Key Insights

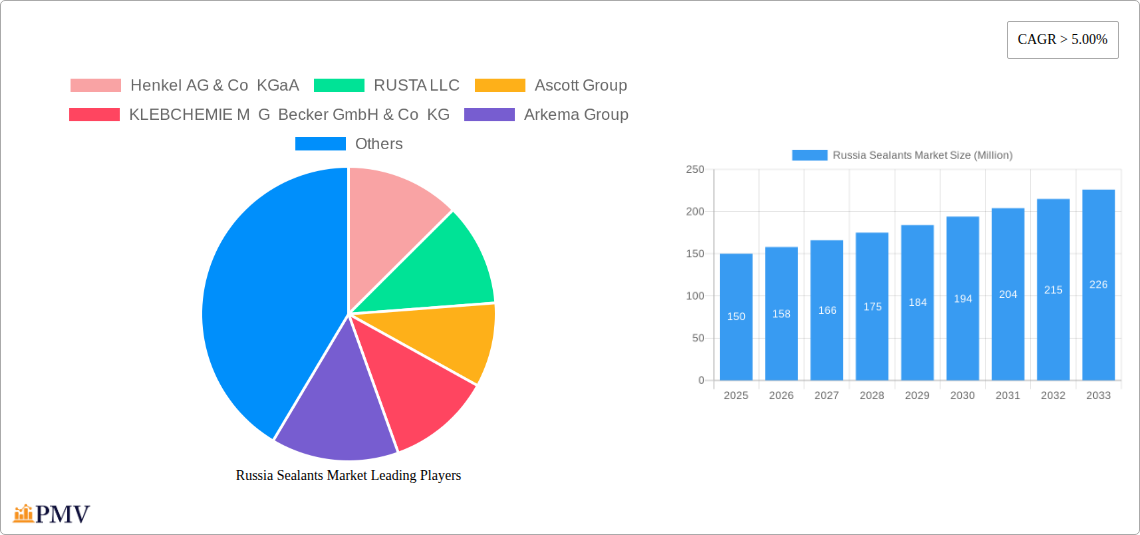

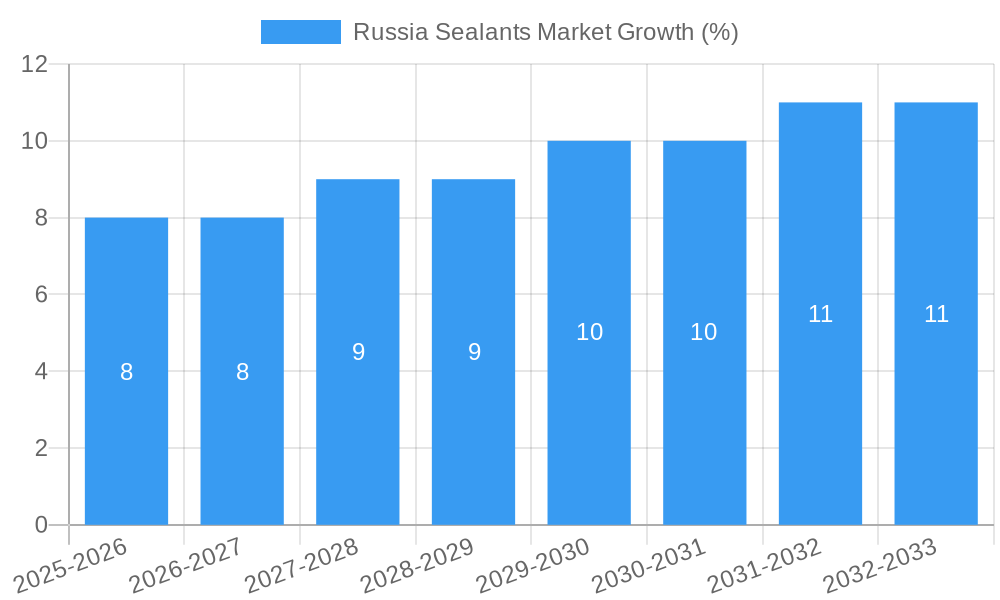

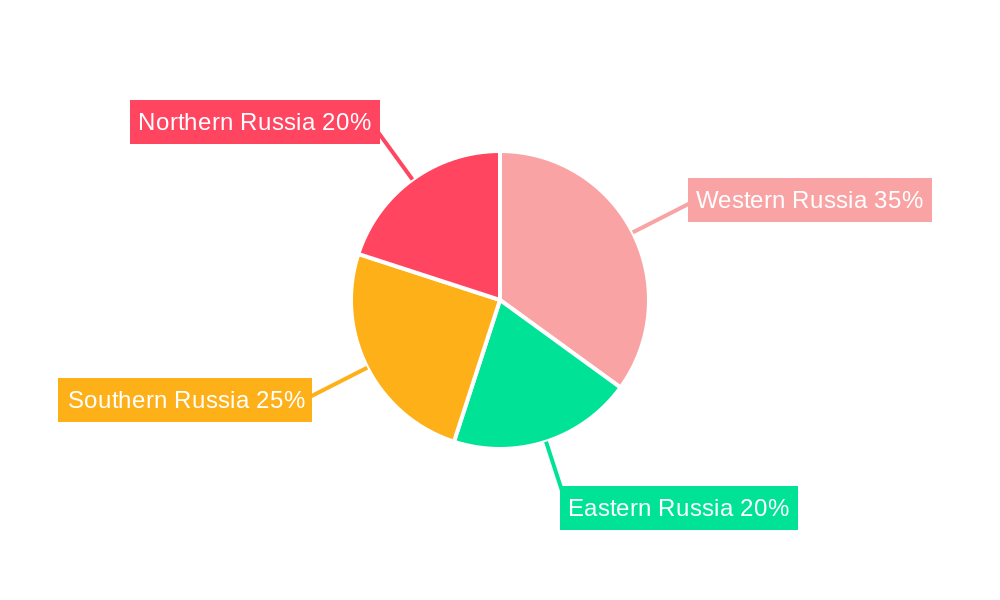

The Russia sealants market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 5% CAGR from 2025 to 2033. This expansion is driven by several key factors. The burgeoning construction sector, particularly in rapidly developing urban areas across Russia, fuels significant demand for sealants in building and infrastructure projects. Furthermore, the increasing adoption of advanced sealants in automotive and aerospace applications, emphasizing superior durability and performance, contributes to market growth. Growth is also fueled by the rising demand for high-performance sealants in diverse end-use industries such as healthcare and industrial manufacturing, where reliable sealing solutions are crucial. However, economic fluctuations and potential import restrictions could act as market restraints, impacting material availability and pricing. The market segmentation reveals a strong preference for acrylic, epoxy, and polyurethane resins, reflecting their versatility and suitability across various applications. Leading players such as Henkel, Sika, and Dow are actively shaping the market landscape through product innovation and strategic partnerships, further intensifying competition and driving market growth. Regional variations in market dynamics are expected, with Western and Southern Russia potentially experiencing faster growth due to higher infrastructural investment.

The forecast period (2025-2033) will witness a continued expansion of the Russia sealants market, propelled by ongoing investments in infrastructure development and industrial growth. The market's diverse applications, ranging from residential to industrial construction, along with the increasing demand for specialized sealants with enhanced properties, will be significant growth drivers. While economic conditions might introduce volatility, the long-term outlook remains positive, driven by continued urbanization, technological advancements in sealant formulations, and growing awareness of the importance of high-quality sealing solutions across various sectors. The competitive landscape is characterized by a blend of established multinational players and local manufacturers, leading to intensified competition and a dynamic market environment. The market segmentation across resin types and end-user industries provides valuable insights into the specific demands and opportunities within each segment. Therefore, strategic investments in research and development, focusing on advanced materials and application techniques, are likely to be pivotal for successful market participation.

Russia Sealants Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Russia sealants market, offering in-depth insights into market dynamics, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for businesses operating in or planning to enter the Russian sealants market, providing actionable intelligence for strategic decision-making.

Russia Sealants Market Structure & Competitive Dynamics

The Russia sealants market exhibits a moderately concentrated structure, with key players like Henkel AG & Co KGaA, Henkel, RUSTA LLC, Ascott Group, KLEBCHEMIE M G Becker GmbH & Co KG, Arkema Group, Arkema, Dow, Dow, Soudal Holding N V, Soudal, MAPEI S p A, MAPEI, Sika AG, Sika, and Kiilto holding significant market share. Market concentration is influenced by factors such as established brand reputation, technological capabilities, and distribution networks. The market displays a dynamic innovation ecosystem, with ongoing R&D efforts focused on developing high-performance, eco-friendly sealants. Regulatory frameworks, including those related to environmental protection and product safety, significantly impact market operations. Substitute products, such as tapes and adhesives, pose competitive pressure. End-user trends, particularly in the building and construction sector, are driving demand for specialized sealants with enhanced properties. M&A activity, exemplified by Soudal’s acquisition of Profflex in 2019 (estimated deal value: xx Million), demonstrates the strategic importance of market consolidation. The overall market share distribution is estimated as follows (2025): Henkel (18%), Soudal (15%), Sika (12%), Dow (10%), others (45%).

Russia Sealants Market Industry Trends & Insights

The Russia sealants market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include robust infrastructure development, particularly in urban areas, coupled with rising construction activities. The automotive industry's expansion contributes significantly to demand for specialized sealants. Technological advancements, such as the development of high-performance, sustainable sealants, are driving innovation and creating new market opportunities. Consumer preference shifts towards eco-friendly and energy-efficient products are impacting product development strategies. Intense competition among market players is leading to price optimization and product differentiation. Market penetration of advanced sealant technologies, like polyurethane and silicone-based sealants, is gradually increasing, driven by superior performance attributes. However, economic fluctuations and geopolitical factors could pose challenges to market growth. The building and construction sector, with its xx% market penetration in 2025, represents the largest end-user segment, while silicone sealants, with xx% market share, dominate the resin segment due to high durability and versatility.

Dominant Markets & Segments in Russia Sealants Market

The building and construction sector represents the dominant end-user industry in the Russia sealants market, accounting for approximately xx% of total market value in 2025. This dominance is driven by several key factors:

- Robust infrastructure development: Government initiatives focused on modernizing infrastructure create considerable demand for sealants.

- Residential and commercial construction: A growing urban population and increasing urbanization fuels a significant need for construction materials, including sealants.

- Government investments: Public spending on infrastructure projects further drives market expansion.

Silicone sealants hold a prominent position in the resin segment, accounting for approximately xx% of the market share in 2025. This dominance stems from their superior performance characteristics:

- Excellent durability and weather resistance: Silicone sealants are highly resistant to extreme temperatures and environmental factors, ensuring long-term protection.

- Versatility and wide range of applications: They can be used in diverse applications across various industries.

- Ease of application: User-friendly application methods make them attractive to both professional and DIY users.

The Moscow region is anticipated to be the leading regional market within Russia, driven by its status as the country's economic and population hub.

Russia Sealants Market Product Innovations

Recent product innovations in the Russia sealants market have centered around developing sustainable and high-performance sealants. Manufacturers are focusing on creating sealants with improved durability, weather resistance, and reduced environmental impact. The emphasis on incorporating eco-friendly materials and reducing VOC emissions is noteworthy. These innovations are designed to meet the increasing demands for environmentally conscious construction and industrial practices, and to cater to evolving consumer preferences. The development of specialized sealants for niche applications in industries like aerospace and healthcare is another prominent trend.

Report Segmentation & Scope

The Russia sealants market is segmented by end-user industry (Aerospace, Automotive, Building and Construction, Healthcare, Other End-user Industries) and by resin type (Acrylic, Epoxy, Polyurethane, Silicone, Other Resins). Each segment exhibits unique growth trajectories and competitive dynamics. The Building and Construction segment is expected to demonstrate the highest growth, driven by continued infrastructure development. The Automotive segment is anticipated to experience steady growth, driven by increased vehicle production. The Silicone resin segment is projected to dominate the market due to its superior performance properties and versatility. Other resin types also contribute significantly to the market, with growth prospects varying depending on specific application areas. Market sizes and growth projections are provided for each segment in the detailed report.

Key Drivers of Russia Sealants Market Growth

Several key factors drive the growth of the Russia sealants market. Firstly, significant investments in infrastructure development, particularly in transportation and housing, create substantial demand for sealants. Secondly, the increasing adoption of sustainable building practices encourages the use of eco-friendly sealants. Thirdly, technological advancements are leading to the development of high-performance sealants with enhanced properties, such as improved durability and weather resistance. Finally, the growth of the automotive and aerospace industries also contributes to the overall market expansion.

Challenges in the Russia Sealants Market Sector

The Russia sealants market faces certain challenges. Economic fluctuations and geopolitical instability create uncertainties in market demand. Supply chain disruptions due to import restrictions or logistical complexities can impact availability and pricing. Intense competition among established and emerging players necessitates continuous innovation and differentiation. Additionally, stringent regulatory requirements and environmental regulations add to the operational complexity of businesses. These challenges collectively influence market growth and profitability.

Leading Players in the Russia Sealants Market Market

- Henkel AG & Co KGaA

- RUSTA LLC

- Ascott Group

- KLEBCHEMIE M G Becker GmbH & Co KG

- Arkema Group

- Dow

- Soudal Holding N V

- MAPEI S p A

- Sika AG

- Kiilto

Key Developments in Russia Sealants Market Sector

- June 2019: Soudal acquired Profflex, expanding its market presence in Eastern Europe. This acquisition strengthened Soudal's product portfolio and distribution network in the region.

- April 2019: Dow completed the separation of its Material Science division, impacting its focus and strategic direction within the sealants market. This restructuring could lead to altered market strategies and product offerings.

Strategic Russia Sealants Market Market Outlook

The Russia sealants market presents significant growth potential driven by sustained infrastructure development, increasing urbanization, and technological advancements. Strategic opportunities lie in developing innovative, sustainable sealants to cater to the growing demand for eco-friendly construction materials. Focusing on niche applications within specialized industries, like aerospace and healthcare, could also yield high returns. Companies should proactively adapt to evolving regulatory landscapes and optimize supply chain operations to mitigate risks and capitalize on emerging market trends. The long-term outlook remains positive, with continued expansion expected across various segments.

Russia Sealants Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Healthcare

- 1.5. Other End-user Industries

-

2. Resin

- 2.1. Acrylic

- 2.2. Epoxy

- 2.3. Polyurethane

- 2.4. Silicone

- 2.5. Other Resins

Russia Sealants Market Segmentation By Geography

- 1. Russia

Russia Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand from Construction Industry; Adoption of Vacuum Insulation Panel for Automated Storage and Retrieval; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of VIPs for Non-standard Sizes; Heavy Weight of Vacuum Insulation Panels

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Sealants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Healthcare

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin

- 5.2.1. Acrylic

- 5.2.2. Epoxy

- 5.2.3. Polyurethane

- 5.2.4. Silicone

- 5.2.5. Other Resins

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Western Russia Russia Sealants Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Sealants Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Sealants Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Sealants Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Henkel AG & Co KGaA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 RUSTA LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ascott Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 KLEBCHEMIE M G Becker GmbH & Co KG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Arkema Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dow

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Soudal Holding N V

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 MAPEI S p A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sika AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kiilto

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Russia Sealants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Sealants Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Sealants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Sealants Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Russia Sealants Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 4: Russia Sealants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Sealants Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Russia Sealants Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 12: Russia Sealants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Sealants Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Russia Sealants Market?

Key companies in the market include Henkel AG & Co KGaA, RUSTA LLC, Ascott Group, KLEBCHEMIE M G Becker GmbH & Co KG, Arkema Group, Dow, Soudal Holding N V, MAPEI S p A, Sika AG, Kiilto.

3. What are the main segments of the Russia Sealants Market?

The market segments include End User Industry, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand from Construction Industry; Adoption of Vacuum Insulation Panel for Automated Storage and Retrieval; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of VIPs for Non-standard Sizes; Heavy Weight of Vacuum Insulation Panels.

8. Can you provide examples of recent developments in the market?

June 2019: Soudal acquired Profflex, a Russia-based foam and sealant manufacturer, to strengthen its position in the Eastern European market.April 2019: Dow completed the separation of its Material Science division through a spin-off of Dow Inc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Sealants Market?

To stay informed about further developments, trends, and reports in the Russia Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence