Key Insights

The United Kingdom container glass market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 2.21%, presents a dynamic landscape shaped by several key factors. The market's size in 2025 is estimated to be around £800 million (assuming a reasonable market size based on comparable European markets and the given CAGR). Growth drivers include the rising demand for sustainable packaging solutions, as glass is increasingly favored over plastics for its recyclability and perceived environmental friendliness. This trend is amplified by stricter environmental regulations and growing consumer awareness of sustainability issues. Furthermore, innovations in glass manufacturing, such as lighter-weight containers and improved production efficiency, contribute positively to market expansion. However, the market faces constraints such as fluctuating raw material prices (sand, soda ash, etc.), increased energy costs associated with glass production, and competition from alternative packaging materials like plastics and aluminum. Market segmentation likely includes various container types (bottles, jars, etc.) and applications (food & beverage, cosmetics, pharmaceuticals, etc.), each showing varying growth rates based on consumer preferences and industry trends. Major players like Verallia Packaging, O-I Glass, and Ardagh Group dominate the market, leveraging their established manufacturing capabilities and extensive distribution networks.

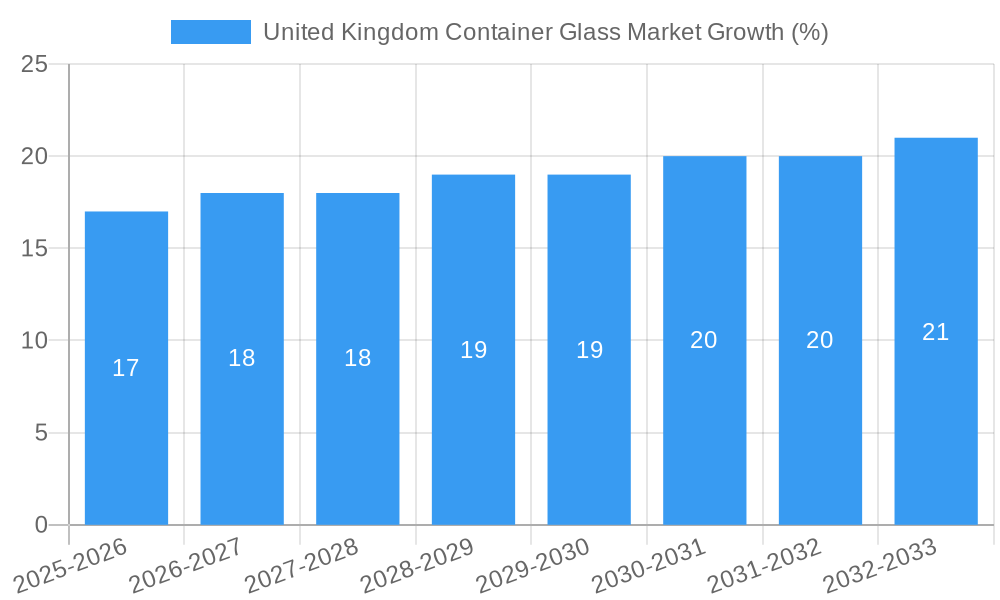

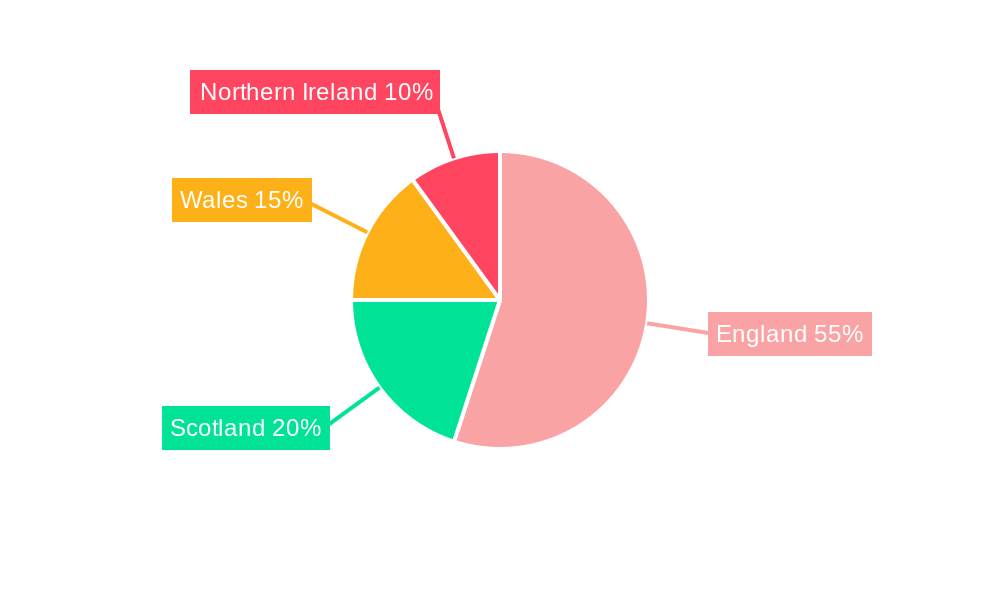

The forecast period (2025-2033) anticipates continued growth, albeit at a pace influenced by economic conditions and evolving consumer behavior. The emphasis on sustainable packaging will likely remain a key driver, potentially leading to increased investments in recycling infrastructure and the development of innovative glass packaging solutions. Competition within the market is expected to intensify, driving further innovation and potentially impacting pricing strategies. Regional variations in growth may arise due to differences in consumer preferences, regulatory landscapes, and the concentration of key players within specific UK regions. Successfully navigating these challenges and capitalizing on growth opportunities will require strategic planning, a focus on sustainability, and continuous innovation within the UK container glass industry.

This in-depth report provides a comprehensive analysis of the United Kingdom container glass market, offering valuable insights for businesses, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. It delves into market structure, competitive dynamics, industry trends, key players, and future growth opportunities. The market is segmented by various factors, providing detailed analysis of market size and growth projections for each segment. This report is crucial for understanding the UK's container glass landscape and making informed strategic decisions.

United Kingdom Container Glass Market Market Structure & Competitive Dynamics

The UK container glass market exhibits a moderately consolidated structure, with several key players holding significant market share. Market concentration is influenced by factors like economies of scale, technological capabilities, and access to raw materials. The competitive landscape is characterized by intense rivalry, driven by product innovation, pricing strategies, and customer acquisition. Innovation ecosystems are developing, focusing on sustainable packaging solutions and enhanced decoration techniques. The regulatory framework, encompassing environmental regulations and food safety standards, significantly impacts market operations. Product substitutes, such as plastic and metal containers, pose a challenge, necessitating continuous innovation. End-user trends, particularly towards sustainability and premiumization, influence market demand. M&A activities have been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focused on expanding market reach and enhancing product portfolios. Key players’ market share fluctuates, with estimates showing the top three players holding approximately xx% of the market in 2025.

United Kingdom Container Glass Market Industry Trends & Insights

The UK container glass market is experiencing steady growth, driven by increasing demand across various end-use sectors. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). Market penetration of container glass in certain sectors, such as food and beverages, remains high, reflecting the inherent properties of glass, such as its inertness and recyclability. Technological disruptions, particularly in automation and decoration techniques, are enhancing production efficiency and product differentiation. Consumer preferences are shifting towards sustainable and aesthetically appealing packaging, pushing manufacturers to adopt eco-friendly practices and innovative designs. Competitive dynamics are characterized by continuous product development, expansion into new market segments, and strategic partnerships. Market growth is further influenced by the increasing preference for premium products and brands across various consumer goods sectors, where glass containers contribute significantly to enhancing perception of quality.

Dominant Markets & Segments in United Kingdom Container Glass Market

The dominant segment in the UK container glass market is the food and beverage sector, accounting for approximately xx% of the total market value in 2025.

- Key Drivers:

- Strong demand for packaged food and beverages.

- Growing preference for glass packaging due to its perceived safety and premium image.

- Robust and established distribution networks.

- Government support for sustainable packaging practices.

The dominance of the food and beverage sector is reinforced by the established supply chain infrastructure and the consumer's strong preference for glass containers when it comes to food and beverage products. The segment's growth is further propelled by evolving consumer preference for premium products. While other sectors like cosmetics and pharmaceuticals also contribute, the food and beverage segment's sheer volume and consistent demand solidify its leading position.

United Kingdom Container Glass Market Product Innovations

Recent product innovations in the UK container glass market are centered on sustainability and enhanced design features. Companies are actively developing lighter weight bottles and jars to reduce carbon footprints and improve transportation efficiency. New decoration techniques, such as the in-house decoration service launched by Beatson Clark, offer increased design flexibility, appealing to brands seeking unique packaging solutions. These innovations are enhancing the competitive landscape and addressing evolving consumer demands for sustainable and visually appealing packaging. Technological trends are also focused on improving production efficiency and reducing energy consumption.

Report Segmentation & Scope

This report segments the UK container glass market based on several key factors including: Type of Container (bottles, jars, etc.), End-Use Industry (food & beverage, cosmetics, pharmaceuticals, etc.), and Packaging Type (clear, colored, decorated). Each segment provides market size, growth projections, competitive landscape analysis and key trends. The detailed breakdown offers a comprehensive view of different market segments within the UK container glass market, focusing on historical trends, current market sizes, and projected future growth.

Key Drivers of United Kingdom Container Glass Market Growth

Several factors fuel the growth of the UK container glass market. These include: Increased consumer demand for premium packaged goods, particularly in the food and beverage sector, driving the need for high-quality glass containers. The growing focus on sustainability and eco-friendly packaging is another significant driver, with glass being a highly recyclable material. Furthermore, ongoing advancements in glass manufacturing technologies contribute to cost efficiencies and expanded production capacities, bolstering the market's growth trajectory. Stringent food safety regulations, further prioritize glass packaging due to its inherent inertness, supporting market expansion.

Challenges in the United Kingdom Container Glass Market Sector

The UK container glass market faces certain challenges, including increasing raw material costs, fluctuating energy prices, and intense competition from alternative packaging materials like plastics. Supply chain disruptions can also cause instability, affecting production and delivery timelines. Furthermore, stringent environmental regulations necessitate continuous investment in sustainable production processes, impacting profitability. These factors present obstacles to market growth and require ongoing adaptation and strategic responses from industry players.

Leading Players in the United Kingdom Container Glass Market Market

- Verallia Packaging (Verallia SA) [Verallia]

- Ciner Glass Ltd

- O-I Glass Inc [O-I Glass]

- Ardagh Group [Ardagh Group]

- Glassworks International Limited

- Gaasch Packaging

- Berlin Packaging [Berlin Packaging]

- Vidrala SA [Vidrala]

- Beatson Clark

- Stoelzle Flaconnage Ltd

Key Developments in United Kingdom Container Glass Market Sector

- August 2024: Beatson Clark launched an in-house decoration service, offering versatile glass packaging decoration options. This innovation expands customization choices and enhances product appeal.

- August 2024: Verallia UK unveiled ECOVA, a sustainable premium spirit bottle range. This launch showcases commitment to eco-friendly practices and boosts pallet capacity, optimizing logistics and reducing carbon emissions.

Strategic United Kingdom Container Glass Market Market Outlook

The UK container glass market exhibits significant growth potential, driven by sustained demand, a growing emphasis on sustainability, and ongoing product innovations. Strategic opportunities lie in developing lightweight, eco-friendly containers, expanding into niche market segments, and leveraging technological advancements to enhance production efficiency and reduce costs. Companies that successfully adapt to evolving consumer preferences and address environmental concerns are poised to capture a larger market share and achieve substantial growth in the coming years.

United Kingdom Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholi

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Soft Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End User Verticals

-

1.1. Beverage

United Kingdom Container Glass Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market

- 3.4. Market Trends

- 3.4.1. Beverage is Expected to Account For Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Soft Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End User Verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Verallia Packaging (Verallia SA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ciner Glass Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 O-I Glass Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ardagh Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Glassworks International Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gaasch Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berlin Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vidrala SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beatson Clark

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stoelzle Flaconnage Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Verallia Packaging (Verallia SA)

List of Figures

- Figure 1: United Kingdom Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: United Kingdom Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United Kingdom Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: United Kingdom Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Container Glass Market?

The projected CAGR is approximately 2.21%.

2. Which companies are prominent players in the United Kingdom Container Glass Market?

Key companies in the market include Verallia Packaging (Verallia SA), Ciner Glass Ltd, O-I Glass Inc, Ardagh Group, Glassworks International Limited, Gaasch Packaging, Berlin Packaging, Vidrala SA, Beatson Clark, Stoelzle Flaconnage Ltd*List Not Exhaustive.

3. What are the main segments of the United Kingdom Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market.

6. What are the notable trends driving market growth?

Beverage is Expected to Account For Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market.

8. Can you provide examples of recent developments in the market?

August 2024: Beatson Clark, a glass manufacturer based in the UK, launched an in-house decoration service. This new facility enables Beatson Clark to spray glass packaging in any color, achieving stunning effects like opaque, frosted, glitter, vignette, and pearlescent. Located in Rotherham, UK, this container glass producer provides a versatile service, decorating not only its own bottles and jars but also customer-provided glass containers, depending on their suitability.August 2024: Verallia UK, committed to sustainable innovation, unveiled ECOVA, a premium spirit bottle standard of sustainable off-the-shelf glass packaging. The name ECOVA, merging 'ecology' and 'value', underscores the range's sustainability focus. Featuring four new designs, Patet, Caeli, Vita, and Terra, each weighing 500g, the innovative design boosts the average pallet capacity by 200 bottles. This enhancement minimizes shipping packaging for UK customers. The creation of the ECOVA range was driven by the goal of lightening bottle weight, thereby curbing carbon emissions for both Verallia UK and its clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Container Glass Market?

To stay informed about further developments, trends, and reports in the United Kingdom Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence