Key Insights

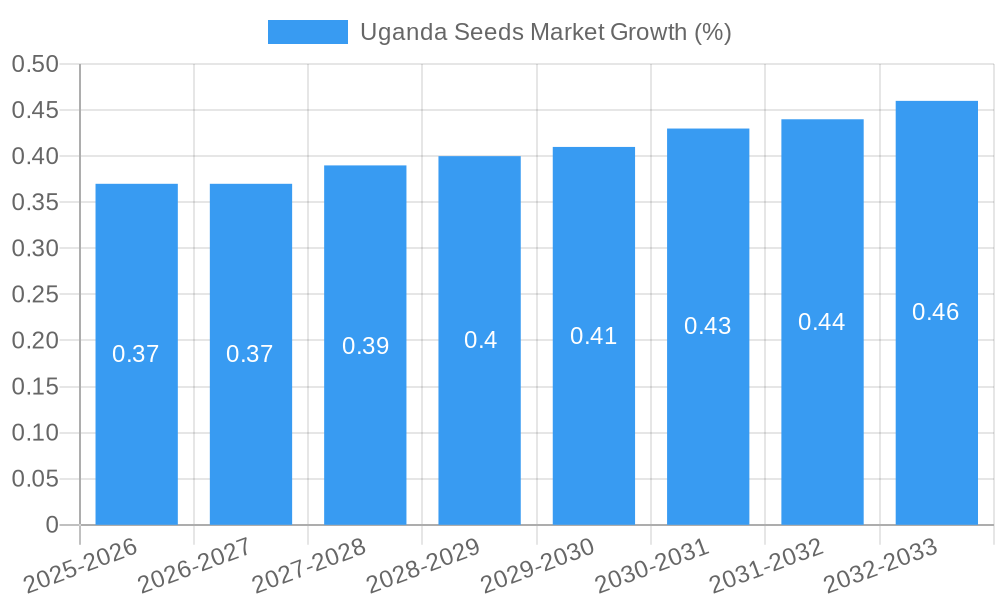

The Ugandan seed market, valued at $8.25 million in 2025, is projected to experience robust growth, driven by increasing agricultural production and a rising demand for high-yielding and improved seed varieties. A compound annual growth rate (CAGR) of 4.40% from 2025 to 2033 indicates a significant expansion, reaching an estimated value of approximately $12.5 million by 2033. This growth is fueled by several factors, including government initiatives promoting agricultural modernization, the adoption of improved farming techniques, and a growing awareness among farmers about the benefits of certified seeds. The market segmentation reveals a diverse landscape, with grains and cereals, pulses and oilseeds, and vegetables comprising the dominant crop types. The non-GM/hybrid seed segment is expected to maintain a larger market share compared to GM seeds, reflecting existing consumer preferences and regulatory frameworks. Major players like Syngenta, Equator Seeds, and others are driving innovation and competition, contributing to the market's dynamism. However, challenges such as limited access to financing, climate change vulnerability, and inadequate storage and distribution infrastructure could potentially restrain market growth.

The Ugandan seed market presents both opportunities and challenges. The presence of established international and local seed companies suggests a competitive yet dynamic environment. Strategic partnerships between seed companies, government agencies, and farmer cooperatives are crucial to enhance seed distribution networks and ensure accessibility for smallholder farmers. Furthermore, investments in research and development focused on climate-resilient seed varieties are vital to mitigating the impact of climate change and improving crop yields. Focus on increasing farmer awareness about the benefits of quality seeds, and providing training on improved agricultural practices, will be key to driving further market expansion. Sustained growth will also depend on improvements in post-harvest handling and storage to reduce seed losses and improve profitability for farmers.

This comprehensive report provides a detailed analysis of the Uganda seeds market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and growth projections, equipping stakeholders with actionable intelligence for strategic decision-making. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an indispensable resource for businesses operating in or considering entry into this dynamic market. The total market size is predicted to reach xx Million by 2033.

Uganda Seeds Market Market Structure & Competitive Dynamics

The Ugandan seeds market exhibits a moderately concentrated structure, with a handful of multinational and regional players dominating various segments. Key players include Syngenta, Equator Seeds, Victoria Seeds, Bejo, Sakata, Kenya Highland Seed, Rijk Zwaan, Seed Co, East-West Seed, East African Seed, Limagrain, FICA Seeds, and NASECO. Market share analysis reveals that the top five players collectively hold approximately 60% of the market, indicating a competitive landscape with both established giants and emerging players.

The innovation ecosystem is relatively nascent, with a focus primarily on improving existing varieties rather than developing entirely new ones. Regulatory frameworks, while present, are still evolving, impacting product registration and market entry. The market witnesses minimal M&A activity compared to more mature markets, however, strategic partnerships and collaborations are increasingly common, driving efficiency and access to resources.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share.

- Innovation: Primarily focused on improving existing varieties.

- Regulatory Framework: Evolving, influencing product registration and market entry.

- Product Substitutes: Limited, as seed quality significantly impacts yield.

- End-User Trends: Growing demand for high-yielding, disease-resistant varieties.

- M&A Activity: Relatively low, with greater emphasis on strategic partnerships. Estimated M&A deal value in the past five years: xx Million.

Uganda Seeds Market Industry Trends & Insights

The Ugandan seeds market is characterized by robust growth driven by several factors. Increasing government investment in agricultural development, rising consumer demand for higher-quality produce, and the expanding adoption of improved farming techniques are key contributors. The market has witnessed a Compound Annual Growth Rate (CAGR) of approximately xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of improved seeds remains relatively low, offering significant potential for expansion. Technological disruptions, such as the introduction of precision agriculture techniques and improved seed testing methodologies, are gradually gaining traction, further propelling growth. Changing consumer preferences towards nutritional and organically produced foods are influencing demand for specific seed varieties. Competition is intensifying, with both established players and newer entrants vying for market share.

Dominant Markets & Segments in Uganda Seeds Market

The Ugandan seeds market shows significant potential across various segments, with the grains and cereals segment, especially maize and beans (pulses), dominating the market due to their large-scale cultivation and consumption. The vegetables segment displays considerable growth potential, driven by urbanization and changing dietary habits. While cotton holds a significant position in the agricultural landscape, its seed market is relatively smaller compared to grains and cereals and vegetables.

Key Drivers:

- Grains and Cereals: High demand for staple food crops, government support for agricultural development.

- Pulses and Oilseeds: Growing awareness of nutritional benefits, diversification of diets.

- Vegetables: Urbanization, increased disposable incomes, shift towards healthier diets.

- Cotton: Significant role in the agricultural economy but comparatively smaller seed market.

- Other Crops: Niche markets with specific needs and growth potential (e.g., coffee, tea).

Dominance Analysis: The dominance of grains and cereals reflects the dietary staple in Uganda. The growth in vegetables points to shifts in consumer habits. The overall market is driven by high demand for high-yielding, disease-resistant, and improved varieties across all segments.

Uganda Seeds Market Product Innovations

Recent product innovations focus on developing hybrid and non-GM seeds with enhanced characteristics like disease resistance, improved yield, and adaptability to varying agro-ecological conditions. Technological advancements in seed treatment and coating techniques are further improving seed quality and germination rates. These innovations cater to the evolving needs of Ugandan farmers and contribute to improved agricultural productivity. The market sees a significant preference for non-GM seeds, although GM seed adoption remains limited.

Report Segmentation & Scope

This report comprehensively segments the Ugandan seeds market by:

Crop Type: Grains and Cereals, Pulses and Oilseeds, Vegetables, Cotton, Other Crops. Each segment's growth projections, market size, and competitive dynamics are analyzed separately. The Grains and Cereals segment is expected to retain its leading position, while vegetables segment exhibits the highest projected growth.

Product Type: Non-GM/Hybrid Seeds, GM Seeds, Varietal Seeds. Market share and growth projections for each category are assessed, reflecting consumer preferences and technological advancements. Non-GM/Hybrid seeds are dominant but GM seeds have potential for future growth.

The report's scope encompasses market size estimations, competitive landscape analysis, industry trends, and growth projections for each segment across the historical, base, and forecast periods.

Key Drivers of Uganda Seeds Market Growth

Several factors fuel the growth of the Ugandan seeds market. These include increasing government investment in agricultural research and extension services, supportive policies aimed at improving agricultural productivity, growing demand for high-yielding and disease-resistant seed varieties, and increasing awareness among farmers about the benefits of improved seed technology. Favorable climatic conditions in certain regions further bolster the sector.

Challenges in the Uganda Seeds Market Sector

Challenges include limited access to quality seeds in remote areas due to poor infrastructure, the high cost of improved seeds making it inaccessible to smallholder farmers, counterfeiting of seeds compromising quality and farmer trust, and the need for enhanced seed storage and handling infrastructure to minimize post-harvest losses. These factors collectively impact market expansion and the overall agricultural productivity. The estimated loss due to seed quality issues and supply chain inefficiencies is approximately xx Million annually.

Leading Players in the Uganda Seeds Market Market

- Syngenta

- Equator Seeds

- Victoria Seeds

- Bejo

- Sakata

- Kenya Highland Seed

- Rijk Zwaan

- Seed Co

- East-West Seed

- East African Seed

- Limagrain

- FICA Seeds

- NASECO

Key Developments in Uganda Seeds Market Sector

- November 2021: East-West Seed Company launched new vegetable seeds in the African market, including Tomato Diva F1, Papa Gymbia F1, and others, boosting product diversity.

- July 2022: Sixteen farmer groups received planting seeds under the Seed Effect Uganda Project, demonstrating enhanced access to improved seeds.

- August 2022: A nine-year project launched to develop new vegetable varieties, strengthen seed certification, and improve farmer skills, indicating significant government commitment to sector development.

Strategic Uganda Seeds Market Market Outlook

The Ugandan seeds market presents substantial growth potential driven by increasing agricultural investment, growing demand for high-quality produce, and supportive government policies. Strategic opportunities lie in expanding access to improved seeds for smallholder farmers through public-private partnerships, investing in seed production and distribution infrastructure, and focusing on developing climate-resilient and disease-resistant varieties. The market is poised for significant expansion, with strategic players well-positioned to capitalize on these opportunities.

Uganda Seeds Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Uganda Seeds Market Segmentation By Geography

- 1. Uganda

Uganda Seeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Government Support to the Seed Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uganda Seeds Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Uganda

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Syngent

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equator Seeds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Victoria Seeds

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bejo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sakata

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kenya Highland Seed

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rijk Zwaan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Seed Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East-West Seed

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 East African Seed

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Limagrain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 FICA Seeds

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 NASECO

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Syngent

List of Figures

- Figure 1: Uganda Seeds Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uganda Seeds Market Share (%) by Company 2024

List of Tables

- Table 1: Uganda Seeds Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uganda Seeds Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Uganda Seeds Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Uganda Seeds Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Uganda Seeds Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Uganda Seeds Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Uganda Seeds Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Uganda Seeds Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Uganda Seeds Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Uganda Seeds Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Uganda Seeds Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Uganda Seeds Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Uganda Seeds Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Uganda Seeds Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uganda Seeds Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Uganda Seeds Market?

Key companies in the market include Syngent, Equator Seeds, Victoria Seeds, Bejo, Sakata, Kenya Highland Seed, Rijk Zwaan, Seed Co, East-West Seed, East African Seed, Limagrain, FICA Seeds, NASECO.

3. What are the main segments of the Uganda Seeds Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Government Support to the Seed Industry.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

August 2022: The Government of Uganda, with support from the Government of the Republic of Korea through the Korea International Cooperation Agency (KOICA), has launched a nine-year project to develop new varieties of vegetables, strengthen seed certification capacity, and improve the technical skills of vegetable farmers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uganda Seeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uganda Seeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uganda Seeds Market?

To stay informed about further developments, trends, and reports in the Uganda Seeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence