Key Insights

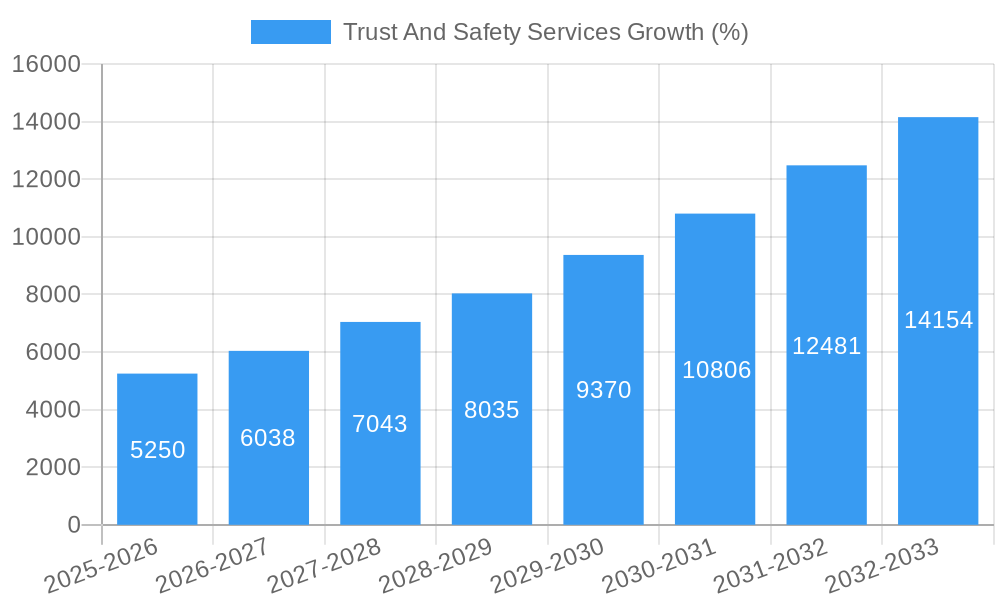

The Trust and Safety Services market is experiencing robust growth, driven by the escalating need for online platforms to mitigate risks associated with harmful content, fraud, and user abuse. The increasing adoption of digital technologies across various sectors, coupled with stringent government regulations and rising consumer demand for secure online experiences, are key catalysts. While precise market sizing data is absent, leveraging industry reports and considering a typical CAGR (Compound Annual Growth Rate) of 15-20% for rapidly expanding tech services, a reasonable estimate for the 2025 market size could be placed between $30 billion and $40 billion, based on a projected growth trajectory. This growth is further fueled by the expansion of e-commerce, social media, and online gaming, which are particularly vulnerable to malicious activities. The market is segmented by service type (content moderation, fraud prevention, identity verification, etc.), deployment model (cloud, on-premises), and end-user industry (social media, e-commerce, gaming, finance).

The competitive landscape is highly fragmented, with a mix of large multinational corporations like Accenture, Cognizant, and Teleperformance, and specialized smaller firms like ModSquad and Appen. These companies compete based on their technological capabilities, service offerings, geographic reach, and pricing strategies. Future market growth hinges on advancements in AI and machine learning, which are crucial for automating and enhancing the accuracy of trust and safety operations. However, challenges remain, including the evolving nature of online threats, the need for skilled professionals, and ethical considerations surrounding data privacy and algorithmic bias. Addressing these challenges will be key to sustainable growth within the Trust and Safety Services market in the coming years. The market's future trajectory is promising, anticipating continued expansion as the digital world becomes increasingly interconnected and reliant on secure online interactions.

This comprehensive report provides a detailed analysis of the global Trust and Safety Services market, offering invaluable insights for businesses, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to deliver a precise and actionable overview of this rapidly evolving sector. The global market value is projected to reach $XX million by 2033, exhibiting a CAGR of XX% during the forecast period.

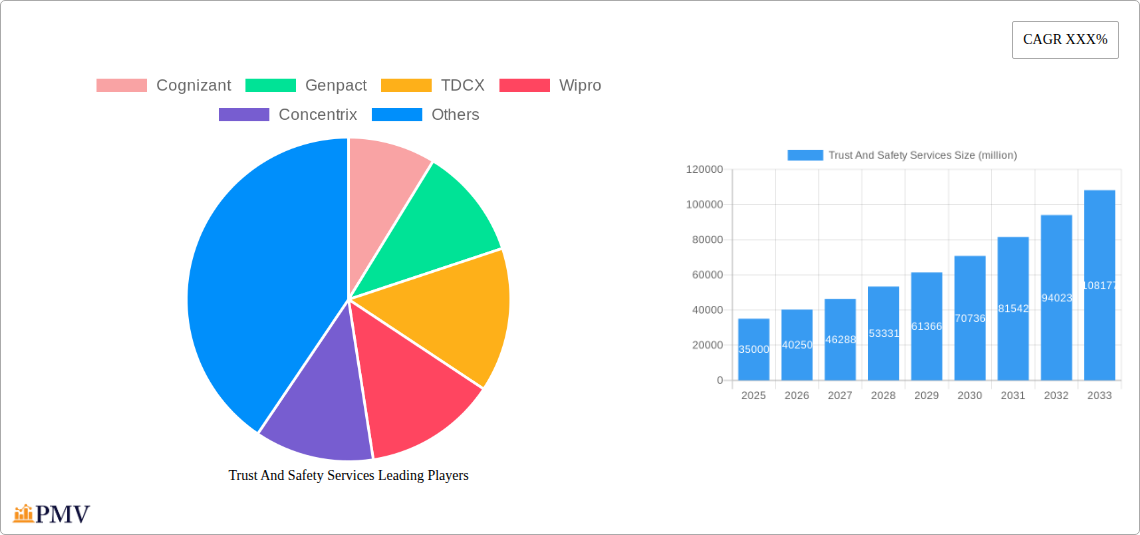

Trust And Safety Services Market Structure & Competitive Dynamics

The Trust and Safety Services market exhibits a moderately concentrated structure, with several key players commanding significant market share. The top 10 companies, including Cognizant, Genpact, TDCX, Wipro, Concentrix, Teleperformance, Accenture, TaskUs, TELUS International, and Sutherland, collectively account for approximately XX% of the global market in 2025. The market is characterized by intense competition, fueled by continuous innovation and a growing demand for robust security solutions.

Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at XX, indicating a moderately concentrated market.

Innovation Ecosystems: Significant investments in R&D are driving the development of advanced technologies such as AI-powered fraud detection and enhanced user authentication systems. These innovations are reshaping the competitive landscape and creating new opportunities for market entrants.

Regulatory Frameworks: Stringent data privacy regulations, such as GDPR and CCPA, are shaping the market by driving the demand for compliant trust and safety solutions. This also influences M&A activity as companies seek to consolidate expertise and resources to navigate compliance challenges.

Product Substitutes: While direct substitutes are limited, alternative approaches to security, like self-service password resets, can impact the demand for specialized Trust and Safety Services.

End-User Trends: The increasing adoption of digital platforms and the growing awareness of online security threats are key drivers of market growth. Consumers increasingly expect robust security measures, pushing businesses to invest in comprehensive trust and safety solutions.

M&A Activities: The market has witnessed a surge in mergers and acquisitions in recent years, with deal values exceeding $XX million in the period 2019-2024. These transactions reflect the strategic importance of trust and safety capabilities and the desire of larger players to expand their market share. Examples include:

- Acquisition of [Company A] by [Company B] for $XX million in 2022.

- Strategic partnership between [Company C] and [Company D] in 2023 to jointly develop a new product line.

Trust And Safety Services Industry Trends & Insights

The Trust and Safety Services market is experiencing robust growth, driven by a confluence of factors. The increasing adoption of digital technologies across various industries, coupled with escalating cyber threats and growing regulatory scrutiny, are key growth drivers. Technological advancements, such as AI and machine learning, are revolutionizing the sector, enabling more efficient and effective trust and safety solutions. Consumer expectations regarding online safety are also rising, further stimulating demand.

Market growth is further propelled by the increasing adoption of cloud-based solutions, providing scalable and cost-effective options for organizations of all sizes. The market’s competitive intensity is high, with established players facing challenges from innovative startups offering specialized solutions. The market penetration rate is estimated at XX% in 2025 and is projected to reach XX% by 2033, demonstrating significant growth potential.

The market is witnessing a significant shift towards proactive security measures, rather than purely reactive ones. This is driven by the need to prevent security breaches before they occur, rather than merely responding to them afterward. The CAGR for the market from 2025 to 2033 is projected at XX%.

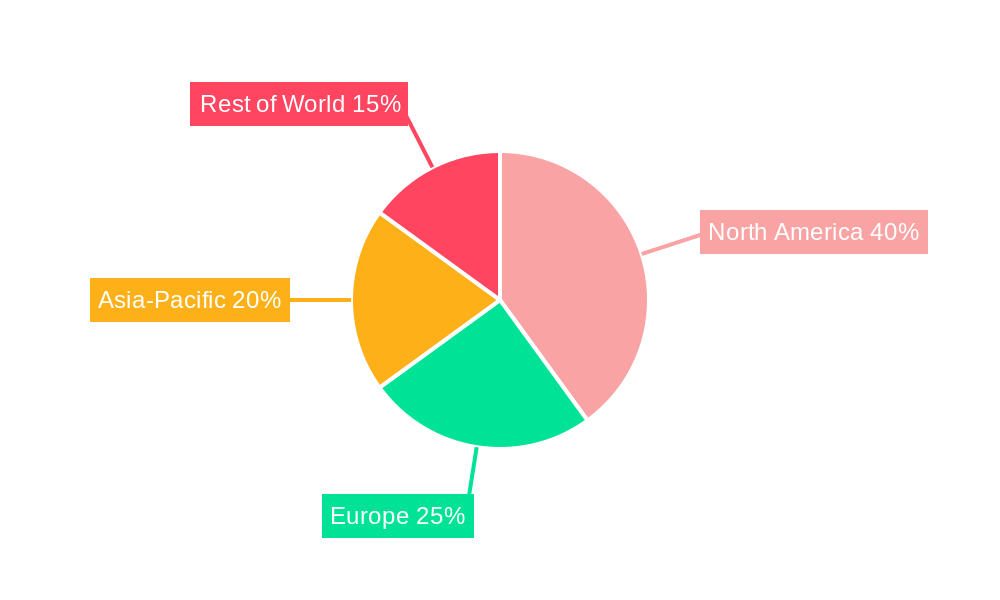

Dominant Markets & Segments in Trust And Safety Services

North America currently dominates the global Trust and Safety Services market, accounting for the largest share of revenue in 2025. This dominance is attributed to several factors:

- Robust technological infrastructure: A well-developed IT infrastructure supports the adoption and deployment of advanced trust and safety solutions.

- High levels of digital adoption: A high percentage of the population uses digital platforms and services, creating a larger potential market for security solutions.

- Stringent data privacy regulations: The presence of regulations such as CCPA has accelerated the adoption of compliant security measures.

- High levels of venture capital investment: Significant investments from venture capitalists have funded innovation in the sector.

This region is characterized by high levels of consumer awareness and demand for online safety, and companies are responding by offering increasingly sophisticated security solutions. The ongoing maturation of existing markets, coupled with rapid growth in emerging markets, suggests the global Trust and Safety Services market will see significant expansion in the coming years. The dominance of North America is expected to continue throughout the forecast period, although other regions, such as Asia-Pacific, are expected to witness faster growth rates.

Trust And Safety Services Product Innovations

Recent product innovations in the trust and safety sector focus on leveraging artificial intelligence and machine learning to enhance fraud detection capabilities, improve content moderation, and provide more personalized user experiences. These advancements allow for the automation of many tasks previously requiring significant human intervention, improving efficiency and scalability while reducing costs. The integration of these technologies into existing trust and safety platforms is driving market expansion and creating new competitive advantages. The market is also witnessing the rise of specialized solutions tailored to specific industry needs, such as those designed for e-commerce, social media, and gaming.

Report Segmentation & Scope

The Trust and Safety Services market is segmented by several key criteria, including service type (fraud detection, content moderation, user authentication, etc.), deployment model (cloud-based, on-premise), end-user industry (finance, healthcare, retail, etc.), and region (North America, Europe, Asia-Pacific, etc.). Each segment exhibits unique growth dynamics and competitive landscapes, offering specific opportunities for market participants. For example, the cloud-based segment is experiencing rapid growth due to its scalability and flexibility, while the healthcare sector is characterized by stringent regulatory requirements that influence market dynamics. Growth projections for each segment vary, reflecting differing adoption rates and market maturity levels. The overall market size is projected to reach $XX million by 2033, with varying contributions from each segment.

Key Drivers of Trust And Safety Services Growth

Several key factors are driving the growth of the Trust and Safety Services market. The rise in cybercrime and online fraud is a primary driver, compelling organizations to invest in advanced security solutions. Increasing data privacy regulations also play a significant role, as organizations must comply with stringent standards to avoid penalties. Moreover, the expanding adoption of digital technologies across various industries creates an increased need for robust security measures. Finally, the rising awareness among consumers regarding online safety and security is a significant catalyst driving demand for these services.

Challenges in the Trust And Safety Services Sector

Despite the positive growth trajectory, several challenges exist within the Trust and Safety Services sector. These include the increasing sophistication of cyberattacks, the ongoing evolution of regulatory requirements, and the pressure on margins from intense competition. The need for continuous innovation to stay ahead of evolving threats also poses a significant challenge. The sector must also address the ethical considerations associated with the use of artificial intelligence and data analytics in security solutions. These challenges can lead to increased costs, operational complexities and limitations in the scalability of security solutions. Failure to address these challenges effectively can impact revenue growth and market share for players in this sector.

Leading Players in the Trust And Safety Services Market

- Cognizant

- Genpact

- TDCX

- Wipro

- Concentrix

- Teleperformance

- Vaco

- Accenture

- TaskUs

- TELUS International

- Sutherland

- Tech Mahindra

- Foundever

- Alorica

- GlobalLogic

- Appen

- Conectys

- ModSquad

- TTEC

- Transcosmos

- WebPrrify

Key Developments in Trust And Safety Services Sector

- January 2023: Launch of AI-powered fraud detection system by [Company Name].

- March 2024: Acquisition of [Company X] by [Company Y] for $XX million.

- June 2024: Introduction of new regulations impacting data privacy in [Region].

- October 2024: Partnership between [Company A] and [Company B] to develop a joint solution.

Strategic Trust And Safety Services Market Outlook

The Trust and Safety Services market is poised for continued expansion in the coming years, driven by persistent growth in digital adoption, increased cyber threats, and evolving regulatory environments. Strategic opportunities exist for companies that can offer innovative, scalable, and compliant solutions. Companies should prioritize investments in AI, machine learning, and other emerging technologies to enhance their offerings and gain a competitive edge. A focus on building strong partnerships and strategic alliances will also be crucial for success in this dynamic market. The market's future is bright, promising substantial growth and substantial returns for those who strategically position themselves to capitalize on the emerging trends and demands within this critical industry.

Trust And Safety Services Segmentation

-

1. Application

- 1.1. Media and Social media

- 1.2. E-commerce

- 1.3. Game

- 1.4. Others

-

2. Type

- 2.1. Fully Managed

- 2.2. Semi-Managed

Trust And Safety Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Trust And Safety Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trust And Safety Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Media and Social media

- 5.1.2. E-commerce

- 5.1.3. Game

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fully Managed

- 5.2.2. Semi-Managed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Trust And Safety Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Media and Social media

- 6.1.2. E-commerce

- 6.1.3. Game

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fully Managed

- 6.2.2. Semi-Managed

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Trust And Safety Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Media and Social media

- 7.1.2. E-commerce

- 7.1.3. Game

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fully Managed

- 7.2.2. Semi-Managed

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Trust And Safety Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Media and Social media

- 8.1.2. E-commerce

- 8.1.3. Game

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fully Managed

- 8.2.2. Semi-Managed

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Trust And Safety Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Media and Social media

- 9.1.2. E-commerce

- 9.1.3. Game

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fully Managed

- 9.2.2. Semi-Managed

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Trust And Safety Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Media and Social media

- 10.1.2. E-commerce

- 10.1.3. Game

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fully Managed

- 10.2.2. Semi-Managed

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cognizant

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Genpact

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TDCX

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wipro

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Concentrix

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teleperformance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vaco

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Accenture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TaskUs

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TELUS International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sutherland

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tech Mahindra

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Foundever

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Alorica

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 GlibalLogic

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Appen

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Conectys

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ModSquad

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 TTEC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Transcosmos

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 WebPrrify

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Cognizant

List of Figures

- Figure 1: Global Trust And Safety Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Trust And Safety Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Trust And Safety Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Trust And Safety Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Trust And Safety Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Trust And Safety Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Trust And Safety Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Trust And Safety Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Trust And Safety Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Trust And Safety Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Trust And Safety Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Trust And Safety Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Trust And Safety Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Trust And Safety Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Trust And Safety Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Trust And Safety Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Trust And Safety Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Trust And Safety Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Trust And Safety Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Trust And Safety Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Trust And Safety Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Trust And Safety Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Trust And Safety Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Trust And Safety Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Trust And Safety Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Trust And Safety Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Trust And Safety Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Trust And Safety Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Trust And Safety Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Trust And Safety Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Trust And Safety Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Trust And Safety Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Trust And Safety Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Trust And Safety Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Trust And Safety Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Trust And Safety Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Trust And Safety Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Trust And Safety Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Trust And Safety Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Trust And Safety Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Trust And Safety Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Trust And Safety Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Trust And Safety Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Trust And Safety Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Trust And Safety Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Trust And Safety Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Trust And Safety Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Trust And Safety Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Trust And Safety Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Trust And Safety Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Trust And Safety Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trust And Safety Services?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Trust And Safety Services?

Key companies in the market include Cognizant, Genpact, TDCX, Wipro, Concentrix, Teleperformance, Vaco, Accenture, TaskUs, TELUS International, Sutherland, Tech Mahindra, Foundever, Alorica, GlibalLogic, Appen, Conectys, ModSquad, TTEC, Transcosmos, WebPrrify.

3. What are the main segments of the Trust And Safety Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trust And Safety Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trust And Safety Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trust And Safety Services?

To stay informed about further developments, trends, and reports in the Trust And Safety Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence