Key Insights

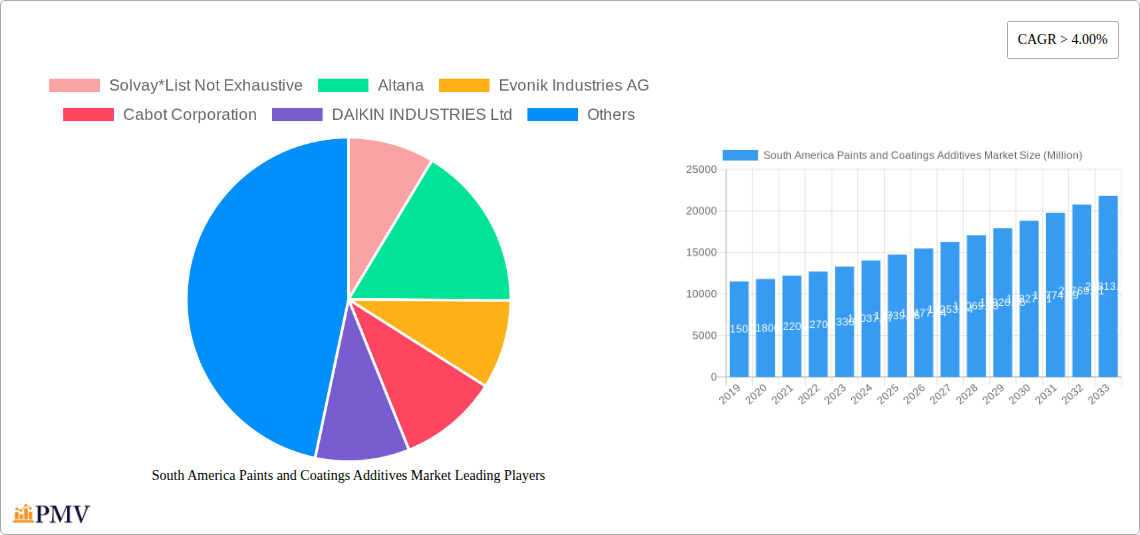

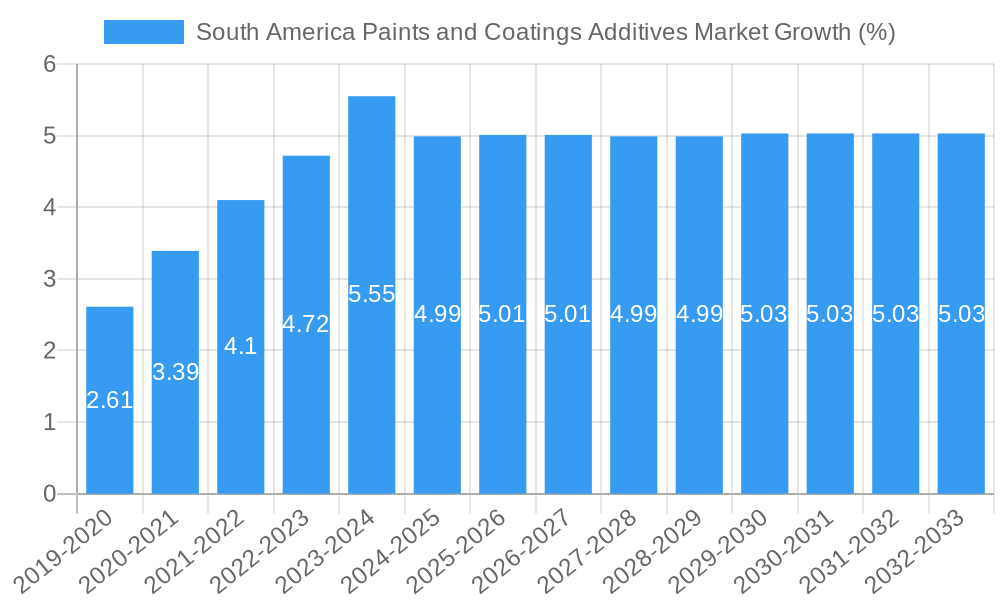

The South America Paints and Coatings Additives Market is poised for substantial growth, projected to reach USD 14,037.77 million by 2024, with a robust Compound Annual Growth Rate (CAGR) of 4.8% expected throughout the forecast period of 2025-2033. This expansion is fundamentally driven by the escalating demand for enhanced performance and durability in coatings across various end-use industries. The architectural segment, in particular, is a significant contributor, fueled by increasing urbanization, infrastructure development projects, and a growing consumer preference for aesthetic appeal and protective finishes in residential and commercial properties. Furthermore, the transportation sector, encompassing automotive and marine coatings, is witnessing a surge in demand for specialized additives that improve fuel efficiency, corrosion resistance, and overall vehicle longevity.

The market's trajectory is also shaped by emerging trends such as the growing emphasis on sustainable and eco-friendly coating solutions. Manufacturers are increasingly investing in the development of low-VOC (Volatile Organic Compound) and water-based additives, aligning with stringent environmental regulations and rising consumer consciousness. Key segments like biocides, dispersants, wetting agents, and rheology modifiers are experiencing heightened demand as they play a crucial role in achieving desired properties like improved application, extended shelf-life, and enhanced surface characteristics. While the market presents lucrative opportunities, challenges such as fluctuating raw material prices and the need for significant R&D investment in innovative formulations will require strategic navigation by industry players. Nonetheless, the persistent need for high-performance coatings across diverse applications in South America underpins a promising outlook for the paints and coatings additives market.

This in-depth report provides a detailed analysis of the South America paints and coatings additives market, covering market size, trends, growth drivers, challenges, and competitive landscape. With a robust study period of 2019–2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers actionable insights for stakeholders seeking to capitalize on the burgeoning South American coatings additives market. Our research encompasses key segments such as biocides, dispersants and wetting agents, defoamers and deaerators, rheology modifiers, surface modifiers, stabilizers, flow and leveling additives, and various paint and coating applications including architectural, wood, transportation, and protective coatings.

South America Paints and Coatings Additives Market Market Structure & Competitive Dynamics

The South America paints and coatings additives market exhibits a moderately concentrated structure, with a few key global players and several regional manufacturers vying for market share. Innovation ecosystems are driven by research and development initiatives focused on sustainable and high-performance additive solutions. Regulatory frameworks, particularly concerning environmental compliance and VOC reduction, are increasingly shaping product development and market entry strategies. Product substitutes, such as the development of more durable base coatings that require fewer additives, pose a potential long-term challenge. End-user trends favor additives that enhance durability, aesthetics, and sustainability across diverse applications. Merger and acquisition activities are anticipated to play a significant role in market consolidation, with estimated M&A deal values in the hundreds of millions for strategic acquisitions. Key players are investing in advanced manufacturing capabilities and localized production to serve the growing demand for specialty coatings additives in South America. The market penetration of advanced additive technologies is expected to rise, driven by increasing awareness of their performance benefits.

South America Paints and Coatings Additives Market Industry Trends & Insights

The South America paints and coatings additives market is poised for robust growth, driven by several compelling industry trends. A significant growth driver is the expanding construction sector across major economies like Brazil and Colombia, fueling demand for architectural coatings and, consequently, the additives that enhance their performance and aesthetics. The increasing adoption of eco-friendly and low-VOC (Volatile Organic Compound) formulations is a pivotal trend, spurring innovation in sustainable coatings additives. This shift is propelled by stricter environmental regulations and growing consumer preference for healthier living spaces. Technological disruptions, such as advancements in nanotechnologies for enhanced surface properties and the development of novel biocides for improved preservation, are reshaping product offerings. The rising disposable incomes in several South American nations are leading to increased spending on home renovations and infrastructure development, indirectly boosting the demand for high-quality paints and coatings. The transportation sector, particularly the automotive and aerospace segments, is also a significant contributor, demanding specialized coatings additives for corrosion resistance, scratch resistance, and aesthetic appeal. The CAGR for the South America paints and coatings additives market is projected to be around 5.5% during the forecast period, reflecting strong underlying economic and industry drivers. Market penetration of advanced additives, such as high-performance rheology modifiers and advanced dispersants, is expected to accelerate as manufacturers increasingly recognize their value proposition in terms of improved product quality, processing efficiency, and extended coating lifespan. The competitive dynamics are characterized by a blend of global chemical giants and agile regional players, each focusing on specific product niches and geographical markets within South America. Furthermore, the increasing preference for DIY (Do-It-Yourself) projects in residential settings is also contributing to the demand for user-friendly and aesthetically pleasing paint formulations, necessitating specialized additives. The global shift towards digitalization and smart manufacturing is also influencing the additives market, with a focus on optimizing production processes and supply chain management. The rising demand for protective coatings in industrial applications, such as in oil and gas infrastructure and marine environments, further underscores the growth potential for specialized coatings additives in South America.

Dominant Markets & Segments in South America Paints and Coatings Additives Market

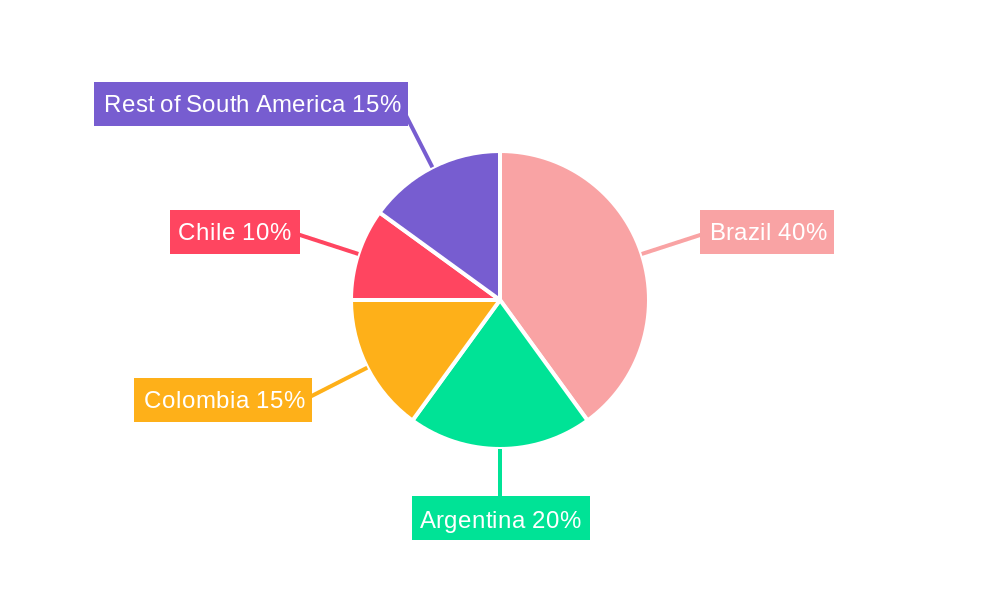

The South America paints and coatings additives market is significantly influenced by regional economic activity and specific application demands. Brazil stands out as the dominant market, driven by its large population, substantial infrastructure development projects, and a well-established construction industry. The architectural segment represents the largest application, accounting for an estimated 40% of the total market revenue, owing to continuous urbanization and a growing demand for both residential and commercial buildings. Within the types of additives, dispersants and wetting agents are crucial, often constituting over 20% of the market, essential for pigment dispersion and improving the flow properties of paints.

Key drivers for Brazil's dominance include:

- Economic Policies: Government initiatives promoting infrastructure development and housing projects directly stimulate the demand for paints and coatings.

- Infrastructure Development: Large-scale projects like new roads, bridges, and public facilities require extensive use of protective and architectural coatings.

- Growing Middle Class: Rising disposable incomes lead to increased spending on home improvements and aesthetic enhancements.

Colombia is emerging as a significant growth market, driven by post-conflict reconstruction efforts and ongoing investments in urban infrastructure. The protective coatings segment is particularly strong in Colombia, serving industries such as oil and gas and mining, where corrosion resistance is paramount.

In terms of additive types, rheology modifiers are gaining prominence across the region, particularly in high-performance coatings, as they control viscosity and application properties. Their market share is projected to reach 15% by 2033. Defoamers and deaerators are also critical for ensuring smooth, defect-free finishes in various applications, holding a substantial portion of the market.

The Rest of South America, encompassing countries like Peru, Ecuador, and Bolivia, collectively represents a growing market, albeit with smaller individual shares. These regions are experiencing increased industrialization and infrastructure development, boosting the demand for paints and coatings additives across various applications. The transportation segment, including automotive refinishing and OEM coatings, is a key growth area in countries with developing automotive industries, such as Argentina. The demand for durable and aesthetically pleasing coatings in this sector necessitates advanced surface modifiers and flow and leveling additives. The market share for biocides is consistently significant across all regions, essential for preventing microbial growth and extending the shelf life of paints and coatings.

South America Paints and Coatings Additives Market Product Innovations

The South America paints and coatings additives market is witnessing a wave of product innovations driven by the demand for enhanced performance, sustainability, and cost-effectiveness. Companies are focusing on developing low-VOC and waterborne-compatible additives to meet stringent environmental regulations. Innovations in rheology modifiers are yielding products that offer superior sag resistance and improved application properties for both brush and spray applications. Advances in dispersants and wetting agents are leading to improved pigment stability and color development in paints. Furthermore, there's a growing emphasis on multifunctional additives that combine properties like biocidal activity with enhanced dispersion or rheology modification, offering greater value to formulators. The competitive advantage lies in offering tailored solutions that address specific regional challenges and application needs.

Report Segmentation & Scope

This report meticulously segments the South America paints and coatings additives market to provide a granular understanding of its dynamics. The segmentation includes:

By Type:

- Biocides: Essential for preventing microbial contamination, estimated to hold a xx% market share by 2033.

- Dispersants and Wetting Agents: Crucial for pigment dispersion and substrate wetting, projected for xx% growth.

- Defoamers and Deaerators: Key for eliminating foam and air bubbles, with an anticipated xx% market share.

- Rheology Modifiers: Controlling viscosity and application properties, expected to experience xx% growth.

- Surface Modifiers: Enhancing surface characteristics like scratch resistance and gloss, with a projected xx% market share.

- Stabilizers: Improving paint stability and shelf life, anticipated to grow at xx% CAGR.

- Flow and Leveling Additives: Ensuring smooth finishes, with an estimated xx% market share.

- Other Types: Encompassing a range of specialized additives.

By Application:

- Architectural: The largest segment, driven by construction and renovation, forecast to grow at xx% CAGR.

- Wood Coatings: Used for furniture, flooring, and structural wood, with an estimated xx% market share.

- Transportation Coatings: Including automotive and aerospace, demanding high-performance additives.

- Protective Coatings: For industrial infrastructure and harsh environments, showing xx% growth potential.

- Other Applications: Including industrial and specialty coatings.

By Geography:

- Brazil: The leading market, expected to maintain its dominance.

- Argentina: A significant market with growing demand in automotive and industrial sectors.

- Colombia: Experiencing robust growth driven by infrastructure and reconstruction.

- Chile: A mature market with consistent demand for high-quality coatings.

- Rest of South America: Collective growth from emerging economies.

Key Drivers of South America Paints and Coatings Additives Market Growth

The South America paints and coatings additives market is propelled by a confluence of powerful drivers. Economic recovery and sustained infrastructure development across key nations like Brazil and Colombia are significantly boosting the demand for architectural and protective coatings. Growing urbanization and a rising middle class are fueling residential and commercial construction, directly impacting the need for high-quality paints and the additives that enhance their performance and durability. Furthermore, increasingly stringent environmental regulations are pushing manufacturers towards more sustainable formulations, thus driving the adoption of eco-friendly additives such as low-VOC and waterborne-compatible solutions. Technological advancements in additive chemistry, leading to improved product properties like enhanced scratch resistance, better UV protection, and superior pigment dispersion, are also critical growth enablers. The demand for specialized coatings in sectors like automotive, aerospace, and industrial maintenance further contributes to the market's expansion.

Challenges in the South America Paints and Coatings Additives Market Sector

Despite the promising growth trajectory, the South America paints and coatings additives market faces several challenges. Fluctuations in raw material prices, particularly for petrochemical derivatives, can impact manufacturing costs and profit margins. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities within the region, can affect the availability and timely delivery of additives. Stringent and evolving regulatory landscapes, especially concerning environmental compliance and product safety, require continuous investment in research and development to meet new standards. Intense competition from both global players and local manufacturers can lead to price pressures. Additionally, the economic volatility in some South American countries can impact overall construction and industrial spending, indirectly affecting the demand for paints and coatings additives. The adoption of advanced, higher-cost additive technologies may also be slower in price-sensitive segments.

Leading Players in the South America Paints and Coatings Additives Market Market

- Solvay

- Altana

- Evonik Industries AG

- Cabot Corporation

- DAIKIN INDUSTRIES Ltd

- Ashland

- BASF SE

- Arkema Group

- ELEMENTIS PLC

- ALLNEX NETHERLANDS B V

- Akzo Nobel N V

- Dow

- Eastman Chemical Company

- Momentive Specialty Chemicals Inc

- The Lubrizol Corporation

- AGC Inc

Key Developments in South America Paints and Coatings Additives Market Sector

- 2023/08: BASF SE launched a new range of sustainable biocides for waterborne coatings, addressing growing environmental concerns in the region.

- 2023/06: Evonik Industries AG expanded its production capacity for dispersants and wetting agents in South America to meet rising demand.

- 2022/11: Arkema Group acquired a regional producer of rheology modifiers, strengthening its portfolio in the Brazilian market.

- 2022/05: Solvay introduced advanced flow and leveling additives designed for high-performance architectural coatings.

- 2021/10: Dow announced strategic partnerships with local distributors to enhance its market reach for specialty coatings additives across South America.

- 2021/04: Altana developed innovative surface modifiers offering enhanced scratch and chemical resistance for transportation coatings.

Strategic South America Paints and Coatings Additives Market Market Outlook

- 2023/08: BASF SE launched a new range of sustainable biocides for waterborne coatings, addressing growing environmental concerns in the region.

- 2023/06: Evonik Industries AG expanded its production capacity for dispersants and wetting agents in South America to meet rising demand.

- 2022/11: Arkema Group acquired a regional producer of rheology modifiers, strengthening its portfolio in the Brazilian market.

- 2022/05: Solvay introduced advanced flow and leveling additives designed for high-performance architectural coatings.

- 2021/10: Dow announced strategic partnerships with local distributors to enhance its market reach for specialty coatings additives across South America.

- 2021/04: Altana developed innovative surface modifiers offering enhanced scratch and chemical resistance for transportation coatings.

Strategic South America Paints and Coatings Additives Market Market Outlook

The South America paints and coatings additives market presents a dynamic and evolving landscape with significant growth opportunities. Key growth accelerators include the continued urbanization and infrastructure development in emerging economies, a growing preference for sustainable and eco-friendly coating solutions, and the increasing demand for high-performance additives that enhance durability and aesthetics. Strategic opportunities lie in developing localized production capabilities, investing in R&D for innovative and sustainable additive technologies, and forming strong distribution partnerships to penetrate diverse geographical markets. The focus on specialty additives for niche applications within the transportation and protective coatings sectors will also be crucial. Companies that can adapt to evolving regulatory environments and cater to the specific needs of the South American market are well-positioned for success. The projected market growth indicates a positive outlook for this sector.

South America Paints and Coatings Additives Market Segmentation

-

1. Type

- 1.1. Biocides

- 1.2. Dispersants and Wetting Agents

- 1.3. Defoamers and Deaerators

- 1.4. Rheology Modifiers

- 1.5. Surface Modifiers

- 1.6. Stabilizers

- 1.7. Flow and Leveling Additives

- 1.8. Other Types

-

2. Application

- 2.1. Architectural

- 2.2. Wood

- 2.3. Transportation

- 2.4. Protective

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of South America

South America Paints and Coatings Additives Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Paints and Coatings Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Environment-Friendly Products; Strong Growth in Emerging Markets because of Booming Construction Activity

- 3.3. Market Restrains

- 3.3.1. ; Environmental Impacts and Regulations; Presence of Low Quality Substitute

- 3.4. Market Trends

- 3.4.1. Architectural Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biocides

- 5.1.2. Dispersants and Wetting Agents

- 5.1.3. Defoamers and Deaerators

- 5.1.4. Rheology Modifiers

- 5.1.5. Surface Modifiers

- 5.1.6. Stabilizers

- 5.1.7. Flow and Leveling Additives

- 5.1.8. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Architectural

- 5.2.2. Wood

- 5.2.3. Transportation

- 5.2.4. Protective

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biocides

- 6.1.2. Dispersants and Wetting Agents

- 6.1.3. Defoamers and Deaerators

- 6.1.4. Rheology Modifiers

- 6.1.5. Surface Modifiers

- 6.1.6. Stabilizers

- 6.1.7. Flow and Leveling Additives

- 6.1.8. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Architectural

- 6.2.2. Wood

- 6.2.3. Transportation

- 6.2.4. Protective

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biocides

- 7.1.2. Dispersants and Wetting Agents

- 7.1.3. Defoamers and Deaerators

- 7.1.4. Rheology Modifiers

- 7.1.5. Surface Modifiers

- 7.1.6. Stabilizers

- 7.1.7. Flow and Leveling Additives

- 7.1.8. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Architectural

- 7.2.2. Wood

- 7.2.3. Transportation

- 7.2.4. Protective

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biocides

- 8.1.2. Dispersants and Wetting Agents

- 8.1.3. Defoamers and Deaerators

- 8.1.4. Rheology Modifiers

- 8.1.5. Surface Modifiers

- 8.1.6. Stabilizers

- 8.1.7. Flow and Leveling Additives

- 8.1.8. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Architectural

- 8.2.2. Wood

- 8.2.3. Transportation

- 8.2.4. Protective

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Chile South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biocides

- 9.1.2. Dispersants and Wetting Agents

- 9.1.3. Defoamers and Deaerators

- 9.1.4. Rheology Modifiers

- 9.1.5. Surface Modifiers

- 9.1.6. Stabilizers

- 9.1.7. Flow and Leveling Additives

- 9.1.8. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Architectural

- 9.2.2. Wood

- 9.2.3. Transportation

- 9.2.4. Protective

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of South America South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Biocides

- 10.1.2. Dispersants and Wetting Agents

- 10.1.3. Defoamers and Deaerators

- 10.1.4. Rheology Modifiers

- 10.1.5. Surface Modifiers

- 10.1.6. Stabilizers

- 10.1.7. Flow and Leveling Additives

- 10.1.8. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Architectural

- 10.2.2. Wood

- 10.2.3. Transportation

- 10.2.4. Protective

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Brazil South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 12. Argentina South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America South America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Solvay*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Altana

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Evonik Industries AG

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cabot Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 DAIKIN INDUSTRIES Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Ashland

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 BASF SE

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Arkema Group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 ELEMENTIS PLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 ALLNEX NETHERLANDS B V

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Akzo Nobel N V

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Dow

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Eastman Chemical Company

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Momentive Specialty Chemicals Inc

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 The Lubrizol Corporation

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 AGC Inc

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 Solvay*List Not Exhaustive

List of Figures

- Figure 1: South America Paints and Coatings Additives Market Revenue Breakdown (undefined, %) by Product 2024 & 2032

- Figure 2: South America Paints and Coatings Additives Market Share (%) by Company 2024

List of Tables

- Table 1: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Region 2019 & 2032

- Table 2: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2019 & 2032

- Table 3: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 4: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 5: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Region 2019 & 2032

- Table 6: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Paints and Coatings Additives Market Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Paints and Coatings Additives Market Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Paints and Coatings Additives Market Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 10: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2019 & 2032

- Table 11: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 12: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 13: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 14: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2019 & 2032

- Table 15: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 16: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 17: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 18: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2019 & 2032

- Table 19: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 20: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 21: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 22: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2019 & 2032

- Table 23: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 24: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 25: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2019 & 2032

- Table 26: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2019 & 2032

- Table 27: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2019 & 2032

- Table 28: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2019 & 2032

- Table 29: South America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Paints and Coatings Additives Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the South America Paints and Coatings Additives Market?

Key companies in the market include Solvay*List Not Exhaustive, Altana, Evonik Industries AG, Cabot Corporation, DAIKIN INDUSTRIES Ltd, Ashland, BASF SE, Arkema Group, ELEMENTIS PLC, ALLNEX NETHERLANDS B V, Akzo Nobel N V, Dow, Eastman Chemical Company, Momentive Specialty Chemicals Inc, The Lubrizol Corporation, AGC Inc.

3. What are the main segments of the South America Paints and Coatings Additives Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Environment-Friendly Products; Strong Growth in Emerging Markets because of Booming Construction Activity.

6. What are the notable trends driving market growth?

Architectural Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Environmental Impacts and Regulations; Presence of Low Quality Substitute.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Paints and Coatings Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Paints and Coatings Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Paints and Coatings Additives Market?

To stay informed about further developments, trends, and reports in the South America Paints and Coatings Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence