Key Insights

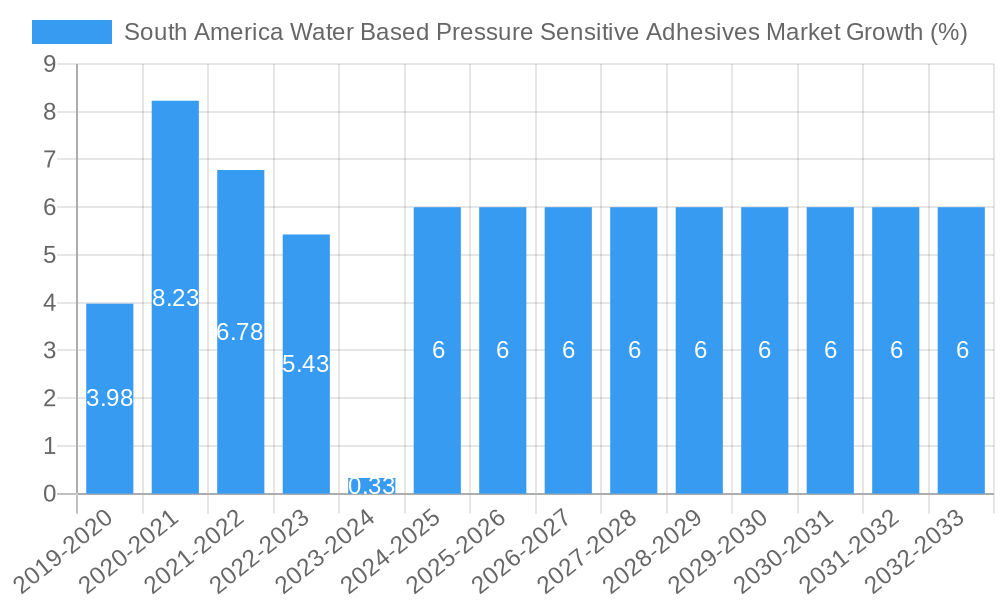

The South America Water-Based Pressure Sensitive Adhesives (WBPASA) market is poised for robust expansion, projected to reach approximately USD 1.5 billion in 2024, with a Compound Annual Growth Rate (CAGR) of 6% anticipated through 2033. This growth is primarily fueled by the increasing demand from key end-user industries such as packaging, medical, and transportation, all of which are experiencing significant development across South America. The rising consumer awareness regarding environmental sustainability is a major driver, leading to a strong preference for eco-friendly water-based formulations over solvent-based alternatives. This shift aligns with stricter environmental regulations being implemented across the region, further bolstering the adoption of WBPASA. Furthermore, advancements in adhesive technology, including improved performance characteristics like enhanced tack, peel, and shear strength, are expanding the application scope of these adhesives into more demanding sectors.

Several factors are contributing to this positive market trajectory. The growing e-commerce sector in South America is creating a surge in demand for high-quality, reliable packaging solutions, where WBPASA play a crucial role in labels and tapes. The expanding healthcare industry, with its increasing need for medical tapes and wound care products, also presents a substantial growth opportunity. While the market is largely driven by positive trends, potential restraints include the initial cost of adopting new technologies and the need for specialized application equipment, which could pose challenges for smaller manufacturers. However, the long-term benefits of improved performance, reduced environmental impact, and compliance with evolving regulations are expected to outweigh these initial hurdles, solidifying the dominance of WBPASA in the South American market. The market segmentation reveals a strong presence of acrylics and silicones within the resin category, while water-based technology leads the pack, underscoring the dominant trend towards sustainable solutions.

This comprehensive report offers an in-depth analysis of the South America Water Based Pressure Sensitive Adhesives Market, providing critical insights for industry stakeholders. Covering the 2019–2033 study period, with 2025 as the base and estimated year, and a robust 2025–2033 forecast period, this research delves into the evolving landscape of PSA solutions across the region. The report meticulously examines various water-based PSA technologies and their applications in key industries, making it an indispensable resource for understanding market dynamics, competitive strategies, and future growth opportunities. The global demand for eco-friendly and sustainable adhesive solutions is significantly influencing the expansion of the water-based PSA market.

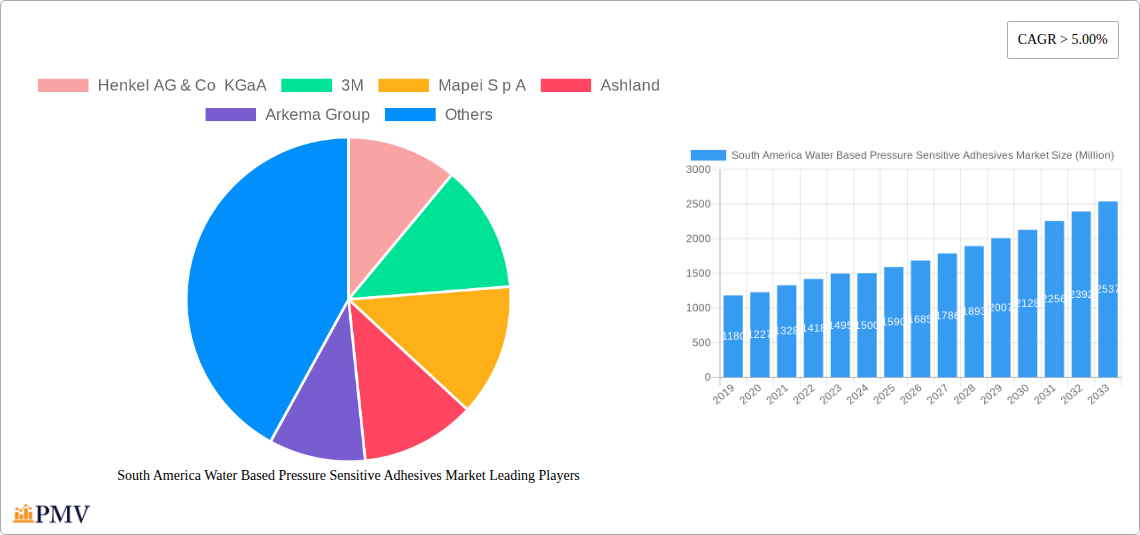

South America Water Based Pressure Sensitive Adhesives Market Market Structure & Competitive Dynamics

The South America Water Based Pressure Sensitive Adhesives Market exhibits a moderately concentrated structure, with a few key players dominating significant market share. Leading companies like Henkel AG & Co KGaA, 3M, Mapei S p A, Ashland, Arkema Group, Dow, H B Fuller Company, Franklin International, Sika AG, Jowat SE, and Wacker Chemie AG are actively engaged in product innovation and market expansion. The innovation ecosystem is driven by increasing demand for high-performance, environmentally friendly adhesives. Regulatory frameworks, particularly concerning VOC emissions and sustainability, are shaping product development and market entry strategies. Product substitutes, such as solvent-based adhesives and tapes, continue to pose a competitive challenge, though the environmental advantages of water-based PSAs are driving a shift. End-user trends are leaning towards lighter-weight materials, improved adhesion performance, and recyclability, directly impacting the development of advanced water-based PSA formulations. Mergers and acquisitions (M&A) activities are observed, with significant M&A deal values in the multi-billion dollar range, aimed at consolidating market presence and expanding product portfolios. The competitive landscape is characterized by a focus on research and development, strategic partnerships, and expanding distribution networks to cater to diverse regional needs.

South America Water Based Pressure Sensitive Adhesives Market Industry Trends & Insights

The South America Water Based Pressure Sensitive Adhesives Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is primarily fueled by the escalating demand for sustainable and eco-friendly adhesive solutions across various end-user industries. The shift away from solvent-based adhesives due to environmental regulations and health concerns is a significant market driver. Advancements in water-based PSA technology, including improved tack, peel strength, and shear resistance, are enabling wider adoption in demanding applications. Consumer preferences are increasingly aligning with brands that demonstrate environmental responsibility, leading manufacturers to prioritize sustainable packaging and product assembly solutions. The packaging industry, in particular, is a major consumer of water-based PSAs, driven by the growth of e-commerce and the need for efficient and reliable labeling and sealing solutions. The medical sector is also witnessing increased adoption of water-based PSAs for sensitive applications like wound dressings and medical tapes, owing to their biocompatibility and reduced risk of skin irritation. Woodworking and joinery applications are benefiting from water-based PSAs' ease of use and low VOC emissions. The commercial graphics sector relies on these adhesives for durable and visually appealing signage and displays. Furthermore, the automotive and electronics industries are exploring water-based PSAs for their lightweighting and insulating properties. Technological disruptions, such as the development of bio-based resins and advanced polymer chemistries, are further enhancing the performance and sustainability profile of these adhesives. The market penetration of water-based PSAs is expected to rise steadily as their cost-effectiveness and performance capabilities continue to improve, challenging traditional adhesive technologies. The competitive dynamics are characterized by ongoing product innovation, strategic collaborations, and a focus on customized solutions to meet specific industry requirements. The increasing disposable income and rising middle class in South American countries are also contributing to the growth of end-user industries, thereby boosting the demand for PSAs. The market is witnessing investments in production capacity expansion and research & development to cater to the evolving demands of the South American market.

Dominant Markets & Segments in South America Water Based Pressure Sensitive Adhesives Market

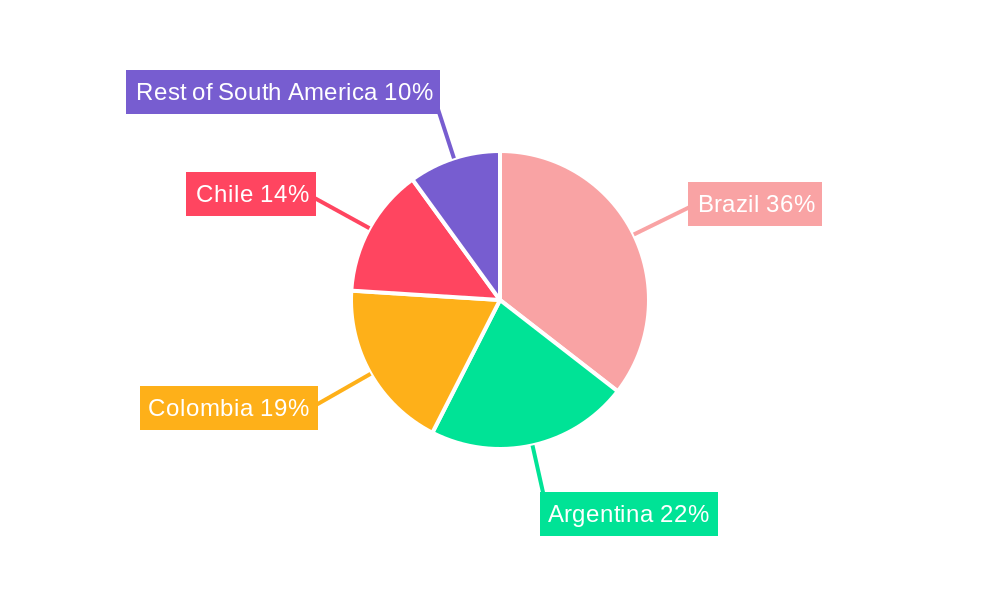

The South America Water Based Pressure Sensitive Adhesives Market is significantly dominated by Brazil, which represents the largest geographical market due to its substantial industrial base and growing manufacturing sector. The Packaging industry is the leading end-user industry, accounting for a substantial share of the market, driven by the burgeoning e-commerce sector and the demand for high-quality, sustainable packaging materials. Within the Resin segment, Acrylics hold the largest market share, owing to their versatility, excellent performance characteristics, and cost-effectiveness, making them ideal for a wide range of applications. In terms of Technology, Water-based formulations are clearly the dominant and fastest-growing segment, directly aligning with the global trend towards environmentally friendly and low-VOC adhesive solutions. The Application segment is led by Labels, which are crucial for product identification, branding, and regulatory compliance across numerous industries.

Dominant Geography: Brazil

- Economic Policies: Favorable government policies supporting manufacturing and export activities, coupled with a large domestic consumer base, drive demand.

- Infrastructure Development: Investments in logistics and transportation networks facilitate the efficient distribution of adhesive products.

- Industrial Growth: A strong presence in sectors like food and beverage, automotive, and consumer goods fuels the demand for PSAs.

Dominant End-user Industry: Packaging

- E-commerce Boom: The exponential growth of online retail necessitates reliable and efficient labeling and sealing solutions.

- Sustainability Mandates: Increasing consumer and regulatory pressure for eco-friendly packaging solutions favors water-based PSAs.

- Food & Beverage Sector: Stringent requirements for food-grade adhesives and tamper-evident packaging solutions contribute to demand.

Dominant Resin: Acrylics

- Versatility: Suitable for a broad spectrum of substrates and application conditions.

- Performance: Offers excellent UV resistance, aging stability, and adhesion to various surfaces.

- Cost-Effectiveness: Provides a favorable balance between performance and price point for mass-market applications.

Dominant Technology: Water-based

- Environmental Compliance: Meets stringent regulations regarding Volatile Organic Compounds (VOCs) and hazardous air pollutants.

- Safety: Offers a safer working environment compared to solvent-based alternatives.

- Performance Improvements: Continuous advancements are closing the performance gap with traditional solvent-based PSAs.

Dominant Application: Labels

- Product Identification & Branding: Essential for consumer goods, industrial products, and pharmaceuticals.

- Regulatory Compliance: Crucial for providing information such as nutritional facts, safety warnings, and batch numbers.

- Tamper-Evident Features: Used in sensitive applications to ensure product integrity.

South America Water Based Pressure Sensitive Adhesives Market Product Innovations

Recent product innovations in the South America Water Based Pressure Sensitive Adhesives Market focus on enhancing sustainability, improving performance, and catering to niche applications. Developments include novel bio-based acrylic formulations offering reduced environmental impact and improved biodegradability. Advancements in tackifier resins and polymer architectures are yielding PSAs with superior adhesion to challenging surfaces, including low-surface-energy plastics and recycled materials. Innovations also extend to the development of PSAs with enhanced temperature resistance for demanding industrial environments and specialized adhesives for the medical sector, prioritizing biocompatibility and gentle skin adhesion. These innovations are driven by a need to offer competitive advantages, meet evolving regulatory standards, and address the specific performance requirements of the South American market.

Report Segmentation & Scope

This report segments the South America Water Based Pressure Sensitive Adhesives Market across key categories to provide a granular understanding of market dynamics. The Resin segmentation includes Acrylics, Silicones, Elastomers, and Other Resins, each offering distinct properties for various applications. The Technology segmentation details Water-based, Solvent-based, Hot Melt, and Radiation curing technologies, with a primary focus on the growth of water-based systems. The Application segmentation covers Tapes, Labels, Graphics, and Other Applications, highlighting their respective market sizes and growth trajectories. The End-user Industry segmentation analyzes the market across Packaging, Woodworking and Joinery, Medical, Commercial Graphics, Transportation, Electronics, and Other End-user Industries. Geographically, the market is analyzed across Brazil, Argentina, Colombia, Chile, and the Rest of South America, with Brazil expected to lead in market size and growth. Detailed analysis includes current market sizes, projected growth rates (CAGR), and key competitive factors within each segment.

Key Drivers of South America Water Based Pressure Sensitive Adhesives Market Growth

The growth of the South America Water Based Pressure Sensitive Adhesives Market is propelled by a confluence of factors. Firstly, stringent environmental regulations in several South American countries are mandating a reduction in VOC emissions, making water-based PSAs the preferred choice over solvent-based alternatives. Secondly, the escalating demand for sustainable and eco-friendly products from consumers and businesses alike is driving manufacturers to adopt greener adhesive technologies. Thirdly, the robust growth of key end-user industries, particularly packaging due to the e-commerce surge, is a significant contributor. Continuous technological advancements leading to improved performance characteristics of water-based PSAs, such as enhanced adhesion and durability, are further expanding their application scope. Finally, increasing disposable incomes and industrialization in emerging economies within South America are boosting overall market demand.

Challenges in the South America Water Based Pressure Sensitive Adhesives Market Sector

Despite the positive growth trajectory, the South America Water Based Pressure Sensitive Adhesives Market faces several challenges. One significant hurdle is the perception and historical performance comparison with solvent-based adhesives, where certain high-performance applications might still favor traditional solvent systems. Supply chain disruptions, common in the region, can impact the availability and cost of raw materials, affecting production efficiency. Fluctuating raw material prices, particularly for petrochemical derivatives used in PSA formulations, can lead to price volatility and impact profitability. Furthermore, the adoption of new technologies requires significant investment in research and development, which can be a challenge for smaller players. Intense price competition among market participants, especially for commodity applications, can put pressure on profit margins.

Leading Players in the South America Water Based Pressure Sensitive Adhesives Market Market

- Henkel AG & Co KGaA

- 3M

- Mapei S p A

- Ashland

- Arkema Group

- Dow

- H B Fuller Company

- Franklin International

- Sika AG

- Jowat SE

- Wacker Chemie AG

Key Developments in South America Water Based Pressure Sensitive Adhesives Market Sector

- 2023/Q4: Launch of a new line of high-performance, low-VOC water-based acrylic PSAs for label applications, offering superior adhesion to recycled plastics.

- 2023/Q3: Strategic partnership formed between a leading adhesive manufacturer and a regional packaging converter to develop customized PSA solutions for sustainable food packaging.

- 2023/Q2: Expansion of manufacturing capacity for water-based PSAs in Brazil to meet growing domestic and export demand.

- 2023/Q1: Acquisition of a specialty adhesive producer by a major global player, strengthening its portfolio in the medical and electronics segments within South America.

- 2022/Q4: Introduction of a novel bio-based PSA formulation for tapes and labels, emphasizing its biodegradability and reduced carbon footprint.

Strategic South America Water Based Pressure Sensitive Adhesives Market Market Outlook

The strategic outlook for the South America Water Based Pressure Sensitive Adhesives Market remains highly positive, driven by the unyielding demand for sustainable and eco-friendly solutions. Key growth accelerators include continued innovation in polymer science leading to enhanced performance characteristics, enabling wider adoption in demanding sectors. The ongoing expansion of e-commerce will continue to fuel demand from the packaging industry. Government initiatives promoting green manufacturing and circular economy principles will further incentivize the use of water-based PSAs. Strategic opportunities lie in expanding product offerings for niche applications like medical devices and electric vehicle components, as well as investing in localized production and R&D to cater to specific regional needs and reduce supply chain dependencies. Mergers and acquisitions are expected to continue as companies seek to consolidate market share and expand technological capabilities.

South America Water Based Pressure Sensitive Adhesives Market Segmentation

-

1. Resin

- 1.1. Acrylics

- 1.2. Silicones

- 1.3. Elastomers

- 1.4. Other Resins

-

2. Technology

- 2.1. Water-based

- 2.2. Solvent-based

- 2.3. Hot Melt

- 2.4. Radiation

-

3. Application

- 3.1. Tapes

- 3.2. Labels

- 3.3. Graphics

- 3.4. Other Applications

-

4. End-user Industry

- 4.1. Packaging

- 4.2. Woodworking and Joinery

- 4.3. Medical

- 4.4. Commercial Graphics

- 4.5. Transportation

- 4.6. Electronics

- 4.7. Other End-user Industries

-

5. Geography

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Colombia

- 5.4. Chile

- 5.5. Rest of South America

South America Water Based Pressure Sensitive Adhesives Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Water Based Pressure Sensitive Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Construction Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations Regarding VOC Emissions; Other Restraints

- 3.4. Market Trends

- 3.4.1. Water-borne PSAs to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylics

- 5.1.2. Silicones

- 5.1.3. Elastomers

- 5.1.4. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-based

- 5.2.2. Solvent-based

- 5.2.3. Hot Melt

- 5.2.4. Radiation

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Tapes

- 5.3.2. Labels

- 5.3.3. Graphics

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Packaging

- 5.4.2. Woodworking and Joinery

- 5.4.3. Medical

- 5.4.4. Commercial Graphics

- 5.4.5. Transportation

- 5.4.6. Electronics

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Colombia

- 5.5.4. Chile

- 5.5.5. Rest of South America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Colombia

- 5.6.4. Chile

- 5.6.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Brazil South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Resin

- 6.1.1. Acrylics

- 6.1.2. Silicones

- 6.1.3. Elastomers

- 6.1.4. Other Resins

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water-based

- 6.2.2. Solvent-based

- 6.2.3. Hot Melt

- 6.2.4. Radiation

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Tapes

- 6.3.2. Labels

- 6.3.3. Graphics

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Packaging

- 6.4.2. Woodworking and Joinery

- 6.4.3. Medical

- 6.4.4. Commercial Graphics

- 6.4.5. Transportation

- 6.4.6. Electronics

- 6.4.7. Other End-user Industries

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Brazil

- 6.5.2. Argentina

- 6.5.3. Colombia

- 6.5.4. Chile

- 6.5.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Resin

- 7. Argentina South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Resin

- 7.1.1. Acrylics

- 7.1.2. Silicones

- 7.1.3. Elastomers

- 7.1.4. Other Resins

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water-based

- 7.2.2. Solvent-based

- 7.2.3. Hot Melt

- 7.2.4. Radiation

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Tapes

- 7.3.2. Labels

- 7.3.3. Graphics

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Packaging

- 7.4.2. Woodworking and Joinery

- 7.4.3. Medical

- 7.4.4. Commercial Graphics

- 7.4.5. Transportation

- 7.4.6. Electronics

- 7.4.7. Other End-user Industries

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Brazil

- 7.5.2. Argentina

- 7.5.3. Colombia

- 7.5.4. Chile

- 7.5.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Resin

- 8. Colombia South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Resin

- 8.1.1. Acrylics

- 8.1.2. Silicones

- 8.1.3. Elastomers

- 8.1.4. Other Resins

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water-based

- 8.2.2. Solvent-based

- 8.2.3. Hot Melt

- 8.2.4. Radiation

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Tapes

- 8.3.2. Labels

- 8.3.3. Graphics

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Packaging

- 8.4.2. Woodworking and Joinery

- 8.4.3. Medical

- 8.4.4. Commercial Graphics

- 8.4.5. Transportation

- 8.4.6. Electronics

- 8.4.7. Other End-user Industries

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Brazil

- 8.5.2. Argentina

- 8.5.3. Colombia

- 8.5.4. Chile

- 8.5.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Resin

- 9. Chile South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Resin

- 9.1.1. Acrylics

- 9.1.2. Silicones

- 9.1.3. Elastomers

- 9.1.4. Other Resins

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Water-based

- 9.2.2. Solvent-based

- 9.2.3. Hot Melt

- 9.2.4. Radiation

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Tapes

- 9.3.2. Labels

- 9.3.3. Graphics

- 9.3.4. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Packaging

- 9.4.2. Woodworking and Joinery

- 9.4.3. Medical

- 9.4.4. Commercial Graphics

- 9.4.5. Transportation

- 9.4.6. Electronics

- 9.4.7. Other End-user Industries

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. Brazil

- 9.5.2. Argentina

- 9.5.3. Colombia

- 9.5.4. Chile

- 9.5.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Resin

- 10. Rest of South America South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Resin

- 10.1.1. Acrylics

- 10.1.2. Silicones

- 10.1.3. Elastomers

- 10.1.4. Other Resins

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Water-based

- 10.2.2. Solvent-based

- 10.2.3. Hot Melt

- 10.2.4. Radiation

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Tapes

- 10.3.2. Labels

- 10.3.3. Graphics

- 10.3.4. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Packaging

- 10.4.2. Woodworking and Joinery

- 10.4.3. Medical

- 10.4.4. Commercial Graphics

- 10.4.5. Transportation

- 10.4.6. Electronics

- 10.4.7. Other End-user Industries

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. Brazil

- 10.5.2. Argentina

- 10.5.3. Colombia

- 10.5.4. Chile

- 10.5.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Resin

- 11. Brazil South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 12. Argentina South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America South America Water Based Pressure Sensitive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Henkel AG & Co KGaA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 3M

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Mapei S p A

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Ashland

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Arkema Group

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Dow

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 H B Fuller Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Franklin International

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sika AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Jowat SE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Wacker Chemie AG*List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: South America Water Based Pressure Sensitive Adhesives Market Revenue Breakdown (undefined, %) by Product 2024 & 2032

- Figure 2: South America Water Based Pressure Sensitive Adhesives Market Share (%) by Company 2024

List of Tables

- Table 1: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Region 2019 & 2032

- Table 2: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Resin 2019 & 2032

- Table 3: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Technology 2019 & 2032

- Table 4: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 5: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 6: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 7: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Region 2019 & 2032

- Table 8: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 9: Brazil South America Water Based Pressure Sensitive Adhesives Market Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 10: Argentina South America Water Based Pressure Sensitive Adhesives Market Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America South America Water Based Pressure Sensitive Adhesives Market Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 12: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Resin 2019 & 2032

- Table 13: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Technology 2019 & 2032

- Table 14: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 15: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 16: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 17: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 18: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Resin 2019 & 2032

- Table 19: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Technology 2019 & 2032

- Table 20: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 21: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 22: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 23: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 24: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Resin 2019 & 2032

- Table 25: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Technology 2019 & 2032

- Table 26: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 27: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 28: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 29: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 30: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Resin 2019 & 2032

- Table 31: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Technology 2019 & 2032

- Table 32: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 33: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 34: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 35: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 36: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Resin 2019 & 2032

- Table 37: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Technology 2019 & 2032

- Table 38: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 39: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 40: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 41: South America Water Based Pressure Sensitive Adhesives Market Revenue undefined Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Water Based Pressure Sensitive Adhesives Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the South America Water Based Pressure Sensitive Adhesives Market?

Key companies in the market include Henkel AG & Co KGaA, 3M, Mapei S p A, Ashland, Arkema Group, Dow, H B Fuller Company, Franklin International, Sika AG, Jowat SE, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the South America Water Based Pressure Sensitive Adhesives Market?

The market segments include Resin, Technology, Application, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Construction Industry; Other Drivers.

6. What are the notable trends driving market growth?

Water-borne PSAs to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations Regarding VOC Emissions; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Water Based Pressure Sensitive Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Water Based Pressure Sensitive Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Water Based Pressure Sensitive Adhesives Market?

To stay informed about further developments, trends, and reports in the South America Water Based Pressure Sensitive Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence