Key Insights

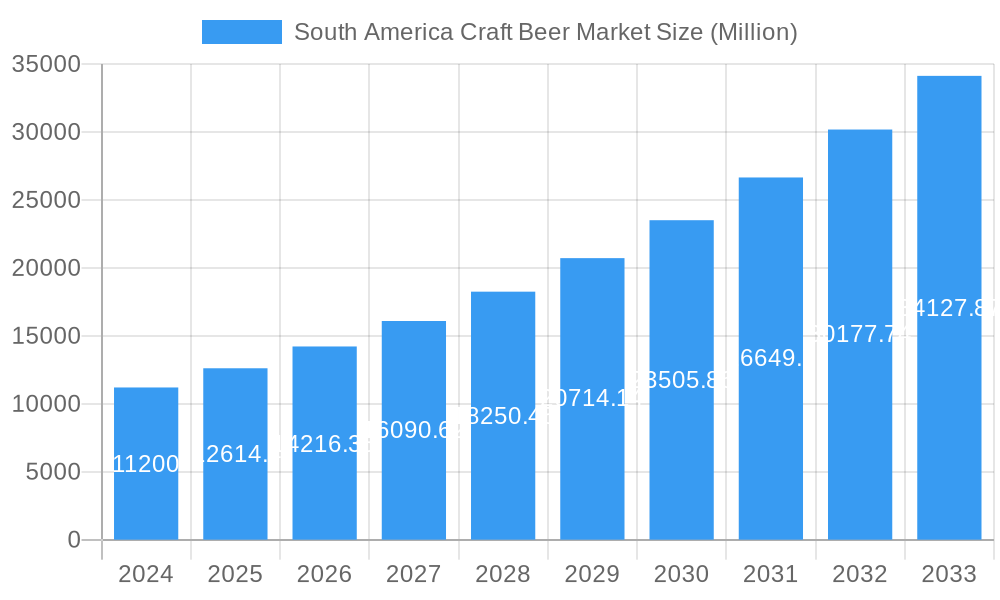

The South America craft beer market is poised for significant expansion, exhibiting a robust CAGR of 12.48% and a projected market size of USD 11.2 billion in 2024. This impressive growth trajectory is fueled by a confluence of factors, primarily driven by an evolving consumer preference for premium, artisanal beverages and a burgeoning middle class with increased disposable income across the region. The rising popularity of craft beer is particularly evident in urban centers of Argentina and Brazil, where a vibrant on-trade scene, encompassing bars, pubs, and restaurants, actively promotes diverse beer offerings. Furthermore, the increasing accessibility through off-trade channels, including dedicated craft beer stores and a rapidly growing online sales segment, is democratizing access to these specialized brews, further stimulating demand. The segment of specialty beers is experiencing an accelerated uptake, indicating a consumer desire for unique flavors and brewing techniques, moving beyond traditional lager styles.

South America Craft Beer Market Market Size (In Billion)

The market is not without its challenges, however. While the overall outlook is highly positive, potential restraints could stem from fluctuating raw material costs, particularly for hops and malts, which can impact production expenses for smaller breweries. Additionally, regulatory landscapes can vary across South American nations, potentially introducing complexities for market entrants and expansion. Despite these hurdles, the innovative spirit of craft breweries, coupled with strategic distribution by major players like Anheuser-Busch InBev and Heineken NV, alongside dedicated craft brewers such as New Belgium Brewing Co. and The Boston Beer Company, is expected to drive sustained growth. The expansion into the "Rest of South America" is also a key trend, as smaller economies begin to embrace the craft beer phenomenon, presenting untapped opportunities for market penetration and diversification.

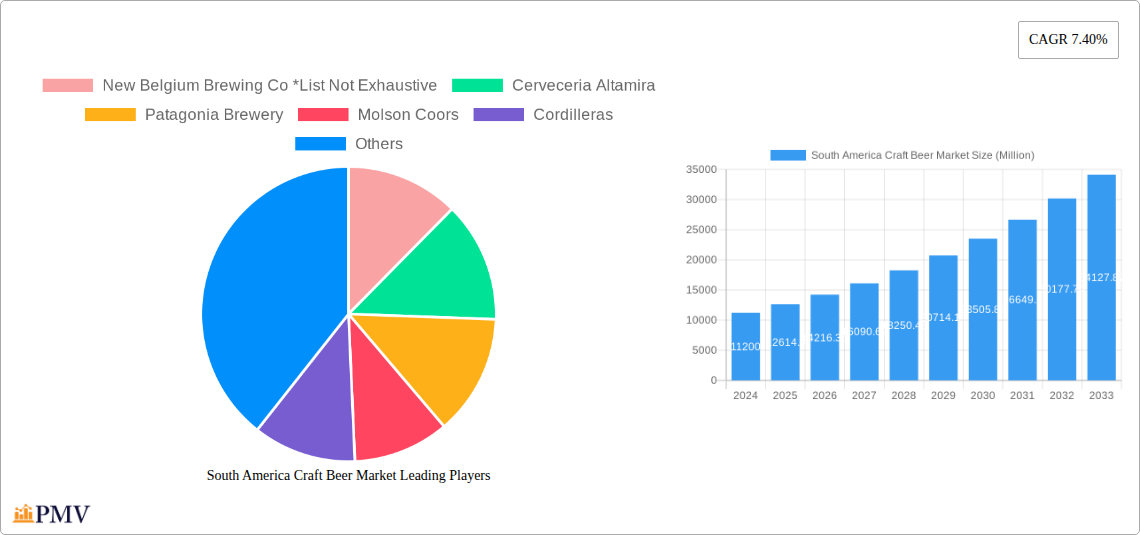

South America Craft Beer Market Company Market Share

South America Craft Beer Market: Comprehensive Market Analysis & Growth Forecast (2019–2033)

This in-depth market research report provides a detailed analysis of the South America craft beer market, offering critical insights into market structure, competitive dynamics, industry trends, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report equips stakeholders with actionable intelligence to navigate the evolving landscape of craft beer in South America. Discover emerging opportunities, understand key challenges, and leverage strategic recommendations for sustained growth. This report is essential for breweries, distributors, investors, and industry professionals seeking to capitalize on the burgeoning South American craft beer scene.

South America Craft Beer Market Market Structure & Competitive Dynamics

The South America craft beer market is characterized by a moderate to high level of market concentration, with a significant portion of the market share held by a few dominant players, alongside a vibrant and growing number of independent craft breweries. The innovation ecosystem is rapidly expanding, driven by a desire for unique flavors, local ingredients, and sustainable brewing practices. Regulatory frameworks vary across countries in South America, presenting both opportunities and challenges for market entrants and established players. Product substitutes include traditional mass-produced beers, wine, and spirits, but the distinctiveness and premium positioning of craft beer mitigate this competition to a considerable extent. End-user trends indicate a rising demand for premium quality, diverse flavor profiles, and locally sourced ingredients. Mergers and acquisition (M&A) activities are on the rise as larger breweries seek to acquire innovative craft brands and expand their market reach. For instance, a significant M&A deal valued at an estimated USD 500 million involved the acquisition of a prominent regional craft brewery in Brazil. Market share data reveals that established international players and well-known South American craft breweries collectively hold approximately 65% of the market, with the remaining 35% fragmented among smaller independent producers.

South America Craft Beer Market Industry Trends & Insights

The South America craft beer market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is fueled by a confluence of factors, including a growing middle class with increasing disposable income, a rising consumer appreciation for premium and artisanal products, and a cultural shift towards exploring diverse culinary experiences. Technological disruptions are playing a pivotal role, with advancements in brewing techniques, fermentation processes, and packaging solutions enhancing product quality and variety. The adoption of data analytics for understanding consumer preferences and optimizing supply chains is also becoming increasingly prevalent. Consumer preferences are evolving beyond traditional lager styles, with a strong demand for specialty beers, including IPAs, stouts, sours, and fruit-infused varieties. The emphasis on authenticity, local ingredients, and sustainable production methods is a significant differentiator for craft breweries. Competitive dynamics are intensifying, with both established craft breweries and new entrants vying for market share. The rise of independent craft breweries is a defining characteristic, challenging the dominance of larger, multinational corporations. Market penetration for craft beer is steadily increasing, particularly in urban centers, as consumer awareness and accessibility grow. The influence of social media and online communities in shaping consumer tastes and promoting new brands cannot be understated. The integration of e-commerce platforms and direct-to-consumer sales models is also a growing trend, expanding reach and improving customer engagement.

Dominant Markets & Segments in South America Craft Beer Market

Brazil stands out as the dominant market within the South America craft beer landscape, owing to its large population, a burgeoning middle class with significant purchasing power, and a well-established brewing tradition that is increasingly embracing craft innovation. The economic policies in Brazil, including supportive measures for small and medium-sized enterprises, further foster the growth of craft breweries. The "Rest of South America" region, encompassing countries like Colombia, Chile, and Peru, presents a significant growth opportunity, driven by increasing disposable incomes and a growing appreciation for premium beverages.

Type Segmentation:

- Ales, Pilsners and Pale Lagers: This segment continues to hold a substantial market share due to their widespread appeal and familiarity among consumers. However, growth is being increasingly challenged by specialty beer categories.

- Specialty Beers: This is the fastest-growing segment, driven by consumer demand for unique flavors, experimental brews, and limited editions. This segment benefits from the trend of premiumization and the desire for differentiated drinking experiences.

- Others: This includes niche styles and seasonal offerings, which contribute to the diversity of the market and cater to specific consumer preferences.

Distribution Channel Segmentation:

- On-Trade: This channel, including bars, restaurants, and pubs, remains a crucial outlet for craft beer, offering consumers the opportunity to experience freshly poured brews and explore new brands in a social setting.

- Off-Trade (Online Channel): The online channel, including e-commerce platforms and direct-to-consumer sales, is experiencing rapid growth, driven by convenience and the ability of consumers to access a wider variety of craft beers from the comfort of their homes. Infrastructure development supporting online retail logistics is key to this segment's expansion.

- Off-Trade (Offline Channel): Traditional retail outlets such as supermarkets and liquor stores are also important for off-trade sales, providing accessibility to a broader consumer base.

South America Craft Beer Market Product Innovations

Product innovation in the South America craft beer market is a key driver of growth, with breweries focusing on unique flavor profiles, indigenous ingredients, and sustainable brewing practices. For example, the launch of "Runt pale ale" by Feral Brewing Co. in August 2021, with its tropical punch and stone fruit flavors, exemplifies the trend towards bold and distinctive taste experiences. The integration of local fruits, spices, and even unique yeasts sourced from the region adds a distinctive regional character to many craft beers, appealing to consumers seeking authentic experiences. Technological advancements in hop cultivation and fermentation are also enabling the creation of novel beer styles and enhanced product quality, providing a competitive edge.

Report Segmentation & Scope

This report segments the South America craft beer market comprehensively across key categories. The Type segmentation includes Ales, Pilsners and Pale Lagers, Specialty Beers, and Others, each offering distinct growth trajectories and market potentials. The Distribution Channel is analyzed through On-Trade and Off-Trade (further divided into Online and Offline Channels), highlighting the evolving ways consumers access craft beer. Geographically, the market is divided into Argentina, Brazil, and the Rest of South America, providing granular insights into regional dynamics and varying market maturity levels. Market sizes and growth projections are detailed for each segment, offering a complete view of the competitive landscape.

Key Drivers of South America Craft Beer Market Growth

The South America craft beer market is propelled by several key drivers. Economic growth and rising disposable incomes empower consumers to spend more on premium and artisanal beverages. A growing appreciation for unique flavors and diverse brewing styles fuels demand for craft beer over traditional options. Technological advancements in brewing and packaging enable greater product quality and variety. Furthermore, supportive government policies and initiatives for small and medium-sized enterprises in some South American nations foster the growth of independent craft breweries. The increasing popularity of experiential consumption and the "foodie culture" also drives interest in craft beer as an accompaniment to dining.

Challenges in the South America Craft Beer Market Sector

Despite the positive outlook, the South America craft beer market faces several challenges. Stringent and inconsistent regulatory frameworks across different countries can pose significant hurdles for market entry and expansion. Supply chain complexities and distribution logistics, especially in vast and geographically diverse regions, can impact product availability and cost. Intense competition from both established multinational corporations and a growing number of local craft breweries demands continuous innovation and effective marketing strategies. Fluctuations in the cost of raw materials, such as hops and malt, can affect profit margins. Moreover, limited consumer awareness and education regarding craft beer nuances in certain developing markets can slow down adoption rates.

Leading Players in the South America Craft Beer Market Market

- New Belgium Brewing Co

- Cerveceria Altamira

- Patagonia Brewery

- Molson Coors

- Cordilleras

- The Boston Beer Company Inc

- Anheuser-Busch InBev SA/NV

- Feral Brewing co

- Bogota Beer Company

- Heineken NV

Key Developments in South America Craft Beer Market Sector

- April 2022: Anheuser-Busch's Brazilian brewer, Ambev, invested USD 154 million in a new eco-sustainable glass plant in Parana, Brazil. This plant supports sustainable glass bottle production for craft beer, utilizing biofuels, water and energy-efficient technology, and 100% renewable electricity.

- March 2022: Heineken launched the world's first virtual beer for the metaverse, hosting a product launch event at its virtual brewery and inviting journalists to promote the product as a true virtual offering.

- August 2021: Feral Brewing co. launched Runt pale ale, a mid-strength (3.5% ABV) craft beer featuring a strong tropical punch with notes of stone fruit and wood.

Strategic South America Craft Beer Market Market Outlook

The strategic outlook for the South America craft beer market is exceptionally bright, characterized by significant growth potential driven by evolving consumer tastes and increasing disposable incomes. The ongoing premiumization trend, coupled with a strong desire for authentic and locally sourced products, presents a fertile ground for innovation and expansion. Strategic opportunities lie in tapping into the "Rest of South America" markets, developing niche product portfolios to cater to diverse palates, and leveraging the expanding online distribution channels for wider reach. Investments in sustainable brewing practices and ingredient sourcing will not only appeal to environmentally conscious consumers but also offer long-term cost efficiencies. Collaborations between craft breweries and the hospitality sector will further enhance market penetration and consumer engagement. The market is poised for continued expansion, offering substantial returns for agile and forward-thinking players.

South America Craft Beer Market Segmentation

-

1. Type

- 1.1. Ales

- 1.2. Pilsners and Pale Lagers

- 1.3. Specialty Beers

- 1.4. Others

-

2. Distriburtion Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Online Channel

- 2.2.2. Offline Channel

-

3. Geography

- 3.1. Argentina

- 3.2. Brazil

- 3.3. Rest of South America

South America Craft Beer Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Craft Beer Market Regional Market Share

Geographic Coverage of South America Craft Beer Market

South America Craft Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. The increasing number of microbreweries elevates the demand for craft beer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Craft Beer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ales

- 5.1.2. Pilsners and Pale Lagers

- 5.1.3. Specialty Beers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Online Channel

- 5.2.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Argentina

- 5.3.2. Brazil

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Argentina South America Craft Beer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ales

- 6.1.2. Pilsners and Pale Lagers

- 6.1.3. Specialty Beers

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Online Channel

- 6.2.2.2. Offline Channel

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Argentina

- 6.3.2. Brazil

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil South America Craft Beer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ales

- 7.1.2. Pilsners and Pale Lagers

- 7.1.3. Specialty Beers

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Online Channel

- 7.2.2.2. Offline Channel

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Argentina

- 7.3.2. Brazil

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Craft Beer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ales

- 8.1.2. Pilsners and Pale Lagers

- 8.1.3. Specialty Beers

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Online Channel

- 8.2.2.2. Offline Channel

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Argentina

- 8.3.2. Brazil

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 New Belgium Brewing Co *List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cerveceria Altamira

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Patagonia Brewery

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Molson Coors

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cordilleras

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Boston Beer Company Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Anheuser-Busch InBev SA/NV

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Feral Brewing co

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bogota Beer Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Heineken NV

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 New Belgium Brewing Co *List Not Exhaustive

List of Figures

- Figure 1: South America Craft Beer Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Craft Beer Market Share (%) by Company 2025

List of Tables

- Table 1: South America Craft Beer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Craft Beer Market Volume liter Forecast, by Type 2020 & 2033

- Table 3: South America Craft Beer Market Revenue undefined Forecast, by Distriburtion Channel 2020 & 2033

- Table 4: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2020 & 2033

- Table 5: South America Craft Beer Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Craft Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 7: South America Craft Beer Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: South America Craft Beer Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: South America Craft Beer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Craft Beer Market Volume liter Forecast, by Type 2020 & 2033

- Table 11: South America Craft Beer Market Revenue undefined Forecast, by Distriburtion Channel 2020 & 2033

- Table 12: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2020 & 2033

- Table 13: South America Craft Beer Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: South America Craft Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 15: South America Craft Beer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Craft Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 17: South America Craft Beer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: South America Craft Beer Market Volume liter Forecast, by Type 2020 & 2033

- Table 19: South America Craft Beer Market Revenue undefined Forecast, by Distriburtion Channel 2020 & 2033

- Table 20: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2020 & 2033

- Table 21: South America Craft Beer Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Craft Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 23: South America Craft Beer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Craft Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 25: South America Craft Beer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: South America Craft Beer Market Volume liter Forecast, by Type 2020 & 2033

- Table 27: South America Craft Beer Market Revenue undefined Forecast, by Distriburtion Channel 2020 & 2033

- Table 28: South America Craft Beer Market Volume liter Forecast, by Distriburtion Channel 2020 & 2033

- Table 29: South America Craft Beer Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: South America Craft Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 31: South America Craft Beer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: South America Craft Beer Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Craft Beer Market?

The projected CAGR is approximately 12.48%.

2. Which companies are prominent players in the South America Craft Beer Market?

Key companies in the market include New Belgium Brewing Co *List Not Exhaustive, Cerveceria Altamira, Patagonia Brewery, Molson Coors, Cordilleras, The Boston Beer Company Inc, Anheuser-Busch InBev SA/NV, Feral Brewing co, Bogota Beer Company, Heineken NV.

3. What are the main segments of the South America Craft Beer Market?

The market segments include Type, Distriburtion Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

The increasing number of microbreweries elevates the demand for craft beer.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In April 2022, Anheuser-Busch's Brazilian brewer, Ambev invested USD 154 million in a new eco-sustainable glass plant in Parana, Brazil. The new glass plant provides sustainable glass bottles for the packaging of craft beer. The glass plant is able to run on biofuels, use cutting-edge technology to assure excellent water and energy efficiency, and operate on 100% renewable electricity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in liter.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Craft Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Craft Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Craft Beer Market?

To stay informed about further developments, trends, and reports in the South America Craft Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence