Key Insights

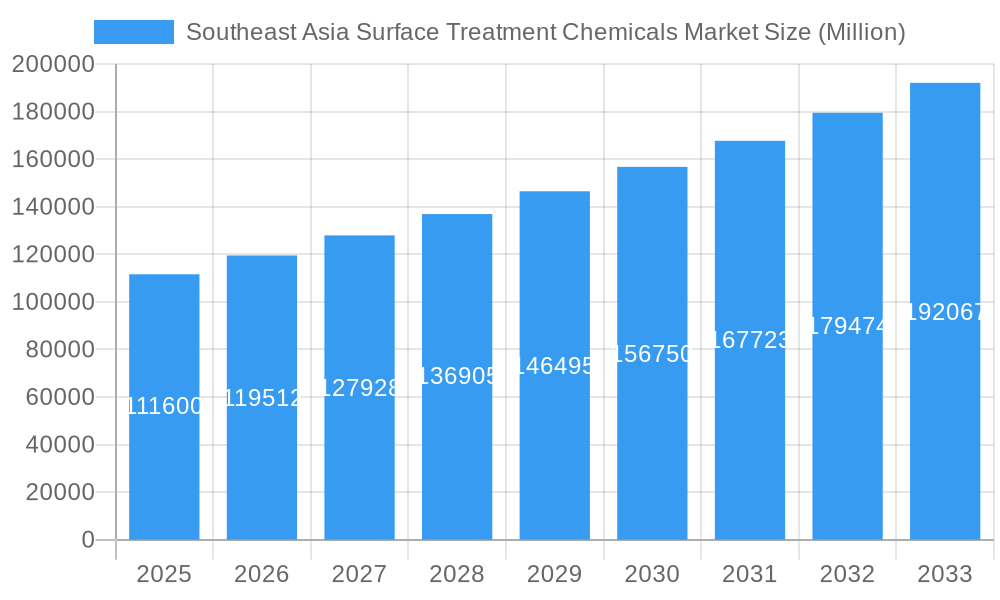

The Southeast Asia Surface Treatment Chemicals Market is poised for significant growth, projected to reach an estimated $111.6 billion by 2025. This expansion is driven by a robust CAGR of 7%, indicating a dynamic and expanding industry throughout the forecast period of 2025-2033. Key factors fueling this growth include the escalating demand from the automotive and transportation sector, which relies heavily on advanced surface treatment solutions for corrosion resistance, aesthetics, and performance enhancement. The burgeoning electronics industry, with its increasing production of sophisticated devices, also presents a substantial opportunity, requiring specialized chemical treatments for component protection and functionality. Furthermore, the construction industry's continuous development and infrastructure projects across Southeast Asia contribute to the market's upward trajectory, necessitating durable and protective surface finishes for building materials.

Southeast Asia Surface Treatment Chemicals Market Market Size (In Billion)

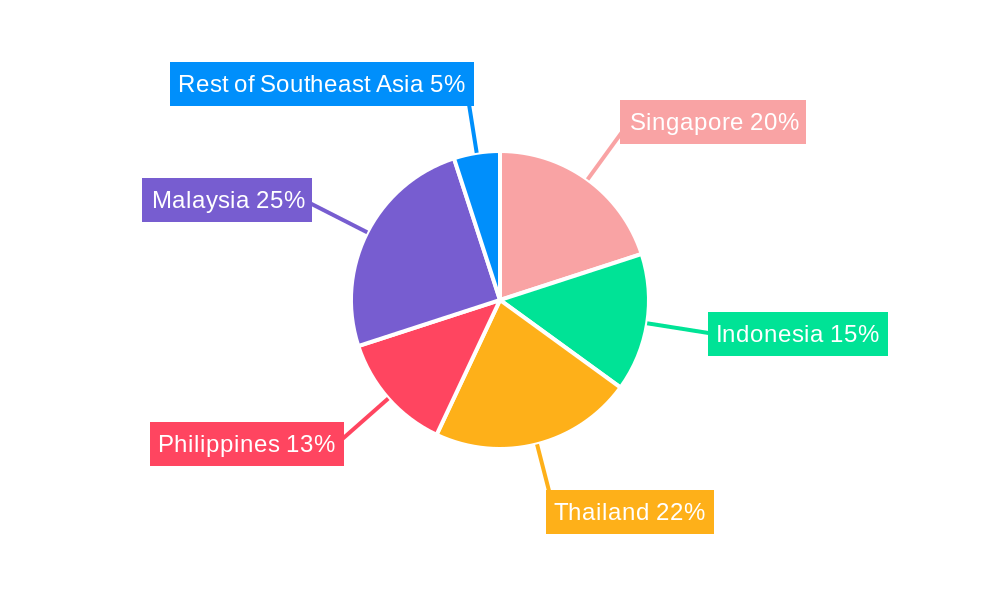

The market is segmented into several crucial chemical types, with Plating Chemicals and Cleaners expected to dominate due to their widespread application in various manufacturing processes. Conversion Coatings also hold significant importance, offering enhanced adhesion and corrosion resistance. The demand for these chemicals is intrinsically linked to the growth of key base materials like metals and plastics, which are integral to the aforementioned end-user industries. Geographically, countries like Malaysia, Singapore, and Thailand are anticipated to be leading markets, owing to their established manufacturing bases and favorable investment climates. Emerging economies like Indonesia and the Philippines are also demonstrating considerable growth potential. However, the market may face certain restraints, potentially including fluctuating raw material prices and increasing environmental regulations, which could necessitate strategic adaptations and investments in sustainable chemical solutions by leading companies such as Henkel AG & Co. KGa, PPG Industries Inc., and The Sherwin-Williams Company.

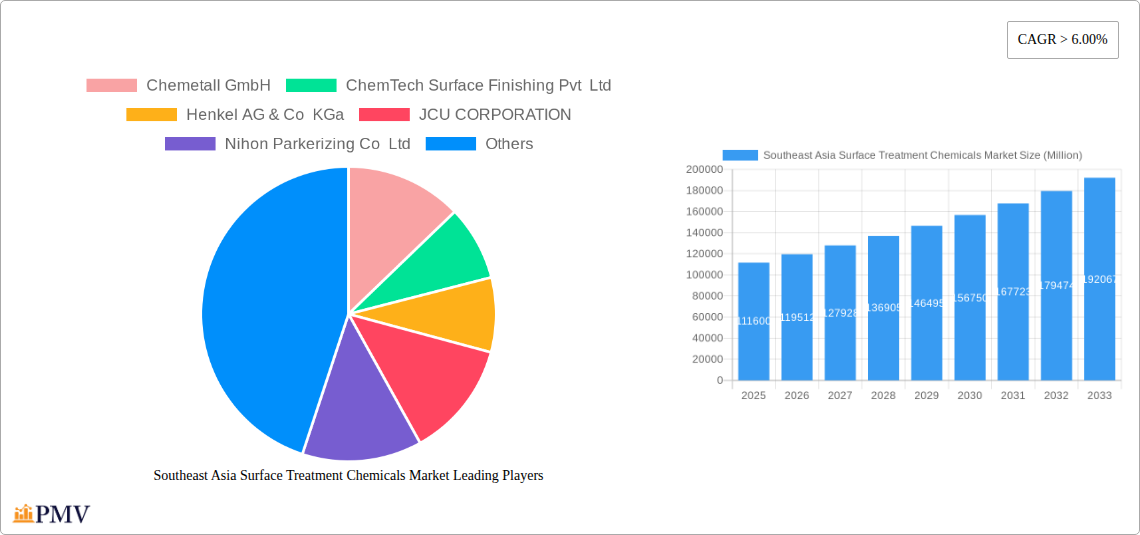

Southeast Asia Surface Treatment Chemicals Market Company Market Share

Report Description:

Gain a strategic advantage in the burgeoning Southeast Asia Surface Treatment Chemicals Market with our in-depth, actionable report. This comprehensive analysis delves into market dynamics, key trends, segment-specific insights, and competitive landscapes from 2019 to 2033, with a robust forecast for 2025-2033. Understand the intricate interplay of plating chemicals, cleaners, conversion coatings, and other vital surface treatment chemicals across diverse base materials like metals and plastics, serving critical end-user industries such as automotive, construction, electronics, and industrial machinery.

This report provides an exhaustive market overview, meticulously segmented by geography including Singapore, Indonesia, Thailand, Philippines, Malaysia, and the Rest of Southeast Asia. We dissect the influence of Chemetall GmbH, Henkel AG & Co KGa, JCU CORPORATION, Nihon Parkerizing Co Ltd, Nippon Paint Holdings Co Ltd, NOF CORPORATION, PPG Industries Inc, The Sherwin-Williams Company, and other prominent players (list not exhaustive). Uncover the impact of industry developments like CemeCon's expansion and the strategic partnership between CRW Consulting & Distribution and Blast Abrasives Supply.

With a base year of 2025 and an estimated year of 2025, this report offers precise market valuations in billions, projecting significant market penetration and compound annual growth rates (CAGRs). Whether you’re a manufacturer, supplier, investor, or industry stakeholder, this report is your definitive guide to navigating the Southeast Asia industrial coatings market, metal finishing chemicals market, and automotive surface treatment market.

Southeast Asia Surface Treatment Chemicals Market Market Structure & Competitive Dynamics

The Southeast Asia Surface Treatment Chemicals Market is characterized by a moderate to high degree of market concentration, with a few dominant global players holding significant market share, alongside a growing number of regional and specialized suppliers. The innovation ecosystem is driven by increasing demand for eco-friendly and high-performance solutions, pushing companies to invest heavily in R&D for advanced formulations that offer enhanced corrosion resistance, improved adhesion, and reduced environmental impact. Regulatory frameworks are evolving, with a growing emphasis on sustainability and stricter controls on hazardous substances, influencing product development and market entry strategies. Product substitutes are available, particularly in less demanding applications, but specialized surface treatment chemicals offer unique performance advantages that are difficult to replicate. End-user trends are shifting towards greater automation in application processes and a demand for customized solutions tailored to specific material and performance requirements. Mergers and Acquisition (M&A) activities are a key feature, as larger companies seek to expand their geographical reach, acquire innovative technologies, and consolidate market position. Significant M&A deal values in the billions are anticipated as the market matures.

Southeast Asia Surface Treatment Chemicals Market Industry Trends & Insights

The Southeast Asia Surface Treatment Chemicals Market is experiencing robust growth, propelled by several intersecting industry trends. A primary growth driver is the escalating demand from the automotive and transportation sector, fueled by increasing vehicle production and the need for advanced corrosion protection and aesthetic finishing. The burgeoning construction industry, with its significant infrastructure development projects across the region, also contributes substantially to the demand for industrial coatings and surface treatment chemicals that enhance durability and longevity. Furthermore, the rapidly expanding electronics manufacturing sector, a cornerstone of many Southeast Asian economies, requires sophisticated surface treatments for components, driving innovation in plating chemicals and cleaners.

Technological disruptions are playing a crucial role. The development of eco-friendly, low-VOC (Volatile Organic Compound) formulations and water-based surface treatment chemicals is a significant trend, driven by stringent environmental regulations and growing consumer preference for sustainable products. Advancements in nanotechnologies are also leading to the creation of novel coatings with superior performance characteristics, such as self-healing properties and enhanced scratch resistance. The adoption of smart manufacturing and Industry 4.0 principles is influencing the application of surface treatment chemicals, leading to more automated, precise, and efficient processes.

Consumer preferences are increasingly leaning towards visually appealing and durable finishes, especially in consumer goods and architectural applications. This is driving demand for a wider array of colors, textures, and functional coatings. Competitive dynamics are intense, with both established global players and agile local manufacturers vying for market share. Strategic partnerships and collaborations are becoming more prevalent as companies seek to leverage each other's strengths in technology, distribution, and market access. The overall market penetration is steadily increasing, with a projected CAGR in the mid-single digits, indicating sustained and healthy expansion over the forecast period.

Dominant Markets & Segments in Southeast Asia Surface Treatment Chemicals Market

The Automotive & Transportation end-user industry stands as a dominant segment within the Southeast Asia Surface Treatment Chemicals Market, propelled by the region's robust manufacturing capabilities and increasing domestic demand for vehicles. Economic policies encouraging foreign direct investment in automotive production and supportive infrastructure development initiatives further bolster this segment's growth.

Among the base materials, Metals consistently represent the largest segment, owing to their widespread use across all major industries, from automotive and construction to industrial machinery and electronics. The inherent need for corrosion protection, wear resistance, and aesthetic enhancement in metallic components drives the continuous demand for advanced surface treatment solutions.

In terms of chemical types, Plating Chemicals and Conversion Coatings are leading segments. Plating chemicals are critical for providing a protective and decorative layer, essential for components in automotive, electronics, and industrial machinery. Conversion coatings, such as phosphating and chromating, are indispensable for preparing metal surfaces for subsequent painting or coating, significantly enhancing adhesion and corrosion resistance, especially in the automotive and construction sectors.

Geographically, Thailand and Indonesia are emerging as dominant markets. Thailand, with its established automotive manufacturing hub, continues to be a significant consumer of surface treatment chemicals. Indonesia, with its large population and growing industrial base, presents substantial opportunities, particularly in the construction and automotive sectors. Malaysia also plays a crucial role, driven by its strong electronics manufacturing sector and increasing focus on high-value industrial production.

- Key Drivers for Dominance:

- Automotive & Transportation: Strong regional vehicle manufacturing, increasing disposable incomes, and government support for the automotive sector.

- Metals: Widespread application in critical industries, essential for durability and performance.

- Plating Chemicals & Conversion Coatings: Integral to manufacturing processes for corrosion resistance, adhesion, and aesthetic appeal.

- Thailand & Indonesia: Favorable investment climates, robust industrial growth, and significant domestic market size.

The Electronics end-user industry is another significant growth engine, driven by the region's position as a global hub for electronics manufacturing. Here, specialized cleaners and plating chemicals are crucial for intricate components.

The Rest of Southeast Asia, encompassing countries like Vietnam and the Philippines, presents considerable untapped potential, with rapid industrialization and increasing foreign investment signaling future growth opportunities.

Southeast Asia Surface Treatment Chemicals Market Product Innovations

Product innovation in the Southeast Asia Surface Treatment Chemicals Market is primarily driven by the demand for eco-friendly solutions and enhanced performance. Key developments include the introduction of advanced chromium-free conversion coatings offering superior corrosion resistance without the environmental concerns associated with traditional hexavalent chromium. Novel low-temperature cleaners and degreasers are gaining traction, reducing energy consumption during application. Furthermore, R&D is focusing on developing smart coatings with self-cleaning, anti-microbial, or self-healing properties, catering to specialized applications in electronics, healthcare, and infrastructure. These innovations provide competitive advantages by meeting stringent regulatory requirements and addressing evolving end-user needs for sustainability and advanced functionality.

Report Segmentation & Scope

This report comprehensively segments the Southeast Asia Surface Treatment Chemicals Market across key dimensions. The Chemical Type segmentation includes Plating Chemicals, Cleaners, Conversion Coatings, and Other Chemical Types, each with distinct growth trajectories and market sizes. The Base Material segmentation covers Metals, Plastics, and Other Base Materials, reflecting the diverse substrates requiring surface treatment. The End-user Industry segmentation is detailed across Automotive & Transportation, Construction, Electronics, Industrial Machinery, and Other End-user Industries, highlighting the application-specific demand drivers. Geographically, the market is dissected into Singapore, Indonesia, Thailand, Philippines, Malaysia, and the Rest of Southeast Asia, providing granular insights into regional market dynamics and growth projections. Market sizes are projected in billions, with specific CAGR estimates for each segment, offering a clear view of competitive landscapes and future opportunities.

Key Drivers of Southeast Asia Surface Treatment Chemicals Market Growth

The growth of the Southeast Asia Surface Treatment Chemicals Market is propelled by several key factors. Economically, increasing industrialization and manufacturing output across the region, particularly in automotive and electronics, fuels the demand for surface treatment chemicals. Technologically, advancements in eco-friendly formulations, such as chromium-free coatings and low-VOC solutions, are critical for meeting stringent environmental regulations and consumer preferences for sustainability. Regulatory frameworks, while sometimes posing challenges, also drive innovation by mandating the adoption of safer and more sustainable chemical alternatives. Government initiatives promoting foreign direct investment in manufacturing sectors and infrastructure development projects further stimulate market expansion. For instance, the growing emphasis on durable and aesthetically pleasing finishes in construction and consumer goods directly translates to increased demand for high-performance surface treatment chemicals.

Challenges in the Southeast Asia Surface Treatment Chemicals Market Sector

Despite robust growth prospects, the Southeast Asia Surface Treatment Chemicals Market faces several challenges. Stringent and evolving environmental regulations in various countries can increase compliance costs and necessitate significant R&D investment for product reformulation. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities within the region, can impact raw material availability and pricing, leading to increased operational expenses. Intense competitive pressures from both global and local players can lead to price wars and reduce profit margins. Furthermore, the adoption of new, more advanced surface treatment technologies can require substantial capital investment from end-users, potentially slowing down market penetration in certain segments. Educating smaller and medium-sized enterprises (SMEs) on the benefits of advanced surface treatment solutions also remains a challenge.

Leading Players in the Southeast Asia Surface Treatment Chemicals Market Market

- Chemetall GmbH

- ChemTech Surface Finishing Pvt Ltd

- Henkel AG & Co KGa

- JCU CORPORATION

- Nihon Parkerizing Co Ltd

- Nippon Paint Holdings Co Ltd

- NOF CORPORATION

- OC Oerlikon

- PPG Industries Inc

- Siam YUKEN Co Ltd

- The Sherwin-Williams Company

Key Developments in Southeast Asia Surface Treatment Chemicals Market Sector

- April 2022: CemeCon established its Indian subsidiary, CemeCon Coating Pvt. Ltd. in Pune, India, to cater to the growing machining sector in India and the Southeast Asian market, serving a potential customer base across ASEAN countries and India.

- September 2021: Houston-based CRW Consulting & Distribution and Kuala Lumpur-based Blast Abrasives Supply announced a strategic partnership to promote and develop the sales of Corr-Ze Products, a metal surface preparation product, across the Southeast Asia region.

Strategic Southeast Asia Surface Treatment Chemicals Market Market Outlook

The strategic outlook for the Southeast Asia Surface Treatment Chemicals Market is highly positive, driven by sustained industrial expansion and a growing emphasis on high-performance, sustainable solutions. The market is poised for significant growth, accelerated by increasing demand from the automotive, electronics, and construction sectors. Opportunities lie in the development and adoption of eco-friendly chemicals, smart coatings with advanced functionalities, and customized solutions tailored to specific industry needs. Strategic partnerships, technological innovation, and a focus on regional market penetration will be crucial for companies looking to capitalize on this dynamic and expanding market. Investments in R&D for advanced surface finishing technologies and a keen understanding of evolving regulatory landscapes will pave the way for market leadership.

Southeast Asia Surface Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Plating Chemicals

- 1.2. Cleaners

- 1.3. Conversion Coatings

- 1.4. Other Chemical Types

-

2. Base Material

- 2.1. Metals

- 2.2. Plastics

- 2.3. Other Base Materials

-

3. End-user Industry

- 3.1. Automotive & Transportation

- 3.2. Construction

- 3.3. Electronics

- 3.4. Industrial Machinery

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. Singapore

- 4.2. Indonesia

- 4.3. Thailand

- 4.4. Philippines

- 4.5. Malaysia

- 4.6. Rest of Southeast Asia

Southeast Asia Surface Treatment Chemicals Market Segmentation By Geography

- 1. Singapore

- 2. Indonesia

- 3. Thailand

- 4. Philippines

- 5. Malaysia

- 6. Rest of Southeast Asia

Southeast Asia Surface Treatment Chemicals Market Regional Market Share

Geographic Coverage of Southeast Asia Surface Treatment Chemicals Market

Southeast Asia Surface Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Industrialization Across the Region; Growing Demand from Automotive & Transportation Industry

- 3.3. Market Restrains

- 3.3.1. Rapid Industrialization Across the Region; Growing Demand from Automotive & Transportation Industry

- 3.4. Market Trends

- 3.4.1. Growing Application in the Automobile Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Plating Chemicals

- 5.1.2. Cleaners

- 5.1.3. Conversion Coatings

- 5.1.4. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by Base Material

- 5.2.1. Metals

- 5.2.2. Plastics

- 5.2.3. Other Base Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive & Transportation

- 5.3.2. Construction

- 5.3.3. Electronics

- 5.3.4. Industrial Machinery

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Singapore

- 5.4.2. Indonesia

- 5.4.3. Thailand

- 5.4.4. Philippines

- 5.4.5. Malaysia

- 5.4.6. Rest of Southeast Asia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Singapore

- 5.5.2. Indonesia

- 5.5.3. Thailand

- 5.5.4. Philippines

- 5.5.5. Malaysia

- 5.5.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Singapore Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Plating Chemicals

- 6.1.2. Cleaners

- 6.1.3. Conversion Coatings

- 6.1.4. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by Base Material

- 6.2.1. Metals

- 6.2.2. Plastics

- 6.2.3. Other Base Materials

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive & Transportation

- 6.3.2. Construction

- 6.3.3. Electronics

- 6.3.4. Industrial Machinery

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Singapore

- 6.4.2. Indonesia

- 6.4.3. Thailand

- 6.4.4. Philippines

- 6.4.5. Malaysia

- 6.4.6. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Indonesia Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Plating Chemicals

- 7.1.2. Cleaners

- 7.1.3. Conversion Coatings

- 7.1.4. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by Base Material

- 7.2.1. Metals

- 7.2.2. Plastics

- 7.2.3. Other Base Materials

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive & Transportation

- 7.3.2. Construction

- 7.3.3. Electronics

- 7.3.4. Industrial Machinery

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Singapore

- 7.4.2. Indonesia

- 7.4.3. Thailand

- 7.4.4. Philippines

- 7.4.5. Malaysia

- 7.4.6. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Thailand Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Plating Chemicals

- 8.1.2. Cleaners

- 8.1.3. Conversion Coatings

- 8.1.4. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by Base Material

- 8.2.1. Metals

- 8.2.2. Plastics

- 8.2.3. Other Base Materials

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive & Transportation

- 8.3.2. Construction

- 8.3.3. Electronics

- 8.3.4. Industrial Machinery

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Singapore

- 8.4.2. Indonesia

- 8.4.3. Thailand

- 8.4.4. Philippines

- 8.4.5. Malaysia

- 8.4.6. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Philippines Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Plating Chemicals

- 9.1.2. Cleaners

- 9.1.3. Conversion Coatings

- 9.1.4. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by Base Material

- 9.2.1. Metals

- 9.2.2. Plastics

- 9.2.3. Other Base Materials

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive & Transportation

- 9.3.2. Construction

- 9.3.3. Electronics

- 9.3.4. Industrial Machinery

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Singapore

- 9.4.2. Indonesia

- 9.4.3. Thailand

- 9.4.4. Philippines

- 9.4.5. Malaysia

- 9.4.6. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Malaysia Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Plating Chemicals

- 10.1.2. Cleaners

- 10.1.3. Conversion Coatings

- 10.1.4. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by Base Material

- 10.2.1. Metals

- 10.2.2. Plastics

- 10.2.3. Other Base Materials

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive & Transportation

- 10.3.2. Construction

- 10.3.3. Electronics

- 10.3.4. Industrial Machinery

- 10.3.5. Other End-user Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Singapore

- 10.4.2. Indonesia

- 10.4.3. Thailand

- 10.4.4. Philippines

- 10.4.5. Malaysia

- 10.4.6. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Plating Chemicals

- 11.1.2. Cleaners

- 11.1.3. Conversion Coatings

- 11.1.4. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by Base Material

- 11.2.1. Metals

- 11.2.2. Plastics

- 11.2.3. Other Base Materials

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Automotive & Transportation

- 11.3.2. Construction

- 11.3.3. Electronics

- 11.3.4. Industrial Machinery

- 11.3.5. Other End-user Industries

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Singapore

- 11.4.2. Indonesia

- 11.4.3. Thailand

- 11.4.4. Philippines

- 11.4.5. Malaysia

- 11.4.6. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Chemetall GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ChemTech Surface Finishing Pvt Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Henkel AG & Co KGa

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 JCU CORPORATION

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nihon Parkerizing Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nippon Paint Holdings Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NOF CORPORATION

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 OC Oerlikon

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 PPG Industries Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Siam YUKEN Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 The Sherwin-Williams Company*List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Chemetall GmbH

List of Figures

- Figure 1: Global Southeast Asia Surface Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 3: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 5: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 6: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 9: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: Singapore Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 13: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 14: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 15: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 16: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 19: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Indonesia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 23: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 24: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 25: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 26: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 27: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 29: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Thailand Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 33: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 34: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 35: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 36: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Philippines Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 43: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 44: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 45: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 46: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 47: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 49: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 51: Malaysia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 53: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 54: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 55: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 56: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 57: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 59: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 61: Rest of Southeast Asia Southeast Asia Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 3: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 7: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 8: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 12: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 13: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 17: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 18: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 23: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 27: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 28: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 32: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 33: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 35: Global Southeast Asia Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Surface Treatment Chemicals Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Southeast Asia Surface Treatment Chemicals Market?

Key companies in the market include Chemetall GmbH, ChemTech Surface Finishing Pvt Ltd, Henkel AG & Co KGa, JCU CORPORATION, Nihon Parkerizing Co Ltd, Nippon Paint Holdings Co Ltd, NOF CORPORATION, OC Oerlikon, PPG Industries Inc, Siam YUKEN Co Ltd, The Sherwin-Williams Company*List Not Exhaustive.

3. What are the main segments of the Southeast Asia Surface Treatment Chemicals Market?

The market segments include Chemical Type, Base Material, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapid Industrialization Across the Region; Growing Demand from Automotive & Transportation Industry.

6. What are the notable trends driving market growth?

Growing Application in the Automobile Industry.

7. Are there any restraints impacting market growth?

Rapid Industrialization Across the Region; Growing Demand from Automotive & Transportation Industry.

8. Can you provide examples of recent developments in the market?

April 2022: To cater to the growing machining sector in India and the Southeast Asian market, CemeCon established its Indian subsidiary CemeCon Coating Pvt. Ltd. in Pune, India, to serve a potential customer base across ASEAN countries and India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Surface Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Surface Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Surface Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Surface Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence