Key Insights

The South American Industrial Catalysts market is forecast to reach $43.6 billion by 2025, expanding at a compound annual growth rate (CAGR) of 4.3% from 2025 to 2033. Growth is propelled by the robust expansion of the petrochemical and refining industries in key economies such as Brazil and Argentina. Increased investments in refinery modernization and capacity expansion, driven by escalating domestic energy consumption and a strategic shift towards producing higher-value refined products, are primary market accelerators. Furthermore, the increasing stringency of environmental regulations and the industry’s commitment to cleaner production methodologies are fostering demand for advanced catalysts essential for processes like hydrotreating and hydrocracking, thereby reducing sulfur and nitrogen emissions. While potential market headwinds include volatile oil prices and the inherent economic fluctuations of emerging markets, the long-term growth trajectory remains favorable. The market is characterized by a diverse range of catalyst types, including fluid catalytic cracking, reforming, hydrotreating, hydrocracking, isomerization, and alkylation catalysts, addressing a broad spectrum of industrial applications and ensuring consistent demand throughout the forecast period. The competitive landscape, marked by the presence of established multinational corporations and agile regional manufacturers, contributes to market vitality and competitive pricing, positioning South America as a prime investment destination for the industrial catalysts sector. Specific segment growth will be closely linked to the expansion rates of various refining operations and petrochemical production activities within Brazil and Argentina.

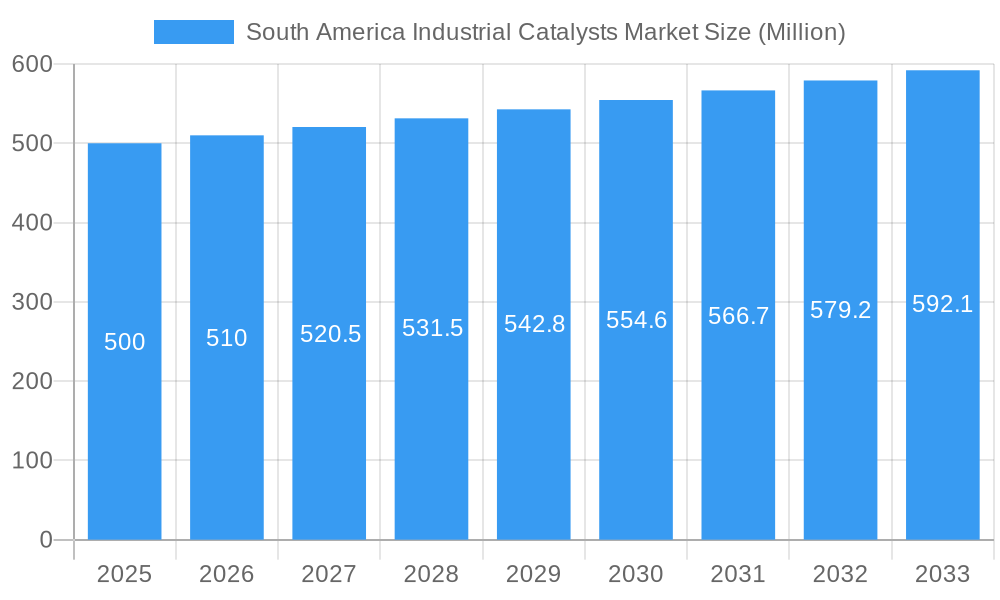

South America Industrial Catalysts Market Market Size (In Billion)

Fluid catalytic cracking catalysts currently command a significant market share due to their widespread application in refining operations. However, the growing imperative for cleaner fuel production is expected to drive increased adoption of hydrotreating and hydrocracking catalysts, signaling a potential shift in segmental market dominance over the forecast horizon. Leading industry players, including Haldor Topsoe, Axens, Honeywell, and Clariant, are strategically leveraging their technological expertise and established market presence to secure and expand their market share. Concurrently, regional manufacturers are concentrating on localized production and optimized distribution channels to enhance their competitive standing. Brazil’s extensive and diversified industrial infrastructure, complemented by Argentina’s burgeoning petrochemical sector, presents substantial opportunities for catalyst suppliers seeking to penetrate this expanding market, fostering an environment conducive to further industry consolidation and technological innovation.

South America Industrial Catalysts Market Company Market Share

South America Industrial Catalysts Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Industrial Catalysts market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study unveils the market's dynamics, growth drivers, challenges, and future outlook. The report meticulously segments the market by ingredient (Zeolite, Metal, Chemical Compounds) and catalyst type (Fluid Catalytic Cracking Catalysts, Reforming Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Isomerization Catalysts, Alkylation Catalysts), providing granular data and analysis for informed strategic planning. Key players like Haldor Topsoe A/S, Axens, Honeywell International Inc, Clariant, Exxon Mobil Corporation, Evonik Industries AG, W R Grace & Co -Conn, BASF SE, Chevron Corporation, DuPont, JGC C & C, Johnson Matthey, and Albemarle Corporation are profiled, highlighting their market share, strategies, and competitive landscape.

South America Industrial Catalysts Market Market Structure & Competitive Dynamics

The South America Industrial Catalysts market is characterized by a moderately concentrated landscape, with a handful of dominant players holding a substantial market share. The competitive environment is dynamic, shaped by relentless innovation in catalyst technology, the increasing stringency of environmental mandates, the rise of viable substitute materials, the evolving needs of key end-user sectors such as petrochemicals and refining, and a consistent wave of mergers and acquisitions (M&A). Between 2019 and 2024, M&A activities amounted to approximately $XX million, with transactions primarily focused on broadening geographical footprints and bolstering technological proficiencies. The market share of the top 5 key players is estimated at around XX%, indicating a degree of consolidation. The regulatory framework, while continually adapting, presents a dual landscape of hurdles and avenues for growth, steering investment towards sustainable and high-performance catalyst solutions. Innovation ecosystems are largely propelled by robust collaborations between catalyst manufacturers, esteemed research institutions, and the diverse array of end-user industries. The strategic substitution of conventional catalysts with more efficient and eco-friendly alternatives is also a significant influencer of market dynamics. Current end-user trends are strongly oriented towards enhanced performance, reduced emissions, and extended catalyst lifespan, compelling manufacturers to concentrate their research and development endeavors in these critical areas.

South America Industrial Catalysts Market Industry Trends & Insights

The South America Industrial Catalysts market is anticipated to experience robust expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately XX% throughout the forecast period spanning from 2025 to 2033. This projected growth is primarily propelled by escalating demand originating from the petrochemical and refining sectors, driven by ongoing expansions in production capacities and significant infrastructure development initiatives across the continent. Breakthroughs in technological domains, particularly in nanotechnology and advanced materials science, are instrumental in the development of catalysts exhibiting superior efficiency and selectivity, consequently leading to improved process yields and a diminished environmental footprint. Evolving consumer preferences leaning towards cleaner fuels and more sustainable manufacturing practices are creating substantial market opportunities. The integration of advanced catalyst technologies into various industrial processes is steadily gaining traction, notably in nations with rigorous environmental regulations. The competitive arena is marked by fierce rivalry among established industry leaders and the emergence of new agile players, which in turn fosters price competition and spurs continuous innovation. The market is also witnessing a growing embrace of digital technologies aimed at optimizing industrial processes and enhancing supply chain management efficiencies.

Dominant Markets & Segments in South America Industrial Catalysts Market

Leading Region/Country: Brazil dominates the South America Industrial Catalysts market due to its large and well-established petrochemical and refining sector, coupled with supportive government policies promoting industrial growth. Other key countries include Argentina, Colombia, and Mexico, but they have smaller market shares in comparison to Brazil.

Dominant Ingredient: Zeolite catalysts constitute the largest segment by ingredient, owing to their wide applicability in various catalytic processes, including fluid catalytic cracking. Metal catalysts hold a significant share, driven by their catalytic activity in diverse chemical reactions. Chemical Compounds make up the remaining segment, with continuous growth potential due to advancements in catalyst formulations.

Dominant Catalyst Type: Fluid Catalytic Cracking (FCC) catalysts lead the market in terms of volume and value, propelled by their extensive use in petroleum refining for maximizing gasoline and diesel yields. Reforming catalysts also hold a substantial market share, playing a critical role in upgrading the octane number of gasoline. Other catalyst types such as Hydrotreating, Hydrocracking, Isomerization, and Alkylation catalysts have relatively smaller market shares but exhibit potential growth driven by specific niche applications.

Key Drivers:

- Strong growth of the petrochemical and refining sectors in Brazil.

- Increasing investment in infrastructure development.

- Government initiatives supporting industrial development and environmental sustainability.

- Growing demand for cleaner fuels and environmentally friendly processes.

South America Industrial Catalysts Market Product Innovations

Recent innovations focus on developing catalysts with enhanced activity, selectivity, and longevity, leading to improved process efficiency and reduced operational costs. The application of nanotechnology and advanced materials science results in catalysts with larger surface areas and improved pore structures. These advancements enhance catalytic performance and improve overall yield and selectivity, minimizing waste generation. This addresses the growing market need for environmentally friendly and cost-effective catalytic solutions. The competitive advantage lies in offering customized catalysts tailored to specific process requirements, thereby achieving enhanced productivity and profitability.

Report Segmentation & Scope

The report segments the South America Industrial Catalysts market by ingredient: Zeolite, Metal, and Chemical Compounds. Each segment's growth is projected based on factors including demand from downstream industries, technological advancements, and regulatory changes. The market is further categorized by catalyst type: Fluid Catalytic Cracking Catalysts, Reforming Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Isomerization Catalysts, and Alkylation Catalysts, providing a detailed analysis of each type's market size, growth projections, and competitive dynamics. The competitive landscape within each segment is examined, analyzing the strategies employed by key players to gain market share. Market size estimates are provided for each segment for the historical period (2019-2024), base year (2025), and forecast period (2025-2033).

Key Drivers of South America Industrial Catalysts Market Growth

The South America Industrial Catalysts market is experiencing a period of significant expansion, underpinned by a confluence of powerful drivers. The burgeoning petrochemical and refining industries, stimulated by robust domestic consumption and increasing export volumes, are a major impetus for catalyst demand. Continuous advancements in catalyst design and manufacturing methodologies are yielding catalysts with enhanced efficiency and superior selectivity, attracting substantial investment and fostering innovation. Government policies and regulations that actively promote cleaner fuel alternatives and prioritize environmental sustainability are providing strong incentives for the adoption of cutting-edge catalyst technologies. Moreover, the increasing implementation of sophisticated refining processes further contributes to the overall market expansion and technological evolution.

Challenges in the South America Industrial Catalysts Market Sector

Despite the positive growth trajectory, the South America Industrial Catalysts market is not without its challenges. Significant fluctuations in the prices of essential raw materials can directly impact production costs for catalyst manufacturers. Disruptions within the global supply chain can compromise the availability and timely delivery of catalysts, potentially disrupting crucial industrial operations. The highly competitive nature of the market, characterized by intense rivalry among catalyst producers, exerts downward pressure on pricing, compelling companies to prioritize continuous innovation to sustain profitability. Furthermore, the ever-evolving landscape of stringent environmental regulations necessitates ongoing adaptation and investment from manufacturers to meet emerging standards, presenting both significant hurdles and strategic opportunities. These combined challenges are estimated to exert a negative impact on market growth by approximately XX% annually during the forecast period, underscoring the need for proactive mitigation strategies.

Leading Players in the South America Industrial Catalysts Market Market

- Haldor Topsoe A/S

- Axens

- Honeywell International Inc

- Clariant

- Exxon Mobil Corporation

- Evonik Industries AG

- W R Grace & Co -Conn

- BASF SE

- Chevron Corporation

- DuPont

- JGC C & C

- Johnson Matthey

- Albemarle Corporation

Key Developments in South America Industrial Catalysts Market Sector

- 2022 Q4: Albemarle Corporation announced a significant expansion of its catalyst production capacity in Brazil.

- 2023 Q1: BASF SE launched a new generation of hydrotreating catalysts with improved performance and environmental characteristics.

- 2023 Q3: A merger between two smaller catalyst manufacturers in Argentina resulted in a consolidation of market share.

- 2024 Q2: Honeywell International Inc. invested in a new R&D facility focused on developing sustainable catalyst technologies for the South American market. (Note: These are examples; actual dates and events will need to be researched and inserted).

Strategic South America Industrial Catalysts Market Market Outlook

The South America Industrial Catalysts market presents significant growth opportunities, driven by expanding downstream industries and technological advancements. Strategic investments in R&D, focusing on sustainable and high-performance catalysts, are crucial for market leadership. Collaborations and partnerships among manufacturers, research institutions, and end-users will accelerate innovation and market penetration. Expansion into new markets and geographic diversification are essential strategies for long-term success. The emphasis on cleaner fuels and environmental sustainability will further shape the market landscape, rewarding players who prioritize sustainable and environmentally friendly technologies. The market's potential for growth is significant, offering substantial returns for strategically positioned businesses.

South America Industrial Catalysts Market Segmentation

-

1. Ingredient

- 1.1. Zeolite

- 1.2. Metal

- 1.3. Chemical Compounds

-

2. Type

- 2.1. Fluid Catalytic Cracking Catalysts

- 2.2. Reforming Catalysts

- 2.3. Hydrotreating Catalysts

- 2.4. Hydrocracking Catalysts

- 2.5. Isomerization Catalysts

- 2.6. Alkylation Catalysts

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of South America

South America Industrial Catalysts Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Industrial Catalysts Market Regional Market Share

Geographic Coverage of South America Industrial Catalysts Market

South America Industrial Catalysts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Accelerating Demand for Higher Octane Fuels; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Precious Metal Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Industrial Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 5.1.1. Zeolite

- 5.1.2. Metal

- 5.1.3. Chemical Compounds

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fluid Catalytic Cracking Catalysts

- 5.2.2. Reforming Catalysts

- 5.2.3. Hydrotreating Catalysts

- 5.2.4. Hydrocracking Catalysts

- 5.2.5. Isomerization Catalysts

- 5.2.6. Alkylation Catalysts

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 6. Brazil South America Industrial Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 6.1.1. Zeolite

- 6.1.2. Metal

- 6.1.3. Chemical Compounds

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fluid Catalytic Cracking Catalysts

- 6.2.2. Reforming Catalysts

- 6.2.3. Hydrotreating Catalysts

- 6.2.4. Hydrocracking Catalysts

- 6.2.5. Isomerization Catalysts

- 6.2.6. Alkylation Catalysts

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 7. Argentina South America Industrial Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 7.1.1. Zeolite

- 7.1.2. Metal

- 7.1.3. Chemical Compounds

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fluid Catalytic Cracking Catalysts

- 7.2.2. Reforming Catalysts

- 7.2.3. Hydrotreating Catalysts

- 7.2.4. Hydrocracking Catalysts

- 7.2.5. Isomerization Catalysts

- 7.2.6. Alkylation Catalysts

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 8. Colombia South America Industrial Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 8.1.1. Zeolite

- 8.1.2. Metal

- 8.1.3. Chemical Compounds

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fluid Catalytic Cracking Catalysts

- 8.2.2. Reforming Catalysts

- 8.2.3. Hydrotreating Catalysts

- 8.2.4. Hydrocracking Catalysts

- 8.2.5. Isomerization Catalysts

- 8.2.6. Alkylation Catalysts

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 9. Chile South America Industrial Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient

- 9.1.1. Zeolite

- 9.1.2. Metal

- 9.1.3. Chemical Compounds

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fluid Catalytic Cracking Catalysts

- 9.2.2. Reforming Catalysts

- 9.2.3. Hydrotreating Catalysts

- 9.2.4. Hydrocracking Catalysts

- 9.2.5. Isomerization Catalysts

- 9.2.6. Alkylation Catalysts

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Ingredient

- 10. Rest of South America South America Industrial Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient

- 10.1.1. Zeolite

- 10.1.2. Metal

- 10.1.3. Chemical Compounds

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fluid Catalytic Cracking Catalysts

- 10.2.2. Reforming Catalysts

- 10.2.3. Hydrotreating Catalysts

- 10.2.4. Hydrocracking Catalysts

- 10.2.5. Isomerization Catalysts

- 10.2.6. Alkylation Catalysts

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Ingredient

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Haldor Topsoe A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Axens

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Clariant

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Exxon Mobil Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evonik Industries AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 W R Grace & Co -Conn

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chevron Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DuPont

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JGC C & C

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Johnson Matthey

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Albemarle Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Haldor Topsoe A/S

List of Figures

- Figure 1: South America Industrial Catalysts Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Industrial Catalysts Market Share (%) by Company 2025

List of Tables

- Table 1: South America Industrial Catalysts Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 2: South America Industrial Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 3: South America Industrial Catalysts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: South America Industrial Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: South America Industrial Catalysts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Industrial Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: South America Industrial Catalysts Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Industrial Catalysts Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: South America Industrial Catalysts Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 10: South America Industrial Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 11: South America Industrial Catalysts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: South America Industrial Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 13: South America Industrial Catalysts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Industrial Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: South America Industrial Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Industrial Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: South America Industrial Catalysts Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 18: South America Industrial Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 19: South America Industrial Catalysts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: South America Industrial Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: South America Industrial Catalysts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Industrial Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: South America Industrial Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Industrial Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: South America Industrial Catalysts Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 26: South America Industrial Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 27: South America Industrial Catalysts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: South America Industrial Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: South America Industrial Catalysts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: South America Industrial Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: South America Industrial Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Industrial Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: South America Industrial Catalysts Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 34: South America Industrial Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 35: South America Industrial Catalysts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: South America Industrial Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: South America Industrial Catalysts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: South America Industrial Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: South America Industrial Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: South America Industrial Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: South America Industrial Catalysts Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 42: South America Industrial Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 43: South America Industrial Catalysts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 44: South America Industrial Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 45: South America Industrial Catalysts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: South America Industrial Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: South America Industrial Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: South America Industrial Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Industrial Catalysts Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the South America Industrial Catalysts Market?

Key companies in the market include Haldor Topsoe A/S, Axens, Honeywell International Inc, Clariant, Exxon Mobil Corporation, Evonik Industries AG, W R Grace & Co -Conn, BASF SE, Chevron Corporation, DuPont, JGC C & C, Johnson Matthey, Albemarle Corporation.

3. What are the main segments of the South America Industrial Catalysts Market?

The market segments include Ingredient, Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Accelerating Demand for Higher Octane Fuels; Other Drivers.

6. What are the notable trends driving market growth?

Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market.

7. Are there any restraints impacting market growth?

; Volatility in Precious Metal Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Industrial Catalysts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Industrial Catalysts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Industrial Catalysts Market?

To stay informed about further developments, trends, and reports in the South America Industrial Catalysts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence