Key Insights

The South American botanical supplements market, valued at approximately $60.02 billion in 2025, is poised for substantial expansion. Driven by heightened consumer health awareness and increasing disposable incomes across the region, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.24% between the base year of 2025 and 2033. Key growth factors include a discernible shift towards natural and herbal remedies, stemming from concerns over synthetic drug adverse effects and a growing embrace of holistic wellness. The escalating incidence of chronic ailments, such as diabetes and cardiovascular diseases, further propels demand as consumers seek botanical supplements for preventive and complementary health management. Market segmentation highlights a strong preference for powdered and capsule formats, with supermarkets, hypermarkets, pharmacies, and drug stores serving as primary distribution channels. The expanding e-commerce landscape in South America also fuels notable growth in online sales. Nevertheless, the market confronts challenges, including regulatory complexities surrounding the standardization and quality assurance of botanical supplements, and the potential for variable product efficacy.

South America Botanical Supplements Market Market Size (In Billion)

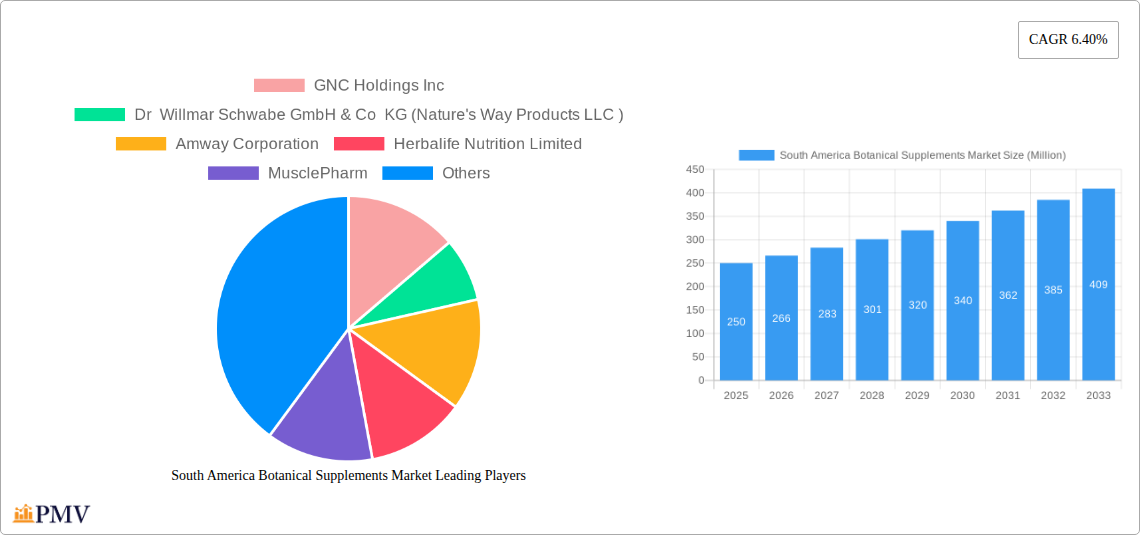

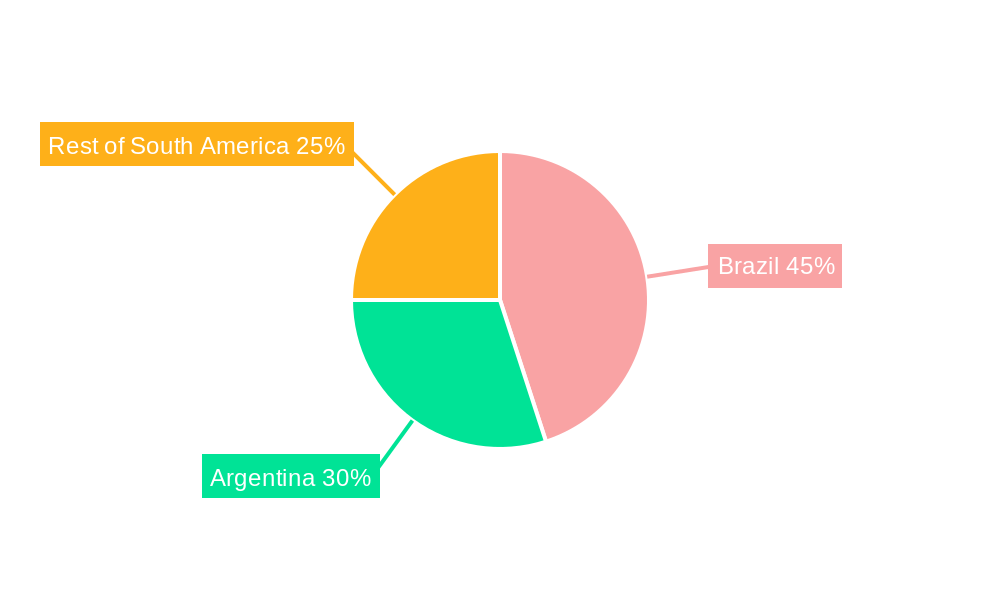

Brazil and Argentina emerge as the leading markets within South America, attributed to their substantial populations and higher per capita incomes. The competitive arena features a blend of established global corporations, including GNC Holdings Inc., Nature's Way Products LLC, and Amway Corporation, alongside regional contenders and specialized smaller brands. Intensified competition is anticipated as new entrants are drawn to the market's growth potential. Future expansion will hinge on successfully navigating regulatory landscapes, elevating consumer understanding of botanical supplement benefits and potential risks, and innovating product formulations to align with evolving consumer preferences. Strategic emphasis will likely be placed on marketing approaches that underscore product efficacy, safety, and sustainability to secure greater market share. A pronounced focus on transparency in sourcing and production processes will be crucial for fostering consumer trust and brand loyalty. Consequently, the South American botanical supplements market presents a favorable outlook for both established and nascent enterprises, contingent upon their adeptness in addressing challenges and capitalizing on the escalating demand for natural health solutions.

South America Botanical Supplements Market Company Market Share

South America Botanical Supplements Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Botanical Supplements Market, offering valuable insights for businesses, investors, and industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future outlook. The market size is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period.

South America Botanical Supplements Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the South America Botanical Supplements market, encompassing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure, with key players holding significant market share. However, a growing number of smaller, niche players are also emerging, driven by increasing consumer demand for specialized botanical supplements.

- Market Concentration: The top five players collectively hold approximately xx% of the market share in 2025, indicating a moderate level of concentration. However, this is expected to slightly decrease due to increased competition and market entry of smaller players.

- Innovation Ecosystems: Innovation in the South American botanical supplements market is driven by the development of new formulations, improved extraction techniques, and the incorporation of novel ingredients. The rise of personalized nutrition and functional foods is boosting innovation.

- Regulatory Frameworks: Regulatory landscapes vary across South American countries, influencing product approvals and market access. Harmonization of regulations across the region is anticipated to facilitate market expansion.

- Product Substitutes: The market faces competition from synthetic supplements and other health products. However, the growing preference for natural and organic products is driving demand for botanical supplements.

- End-User Trends: Consumers are increasingly aware of the health benefits of botanical supplements and are seeking products that address specific health needs, leading to increased demand for specialized formulations.

- M&A Activities: M&A activities in the market are expected to increase as larger companies seek to expand their product portfolios and market reach. The total value of M&A deals in the past five years is estimated at approximately xx Million. Examples include Herbalife Nutrition's share repurchase in 2021.

South America Botanical Supplements Market Industry Trends & Insights

This section delves into the key trends shaping the South America Botanical Supplements market, encompassing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing robust growth, fueled by factors such as rising health consciousness, increasing disposable incomes, and growing awareness of the benefits of natural remedies.

The increasing prevalence of chronic diseases, coupled with a growing preference for natural health solutions, is a primary driver. Technological advancements in extraction and formulation are improving product quality and efficacy. The increasing adoption of e-commerce platforms is also widening market access. However, challenges such as stringent regulations, inconsistent product quality, and fluctuating raw material prices pose restraints. The market is anticipated to witness a substantial rise in demand for products addressing specific health concerns, such as stress management, immune support, and cognitive function. The adoption rate of online channels for botanical supplement purchases is expected to increase significantly, influencing the market’s dynamics.

Dominant Markets & Segments in South America Botanical Supplements Market

This section identifies the leading regions, countries, and segments within the South America Botanical Supplements market. By Form, capsules dominate, capturing xx% of the market share in 2025. By Distribution Channel, Pharmacies/Drug Stores hold the largest share due to their established presence and credibility.

- Leading Region/Country: Brazil is the dominant market in South America, followed by xx and xx. This is driven by factors like higher population density, greater health consciousness, and a rapidly expanding middle class.

- Dominant Segments:

- By Form: Capsules are the most preferred form, owing to ease of consumption and higher bioavailability. Tablets and powdered forms also hold substantial market shares.

- By Distribution Channel: Pharmacies and drug stores maintain dominance due to consumer trust and accessibility, with online channels rapidly gaining traction. Supermarkets and hypermarkets also represent a significant distribution channel.

- Key Drivers:

- Economic Growth: Rising disposable incomes in several South American countries are boosting spending on health and wellness products.

- Improved Healthcare Infrastructure: Enhanced healthcare infrastructure is increasing awareness of health and wellness, driving demand for supplements.

- Government Initiatives: Government support for the wellness sector is further contributing to market expansion.

South America Botanical Supplements Market Product Innovations

Recent product innovations include the launch of specialized mushroom blends by Gaia Herbs in 2021, targeting specific health benefits. This trend highlights the focus on functional and targeted supplements. Companies are increasingly integrating technology to enhance extraction processes, leading to higher quality and potency. The market is witnessing a trend towards personalized supplements tailored to individual health needs and genetic profiles, creating competitive advantages.

Report Segmentation & Scope

This report segments the South America Botanical Supplements market by form (powdered, capsules, tablets, other forms) and distribution channel (supermarket/hypermarket, pharmacies/drug stores, online stores, other distribution channels). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed. The "Other Forms" segment includes liquids, gels, and others. The "Other Distribution Channels" include direct selling and specialty stores. Market size projections and CAGR data are provided for each segment.

Key Drivers of South America Botanical Supplements Market Growth

Several key factors fuel the growth of the South America Botanical Supplements market. These include the rising prevalence of chronic diseases, leading to increased demand for preventative and therapeutic supplements; the growing awareness of the benefits of natural and organic health solutions amongst consumers; and the increasing disposable incomes among the expanding middle class, increasing spending power on health and wellness products. Technological advancements in extraction methods and formulation also contribute significantly to market expansion.

Challenges in the South America Botanical Supplements Market Sector

The South America Botanical Supplements market faces challenges such as stringent regulatory requirements and inconsistent product quality across different brands. Supply chain disruptions, particularly those related to raw material sourcing, can lead to price volatility and shortages. Furthermore, intensifying competition from both established and emerging players requires continuous innovation and differentiation to maintain market share.

Leading Players in the South America Botanical Supplements Market Market

- GNC Holdings Inc

- Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )

- Amway Corporation

- Herbalife Nutrition Limited

- MusclePharm

- Nature's Bounty Co

- NOW Foods

- Blackmores Limited

- Arizona Natural Products

- Gaia Herbs

Key Developments in South America Botanical Supplements Market Sector

- October 2021: GNC Holdings Inc. partners with GLAXON for athletic nutrition supplements.

- March 2021: Gaia Herbs introduces a new line of mushroom capsules for overall wellness.

- January 2021: Herbalife Nutrition repurchases USD 600 Million of its shares.

Strategic South America Botanical Supplements Market Outlook

The South America Botanical Supplements market presents significant growth opportunities. Continued innovation in product formulations, expansion into new markets within South America, and leveraging the growth of e-commerce will drive future growth. Strategic partnerships and acquisitions will also play a crucial role in shaping the market landscape. The focus on personalized nutrition and functional foods will continue to attract investment and drive market expansion.

South America Botanical Supplements Market Segmentation

-

1. Form

- 1.1. Powdered

- 1.2. Capsules

- 1.3. Tablets

- 1.4. Other Forms

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Pharmacies/Drug Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Argentina

- 3.2. Brazil

- 3.3. Rest of South America

South America Botanical Supplements Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Botanical Supplements Market Regional Market Share

Geographic Coverage of South America Botanical Supplements Market

South America Botanical Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Increased Focus on Preventive Healthcare

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powdered

- 5.1.2. Capsules

- 5.1.3. Tablets

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Pharmacies/Drug Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Argentina

- 5.3.2. Brazil

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Argentina South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powdered

- 6.1.2. Capsules

- 6.1.3. Tablets

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Pharmacies/Drug Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Argentina

- 6.3.2. Brazil

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Brazil South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powdered

- 7.1.2. Capsules

- 7.1.3. Tablets

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Pharmacies/Drug Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Argentina

- 7.3.2. Brazil

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Rest of South America South America Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powdered

- 8.1.2. Capsules

- 8.1.3. Tablets

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Pharmacies/Drug Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Argentina

- 8.3.2. Brazil

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GNC Holdings Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Amway Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Herbalife Nutrition Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 MusclePharm

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nature's Bounty Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 NOW Foods

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Blackmores Limited*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Arizona Natural Products

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Gaia Herbs

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 GNC Holdings Inc

List of Figures

- Figure 1: South America Botanical Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Botanical Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Botanical Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 6: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 10: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: South America Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Botanical Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Botanical Supplements Market?

The projected CAGR is approximately 10.24%.

2. Which companies are prominent players in the South America Botanical Supplements Market?

Key companies in the market include GNC Holdings Inc, Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC ), Amway Corporation, Herbalife Nutrition Limited, MusclePharm, Nature's Bounty Co, NOW Foods, Blackmores Limited*List Not Exhaustive, Arizona Natural Products, Gaia Herbs.

3. What are the main segments of the South America Botanical Supplements Market?

The market segments include Form, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Increased Focus on Preventive Healthcare.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

In October 2021, GNC Holdings Inc. and GLAXON have established a strategic product partnership. GLAXON supplies nutrition supplements for athletes. The collaboration with GNC is the first to emerge from GNC Ventures, the subsidiary that fosters innovation and technology and is connected to GNC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Botanical Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Botanical Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Botanical Supplements Market?

To stay informed about further developments, trends, and reports in the South America Botanical Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence