Key Insights

The Southeast Asia industrial flooring market is experiencing robust growth, driven by the region's expanding manufacturing and logistics sectors. A CAGR exceeding 5.50% from 2019 to 2024 suggests a significant market expansion, projected to continue through 2033. Key drivers include increasing investments in industrial infrastructure, rising demand for hygienic and durable flooring solutions in food and beverage, chemical, and healthcare facilities, and the growing adoption of advanced resin types like epoxy and polyaspartic for their superior performance characteristics. The strong growth is further fueled by the increasing emphasis on safety and productivity within industrial settings. The market is segmented by resin type (epoxy, polyaspartic, polyurethane, acrylic, and others), application (concrete, wood, and others), and end-user industry (food and beverage, chemical, transportation and aviation, healthcare, and others). Epoxy resins currently hold a significant market share due to their versatility and cost-effectiveness, but polyaspartic and polyurethane are gaining traction due to their faster curing times and enhanced durability. While the market faces restraints like fluctuating raw material prices and potential supply chain disruptions, the overall positive outlook driven by regional economic development and industrialization is expected to mitigate these challenges. The significant presence of major international players like Tremco, RPM International, and Sika, along with regional companies, indicates a competitive yet dynamic market landscape. Within Southeast Asia, countries like China, India, and Indonesia are expected to contribute significantly to the overall market growth due to their large industrial bases and ongoing infrastructure development projects.

Southeast Asia Industrial Flooring Market Market Size (In Billion)

The forecast for the Southeast Asia industrial flooring market shows a continued upward trajectory, with the market value expected to exceed current estimates substantially by 2033. The market will likely witness increased adoption of sustainable and eco-friendly flooring solutions, driven by growing environmental concerns. Furthermore, technological advancements in resin formulations and application techniques will likely shape future market trends. Competition is likely to intensify as both established players and new entrants vie for market share. However, the market's resilience and projected growth suggest ample opportunities for businesses offering innovative and high-quality industrial flooring solutions tailored to the specific needs of different industries and applications within the region. Strategic partnerships and collaborations are likely to play an increasingly important role in this competitive landscape.

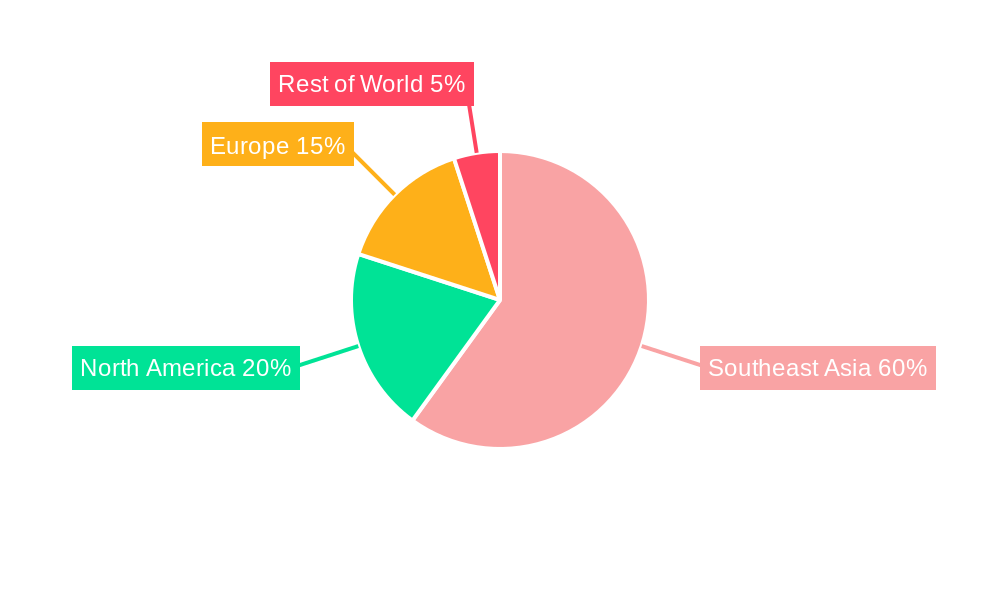

Southeast Asia Industrial Flooring Market Company Market Share

Southeast Asia Industrial Flooring Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Southeast Asia industrial flooring market, offering valuable insights for businesses operating in or planning to enter this dynamic sector. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report meticulously analyzes market trends, competitive dynamics, key players, and future growth potential, providing actionable intelligence for strategic decision-making. The total market size is projected to reach xx Million by 2033.

Southeast Asia Industrial Flooring Market Market Structure & Competitive Dynamics

The Southeast Asia industrial flooring market exhibits a moderately concentrated structure, with several major players holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by the continuous development of new resin types, application techniques, and sustainable materials. Regulatory frameworks, particularly those concerning environmental protection and worker safety, play a crucial role in shaping market practices. Product substitutes, such as advanced coatings and alternative flooring materials, exert competitive pressure. End-user trends, particularly in sectors like e-commerce and manufacturing, significantly influence market demand. Mergers and acquisitions (M&A) activity is moderate, with deal values averaging xx Million in recent years. Key players are actively engaging in strategic partnerships and collaborations to enhance their market position and technological capabilities. Examples include the xx% market share held by 3M and the xx Million acquisition of Company X by Company Y in 2023.

- Market Concentration: Moderately concentrated

- Innovation Ecosystem: Highly dynamic

- Regulatory Framework: Stringent, evolving

- M&A Activity: Moderate, with deals averaging xx Million.

Southeast Asia Industrial Flooring Market Industry Trends & Insights

The Southeast Asia industrial flooring market is experiencing robust growth, driven by several factors. The construction boom across the region, fueled by rapid urbanization and infrastructure development, is a primary driver. Rising demand from key end-user industries, including food and beverage, chemical processing, and transportation, further fuels market expansion. Technological advancements, such as the introduction of high-performance resin systems and automated application methods, are transforming the industry. Consumer preferences are shifting towards durable, sustainable, and aesthetically pleasing flooring solutions. The market exhibits intense competitive dynamics, with established players and new entrants vying for market share. The compound annual growth rate (CAGR) is estimated at xx% during the forecast period (2025-2033), and market penetration is expected to reach xx% by 2033.

Dominant Markets & Segments in Southeast Asia Industrial Flooring Market

The Southeast Asia industrial flooring market is segmented by resin type, application, and end-user industry. Among resin types, epoxy dominates the market due to its versatility, durability, and cost-effectiveness. Concrete remains the leading application, driven by its widespread use in industrial construction. The food and beverage sector is a significant end-user, demanding high-performance flooring with stringent hygiene requirements.

- By Resin Type: Epoxy holds the largest market share, followed by polyurethane and polyaspartic. The growth of the polyaspartic segment is driven by its rapid curing time and excellent chemical resistance.

- By Application: Concrete application dominates due to its prevalence in industrial settings. Wood flooring holds a smaller, niche market segment.

- By End-user Industry: The food and beverage industry exhibits significant growth owing to stringent hygiene requirements. The chemical and transportation sectors also contribute significantly to market demand.

Dominant Regions/Countries: [Insert details of dominant regions and countries, include factors driving dominance such as economic growth, infrastructure development, government policies, etc. for each]. For example, Singapore's strong manufacturing base and high construction activity contribute to its leading market position.

Southeast Asia Industrial Flooring Market Product Innovations

Recent product innovations in the Southeast Asia industrial flooring market have focused on enhancing performance characteristics, such as durability, chemical resistance, and hygiene. The development of eco-friendly and sustainable flooring solutions is gaining traction, driven by increasing environmental concerns. New application methods, such as automated dispensing systems, are improving efficiency and reducing installation time. These innovations are aimed at meeting the evolving needs of end-users, particularly in terms of performance, sustainability, and cost-effectiveness. The adoption of smart flooring solutions, incorporating sensors and IoT capabilities, is expected to shape future market trends.

Report Segmentation & Scope

This report provides a detailed segmentation of the Southeast Asia industrial flooring market across three key aspects:

By Resin Type: Epoxy, Polyaspartic, Polyurethane, Acrylic, Other Resin Types. Each segment's market size, growth projections, and competitive dynamics are analyzed.

By Application: Concrete, Wood, Other Applications. Each segment's unique characteristics, market trends, and growth drivers are explored.

By End-user Industry: Food and Beverage, Chemical, Transportation and Aviation, Healthcare, Other End-user Industries. The report analyzes the specific flooring requirements and market opportunities within each industry sector.

Key Drivers of Southeast Asia Industrial Flooring Market Growth

Several factors drive the growth of the Southeast Asia industrial flooring market. Rapid urbanization and infrastructure development create a high demand for industrial construction. The expansion of manufacturing and industrial sectors fuels the need for durable and high-performance flooring solutions. Stringent hygiene regulations in sectors like food and beverage mandate the adoption of specialized flooring materials. Government initiatives promoting industrial growth further stimulate market expansion. Technological advancements, such as the introduction of innovative resin systems and automated application methods, enhance efficiency and performance.

Challenges in the Southeast Asia Industrial Flooring Market Sector

Despite significant growth potential, the Southeast Asia industrial flooring market faces several challenges. Fluctuations in raw material prices can impact profitability. Supply chain disruptions can affect production and delivery timelines. Intense competition from both established and emerging players creates pricing pressures. Regulatory compliance requirements can be complex and increase operational costs. Meeting the diverse and evolving needs of end-users while maintaining cost-effectiveness presents a constant challenge. The lack of skilled labor for installation can also pose a challenge.

Leading Players in the Southeast Asia Industrial Flooring Market Market

- Tremco Incorporated

- RPM International Inc

- MBCC Group

- Akzo Nobel NV

- Sherwin-Williams Company

- Lubrizol Corporation

- 3M

- Nippon Paint Holdings Co Ltd

- Applied Flooring

- CoGri Group Ltd

- Sika AG

Key Developments in Southeast Asia Industrial Flooring Market Sector

- December 2022: Hafary Holdings Limited formed a joint venture, International Ceramics Manufacturing Hub Sdn Bhd (ICMHSB), to expand manufacturing capabilities in the region. This move signifies increased investment and potential for future market growth.

- February 2022: Sherwin-Williams launched Sher-Crete® SLX and Sher-Crete® BU products for underlay and floor leveling, targeting warehouses, manufacturing facilities, and storage areas across various industries (including aviation and automotive). This product launch indicates increased focus on specific industrial applications and potential market share gains.

Strategic Southeast Asia Industrial Flooring Market Market Outlook

The Southeast Asia industrial flooring market holds immense potential for future growth. Continued urbanization, infrastructure development, and industrial expansion will drive demand for high-performance flooring solutions. Technological advancements, particularly in sustainable and smart flooring technologies, will offer significant opportunities. Companies that can effectively cater to the diverse needs of end-users, while mitigating challenges like supply chain disruptions and regulatory complexities, are well-positioned to achieve success in this dynamic market. Strategic partnerships, technological innovations, and a focus on sustainability will be crucial for achieving sustained growth and market leadership.

Southeast Asia Industrial Flooring Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Polyaspartic

- 1.3. Polyurethane

- 1.4. Acrylic

- 1.5. Other Resin Types

-

2. Application

- 2.1. Concrete

- 2.2. Wood

- 2.3. Other Applications

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Chemical

- 3.3. Transporation and Aviation

- 3.4. Healthcare

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. Indonesia

- 4.2. Thailand

- 4.3. Vietnam

- 4.4. Malaysia

- 4.5. Rest of Southeast Asia

Southeast Asia Industrial Flooring Market Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Malaysia

- 5. Rest of Southeast Asia

Southeast Asia Industrial Flooring Market Regional Market Share

Geographic Coverage of Southeast Asia Industrial Flooring Market

Southeast Asia Industrial Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on VOCs Released from Industrial Floorings

- 3.4. Market Trends

- 3.4.1. Growth in the Food and Beverages Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartic

- 5.1.3. Polyurethane

- 5.1.4. Acrylic

- 5.1.5. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete

- 5.2.2. Wood

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Chemical

- 5.3.3. Transporation and Aviation

- 5.3.4. Healthcare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Vietnam

- 5.4.4. Malaysia

- 5.4.5. Rest of Southeast Asia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.5.2. Thailand

- 5.5.3. Vietnam

- 5.5.4. Malaysia

- 5.5.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Indonesia Southeast Asia Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Polyaspartic

- 6.1.3. Polyurethane

- 6.1.4. Acrylic

- 6.1.5. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete

- 6.2.2. Wood

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Chemical

- 6.3.3. Transporation and Aviation

- 6.3.4. Healthcare

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Indonesia

- 6.4.2. Thailand

- 6.4.3. Vietnam

- 6.4.4. Malaysia

- 6.4.5. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Thailand Southeast Asia Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Polyaspartic

- 7.1.3. Polyurethane

- 7.1.4. Acrylic

- 7.1.5. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete

- 7.2.2. Wood

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Chemical

- 7.3.3. Transporation and Aviation

- 7.3.4. Healthcare

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Indonesia

- 7.4.2. Thailand

- 7.4.3. Vietnam

- 7.4.4. Malaysia

- 7.4.5. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Vietnam Southeast Asia Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Polyaspartic

- 8.1.3. Polyurethane

- 8.1.4. Acrylic

- 8.1.5. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete

- 8.2.2. Wood

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Chemical

- 8.3.3. Transporation and Aviation

- 8.3.4. Healthcare

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Indonesia

- 8.4.2. Thailand

- 8.4.3. Vietnam

- 8.4.4. Malaysia

- 8.4.5. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Malaysia Southeast Asia Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Polyaspartic

- 9.1.3. Polyurethane

- 9.1.4. Acrylic

- 9.1.5. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Concrete

- 9.2.2. Wood

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Chemical

- 9.3.3. Transporation and Aviation

- 9.3.4. Healthcare

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Indonesia

- 9.4.2. Thailand

- 9.4.3. Vietnam

- 9.4.4. Malaysia

- 9.4.5. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Rest of Southeast Asia Southeast Asia Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Epoxy

- 10.1.2. Polyaspartic

- 10.1.3. Polyurethane

- 10.1.4. Acrylic

- 10.1.5. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Concrete

- 10.2.2. Wood

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverage

- 10.3.2. Chemical

- 10.3.3. Transporation and Aviation

- 10.3.4. Healthcare

- 10.3.5. Other End-user Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Indonesia

- 10.4.2. Thailand

- 10.4.3. Vietnam

- 10.4.4. Malaysia

- 10.4.5. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tremco Incorporated*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RPM International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MBCC Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Akzo Nobel NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sherwin-Williams Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lubrizol Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nippon Paint Holdings Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Applied Flooring

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CoGri Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sika AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Tremco Incorporated*List Not Exhaustive

List of Figures

- Figure 1: Southeast Asia Industrial Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Industrial Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 7: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 17: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 22: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 27: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Southeast Asia Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Industrial Flooring Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Southeast Asia Industrial Flooring Market?

Key companies in the market include Tremco Incorporated*List Not Exhaustive, RPM International Inc, MBCC Group, Akzo Nobel NV, Sherwin-Williams Company, Lubrizol Corporation, 3M, Nippon Paint Holdings Co Ltd, Applied Flooring, CoGri Group Ltd, Sika AG.

3. What are the main segments of the Southeast Asia Industrial Flooring Market?

The market segments include Resin Type, Application, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry.

6. What are the notable trends driving market growth?

Growth in the Food and Beverages Industry.

7. Are there any restraints impacting market growth?

Stringent Regulations on VOCs Released from Industrial Floorings.

8. Can you provide examples of recent developments in the market?

December 2022: Hafary Holdings Limited, a leading supplier of premium tiles, wood flooring, stone, and other products in Singapore, incorporated a new Joint Venture (JV) Company, International Ceramics Manufacturing Hub Sdn Bhd (ICMHSB). The JV will help the group to expand its operations across the region by acquiring manufacturing capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Industrial Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Industrial Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Industrial Flooring Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Industrial Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence