Key Insights

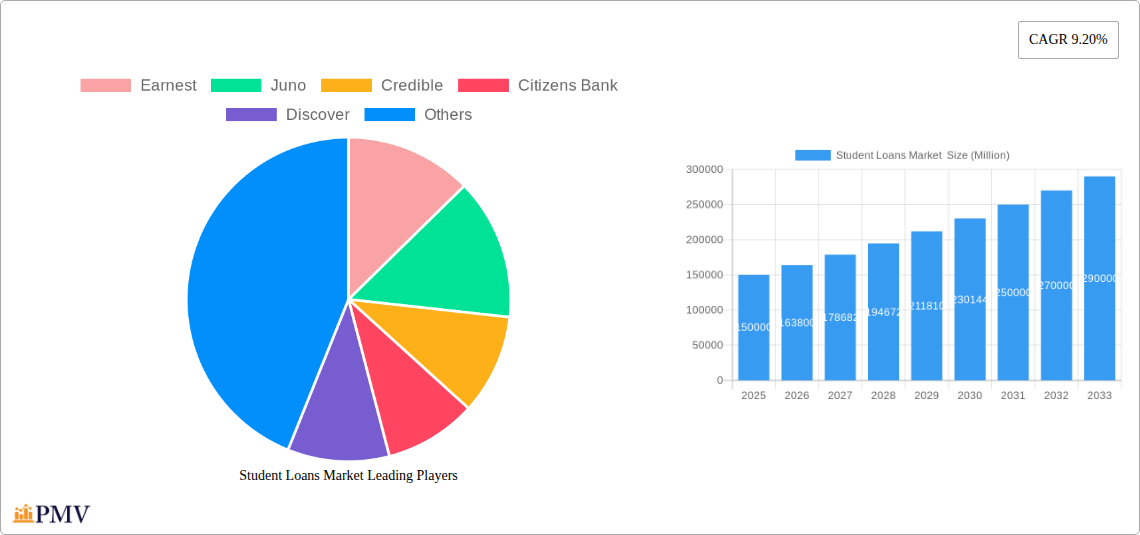

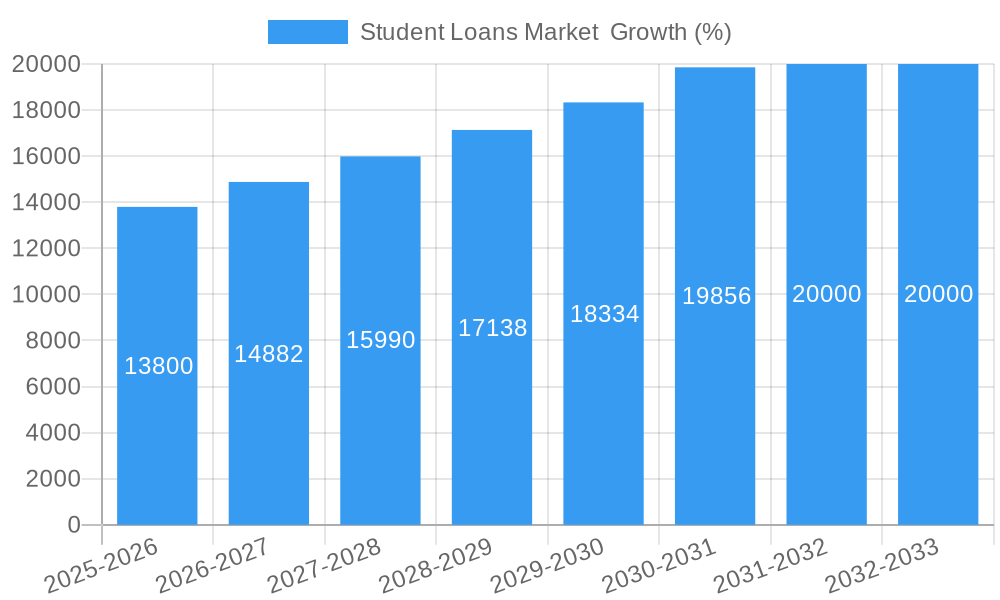

The student loan market, currently experiencing robust growth, is projected to maintain a significant expansion over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 9.20% suggests a substantial increase in market value. Several factors drive this growth, including rising higher education costs, increased student enrollment, and the availability of various loan products catering to diverse student needs. The increasing prevalence of private student loans, alongside government-backed options, fuels market expansion. Technological advancements, such as online loan applications and streamlined repayment options, also contribute to market expansion. However, factors such as fluctuating interest rates, stringent lending criteria, and concerns over student loan debt burdens represent challenges. The market is segmented based on loan type (federal, private, etc.), repayment plans, and borrower demographics. Key players like Earnest, Juno, Credible, Citizens Bank, Discover, Mpower, Prodigy, Federal Student Aid, Sallie Mae, and College Ave compete in this dynamic landscape, constantly innovating to attract and retain customers. Competition is fierce, leading to innovative product offerings and competitive pricing strategies.

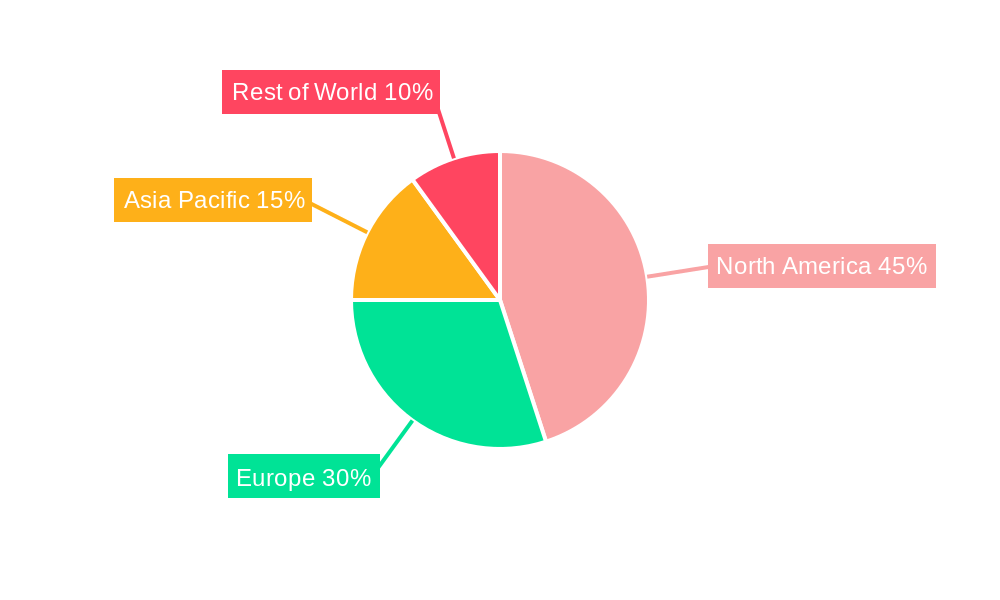

The market's future trajectory hinges on several critical factors. Government policies regarding student loan forgiveness or interest rate adjustments will profoundly impact market dynamics. Economic fluctuations and employment rates also influence borrower repayment capabilities and subsequent demand for new loans. Technological disruptions, including the adoption of AI and machine learning in loan processing and risk assessment, will reshape the market landscape. Furthermore, shifts in student demographics and evolving educational choices will influence the demand for student loans. To remain competitive, players must adapt to evolving regulatory landscapes, leverage technological advances, and effectively manage risks associated with lending in this sector. The market exhibits significant regional variations, with North America and Europe likely holding dominant market shares, although specific data is needed for precise quantification. Market penetration will likely increase in developing economies as access to higher education expands.

Student Loans Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Student Loans Market from 2019 to 2033, encompassing market structure, competitive dynamics, industry trends, and future projections. The study period covers 2019-2024 (historical period), with 2025 as the base and estimated year, and a forecast period extending to 2033. The report offers actionable insights for industry stakeholders, investors, and policymakers, revealing a market poised for significant growth and transformation. The total market size in 2025 is estimated at $xx Million.

Student Loans Market Market Structure & Competitive Dynamics

The Student Loans Market exhibits a complex structure characterized by a mix of public and private lenders, varying levels of market concentration across different geographical regions, and a dynamic competitive landscape shaped by technological innovation and regulatory changes. The market is segmented by loan type (federal, private), borrower type (undergraduate, graduate), and loan repayment plans (income-driven, standard). Market concentration is moderate, with a few major players holding significant market share, alongside numerous smaller regional and niche players.

Key aspects analyzed include:

- Market Concentration: The top 5 players (Sallie Mae, Discover, College Ave, Citizens Bank, Earnest) hold an estimated xx% market share in the US in 2025. Global market concentration is lower due to diverse regional regulations and lender landscapes.

- Innovation Ecosystems: Fintech companies are driving innovation, introducing AI-powered risk assessment, personalized repayment plans, and streamlined application processes.

- Regulatory Frameworks: Government regulations, particularly around interest rates, loan forgiveness programs, and consumer protection, significantly influence market dynamics. Changes in these frameworks can lead to substantial shifts in market share and profitability.

- Product Substitutes: Savings plans, scholarships, and grants represent potential substitutes for student loans. The increasing availability of alternative funding sources could impact market growth.

- End-User Trends: Growing student debt burdens and increasing awareness of financial literacy are shaping borrower behavior and influencing demand for specific loan products.

- M&A Activities: The last five years have witnessed several significant M&A transactions within the Student Loans Market, with a total deal value exceeding $xx Million in 2024, driving consolidation and market reshaping. These transactions are primarily driven by the need for expansion into new markets and the acquisition of technological capabilities.

Student Loans Market Industry Trends & Insights

The Student Loans Market is experiencing robust growth driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Rising higher education costs, increasing student enrollment, and evolving consumer preferences are fueling market expansion.

- Market Growth Drivers: The rising cost of higher education is a primary driver, compelling more students to seek financing options. Technological advancements are also contributing significantly by streamlining processes, improving accessibility, and creating new financial products.

- Technological Disruptions: Fintech companies are transforming the sector through the use of AI, machine learning, and blockchain technology to enhance efficiency, customer service, and risk management.

- Consumer Preferences: Consumers are increasingly demanding personalized loan offerings, flexible repayment plans, and transparent pricing. This is pushing lenders to innovate and develop new products that cater to diverse needs and preferences.

- Competitive Dynamics: Competition is fierce, with established lenders facing challenges from innovative fintech startups and alternative lending platforms.

Dominant Markets & Segments in Student Loans Market

The United States currently dominates the global Student Loans Market, accounting for a significant share of the total market value ($xx Million in 2025). This dominance is attributed to several factors:

- Key Drivers for US Dominance:

- High cost of higher education

- Extensive higher education infrastructure

- Well-established financial institutions and regulatory frameworks

- Large student population

This analysis provides a detailed breakdown of the US market, including regional variations, alongside analysis of growth potential in other key markets like Canada, the UK, and Australia. Further analysis of market dominance considers factors like the concentration of higher education institutions, population demographics and government policies related to student financing.

Student Loans Market Product Innovations

Recent product innovations include AI-driven credit scoring systems, personalized repayment options, and digital loan applications aimed at enhancing accessibility and affordability. Innovative platforms leverage technology to improve the customer experience and provide tailored financial solutions, improving market fit and customer satisfaction. These innovations are reshaping competitive dynamics and driving market growth.

Report Segmentation & Scope

This report segments the Student Loans Market based on several key criteria:

- By Loan Type: Federal Student Loans and Private Student Loans. Private student loans are projected to see a CAGR of xx% driven by unmet demand.

- By Borrower Type: Undergraduate and Graduate students. Graduate students are a higher-growth segment due to the increased cost of postgraduate education.

- By Repayment Plan: Standard repayment plans and income-driven repayment plans.

- By Region: North America, Europe, Asia-Pacific, and Rest of the World.

Key Drivers of Student Loans Market Growth

Several factors contribute to the growth of this market:

- Rising Higher Education Costs: The steadily increasing cost of tuition, fees, and living expenses drives demand for student loans.

- Increased Student Enrollment: The continued growth in the number of students pursuing higher education fuels market expansion.

- Government Policies: Government initiatives supporting student access to higher education through loan programs and grants influence market growth.

Challenges in the Student Loans Market Sector

The Student Loans Market faces several challenges:

- High Student Debt Burden: The significant accumulation of student loan debt poses a major societal and economic challenge, impacting market sustainability.

- Regulatory Scrutiny: Stringent regulations and evolving compliance requirements present challenges for lenders.

- Economic Downturns: Economic recessions can lead to increased loan defaults and negatively impact market profitability.

Leading Players in the Student Loans Market Market

- Earnest

- Juno

- Credible

- Citizens Bank

- Discover

- Mpower

- Prodigy

- Federal Student Aid

- Sallie Mae

- College Ave

Key Developments in Student Loans Market Sector

- October 2023: Discover launched its "Especially for Everyone" brand campaign, featuring Jennifer Coolidge, marking its entry into promoting deposit products. This significantly expands Discover's market presence and brand appeal, potentially attracting new customer segments.

- July 2023: Earnest partnered with Nova Credit to offer International Private Student Loans, expanding its market reach and addressing an underserved segment of international students. This move enhances Earnest's competitive position and boosts market share among international students.

Strategic Student Loans Market Market Outlook

The Student Loans Market is poised for continued growth, driven by persistent increases in higher education costs and evolving technological capabilities. Strategic opportunities exist for lenders to leverage innovative technologies, improve customer experiences, and develop customized products catering to specific borrower segments. The market's future trajectory depends on managing the challenges posed by rising student debt levels and adapting to shifts in regulatory frameworks. New entrants and innovative business models are expected to further reshape the market landscape over the forecast period.

Student Loans Market Segmentation

-

1. Type

- 1.1. Federal/Government Loan

- 1.2. Private Loan

-

2. Repayment Plan

- 2.1. Standard Repayment Plan

- 2.2. Graduated Repayment Plan

- 2.3. Revised Pay As You Earn (REPAYE)

- 2.4. Income-based (IBR)

- 2.5. Other Repayment Plans

-

3. Age Group

- 3.1. 24 or Younger

- 3.2. 25 to 34

- 3.3. Above 35

-

4. End User

- 4.1. Graduate Students

- 4.2. High School Student

- 4.3. Other End-Users

Student Loans Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Student Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market

- 3.4. Market Trends

- 3.4.1. High Education Costs is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Student Loans Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Federal/Government Loan

- 5.1.2. Private Loan

- 5.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 5.2.1. Standard Repayment Plan

- 5.2.2. Graduated Repayment Plan

- 5.2.3. Revised Pay As You Earn (REPAYE)

- 5.2.4. Income-based (IBR)

- 5.2.5. Other Repayment Plans

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. 24 or Younger

- 5.3.2. 25 to 34

- 5.3.3. Above 35

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Graduate Students

- 5.4.2. High School Student

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Student Loans Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Federal/Government Loan

- 6.1.2. Private Loan

- 6.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 6.2.1. Standard Repayment Plan

- 6.2.2. Graduated Repayment Plan

- 6.2.3. Revised Pay As You Earn (REPAYE)

- 6.2.4. Income-based (IBR)

- 6.2.5. Other Repayment Plans

- 6.3. Market Analysis, Insights and Forecast - by Age Group

- 6.3.1. 24 or Younger

- 6.3.2. 25 to 34

- 6.3.3. Above 35

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Graduate Students

- 6.4.2. High School Student

- 6.4.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Student Loans Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Federal/Government Loan

- 7.1.2. Private Loan

- 7.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 7.2.1. Standard Repayment Plan

- 7.2.2. Graduated Repayment Plan

- 7.2.3. Revised Pay As You Earn (REPAYE)

- 7.2.4. Income-based (IBR)

- 7.2.5. Other Repayment Plans

- 7.3. Market Analysis, Insights and Forecast - by Age Group

- 7.3.1. 24 or Younger

- 7.3.2. 25 to 34

- 7.3.3. Above 35

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Graduate Students

- 7.4.2. High School Student

- 7.4.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Student Loans Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Federal/Government Loan

- 8.1.2. Private Loan

- 8.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 8.2.1. Standard Repayment Plan

- 8.2.2. Graduated Repayment Plan

- 8.2.3. Revised Pay As You Earn (REPAYE)

- 8.2.4. Income-based (IBR)

- 8.2.5. Other Repayment Plans

- 8.3. Market Analysis, Insights and Forecast - by Age Group

- 8.3.1. 24 or Younger

- 8.3.2. 25 to 34

- 8.3.3. Above 35

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Graduate Students

- 8.4.2. High School Student

- 8.4.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Student Loans Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Federal/Government Loan

- 9.1.2. Private Loan

- 9.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 9.2.1. Standard Repayment Plan

- 9.2.2. Graduated Repayment Plan

- 9.2.3. Revised Pay As You Earn (REPAYE)

- 9.2.4. Income-based (IBR)

- 9.2.5. Other Repayment Plans

- 9.3. Market Analysis, Insights and Forecast - by Age Group

- 9.3.1. 24 or Younger

- 9.3.2. 25 to 34

- 9.3.3. Above 35

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Graduate Students

- 9.4.2. High School Student

- 9.4.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Student Loans Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Federal/Government Loan

- 10.1.2. Private Loan

- 10.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 10.2.1. Standard Repayment Plan

- 10.2.2. Graduated Repayment Plan

- 10.2.3. Revised Pay As You Earn (REPAYE)

- 10.2.4. Income-based (IBR)

- 10.2.5. Other Repayment Plans

- 10.3. Market Analysis, Insights and Forecast - by Age Group

- 10.3.1. 24 or Younger

- 10.3.2. 25 to 34

- 10.3.3. Above 35

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Graduate Students

- 10.4.2. High School Student

- 10.4.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Earnest

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Juno

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Credible

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Citizens Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Discover

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mpower

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Prodigy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Federal Student Aid

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sallie Mae

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 College Ave**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Earnest

List of Figures

- Figure 1: Global Student Loans Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Student Loans Market Revenue (Million), by Type 2024 & 2032

- Figure 3: North America Student Loans Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Student Loans Market Revenue (Million), by Repayment Plan 2024 & 2032

- Figure 5: North America Student Loans Market Revenue Share (%), by Repayment Plan 2024 & 2032

- Figure 6: North America Student Loans Market Revenue (Million), by Age Group 2024 & 2032

- Figure 7: North America Student Loans Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 8: North America Student Loans Market Revenue (Million), by End User 2024 & 2032

- Figure 9: North America Student Loans Market Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America Student Loans Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Student Loans Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Student Loans Market Revenue (Million), by Type 2024 & 2032

- Figure 13: South America Student Loans Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America Student Loans Market Revenue (Million), by Repayment Plan 2024 & 2032

- Figure 15: South America Student Loans Market Revenue Share (%), by Repayment Plan 2024 & 2032

- Figure 16: South America Student Loans Market Revenue (Million), by Age Group 2024 & 2032

- Figure 17: South America Student Loans Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 18: South America Student Loans Market Revenue (Million), by End User 2024 & 2032

- Figure 19: South America Student Loans Market Revenue Share (%), by End User 2024 & 2032

- Figure 20: South America Student Loans Market Revenue (Million), by Country 2024 & 2032

- Figure 21: South America Student Loans Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Student Loans Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Student Loans Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Student Loans Market Revenue (Million), by Repayment Plan 2024 & 2032

- Figure 25: Europe Student Loans Market Revenue Share (%), by Repayment Plan 2024 & 2032

- Figure 26: Europe Student Loans Market Revenue (Million), by Age Group 2024 & 2032

- Figure 27: Europe Student Loans Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 28: Europe Student Loans Market Revenue (Million), by End User 2024 & 2032

- Figure 29: Europe Student Loans Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe Student Loans Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Student Loans Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa Student Loans Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East & Africa Student Loans Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East & Africa Student Loans Market Revenue (Million), by Repayment Plan 2024 & 2032

- Figure 35: Middle East & Africa Student Loans Market Revenue Share (%), by Repayment Plan 2024 & 2032

- Figure 36: Middle East & Africa Student Loans Market Revenue (Million), by Age Group 2024 & 2032

- Figure 37: Middle East & Africa Student Loans Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 38: Middle East & Africa Student Loans Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East & Africa Student Loans Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East & Africa Student Loans Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East & Africa Student Loans Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Asia Pacific Student Loans Market Revenue (Million), by Type 2024 & 2032

- Figure 43: Asia Pacific Student Loans Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: Asia Pacific Student Loans Market Revenue (Million), by Repayment Plan 2024 & 2032

- Figure 45: Asia Pacific Student Loans Market Revenue Share (%), by Repayment Plan 2024 & 2032

- Figure 46: Asia Pacific Student Loans Market Revenue (Million), by Age Group 2024 & 2032

- Figure 47: Asia Pacific Student Loans Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 48: Asia Pacific Student Loans Market Revenue (Million), by End User 2024 & 2032

- Figure 49: Asia Pacific Student Loans Market Revenue Share (%), by End User 2024 & 2032

- Figure 50: Asia Pacific Student Loans Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Student Loans Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Student Loans Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Student Loans Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Student Loans Market Revenue Million Forecast, by Repayment Plan 2019 & 2032

- Table 4: Global Student Loans Market Revenue Million Forecast, by Age Group 2019 & 2032

- Table 5: Global Student Loans Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Student Loans Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Student Loans Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global Student Loans Market Revenue Million Forecast, by Repayment Plan 2019 & 2032

- Table 9: Global Student Loans Market Revenue Million Forecast, by Age Group 2019 & 2032

- Table 10: Global Student Loans Market Revenue Million Forecast, by End User 2019 & 2032

- Table 11: Global Student Loans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Student Loans Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Student Loans Market Revenue Million Forecast, by Repayment Plan 2019 & 2032

- Table 17: Global Student Loans Market Revenue Million Forecast, by Age Group 2019 & 2032

- Table 18: Global Student Loans Market Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Global Student Loans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Student Loans Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Student Loans Market Revenue Million Forecast, by Repayment Plan 2019 & 2032

- Table 25: Global Student Loans Market Revenue Million Forecast, by Age Group 2019 & 2032

- Table 26: Global Student Loans Market Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Global Student Loans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Student Loans Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Student Loans Market Revenue Million Forecast, by Repayment Plan 2019 & 2032

- Table 39: Global Student Loans Market Revenue Million Forecast, by Age Group 2019 & 2032

- Table 40: Global Student Loans Market Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global Student Loans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Student Loans Market Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Student Loans Market Revenue Million Forecast, by Repayment Plan 2019 & 2032

- Table 50: Global Student Loans Market Revenue Million Forecast, by Age Group 2019 & 2032

- Table 51: Global Student Loans Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Student Loans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Student Loans Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Student Loans Market ?

The projected CAGR is approximately 9.20%.

2. Which companies are prominent players in the Student Loans Market ?

Key companies in the market include Earnest, Juno, Credible, Citizens Bank, Discover, Mpower, Prodigy, Federal Student Aid, Sallie Mae, College Ave**List Not Exhaustive.

3. What are the main segments of the Student Loans Market ?

The market segments include Type, Repayment Plan, Age Group, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market.

6. What are the notable trends driving market growth?

High Education Costs is Driving the Market.

7. Are there any restraints impacting market growth?

Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: Discover unveiled its latest national brand campaign, titled "Especially for Everyone," featuring the acclaimed actress Jennifer Coolidge. In a groundbreaking move, Coolidge will take center stage in nationwide advertising efforts, spotlighting Discover's array of benefits and products. Of notable significance, this campaign marks the company's inaugural foray into promoting a deposit product, specifically highlighting Discover's Cashback Debit Checking Account.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Student Loans Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Student Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Student Loans Market ?

To stay informed about further developments, trends, and reports in the Student Loans Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence