Key Insights

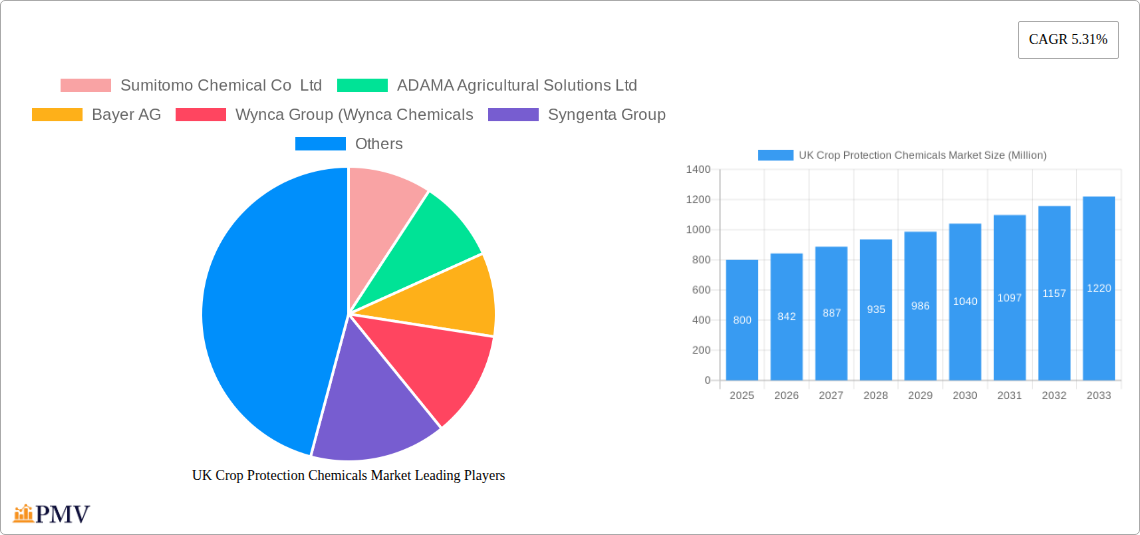

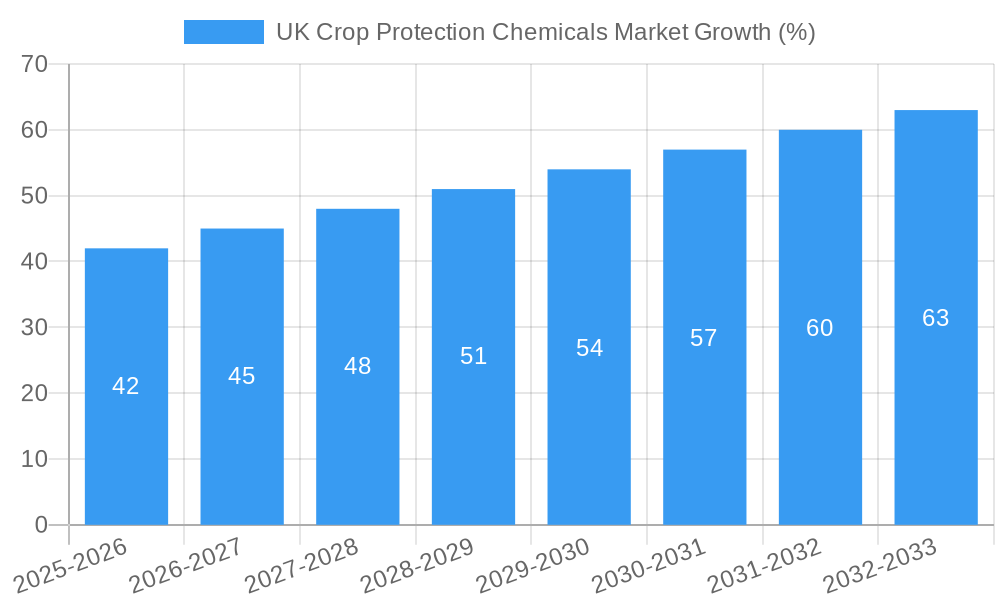

The UK crop protection chemicals market, valued at approximately £800 million in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 5.31% from 2025 to 2033. This growth is driven by several key factors. Increasing concerns about crop diseases and pest infestations, coupled with the rising demand for higher crop yields to meet the growing population, are fueling the demand for effective crop protection solutions. Furthermore, the shift towards sustainable agriculture practices, including integrated pest management (IPM) strategies, is influencing the adoption of more targeted and environmentally friendly crop protection chemicals. However, stringent regulations concerning the use of certain chemicals and increasing consumer awareness about the potential environmental impact of pesticides are posing challenges to market expansion. The market is segmented by application mode (chemigation, foliar, fumigation, seed treatment, soil treatment), crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), and function (fungicide, herbicide, insecticide, molluscicide, nematicide). Major players like Sumitomo Chemical, Adama Agricultural Solutions, Bayer, Syngenta, and BASF are actively engaged in research and development to introduce innovative and sustainable crop protection solutions, further shaping market dynamics.

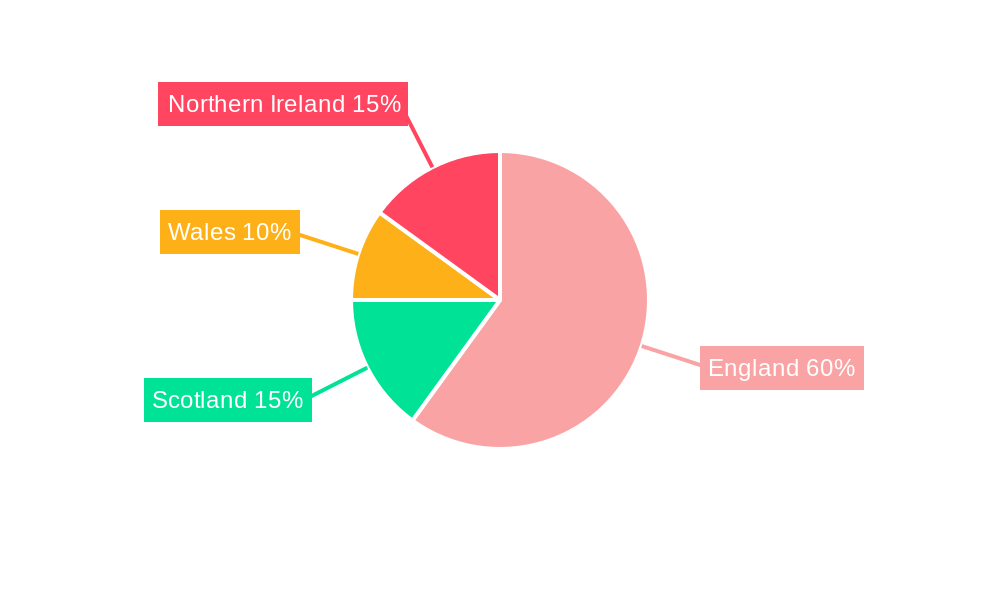

The regional distribution within the UK shows varied adoption rates across England, Wales, Scotland, and Northern Ireland, with England likely holding the largest market share due to its larger agricultural output. The historical period (2019-2024) likely saw fluctuations influenced by weather patterns and governmental policies, while the forecast period (2025-2033) anticipates continuous growth, although potentially at a moderated rate due to regulatory pressures and increasing focus on biological alternatives. The market's future trajectory hinges on the successful introduction of biopesticides and other eco-friendly solutions that can effectively balance crop protection needs with environmental sustainability concerns. The competitive landscape is intense, characterized by both established multinational companies and smaller specialized firms, fostering innovation and driving price competitiveness.

UK Crop Protection Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK Crop Protection Chemicals market, offering valuable insights for stakeholders across the industry. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The study incorporates detailed segmentation by application mode, crop type, and chemical function, offering granular data and actionable intelligence.

UK Crop Protection Chemicals Market Structure & Competitive Dynamics

The UK crop protection chemicals market exhibits a moderately consolidated structure, with a few multinational players commanding significant market share. The market is characterized by intense competition driven by innovation, regulatory changes, and evolving end-user preferences. Major players, such as Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Syngenta Group, UPL Limited, BASF SE, FMC Corporation, Corteva Agriscience, and Nufarm Ltd, constantly strive to enhance their product portfolios and expand their market reach. Market share fluctuations are influenced by factors such as new product launches, R&D investments, and strategic partnerships.

The regulatory landscape significantly impacts market dynamics, with stringent regulations concerning pesticide usage and environmental protection shaping industry practices. The market also witnesses considerable M&A activity. In recent years, deal values have ranged from xx Million to xx Million, driven by a pursuit of synergies and expansion into new segments. Product substitution, particularly with the emergence of biopesticides, presents both opportunities and challenges for established players. End-user trends, such as increased demand for sustainable and environmentally friendly solutions, are reshaping the market landscape, prompting the development of new formulations and technologies.

- Market Concentration: Moderately consolidated, with top players holding approximately xx% of market share.

- Innovation Ecosystems: Strong focus on R&D, with investments in biopesticides and precision application technologies.

- Regulatory Frameworks: Stringent regulations regarding pesticide use and environmental impact.

- Product Substitutes: Growing adoption of biopesticides and other sustainable alternatives.

- End-User Trends: Increasing preference for eco-friendly crop protection solutions.

- M&A Activity: Significant activity with deal values ranging from xx Million to xx Million.

UK Crop Protection Chemicals Market Industry Trends & Insights

The UK crop protection chemicals market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors drive this growth, including rising agricultural production, increasing crop yields, and growing demand for high-quality food. Technological advancements, such as the development of precision application technologies and targeted pesticides, are boosting efficiency and reducing environmental impact. Consumer preferences towards naturally produced food are increasingly influencing the demand for eco-friendly crop protection solutions, which is promoting the market adoption of bio-pesticides. However, stringent regulatory restrictions on pesticide use and environmental concerns pose challenges to market expansion. Competitive dynamics also significantly impact the growth trajectory. Market penetration of advanced technologies varies by segment, with higher adoption rates observed in segments like seed treatment and foliar application.

Dominant Markets & Segments in UK Crop Protection Chemicals Market

The UK crop protection chemicals market is segmented by application mode, crop type, and chemical function. While a detailed dominance analysis requires a more extensive exploration, the following bullet points illustrate some of the leading segments:

Application Mode: Foliar application remains a dominant segment, accounting for approximately xx% of the market in 2025, driven by its widespread applicability across various crops and its relative ease of use. Seed treatment is also a rapidly growing segment, as farmers seek to enhance seedling vigor and improve crop yield.

Crop Type: Grains & Cereals and Fruits & Vegetables represent the largest segments, driven by their extensive acreage and high value. The growing demand for high-quality fruits and vegetables is expected to continue driving growth in this segment.

Chemical Function: Herbicides constitute a significant portion of the market, reflecting the persistent need for effective weed control. The increasing incidence of crop diseases is driving the demand for fungicides, making it another rapidly expanding segment.

- Key Drivers (Examples):

- Economic Policies: Government support for sustainable agricultural practices and innovation.

- Infrastructure: Development of efficient distribution networks for crop protection products.

- Technological Advancements: Adoption of precision agriculture technologies.

UK Crop Protection Chemicals Market Product Innovations

Recent years have witnessed significant product innovations in the UK crop protection chemicals market. These innovations focus on enhancing efficacy, reducing environmental impact, and improving targeted application. The development of novel formulations, such as biologicals and low-toxicity chemicals, is a key trend. Biopesticides are gaining traction due to their reduced environmental footprint and growing consumer preference for natural solutions. Furthermore, precision application technologies enable the targeted delivery of crop protection products, reducing the overall amount needed and minimizing environmental risks. These innovations are expected to shape market competition and drive further growth.

Report Segmentation & Scope

This report provides a detailed segmentation of the UK crop protection chemicals market based on:

- Application Mode: Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment. Each segment's market size, growth projections, and competitive dynamics are analyzed.

- Crop Type: Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental. Growth projections vary significantly based on crop-specific needs and market trends.

- Chemical Function: Fungicide, Herbicide, Insecticide, Molluscicide, Nematicide. Each function exhibits different market dynamics based on pest and disease prevalence.

All segments are analyzed based on historical data (2019-2024), estimated data for 2025, and projected data for 2025-2033.

Key Drivers of UK Crop Protection Chemicals Market Growth

Several key factors contribute to the growth of the UK crop protection chemicals market. Technological advancements, including the development of highly targeted pesticides and biopesticides, play a crucial role in enhancing efficacy and minimizing environmental impacts. Economic factors such as the growing demand for food and the increasing need for higher crop yields also drive market growth. Furthermore, supportive government policies and initiatives promoting sustainable agricultural practices contribute to market expansion.

Challenges in the UK Crop Protection Chemicals Market Sector

The UK crop protection chemicals market faces several challenges. Stricter environmental regulations and increasing public scrutiny regarding pesticide use pose significant hurdles for market expansion. Supply chain disruptions and price volatility of raw materials can impact the availability and affordability of crop protection products. Intense competition from both established players and new entrants, particularly in the biopesticide sector, also poses a challenge. These factors can collectively constrain market growth.

Leading Players in the UK Crop Protection Chemicals Market Market

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- BASF SE

- FMC Corporation

- Corteva Agriscience

- Nufarm Ltd

Key Developments in UK Crop Protection Chemicals Market Sector

- August 2022: BASF and Corteva Agriscience collaborated to develop advanced soybean weed control solutions. This strategic partnership aims to address the increasing weed resistance challenge.

- November 2022: Syngenta launched its A.I.R. TM technology, a powerful herbicide tolerance system for sunflowers, enhancing weed management capabilities in European agriculture.

- January 2023: Bayer partnered with Oerth Bio to develop more sustainable and environmentally friendly crop protection technologies. This collaboration emphasizes the shift towards eco-conscious crop protection solutions.

Strategic UK Crop Protection Chemicals Market Outlook

The UK crop protection chemicals market holds significant growth potential in the coming years. Strategic opportunities exist in developing and commercializing sustainable and environmentally friendly solutions, such as biopesticides and precision application technologies. Further growth can be achieved through strategic partnerships, mergers, and acquisitions to expand market reach and enhance product portfolios. Companies focusing on innovation and meeting the evolving needs of farmers and consumers are poised to gain a competitive advantage in this dynamic market.

UK Crop Protection Chemicals Market Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Herbicide

- 1.3. Insecticide

- 1.4. Molluscicide

- 1.5. Nematicide

-

2. Application Mode

- 2.1. Chemigation

- 2.2. Foliar

- 2.3. Fumigation

- 2.4. Seed Treatment

- 2.5. Soil Treatment

-

3. Crop Type

- 3.1. Commercial Crops

- 3.2. Fruits & Vegetables

- 3.3. Grains & Cereals

- 3.4. Pulses & Oilseeds

- 3.5. Turf & Ornamental

-

4. Function

- 4.1. Fungicide

- 4.2. Herbicide

- 4.3. Insecticide

- 4.4. Molluscicide

- 4.5. Nematicide

-

5. Application Mode

- 5.1. Chemigation

- 5.2. Foliar

- 5.3. Fumigation

- 5.4. Seed Treatment

- 5.5. Soil Treatment

-

6. Crop Type

- 6.1. Commercial Crops

- 6.2. Fruits & Vegetables

- 6.3. Grains & Cereals

- 6.4. Pulses & Oilseeds

- 6.5. Turf & Ornamental

UK Crop Protection Chemicals Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Crop Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing pests and disease infestations in the country are leading to severe yield losses and driving the market for different crop protection chemicals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Herbicide

- 5.1.3. Insecticide

- 5.1.4. Molluscicide

- 5.1.5. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Chemigation

- 5.2.2. Foliar

- 5.2.3. Fumigation

- 5.2.4. Seed Treatment

- 5.2.5. Soil Treatment

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Commercial Crops

- 5.3.2. Fruits & Vegetables

- 5.3.3. Grains & Cereals

- 5.3.4. Pulses & Oilseeds

- 5.3.5. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Fungicide

- 5.4.2. Herbicide

- 5.4.3. Insecticide

- 5.4.4. Molluscicide

- 5.4.5. Nematicide

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Chemigation

- 5.5.2. Foliar

- 5.5.3. Fumigation

- 5.5.4. Seed Treatment

- 5.5.5. Soil Treatment

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Commercial Crops

- 5.6.2. Fruits & Vegetables

- 5.6.3. Grains & Cereals

- 5.6.4. Pulses & Oilseeds

- 5.6.5. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Fungicide

- 6.1.2. Herbicide

- 6.1.3. Insecticide

- 6.1.4. Molluscicide

- 6.1.5. Nematicide

- 6.2. Market Analysis, Insights and Forecast - by Application Mode

- 6.2.1. Chemigation

- 6.2.2. Foliar

- 6.2.3. Fumigation

- 6.2.4. Seed Treatment

- 6.2.5. Soil Treatment

- 6.3. Market Analysis, Insights and Forecast - by Crop Type

- 6.3.1. Commercial Crops

- 6.3.2. Fruits & Vegetables

- 6.3.3. Grains & Cereals

- 6.3.4. Pulses & Oilseeds

- 6.3.5. Turf & Ornamental

- 6.4. Market Analysis, Insights and Forecast - by Function

- 6.4.1. Fungicide

- 6.4.2. Herbicide

- 6.4.3. Insecticide

- 6.4.4. Molluscicide

- 6.4.5. Nematicide

- 6.5. Market Analysis, Insights and Forecast - by Application Mode

- 6.5.1. Chemigation

- 6.5.2. Foliar

- 6.5.3. Fumigation

- 6.5.4. Seed Treatment

- 6.5.5. Soil Treatment

- 6.6. Market Analysis, Insights and Forecast - by Crop Type

- 6.6.1. Commercial Crops

- 6.6.2. Fruits & Vegetables

- 6.6.3. Grains & Cereals

- 6.6.4. Pulses & Oilseeds

- 6.6.5. Turf & Ornamental

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Fungicide

- 7.1.2. Herbicide

- 7.1.3. Insecticide

- 7.1.4. Molluscicide

- 7.1.5. Nematicide

- 7.2. Market Analysis, Insights and Forecast - by Application Mode

- 7.2.1. Chemigation

- 7.2.2. Foliar

- 7.2.3. Fumigation

- 7.2.4. Seed Treatment

- 7.2.5. Soil Treatment

- 7.3. Market Analysis, Insights and Forecast - by Crop Type

- 7.3.1. Commercial Crops

- 7.3.2. Fruits & Vegetables

- 7.3.3. Grains & Cereals

- 7.3.4. Pulses & Oilseeds

- 7.3.5. Turf & Ornamental

- 7.4. Market Analysis, Insights and Forecast - by Function

- 7.4.1. Fungicide

- 7.4.2. Herbicide

- 7.4.3. Insecticide

- 7.4.4. Molluscicide

- 7.4.5. Nematicide

- 7.5. Market Analysis, Insights and Forecast - by Application Mode

- 7.5.1. Chemigation

- 7.5.2. Foliar

- 7.5.3. Fumigation

- 7.5.4. Seed Treatment

- 7.5.5. Soil Treatment

- 7.6. Market Analysis, Insights and Forecast - by Crop Type

- 7.6.1. Commercial Crops

- 7.6.2. Fruits & Vegetables

- 7.6.3. Grains & Cereals

- 7.6.4. Pulses & Oilseeds

- 7.6.5. Turf & Ornamental

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Fungicide

- 8.1.2. Herbicide

- 8.1.3. Insecticide

- 8.1.4. Molluscicide

- 8.1.5. Nematicide

- 8.2. Market Analysis, Insights and Forecast - by Application Mode

- 8.2.1. Chemigation

- 8.2.2. Foliar

- 8.2.3. Fumigation

- 8.2.4. Seed Treatment

- 8.2.5. Soil Treatment

- 8.3. Market Analysis, Insights and Forecast - by Crop Type

- 8.3.1. Commercial Crops

- 8.3.2. Fruits & Vegetables

- 8.3.3. Grains & Cereals

- 8.3.4. Pulses & Oilseeds

- 8.3.5. Turf & Ornamental

- 8.4. Market Analysis, Insights and Forecast - by Function

- 8.4.1. Fungicide

- 8.4.2. Herbicide

- 8.4.3. Insecticide

- 8.4.4. Molluscicide

- 8.4.5. Nematicide

- 8.5. Market Analysis, Insights and Forecast - by Application Mode

- 8.5.1. Chemigation

- 8.5.2. Foliar

- 8.5.3. Fumigation

- 8.5.4. Seed Treatment

- 8.5.5. Soil Treatment

- 8.6. Market Analysis, Insights and Forecast - by Crop Type

- 8.6.1. Commercial Crops

- 8.6.2. Fruits & Vegetables

- 8.6.3. Grains & Cereals

- 8.6.4. Pulses & Oilseeds

- 8.6.5. Turf & Ornamental

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Fungicide

- 9.1.2. Herbicide

- 9.1.3. Insecticide

- 9.1.4. Molluscicide

- 9.1.5. Nematicide

- 9.2. Market Analysis, Insights and Forecast - by Application Mode

- 9.2.1. Chemigation

- 9.2.2. Foliar

- 9.2.3. Fumigation

- 9.2.4. Seed Treatment

- 9.2.5. Soil Treatment

- 9.3. Market Analysis, Insights and Forecast - by Crop Type

- 9.3.1. Commercial Crops

- 9.3.2. Fruits & Vegetables

- 9.3.3. Grains & Cereals

- 9.3.4. Pulses & Oilseeds

- 9.3.5. Turf & Ornamental

- 9.4. Market Analysis, Insights and Forecast - by Function

- 9.4.1. Fungicide

- 9.4.2. Herbicide

- 9.4.3. Insecticide

- 9.4.4. Molluscicide

- 9.4.5. Nematicide

- 9.5. Market Analysis, Insights and Forecast - by Application Mode

- 9.5.1. Chemigation

- 9.5.2. Foliar

- 9.5.3. Fumigation

- 9.5.4. Seed Treatment

- 9.5.5. Soil Treatment

- 9.6. Market Analysis, Insights and Forecast - by Crop Type

- 9.6.1. Commercial Crops

- 9.6.2. Fruits & Vegetables

- 9.6.3. Grains & Cereals

- 9.6.4. Pulses & Oilseeds

- 9.6.5. Turf & Ornamental

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Fungicide

- 10.1.2. Herbicide

- 10.1.3. Insecticide

- 10.1.4. Molluscicide

- 10.1.5. Nematicide

- 10.2. Market Analysis, Insights and Forecast - by Application Mode

- 10.2.1. Chemigation

- 10.2.2. Foliar

- 10.2.3. Fumigation

- 10.2.4. Seed Treatment

- 10.2.5. Soil Treatment

- 10.3. Market Analysis, Insights and Forecast - by Crop Type

- 10.3.1. Commercial Crops

- 10.3.2. Fruits & Vegetables

- 10.3.3. Grains & Cereals

- 10.3.4. Pulses & Oilseeds

- 10.3.5. Turf & Ornamental

- 10.4. Market Analysis, Insights and Forecast - by Function

- 10.4.1. Fungicide

- 10.4.2. Herbicide

- 10.4.3. Insecticide

- 10.4.4. Molluscicide

- 10.4.5. Nematicide

- 10.5. Market Analysis, Insights and Forecast - by Application Mode

- 10.5.1. Chemigation

- 10.5.2. Foliar

- 10.5.3. Fumigation

- 10.5.4. Seed Treatment

- 10.5.5. Soil Treatment

- 10.6. Market Analysis, Insights and Forecast - by Crop Type

- 10.6.1. Commercial Crops

- 10.6.2. Fruits & Vegetables

- 10.6.3. Grains & Cereals

- 10.6.4. Pulses & Oilseeds

- 10.6.5. Turf & Ornamental

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. England UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Sumitomo Chemical Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ADAMA Agricultural Solutions Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bayer AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Wynca Group (Wynca Chemicals

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Syngenta Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 UPL Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 BASF SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 FMC Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Corteva Agriscience

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Nufarm Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Global UK Crop Protection Chemicals Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Crop Protection Chemicals Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Crop Protection Chemicals Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 5: North America UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 6: North America UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 7: North America UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 8: North America UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 9: North America UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 10: North America UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 11: North America UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 12: North America UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 13: North America UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 14: North America UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 15: North America UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 16: North America UK Crop Protection Chemicals Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America UK Crop Protection Chemicals Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 19: South America UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 20: South America UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 21: South America UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 22: South America UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 23: South America UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 24: South America UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 25: South America UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 26: South America UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 27: South America UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 28: South America UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 29: South America UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 30: South America UK Crop Protection Chemicals Market Revenue (Million), by Country 2024 & 2032

- Figure 31: South America UK Crop Protection Chemicals Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Europe UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 33: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 34: Europe UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 35: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 36: Europe UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 37: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 38: Europe UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 39: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 40: Europe UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 41: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 42: Europe UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 43: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 44: Europe UK Crop Protection Chemicals Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Europe UK Crop Protection Chemicals Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 47: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 48: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 49: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 50: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 51: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 52: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 53: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 54: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 55: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 56: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 57: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 58: Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa UK Crop Protection Chemicals Market Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 61: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 62: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 63: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 64: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 65: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 66: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Function 2024 & 2032

- Figure 67: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Function 2024 & 2032

- Figure 68: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Application Mode 2024 & 2032

- Figure 69: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Application Mode 2024 & 2032

- Figure 70: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Crop Type 2024 & 2032

- Figure 71: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Crop Type 2024 & 2032

- Figure 72: Asia Pacific UK Crop Protection Chemicals Market Revenue (Million), by Country 2024 & 2032

- Figure 73: Asia Pacific UK Crop Protection Chemicals Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 4: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 5: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 6: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 7: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 8: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: England UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Wales UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Scotland UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Northern UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Ireland UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 16: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 17: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 18: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 19: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 20: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 21: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 26: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 27: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 28: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 29: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 30: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 31: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of South America UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 36: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 37: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 38: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 39: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 40: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 41: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Kingdom UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Germany UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Spain UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Russia UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Benelux UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Nordics UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 52: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 53: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 54: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 55: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 56: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 57: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Turkey UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Israel UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: GCC UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: North Africa UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Africa UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Middle East & Africa UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 65: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 66: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 67: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Function 2019 & 2032

- Table 68: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 69: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 70: Global UK Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 71: China UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: India UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Japan UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Korea UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: ASEAN UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Oceania UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Asia Pacific UK Crop Protection Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Crop Protection Chemicals Market?

The projected CAGR is approximately 5.31%.

2. Which companies are prominent players in the UK Crop Protection Chemicals Market?

Key companies in the market include Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, BASF SE, FMC Corporation, Corteva Agriscience, Nufarm Ltd.

3. What are the main segments of the UK Crop Protection Chemicals Market?

The market segments include Function, Application Mode, Crop Type, Function, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increasing pests and disease infestations in the country are leading to severe yield losses and driving the market for different crop protection chemicals.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.November 2022: Syngenta launched the new A.I.R. TM technology, which is the most powerful herbicide tolerance system for sunflower agriculture that helps farmers in Europe overcome the difficulties associated with weed management.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Crop Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Crop Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Crop Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the UK Crop Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence