Key Insights

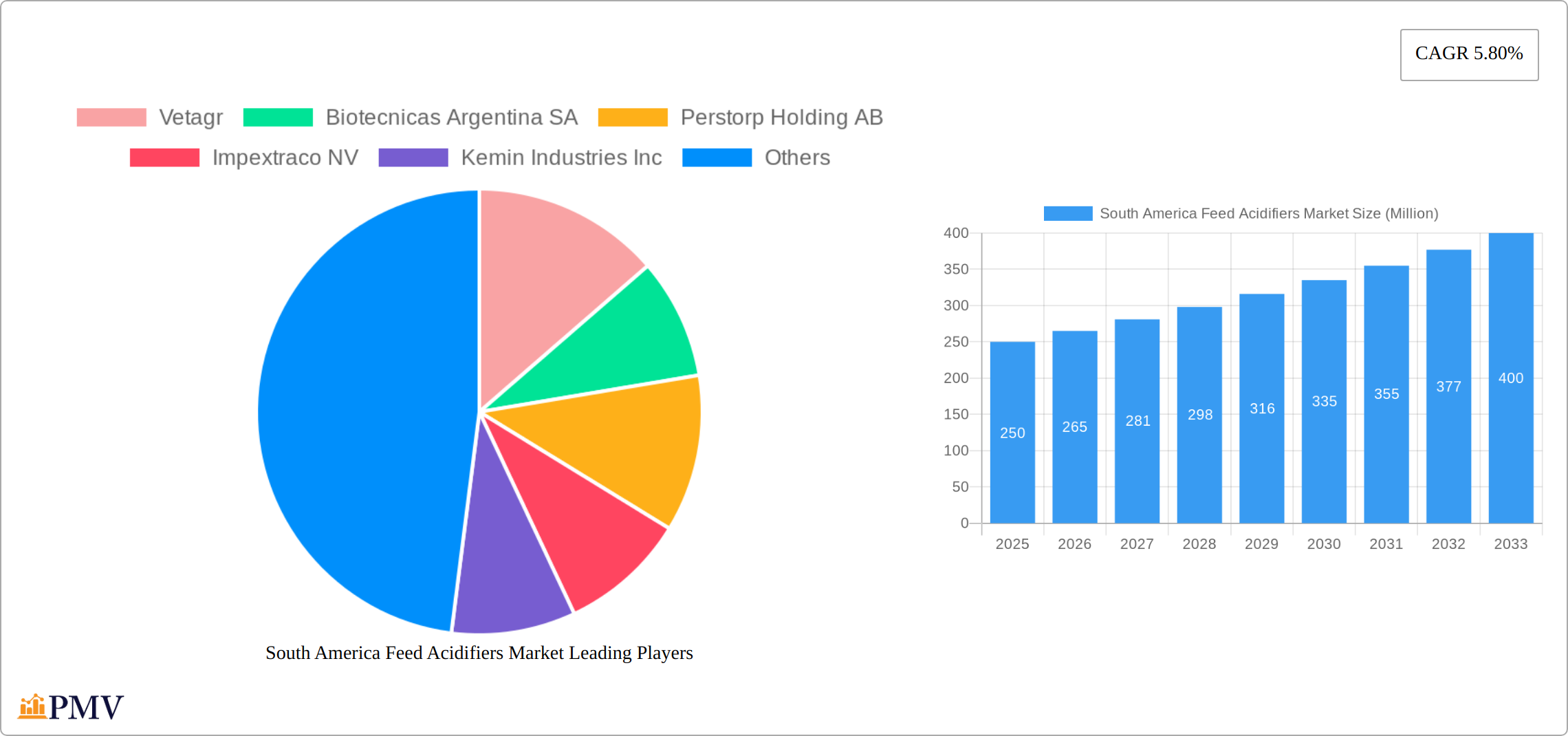

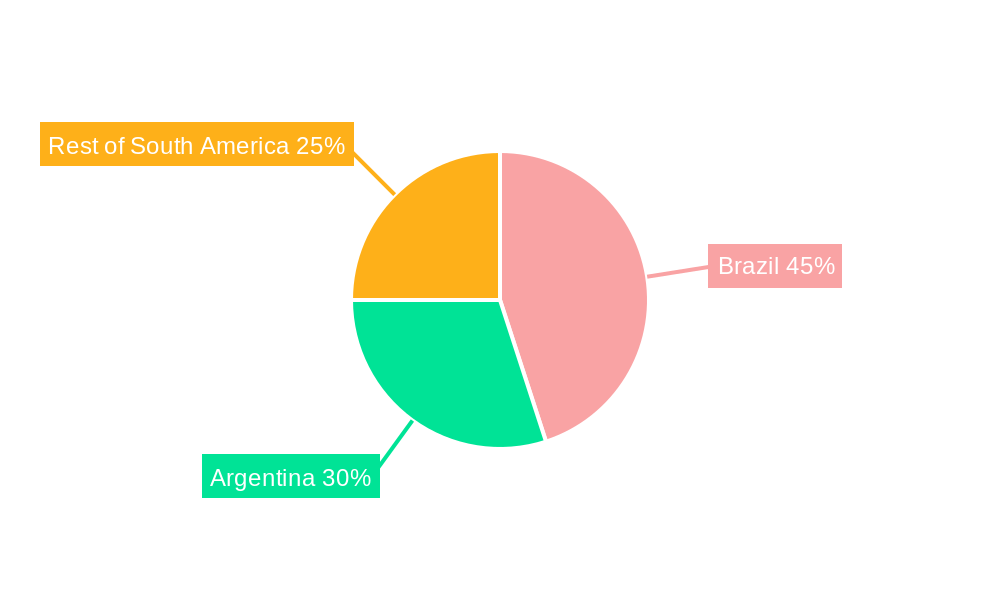

The South America feed acidifiers market, valued at approximately $XXX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand for animal protein sources across South America fuels the need for efficient and cost-effective feed solutions. Feed acidifiers play a crucial role in improving gut health, enhancing nutrient digestibility, and optimizing animal growth, leading to improved productivity and profitability for livestock farmers. Furthermore, growing consumer awareness of food safety and the increasing adoption of sustainable farming practices are contributing to the market's growth. The rising prevalence of poultry and aquaculture farming, coupled with the increasing focus on ruminant animal health and productivity, further boosts demand for diverse feed acidifier types, including lactic acid, propionic acid, fumaric acid, and others. Brazil and Argentina constitute the largest segments within the South American market due to their significant livestock populations and established feed industries. However, the market also faces challenges, such as fluctuating raw material prices and potential regulatory hurdles impacting the production and use of specific acidifiers. The competitive landscape is characterized by both multinational corporations and regional players, each offering a variety of products tailored to specific animal types and farming practices.

The continued expansion of the South American feed acidifiers market is anticipated to be further propelled by technological advancements in acidifier production and formulation. Innovations leading to improved efficacy, enhanced palatability, and reduced environmental impact are key drivers. Furthermore, government initiatives focused on promoting sustainable livestock farming practices and improving animal welfare are expected to positively influence market growth. While the market presents opportunities for growth, companies need to carefully navigate the challenges posed by price volatility, regulatory compliance, and intense competition. Strategic partnerships, investments in research and development, and targeted marketing efforts are crucial for gaining market share and achieving sustainable growth in this dynamic sector. Market segmentation based on acid type (lactic, propionic, fumaric, etc.) and animal type (ruminant, poultry, swine, aquaculture) provides valuable insights into specific market trends and consumer preferences. This detailed segmentation analysis facilitates targeted marketing strategies and informed business decisions by key players. We estimate a market size for 2033 to be approximately $YYY million, based on the provided CAGR and considering expected market dynamics. (Note: XXX and YYY represent estimations based on the 5.80% CAGR and general market growth trends, requiring further market research to obtain precise figures).

South America Feed Acidifiers Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the South America Feed Acidifiers market, offering invaluable insights for businesses, investors, and stakeholders. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report meticulously examines market size, segmentation, growth drivers, challenges, competitive dynamics, and future outlook for this dynamic sector. Keywords: South America Feed Acidifiers Market, Feed Acidifiers, Lactic Acid, Propionic Acid, Fumaric Acid, Ruminant, Poultry, Swine, Aquaculture, Market Size, Market Share, Market Growth, CAGR, Vetagr, Biotecnicas Argentina SA, Perstorp Holding AB, Impextraco NV, Kemin Industries Inc, Pancosma, Lignotech feed, Cladan.

South America Feed Acidifiers Market Structure & Competitive Dynamics

The South America Feed Acidifiers market exhibits a moderately concentrated structure, with key players holding significant market shares. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance. The market’s innovation ecosystem is characterized by ongoing R&D efforts focused on developing more efficient and sustainable feed acidifiers. Regulatory frameworks, varying across South American countries, influence product approvals and market access. Substitute products, such as antibiotics, face increasing scrutiny due to concerns regarding antimicrobial resistance. End-user trends, including a growing preference for sustainable and environmentally friendly feed solutions, are shaping market demand. M&A activities have been relatively moderate in recent years, with deal values averaging xx Million annually during the historical period (2019-2024). Key players such as Kemin Industries Inc. and Pancosma have demonstrated aggressive expansion strategies through product diversification and market penetration. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market share in 2025, indicating a slightly oligopolistic structure.

South America Feed Acidifiers Market Industry Trends & Insights

The South American Feed Acidifiers market is experiencing robust growth, fueled by a confluence of factors. The escalating demand for animal protein, driven by a growing population and rising per capita consumption, is a primary catalyst. This increased demand necessitates efficient and cost-effective feed solutions, driving the adoption of feed acidifiers. Furthermore, a heightened consumer awareness regarding animal welfare, health, and the overall quality and sustainability of animal products is significantly impacting market dynamics. Consumers are increasingly demanding sustainably-produced meat and dairy, favoring feed additives with reduced environmental footprints. This growing awareness creates a strong impetus for the market's expansion.

Technological advancements within the acidifier production sector are also contributing to market growth. Innovations in acidifier formulation and delivery systems are leading to the development of more effective, efficient, and cost-competitive products. For instance, the emergence of encapsulated acidifiers and those incorporating prebiotics or probiotics is enhancing product value and market appeal. Simultaneously, improvements in fermentation and extraction processes are lowering production costs and improving overall product quality. These combined factors contribute to a more favorable market environment for feed acidifiers.

The competitive landscape is dynamic, with established players vying for market share alongside emerging entrants. This competition fosters innovation and ultimately benefits consumers through improved product offerings and competitive pricing. The CAGR for the South America Feed Acidifiers market is projected to be xx% during the forecast period (2025-2033), signifying substantial market expansion. Market penetration is particularly strong in the poultry and swine sectors, reflecting the high adoption rates within these segments.

Dominant Markets & Segments in South America Feed Acidifiers Market

Brazil stands as the dominant market within South America for feed acidifiers, commanding approximately xx% of the total market value in 2025. Several key factors underpin this market leadership:

- Extensive Livestock Industry: Brazil boasts a large and rapidly expanding livestock sector, generating significant demand for feed additives like acidifiers.

- Supportive Government Policies: Government initiatives designed to bolster the agricultural sector, including incentives and subsidies, contribute to the favorable market environment.

- Robust Infrastructure: Efficient logistics and distribution networks ensure widespread access to feed acidifiers across the country.

Analyzing product segments, propionic acid maintains the largest market share (xx%), followed by lactic acid (xx%). The ruminant segment dominates the animal type category, reflecting the substantial cattle population across South America.

South America Feed Acidifiers Market Product Innovations

Recent years have been marked by substantial innovation within the feed acidifier sector. The focus is on enhancing product efficacy, improving palatability for animals, and minimizing environmental impact. The development of novel formulations, such as encapsulated acidifiers incorporating prebiotics or probiotics, significantly improves product performance and consumer perception. These innovations address the evolving needs of livestock producers who seek enhanced animal health, improved feed efficiency, and reduced environmental footprint.

Furthermore, technological advancements in fermentation and extraction processes are not only reducing production costs but also contributing to superior product quality. These ongoing improvements in both formulation and production processes are driving increased market adoption of feed acidifiers.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the South America Feed Acidifiers market, categorized by type (Lactic Acid, Propionic Acid, Fumaric Acid, Other Types) and animal type (Ruminant, Poultry, Swine, Aquaculture). Each segment undergoes detailed analysis, offering insights into growth projections, market sizes, and competitive dynamics. For example, the Lactic Acid segment is projected to experience a CAGR of xx% during the forecast period, driven largely by its widespread use in poultry feed. Similarly, the Ruminant segment demonstrates steady growth, fueled by the expanding cattle industry. The report thoroughly examines market dynamics within each segment, including key growth drivers and potential challenges.

Key Drivers of South America Feed Acidifiers Market Growth

The growth of the South America Feed Acidifiers market is propelled by several key factors. The rising demand for animal protein, driven by population growth and increased per capita meat and dairy consumption, stands as a primary driver. Simultaneously, technological advancements resulting in more effective and sustainable feed acidifiers contribute significantly to market expansion. Furthermore, favorable government policies promoting agricultural sector development and robust regulatory frameworks supporting animal health create a positive and supportive market environment, fostering further growth.

Challenges in the South America Feed Acidifiers Market Sector

The South America Feed Acidifiers market faces certain challenges. Fluctuations in raw material prices can impact profitability. Regulatory hurdles and varying compliance standards across different countries pose challenges for manufacturers. Intense competition among numerous established players and emerging entrants creates pricing pressure. These combined factors can affect the overall growth trajectory of the market.

Leading Players in the South America Feed Acidifiers Market Market

- Vetagr

- Biotecnicas Argentina SA

- Perstorp Holding AB (Perstorp Holding AB)

- Impextraco NV (Impextraco NV)

- Kemin Industries Inc. (Kemin Industries Inc.)

- Pancosma

- Lignotech feed

- Cladan

Key Developments in South America Feed Acidifiers Market Sector

- 2022 Q4: Kemin Industries Inc. launched a new line of organic acidifiers for poultry.

- 2023 Q1: Pancosma acquired a smaller regional feed acidifier producer.

- 2023 Q3: New regulations concerning the use of certain feed acidifiers were implemented in Brazil.

Strategic South America Feed Acidifiers Market Outlook

The South America Feed Acidifiers market presents significant opportunities for growth and expansion. Continued investments in research and development, focusing on innovative product formulations and sustainable production processes, are crucial. Strategic partnerships and collaborations among market players can further accelerate market growth. Expansion into new geographical markets and diversification of product offerings are key strategic initiatives to enhance market competitiveness and capture untapped market potential. The continued growth of the livestock sector and increased awareness of animal health and welfare will further drive market expansion in the coming years.

South America Feed Acidifiers Market Segmentation

-

1. Type

- 1.1. Lactic Acid

- 1.2. Propionic Acid

- 1.3. Fumaric Acid

- 1.4. Other Types

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Acidifiers Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Acidifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Increasing Animal Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lactic Acid

- 5.1.2. Propionic Acid

- 5.1.3. Fumaric Acid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lactic Acid

- 6.1.2. Propionic Acid

- 6.1.3. Fumaric Acid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lactic Acid

- 7.1.2. Propionic Acid

- 7.1.3. Fumaric Acid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lactic Acid

- 8.1.2. Propionic Acid

- 8.1.3. Fumaric Acid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Feed Acidifiers Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Vetagr

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Biotecnicas Argentina SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Perstorp Holding AB

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Impextraco NV

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kemin Industries Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 pancosma

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Lignotech feed

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cladan

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Vetagr

List of Figures

- Figure 1: South America Feed Acidifiers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Feed Acidifiers Market Share (%) by Company 2024

List of Tables

- Table 1: South America Feed Acidifiers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Feed Acidifiers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Feed Acidifiers Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 4: South America Feed Acidifiers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Feed Acidifiers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Feed Acidifiers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Feed Acidifiers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Feed Acidifiers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Feed Acidifiers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Feed Acidifiers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Feed Acidifiers Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 12: South America Feed Acidifiers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Feed Acidifiers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Feed Acidifiers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Feed Acidifiers Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 16: South America Feed Acidifiers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Feed Acidifiers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Feed Acidifiers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Feed Acidifiers Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 20: South America Feed Acidifiers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Feed Acidifiers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Acidifiers Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the South America Feed Acidifiers Market?

Key companies in the market include Vetagr, Biotecnicas Argentina SA, Perstorp Holding AB, Impextraco NV, Kemin Industries Inc, pancosma, Lignotech feed, Cladan.

3. What are the main segments of the South America Feed Acidifiers Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Increasing Animal Production Drives the Market.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Acidifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Acidifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Acidifiers Market?

To stay informed about further developments, trends, and reports in the South America Feed Acidifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence