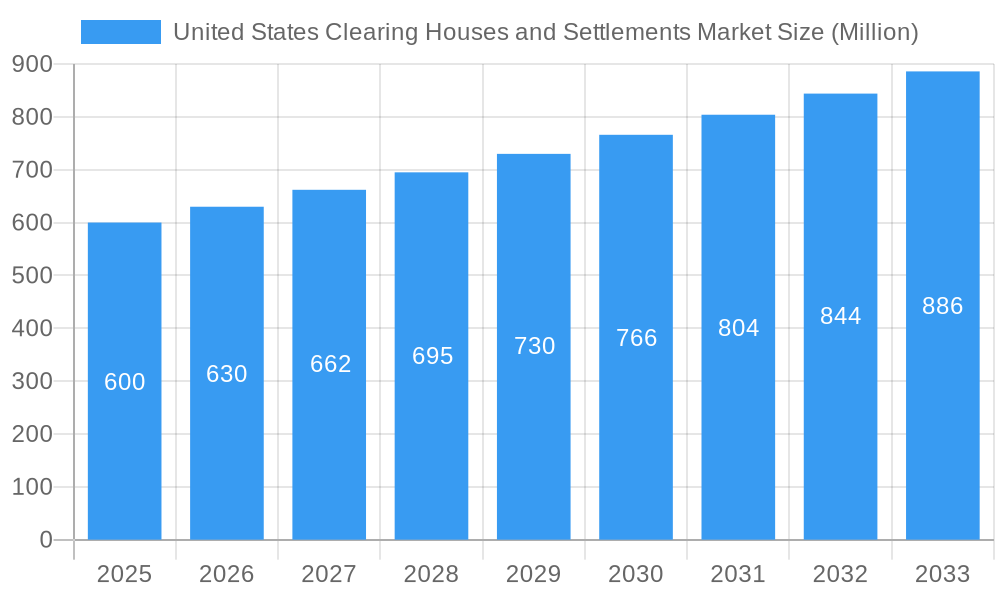

The United States Clearing Houses and Settlements Market is poised for substantial expansion, driven by escalating trading volumes, the proliferation of electronic trading platforms, and an increasing need for streamlined, secure post-trade processing. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 5%. This growth is underpinned by several key drivers. First, the growing complexity and volume of financial transactions necessitate sophisticated clearing and settlement solutions to effectively mitigate risks and ensure operational efficiency. Second, evolving regulatory frameworks designed to bolster market stability and transparency are compelling market participants to adopt more robust systems. Finally, technological advancements, including blockchain and distributed ledger technologies, are anticipated to optimize these processes and foster market innovation. The estimated market size in 2025 is projected to be $6.75 billion.

United States Clearing Houses and Settlements Market Market Size (In Billion)

Looking ahead to 2033, the market trajectory indicates sustained expansion across key segments such as equity clearing, derivatives clearing, and fixed-income clearing. These areas are expected to benefit from the rise of algorithmic trading and the growing demand for advanced risk management tools. While competitive pressures from established entities and emerging technologies may present challenges, the overall market outlook remains optimistic. Continued technological integration and the evolving regulatory landscape will shape the future of this critical component of the US financial system, creating opportunities for innovation and consolidation among leading players like the New York Stock Exchange and NASDAQ. This ongoing growth highlights the indispensable role of clearing houses and settlement systems in preserving the integrity and stability of US financial markets.

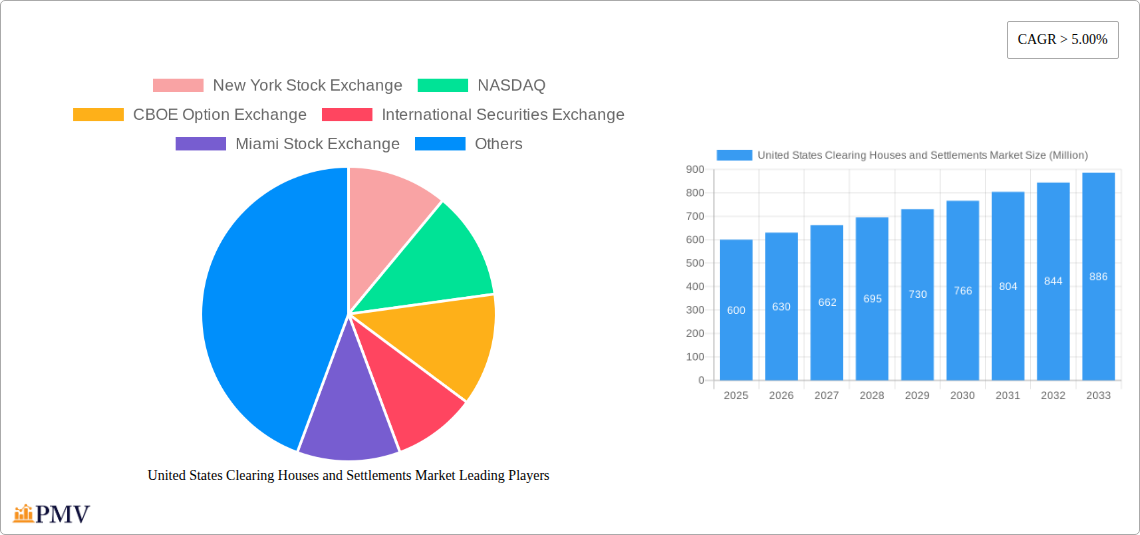

United States Clearing Houses and Settlements Market Company Market Share

This comprehensive report offers an in-depth analysis of the United States Clearing Houses and Settlements Market, covering the period from 2019 to 2033. It provides strategic insights into market dynamics, competitive landscapes, industry trends, and future growth potential. With a base year of 2024 and a forecast period extending to 2033, this report is essential for investors, market participants, and decision-makers seeking a thorough understanding of this vital sector within the US financial market.

United States Clearing Houses and Settlements Market Market Structure & Competitive Dynamics

The US clearing houses and settlements market exhibits a moderately concentrated structure, dominated by established players like the New York Stock Exchange, NASDAQ, and CBOE Global Markets. However, the market also accommodates smaller, specialized exchanges, fostering a dynamic competitive landscape. Market share is highly dependent on the specific segment (e.g., equities, derivatives, fixed income), with some players exhibiting significant dominance within their niche. The market concentration ratio (CR4) for equities clearing is estimated at xx%, reflecting the influence of the largest players. Innovation within the ecosystem focuses on enhancing efficiency, reducing risk, and leveraging technological advancements such as blockchain and AI. Regulatory frameworks, primarily overseen by the Securities and Exchange Commission (SEC) and other bodies, significantly impact market operations and innovation. Substitutes for clearing houses are limited due to the critical role they play in risk mitigation and transaction settlement. End-user trends lean towards automated, high-speed clearing systems and demand for greater transparency. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values averaging approximately xx Million annually, driven primarily by strategic acquisitions to expand market share or capabilities. Key M&A activities have included (list specific examples if available with deal values if known). The competitive landscape is further shaped by factors such as technological advancements, regulatory changes, and the evolving needs of market participants.

United States Clearing Houses and Settlements Market Industry Trends & Insights

The US clearing houses and settlements market is experiencing significant growth, driven by factors such as increased trading volumes, regulatory changes mandating increased clearing house usage, and the adoption of advanced technologies. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). Market penetration of automated clearing systems is steadily increasing, reaching an estimated xx% in 2025. Technological disruptions, particularly in areas such as distributed ledger technology (DLT) and AI, are reshaping market operations, leading to increased efficiency and reduced operational costs. Consumer preferences are shifting towards increased transparency, faster settlement times, and reduced risk. The competitive dynamics are characterized by ongoing innovation, strategic partnerships, and a focus on regulatory compliance. The market is projected to maintain robust growth during the forecast period (2025-2033), fueled by increased trading activity across various asset classes and continued technological advancements.

Dominant Markets & Segments in United States Clearing Houses and Settlements Market

The New York Stock Exchange and NASDAQ dominate the US clearing houses and settlements market for equities, accounting for a combined market share of approximately xx% in 2025. Other significant segments include options, futures, and fixed income. This dominance stems from several factors:

- Established Infrastructure: Decades of experience and robust infrastructure enable high transaction throughput and operational efficiency.

- Network Effects: Large trading volumes attract more participants, creating a positive feedback loop.

- Regulatory Compliance: Stringent compliance standards reinforce trust and market stability.

- Technological Advancements: Continuous investment in technology enhances speed, efficiency, and security.

New York and other major financial centers across the nation are the leading regions due to the concentration of financial institutions and trading activity. The market growth in this segment is primarily fueled by consistently high trading volumes and robust economic activity in these key centers. Further dominance analysis reveals a positive correlation between economic strength and clearing house activity.

United States Clearing Houses and Settlements Market Product Innovations

Recent product innovations are primarily focused on enhancing speed, efficiency, and risk management. This includes the implementation of advanced technologies like AI and machine learning for fraud detection and risk assessment, as well as the exploration of distributed ledger technologies (DLT) for improved transparency and settlement efficiency. These innovations are aimed at reducing operational costs, improving processing speed, and enhancing the overall resilience of the market. The market fit of these innovations is high, reflecting the ongoing demand for secure and efficient clearing and settlement solutions.

Report Segmentation & Scope

This report segments the market based on asset class (Equities, Derivatives, Fixed Income, etc.), clearing house type (central counterparty clearing houses (CCPs), etc.), and geographic location. Growth projections vary across segments, with the derivatives segment expected to show significant growth due to the increasing complexity and volume of derivative transactions. Market sizes are estimated for each segment, providing granular insight into the market structure. Competitive dynamics within each segment are assessed, highlighting key players and their market positions.

Key Drivers of United States Clearing Houses and Settlements Market Growth

Growth in the US clearing houses and settlements market is propelled by several key factors: increasing trading volumes across various asset classes; regulatory mandates aimed at reducing systemic risk by funneling trades through clearinghouses (as exemplified by the December 2023 regulations impacting the $26 trillion US Treasury market); technological advancements, particularly in areas such as AI and DLT; and robust economic activity, which fuels trading volumes. These factors create a synergistic environment for continued market growth.

Challenges in the United States Clearing Houses and Settlements Market Sector

The sector faces challenges including adapting to rapid technological changes, managing cybersecurity risks, and complying with evolving regulatory requirements, which can lead to increased operational costs. Maintaining robust risk management systems in the face of increasing trading volumes and complexity represents a significant challenge, potentially leading to xx Million in additional compliance costs annually. Supply chain disruptions impacting technology infrastructure can also impact market operations, albeit with limited quantifiable impact currently. The competitive pressure among clearing houses adds further complexity.

Leading Players in the United States Clearing Houses and Settlements Market Market

- New York Stock Exchange

- NASDAQ

- CBOE Option Exchange

- International Securities Exchange

- Miami Stock Exchange

- National Stock Exchange

- Philadelphia Stock Exchange

Key Developments in United States Clearing Houses and Settlements Market Sector

- December 2023: Miami International Holdings, Inc. launched MIAX Sapphire, a new physical trading floor and electronic exchange in Miami, expanding options trading capacity. This significantly boosts the market's physical trading infrastructure.

- December 2023: New regulations mandated increased clearing house usage for US Treasury markets, aiming to reduce systemic risk within the $26 trillion market. This has a profound impact on market dynamics by increasing clearing house volumes and potentially reshaping competitive landscape.

Strategic United States Clearing Houses and Settlements Market Market Outlook

The future outlook for the US clearing houses and settlements market is positive, driven by continued technological advancements, regulatory changes, and robust economic growth. Strategic opportunities exist for players focusing on innovative technologies like DLT and AI, enhanced risk management solutions, and expanding into new asset classes and markets. The market's growth trajectory is expected to remain strong, presenting significant opportunities for both existing and new market participants. This suggests continued investment in infrastructure and technological advancement will be crucial to capitalize on the market's long-term potential.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

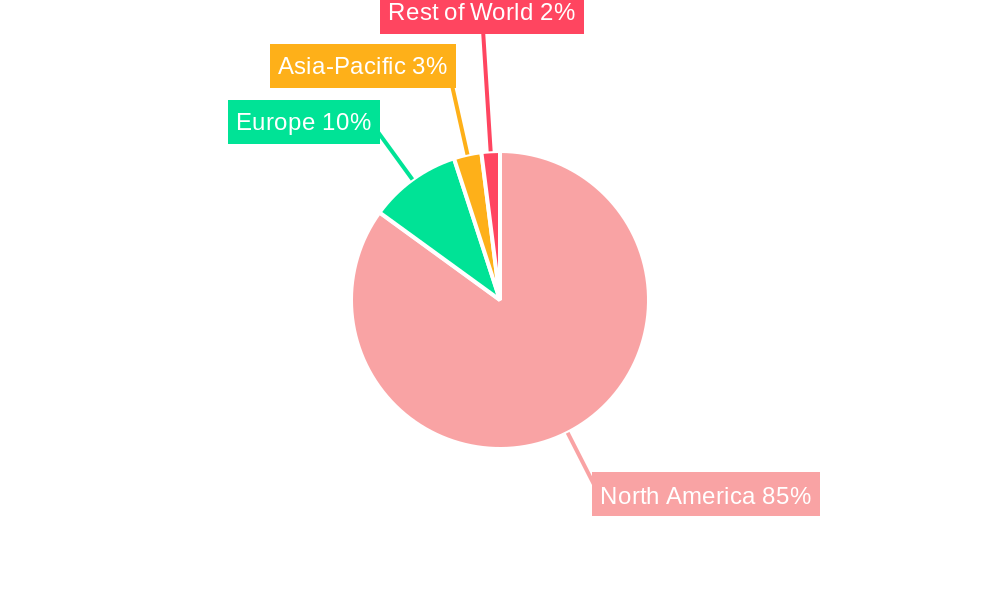

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence