Key Insights

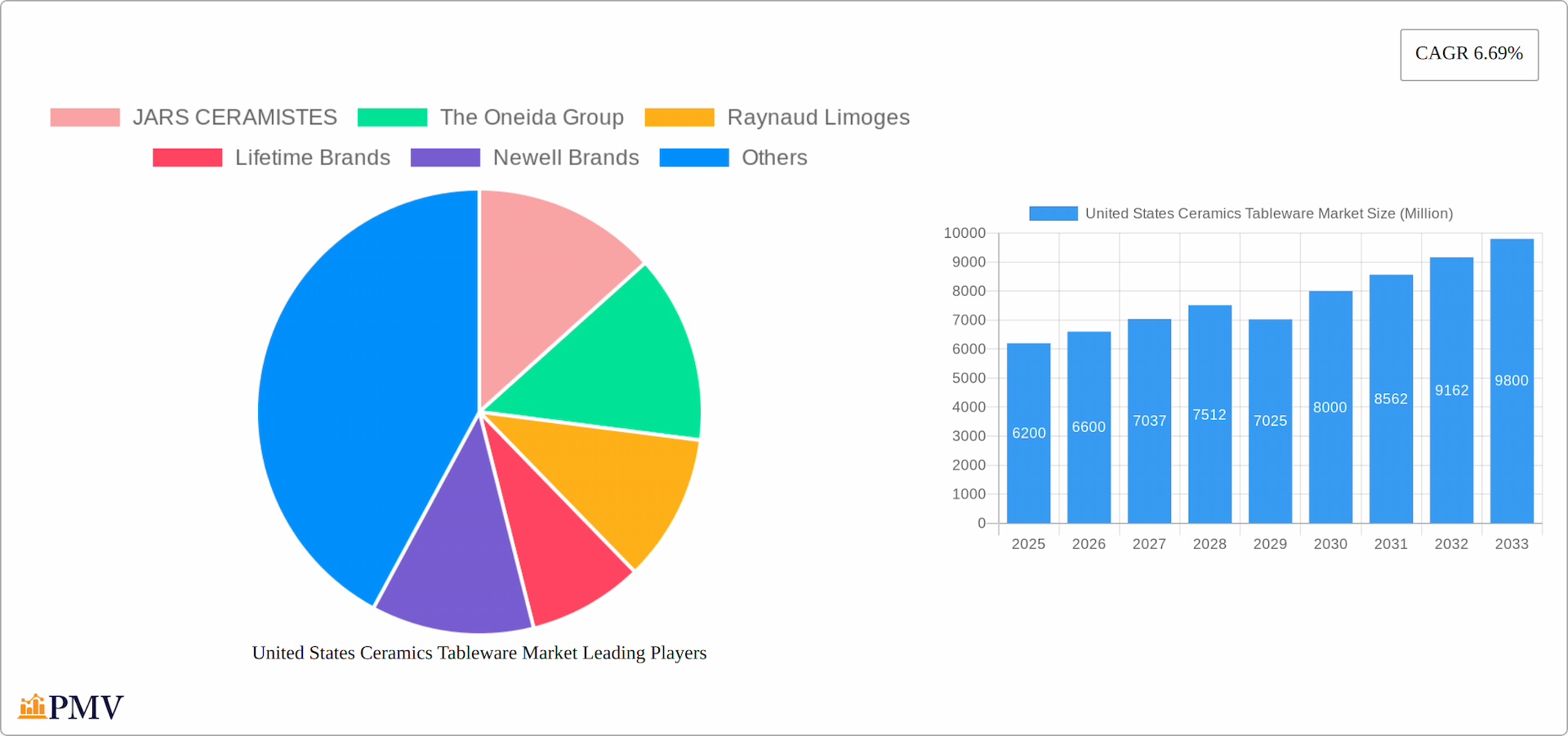

The United States ceramics tableware market, valued at $6.20 billion in 2025, is projected to experience robust growth, driven by several key factors. A rising preference for aesthetically pleasing and durable tableware among consumers fuels demand across both household and commercial segments. The increasing popularity of casual dining and home entertaining contributes significantly to this trend. Furthermore, the expansion of online retail channels provides convenient access to a wider variety of products, stimulating market growth. While the market is segmented by tableware type (porcelain and bone china, stoneware, and others), end-user (household and commercial), and distribution channel (supermarkets, specialty stores, online, etc.), the household segment currently dominates, reflecting a strong consumer preference for upgrading home dining experiences. Growth within the commercial sector is also anticipated, driven by the hospitality industry's focus on enhancing customer experiences through high-quality tableware. While supply chain disruptions and fluctuating raw material costs present challenges, the overall market outlook remains positive, with continued innovation in design and materials expected to maintain consumer interest and drive market expansion throughout the forecast period.

United States Ceramics Tableware Market Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 6.69% for the period 2025-2033 indicates substantial growth potential. This growth is anticipated to be fueled by evolving consumer preferences towards premium quality and sustainable products. Manufacturers are responding by offering eco-friendly ceramics and innovative designs, catering to the demand for both functionality and style. Stoneware, with its durability and versatility, is anticipated to maintain a significant market share, while porcelain and bone china segments will continue to attract consumers seeking high-end tableware. The continued growth of e-commerce will also influence the distribution landscape, with online retailers playing an increasingly prominent role. Competition among established players and the emergence of new brands will further shape the market dynamics, leading to ongoing innovation and competitive pricing strategies.

United States Ceramics Tableware Market Company Market Share

This comprehensive report provides a detailed analysis of the United States ceramics tableware market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The report includes a detailed segmentation analysis across product type, end-user, and distribution channel, providing granular data and projections to facilitate informed strategic planning.

United States Ceramics Tableware Market Structure & Competitive Dynamics

The US ceramics tableware market exhibits a moderately concentrated structure, with key players holding significant market share. The market's competitive landscape is shaped by factors including innovation, regulatory compliance, the availability of substitute materials (like melamine or plastic), evolving end-user preferences (e.g., towards sustainable and ethically sourced products), and ongoing mergers and acquisitions (M&A) activity.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable during the forecast period, with minor shifts due to strategic acquisitions and new product launches.

- Innovation Ecosystems: Companies are increasingly investing in research and development to introduce innovative designs, materials, and manufacturing processes. This includes the exploration of eco-friendly materials and sustainable production techniques.

- Regulatory Frameworks: The market is subject to regulations concerning food safety, material composition, and labeling requirements. Compliance with these regulations is crucial for market entry and sustained operations.

- Product Substitutes: The market faces competition from alternative materials like melamine and plastic, particularly in the lower-priced segments. However, the demand for high-quality, durable ceramics remains strong, especially in the premium segment.

- End-User Trends: The increasing popularity of casual dining and home entertaining contributes to the demand for ceramics tableware. Furthermore, the shift towards sustainable and ethically produced goods influences purchasing decisions.

- M&A Activity: Recent M&A activity, such as Lifetime Brands' acquisition of S'well Bottle in March 2022, highlights the strategic consolidation within the industry. The total value of M&A deals in the sector during the historical period (2019-2024) is estimated at $xx Million.

United States Ceramics Tableware Market Industry Trends & Insights

The US ceramics tableware market is poised for robust growth, projecting a Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR Here, e.g., 5.5%]%** during the forecast period (2025-2033). This expansion is being propelled by a confluence of factors, including steadily increasing disposable incomes across the nation, the ongoing trend of urbanization, and a heightened consumer appreciation for tableware that is not only aesthetically appealing but also exceptionally durable. Innovations in manufacturing technologies are continuously enhancing product quality while simultaneously driving down production costs, making premium ceramics tableware more accessible.

Despite these positive trends, the market navigates certain challenges, such as the volatility in raw material pricing and the intensifying competition from imported goods. A significant emerging trend is the growing consumer demand for eco-friendly and sustainable tableware options, presenting a valuable opportunity for manufacturers to innovate and integrate green practices into their product lines and manufacturing processes. The digital landscape is also reshaping the market, with the online sales channel expected to witness continued expansion, profoundly influencing traditional distribution strategies. The competitive arena remains vibrant, characterized by established industry leaders and agile new entrants actively pursuing market share through distinctive product offerings and strategic branding initiatives.

Dominant Markets & Segments in United States Ceramics Tableware Market

The **Household segment** is the undisputed leader within the end-user market, projected to command approximately **[Insert Specific Percentage Here, e.g., 70%]%** of the total revenue in 2025. Within the product types, **Porcelain and Bone China** continue to lead, their dominance attributed to their inherent perceived quality, exquisite craftsmanship, and timeless aesthetic appeal. In terms of distribution, **Supermarkets and Hypermarkets** represent the most significant channel, effectively catering to a broad and diverse consumer base through their extensive reach and convenience.

- Key Drivers for Household Segment Dominance: Elevated disposable incomes, a sustained and growing interest in home entertaining and dining experiences, and a pervasive preference for aesthetically refined tableware that elevates the overall dining ambiance.

- Key Drivers for Porcelain/Bone China Dominance: Their reputation for superior quality, exceptional durability, and an unparalleled aesthetic appeal, particularly resonating with consumers seeking premium and elegant tableware solutions.

- Key Drivers for Supermarkets/Hypermarkets Channel Dominance: The unparalleled convenience, extensive product availability, wide geographic reach, and competitive pricing strategies that attract a large volume of consumers.

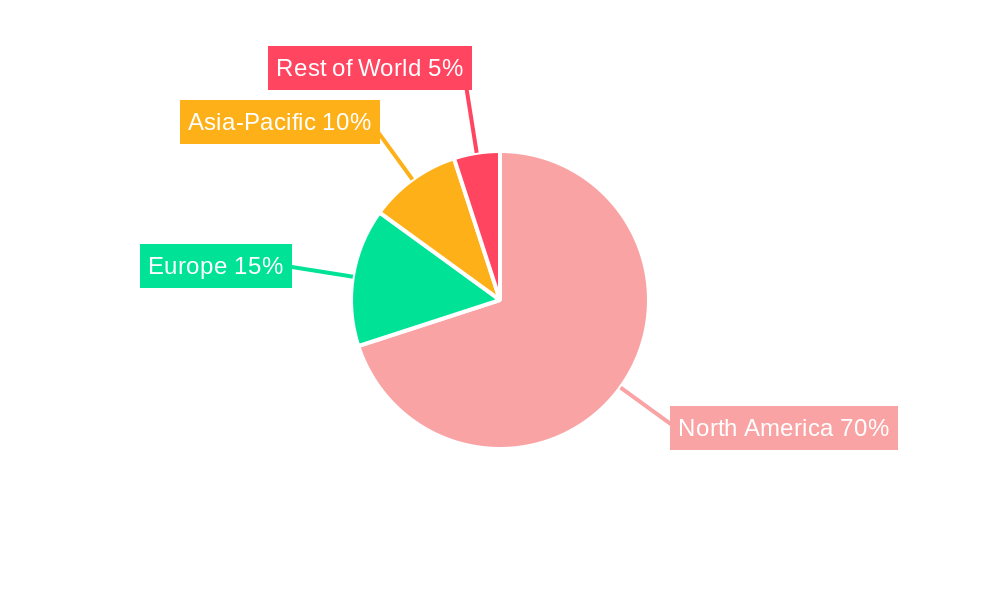

Geographically, the market's distribution is closely correlated with population density and the vitality of regional economies. The **Northeast and West Coast** regions, in particular, demonstrate a stronger demand for ceramics tableware, largely due to their higher population concentrations and robust disposable income levels.

United States Ceramics Tableware Market Product Innovations

Recent innovations in the US ceramics tableware market include the development of lightweight yet durable materials, improved glaze technologies for enhanced durability and aesthetics, and the incorporation of sustainable and eco-friendly materials. These innovations aim to cater to evolving consumer preferences for both functionality and environmental responsibility. The introduction of unique designs and patterns, often reflecting current lifestyle trends, further strengthens the appeal of these products.

Report Segmentation & Scope

This comprehensive report meticulously segments the US ceramics tableware market across three critical dimensions, offering granular insights into each:

- Type: The market is categorized into Porcelain and Bone China, Stoneware (Ceramic), and Other Types. The Porcelain and Bone China segment is anticipated to exhibit the most substantial growth rate throughout the forecast period. This growth is underpinned by its established premium positioning, sophisticated design, and enduring aesthetic appeal that appeals to discerning consumers.

- End User: Segments include Household and Commercial. The Household segment currently holds the largest market share, a reflection of the ubiquitous presence and widespread adoption of ceramics tableware in residential settings across the United States.

- Distribution Channel: The analysis covers Supermarkets and Hypermarkets, Specialty Stores, Wholesalers, Online, and Other Distribution Channels. The Online channel is expected to experience particularly significant growth momentum, propelled by the relentless rise of e-commerce penetration and evolving consumer shopping habits. Detailed market size assessments and competitive analyses are provided for each segment within the full report.

Key Drivers of United States Ceramics Tableware Market Growth

The expansion of the US ceramics tableware market is being significantly influenced by several powerful drivers. Firstly, the sustained increase in disposable incomes empowers consumers to allocate a larger portion of their spending towards discretionary items such as home goods, including high-quality tableware. Secondly, the ongoing trend of urbanization contributes to increased demand for home furnishings and décor as populations shift to urban centers. Thirdly, there is a discernible and growing consumer preference for high-quality, aesthetically pleasing tableware that not only serves a functional purpose but also enhances the overall dining experience and ambiance. Furthermore, continuous technological advancements, particularly in innovative design techniques and efficient manufacturing processes, are instrumental in improving both the quality and the perceived value of ceramics tableware, contributing directly to market growth.

Challenges in the United States Ceramics Tableware Market Sector

Challenges facing the US ceramics tableware market include fluctuations in raw material prices, particularly clay and glaze components, impacting production costs. Increased competition from imports, primarily from countries with lower labor costs, creates price pressures. Furthermore, environmental regulations concerning waste disposal and material sourcing require manufacturers to implement sustainable practices, which can increase production costs.

Leading Players in the United States Ceramics Tableware Market Market

- JARS CERAMISTES

- The Oneida Group

- Raynaud Limoges

- Lifetime Brands

- Newell Brands

- Homer Laughlin China

- International Tableware

- Meyer Corporation

- CuisinArt

- Mikasa

Key Developments in United States Ceramics Tableware Market Sector

- October 2022: Jars Ceramistes launches a new showroom showcasing new stoneware collections. This move strengthens their brand presence and expands market reach.

- March 2022: Lifetime Brands' acquisition of S'well Bottle expands their product portfolio and market reach, increasing competition.

Strategic United States Ceramics Tableware Market Outlook

The US ceramics tableware market presents significant growth opportunities for companies that can effectively adapt to changing consumer preferences and technological advancements. Focusing on sustainability, innovative designs, and efficient distribution strategies will be crucial for success. The premium segment, particularly porcelain and bone china, offers substantial growth potential. Expanding online sales channels and strategically targeting emerging consumer segments will further enhance market penetration and revenue streams.

United States Ceramics Tableware Market Segmentation

-

1. Type

- 1.1. Porcelain and Bone China

- 1.2. Stoneware (Ceramic)

- 1.3. Other Types

-

2. End User

- 2.1. Household

-

2.2. Commercial

- 2.2.1. Accomodation and Hospitality Segment

- 2.2.2. Food Service Segment

- 2.2.3. Other End Users

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online

- 3.5. Other Distribution Channels

United States Ceramics Tableware Market Segmentation By Geography

- 1. United States

United States Ceramics Tableware Market Regional Market Share

Geographic Coverage of United States Ceramics Tableware Market

United States Ceramics Tableware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods

- 3.3. Market Restrains

- 3.3.1. Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power

- 3.4. Market Trends

- 3.4.1. Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramics Tableware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Porcelain and Bone China

- 5.1.2. Stoneware (Ceramic)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.2.2.1. Accomodation and Hospitality Segment

- 5.2.2.2. Food Service Segment

- 5.2.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JARS CERAMISTES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Oneida Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raynaud Limoges

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lifetime Brands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Newell Brands

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homer Laughlin China

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tableware

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meyer Coroporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CuisinArt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mikasa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JARS CERAMISTES

List of Figures

- Figure 1: United States Ceramics Tableware Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramics Tableware Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Ceramics Tableware Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Ceramics Tableware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Ceramics Tableware Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Ceramics Tableware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramics Tableware Market?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the United States Ceramics Tableware Market?

Key companies in the market include JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Coroporation, CuisinArt, Mikasa.

3. What are the main segments of the United States Ceramics Tableware Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods.

6. What are the notable trends driving market growth?

Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market.

7. Are there any restraints impacting market growth?

Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power.

8. Can you provide examples of recent developments in the market?

In October 2022, Jars Ceramics launches a new showroom at 41 Madison during the New York Tabletop Show. The company will showcase new stoneware pieces with rich glazes and colors including deep and moody blues, greens, and blacks in the Wabi and Dashi collections and vintage, charming pastels in the Canine collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramics Tableware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramics Tableware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramics Tableware Market?

To stay informed about further developments, trends, and reports in the United States Ceramics Tableware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence