Key Insights

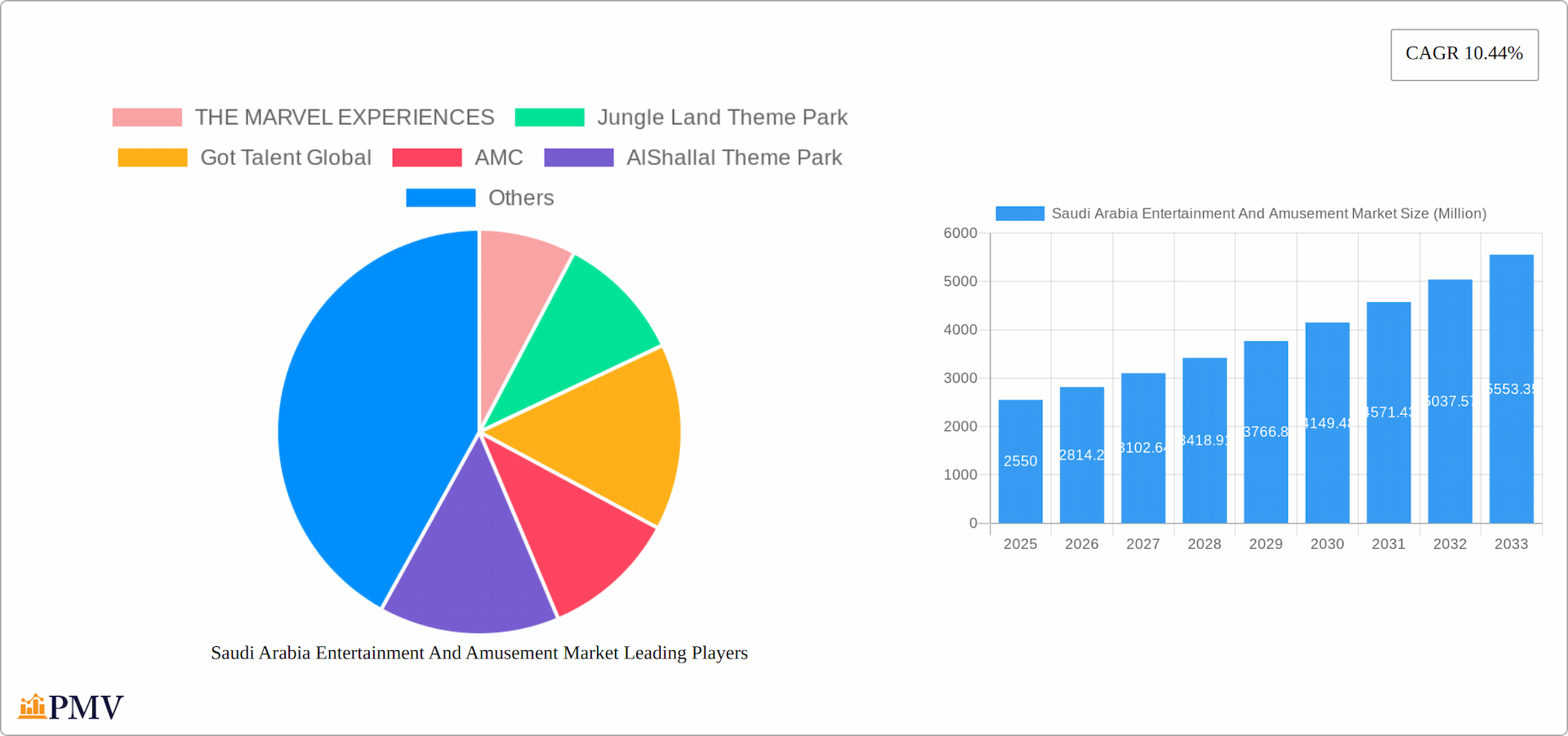

The Saudi Arabia entertainment and amusement market is experiencing robust growth, projected to reach \$2.55 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.44% from 2025 to 2033. This expansion is fueled by several key factors. Significant government investment in infrastructure development, including the construction of new theme parks and entertainment venues, is a primary driver. Furthermore, Vision 2030's emphasis on diversifying the Saudi economy and improving the quality of life for citizens is directly boosting the sector. Increased disposable incomes among Saudi citizens, coupled with a young and growing population eager for leisure activities, further fuels demand. The market is segmented by entertainment type (cinemas, theme parks, zoos, etc.), revenue source (tickets, food & beverage, merchandise), and geographic location (Riyadh, Jeddah, Makkah, etc.). The presence of both international giants like Disney and Six Flags, alongside local players like AlShallal Theme Park, indicates a vibrant and competitive landscape. Growth in the food and beverage segment, particularly within theme parks and entertainment complexes, is expected to be particularly significant as these venues become increasingly integrated entertainment destinations.

Saudi Arabia Entertainment And Amusement Market Market Size (In Billion)

While the market enjoys considerable momentum, challenges remain. These include the need to develop a highly skilled workforce to support the expanding industry, ensuring sufficient infrastructure to accommodate growing visitor numbers, and maintaining a balance between catering to both local and international tourists. The success of the Saudi Arabia entertainment and amusement market hinges on continuing government support, effective infrastructure management, and a consistent focus on innovation and quality to maintain its appeal and attract further investment. This creates numerous opportunities for both established players and emerging businesses within the sector, particularly those that can adapt to evolving consumer preferences and technological advancements. The forecast suggests a strong trajectory for the market over the next decade, solidifying Saudi Arabia's position as a regional entertainment hub.

Saudi Arabia Entertainment And Amusement Market Company Market Share

Saudi Arabia Entertainment and Amusement Market: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Saudi Arabia entertainment and amusement market, offering invaluable insights for investors, industry players, and stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth potential. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Saudi Arabia Entertainment And Amusement Market Market Structure & Competitive Dynamics

The Saudi Arabian entertainment and amusement market exhibits a dynamic blend of established international corporations and a burgeoning local industry. While a few key players dominate specific market segments, resulting in moderate market concentration, a multitude of smaller businesses thrive in niche areas. Vision 2030's ambitious economic diversification and tourism-boosting initiatives are significantly accelerating the growth of the market's innovation ecosystem. This has spurred substantial investments in infrastructure, cutting-edge technologies, and talent cultivation, creating a fertile ground for expansion and competition.

The regulatory landscape is in constant evolution, with government policies actively encouraging the entertainment sector's expansion. This includes streamlined licensing procedures and strategic public-private partnerships. Although home entertainment options present competitive challenges, the surging demand for immersive and shared experiences effectively mitigates this threat. Consumer trends reveal a strong preference for diverse entertainment, encompassing theme parks, cinemas, live events, and interactive gaming experiences. The market is witnessing a rise in mergers and acquisitions (M&A) activity, with larger companies strategically acquiring smaller entities to broaden their reach and service offerings. For example, the estimated value of M&A deals in 2024 reached [Insert Updated Value] Million, underscoring significant investment in market consolidation and expansion.

- Market Concentration: Moderate, with key players dominating specific segments.

- Innovation Ecosystem: Robust and rapidly expanding, fueled by Vision 2030 and private investment.

- Regulatory Framework: Supportive and evolving, characterized by government initiatives promoting growth and easing regulations.

- M&A Activity: Increasing significantly, with substantial deal values reflecting market consolidation and expansion efforts. (e.g., [Insert Updated Value] Million in 2024).

Saudi Arabia Entertainment And Amusement Market Industry Trends & Insights

The Saudi Arabian entertainment and amusement market is experiencing explosive growth, driven by several converging factors. A young and rapidly expanding population, coupled with rising disposable incomes, is fueling strong demand for diverse entertainment experiences. Vision 2030's initiatives are instrumental in driving market expansion through substantial investments and strategic infrastructure development. The influx of international players contributes advanced technologies and management expertise, complementing the innovation and cultural sensitivity offered by local businesses. Disruptive technologies such as virtual reality (VR) and augmented reality (AR) are rapidly gaining traction, enhancing entertainment offerings and creating unique experiences. Consumer preferences increasingly gravitate towards immersive and interactive entertainment, driving demand for innovative theme parks, technologically advanced gaming centers, and state-of-the-art cinemas. The market also observes a growing demand for family-oriented entertainment, significantly impacting the expansion strategies of numerous industry players. The penetration rate of advanced technologies is steadily increasing, projected to grow at a rate of [Insert Updated Percentage]% annually.

Dominant Markets & Segments in Saudi Arabia Entertainment And Amusement Market

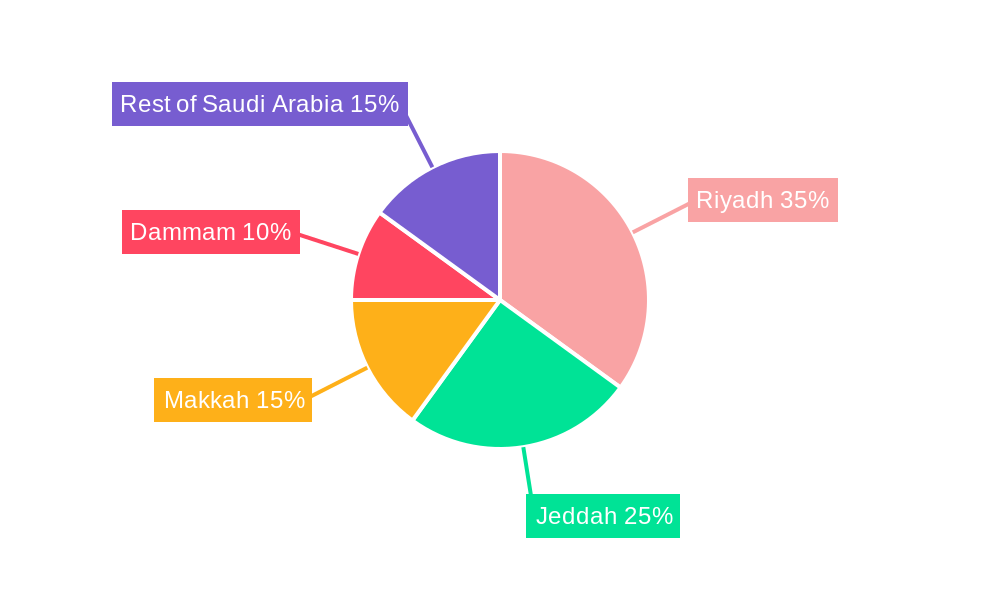

The Saudi Arabian entertainment and amusement market is fragmented across various segments. By city, Riyadh holds a dominant position, benefiting from its large population and concentrated infrastructure. Jeddah follows as a major hub, while Makkah and Dammam also contribute significantly.

By Type of Entertainment Destination: Amusement and theme parks exhibit the highest growth, driven by increasing tourism and investment. Cinemas and theaters also hold a significant market share.

By Source of Revenue: Ticket sales contribute the largest portion of revenue, but food and beverage, and merchandise sales also play a crucial role, demonstrating significant growth potential.

By City:

- Riyadh: Dominant market share due to high population density and developed infrastructure. Key drivers include government investment and large-scale developments such as the Qiddiya entertainment city project.

- Jeddah: Significant market presence fueled by tourism and port-related activity.

- Makkah & Dammam: These cities contribute substantially, benefiting from both local and religious tourism.

Saudi Arabia Entertainment And Amusement Market Product Innovations

Recent product developments are heavily focused on integrating cutting-edge technologies, such as VR and AR, into amusement parks and gaming centers. Interactive and personalized entertainment experiences are becoming increasingly sought after, creating a competitive edge for companies that provide unique and technologically advanced products tailored to the evolving preferences of Saudi consumers. This includes advancements in [mention specific examples like advanced simulation rides, interactive storytelling experiences, or personalized gaming options].

Report Segmentation & Scope

This report segments the Saudi Arabia entertainment and amusement market in three key ways:

By Type of Entertainment Destination: Cinemas and Theatres, Amusement and Theme Parks, Gardens and Zoos, Malls, Gaming Centers, Others. Each segment's market size, growth projections, and competitive dynamics are analyzed. Amusement parks, in particular, show strong growth potential.

By Source of Revenue: Tickets, Food & Beverages, Merchandise, Advertising, Others. The report details the revenue contribution from each source and its growth prospects. Food & beverage is showing robust growth as an increasingly crucial revenue stream.

By City: Riyadh, Jeddah, Makkah, Dammam, Rest of Saudi Arabia. The report analyzes the market size and growth trajectory of each city, considering population density, tourism, and infrastructure.

Key Drivers of Saudi Arabia Entertainment And Amusement Market Growth

The remarkable growth of the Saudi Arabian entertainment and amusement market is primarily propelled by the government's Vision 2030 initiative. This ambitious plan aims to diversify the economy, attract significant tourism investment, and foster national development, resulting in massive infrastructure development and investment in entertainment projects. The rising disposable incomes and a young, dynamic population also contribute significantly to increased spending on leisure and entertainment. Furthermore, technological advancements and the growing preference for immersive experiences are key factors driving market expansion and innovation.

Challenges in the Saudi Arabia Entertainment And Amusement Market Sector

The market faces challenges such as the need to develop local talent and expertise. Maintaining a balance between international best practices and cultural sensitivities is also crucial. Furthermore, managing infrastructure development and ensuring its sustainability are critical factors in sustaining the market's growth. Competition from international players also requires local companies to adapt and innovate constantly. The impact of these challenges may include delays in project completion and a potential increase in operational costs.

Leading Players in the Saudi Arabia Entertainment And Amusement Market Market

- THE MARVEL EXPERIENCES

- Jungle Land Theme Park

- Got Talent Global

- AMC

- AlShallal Theme Park

- Cirque Du Soleil

- IMG Artists

- National geographic

- Broadway Entertainment

- AVEX

- SIX FLAGS

- Disney Frozen

- FELD ENTERTAINMENT

- Loopagoon Water Park

- List Not Exhaustive

Key Developments in Saudi Arabia Entertainment And Amusement Market Sector

- May 2022: Muvi Cinemas launched Muvi Studios, a significant step towards boosting local content creation and strengthening the Kingdom's cinema sector. [Add further details or impact of this launch]

- September 2022: Flash Entertainment established its KSA headquarters, underscoring its commitment to the Kingdom's entertainment industry growth in alignment with Vision 2030. This strategic move signifies a notable increase in international investment and support for Saudization. [Add further details or impact of this establishment]

- [Add other key developments with dates and brief descriptions, including any significant partnerships, new park openings, or festival launches.]

Strategic Saudi Arabia Entertainment And Amusement Market Market Outlook

The Saudi Arabian entertainment and amusement market holds immense future potential. Continued government support, coupled with increasing private sector investments, ensures robust growth. Focus on developing unique experiences, leveraging technology, and catering to diverse preferences will be key for success. The market is poised to become a regional leader, offering innovative entertainment options and contributing substantially to the Kingdom’s economic diversification goals.

Saudi Arabia Entertainment And Amusement Market Segmentation

-

1. Type of Entertainment Destination

- 1.1. Cinemas and Theatres

- 1.2. Amusement and Theme Parks

- 1.3. Gardens and Zoos

- 1.4. Malls

- 1.5. Gaming Centers

- 1.6. Others

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Food & Beverages

- 2.3. Merchandise

- 2.4. Advertising

- 2.5. Others

-

3. City

- 3.1. Riyadh

- 3.2. Jeddah

- 3.3. Makkah

- 3.4. Dammam

- 3.5. Rest of Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Regional Market Share

Geographic Coverage of Saudi Arabia Entertainment And Amusement Market

Saudi Arabia Entertainment And Amusement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Costs is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Entertainment And Amusement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 5.1.1. Cinemas and Theatres

- 5.1.2. Amusement and Theme Parks

- 5.1.3. Gardens and Zoos

- 5.1.4. Malls

- 5.1.5. Gaming Centers

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Food & Beverages

- 5.2.3. Merchandise

- 5.2.4. Advertising

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Riyadh

- 5.3.2. Jeddah

- 5.3.3. Makkah

- 5.3.4. Dammam

- 5.3.5. Rest of Saudi Arabia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THE MARVEL EXPERIENCES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jungle Land Theme Park

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Got Talent Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlShallal Theme Park

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cirque Du Soleil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IMG Artists

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 National geographic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broadway Entertainment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVEX

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIX FLAGS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Disney Frozen

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FELD ENTERTAINMENT

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Loopagoon Water Park**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 THE MARVEL EXPERIENCES

List of Figures

- Figure 1: Saudi Arabia Entertainment And Amusement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Entertainment And Amusement Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 2: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 4: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 6: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 7: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 8: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Entertainment And Amusement Market?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Saudi Arabia Entertainment And Amusement Market?

Key companies in the market include THE MARVEL EXPERIENCES, Jungle Land Theme Park, Got Talent Global, AMC, AlShallal Theme Park, Cirque Du Soleil, IMG Artists, National geographic, Broadway Entertainment, AVEX, SIX FLAGS, Disney Frozen, FELD ENTERTAINMENT, Loopagoon Water Park**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Entertainment And Amusement Market?

The market segments include Type of Entertainment Destination, Source of Revenue, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs is Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Arabia's leading theater operator Muvi Cinemas launched Muvi Studios. The new Studio will focus on developing both Saudi and Egyptian films for the Saudi public, concentrating on films for the big screen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Entertainment And Amusement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Entertainment And Amusement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Entertainment And Amusement Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Entertainment And Amusement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence