Key Insights

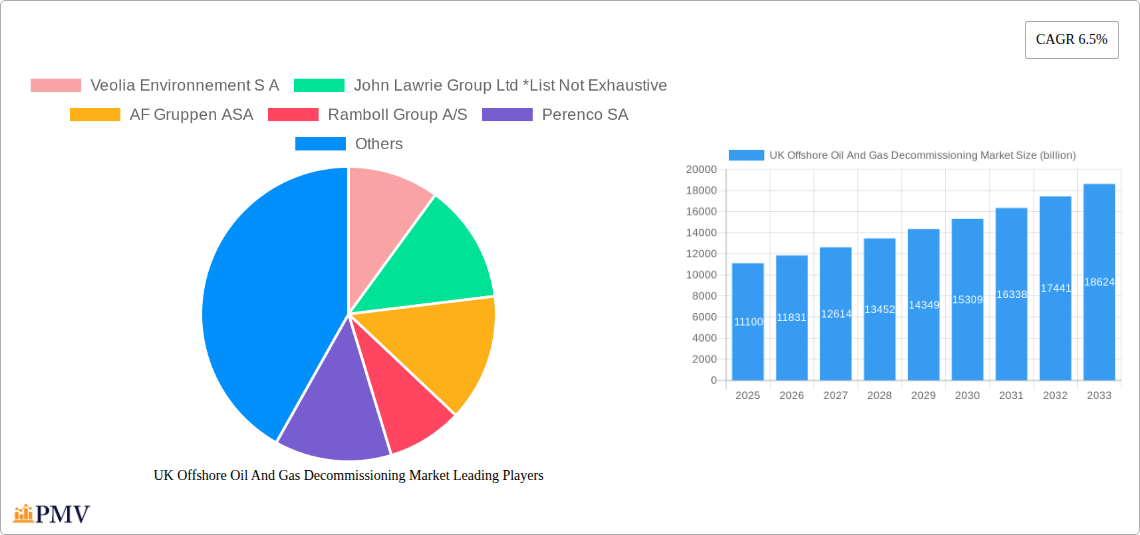

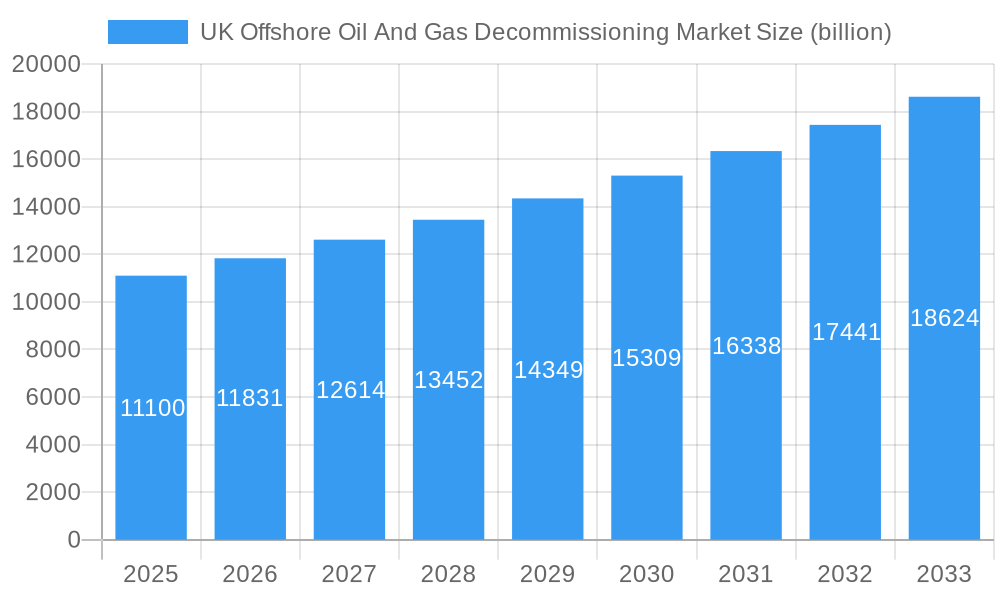

The UK Offshore Oil and Gas Decommissioning Market is poised for significant expansion, driven by a confluence of regulatory mandates, aging infrastructure, and the imperative to transition towards sustainable energy practices. The market is projected to reach USD 11.1 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.5% through to 2033. This growth is primarily fueled by the increasing number of offshore platforms and subsea infrastructure nearing the end of their operational lifespans, necessitating comprehensive decommissioning strategies. Key drivers include stringent environmental regulations set by bodies like the North Sea Transition Authority (NSTA), which are compelling operators to invest heavily in safe and environmentally responsible asset cessation. Furthermore, advancements in decommissioning technologies, such as modular cut-and-sew techniques and innovative vessel designs, are enhancing efficiency and reducing costs, thereby stimulating market activity.

UK Offshore Oil And Gas Decommissioning Market Market Size (In Billion)

The market's trajectory is further shaped by evolving industry trends, including the growing adoption of integrated decommissioning campaigns to optimize resource allocation and minimize disruption. While the deepwater and ultra-deepwater segments present complex challenges and higher costs, they also offer substantial opportunities for specialized service providers. Conversely, the shallow water segment, while less technically demanding, constitutes a larger volume of decommissioning projects. Potential restraints, such as fluctuating oil prices and the availability of skilled labor, could moderate growth, but the sustained commitment to net-zero targets and the need to free up valuable North Sea acreage for renewable energy development are expected to outweigh these challenges. Major players like Veolia Environnement S.A. and John Lawrie Group are actively participating, indicating a competitive landscape focused on innovation and service excellence to capitalize on this burgeoning market.

UK Offshore Oil And Gas Decommissioning Market Company Market Share

This comprehensive report delves into the intricate landscape of the UK offshore oil and gas decommissioning market, a sector poised for significant growth due to aging infrastructure and increasing regulatory pressures. With over 2,000 abandoned wells in the North Sea alone, estimated at EUR 20 billion in decommissioning operations, this market presents a robust opportunity for specialized service providers. Our analysis spans from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025–2033, providing actionable insights for stakeholders. We examine key segments including Shallow Water Decommissioning and Deepwater and Ultra-Deep Water Decommissioning, alongside industry developments and the competitive strategies of major players like Veolia Environnement S.A., John Lawrie Group Ltd, AF Gruppen ASA, Ramboll Group A/S, Perenco SA, and Derrick Services (UK) Ltd.

UK Offshore Oil And Gas Decommissioning Market Market Structure & Competitive Dynamics

The UK offshore oil and gas decommissioning market exhibits a moderately concentrated structure, driven by the specialized nature of services and the significant capital investment required. Leading players like Veolia Environnement S.A. and John Lawrie Group Ltd hold substantial market share, particularly in well decommissioning and infrastructure removal. Innovation ecosystems are flourishing, spurred by the need for cost-effective and environmentally sound solutions. Regulatory frameworks, such as those governed by the Offshore Petroleum Activities (Oil and Gas) Act, play a pivotal role in shaping market entry and operational standards. While direct product substitutes are limited, advancements in robotic dismantling and advanced subsea technologies are emerging as disruptive forces. End-user trends are heavily influenced by the drive for sustainability and the increasing burden of environmental remediation costs on operators. Mergers and acquisitions (M&A) activity is a key feature, with deal values anticipated to rise as companies consolidate expertise and expand service portfolios to capture a larger share of the estimated EUR 20 billion worth of decommissioning operations. For instance, strategic acquisitions of specialized engineering firms and asset integrity management companies are becoming more prevalent.

UK Offshore Oil And Gas Decommissioning Market Industry Trends & Insights

The UK offshore oil and gas decommissioning market is experiencing a transformative period, characterized by escalating activity driven by aging North Sea assets and stringent environmental regulations. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) as operators face increasing pressure to cease production from mature fields and responsibly dismantle associated infrastructure. Technological disruptions are at the forefront, with advancements in subsea robotics, remote-operated vehicles (ROVs), and laser cutting technologies enhancing efficiency and safety while reducing operational costs and environmental impact. These innovations are crucial for tackling the complexities of decommissioning in both shallow and deepwater environments. Consumer preferences, largely dictated by oil and gas operators, are shifting towards integrated service providers offering end-to-end solutions, from initial assessment and planning to final site restoration. Competitive dynamics are intensifying, with established players vying for contracts and new entrants leveraging specialized technologies. The market penetration of advanced decommissioning techniques is steadily increasing, reflecting a growing industry-wide commitment to sustainable practices. The sheer volume of abandoned wells, exceeding 2,000 in the North Sea as of November 2022, underscores the scale of the challenge and the immense market potential for services related to plugging and abandonment, removal of subsea structures, and pipeline decommissioning. The industry group Offshore Energies UK (OEUK) highlights the significant financial commitment required for these operations, estimated to be in the billions of pounds sterling.

Dominant Markets & Segments in UK Offshore Oil And Gas Decommissioning Market

The UK offshore oil and gas decommissioning market is predominantly influenced by the North Sea basin, which represents the most mature and extensive area for offshore E&P activities in the region. Within this, the Shallow Water segment historically accounts for a significant portion of decommissioning expenditure due to the sheer number of platforms and subsea infrastructure that have reached the end of their operational life. Key drivers for dominance in shallow waters include the relative ease of access for vessels and personnel, as well as the established logistical networks built over decades of exploration and production. Economic policies such as tax reliefs and incentives for decommissioning activities further bolster investment in this segment.

Conversely, the Deepwater and Ultra-Deep Water segment, while currently representing a smaller share of the total market value, is experiencing rapid growth. This is driven by the increasing complexity and cost of decommissioning facilities in deeper, harsher environments, requiring highly specialized equipment and advanced technological solutions. Infrastructure development in these deeper regions is less extensive, making each decommissioning project a substantial undertaking. Regulatory frameworks are increasingly mandating the removal of deepwater infrastructure to minimize long-term environmental risks. The economic policies are gradually adapting to accommodate the higher costs associated with these complex operations, and operators are proactively investing in innovative technologies to manage the risks and optimize the decommissioning process. The challenges posed by deepwater decommissioning, including high pressures, remote locations, and the need for sophisticated subsea intervention, are creating significant opportunities for specialized contractors with cutting-edge capabilities. The strategic importance of addressing these deeper assets is paramount for ensuring the long-term environmental integrity of the UK's offshore waters.

UK Offshore Oil And Gas Decommissioning Market Product Innovations

Product innovations in the UK offshore oil and gas decommissioning market are primarily focused on enhancing safety, reducing environmental impact, and optimizing cost-effectiveness. Key developments include the use of advanced robotics and autonomous underwater vehicles (AUVs) for detailed site surveys and inspection, minimizing the need for human intervention in hazardous environments. Cutting-edge dismantling technologies, such as precision abrasive waterjet cutting and specialized subsea cutting tools, are improving the efficiency of infrastructure removal. Furthermore, innovations in well plugging and abandonment (P&A) techniques, utilizing novel materials and in-situ curing processes, are proving more reliable and cost-effective. These advancements provide a competitive advantage by offering operators more sustainable and economically viable decommissioning solutions.

Report Segmentation & Scope

This report segments the UK offshore oil and gas decommissioning market into two primary categories: Shallow Water Decommissioning and Deepwater and Ultra-Deep Water Decommissioning.

The Shallow Water segment encompasses the decommissioning of platforms, subsea structures, and pipelines located in depths typically up to 300 meters. This segment is expected to continue to be a significant contributor to market value due to the large installed base of aging infrastructure. Growth projections are stable, with ongoing activity driven by the maturity of numerous fields.

The Deepwater and Ultra-Deep Water segment covers decommissioning activities in depths exceeding 300 meters. This segment is anticipated to experience robust growth due to the increasing complexity and cost associated with these operations. Market sizes are projected to expand as more challenging assets reach their end-of-life, requiring advanced technological solutions and specialized expertise.

Key Drivers of UK Offshore Oil And Gas Decommissioning Market Growth

The growth of the UK offshore oil and gas decommissioning market is propelled by a confluence of factors. Firstly, the aging infrastructure of North Sea oil and gas fields, many of which have been in operation for decades, necessitates decommissioning as they reach the end of their economic life. Secondly, increasingly stringent environmental regulations and a growing emphasis on corporate social responsibility compel operators to undertake responsible asset retirement. Technological advancements, particularly in robotics, AI-driven inspection, and advanced cutting techniques, are making decommissioning operations safer, more efficient, and more cost-effective, thereby accelerating activity. The significant number of abandoned wells, exceeding 2,000 in the North Sea, represents a substantial pipeline of work. Finally, government incentives and tax reliefs aimed at encouraging decommissioning expenditure further stimulate market growth.

Challenges in the UK Offshore Oil And Gas Decommissioning Market Sector

Despite the significant growth prospects, the UK offshore oil and gas decommissioning market faces several challenges. The sheer scale and complexity of dismantling aging offshore infrastructure, particularly in deepwater environments, present substantial technical hurdles. High operational costs associated with specialized vessels, equipment, and personnel remain a significant barrier. Uncertainties in regulatory frameworks and potential changes in policy can create planning and investment risks for decommissioning service providers. Furthermore, the availability of skilled labor and specialized equipment can be constrained, leading to potential supply chain bottlenecks. The long lead times required for planning and execution of decommissioning projects can also impact cash flow and project management.

Leading Players in the UK Offshore Oil And Gas Decommissioning Market Market

- Veolia Environnement S.A.

- John Lawrie Group Ltd

- AF Gruppen ASA

- Ramboll Group A/S

- Perenco SA

- Derrick Services (UK) Ltd

Key Developments in UK Offshore Oil And Gas Decommissioning Market Sector

- November 2022: More than 2,000 abandoned oil and gas wells in the North Sea began a period of increased focus for decommissioning, with operations worth EUR 20 billion expected to be decommissioned and shut down. Research by Offshore Energies UK (OEUK) provides fresh insight into petroleum decommissioning efforts.

- September 2022: The Nuclear Decommissioning Authority (NDA) of the United Kingdom and the National Decommissioning Centre (NDC) of the United Kingdom signed a three-year collaborative research agreement, marking the first instance of collaboration between the nuclear and oil and gas decommissioning industries.

Strategic UK Offshore Oil And Gas Decommissioning Market Market Outlook

The strategic outlook for the UK offshore oil and gas decommissioning market remains exceptionally strong, driven by an unyielding pipeline of aging assets and a robust regulatory mandate for environmental stewardship. The estimated EUR 20 billion in planned decommissioning operations, coupled with the ongoing identification of further wells requiring attention, positions the market for sustained expansion throughout the forecast period. Strategic opportunities lie in the development and deployment of cutting-edge technologies that reduce costs and environmental impact, particularly for deepwater and complex infrastructure. Collaboration between industry stakeholders, including operators, service providers, and research institutions like the National Decommissioning Centre, will be crucial for fostering innovation and efficiency. Companies that can offer integrated, end-to-end decommissioning solutions, encompassing well P&A, structure removal, and waste management, are set to capture significant market share and capitalize on this critical phase of the UK's offshore energy lifecycle.

UK Offshore Oil And Gas Decommissioning Market Segmentation

- 1. Shallow Water

- 2. Deepwater and Ultra-Deep Water

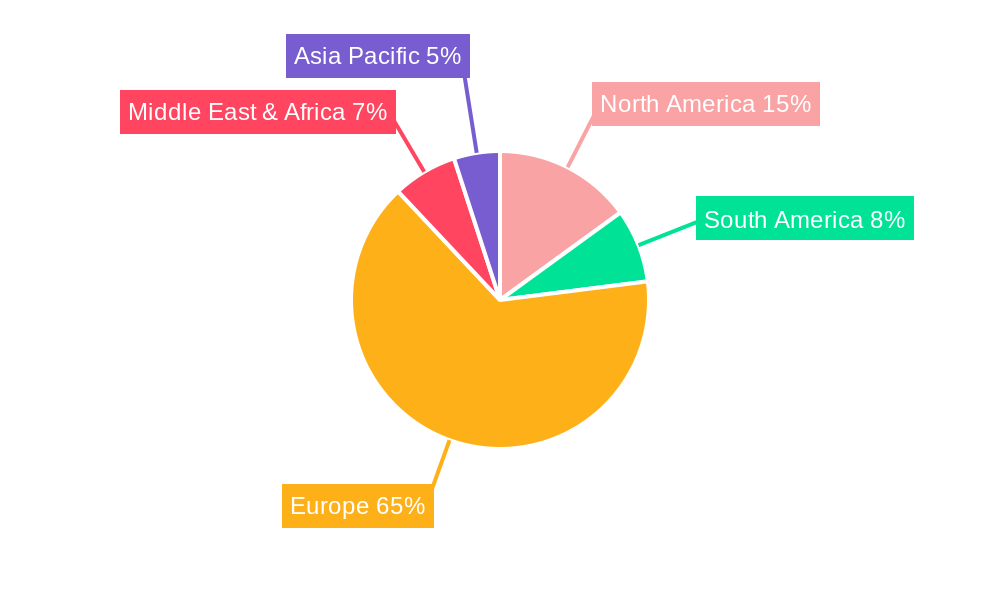

UK Offshore Oil And Gas Decommissioning Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Offshore Oil And Gas Decommissioning Market Regional Market Share

Geographic Coverage of UK Offshore Oil And Gas Decommissioning Market

UK Offshore Oil And Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies in Developing Solar Energy4.; Abundant Solar Resources Across the Country

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Conventional Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Decommissioning Projects to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Shallow Water

- 5.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Shallow Water

- 6. North America UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Shallow Water

- 6.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 6.1. Market Analysis, Insights and Forecast - by Shallow Water

- 7. South America UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Shallow Water

- 7.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 7.1. Market Analysis, Insights and Forecast - by Shallow Water

- 8. Europe UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Shallow Water

- 8.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 8.1. Market Analysis, Insights and Forecast - by Shallow Water

- 9. Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Shallow Water

- 9.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 9.1. Market Analysis, Insights and Forecast - by Shallow Water

- 10. Asia Pacific UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Shallow Water

- 10.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 10.1. Market Analysis, Insights and Forecast - by Shallow Water

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Veolia Environnement S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 John Lawrie Group Ltd *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AF Gruppen ASA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ramboll Group A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Perenco SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Derrick Services (UK) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Veolia Environnement S A

List of Figures

- Figure 1: Global UK Offshore Oil And Gas Decommissioning Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global UK Offshore Oil And Gas Decommissioning Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 4: North America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 5: North America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 6: North America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 7: North America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 8: North America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 9: North America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 10: North America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 11: North America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 16: South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 17: South America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 18: South America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 19: South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 20: South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 21: South America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 22: South America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 23: South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 24: South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 25: South America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 28: Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 29: Europe UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 30: Europe UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 31: Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 32: Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 33: Europe UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 34: Europe UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 35: Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 40: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 41: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 42: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 43: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 44: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 45: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 46: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 47: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 52: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 53: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 54: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 55: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 56: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 57: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 58: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 59: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 2: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 3: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 4: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 5: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 8: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 9: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 10: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 11: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 20: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 21: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 22: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 23: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 32: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 33: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 34: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 35: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 56: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 57: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 58: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 59: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 74: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 75: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 76: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 77: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Offshore Oil And Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the UK Offshore Oil And Gas Decommissioning Market?

Key companies in the market include Veolia Environnement S A, John Lawrie Group Ltd *List Not Exhaustive, AF Gruppen ASA, Ramboll Group A/S, Perenco SA, Derrick Services (UK) Ltd.

3. What are the main segments of the UK Offshore Oil And Gas Decommissioning Market?

The market segments include Shallow Water, Deepwater and Ultra-Deep Water.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies in Developing Solar Energy4.; Abundant Solar Resources Across the Country.

6. What are the notable trends driving market growth?

Increasing Decommissioning Projects to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Conventional Energy Sources.

8. Can you provide examples of recent developments in the market?

November 2022: there were more than 2,000 abandoned oil and gas wells in the North Sea begin, The high number of abandoned wells is expected to lead to an increase in activity as operations worth EUR 20 billion are decommissioned and shut down. The research was conducted by industry group Offshore Energies UK (OEUK), formerly Oil & Gas UK, which provides fresh insight into petroleum decommissioning efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Offshore Oil And Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Offshore Oil And Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Offshore Oil And Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the UK Offshore Oil And Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence