Key Insights

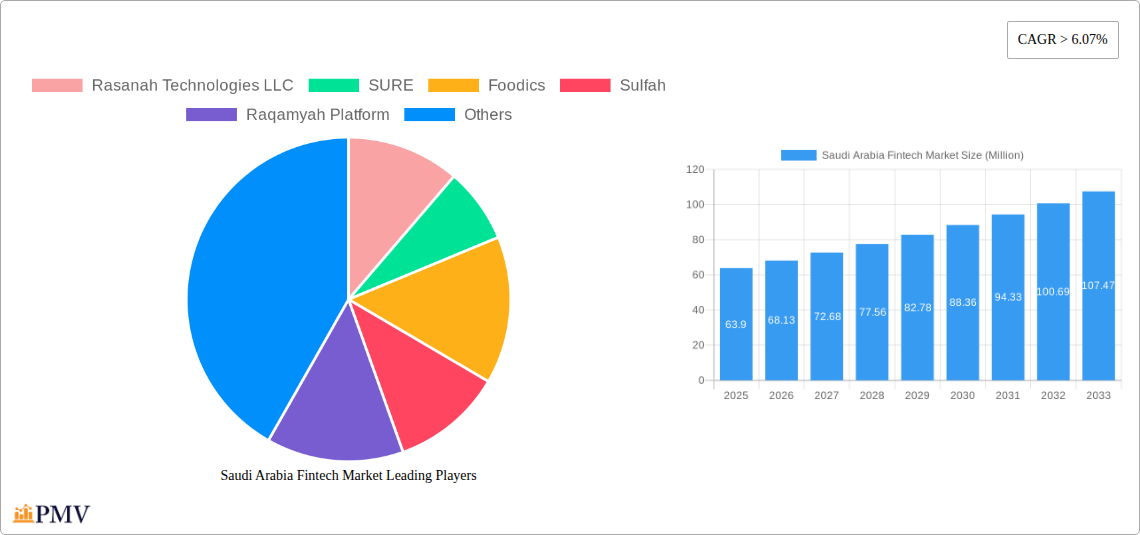

The Saudi Arabian Fintech market, valued at $63.90 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.07% from 2025 to 2033. This expansion is fueled by several key drivers. The Saudi Vision 2030 initiative, focused on diversifying the economy and promoting digital transformation, is a significant catalyst. Increased smartphone penetration and internet access among the Saudi population are creating a fertile ground for the adoption of digital financial services. Government support for fintech innovation, including regulatory frameworks designed to foster competition and encourage investment, further contributes to market growth. The rising demand for convenient and efficient payment solutions, coupled with the increasing preference for cashless transactions, fuels the demand for fintech solutions across various segments, including mobile payments, digital lending, and investment platforms. Furthermore, a young and tech-savvy population readily embraces new technologies, accelerating the adoption rate of fintech products and services.

Saudi Arabia Fintech Market Market Size (In Million)

However, the market's growth is not without challenges. While the regulatory environment is supportive, navigating the complexities of implementing and complying with regulations can pose hurdles for some fintech companies. Cybersecurity concerns and data privacy regulations also represent significant constraints. Competition within the market, especially from established financial institutions integrating fintech solutions, will intensify. Addressing these challenges effectively will be crucial for sustaining the high growth trajectory of the Saudi Arabian fintech market. Key players like Rasanah Technologies LLC, SURE, Foodics, and Tamara are strategically positioned to capitalize on these opportunities and contribute to the market's continued expansion. Future growth will likely hinge on successful partnerships between fintech firms and traditional banks, resulting in enhanced offerings and greater market penetration.

Saudi Arabia Fintech Market Company Market Share

This comprehensive report provides an in-depth analysis of the Saudi Arabia Fintech market, covering the period 2019-2033, with a focus on the estimated year 2025. It offers invaluable insights for investors, businesses, and industry stakeholders seeking to understand the market's structure, trends, and future potential. The report utilizes extensive data analysis to project the market's trajectory and identify key opportunities. The base year for this analysis is 2025, with a forecast period extending from 2025 to 2033, encompassing both historical data (2019-2024) and future projections.

Saudi Arabia Fintech Market Structure & Competitive Dynamics

The Saudi Arabian Fintech market is characterized by a dynamic competitive landscape, exhibiting a moderate level of concentration. While a few major players dominate certain segments, numerous smaller fintech companies are rapidly emerging, fostering innovation and competition. The market's structure is influenced by the regulatory framework established by the Saudi Arabian Monetary Authority (SAMA), which actively promotes growth while ensuring stability and consumer protection. The regulatory landscape encourages both domestic and international players, driving M&A activity.

The innovation ecosystem is vibrant, fueled by government initiatives promoting digital transformation and a burgeoning startup scene. Several accelerators and incubators support Fintech innovation, leading to a steady stream of new products and services. Product substitutes, such as traditional banking services, continue to compete, but the Fintech sector's agility and focus on user experience are proving compelling. End-user trends show a strong preference for mobile-first solutions and personalized financial services.

M&A activity is significant. Recent deals, though not all publicly disclosed, suggest consolidation and expansion strategies amongst players, with deal values estimated at xx Million in 2024, projected to reach xx Million by 2028. Market share data suggests that the top five players collectively hold approximately xx% of the market, leaving significant room for growth and diversification.

- Market Concentration: Moderate, with a few dominant players.

- M&A Activity: Increasing, with deal values expected to grow significantly.

- Innovation Ecosystem: Highly dynamic, with government support and vibrant startup scene.

- Regulatory Framework: Supportive and conducive to growth.

Saudi Arabia Fintech Market Industry Trends & Insights

The Saudi Arabia Fintech market is experiencing robust growth, driven by several key factors. The government’s Vision 2030 initiative, aimed at diversifying the economy and promoting digital transformation, plays a pivotal role. Increased smartphone penetration and internet access have fueled the adoption of digital financial services, particularly among the younger population. Rising financial inclusion rates, with a push to reach underserved segments, is further driving the expansion of the sector. Technological disruptions, especially in payments, lending, and investment, are transforming the landscape. The introduction of open banking APIs is enhancing interoperability and fostering innovation.

Consumer preferences are shifting towards convenience, personalized experiences, and seamless integration of financial services into their daily lives. The increasing use of mobile wallets, AI-powered financial advice tools, and blockchain technologies reflect this change. Competitive dynamics are shaping the market through strategic partnerships, product differentiation, and aggressive marketing. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration steadily increasing, from xx% in 2025 to xx% in 2033.

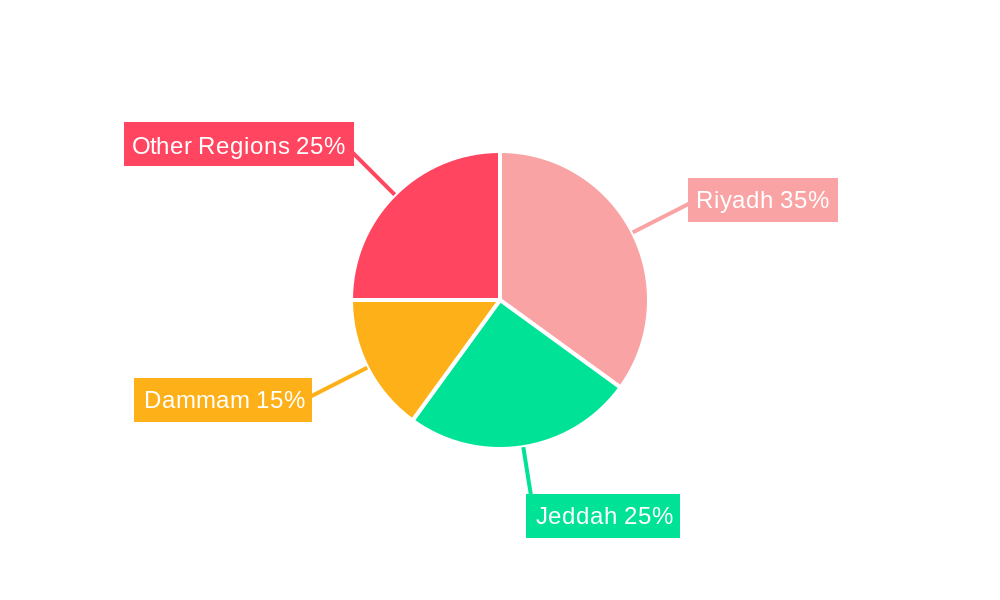

Dominant Markets & Segments in Saudi Arabia Fintech Market

The major urban centers, including Riyadh, Jeddah, and Dammam, are driving the growth of the Fintech market, benefiting from higher internet and smartphone penetration and a more tech-savvy population. Government initiatives targeting these areas, including infrastructure improvements and digital literacy programs, further amplify this dominance.

- Key Drivers:

- Vision 2030 initiatives promoting digitalization.

- High smartphone and internet penetration in urban areas.

- Government support for infrastructure development and digital literacy.

- Increasing financial inclusion efforts.

The payments segment dominates the market, driven by the surge in e-commerce and mobile transactions. The lending segment is also experiencing strong growth, driven by the increasing demand for affordable credit solutions. Investment and wealth management are emerging segments, attracting significant investment and innovation.

Saudi Arabia Fintech Market Product Innovations

The Saudi Arabian Fintech sector is experiencing a dynamic surge in product innovation, driven by the integration of cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and Blockchain. These advancements are not only bolstering security and operational efficiency but also enabling hyper-personalized financial services that significantly enhance user experience. The market is witnessing a proliferation of innovative solutions designed for convenience and accessibility. Leading the charge are sophisticated mobile wallets offering seamless transactions, flexible Buy Now Pay Later (BNPL) solutions catering to evolving consumer spending habits, AI-driven robo-advisors providing intelligent investment guidance, and efficient digital lending platforms streamlining access to capital. The competitive edge in this rapidly evolving landscape is firmly established by those who can deliver unique functionalities, intuitive and frictionless user journeys, and uncompromisingly secure transaction environments.

Report Segmentation & Scope

This comprehensive report meticulously segments the Saudi Arabia Fintech market across a range of critical parameters, providing deep insights into its structure and potential:

- By Product Type: The market is analyzed through its core product categories, including Payments (digital wallets, P2P transfers, POS solutions), Lending (digital loans, P2P lending, BNPL), Wealth Management (robo-advisory, investment platforms), Insurance (Insurtech solutions), and a spectrum of other emerging Fintech services. Each segment is evaluated for its unique growth trajectories and competitive dynamics.

- By Business Model: We dissect the market based on prevalent business models such as Business-to-Consumer (B2C), Business-to-Business (B2B), and Business-to-Business-to-Consumer (B2B2C), offering clarity on varying market sizes, revenue streams, and growth potentials.

- By Technology: The report highlights the impact of key technologies, including Mobile Payments (NFC, QR codes), Cloud-Based Solutions (SaaS, PaaS for financial services), AI-Powered Platforms (fraud detection, personalized recommendations, chatbots), and Blockchain Applications (secure transactions, DLT for finance), to showcase the prevailing technological trends and their market adoption.

- By Demographics: A granular segmentation by demographics, encompassing age groups, income levels, and geographical distribution within Saudi Arabia, offers invaluable insights into untapped market potential and nuanced consumer behavior, enabling targeted strategic planning.

Key Drivers of Saudi Arabia Fintech Market Growth

The Saudi Arabian Fintech market is experiencing robust expansion, propelled by a confluence of powerful growth catalysts:

- Government Initiatives & Vision 2030: The Kingdom's ambitious Vision 2030 agenda, with its strong emphasis on digital transformation and financial inclusion, serves as the paramount driver. This strategic vision actively fosters an environment conducive to Fintech innovation and adoption.

- Technological Advancements: The pervasive integration of AI, ML, and Blockchain is fundamentally reshaping traditional financial services, unlocking novel business models and driving efficiency across the entire ecosystem.

- Rising Smartphone Penetration & Digital Savvy: The widespread and increasing adoption of smartphones across the population has laid a fertile ground for mobile banking, digital payments, and the overall uptake of Fintech solutions.

- Booming E-commerce Landscape: The exponential growth of the e-commerce sector directly fuels the demand for secure, swift, and seamless online payment systems, further stimulating Fintech development.

- Increasing Venture Capital Investment: A growing influx of venture capital and strategic investments into Fintech startups is providing the necessary fuel for innovation, scaling, and market penetration.

- Favorable Regulatory Sandbox Environments: The establishment of regulatory sandboxes by authorities like SAMA allows innovative Fintech solutions to be tested and refined in a controlled environment, promoting responsible growth.

Challenges in the Saudi Arabia Fintech Market Sector

Notwithstanding its considerable growth trajectory, the Saudi Arabia Fintech market navigates several significant challenges:

- Evolving Regulatory Landscape: While supportive, the evolving nature of Fintech regulations requires continuous adaptation and vigilance from both new entrants and established players to ensure full compliance.

- Heightened Cybersecurity Threats: The increasing reliance on digital financial services amplifies vulnerability to sophisticated cyber threats. Robust, multi-layered security measures and continuous vigilance are paramount.

- Intensifying Competition: As the market matures, competition is intensifying. Fintech firms must continually innovate and differentiate their offerings to capture and retain market share.

- Bridging the Digital Literacy Gap: While adoption is growing, ensuring widespread understanding and comfort with digital financial tools across all segments of the population remains a critical factor for achieving universal Fintech penetration.

- Customer Trust and Adoption: Building and maintaining customer trust in digital financial services, especially for sensitive transactions and investments, is an ongoing challenge that requires transparent communication and reliable service delivery.

Leading Players in the Saudi Arabia Fintech Market Market

- Rasanah Technologies LLC

- SURE

- Foodics

- Sulfah

- Raqamyah Platform

- Maalem Financing Company

- Skyband

- Saudi Fintech Company

- Fleap

- Tamara

List Not Exhaustive

Key Developments in Saudi Arabia Fintech Market Sector

- February 2023: Hala's strategic acquisition of Paymennt.com marked a significant expansion of its omnichannel payment capabilities, leading to a remarkable increase of over 250% in its yearly payment processing volume and solidifying its market position.

- January 2022: The Saudi Central Bank (SAMA) continued its proactive approach by issuing licenses to 15 new Fintech companies. This expansion brought the total number of licensed Fintech entities to 45, underscoring the sector's dynamic growth and increasing maturity.

- Ongoing: Continuous development and launch of new digital payment solutions, digital banking platforms, and AI-driven financial advisory services by both established financial institutions and emerging Fintech startups are reshaping the competitive landscape.

- Recent: Increased focus on Sharia-compliant Fintech solutions, catering to the specific religious and cultural preferences of the Saudi population, demonstrating a commitment to localized innovation.

Strategic Saudi Arabia Fintech Market Outlook

The Saudi Arabia Fintech market presents immense growth potential, driven by continued government support, technological advancements, and evolving consumer preferences. Strategic opportunities lie in leveraging AI, blockchain, and open banking to provide innovative and personalized financial services. Expanding into underserved segments and focusing on financial inclusion will unlock further market penetration. Companies that effectively adapt to the evolving regulatory landscape and prioritize cybersecurity will be best positioned for success. The market is poised for significant expansion, offering substantial rewards for both established players and new entrants.

Saudi Arabia Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

Saudi Arabia Fintech Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fintech Market Regional Market Share

Geographic Coverage of Saudi Arabia Fintech Market

Saudi Arabia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Transaction Drives the Market; Cost Reduction Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Transaction Drives the Market; Cost Reduction Drives the Market

- 3.4. Market Trends

- 3.4.1. Digital Transformation and Regulatory Support Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rasanah Technologies LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SURE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Foodics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sulfah

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raqamyah Platform

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maalem Financing Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyband

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saudi Fintech Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fleap

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tamara**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rasanah Technologies LLC

List of Figures

- Figure 1: Saudi Arabia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Saudi Arabia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Saudi Arabia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 6: Saudi Arabia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 7: Saudi Arabia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fintech Market?

The projected CAGR is approximately > 6.07%.

2. Which companies are prominent players in the Saudi Arabia Fintech Market?

Key companies in the market include Rasanah Technologies LLC, SURE, Foodics, Sulfah, Raqamyah Platform, Maalem Financing Company, Skyband, Saudi Fintech Company, Fleap, Tamara**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Transaction Drives the Market; Cost Reduction Drives the Market.

6. What are the notable trends driving market growth?

Digital Transformation and Regulatory Support Driving the Market.

7. Are there any restraints impacting market growth?

Faster Transaction Drives the Market; Cost Reduction Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Hala, a fintech company in Saudi Arabia, purchased Paymennt.com, a payments service provider based in the United Arab Emirates. With this acquisition, Hala can handle omnichannel payments, integrate digital payments into its product offerings, and help its SME clients become more visible online. According to a press release by Wamda, the platform's payment processing increased by more than 250% yearly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fintech Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence