Key Insights

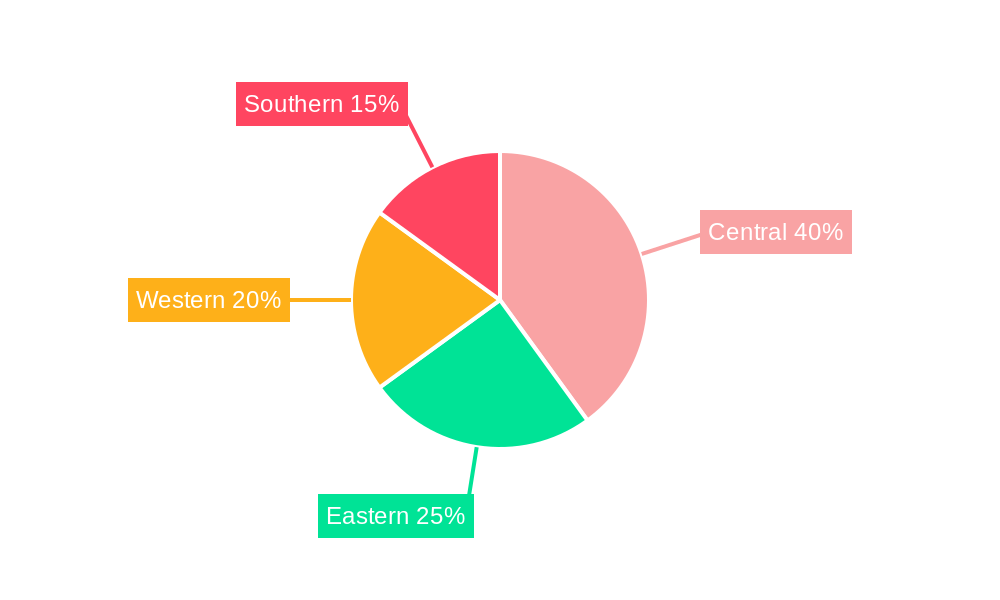

The Saudi Arabian Big Data and Artificial Intelligence (AI) market is experiencing rapid growth, projected to reach a market size of $0.38 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 34.24%. This surge is driven by the Kingdom's Vision 2030, a national transformation plan heavily investing in digital infrastructure and technological advancement. Key drivers include the increasing adoption of cloud computing, the growing need for data-driven decision-making across various sectors (particularly IT & Telecom, BFSI, and Public & Government Institutions), and government initiatives promoting AI adoption. Furthermore, the rising volume of data generated across diverse sectors, coupled with the need for enhanced operational efficiency and improved public services, fuels the market expansion. The market is segmented by end-user, component (hardware, software, services), and organization size (SMEs and large enterprises), with large enterprises currently dominating the landscape due to higher budgets and advanced technological adoption. The regional distribution within Saudi Arabia indicates varying levels of adoption across Central, Eastern, Western, and Southern regions, with central regions potentially leading due to higher concentration of businesses and government bodies. While challenges such as data security concerns and a shortage of skilled professionals exist, the overall growth trajectory remains strongly positive, promising significant market expansion throughout the forecast period (2025-2033).

Saudi Arabia Big Data And Artificial Intelligence Market Market Size (In Million)

The competitive landscape is dynamic, featuring both global technology giants like IBM, Microsoft, and Amazon Web Services, and specialized AI/Big Data firms such as SAS Institute and Qli. These companies are actively vying for market share by offering tailored solutions to meet the specific needs of Saudi Arabian businesses and government entities. The ongoing investments in R&D, strategic partnerships, and acquisitions are shaping the market dynamics and driving innovation. The continued growth of the Saudi Arabian economy and the emphasis on digital transformation initiatives will likely further accelerate the adoption of Big Data and AI solutions across all segments, making it a highly lucrative market for both established players and emerging startups. The future will likely see further specialization within the market, with solutions catering to niche industries like healthcare and energy gaining prominence.

Saudi Arabia Big Data And Artificial Intelligence Market Company Market Share

Saudi Arabia Big Data and Artificial Intelligence Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Saudi Arabia Big Data and Artificial Intelligence (AI) market, offering valuable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The market is segmented by end-user, component, and organization size, providing a granular understanding of its diverse landscape.

Saudi Arabia Big Data And Artificial Intelligence Market Market Structure & Competitive Dynamics

The Saudi Arabia Big Data and AI market is characterized by a dynamic interplay of established global players and emerging local companies. Market concentration is moderate, with several key players holding significant market share, but a considerable number of smaller firms contributing to innovation. The market structure is influenced by the Saudi Vision 2030 initiative, which actively promotes digital transformation and AI adoption across various sectors. This has led to a supportive regulatory framework, although data privacy and security remain key considerations. The market witnesses significant M&A activity, with deal values exceeding xx Million in the past five years, driven primarily by strategic acquisitions aimed at expanding capabilities and market reach. Product substitution is less of a concern, as the focus is on integration and enhancement of existing systems rather than complete replacement. End-user trends showcase a rising preference for cloud-based solutions and AI-powered analytics, driven by the need for scalability and cost-effectiveness.

- Market Leaders: IBM Corporation, Microsoft Corporation, Amazon Web Services Inc, Oracle Corporation hold a combined market share of approximately xx%.

- Emerging Players: Qli, Nala ai are gaining traction with innovative solutions tailored to the Saudi market.

- M&A Activity: The past five years have witnessed xx M&A deals, with an average deal value of xx Million, largely driven by the consolidation of smaller players by larger tech giants.

- Regulatory Landscape: The Saudi government's commitment to digital transformation is fostering a supportive environment, however, data protection regulations and cybersecurity standards are continuously evolving and present an ongoing challenge for market players.

Saudi Arabia Big Data And Artificial Intelligence Market Industry Trends & Insights

The Saudi Arabia Big Data and AI market is experiencing robust growth, driven by several key factors. The Saudi Vision 2030 initiative is a major catalyst, fostering digital transformation across various sectors. Government investments in digital infrastructure and initiatives to promote the development of a skilled workforce are also contributing to the market’s expansion. Technological disruptions, particularly in areas like cloud computing, edge computing, and advanced AI algorithms, are creating new opportunities for innovation and market penetration. Consumer preferences are shifting towards personalized services and data-driven insights, further fueling demand for Big Data and AI solutions. The market is witnessing a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing across different sectors. Competitive dynamics are marked by both cooperation and competition, as companies collaborate on technology development and integration while simultaneously vying for market share. The increasing adoption of AI in sectors like BFSI and healthcare is driving significant growth, while the government sector's focus on digital transformation fuels high demand for sophisticated analytics and cybersecurity solutions.

Dominant Markets & Segments in Saudi Arabia Big Data And Artificial Intelligence Market

By End-User: The Public and Government Institutions segment is currently the most dominant, followed by BFSI and the IT and Telecom sector. This is due to substantial government investment in smart city initiatives, national digital transformation programs, and the expansion of digital infrastructure. The healthcare sector is also showing significant growth potential due to the increasing adoption of AI for disease diagnosis, drug discovery, and personalized medicine.

- Key Drivers: Government initiatives like Vision 2030, significant investments in infrastructure (including 5G rollout), and a push for digital government services are key drivers of this dominance.

By Component: The software segment holds the largest market share, driven by the increasing demand for AI-powered applications and analytical tools. The services segment is also growing rapidly, due to the requirement for professional implementation, integration, and maintenance services. Hardware is important, but the software and services offerings are driving the overall market growth.

- Key Drivers: The rise of cloud-based AI solutions and the increasing reliance on external expertise for successful implementation and support.

By Organization Size: Large enterprises dominate the market due to their greater capacity for investment in advanced technologies and their established IT infrastructure. However, SMEs are rapidly adopting AI solutions to improve efficiency and competitiveness. Government support for SME digitalization is fostering adoption in this sector.

- Key Drivers: Large enterprises have the resources to invest in complex AI solutions and hire specialized personnel. For SMEs, the availability of cloud-based, cost-effective solutions is driving adoption.

Saudi Arabia Big Data And Artificial Intelligence Market Product Innovations

Recent innovations include the development of Arabic language-specific AI models, tailored to the needs of the Saudi market. There's a significant focus on developing AI solutions for specific industry challenges, such as optimizing oil and gas extraction, improving healthcare services, and enhancing the efficiency of government services. Cloud-based AI platforms are gaining popularity due to their scalability and cost-effectiveness. The integration of AI with IoT devices is also driving innovation, creating new opportunities for data collection and analysis in various sectors.

Report Segmentation & Scope

This report provides a detailed segmentation of the Saudi Arabia Big Data and AI market across several key categories:

By End-User: IT and Telecom, Retail, Public and Government Institutions, BFSI, Healthcare, Energy, Construction and Manufacturing, Other End Users (Tourism, Transportation, Education etc.). Each segment's growth trajectory is analyzed, considering unique sector-specific drivers and challenges. Market size projections are provided for each, reflecting anticipated growth rates over the forecast period.

By Component: Hardware, Software, Service. The report assesses the market size and growth potential for each component, analyzing its unique contribution to the overall market dynamics.

By Organization Size: SMEs and Large Enterprises. Growth projections and competitive landscapes are detailed for each, highlighting distinct market dynamics and challenges faced by each group.

Key Drivers of Saudi Arabia Big Data And Artificial Intelligence Market Growth

Government initiatives like Vision 2030 are central to market growth. Increased investments in digital infrastructure, coupled with a supportive regulatory environment, accelerate adoption. The rising demand for data-driven decision-making across various sectors creates a strong pull for Big Data and AI solutions. Technological advancements, such as the development of more sophisticated AI algorithms, are also pivotal.

Challenges in the Saudi Arabia Big Data And Artificial Intelligence Market Sector

Data privacy and security concerns present significant challenges, demanding robust regulatory frameworks and secure data management solutions. The need for a skilled workforce poses a major hurdle, requiring substantial investment in education and training. Cybersecurity threats require continual investment and improvement of protective measures, especially with increased digitalization across all sectors. The high cost of implementation and integration can also limit adoption, especially for SMEs.

Leading Players in the Saudi Arabia Big Data And Artificial Intelligence Market Market

Key Developments in Saudi Arabia Big Data And Artificial Intelligence Market Sector

- January 2023: Launch of a new AI-powered platform for government services by a leading technology firm.

- June 2022: Partnership between a leading Saudi bank and a global AI provider to enhance fraud detection capabilities.

- October 2021: Successful completion of a large-scale AI project in the healthcare sector by a local firm. (Further details would be included in the full report)

Strategic Saudi Arabia Big Data And Artificial Intelligence Market Market Outlook

The Saudi Arabia Big Data and AI market is poised for significant growth over the next decade, driven by sustained government support, ongoing technological advancements, and the increasing adoption of AI across various sectors. Strategic opportunities exist for companies focusing on developing specialized AI solutions for niche industries, those investing in talent development, and those emphasizing data privacy and security. The market's potential is immense, with substantial growth anticipated across all segments.

Saudi Arabia Big Data And Artificial Intelligence Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End User

- 3.1. IT and Telecom

- 3.2. Retail

- 3.3. Public and Government Institutions

- 3.4. BFSI

- 3.5. Healthcare

- 3.6. Energy

- 3.7. Construction and Manufacturing

- 3.8. Other En

Saudi Arabia Big Data And Artificial Intelligence Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Big Data And Artificial Intelligence Market Regional Market Share

Geographic Coverage of Saudi Arabia Big Data And Artificial Intelligence Market

Saudi Arabia Big Data And Artificial Intelligence Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Smart City Initiatives and Rapid Rise in the Flow of Unstructured Data Due to Mass Deployment of Sensors; Adoption of Digital Transformation Technologies in the Enterprises; Favorable Governmental Policies for Inclusions of AI

- 3.3. Market Restrains

- 3.3.1. Operational Challenges Due to Lack of Supporting Infrastructure and Skill set

- 3.4. Market Trends

- 3.4.1. Hardware Sector is Likely to Witness a Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Big Data And Artificial Intelligence Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT and Telecom

- 5.3.2. Retail

- 5.3.3. Public and Government Institutions

- 5.3.4. BFSI

- 5.3.5. Healthcare

- 5.3.6. Energy

- 5.3.7. Construction and Manufacturing

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Qli

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Teradata Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon Web Services Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IQVIA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nvidia Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nala ai

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Intel Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SAP SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Big Data And Artificial Intelligence Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 7: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Saudi Arabia Big Data And Artificial Intelligence Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Big Data And Artificial Intelligence Market?

The projected CAGR is approximately 34.24%.

2. Which companies are prominent players in the Saudi Arabia Big Data And Artificial Intelligence Market?

Key companies in the market include SAS Institute Inc, Qli, IBM Corporation, Teradata Corporation, Microsoft Corporation, Amazon Web Services Inc, IQVIA, NEC Corporation, Oracle Corporation, Nvidia Corporation, Nala ai, Intel Corporation, SAP SE.

3. What are the main segments of the Saudi Arabia Big Data And Artificial Intelligence Market?

The market segments include Component, Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Smart City Initiatives and Rapid Rise in the Flow of Unstructured Data Due to Mass Deployment of Sensors; Adoption of Digital Transformation Technologies in the Enterprises; Favorable Governmental Policies for Inclusions of AI.

6. What are the notable trends driving market growth?

Hardware Sector is Likely to Witness a Major Growth.

7. Are there any restraints impacting market growth?

Operational Challenges Due to Lack of Supporting Infrastructure and Skill set.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Big Data And Artificial Intelligence Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Big Data And Artificial Intelligence Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Big Data And Artificial Intelligence Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Big Data And Artificial Intelligence Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence