Key Insights

The global Sales Enablement market is experiencing robust expansion, projected to reach a market size of $3.50 billion in 2025. This significant growth is fueled by a Compound Annual Growth Rate (CAGR) of 20.23% during the forecast period of 2025-2033. The escalating need for enhanced sales productivity, improved customer engagement, and streamlined sales processes across diverse industries are primary drivers. Organizations are increasingly recognizing the strategic importance of equipping their sales teams with the right content, tools, and training to close deals more effectively and efficiently. The integration of AI and analytics into sales enablement platforms is further accelerating adoption, offering personalized insights and actionable recommendations to sales representatives.

Sales Enablement Industry Market Size (In Billion)

The market is segmented across various components, including platforms and services, catering to the needs of both large enterprises and small to medium-sized businesses. Deployment modes range from cloud-based solutions, offering scalability and flexibility, to on-premises options for organizations with specific data security requirements. Key end-user industries driving this growth include BFSI, IT and Telecom, Healthcare and Life Sciences, and Manufacturing, all of which are heavily reliant on sophisticated sales strategies. Emerging trends such as hyper-personalization of sales interactions and the rise of remote selling further underscore the indispensable role of sales enablement solutions in today's competitive landscape. Despite the strong growth trajectory, challenges such as the initial cost of implementation and the need for effective change management within sales teams may present some restraints.

Sales Enablement Industry Company Market Share

This in-depth report provides a detailed analysis of the global Sales Enablement Industry, offering critical insights into market dynamics, growth drivers, competitive strategies, and future outlook. Covering the study period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report delves into historical trends (2019–2024) and provides a robust forecast period of 2025–2033. Discover the transformative impact of sales enablement platforms, sales enablement services, and sales enablement software on Large Enterprises and Small and Medium-Sized Enterprises across diverse sectors, including BFSI, Consumer Goods and Retail, IT and Telecom, Media and Entertainment, Healthcare and Life Sciences, and Manufacturing.

Sales Enablement Industry Market Structure & Competitive Dynamics

The Sales Enablement Industry is characterized by a dynamic and evolving market structure. While some sales enablement vendors like Seismic Software Inc. and Highspot Inc. have established significant market share, the landscape is continuously shaped by innovation and strategic partnerships. The market exhibits moderate concentration, with a healthy ecosystem of both established players and emerging startups vying for dominance. Regulatory frameworks, while not overly restrictive, emphasize data security and compliance, influencing the development of cloud-based sales enablement solutions. Product substitutes, such as traditional CRM functionalities and standalone content management systems, exist but are increasingly being outmaneuvered by integrated sales enablement platforms offering a comprehensive suite of tools. End-user trends are strongly leaning towards digital transformation and data-driven sales strategies, fueling the demand for advanced sales enablement technology. Merger and acquisition (M&A) activities are notable, with M&A deal values in the tens of millions of dollars, signaling consolidation and the pursuit of market leadership. For instance, the anticipated acquisition of Kompyte by Semrush, a notable sales enablement platform, underscores this trend, with Kompyte's user base heavily concentrated within sales organizations. The market share distribution will be extensively detailed, showcasing the strategic positioning of key companies.

Sales Enablement Industry Industry Trends & Insights

The Sales Enablement Industry is experiencing robust growth, driven by an undeniable surge in demand for enhanced sales productivity and customer engagement. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period, with market penetration reaching an estimated 75% of target organizations by 2033. Key market growth drivers include the increasing complexity of sales cycles, the proliferation of digital selling channels, and the pressing need for sales teams to deliver personalized and data-informed customer experiences. Technological disruptions, such as advancements in Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and content personalization, are revolutionizing sales enablement solutions. Furthermore, evolving consumer preferences for seamless and informed purchasing journeys are compelling businesses to invest in tools that empower their sales forces with the right information at the right time. Competitive dynamics are intensifying, with companies like Showpad, Qorus Software Ltd, ClearSlide, and Mediafly continuously innovating their offerings. The adoption of cloud-based sales enablement platforms is accelerating due to their scalability, accessibility, and cost-effectiveness, impacting deployment modes. The report will provide a granular analysis of these trends, supported by data-driven insights into market expansion and the evolving needs of sales organizations.

Dominant Markets & Segments in Sales Enablement Industry

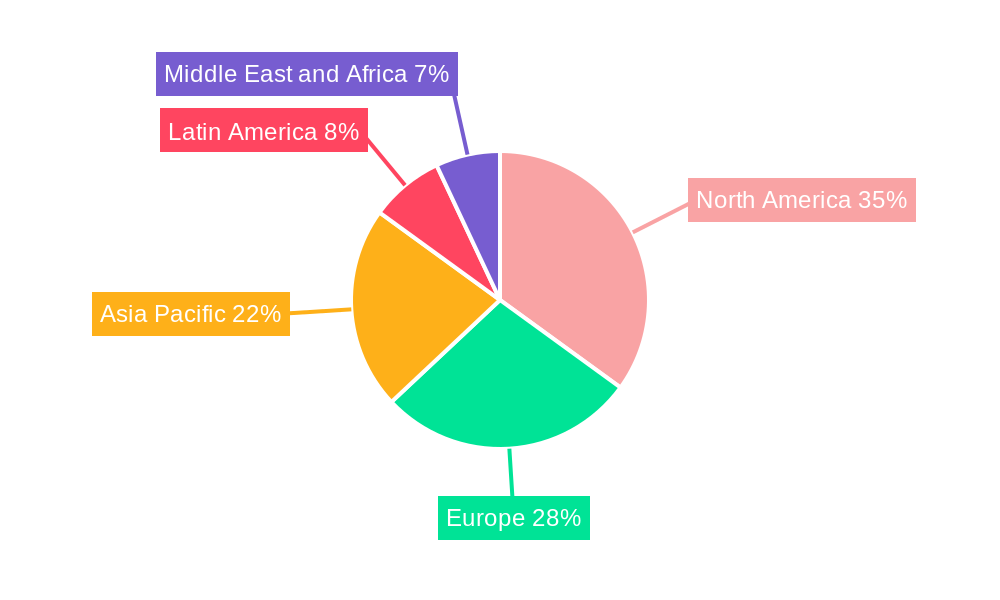

The Sales Enablement Industry demonstrates distinct regional and segmental dominance. North America currently leads the market, driven by early adoption of technology and a strong presence of Large Enterprises in sectors like IT and Telecom and BFSI. However, the Asia Pacific region is emerging as a significant growth market, fueled by increasing digitalization and the expansion of Small and Medium-Sized Enterprises.

Component Dominance:

- Platform: The sales enablement platform segment is expected to maintain its dominant position, accounting for an estimated 70% of the total market value. This dominance is driven by the comprehensive functionalities offered, including content management, training and coaching, analytics, and communication tools. Key drivers include the demand for integrated solutions that streamline sales workflows and provide a single source of truth for sales content.

- Services: While smaller in market share, sales enablement services, encompassing consulting, implementation, and training, are crucial for effective adoption and are projected to grow at a faster CAGR, reflecting the increasing complexity of tailoring solutions to specific business needs.

Organization Size Dominance:

- Large Enterprises: This segment currently represents the largest share of the market, estimated at 65%, due to their substantial sales teams and greater investment capacity in sophisticated sales technology. Their need for robust scalability, advanced analytics, and integration with existing enterprise systems fuels their demand.

- Small and Medium-Sized Enterprises (SMEs): SMEs represent a rapidly growing segment, with an estimated market share of 35%, driven by the increasing availability of cost-effective and user-friendly sales enablement solutions that help them compete with larger organizations.

Deployment Mode Dominance:

- Cloud-based: This mode is overwhelmingly dominant, capturing an estimated 85% of the market, owing to its flexibility, scalability, and lower upfront costs. The ease of access and regular updates offered by cloud solutions make them ideal for modern sales environments.

- On-premises: While declining in market share, on-premises solutions remain relevant for organizations with stringent data security requirements or specific regulatory compliance needs.

End-user Industry Dominance:

- BFSI: This sector, accounting for an estimated 20% of the market, is a major adopter due to the highly regulated nature of their operations and the need for consistent, compliant customer communication.

- IT and Telecom: With an estimated 25% market share, this industry leverages sales enablement tools to manage complex product portfolios and rapid technological advancements, requiring efficient sales collateral and training.

- Consumer Goods and Retail: This sector, with an estimated 15% market share, benefits from sales enablement for managing large product catalogs, seasonal campaigns, and retail partner enablement.

- Healthcare and Life Sciences: Exhibiting significant growth, this industry (estimated 18% market share) relies on sales enablement for compliance, complex product information dissemination, and effective medical representative training.

- Manufacturing: With an estimated 12% market share, manufacturing utilizes sales enablement for managing distribution channels, product configurators, and technical sales support.

Sales Enablement Industry Product Innovations

The Sales Enablement Industry is a hotbed of continuous product innovation. Companies are increasingly integrating AI and machine learning to offer predictive insights, personalized content recommendations, and automated coaching. Advancements in interactive content creation, virtual reality (VR) sales experiences, and sophisticated analytics dashboards are enhancing user engagement and effectiveness. The competitive advantage lies in providing seamless integration with CRM systems, intuitive user interfaces, and robust content management capabilities that empower sales teams with the most relevant information and training. The focus is on creating a unified and intelligent sales environment, exemplified by partnerships like Ceros with Highspot and Showpad, aiming to build an integrated suite for designers and marketers.

Report Segmentation & Scope

This report meticulously segments the Sales Enablement Industry across several key dimensions.

- Component: The market is analyzed based on Platform and Services. The Platform segment, projected to reach a market size of $X Billion by 2033 with a CAGR of XX%, encompasses the core technology offerings. The Services segment, expected to grow at a CAGR of XX%, includes consulting, implementation, and training.

- Organization Size: We dissect the market into Large Enterprises and Small and Medium-Sized Enterprises (SMEs). Large Enterprises, currently holding the dominant share, are projected to continue their expansion, while SMEs represent a high-growth segment with an anticipated market size of $Y Billion by 2033.

- Deployment Mode: The analysis covers Cloud-based and On-premises deployment models. The Cloud-based segment is the clear leader, with an estimated 90% market dominance and continuous growth.

- End-user Industry: The report provides detailed insights into the BFSI, Consumer Goods and Retail, IT and Telecom, Media and Entertainment, Healthcare and Life Sciences, Manufacturing, and Other End-user Industries. Each segment's specific adoption rates, growth drivers, and market potential are thoroughly examined.

Key Drivers of Sales Enablement Industry Growth

The Sales Enablement Industry is propelled by a confluence of powerful drivers:

- Technological Advancements: The rapid evolution of AI, ML, and data analytics enables more personalized content delivery, predictive insights, and automated coaching, significantly boosting sales team performance.

- Demand for Enhanced Sales Productivity: Businesses across all sectors are acutely focused on maximizing sales team efficiency and effectiveness in an increasingly competitive global market.

- Digital Transformation Initiatives: The broader push for digital transformation within organizations necessitates modern, integrated tools to support remote and hybrid sales teams and evolving customer engagement strategies.

- Data-Driven Decision Making: The increasing emphasis on leveraging data to understand customer behavior, optimize sales processes, and measure ROI makes robust analytics a critical component of sales enablement.

- Globalization and Market Complexity: As sales territories expand and product offerings become more intricate, sales enablement tools provide a standardized and accessible way to equip sales professionals with the necessary knowledge and resources.

Challenges in the Sales Enablement Industry Sector

Despite its robust growth, the Sales Enablement Industry faces several challenges:

- Integration Complexities: Seamlessly integrating new sales enablement platforms with existing CRM systems and other legacy software can be a significant technical hurdle and a source of friction for adoption.

- Change Management and User Adoption: Overcoming resistance to change within sales teams and ensuring consistent adoption of new tools and processes requires effective training, ongoing support, and strong leadership buy-in.

- Data Security and Privacy Concerns: As more sensitive customer data is handled by sales enablement solutions, ensuring robust data security and compliance with evolving privacy regulations (e.g., GDPR, CCPA) remains paramount.

- Measuring ROI: Quantifying the precise return on investment for sales enablement initiatives can be challenging, often requiring sophisticated analytics and a clear understanding of key performance indicators.

- Content Overload and Relevance: Ensuring that sales teams can easily find and access the most relevant and up-to-date content amidst a vast library of materials is an ongoing struggle.

Leading Players in the Sales Enablement Industry Market

- Showpad

- Qorus Software Ltd

- ClearSlide

- Mediafly

- MindTickle

- Rallyware Inc

- Accent Technologies

- Seismic Software Inc

- Highspot Inc

- Quark

- DocSend Inc

- Upland Software

- GetAccept Inc

- Pitcher

- Brainshark

- Bigtincan Holdings

- Qstream Inc

- Outreach

Key Developments in Sales Enablement Industry Sector

- March 2022: Ceros, a cloud-based, no-code design platform for interactive content, announced its partnership with Highspot and Showpad, sales enablement vendors. These partnerships aim to create an innovative integrated suite for designers and marketers, from enterprise clients to citizen creators, enhancing content creation and distribution capabilities within sales enablement.

- February 2022: Semrush, an online visibility management SaaS platform, announced its plan to acquire Kompyte, a competitive intelligence automation and sales enablement platform. This acquisition will bolster Semrush's capabilities in competitive intelligence and sales enablement, particularly as 88% of Kompyte's user base is within sales organizations.

Strategic Sales Enablement Industry Market Outlook

The strategic outlook for the Sales Enablement Industry remains exceptionally positive, fueled by continued digital transformation and the relentless pursuit of sales excellence. Future market potential lies in the deeper integration of AI for hyper-personalized selling, the development of immersive sales experiences leveraging AR/VR, and the expansion of sales enablement into new verticals and emerging markets. Strategic opportunities include catering to the growing needs of SMEs with more accessible and scalable solutions, as well as addressing the specific compliance and security demands of highly regulated industries. Companies that focus on providing end-to-end solutions, from content creation and delivery to training, coaching, and analytics, will be best positioned for sustained growth and market leadership in the evolving sales enablement landscape.

Sales Enablement Industry Segmentation

-

1. Component

- 1.1. Platform

- 1.2. Services

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small and Medium-Sized Enterprises

-

3. Deployment Mode

- 3.1. Cloud-based

- 3.2. On-premises

-

4. End-user Industry

- 4.1. BFSI

- 4.2. Consumer Goods and Retail

- 4.3. IT and Telecom

- 4.4. Media and Entertainment

- 4.5. Healthcare and Life Sciences

- 4.6. Manufacturing

- 4.7. Other End-user Industries

Sales Enablement Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Sales Enablement Industry Regional Market Share

Geographic Coverage of Sales Enablement Industry

Sales Enablement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Improve the Internal Business Process; Scaling Sales Efforts With the Help of Advanced Technology

- 3.3. Market Restrains

- 3.3.1. Inconsistent User Experience Across Various Access Channels

- 3.4. Market Trends

- 3.4.1. Consumer Goods and Retail Industry to Exhibit Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sales Enablement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.3.1. Cloud-based

- 5.3.2. On-premises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. BFSI

- 5.4.2. Consumer Goods and Retail

- 5.4.3. IT and Telecom

- 5.4.4. Media and Entertainment

- 5.4.5. Healthcare and Life Sciences

- 5.4.6. Manufacturing

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Sales Enablement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Platform

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small and Medium-Sized Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.3.1. Cloud-based

- 6.3.2. On-premises

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. BFSI

- 6.4.2. Consumer Goods and Retail

- 6.4.3. IT and Telecom

- 6.4.4. Media and Entertainment

- 6.4.5. Healthcare and Life Sciences

- 6.4.6. Manufacturing

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Sales Enablement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Platform

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small and Medium-Sized Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.3.1. Cloud-based

- 7.3.2. On-premises

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. BFSI

- 7.4.2. Consumer Goods and Retail

- 7.4.3. IT and Telecom

- 7.4.4. Media and Entertainment

- 7.4.5. Healthcare and Life Sciences

- 7.4.6. Manufacturing

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Sales Enablement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Platform

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small and Medium-Sized Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.3.1. Cloud-based

- 8.3.2. On-premises

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. BFSI

- 8.4.2. Consumer Goods and Retail

- 8.4.3. IT and Telecom

- 8.4.4. Media and Entertainment

- 8.4.5. Healthcare and Life Sciences

- 8.4.6. Manufacturing

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Sales Enablement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Platform

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small and Medium-Sized Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.3.1. Cloud-based

- 9.3.2. On-premises

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. BFSI

- 9.4.2. Consumer Goods and Retail

- 9.4.3. IT and Telecom

- 9.4.4. Media and Entertainment

- 9.4.5. Healthcare and Life Sciences

- 9.4.6. Manufacturing

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Sales Enablement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Platform

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small and Medium-Sized Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.3.1. Cloud-based

- 10.3.2. On-premises

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. BFSI

- 10.4.2. Consumer Goods and Retail

- 10.4.3. IT and Telecom

- 10.4.4. Media and Entertainment

- 10.4.5. Healthcare and Life Sciences

- 10.4.6. Manufacturing

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Showpad

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Qorus Software Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ClearSlide

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mediafly

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MindTickle

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rallyware Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Accent Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seismic Software Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Highspot Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Quark

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DocSend Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Upland Software

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GetAccept Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pitcher

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Brainshark

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bigtincan Holdings

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Qstream Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Outreach

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Showpad

List of Figures

- Figure 1: Global Sales Enablement Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Sales Enablement Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Sales Enablement Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Sales Enablement Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America Sales Enablement Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Sales Enablement Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 7: North America Sales Enablement Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 8: North America Sales Enablement Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America Sales Enablement Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Sales Enablement Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Sales Enablement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Sales Enablement Industry Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Sales Enablement Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Sales Enablement Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 15: Europe Sales Enablement Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 16: Europe Sales Enablement Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 17: Europe Sales Enablement Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 18: Europe Sales Enablement Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Sales Enablement Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Sales Enablement Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Sales Enablement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Sales Enablement Industry Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Pacific Sales Enablement Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Sales Enablement Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 25: Asia Pacific Sales Enablement Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 26: Asia Pacific Sales Enablement Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 27: Asia Pacific Sales Enablement Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 28: Asia Pacific Sales Enablement Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Sales Enablement Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Sales Enablement Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Sales Enablement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Sales Enablement Industry Revenue (Million), by Component 2025 & 2033

- Figure 33: Latin America Sales Enablement Industry Revenue Share (%), by Component 2025 & 2033

- Figure 34: Latin America Sales Enablement Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 35: Latin America Sales Enablement Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 36: Latin America Sales Enablement Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 37: Latin America Sales Enablement Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 38: Latin America Sales Enablement Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Sales Enablement Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Sales Enablement Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Sales Enablement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Sales Enablement Industry Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East and Africa Sales Enablement Industry Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East and Africa Sales Enablement Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 45: Middle East and Africa Sales Enablement Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 46: Middle East and Africa Sales Enablement Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 47: Middle East and Africa Sales Enablement Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 48: Middle East and Africa Sales Enablement Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 49: Middle East and Africa Sales Enablement Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East and Africa Sales Enablement Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Sales Enablement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sales Enablement Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Sales Enablement Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Sales Enablement Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 4: Global Sales Enablement Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Sales Enablement Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Sales Enablement Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Sales Enablement Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 8: Global Sales Enablement Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 9: Global Sales Enablement Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Sales Enablement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Sales Enablement Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Sales Enablement Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 13: Global Sales Enablement Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 14: Global Sales Enablement Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Sales Enablement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Sales Enablement Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Sales Enablement Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 18: Global Sales Enablement Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 19: Global Sales Enablement Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Sales Enablement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Sales Enablement Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Sales Enablement Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 23: Global Sales Enablement Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 24: Global Sales Enablement Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Sales Enablement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Sales Enablement Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Sales Enablement Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 28: Global Sales Enablement Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 29: Global Sales Enablement Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Sales Enablement Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sales Enablement Industry?

The projected CAGR is approximately 20.23%.

2. Which companies are prominent players in the Sales Enablement Industry?

Key companies in the market include Showpad, Qorus Software Ltd, ClearSlide, Mediafly, MindTickle, Rallyware Inc, Accent Technologies, Seismic Software Inc, Highspot Inc, Quark, DocSend Inc, Upland Software, GetAccept Inc, Pitcher, Brainshark, Bigtincan Holdings, Qstream Inc, Outreach.

3. What are the main segments of the Sales Enablement Industry?

The market segments include Component, Organization Size, Deployment Mode, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Improve the Internal Business Process; Scaling Sales Efforts With the Help of Advanced Technology.

6. What are the notable trends driving market growth?

Consumer Goods and Retail Industry to Exhibit Significant Growth.

7. Are there any restraints impacting market growth?

Inconsistent User Experience Across Various Access Channels.

8. Can you provide examples of recent developments in the market?

March 2022 - Ceros, the cloud-based, no-code design platform for interactive content, today announced its partnership with Highspot and Showpad, sales enablement vendors. These partnerships will provide the company achieve its mission to create an innovative integrated suite for all designers and marketers, from enterprise clients to citizen creators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sales Enablement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sales Enablement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sales Enablement Industry?

To stay informed about further developments, trends, and reports in the Sales Enablement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence