Key Insights

The global Agriculture & Food Testing, Inspection, and Certification (TIC) market is forecast to reach $417.76 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 3.6% from 2025 to 2033. This expansion is propelled by heightened regulatory demands for food safety and quality, escalating consumer consciousness, and the increasing complexity of global food supply chains.

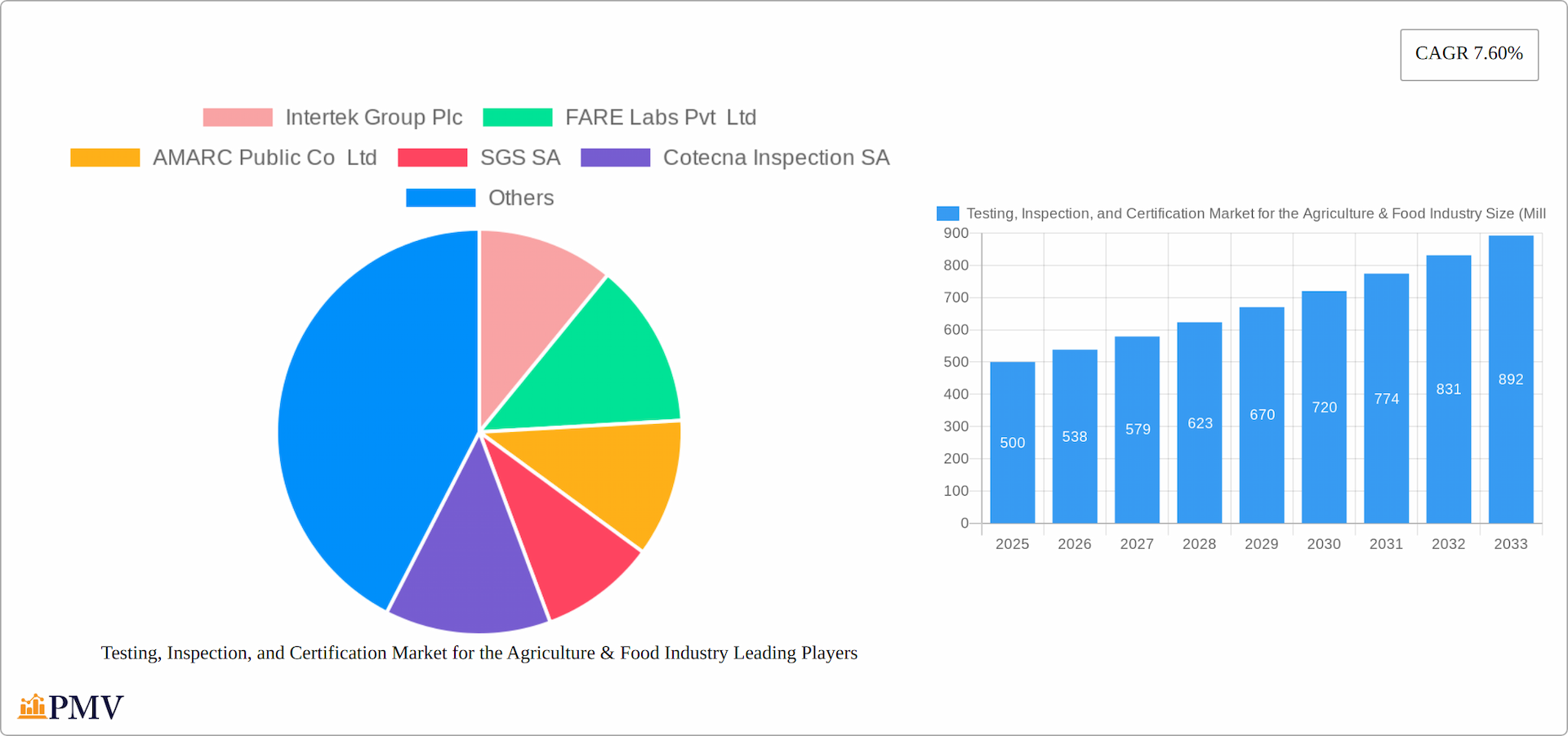

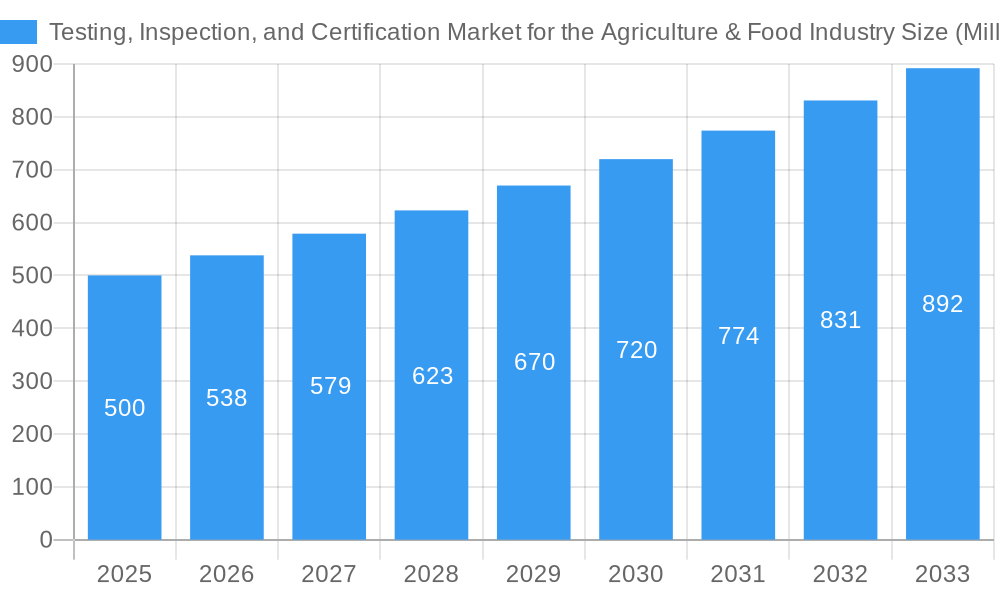

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market Size (In Billion)

The market is segmented by service type into Testing & Inspection Services and Certification Services, and by sourcing into Outsourced and In-House. Outsourced services are projected to capture a larger market share, attributed to their specialized expertise and cost efficiencies. Leading industry players including Intertek Group Plc, SGS SA, and Bureau Veritas are actively enhancing their market positions through strategic mergers, acquisitions, and the expansion of their service offerings to meet the dynamic requirements of the agriculture and food sectors.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Company Market Share

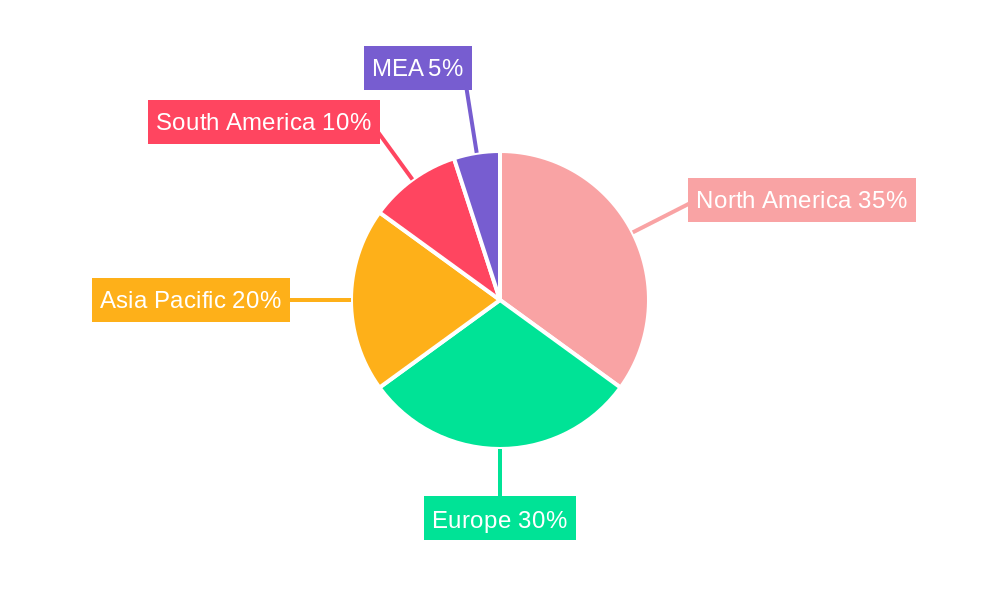

Regionally, North America, led by the United States, is expected to maintain market dominance due to its robust food safety regulations and high adoption rates of quality control methodologies. Europe, with countries like Germany and the UK at the forefront, follows due to stringent food safety standards and a strong emphasis on sustainability. The Asia Pacific region is anticipated to experience significant growth, driven by rapid urbanization and growing concerns regarding food safety in key economies such as China and India. Emerging economies in the Middle East, Africa, and South America are also demonstrating growth, albeit at a more moderate pace, fueled by increasing awareness and the development of food safety standards.

The forecast period from 2025 to 2033 will likely witness continuous innovation in TIC services, with a strategic focus on integrating advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) to optimize inspection and certification processes.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market Structure & Competitive Dynamics

The Testing, Inspection, and Certification (TIC) market within the agriculture and food industry exhibits a moderately to highly concentrated landscape, dominated by several key players holding substantial market shares. Industry giants such as Intertek Group Plc, SGS SA, and Bureau Veritas are prominent examples, each commanding over 10% market share. This sector boasts a vibrant innovation ecosystem, fueled by continuous advancements in food safety testing technologies and evolving certification standards. Stringent regulatory frameworks, notably those established by the FDA and USDA in the US, and equivalent bodies globally, play a pivotal role in shaping market dynamics, guaranteeing food safety and quality, and influencing industry practices. These regulations drive demand for TIC services and contribute significantly to market growth.

The TIC market experiences minimal substitution, as rigorous testing and certification remain indispensable for the agriculture and food industry. A prevailing trend among end-users is the increasing preference for outsourced TIC services, leveraging cost-effectiveness and access to specialized expertise. The market is further characterized by frequent mergers and acquisitions (M&A) activity, with transaction values spanning from $50 million to $200 million, strategically employed to broaden service portfolios and expand geographical reach, enhancing market penetration and competitive positioning.

- Market Share Concentration: Intertek Group Plc, SGS SA, and Bureau Veritas represent a significant portion of the market, each holding over 10% market share, highlighting the industry's consolidated nature.

- Strategic M&A Activity: Deals ranging from $50 million to $200 million are common, reflecting the pursuit of enhanced service capabilities and wider market access.

- Regulatory Influence: Stringent governmental regulations (e.g., FSMA) significantly influence market demand and growth.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Industry Trends & Insights

The TIC market for the Agriculture & Food Industry is experiencing significant growth, driven by increasing consumer awareness about food safety and quality. The global market is projected to grow at a CAGR of 5.5% from 2025 to 2033, reaching a value of $xx Million by 2033. Technological disruptions, such as the adoption of AI and IoT in testing processes, are enhancing the efficiency and accuracy of TIC services. These technologies enable real-time monitoring and predictive analytics, which are becoming crucial in meeting stringent regulatory standards.

Consumer preferences are shifting towards organic and non-GMO products, necessitating more comprehensive testing and certification services. This trend is particularly pronounced in developed markets like the US and Europe, where market penetration of certified products is high. Competitive dynamics are intense, with companies like SGS and Bureau Veritas continuously innovating to offer advanced testing solutions. The integration of blockchain technology for traceability and transparency is another emerging trend that is expected to further propel market growth.

The market is also witnessing a rise in demand for in-house TIC services, particularly among large food manufacturers aiming to streamline their operations and ensure compliance with regulations. However, the outsourced segment remains dominant due to its flexibility and cost-effectiveness. Overall, the TIC market for the Agriculture & Food Industry is poised for steady growth, supported by technological advancements and increasing regulatory pressures.

Dominant Markets & Segments in Testing, Inspection, and Certification Market for the Agriculture & Food Industry

The North American region, particularly the United States, is a dominant market in the TIC sector for the Agriculture & Food Industry, driven by stringent regulatory standards and high consumer awareness about food safety. Within the service type segmentation, the Testing and Inspection Service segment leads, accounting for approximately 60% of the market share. This dominance is attributed to the critical need for thorough testing to ensure compliance with food safety regulations.

- Key Drivers in North America:

- Stringent regulatory environment enforced by bodies like the FDA and USDA.

- High consumer demand for safe and quality food products.

- Advanced infrastructure supporting the adoption of new technologies in TIC services.

The Outsourced segment within the sourcing type category holds a significant market share, around 70%, due to the cost benefits and specialized expertise offered by third-party TIC providers. This segment is particularly dominant in regions where local food manufacturers prefer to focus on their core operations while outsourcing TIC services.

- Key Drivers for Outsourced Segment:

- Cost-effectiveness and access to specialized expertise.

- Flexibility to scale TIC services according to demand.

- Focus on core business activities while ensuring compliance with regulations.

The dominance of these segments and regions is expected to continue, driven by ongoing investments in technology and infrastructure, as well as increasing regulatory requirements. The European market is also a significant player, with a strong emphasis on sustainability and organic certification, which further boosts the demand for TIC services.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Product Innovations

Innovation within the agriculture and food industry's TIC market centers on enhancing the speed, accuracy, and breadth of testing and certification services. Cutting-edge developments include the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) for real-time monitoring and predictive analytics, resulting in substantially improved efficiency in food safety testing. Blockchain technology is also gaining traction, ensuring transparency and traceability across the entire supply chain, building consumer trust and enhancing product accountability. These technological advancements directly address the market's demand for reliable and comprehensive TIC services, providing a considerable competitive advantage to early adopters.

Report Segmentation & Scope

The TIC market for the agriculture and food industry is segmented by service type into Testing and Inspection Services and Certification Services. The Testing and Inspection Services segment is projected to exhibit robust growth, with a Compound Annual Growth Rate (CAGR) of 6% anticipated from 2025 to 2033, driven by escalating regulatory mandates and the ever-increasing consumer focus on food safety. The Certification Services segment, although comparatively smaller, is forecast to achieve a CAGR of 5%, reflecting the growing importance of certification for market access and building consumer confidence in food products.

Based on sourcing type, the market is bifurcated into Outsourced and In-House segments. The Outsourced segment is poised for significant growth, with a projected CAGR of 5.8%, attributed to its inherent cost-effectiveness and operational flexibility. The In-House segment, while smaller, is anticipated to experience a CAGR of 4.5%, driven primarily by large-scale manufacturers seeking tighter control over their internal TIC processes. This reflects varying strategic approaches within the industry.

Key Drivers of Testing, Inspection, and Certification Market for the Agriculture & Food Industry Growth

The expansion of the TIC market within the agriculture and food industry is propelled by several key factors. Technological advancements, particularly the adoption of AI, IoT, and blockchain, are instrumental in improving the efficiency and dependability of TIC services. Economically, the surging demand for safe and high-quality food products is a significant growth driver. Furthermore, robust regulatory factors, including stringent food safety standards implemented by organizations such as the FDA and USDA (and their international counterparts), are compelling businesses to invest in advanced TIC solutions. The FDA's Food Safety Modernization Act (FSMA), for example, has considerably amplified the need for comprehensive testing and certification services, setting a global precedent.

Challenges in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry Sector

The TIC market within the agriculture and food industry faces several challenges that could potentially impact growth. Regulatory inconsistencies across different geographical regions create compliance complexities and add to operational costs. Supply chain disruptions and delays can impede the timely delivery of TIC services. The market is also highly competitive, necessitating continuous innovation to maintain market share and profitability. These challenges, if not effectively mitigated, could potentially result in a 2-3% reduction in the overall market growth rate, emphasizing the importance of proactive solutions and adaptability within the industry.

Leading Players in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market

- Intertek Group Plc

- FARE Labs Pvt Ltd

- AMARC Public Co Ltd

- SGS SA

- Cotecna Inspection SA

- MISTRAS Group Inc

- AIM Control Inspection Group

- AsureQuality Limited

- Bureau Veritas

- Kiwa Ltd

- Applus+ Group

- TUV SUD

Key Developments in Testing, Inspection, and Certification Market for the Agriculture & Food Industry Sector

March 2022: Bureau Veritas opened its fifth Canadian Microbiology Laboratory in Winnipeg, Manitoba. The new laboratory offers Rapid Pathogen testing (E.coli O157:H7, Salmonella & Listeria) and Indicators (Generic E.coli/Coliforms, Total Plate Count, Yeast & Mold), enhancing the company's food testing and certification business in Canada and bolstering its food safety and quality laboratory testing capabilities across North America.

January 2022: SGS announced a collaboration with Microsoft, integrating Microsoft's cross-industry expertise, productivity platforms, and advanced data solutions with SGS's global network and industry competence. This collaboration aims to develop innovative solutions for the TIC industry's customers in sectors like nutrition, health, wellness, sustainability, and climate, significantly impacting market dynamics by introducing cutting-edge TIC solutions.

Strategic Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market Outlook

The future outlook for the TIC market in the Agriculture & Food Industry is promising, with significant growth potential driven by technological advancements and increasing regulatory requirements. Strategic opportunities lie in the adoption of AI, IoT, and blockchain technologies to enhance service offerings. Companies that focus on innovation and sustainability will be well-positioned to capitalize on emerging market trends. The demand for outsourced TIC services is expected to continue growing, offering opportunities for expansion and service diversification.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. Sourcing Type

- 2.1. Outsourced

- 2.2. In-House

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East and Africa

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market for the Agriculture & Food Industry

Testing, Inspection, and Certification Market for the Agriculture & Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Strict Regulations Imposed by the Government; Need for High Reliability and Compliance

- 3.3. Market Restrains

- 3.3.1. Lack of Common Global Standards and Industry Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Packaged Food to Drive the Demand for TIC Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.2.1. Outsourced

- 5.2.2. In-House

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.2.1. Outsourced

- 6.2.2. In-House

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.2.1. Outsourced

- 7.2.2. In-House

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.2.1. Outsourced

- 8.2.2. In-House

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.2.1. Outsourced

- 9.2.2. In-House

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 10.2.1. Outsourced

- 10.2.2. In-House

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FARE Labs Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMARC Public Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cotecna Inspection SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MISTRAS Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AIM Control Inspection Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AsureQuality Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kiwa Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Applus+ Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TUV SUD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 5: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 6: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 11: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 12: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 17: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 18: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 23: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 24: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 29: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 30: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 10: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 11: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 18: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 25: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 26: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Mexico Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 31: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 32: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

Key companies in the market include Intertek Group Plc, FARE Labs Pvt Ltd, AMARC Public Co Ltd, SGS SA, Cotecna Inspection SA, MISTRAS Group Inc , AIM Control Inspection Group, AsureQuality Limited, Bureau Veritas, Kiwa Ltd, Applus+ Group, TUV SUD.

3. What are the main segments of the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

The market segments include Service Type, Sourcing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Strict Regulations Imposed by the Government; Need for High Reliability and Compliance.

6. What are the notable trends driving market growth?

Increasing Consumption of Packaged Food to Drive the Demand for TIC Services.

7. Are there any restraints impacting market growth?

Lack of Common Global Standards and Industry Regulations.

8. Can you provide examples of recent developments in the market?

March 2022 - Bureau Veritas, a leading TIC service provider, opened its fifth Canadian Microbiology Laboratory in Winnipeg, Manitoba. The new laboratory will offer Rapid Pathogen testing (E.coli O157:H7, Salmonella & Listeria) and Indicators (Generic E.coli/Coliforms, Total Plate Count, Yeast & Mold). Expanding the company's food testing and certification business in Canada further enhanced its food safety and quality laboratory testing capabilities across the North American region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market for the Agriculture & Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence