Key Insights

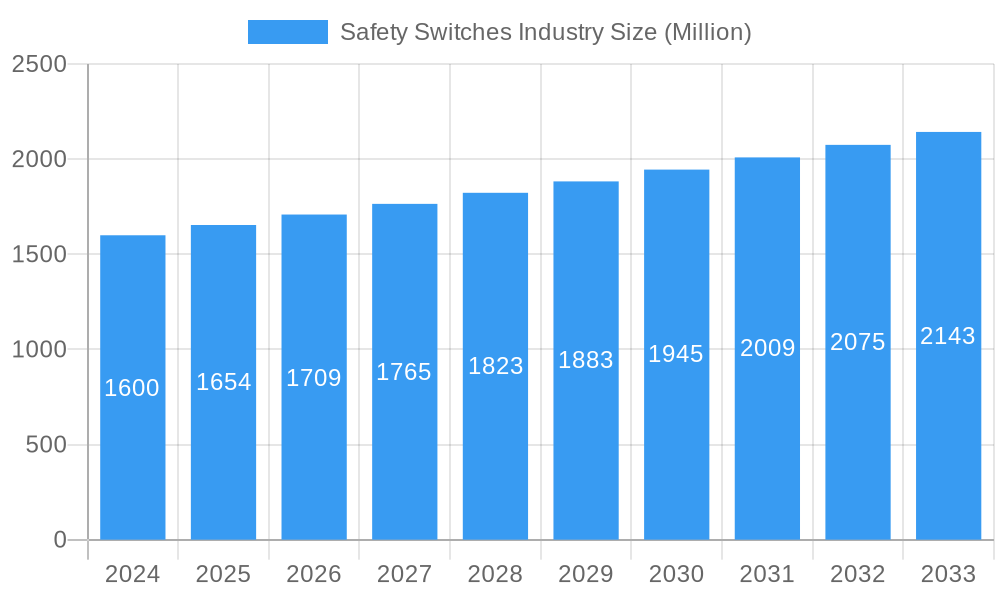

The global Safety Switches market is poised for substantial growth, currently valued at approximately $1.6 billion in 2024. This expansion is driven by an increasing emphasis on industrial safety regulations, the proliferation of automation in manufacturing and logistics, and the critical need to prevent workplace accidents. As industries increasingly adopt sophisticated machinery and complex operational processes, the demand for reliable safety switches that prevent machinery operation until hazardous conditions are cleared, or ensure immediate shutdown in emergencies, is intensifying. The CAGR of 3.4% projected from 2025 through 2033 signifies a consistent and steady upward trajectory for this market. Key growth drivers include the adoption of advanced safety technologies like IoT-enabled switches for remote monitoring and diagnostics, the integration of safety systems in collaborative robotics (cobots), and the ongoing modernization of industrial infrastructure across various sectors.

Safety Switches Industry Market Size (In Billion)

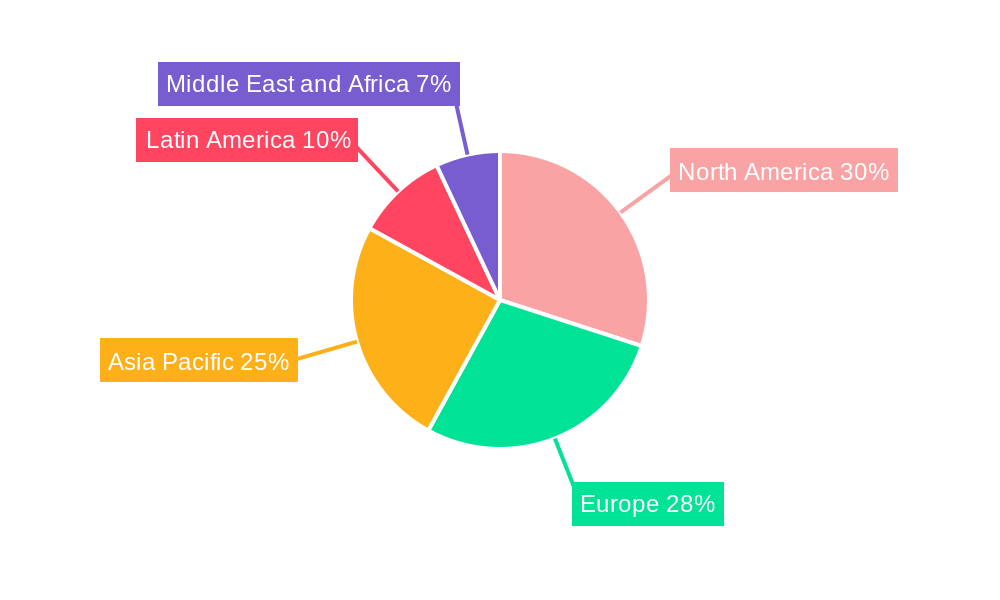

The market is segmented into Electromechanical and Non-contact types, with Non-contact switches gaining prominence due to their durability, reduced wear and tear, and enhanced safety features, particularly in environments with high hygiene or contamination risks. End-users such as the Industrial, Commercial, and Healthcare sectors are the primary adopters, reflecting the broad applicability of safety switches in safeguarding personnel and equipment. Emerging applications in sectors like Oil and Gas, driven by stringent safety protocols, also contribute to market expansion. Geographically, North America and Europe currently lead the market due to established regulatory frameworks and advanced industrial ecosystems. However, the Asia Pacific region is expected to witness the fastest growth, fueled by rapid industrialization, increasing foreign investment in manufacturing, and a growing awareness of workplace safety. The competitive landscape features established players like Siemens AG, Honeywell International Inc., and Schneider Electric, alongside specialized firms such as SICK AG and Pilz GmbH & Co KG, all contributing to innovation and market dynamism.

Safety Switches Industry Company Market Share

Comprehensive Safety Switches Industry Market Report: Navigating a Billion-Dollar Landscape (2019–2033)

This in-depth market research report provides a definitive analysis of the global Safety Switches industry, covering a crucial Study Period from 2019–2033. With a Base Year of 2025, the report offers a detailed Estimated Year analysis for 2025 and a robust Forecast Period extending from 2025–2033, building upon Historical Period data from 2019–2024. The global safety switches market, projected to reach billions in value, is experiencing dynamic shifts driven by industrial automation, stringent safety regulations, and burgeoning demand across diverse end-user sectors. This report delves into the intricate market structure, evolving trends, dominant segments, product innovations, and strategic outlook, offering actionable insights for stakeholders aiming to capitalize on this billion-dollar opportunity.

Safety Switches Industry Market Structure & Competitive Dynamics

The global Safety Switches market is characterized by a moderately concentrated structure, with key players like Siemens AG, Honeywell International Inc., and Schneider Electric holding significant market share. Innovation ecosystems are robust, fueled by continuous research and development in areas like non-contact safety switches and smart sensor technology. Regulatory frameworks, such as ISO standards and regional safety directives, play a pivotal role in shaping market entry and product development, ensuring a baseline level of safety and reliability. Product substitutes, while present, are often outweighed by the specialized performance and certification requirements of safety switches, particularly in critical industrial applications. End-user trends are increasingly leaning towards integrated safety solutions, predictive maintenance capabilities, and compact, versatile switch designs. Merger and acquisition (M&A) activities are strategic, aimed at expanding product portfolios, geographical reach, and technological prowess. For instance, acquisitions in recent years have focused on companies with expertise in advanced sensing technologies and connectivity solutions, bolstering the competitive landscape and innovation capabilities of larger entities. The cumulative M&A deal value in the sector is estimated to be in the billions, indicating a strong consolidation drive.

Safety Switches Industry Industry Trends & Insights

The Safety Switches industry is poised for substantial growth, driven by an increasing emphasis on workplace safety regulations and the pervasive adoption of industrial automation across various sectors. The projected Compound Annual Growth Rate (CAGR) for the safety switches market is approximately 7.5% over the forecast period, translating into billions of dollars in market expansion. Key growth drivers include the escalating demand for sophisticated safety solutions in manufacturing plants, the growing implementation of Industry 4.0 technologies, and the rising number of stringent governmental regulations mandating the use of safety devices to prevent accidents and ensure worker well-being. Technological disruptions are at the forefront, with advancements in non-contact safety switches, magnetic sensors, and RFID technology offering enhanced performance, reduced wear and tear, and greater flexibility in machine safeguarding. The market penetration of smart safety switches, capable of transmitting diagnostic data and integrating with IoT platforms, is rapidly increasing, allowing for predictive maintenance and improved operational efficiency. Consumer preferences are shifting towards solutions that offer ease of integration, minimal downtime, and compliance with evolving international safety standards. Competitive dynamics are intense, with companies investing heavily in R&D to develop innovative products that address specific industry needs and differentiate themselves in the market. The increasing awareness of the long-term cost savings associated with preventing accidents, including reduced downtime and insurance premiums, further fuels the demand for high-quality safety switches, solidifying the market's upward trajectory into the billions.

Dominant Markets & Segments in Safety Switches Industry

The Industrial segment, particularly within manufacturing and heavy industries, represents the dominant end-user market for safety switches, driven by the need to safeguard complex machinery and production lines. This segment is expected to continue its dominance, accounting for over 50% of the global safety switches market value, which is projected to reach billions by 2033. Key drivers include the rapid pace of industrial automation, the implementation of Industry 4.0 initiatives, and the continuous upgrading of existing manufacturing facilities with advanced safety features. Countries with strong manufacturing bases, such as the United States, Germany, China, and Japan, are leading markets due to stringent workplace safety regulations and a high concentration of industrial activity.

Dominant End-User Segment: Industrial

- Key Drivers: Escalating automation in manufacturing, strict safety protocols in heavy industries (automotive, metal fabrication), and the need to comply with international safety standards like IEC 60204-1. The integration of advanced robotics and collaborative robots further necessitates sophisticated safety switch solutions to ensure human-robot interaction safety.

- Market Size: Expected to reach tens of billions by 2033.

- Growth Projections: A steady CAGR of approximately 8% is anticipated for this segment.

Dominant Type Segment: Non-contact Safety Switches

- Key Drivers: Superior durability, resistance to harsh environments, and the elimination of mechanical wear, making them ideal for applications requiring frequent actuation or in environments with contaminants. Their ability to provide diagnostic feedback and integration capabilities with safety PLCs adds significant value.

- Market Size: This segment is a significant contributor to the billions in market revenue.

- Growth Projections: Anticipated to grow at a CAGR of over 9%, outpacing traditional mechanical switches.

Leading Regions: North America and Europe are currently the largest geographical markets, driven by mature industrial bases and rigorous safety legislation. However, the Asia-Pacific region, fueled by rapid industrialization and increasing investments in manufacturing infrastructure, is exhibiting the highest growth potential, projected to become a multi-billion dollar market in the coming years. The Oil and Gas sector also represents a significant, albeit specialized, market with stringent safety requirements due to hazardous operating conditions, contributing billions to the overall market value.

Safety Switches Industry Product Innovations

Recent product innovations in the Safety Switches industry are centered around enhanced intelligence, connectivity, and versatility. Developments in non-contact magnetic safety switches, such as those offering RFID technology, provide tamper-proof operation and sophisticated diagnostics. The introduction of modular safety switch systems allows for greater flexibility in machine design and quicker installation. These innovations offer significant competitive advantages by enabling predictive maintenance, reducing downtime, and simplifying the integration of safety functions into complex automated systems, thereby driving market adoption and contributing to the billions in annual revenue.

Report Segmentation & Scope

This report meticulously segments the Safety Switches market across key categories to provide granular insights.

- Type: The market is analyzed by Type, including Electromagnetic Safety Switches, Non-contact Safety Switches, and Other Types (e.g., mechanical, optoelectronic). Non-contact switches are projected to dominate, with billions in market share, due to their advanced features and durability.

- End-users: The report segments the market by Industrial, Commercial, Healthcare, Oil and Gas, and Other End-users. The Industrial segment is expected to lead, followed by Oil and Gas, with all segments collectively contributing billions to the market's overall value. Growth in the Healthcare sector for machine safety in medical devices is also noteworthy.

Key Drivers of Safety Switches Industry Growth

The Safety Switches industry's growth is propelled by a confluence of technological, economic, and regulatory factors. The increasing adoption of automation and Industry 4.0 principles necessitates robust safety solutions to protect human operators and valuable machinery, driving demand into the billions. Stringent workplace safety regulations globally mandate the implementation of these devices, creating a consistent demand. Economic growth in emerging markets fuels industrial expansion, further boosting the need for safety equipment. Technological advancements, particularly in non-contact and smart safety switches, offer enhanced reliability and integration capabilities, encouraging upgrades and new installations, all contributing to the multi-billion dollar market.

Challenges in the Safety Switches Industry Sector

Despite the robust growth, the Safety Switches industry faces several challenges that could temper its expansion into the billions. The high initial cost of advanced safety switch systems can be a barrier for small and medium-sized enterprises. Evolving and sometimes fragmented global regulatory landscapes require continuous adaptation and compliance efforts. Supply chain disruptions, as experienced in recent years, can impact material availability and lead times, affecting production and project timelines. Furthermore, a shortage of skilled personnel capable of designing, installing, and maintaining complex safety systems presents a significant constraint on market growth.

Leading Players in the Safety Switches Industry Market

- Honeywell International Inc.

- Murrelektronik GmbH

- Omron Electronics LLC

- SICK AG

- Parmley Graham Ltd

- Siemens AG

- Pilz GmbH & Co KG

- Banner Engineering Corp

- Schneider Electric

- Euchner GmbH

- Rockwell Automation Inc.

- Eaton Corporation

Key Developments in Safety Switches Industry Sector

- August 2022: Siemens and MAHLE intend to collaborate in the field of inductive charging of electric vehicles. Both companies have signed a letter of intent to this effect. The two companies intend to work together to close gaps in the standardization of inductive charging systems. This collaboration, while not directly safety switch product-focused, highlights Siemens' commitment to innovation in related industrial electrical systems and potential future integration opportunities for safety components.

- June 2022: Euchner launched the new flex function CTS safety switch device. The CTS switch's key innovation is the new FlexFunction feature, which allows a single device to perform a wide variety of functions that would otherwise require several switch variants. FlexFunction paves the way for new approaches to planning and operation. This development underscores the industry trend towards versatile and adaptable safety solutions, directly impacting the billions in market revenue by offering enhanced value.

Strategic Safety Switches Industry Market Outlook

The strategic outlook for the Safety Switches market remains highly optimistic, projecting continued expansion into multi-billion dollar figures. Growth accelerators include the increasing integration of AI and machine learning into safety systems for predictive hazard identification and the development of increasingly compact and wireless safety switch solutions. The growing demand for smart factory solutions and the push towards enhanced cybersecurity in industrial control systems will also drive innovation and adoption. Companies that focus on providing holistic safety solutions, including software integration and ongoing support, will be best positioned to capture significant market share and capitalize on the evolving needs of a safety-conscious global industrial landscape.

Safety Switches Industry Segmentation

-

1. Type

- 1.1. Electromagnetic

- 1.2. Non-contact

- 1.3. Other Types

-

2. End-users

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Healthcare

- 2.4. Oil and Gas

- 2.5. Other End-users

Safety Switches Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Safety Switches Industry Regional Market Share

Geographic Coverage of Safety Switches Industry

Safety Switches Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Workplace Safety; Stringent Regulations on Machine and Personnel Safety

- 3.3. Market Restrains

- 3.3.1. Adaptability Requirements and Power Outages

- 3.4. Market Trends

- 3.4.1. Safety Switches for Industrial Application to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electromagnetic

- 5.1.2. Non-contact

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-users

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Healthcare

- 5.2.4. Oil and Gas

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electromagnetic

- 6.1.2. Non-contact

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-users

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.2.3. Healthcare

- 6.2.4. Oil and Gas

- 6.2.5. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electromagnetic

- 7.1.2. Non-contact

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-users

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.2.3. Healthcare

- 7.2.4. Oil and Gas

- 7.2.5. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electromagnetic

- 8.1.2. Non-contact

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-users

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.2.3. Healthcare

- 8.2.4. Oil and Gas

- 8.2.5. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electromagnetic

- 9.1.2. Non-contact

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-users

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.2.3. Healthcare

- 9.2.4. Oil and Gas

- 9.2.5. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Electromagnetic

- 10.1.2. Non-contact

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-users

- 10.2.1. Industrial

- 10.2.2. Commercial

- 10.2.3. Healthcare

- 10.2.4. Oil and Gas

- 10.2.5. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Murrelektronik GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Omron Electronics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SICK AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Parmley Graham Ltd*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pilz GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Banner Engineering Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Euchner GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockwell Automation Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eaton Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Safety Switches Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 5: North America Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 6: North America Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 11: Europe Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 12: Europe Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 17: Asia Pacific Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 18: Asia Pacific Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 23: Latin America Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 24: Latin America Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 29: Middle East and Africa Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 30: Middle East and Africa Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 3: Global Safety Switches Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 6: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 11: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 18: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 24: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 25: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 28: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Safety Switches Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Safety Switches Industry?

Key companies in the market include Honeywell International Inc, Murrelektronik GmbH, Omron Electronics LLC, SICK AG, Parmley Graham Ltd*List Not Exhaustive, Siemens AG, Pilz GmbH & Co KG, Banner Engineering Corp, Schneider Electric, Euchner GmbH, Rockwell Automation Inc, Eaton Corporation.

3. What are the main segments of the Safety Switches Industry?

The market segments include Type, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Workplace Safety; Stringent Regulations on Machine and Personnel Safety.

6. What are the notable trends driving market growth?

Safety Switches for Industrial Application to Show Significant Growth.

7. Are there any restraints impacting market growth?

Adaptability Requirements and Power Outages.

8. Can you provide examples of recent developments in the market?

August 2022 - Siemens and MAHLE intend to collaborate in the field of inductive charging of electric vehicles. Both companies have signed a letter of intent to this effect. The two companies intend to work together to close gaps in the standardization of inductive charging systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Safety Switches Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Safety Switches Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Safety Switches Industry?

To stay informed about further developments, trends, and reports in the Safety Switches Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence