Key Insights

The United Kingdom (UK) bed and bath linen market is projected to reach £4.35 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.9%. This expansion is driven by increasing disposable incomes, a growing consumer desire for premium and comfortable home environments, and heightened awareness of hygiene and well-being. The burgeoning e-commerce sector further enhances market accessibility and consumer choice. While raw material price volatility and competitive pressures from budget brands pose challenges, the market's outlook remains favorable. Residential consumers constitute the primary demand segment, with the commercial hospitality sector also contributing significantly. Bed linen commands a substantial market share, with bath linens experiencing robust growth, underscoring a broader trend towards enhancing home comfort and aesthetic appeal. Distribution channels are diverse, encompassing hypermarkets, specialty retailers, and rapidly growing online platforms. Leading players, including Marks & Spencer, John Lewis & Partners, and IKEA, leverage brand equity, product innovation, and strategic pricing to capitalize on market dynamics.

U.K. Bed & Bath Linen Industry Market Size (In Billion)

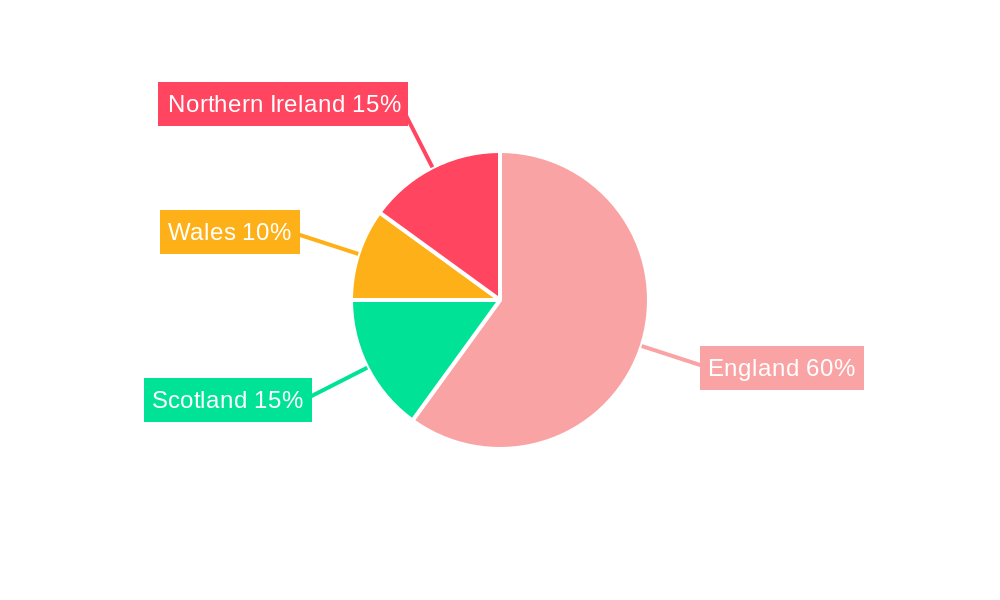

The forecast period (2025-2033) indicates continued market expansion, propelled by evolving consumer preferences for sustainable and ethically sourced products, personalized linen options, and advancements in material science and technology. Opportunities exist for market participants to embrace technological innovations, such as enhanced online shopping experiences and personalized recommendations, alongside a strong commitment to sustainable practices. Geographically, market growth will be concentrated in urban and suburban areas across England, Wales, Scotland, and Northern Ireland, reflecting prevailing consumer spending patterns. Segmentation by price point (budget, mid-range, premium) reveals distinct consumer segments influencing purchasing decisions.

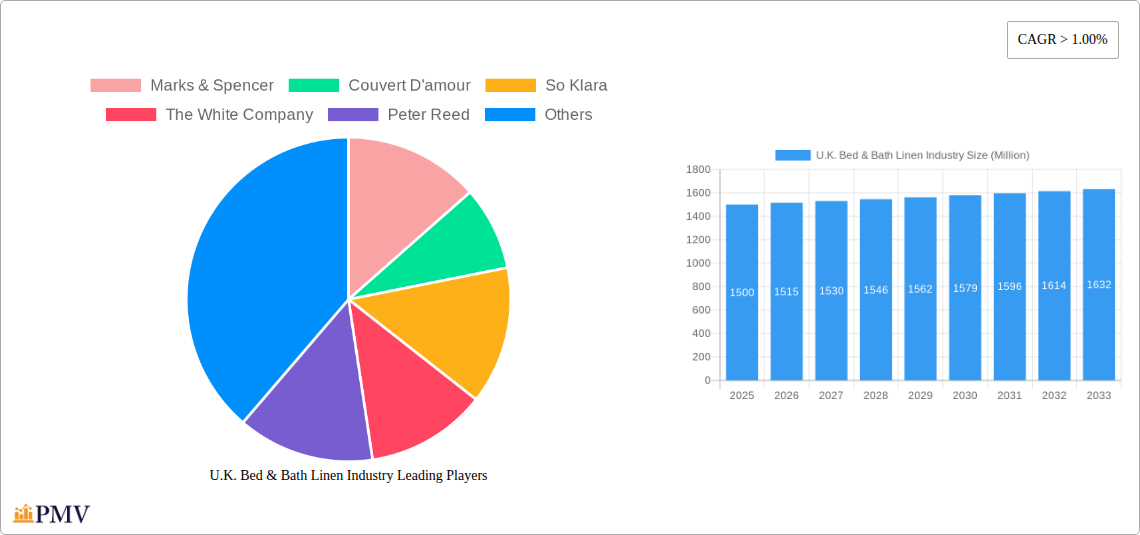

U.K. Bed & Bath Linen Industry Company Market Share

U.K. Bed & Bath Linen Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the U.K. bed and bath linen industry, covering the period 2019-2033. It offers invaluable insights into market size, segmentation, competitive landscape, and future growth potential, equipping businesses with the knowledge to make informed strategic decisions. The report incorporates extensive data analysis, covering key trends and developments impacting this dynamic sector. With a focus on actionable intelligence, this report is essential for industry players, investors, and market researchers seeking a deep understanding of this crucial market. The report's base year is 2025, with estimations for 2025 and forecasts extending to 2033.

U.K. Bed & Bath Linen Industry Market Structure & Competitive Dynamics

The U.K. bed and bath linen market is characterized by a diverse range of players, from large multinational corporations to smaller specialty retailers. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies cater to niche segments. The industry's innovation ecosystem is active, with ongoing developments in material technology, sustainable practices, and design aesthetics. Regulatory frameworks, primarily focused on product safety and consumer protection, influence industry practices. Product substitutes, such as synthetic alternatives, present competitive pressure. End-user trends, such as increasing demand for luxury and sustainable products, significantly impact market dynamics. M&A activity in the sector has been relatively steady, with deal values varying depending on the size and strategic importance of the companies involved. For example, a recent deal valued at approximately £xx Million demonstrated the potential for consolidation.

- Market Share: Dunelm and Marks & Spencer hold a significant portion of the market share (estimated xx% combined in 2025). John Lewis and Partners, The White Company, and IKEA also hold considerable market share. Smaller players such as Couvert D'amour, So Klara, and Peter Reed capture niche segments.

- M&A Activity: Recent years have seen several mergers and acquisitions, driving consolidation and reshaping the competitive landscape. The average M&A deal value in the period 2019-2024 was estimated at £xx Million.

U.K. Bed & Bath Linen Industry Industry Trends & Insights

The U.K. bed and bath linen market is experiencing robust growth, driven by several key factors. Rising disposable incomes and changing lifestyles have fueled demand for higher-quality and aesthetically pleasing products. The growing popularity of online shopping has opened up new distribution channels, broadening market access and fostering competition. Technological advancements in fabric production and design have led to the development of innovative products with enhanced comfort, durability, and sustainability features. However, challenges remain, including fluctuating raw material prices and increasing competition from overseas producers. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, indicating strong growth potential. Market penetration of sustainable and ethically sourced linen is growing at xx% annually. Consumer preference is shifting towards premium quality materials like Egyptian cotton and organic linen, driving up average selling prices. Competitive dynamics are characterized by brand differentiation and value-added services, with prominent players increasingly focusing on omnichannel strategies.

Dominant Markets & Segments in U.K. Bed & Bath Linen Industry

The residential segment dominates the U.K. bed and bath linen market, accounting for approximately xx% of total revenue in 2025. However, the commercial sector is expected to experience significant growth in the forecast period due to the hospitality industry's increasing focus on providing high-quality amenities. E-commerce channels are experiencing the highest growth rate among all distribution channels.

- By Type: Bed linen constitutes the larger segment, with Bath linen showing strong growth potential driven by increasing consumer focus on bathroom luxury.

- By End Users: The residential sector is currently dominant but the commercial sector is poised for accelerated growth, with the hospitality industry a key driver.

- By Distribution Channel: E-commerce channels are rapidly gaining market share, while specialty stores retain a strong presence in the premium segment. Hypermarkets and supermarkets provide broader accessibility, but with often lower margins.

Key Drivers:

- Economic Growth: Rising disposable incomes are driving increased spending on home furnishings.

- Changing Lifestyles: Consumers are prioritizing comfort and aesthetics in their homes.

- Technological Advancements: Innovations in materials and manufacturing processes are driving product improvements.

- E-Commerce Expansion: Online retail is significantly increasing market reach and consumer convenience.

U.K. Bed & Bath Linen Industry Product Innovations

Recent innovations in the U.K. bed and bath linen industry focus on sustainable materials, advanced fabric technologies (e.g., moisture-wicking, temperature-regulating fabrics), and smart home integration. Companies are also investing in designs that cater to diverse aesthetic preferences and emphasize eco-friendly production processes. These developments aim to enhance product appeal and offer consumers added value, resulting in a competitive advantage in the market.

Report Segmentation & Scope

This report segments the U.K. bed and bath linen market by type (bed linen, bath linen, other bed linens), end-user (residential, commercial), and distribution channel (hypermarkets/supermarkets, specialty stores, e-commerce, other). Each segment's growth projections, market sizes (in £ Millions), and competitive dynamics are analysed. The historical period covered is 2019-2024, the base year is 2025, and the forecast period is 2025-2033.

Key Drivers of U.K. Bed & Bath Linen Industry Growth

Several factors are driving the growth of the U.K. bed and bath linen industry. These include rising disposable incomes allowing consumers to spend more on home improvement, changing lifestyles that emphasize comfort and style, and the increasing popularity of e-commerce channels, which are broadening market accessibility. Technological advancements such as improved textile manufacturing and design are also crucial.

Challenges in the U.K. Bed & Bath Linen Industry Sector

The U.K. bed and bath linen industry faces several challenges, including fluctuating raw material prices impacting production costs, increasing competition from lower-cost overseas producers, and the need to adapt to changing consumer preferences and sustainability concerns. Supply chain disruptions have also led to increased uncertainty. The industry faces pressure to ensure ethical and sustainable sourcing of materials.

Leading Players in the U.K. Bed & Bath Linen Industry Market

- Marks & Spencer

- Couvert D'amour

- So Klara

- The White Company

- Peter Reed

- Dunelm

- Primark

- IKEA

- Finest Linen Company

- John Lewis and Partners

- Victoria Linen

- Ralph Lauren Corporation

- Debenhams

- Coco and Wolf

- Emma Hardicker

- Mairi Helena

- NEXT

Key Developments in U.K. Bed & Bath Linen Industry Sector

- May 2023: Standard Fiber secures a licensing agreement with Highclere Castle to develop and distribute bed, bath, and pet products. This expands product offerings and brand partnerships within the market.

- April 2023: XPO Logistics wins a multi-year contract with Christy England for supply chain management, improving efficiency and logistics within the luxury linen sector.

Strategic U.K. Bed & Bath Linen Industry Market Outlook

The U.K. bed and bath linen market exhibits substantial growth potential, driven by ongoing consumer demand for high-quality, aesthetically pleasing, and sustainable products. Strategic opportunities lie in innovation, expanding e-commerce presence, and catering to the growing demand for premium and sustainable options. Companies should focus on creating strong brand identities and leveraging effective marketing strategies. The market's future growth will be shaped by consumer preferences, technological advancements, and sustainability initiatives.

U.K. Bed & Bath Linen Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

U.K. Bed & Bath Linen Industry Segmentation By Geography

- 1. U.K.

U.K. Bed & Bath Linen Industry Regional Market Share

Geographic Coverage of U.K. Bed & Bath Linen Industry

U.K. Bed & Bath Linen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Hospitality Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Number of Hotel Constructions Growing the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marks & Spencer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Couvert D'amour

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 So Klara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The White Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Peter Reed

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dunelm

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Primark

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IKEA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Finest Linen Company**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 John Lewis and Partners

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Victoria Linen

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ralph Lauren Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Debenhams

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Coco and Wolf

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Emma Hardicker

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Mairi Helena

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 NEXT

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Marks & Spencer

List of Figures

- Figure 1: U.K. Bed & Bath Linen Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: U.K. Bed & Bath Linen Industry Share (%) by Company 2025

List of Tables

- Table 1: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. Bed & Bath Linen Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the U.K. Bed & Bath Linen Industry?

Key companies in the market include Marks & Spencer, Couvert D'amour, So Klara, The White Company, Peter Reed, Dunelm, Primark, IKEA, Finest Linen Company**List Not Exhaustive, John Lewis and Partners, Victoria Linen, Ralph Lauren Corporation, Debenhams, Coco and Wolf, Emma Hardicker, Mairi Helena, NEXT.

3. What are the main segments of the U.K. Bed & Bath Linen Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Hospitality Sector is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Number of Hotel Constructions Growing the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions are Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Standard Fiber, one of the suppliers to the home textile and hospitality markets, has established a licensing agreement with Highclere Castle, enabling the company the rights to develop and distribute a broad assortment of bed, bath, and pet products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. Bed & Bath Linen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. Bed & Bath Linen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. Bed & Bath Linen Industry?

To stay informed about further developments, trends, and reports in the U.K. Bed & Bath Linen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence