Key Insights

The Strategic Mineral Materials industry is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 6.3%. This growth trajectory, from a base year of 2025 with an estimated market size of $8.9 billion, is propelled by several critical factors. The rapid ascent of the electric vehicle (EV) market directly fuels demand for essential minerals like rare earth elements, crucial for battery technology and electric motor components. Concurrently, the escalating adoption of renewable energy sources, including solar and wind power, intensifies the need for minerals such as manganese and cobalt. Technological advancements across electronics and aerospace sectors further stimulate market growth by requiring specialized, high-purity mineral materials. While supply chain disruptions and geopolitical considerations present potential challenges, ongoing exploration initiatives and innovations in extraction and processing are actively mitigating these risks. Market segmentation indicates robust demand for optical and reactor-grade minerals in advanced technology applications, alongside substantial consumption of commercially graded materials by the construction and automotive industries. Leading entities such as CBMM, South32, and Glencore are strategically positioned to leverage this growth through optimized resource management, technological innovation, and strategic collaborations. The Asia-Pacific region, spearheaded by China, currently commands the market due to its extensive manufacturing capabilities and pioneering technological progress. Nevertheless, North America and Europe are anticipated to experience considerable growth, driven by substantial investments in renewable energy infrastructure and ongoing technological developments.

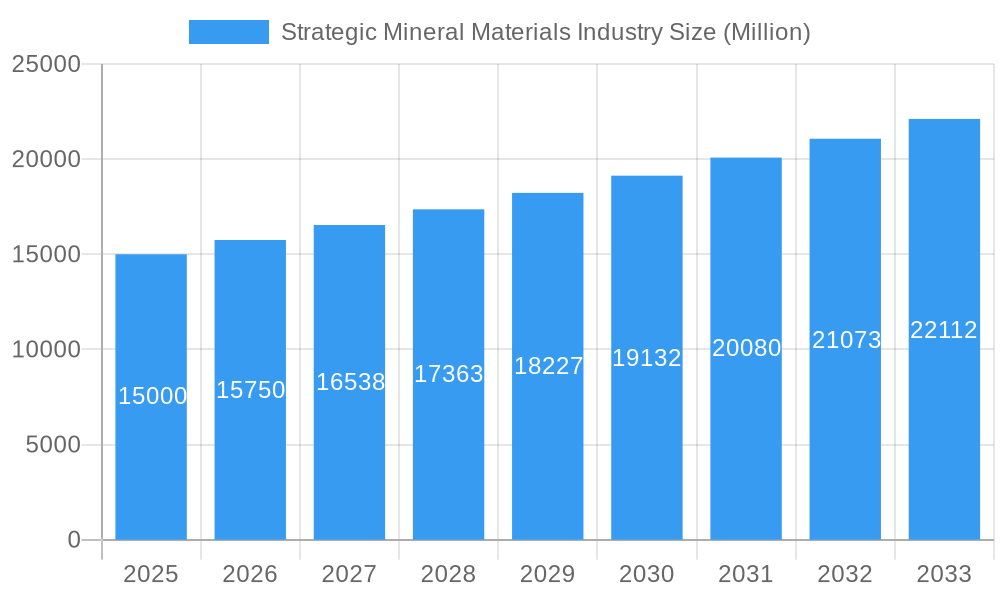

Strategic Mineral Materials Industry Market Size (In Billion)

The multifaceted applications of strategic minerals across a broad spectrum of industries guarantee enduring market demand. The industry's future trajectory is contingent upon effectively addressing sustainability imperatives, refining mining methodologies, and championing responsible sourcing to uphold a stable and ethical supply chain. This encompasses maximizing resource utilization, deploying environmentally benign extraction techniques, and advocating for the recycling and reuse of strategic minerals. Corporations are increasingly channeling investments into research and development to elevate processing efficiency, engineer viable substitutes for scarce materials, and minimize the environmental footprint of mining operations. This proactive strategy will be instrumental in sustaining long-term growth within the Strategic Mineral Materials industry while concurrently mitigating adverse environmental impacts. Government regulations emphasizing sustainable mining practices and responsible sourcing will further influence the industry's evolving landscape.

Strategic Mineral Materials Industry Company Market Share

Strategic Mineral Materials Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Strategic Mineral Materials Industry, offering invaluable insights for businesses, investors, and researchers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The report meticulously examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future growth potential, focusing on key minerals, grades, forms, and end-use industries. The report values are expressed in Millions.

Strategic Mineral Materials Industry Market Structure & Competitive Dynamics

The Strategic Mineral Materials Industry exhibits a moderately concentrated market structure, with key players such as CBMM, South32, Indium Corporation, Anglo American plc, Glencore, Vale, and Materion Corporation holding significant market share. Market concentration is influenced by factors such as economies of scale, technological expertise, and access to resources. The industry's innovation ecosystem is dynamic, with ongoing research and development efforts focused on enhancing material properties, expanding applications, and developing sustainable extraction and processing methods. Regulatory frameworks, varying across regions, significantly impact production and trade. The presence of substitute materials (e.g., alternative alloys) creates competitive pressures. End-user trends, particularly in the electric vehicle, renewable energy, and electronics sectors, are driving demand for specific mineral materials.

Significant M&A activity has been observed in recent years, with deal values exceeding xx Million in the period 2019-2024. These transactions reflect strategic efforts to consolidate market share, gain access to new technologies, and expand geographical reach. For instance, the acquisition of [Company Name] by [Company Name] in [Year] significantly impacted the market share distribution. The report provides a detailed analysis of these activities, including deal values and their impact on the competitive landscape. Further, the report delves into the market share of each major player, offering a precise picture of the current competitive balance.

Strategic Mineral Materials Industry Industry Trends & Insights

The Strategic Mineral Materials Industry is experiencing robust growth, driven by the increasing demand from diverse end-use sectors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological advancements, such as improved extraction techniques, nanomaterials development, and additive manufacturing, are significantly impacting the industry. The shift towards sustainable and environmentally friendly materials is also influencing consumer preferences, leading to increased demand for ethically sourced and recycled materials. Competitive dynamics are shaped by factors such as pricing pressures, supply chain disruptions, and technological innovation. The market penetration of new materials, particularly those with enhanced properties and applications, is accelerating. Growing adoption of electric vehicles and renewable energy technologies is bolstering demand for key materials like cobalt, lithium, and rare earth elements. Stringent environmental regulations are driving the adoption of cleaner production methods and resource efficiency. The increasing emphasis on technological advancements to improve energy efficiency and reduce environmental impact is significantly impacting market trends. This section details the evolving landscape of the strategic mineral materials market, providing actionable insights and forecasting future trajectories.

Dominant Markets & Segments in Strategic Mineral Materials Industry

- Leading Mineral: Rare Earth Elements are currently dominating the market due to their critical role in advanced technologies. High demand from the electronics and renewable energy sectors is a key driver.

- Leading Grade: High-purity grades like Optical Grade and Superconducting Grade command premium prices and are experiencing rapid growth due to their specialized applications in advanced technologies.

- Leading Form: Powder and Fines are the most widely used forms, driven by their suitability for various processing and manufacturing applications. Ingots are also gaining traction, particularly in niche applications.

- Leading End-Use Industry: The Electricals & Electronics sector is the dominant end-use industry, followed closely by the Aerospace and Automotive sectors. Growth in these sectors directly correlates with demand for strategic mineral materials.

- Leading Region/Country: [Specify the leading region/country based on your research. For example: China or the US, justifying the dominance based on factors such as resource availability, manufacturing capacity, or policy support.] This dominance is attributable to [state reasons – e.g., robust manufacturing base, substantial government investments, abundant reserves].

Key drivers for dominance vary across segments. For instance, economic policies promoting the development of high-tech industries are propelling demand in certain regions. Similarly, substantial infrastructure investments in renewable energy are increasing the demand for specific mineral materials.

Strategic Mineral Materials Industry Product Innovations

Significant advancements are occurring in material processing, leading to the development of high-purity materials with enhanced properties. Nanotechnology is enabling the creation of new materials with unique characteristics, leading to applications in high-tech electronics, aerospace, and medical devices. The focus is shifting towards eco-friendly extraction and processing techniques, minimizing environmental impact. These innovations are driving competitive advantages, creating new market opportunities, and reshaping the industrial landscape. Improved material efficiency and cost reductions further enhance their market competitiveness.

Report Segmentation & Scope

This report segments the Strategic Mineral Materials market by mineral (Antimony, Barite, Beryllium, Cobalt, Fluorspar, Gallium, Germanium, Indium, Manganese, Niobium, Platinum Group Elements, Rare Earth Elements, Other), grade (Optical Grade, Vacuum Grade, Reactor Grade, Commercial Grades, Superconducting Grade), form (Lumps, Fines, Briquette, Powder, Ingot), and end-use industry (Aerospace, Automotive, Medical, Electricals & Electronics, Construction, Energy & Power, Packaging, Others). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. Specific growth rates vary considerably across segments depending on factors such as technological advancements, regulatory changes and end-use industry trends. For instance, the rare earth elements segment exhibits a higher projected growth rate than the barite segment due to growing demand in electronics.

Key Drivers of Strategic Mineral Materials Industry Growth

Technological advancements, particularly in electronics and renewable energy, are primary growth drivers. Government policies promoting the development of these sectors further stimulate demand. Economic growth in emerging economies also plays a significant role, fueling demand for infrastructure development and consumer goods that rely on these materials. The increasing use of strategic minerals in next-generation technologies, coupled with resource scarcity, is driving innovation in material science.

Challenges in the Strategic Mineral Materials Industry Sector

Supply chain disruptions, geopolitical instability, and price volatility pose significant challenges. Environmental regulations concerning mining and processing impose cost pressures and complicate operations. Competition from substitute materials and the emergence of new technologies create further challenges. These factors can lead to fluctuations in market prices and impact the profitability of businesses. For example, supply chain disruptions caused by the xx event of [year] impacted the industry significantly impacting supply of [Specific material] for [period].

Leading Players in the Strategic Mineral Materials Industry Market

- CBMM

- South32

- Intercontinental Mining

- Indium Corporation

- WARRIOR GOLD INC

- Anglo American plc

- Glencore

- Vale

- Materion Corporation

Key Developments in Strategic Mineral Materials Industry Sector

- January 2023: [Company Name] announced a new partnership to develop a sustainable mining technique for [mineral]. This development significantly impacts the environmental aspect of the industry and could influence the market share.

- July 2022: [Company Name] launched a new product with improved performance and energy efficiency. This product launch has strengthened the company's market position and increased consumer interest in this specific market segment.

- [Insert further developments with dates and brief explanations of impact]

Strategic Strategic Mineral Materials Industry Market Outlook

The Strategic Mineral Materials Industry is poised for continued growth driven by technological advancements and increasing demand from key end-use sectors. Strategic investments in research and development, sustainable mining practices, and the development of new applications will shape future market potential. Focus on resource efficiency, diversification of supply chains, and collaboration across the value chain are crucial for long-term success. The market offers significant opportunities for businesses to innovate and capitalize on the growing demand for these critical materials.

Strategic Mineral Materials Industry Segmentation

-

1. Mineral

-

1.1. Antimony

- 1.1.1. Flame Retardants

- 1.1.2. Batteries

- 1.1.3. Ceramics and Glass

- 1.1.4. Catalyst

- 1.1.5. Alloys

-

1.2. Barite

- 1.2.1. Oil and Gas

- 1.2.2. Other Ap

-

1.3. Beryllium

- 1.3.1. Electronics

- 1.3.2. Aerospace

- 1.3.3. Automotive

- 1.3.4. Energy

-

1.4. Cobalt

- 1.4.1. Superalloys

- 1.4.2. Cemented Carbides and Diamond Tools

- 1.4.3. Catalysts

-

1.5. Fluorspar

- 1.5.1. Chemicals

- 1.5.2. Steel

- 1.5.3. Aluminum

-

1.6. Gallium

- 1.6.1. Integrated Circuits

- 1.6.2. Laser diodes

- 1.6.3. Photodetectors

- 1.6.4. Solar Cells

-

1.7. Germanium

- 1.7.1. Fiber Optics

- 1.7.2. Infrared Optics

- 1.7.3. Electrical and Solar Equipment

-

1.8. Indium

- 1.8.1. Flat-Panel Display Screens and Touchscreens

- 1.8.2. Low Melting Alloys and Solders

- 1.8.3. Semiconductors

- 1.8.4. Transparent Heat Reflectors

-

1.9. Manganese

- 1.9.1. Casting Alloys

- 1.9.2. Packaging

- 1.9.3. Transportation

- 1.9.4. Construction

-

1.10. Niobium

- 1.10.1. Super Alloys

- 1.10.2. Superconducting Magnets

- 1.10.3. Capacitors

-

1.11. Platinum Group Elements

- 1.11.1. Autocatalyst

- 1.11.2. Jewelry

- 1.11.3. Electrical & Electronics

-

1.12. Rare Earth Elements

- 1.12.1. Magnetic Alloys

- 1.12.2. Metallurgy

-

1.13. Tantalum

- 1.13.1. Medical

-

1.1. Antimony

Strategic Mineral Materials Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Strategic Mineral Materials Industry Regional Market Share

Geographic Coverage of Strategic Mineral Materials Industry

Strategic Mineral Materials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Various End-user Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic; Growing Environmental Concerns over Mining Operations

- 3.4. Market Trends

- 3.4.1. Steel Application to Dominate the Niobium Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Strategic Mineral Materials Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mineral

- 5.1.1. Antimony

- 5.1.1.1. Flame Retardants

- 5.1.1.2. Batteries

- 5.1.1.3. Ceramics and Glass

- 5.1.1.4. Catalyst

- 5.1.1.5. Alloys

- 5.1.2. Barite

- 5.1.2.1. Oil and Gas

- 5.1.2.2. Other Ap

- 5.1.3. Beryllium

- 5.1.3.1. Electronics

- 5.1.3.2. Aerospace

- 5.1.3.3. Automotive

- 5.1.3.4. Energy

- 5.1.4. Cobalt

- 5.1.4.1. Superalloys

- 5.1.4.2. Cemented Carbides and Diamond Tools

- 5.1.4.3. Catalysts

- 5.1.5. Fluorspar

- 5.1.5.1. Chemicals

- 5.1.5.2. Steel

- 5.1.5.3. Aluminum

- 5.1.6. Gallium

- 5.1.6.1. Integrated Circuits

- 5.1.6.2. Laser diodes

- 5.1.6.3. Photodetectors

- 5.1.6.4. Solar Cells

- 5.1.7. Germanium

- 5.1.7.1. Fiber Optics

- 5.1.7.2. Infrared Optics

- 5.1.7.3. Electrical and Solar Equipment

- 5.1.8. Indium

- 5.1.8.1. Flat-Panel Display Screens and Touchscreens

- 5.1.8.2. Low Melting Alloys and Solders

- 5.1.8.3. Semiconductors

- 5.1.8.4. Transparent Heat Reflectors

- 5.1.9. Manganese

- 5.1.9.1. Casting Alloys

- 5.1.9.2. Packaging

- 5.1.9.3. Transportation

- 5.1.9.4. Construction

- 5.1.10. Niobium

- 5.1.10.1. Super Alloys

- 5.1.10.2. Superconducting Magnets

- 5.1.10.3. Capacitors

- 5.1.11. Platinum Group Elements

- 5.1.11.1. Autocatalyst

- 5.1.11.2. Jewelry

- 5.1.11.3. Electrical & Electronics

- 5.1.12. Rare Earth Elements

- 5.1.12.1. Magnetic Alloys

- 5.1.12.2. Metallurgy

- 5.1.13. Tantalum

- 5.1.13.1. Medical

- 5.1.1. Antimony

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mineral

- 6. Asia Pacific Strategic Mineral Materials Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mineral

- 6.1.1. Antimony

- 6.1.1.1. Flame Retardants

- 6.1.1.2. Batteries

- 6.1.1.3. Ceramics and Glass

- 6.1.1.4. Catalyst

- 6.1.1.5. Alloys

- 6.1.2. Barite

- 6.1.2.1. Oil and Gas

- 6.1.2.2. Other Ap

- 6.1.3. Beryllium

- 6.1.3.1. Electronics

- 6.1.3.2. Aerospace

- 6.1.3.3. Automotive

- 6.1.3.4. Energy

- 6.1.4. Cobalt

- 6.1.4.1. Superalloys

- 6.1.4.2. Cemented Carbides and Diamond Tools

- 6.1.4.3. Catalysts

- 6.1.5. Fluorspar

- 6.1.5.1. Chemicals

- 6.1.5.2. Steel

- 6.1.5.3. Aluminum

- 6.1.6. Gallium

- 6.1.6.1. Integrated Circuits

- 6.1.6.2. Laser diodes

- 6.1.6.3. Photodetectors

- 6.1.6.4. Solar Cells

- 6.1.7. Germanium

- 6.1.7.1. Fiber Optics

- 6.1.7.2. Infrared Optics

- 6.1.7.3. Electrical and Solar Equipment

- 6.1.8. Indium

- 6.1.8.1. Flat-Panel Display Screens and Touchscreens

- 6.1.8.2. Low Melting Alloys and Solders

- 6.1.8.3. Semiconductors

- 6.1.8.4. Transparent Heat Reflectors

- 6.1.9. Manganese

- 6.1.9.1. Casting Alloys

- 6.1.9.2. Packaging

- 6.1.9.3. Transportation

- 6.1.9.4. Construction

- 6.1.10. Niobium

- 6.1.10.1. Super Alloys

- 6.1.10.2. Superconducting Magnets

- 6.1.10.3. Capacitors

- 6.1.11. Platinum Group Elements

- 6.1.11.1. Autocatalyst

- 6.1.11.2. Jewelry

- 6.1.11.3. Electrical & Electronics

- 6.1.12. Rare Earth Elements

- 6.1.12.1. Magnetic Alloys

- 6.1.12.2. Metallurgy

- 6.1.13. Tantalum

- 6.1.13.1. Medical

- 6.1.1. Antimony

- 6.1. Market Analysis, Insights and Forecast - by Mineral

- 7. North America Strategic Mineral Materials Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mineral

- 7.1.1. Antimony

- 7.1.1.1. Flame Retardants

- 7.1.1.2. Batteries

- 7.1.1.3. Ceramics and Glass

- 7.1.1.4. Catalyst

- 7.1.1.5. Alloys

- 7.1.2. Barite

- 7.1.2.1. Oil and Gas

- 7.1.2.2. Other Ap

- 7.1.3. Beryllium

- 7.1.3.1. Electronics

- 7.1.3.2. Aerospace

- 7.1.3.3. Automotive

- 7.1.3.4. Energy

- 7.1.4. Cobalt

- 7.1.4.1. Superalloys

- 7.1.4.2. Cemented Carbides and Diamond Tools

- 7.1.4.3. Catalysts

- 7.1.5. Fluorspar

- 7.1.5.1. Chemicals

- 7.1.5.2. Steel

- 7.1.5.3. Aluminum

- 7.1.6. Gallium

- 7.1.6.1. Integrated Circuits

- 7.1.6.2. Laser diodes

- 7.1.6.3. Photodetectors

- 7.1.6.4. Solar Cells

- 7.1.7. Germanium

- 7.1.7.1. Fiber Optics

- 7.1.7.2. Infrared Optics

- 7.1.7.3. Electrical and Solar Equipment

- 7.1.8. Indium

- 7.1.8.1. Flat-Panel Display Screens and Touchscreens

- 7.1.8.2. Low Melting Alloys and Solders

- 7.1.8.3. Semiconductors

- 7.1.8.4. Transparent Heat Reflectors

- 7.1.9. Manganese

- 7.1.9.1. Casting Alloys

- 7.1.9.2. Packaging

- 7.1.9.3. Transportation

- 7.1.9.4. Construction

- 7.1.10. Niobium

- 7.1.10.1. Super Alloys

- 7.1.10.2. Superconducting Magnets

- 7.1.10.3. Capacitors

- 7.1.11. Platinum Group Elements

- 7.1.11.1. Autocatalyst

- 7.1.11.2. Jewelry

- 7.1.11.3. Electrical & Electronics

- 7.1.12. Rare Earth Elements

- 7.1.12.1. Magnetic Alloys

- 7.1.12.2. Metallurgy

- 7.1.13. Tantalum

- 7.1.13.1. Medical

- 7.1.1. Antimony

- 7.1. Market Analysis, Insights and Forecast - by Mineral

- 8. Europe Strategic Mineral Materials Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mineral

- 8.1.1. Antimony

- 8.1.1.1. Flame Retardants

- 8.1.1.2. Batteries

- 8.1.1.3. Ceramics and Glass

- 8.1.1.4. Catalyst

- 8.1.1.5. Alloys

- 8.1.2. Barite

- 8.1.2.1. Oil and Gas

- 8.1.2.2. Other Ap

- 8.1.3. Beryllium

- 8.1.3.1. Electronics

- 8.1.3.2. Aerospace

- 8.1.3.3. Automotive

- 8.1.3.4. Energy

- 8.1.4. Cobalt

- 8.1.4.1. Superalloys

- 8.1.4.2. Cemented Carbides and Diamond Tools

- 8.1.4.3. Catalysts

- 8.1.5. Fluorspar

- 8.1.5.1. Chemicals

- 8.1.5.2. Steel

- 8.1.5.3. Aluminum

- 8.1.6. Gallium

- 8.1.6.1. Integrated Circuits

- 8.1.6.2. Laser diodes

- 8.1.6.3. Photodetectors

- 8.1.6.4. Solar Cells

- 8.1.7. Germanium

- 8.1.7.1. Fiber Optics

- 8.1.7.2. Infrared Optics

- 8.1.7.3. Electrical and Solar Equipment

- 8.1.8. Indium

- 8.1.8.1. Flat-Panel Display Screens and Touchscreens

- 8.1.8.2. Low Melting Alloys and Solders

- 8.1.8.3. Semiconductors

- 8.1.8.4. Transparent Heat Reflectors

- 8.1.9. Manganese

- 8.1.9.1. Casting Alloys

- 8.1.9.2. Packaging

- 8.1.9.3. Transportation

- 8.1.9.4. Construction

- 8.1.10. Niobium

- 8.1.10.1. Super Alloys

- 8.1.10.2. Superconducting Magnets

- 8.1.10.3. Capacitors

- 8.1.11. Platinum Group Elements

- 8.1.11.1. Autocatalyst

- 8.1.11.2. Jewelry

- 8.1.11.3. Electrical & Electronics

- 8.1.12. Rare Earth Elements

- 8.1.12.1. Magnetic Alloys

- 8.1.12.2. Metallurgy

- 8.1.13. Tantalum

- 8.1.13.1. Medical

- 8.1.1. Antimony

- 8.1. Market Analysis, Insights and Forecast - by Mineral

- 9. South America Strategic Mineral Materials Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mineral

- 9.1.1. Antimony

- 9.1.1.1. Flame Retardants

- 9.1.1.2. Batteries

- 9.1.1.3. Ceramics and Glass

- 9.1.1.4. Catalyst

- 9.1.1.5. Alloys

- 9.1.2. Barite

- 9.1.2.1. Oil and Gas

- 9.1.2.2. Other Ap

- 9.1.3. Beryllium

- 9.1.3.1. Electronics

- 9.1.3.2. Aerospace

- 9.1.3.3. Automotive

- 9.1.3.4. Energy

- 9.1.4. Cobalt

- 9.1.4.1. Superalloys

- 9.1.4.2. Cemented Carbides and Diamond Tools

- 9.1.4.3. Catalysts

- 9.1.5. Fluorspar

- 9.1.5.1. Chemicals

- 9.1.5.2. Steel

- 9.1.5.3. Aluminum

- 9.1.6. Gallium

- 9.1.6.1. Integrated Circuits

- 9.1.6.2. Laser diodes

- 9.1.6.3. Photodetectors

- 9.1.6.4. Solar Cells

- 9.1.7. Germanium

- 9.1.7.1. Fiber Optics

- 9.1.7.2. Infrared Optics

- 9.1.7.3. Electrical and Solar Equipment

- 9.1.8. Indium

- 9.1.8.1. Flat-Panel Display Screens and Touchscreens

- 9.1.8.2. Low Melting Alloys and Solders

- 9.1.8.3. Semiconductors

- 9.1.8.4. Transparent Heat Reflectors

- 9.1.9. Manganese

- 9.1.9.1. Casting Alloys

- 9.1.9.2. Packaging

- 9.1.9.3. Transportation

- 9.1.9.4. Construction

- 9.1.10. Niobium

- 9.1.10.1. Super Alloys

- 9.1.10.2. Superconducting Magnets

- 9.1.10.3. Capacitors

- 9.1.11. Platinum Group Elements

- 9.1.11.1. Autocatalyst

- 9.1.11.2. Jewelry

- 9.1.11.3. Electrical & Electronics

- 9.1.12. Rare Earth Elements

- 9.1.12.1. Magnetic Alloys

- 9.1.12.2. Metallurgy

- 9.1.13. Tantalum

- 9.1.13.1. Medical

- 9.1.1. Antimony

- 9.1. Market Analysis, Insights and Forecast - by Mineral

- 10. Middle East and Africa Strategic Mineral Materials Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mineral

- 10.1.1. Antimony

- 10.1.1.1. Flame Retardants

- 10.1.1.2. Batteries

- 10.1.1.3. Ceramics and Glass

- 10.1.1.4. Catalyst

- 10.1.1.5. Alloys

- 10.1.2. Barite

- 10.1.2.1. Oil and Gas

- 10.1.2.2. Other Ap

- 10.1.3. Beryllium

- 10.1.3.1. Electronics

- 10.1.3.2. Aerospace

- 10.1.3.3. Automotive

- 10.1.3.4. Energy

- 10.1.4. Cobalt

- 10.1.4.1. Superalloys

- 10.1.4.2. Cemented Carbides and Diamond Tools

- 10.1.4.3. Catalysts

- 10.1.5. Fluorspar

- 10.1.5.1. Chemicals

- 10.1.5.2. Steel

- 10.1.5.3. Aluminum

- 10.1.6. Gallium

- 10.1.6.1. Integrated Circuits

- 10.1.6.2. Laser diodes

- 10.1.6.3. Photodetectors

- 10.1.6.4. Solar Cells

- 10.1.7. Germanium

- 10.1.7.1. Fiber Optics

- 10.1.7.2. Infrared Optics

- 10.1.7.3. Electrical and Solar Equipment

- 10.1.8. Indium

- 10.1.8.1. Flat-Panel Display Screens and Touchscreens

- 10.1.8.2. Low Melting Alloys and Solders

- 10.1.8.3. Semiconductors

- 10.1.8.4. Transparent Heat Reflectors

- 10.1.9. Manganese

- 10.1.9.1. Casting Alloys

- 10.1.9.2. Packaging

- 10.1.9.3. Transportation

- 10.1.9.4. Construction

- 10.1.10. Niobium

- 10.1.10.1. Super Alloys

- 10.1.10.2. Superconducting Magnets

- 10.1.10.3. Capacitors

- 10.1.11. Platinum Group Elements

- 10.1.11.1. Autocatalyst

- 10.1.11.2. Jewelry

- 10.1.11.3. Electrical & Electronics

- 10.1.12. Rare Earth Elements

- 10.1.12.1. Magnetic Alloys

- 10.1.12.2. Metallurgy

- 10.1.13. Tantalum

- 10.1.13.1. Medical

- 10.1.1. Antimony

- 10.1. Market Analysis, Insights and Forecast - by Mineral

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CBMM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 South32

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intercontinental Mining

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Indium Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 WARRIOR GOLD INC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Anglo American plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Glencore

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vale

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Materion Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CBMM

List of Figures

- Figure 1: Global Strategic Mineral Materials Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Strategic Mineral Materials Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Strategic Mineral Materials Industry Revenue (billion), by Mineral 2025 & 2033

- Figure 4: Asia Pacific Strategic Mineral Materials Industry Volume (K Tons), by Mineral 2025 & 2033

- Figure 5: Asia Pacific Strategic Mineral Materials Industry Revenue Share (%), by Mineral 2025 & 2033

- Figure 6: Asia Pacific Strategic Mineral Materials Industry Volume Share (%), by Mineral 2025 & 2033

- Figure 7: Asia Pacific Strategic Mineral Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 8: Asia Pacific Strategic Mineral Materials Industry Volume (K Tons), by Country 2025 & 2033

- Figure 9: Asia Pacific Strategic Mineral Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Strategic Mineral Materials Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: North America Strategic Mineral Materials Industry Revenue (billion), by Mineral 2025 & 2033

- Figure 12: North America Strategic Mineral Materials Industry Volume (K Tons), by Mineral 2025 & 2033

- Figure 13: North America Strategic Mineral Materials Industry Revenue Share (%), by Mineral 2025 & 2033

- Figure 14: North America Strategic Mineral Materials Industry Volume Share (%), by Mineral 2025 & 2033

- Figure 15: North America Strategic Mineral Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Strategic Mineral Materials Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Strategic Mineral Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Strategic Mineral Materials Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Strategic Mineral Materials Industry Revenue (billion), by Mineral 2025 & 2033

- Figure 20: Europe Strategic Mineral Materials Industry Volume (K Tons), by Mineral 2025 & 2033

- Figure 21: Europe Strategic Mineral Materials Industry Revenue Share (%), by Mineral 2025 & 2033

- Figure 22: Europe Strategic Mineral Materials Industry Volume Share (%), by Mineral 2025 & 2033

- Figure 23: Europe Strategic Mineral Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Strategic Mineral Materials Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Strategic Mineral Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Strategic Mineral Materials Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Strategic Mineral Materials Industry Revenue (billion), by Mineral 2025 & 2033

- Figure 28: South America Strategic Mineral Materials Industry Volume (K Tons), by Mineral 2025 & 2033

- Figure 29: South America Strategic Mineral Materials Industry Revenue Share (%), by Mineral 2025 & 2033

- Figure 30: South America Strategic Mineral Materials Industry Volume Share (%), by Mineral 2025 & 2033

- Figure 31: South America Strategic Mineral Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: South America Strategic Mineral Materials Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America Strategic Mineral Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Strategic Mineral Materials Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Strategic Mineral Materials Industry Revenue (billion), by Mineral 2025 & 2033

- Figure 36: Middle East and Africa Strategic Mineral Materials Industry Volume (K Tons), by Mineral 2025 & 2033

- Figure 37: Middle East and Africa Strategic Mineral Materials Industry Revenue Share (%), by Mineral 2025 & 2033

- Figure 38: Middle East and Africa Strategic Mineral Materials Industry Volume Share (%), by Mineral 2025 & 2033

- Figure 39: Middle East and Africa Strategic Mineral Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 40: Middle East and Africa Strategic Mineral Materials Industry Volume (K Tons), by Country 2025 & 2033

- Figure 41: Middle East and Africa Strategic Mineral Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Strategic Mineral Materials Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Mineral 2020 & 2033

- Table 2: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Mineral 2020 & 2033

- Table 3: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Mineral 2020 & 2033

- Table 6: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Mineral 2020 & 2033

- Table 7: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: China Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: China Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: India Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Japan Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: South Korea Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: South Korea Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: ASEAN Countries Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: ASEAN Countries Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Mineral 2020 & 2033

- Table 22: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Mineral 2020 & 2033

- Table 23: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: United States Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United States Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Canada Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Canada Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Mexico Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Mexico Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Mineral 2020 & 2033

- Table 32: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Mineral 2020 & 2033

- Table 33: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: Germany Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Germany Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: United Kingdom Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Italy Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Italy Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: France Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Spain Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Spain Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Mineral 2020 & 2033

- Table 48: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Mineral 2020 & 2033

- Table 49: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 51: Brazil Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Brazil Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Argentina Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Argentina Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Rest of South America Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of South America Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Mineral 2020 & 2033

- Table 58: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Mineral 2020 & 2033

- Table 59: Global Strategic Mineral Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Strategic Mineral Materials Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Saudi Arabia Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Saudi Arabia Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: South Africa Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Strategic Mineral Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Strategic Mineral Materials Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Strategic Mineral Materials Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Strategic Mineral Materials Industry?

Key companies in the market include CBMM, South32, Intercontinental Mining, Indium Corporation, WARRIOR GOLD INC , Anglo American plc, Glencore, Vale, Materion Corporation.

3. What are the main segments of the Strategic Mineral Materials Industry?

The market segments include Mineral.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.9 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Various End-user Industries; Other Drivers.

6. What are the notable trends driving market growth?

Steel Application to Dominate the Niobium Segment.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic; Growing Environmental Concerns over Mining Operations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Strategic Mineral Materials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Strategic Mineral Materials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Strategic Mineral Materials Industry?

To stay informed about further developments, trends, and reports in the Strategic Mineral Materials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence