Key Insights

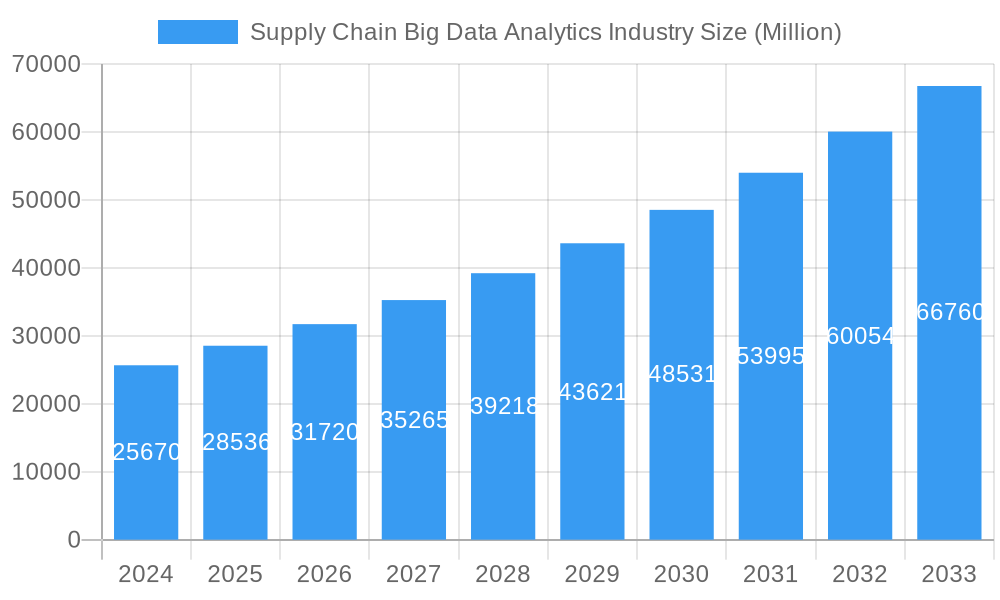

The Supply Chain Big Data Analytics market is poised for substantial growth, projected to reach $25.67 billion in 2024 and expand at a robust Compound Annual Growth Rate (CAGR) of 11.4% through 2033. This expansion is fueled by the increasing need for organizations to gain deeper insights into their complex supply chain operations. The ability to leverage big data analytics empowers businesses to optimize inventory management, enhance demand forecasting accuracy, streamline logistics, and improve overall operational efficiency. Key drivers include the growing adoption of advanced analytics technologies, the proliferation of IoT devices generating vast amounts of supply chain data, and the persistent demand for real-time visibility and predictive capabilities to mitigate risks and improve decision-making in an increasingly volatile global marketplace. The market is segmented by solutions like Supply Chain Procurement and Planning Tools, Sales and Operations Planning, Manufacturing Analytics, and Transportation and Logistics Analytics, all contributing to a more agile and responsive supply chain.

Supply Chain Big Data Analytics Industry Market Size (In Billion)

Further bolstering this growth are the diverse end-user industries actively investing in these solutions. Retail, Transportation and Logistics, and Manufacturing sectors are leading the charge, driven by intense competition and the need to deliver products efficiently and cost-effectively. The healthcare sector is also increasingly recognizing the value of supply chain analytics for critical drug and equipment management. While the market is characterized by significant growth opportunities, potential restraints such as data privacy concerns, the complexity of integrating disparate data sources, and the shortage of skilled data analytics professionals could pose challenges. However, the ongoing evolution of cloud-based analytics platforms and the increasing availability of specialized services like professional support and maintenance are expected to mitigate these issues, paving the way for sustained and dynamic market expansion.

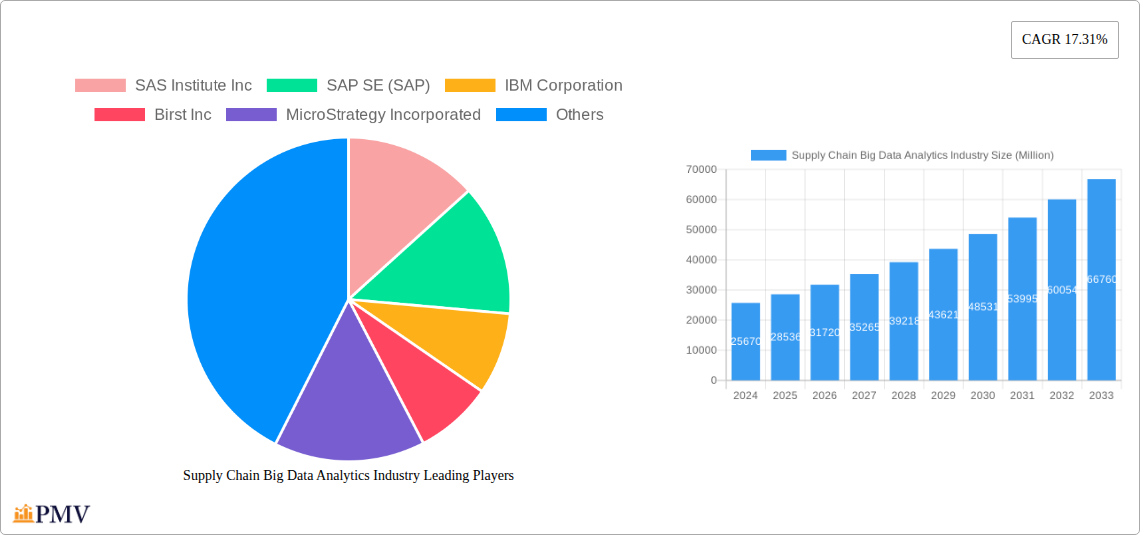

Supply Chain Big Data Analytics Industry Company Market Share

Supply Chain Big Data Analytics Industry: Comprehensive Market Analysis and Forecast (2019–2033)

Gain unparalleled insights into the Supply Chain Big Data Analytics Industry with this in-depth report. Covering the historical period of 2019–2024 and projecting market dynamics through 2033, with a base year of 2025, this analysis provides a strategic roadmap for navigating the evolving landscape of supply chain optimization, predictive analytics, and intelligent logistics. Discover the key market drivers, dominant segments, and competitive strategies shaping the future of supply chain technology and data-driven decision-making. The report delves into a market valued in the hundreds of billions, projecting significant growth driven by the increasing adoption of AI in supply chain management and IoT for supply chain visibility.

Supply Chain Big Data Analytics Industry Market Structure & Competitive Dynamics

The Supply Chain Big Data Analytics Industry is characterized by a dynamic and moderately concentrated market structure. Leading players like SAS Institute Inc, SAP SE, IBM Corporation, and Oracle Corporation command significant market share, leveraging their extensive portfolios in enterprise resource planning (ERP) and business intelligence (BI) solutions. Innovation ecosystems are thriving, with a strong emphasis on artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) integration to enhance supply chain visibility and predictive capabilities. Regulatory frameworks are increasingly focused on data privacy and security, influencing the development and deployment of supply chain analytics solutions. Product substitutes are emerging from niche players offering specialized functionalities, but established vendors maintain an advantage through integrated platforms. End-user trends indicate a strong demand for solutions that improve demand forecasting, optimize inventory management, and enhance transportation and logistics analytics. Mergers and acquisitions (M&A) are a significant feature of the competitive landscape, with recent deal values in the billions, as companies like Accenture acquire specialized consultancies to bolster their supply chain consulting and smart logistics offerings. For instance, Accenture's acquisition of MacGregor Partner in September 2022 exemplifies this trend, strengthening their capabilities in intelligent logistics and warehouse administration. The overall market capitalization is projected to reach hundreds of billions within the forecast period, driven by continuous technological advancements and strategic consolidation.

- Market Concentration: Moderately concentrated with a few dominant global players.

- Innovation Ecosystem: Driven by AI, ML, IoT, and cloud-based analytics platforms.

- Regulatory Landscape: Evolving data privacy and security regulations impact solution design.

- Product Substitutes: Niche solutions offering specialized functionalities are emerging.

- End-User Trends: Growing demand for predictive analytics, real-time visibility, and automation.

- M&A Activities: High-value transactions (billions) for strategic market expansion and capability enhancement.

Supply Chain Big Data Analytics Industry Industry Trends & Insights

The Supply Chain Big Data Analytics Industry is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) in the billions. This expansion is fueled by a confluence of compelling market growth drivers, including the escalating complexity of global supply chains, the imperative for enhanced operational efficiency, and the increasing adoption of digital transformation initiatives across industries. Technological disruptions are at the forefront, with advancements in artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) technologies revolutionizing how organizations collect, process, and derive actionable insights from vast amounts of supply chain data. The proliferation of sensors and connected devices across warehouses, transportation networks, and manufacturing floors is generating unprecedented volumes of real-time data, enabling more precise supply chain visibility and fostering a proactive approach to problem-solving.

Consumer preferences are also playing a crucial role, with customers demanding faster delivery times, greater transparency in product sourcing, and personalized experiences. This necessitates sophisticated supply chain planning tools and demand forecasting solutions capable of adapting to rapidly shifting market dynamics. Furthermore, the competitive landscape is characterized by intense innovation, with companies striving to differentiate themselves by offering advanced supply chain analytics platforms, procurement optimization tools, and transportation management systems. The shift towards cloud-based analytics solutions is enabling greater scalability, accessibility, and cost-effectiveness for businesses of all sizes. The integration of Sales and Operations Planning (S&OP) with big data analytics is becoming a critical differentiator, allowing for more synchronized and agile decision-making across the entire value chain. The market penetration of these advanced analytics solutions is steadily increasing, with organizations increasingly recognizing the substantial return on investment (ROI) achievable through optimized inventory management, reduced waste, and improved customer satisfaction. Industry developments, such as Microsoft's unveiling of the Microsoft Supply Chain System in November 2022, highlight the strategic focus on integrated, open platforms leveraging AI for data estate optimization. The overall market valuation is projected to reach hundreds of billions by the end of the forecast period, underscoring the strategic importance of big data analytics in modern supply chain management.

Dominant Markets & Segments in Supply Chain Big Data Analytics Industry

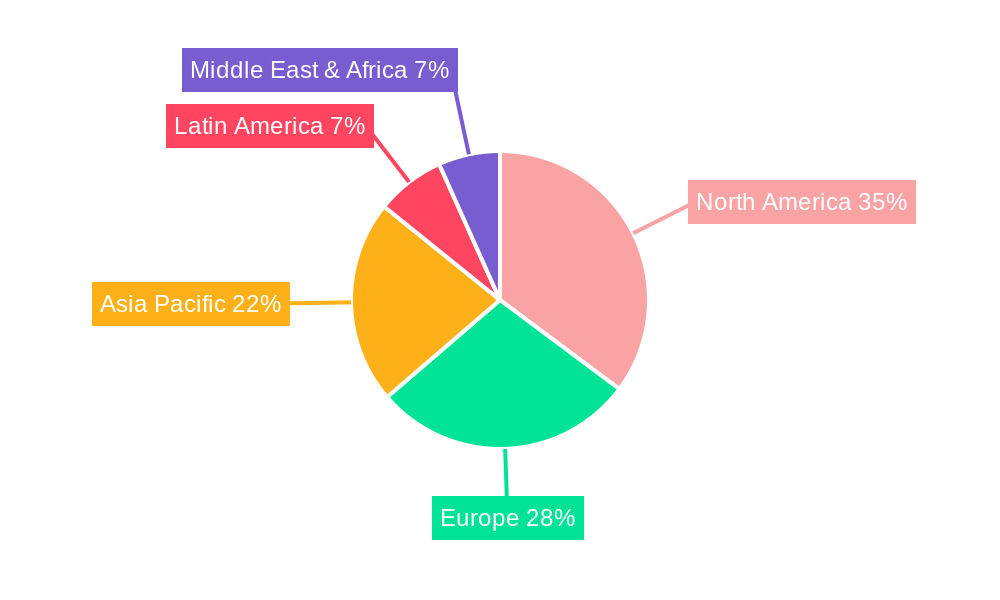

The Supply Chain Big Data Analytics Industry exhibits distinct dominance across various geographical regions, segments, and end-user industries, underscoring its pervasive impact on global commerce. North America currently leads in market penetration and adoption, driven by a mature technological infrastructure, a high concentration of global enterprises, and significant investments in supply chain innovation and digital transformation. The United States, in particular, stands out due to its extensive manufacturing base, sophisticated retail sector, and advanced logistics networks, which necessitate and benefit immensely from sophisticated supply chain analytics.

Within the Type: Solution segmentation, Supply Chain Procurement and Planning Tools and Transportation and Logistics Analytics are emerging as the dominant segments. The increasing global trade complexity, the volatility of raw material prices, and the growing emphasis on ethical sourcing are driving the demand for advanced procurement analytics and supply chain planning software. Simultaneously, the need for real-time tracking, route optimization, and efficient fleet management is propelling the growth of transportation and logistics analytics solutions. These solutions are critical for managing the intricate flow of goods and minimizing costs.

The Service segment sees Professional Services taking the lead. This is attributed to the inherent complexity of implementing and customizing big data analytics solutions within existing supply chain frameworks. Businesses require expert guidance in data integration, model development, and strategic deployment to derive maximum value.

In terms of End User, the Retail and Transportation and Logistics sectors are the primary growth engines. Retailers are under immense pressure to meet evolving consumer expectations for speed, accuracy, and transparency, making supply chain data analytics indispensable for inventory management, demand forecasting, and personalized customer experiences. The Transportation and Logistics industry, by its very nature, relies heavily on efficient data management for route optimization, carrier selection, and freight cost reduction. The Manufacturing sector is also a significant adopter, leveraging analytics for production scheduling, quality control, and predictive maintenance.

Key drivers underpinning this dominance include robust economic policies that foster technological adoption, substantial investments in digital infrastructure, and the continuous pursuit of competitive advantages through operational excellence. The market is projected to see continued growth in these dominant segments, with total market value reaching hundreds of billions globally by 2033.

- Leading Region: North America (driven by the USA).

- Dominant Solution Segments:

- Supply Chain Procurement and Planning Tools: Driven by global trade complexity and cost optimization needs.

- Transportation and Logistics Analytics: Essential for real-time tracking, route optimization, and cost reduction.

- Dominant Service Segment:

- Professional Services: Crucial for complex implementation and strategic deployment.

- Dominant End Users:

- Retail: Essential for meeting consumer expectations of speed, accuracy, and transparency.

- Transportation and Logistics: Relies on efficient data for operations and cost management.

- Key Drivers: Favorable economic policies, advanced digital infrastructure, pursuit of operational excellence.

Supply Chain Big Data Analytics Industry Product Innovations

Product innovations in the Supply Chain Big Data Analytics Industry are increasingly focused on developing intelligent, AI-driven platforms that offer end-to-end visibility and predictive capabilities. Companies are integrating machine learning algorithms for enhanced demand forecasting, anomaly detection, and proactive risk mitigation. Solutions are becoming more modular and interoperable, allowing businesses to integrate specialized analytics tools into their existing supply chain ecosystems. The emphasis is on user-friendly interfaces that empower a wider range of users, not just data scientists, to derive actionable insights. Key competitive advantages are emerging from real-time data processing, sophisticated scenario planning, and the ability to automate complex decision-making processes. The market is witnessing a rise in cloud-native solutions, offering scalability and accessibility.

Report Segmentation & Scope

This report provides a comprehensive analysis of the Supply Chain Big Data Analytics Industry across key segmentation criteria. The Type: Solution segment is meticulously analyzed, including Supply Chain Procurement and Planning Tools, Sales and Operations Planning (S&OP), Manufacturing Analytics, Transportation and Logistics Analytics, and Other Solutions. The Service segment encompasses Professional Service and Support and Maintenance Service. Furthermore, the End User segmentation covers Retail, Transportation and Logistics, Manufacturing, Healthcare, and Other End Users. Each segment's market size, growth projections in the billions, and competitive dynamics are detailed within the forecast period of 2025–2033.

- Type: Solution: Includes detailed analysis of procurement and planning tools, S&OP, manufacturing analytics, and transportation & logistics analytics.

- Service: Covers professional services and ongoing support and maintenance.

- End User: Focuses on key industries such as retail, transportation, logistics, manufacturing, and healthcare.

Key Drivers of Supply Chain Big Data Analytics Industry Growth

The Supply Chain Big Data Analytics Industry is propelled by several key drivers, primarily stemming from the imperative to enhance efficiency and agility in increasingly complex global networks. Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), enable more sophisticated predictive analytics, optimized inventory management, and proactive risk identification. The growing adoption of the Internet of Things (IoT) is generating a wealth of real-time data, offering unprecedented visibility into supply chain operations. Economically, the desire for cost reduction, waste minimization, and improved resource allocation directly fuels the demand for data-driven insights. Regulatory shifts, while sometimes posing challenges, also drive adoption as companies seek compliant and transparent supply chains. The pursuit of competitive advantage through superior supply chain performance remains a paramount driver for investment in these advanced analytics solutions.

Challenges in the Supply Chain Big Data Analytics Industry Sector

Despite its robust growth, the Supply Chain Big Data Analytics Industry faces several challenges. A significant hurdle is the complexity and cost of integrating disparate data sources from various points in the supply chain. Ensuring data quality and integrity across these sources is paramount but often difficult to achieve. Furthermore, a shortage of skilled data scientists and analytics professionals can impede the effective implementation and utilization of these advanced solutions. Cybersecurity threats and data privacy concerns pose significant risks, requiring robust security measures and adherence to evolving regulations. Finally, the resistance to change within traditional supply chain organizations can slow down the adoption of new technologies and data-driven decision-making processes, impacting the market's full potential, estimated in the billions.

Leading Players in the Supply Chain Big Data Analytics Industry Market

- SAS Institute Inc

- SAP SE

- IBM Corporation

- Birst Inc

- MicroStrategy Incorporated

- Salesforce com Inc (Tableau Software Inc)

- Capgemini Group

- Sage Clarity Systems

- Oracle Corporation

- Kinaxis Inc

- Genpact Limited

Key Developments in Supply Chain Big Data Analytics Industry Sector

- September 2022: Accenture announced the acquisition of MacGregor Partner, a prominent supply chain consultant and technology supplier specializing in smart logistics and warehouse administration. This strategic move enhances Accenture's capabilities in intelligent logistics and warehouse management, further strengthening its supply chain network powered by Blue Yonder technology.

- November 2022: o9 Solutions and Genpact collaborated to facilitate a digitization process for Eckes - Granini, a major European provider of fruit drinks and beverages. This partnership aims to eliminate information silos and streamline operations for Eckes - Granini's worldwide supply chain, leveraging AI software platforms for decision-making and planning.

- November 2022: Microsoft Corp. unveiled the Microsoft Supply Chain System. This comprehensive platform is designed to help enterprises optimize their supply chain data estate investments through an open approach, integrating Microsoft AI, low-code capabilities, enhanced security, collaboration tools, and SaaS applications.

Strategic Supply Chain Big Data Analytics Industry Market Outlook

The strategic outlook for the Supply Chain Big Data Analytics Industry is exceptionally strong, with continued expansion driven by the relentless pursuit of end-to-end supply chain visibility and agility. Future growth accelerators include the increasing adoption of AI and ML for predictive maintenance, autonomous decision-making, and hyper-personalized logistics. The integration of advanced analytics with blockchain technology offers promising avenues for enhanced traceability and security. Strategic opportunities lie in developing more integrated and scalable cloud-based solutions that cater to the specific needs of diverse industries, from e-commerce to healthcare. As organizations globally recognize the critical role of data-driven insights in navigating volatility and achieving operational excellence, the market is poised for substantial growth, expected to reach hundreds of billions.

Supply Chain Big Data Analytics Industry Segmentation

-

1. Type

-

1.1. Solution

- 1.1.1. Supply Chain Procurement and Planning Tool

- 1.1.2. Sales and Operations Planning

- 1.1.3. Manufacturing Analytics

- 1.1.4. Transportation and Logistics Analytics

- 1.1.5. Other So

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Support and Maintenance Service

-

1.1. Solution

-

2. End User

- 2.1. Retail

- 2.2. Transportation and Logistics

- 2.3. Manufacturing

- 2.4. Healthcare

- 2.5. Other End Users

Supply Chain Big Data Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Supply Chain Big Data Analytics Industry Regional Market Share

Geographic Coverage of Supply Chain Big Data Analytics Industry

Supply Chain Big Data Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need of Business Data to Improve Efficiency

- 3.3. Market Restrains

- 3.3.1. Operational Complexity Coupled with High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Retail is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solution

- 5.1.1.1. Supply Chain Procurement and Planning Tool

- 5.1.1.2. Sales and Operations Planning

- 5.1.1.3. Manufacturing Analytics

- 5.1.1.4. Transportation and Logistics Analytics

- 5.1.1.5. Other So

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Support and Maintenance Service

- 5.1.1. Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Retail

- 5.2.2. Transportation and Logistics

- 5.2.3. Manufacturing

- 5.2.4. Healthcare

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solution

- 6.1.1.1. Supply Chain Procurement and Planning Tool

- 6.1.1.2. Sales and Operations Planning

- 6.1.1.3. Manufacturing Analytics

- 6.1.1.4. Transportation and Logistics Analytics

- 6.1.1.5. Other So

- 6.1.2. Service

- 6.1.2.1. Professional Service

- 6.1.2.2. Support and Maintenance Service

- 6.1.1. Solution

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Retail

- 6.2.2. Transportation and Logistics

- 6.2.3. Manufacturing

- 6.2.4. Healthcare

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solution

- 7.1.1.1. Supply Chain Procurement and Planning Tool

- 7.1.1.2. Sales and Operations Planning

- 7.1.1.3. Manufacturing Analytics

- 7.1.1.4. Transportation and Logistics Analytics

- 7.1.1.5. Other So

- 7.1.2. Service

- 7.1.2.1. Professional Service

- 7.1.2.2. Support and Maintenance Service

- 7.1.1. Solution

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Retail

- 7.2.2. Transportation and Logistics

- 7.2.3. Manufacturing

- 7.2.4. Healthcare

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solution

- 8.1.1.1. Supply Chain Procurement and Planning Tool

- 8.1.1.2. Sales and Operations Planning

- 8.1.1.3. Manufacturing Analytics

- 8.1.1.4. Transportation and Logistics Analytics

- 8.1.1.5. Other So

- 8.1.2. Service

- 8.1.2.1. Professional Service

- 8.1.2.2. Support and Maintenance Service

- 8.1.1. Solution

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Retail

- 8.2.2. Transportation and Logistics

- 8.2.3. Manufacturing

- 8.2.4. Healthcare

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solution

- 9.1.1.1. Supply Chain Procurement and Planning Tool

- 9.1.1.2. Sales and Operations Planning

- 9.1.1.3. Manufacturing Analytics

- 9.1.1.4. Transportation and Logistics Analytics

- 9.1.1.5. Other So

- 9.1.2. Service

- 9.1.2.1. Professional Service

- 9.1.2.2. Support and Maintenance Service

- 9.1.1. Solution

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Retail

- 9.2.2. Transportation and Logistics

- 9.2.3. Manufacturing

- 9.2.4. Healthcare

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solution

- 10.1.1.1. Supply Chain Procurement and Planning Tool

- 10.1.1.2. Sales and Operations Planning

- 10.1.1.3. Manufacturing Analytics

- 10.1.1.4. Transportation and Logistics Analytics

- 10.1.1.5. Other So

- 10.1.2. Service

- 10.1.2.1. Professional Service

- 10.1.2.2. Support and Maintenance Service

- 10.1.1. Solution

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Retail

- 10.2.2. Transportation and Logistics

- 10.2.3. Manufacturing

- 10.2.4. Healthcare

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solution

- 11.1.1.1. Supply Chain Procurement and Planning Tool

- 11.1.1.2. Sales and Operations Planning

- 11.1.1.3. Manufacturing Analytics

- 11.1.1.4. Transportation and Logistics Analytics

- 11.1.1.5. Other So

- 11.1.2. Service

- 11.1.2.1. Professional Service

- 11.1.2.2. Support and Maintenance Service

- 11.1.1. Solution

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Retail

- 11.2.2. Transportation and Logistics

- 11.2.3. Manufacturing

- 11.2.4. Healthcare

- 11.2.5. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SAS Institute Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAP SE (SAP)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Birst Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MicroStrategy Incorporated

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Salesforce com Inc (Tableau Software Inc )

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Capgemini Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sage Clarity Systems

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Oracle Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kinaxis Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Genpact Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Supply Chain Big Data Analytics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Latin America Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 33: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Italy Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 19: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 27: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Mexico Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Brazil Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 37: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: South Africa Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Supply Chain Big Data Analytics Industry?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Supply Chain Big Data Analytics Industry?

Key companies in the market include SAS Institute Inc, SAP SE (SAP), IBM Corporation, Birst Inc, MicroStrategy Incorporated, Salesforce com Inc (Tableau Software Inc ), Capgemini Group, Sage Clarity Systems, Oracle Corporation, Kinaxis Inc *List Not Exhaustive, Genpact Limited.

3. What are the main segments of the Supply Chain Big Data Analytics Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need of Business Data to Improve Efficiency.

6. What are the notable trends driving market growth?

Retail is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Operational Complexity Coupled with High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

September 2022: Accenture announced the acquisition of MacGregor Partner, a prominent supply chain consultant and technology supplier specializing in smart logistics and warehouse administration. It is an intelligent logistics and warehouse management company, as well as a supply chain consultant and technology supplier. Accenture's supply chain network, powered by Blue Yonder technology, has grown due to the acquisition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Supply Chain Big Data Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Supply Chain Big Data Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Supply Chain Big Data Analytics Industry?

To stay informed about further developments, trends, and reports in the Supply Chain Big Data Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence